How To Sign Pennsylvania Banking PDF

Contact Sales

Make the most out of your eSignature workflows with airSlate SignNow

Extensive suite of eSignature tools

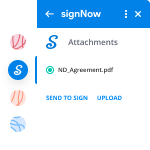

Discover the easiest way to Sign Pennsylvania Banking PDF with our powerful tools that go beyond eSignature. Sign documents and collect data, signatures, and payments from other parties from a single solution.

Robust integration and API capabilities

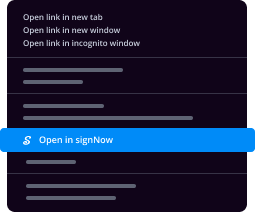

Enable the airSlate SignNow API and supercharge your workspace systems with eSignature tools. Streamline data routing and record updates with out-of-the-box integrations.

Advanced security and compliance

Set up your eSignature workflows while staying compliant with major eSignature, data protection, and eCommerce laws. Use airSlate SignNow to make every interaction with a document secure and compliant.

Various collaboration tools

Make communication and interaction within your team more transparent and effective. Accomplish more with minimal efforts on your side and add value to the business.

Enjoyable and stress-free signing experience

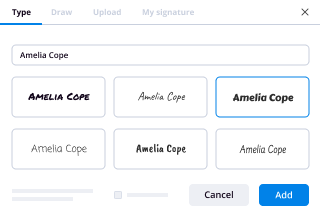

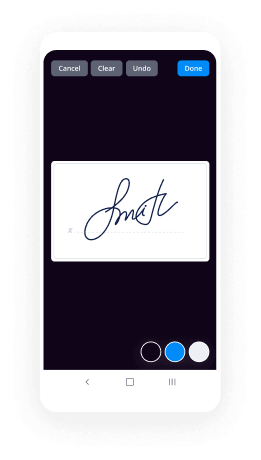

Delight your partners and employees with a straightforward way of signing documents. Make document approval flexible and precise.

Extensive support

Explore a range of video tutorials and guides on how to Sign Pennsylvania Banking PDF. Get all the help you need from our dedicated support team.

How to industry sign banking pennsylvania pdf fast

Keep your eSignature workflows on track

Make the signing process more streamlined and uniform

Take control of every aspect of the document execution process. eSign, send out for signature, manage, route, and save your documents in a single secure solution.

Add and collect signatures from anywhere

Let your customers and your team stay connected even when offline. Access airSlate SignNow to Sign Pennsylvania Banking PDF from any platform or device: your laptop, mobile phone, or tablet.

Ensure error-free results with reusable templates

Templatize frequently used documents to save time and reduce the risk of common errors when sending out copies for signing.

Stay compliant and secure when eSigning

Use airSlate SignNow to Sign Pennsylvania Banking PDF and ensure the integrity and security of your data at every step of the document execution cycle.

Enjoy the ease of setup and onboarding process

Have your eSignature workflow up and running in minutes. Take advantage of numerous detailed guides and tutorials, or contact our dedicated support team to make the most out of the airSlate SignNow functionality.

Benefit from integrations and API for maximum efficiency

Integrate with a rich selection of productivity and data storage tools. Create a more encrypted and seamless signing experience with the airSlate SignNow API.

Collect signatures

24x

faster

Reduce costs by

$30

per document

Save up to

40h

per employee / month

Our user reviews speak for themselves

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

A smarter way to work: —how to industry sign banking integrate

Trusted esignature solution— what our customers are saying

be ready to get more

Get legally-binding signatures now!

Related searches to How To Sign Pennsylvania Banking PDF

Frequently asked questions

How do i add an electronic signature to a word document?

When a client enters information (such as a password) into the online form on , the information is encrypted so the client cannot see it. An authorized representative for the client, called a "Doe Representative," must enter the information into the "Signature" field to complete the signature.

How to sign a pdf on your computer?

How do i create an electronic email signature?

The Electronic Signatures in Global and National Commerce Act of 2002 requires electronic communication service providers to establish and maintain a policy to ensure that all electronic signatures comply with the law. It is unlawful to provide false, deceptive or misleading electronic communications, as well as to knowingly make false or misleading statements under oath.

An electronic signature is not a form of document and will not constitute the receipt of any document. The signature that can be generated through an electronic document is a unique electronic string of characters which appears as if it are handwritten. This is because the computer code that is used to generate, or "encrypt," the signatures of the recipient and senders has little or no human involvement. If the electronic signature used to make a document does not appear as the original signed text, it is not a valid signature of the person or entity signing it. If someone is signing on your behalf but the text cannot be read, that person is signing false or misleading statements under oath.

The law requires that, in order to establish that an electronic signature is genuine, the signer must be able to determine whether the electronic signature was "created by that person or entity in the ordinary course of that person's business." (The Supreme court recently stated that this language was unclear.) The court ruled that the signature must be unique and, since signatures are unique for each person, cannot...

Get more for How To Sign Pennsylvania Banking PDF

- Can I Sign West Virginia Charity Cease And Desist Letter

- Sign Virginia Charity Work Order Mobile

- Sign West Virginia Charity Cease And Desist Letter Safe

- Sign Virginia Charity Work Order Now

- Sign Virginia Charity Work Order Later

- Sign Virginia Charity Work Order Free

- Sign Virginia Charity Work Order Myself

- Sign Virginia Charity Work Order Secure

Find out other How To Sign Pennsylvania Banking PDF

- Wjla nc8 tbd credit app with standard terms revised 110410 form

- E that the interfund loan rate does gpo form

- Non operating private foundation administration service agreement form

- Transcript ir team india call proof readdoc form

- Western society of weed science newsletter wsweedscience form

- Cdss all county information notice i 39 00 dss cahwnet

- Food processing in food service establishments state of michigan michigan form

- Survivor benefits application section one victim jud ct form

- Registration form 4 2007pub village of glendale heights glendaleheights

- Adjudicatorydispositional orders connecticut judicial branch jud ct form

- Jv 432 six month prepermanency attachment reunification services continued welf amp inst code 36621e judicial council forms

- Application for hearing on exempt status of funds jud ct form

- Form 1097 btc issuer s name street address city state zip code irs

- 08 10 form cms 2552 96 36215 column 6 cost report data

- Internal revenue bulletin 2018 44internal revenue service irsgov form

- Application page 1 amazon simple storage service amazon s3 form

- Fundraiser request form coordination lajesfss

- Durable power of attorney for health care notice to person executing this document this is an important legal document form

- Adult registration form city of sierra madre

- Edc registration form 2011 uwiedu