Sign Assignment of Mortgage

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Excellent form management with airSlate SignNow

Gain access to a rich form catalog

Generate reusable templates

Collect signatures via secure links

Keep paperwork safe

Improve collaboration

eSign by means of API integrations

Your complete how-to guide - assignment of mortgage

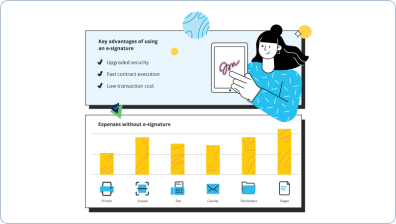

Nowadays, you probably won't find an organization that doesn't use modern day technologies to atomize work-flow. An electronic signature is no longer the future, but the present. Modern businesses using their turnover simply don't want to give up browser software offering advanced data file management automation tools, including Sign Assignment of Mortgage option.

How you can manage Sign Assignment of Mortgage airSlate SignNow feature:

-

After you enter our website, Login or create your account if you don't have one, it will take you a couple of seconds.

-

Upload the appropriate data file or select one from your library folders: Documents, Archive, Templates.

-

cloud-structured storage compatibility, you can quickly import the appropriate doc from favored clouds with virtually any device.

-

You'll find your data document launched within the up-to-date PDF Editor where you can make changes before you decide to move forward.

-

Type text, put in graphics, include annotations or fillable boxes to be completed further.

-

Use My Signature button for self-signing or place Signature Fields to deliver the eSign require to one or multiple individuals.

-

Tap the DONE button when finished to carry on with Sign Assignment of Mortgage function.

airSlate SignNow web-based platform is necessary to boost the effectiveness and productivity of most operational procedures. Sign Assignment of Mortgage is among the features that will help. Utilizing the internet-based software these days is a basic need, not much of a competitive advantage. Try it now!

How it works

Rate your experience

What is the assignment of mortgage

The assignment of mortgage is a legal document that transfers the rights and obligations of a mortgage from one lender to another. This process is crucial in the mortgage industry, as it allows lenders to sell or transfer their interest in a mortgage loan. The assignment document typically includes details such as the names of the original lender and the new lender, the property address, and the terms of the mortgage. Understanding this document is essential for homeowners and lenders alike, as it impacts the ownership and management of mortgage loans.

How to use the assignment of mortgage

Using the assignment of mortgage involves several steps to ensure that the transfer of rights is legally binding. First, the original lender prepares the assignment document, which must be signed by both parties. Once completed, the document should be filed with the appropriate county recorder's office to make the transfer public. With airSlate SignNow, users can easily fill out the assignment of mortgage online, request signatures from relevant parties, and securely store the completed document. This streamlined process enhances efficiency and ensures compliance with legal requirements.

Steps to complete the assignment of mortgage

Completing the assignment of mortgage requires careful attention to detail. Here are the steps involved:

- Obtain the assignment of mortgage template or form.

- Fill in the necessary details, including the names of the original and new lenders, property information, and loan details.

- Ensure all parties review the document for accuracy.

- Use airSlate SignNow to electronically sign the document, making it legally binding.

- File the signed document with the county recorder's office to finalize the transfer.

Key elements of the assignment of mortgage

Several key elements must be included in the assignment of mortgage to ensure its validity:

- Parties involved: Clearly state the names and addresses of the original lender and the new lender.

- Property description: Include the address and legal description of the property associated with the mortgage.

- Loan details: Provide the mortgage loan number and any relevant terms.

- Signatures: Ensure that the document is signed by the original lender and, if necessary, the new lender.

- Date of transfer: Indicate the date on which the assignment takes effect.

Legal use of the assignment of mortgage

The assignment of mortgage must comply with state laws to be legally enforceable. Each state has specific regulations governing the transfer of mortgage rights. It is important for lenders and homeowners to understand these legal requirements to avoid potential disputes. Using airSlate SignNow ensures that the document is completed correctly and securely, minimizing the risk of errors that could lead to legal challenges.

Sending & Signing Methods (Web / Mobile / App)

airSlate SignNow offers multiple methods for sending and signing the assignment of mortgage, making the process flexible and accessible. Users can complete the document on the web, through mobile devices, or via the airSlate SignNow app. This versatility allows users to fill out and eSign documents from anywhere, ensuring that the assignment of mortgage can be processed quickly and efficiently. The electronic signature is legally recognized, providing a secure and convenient alternative to traditional paper-based methods.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What is an assignment of mortgage?

An assignment of mortgage is a legal document that transfers the rights and obligations of a mortgage from one lender to another. This process is essential for maintaining clear ownership and ensuring that payments are directed to the correct entity. Understanding the assignment of mortgage is crucial for both borrowers and lenders.

-

How does airSlate SignNow facilitate the assignment of mortgage process?

airSlate SignNow streamlines the assignment of mortgage process by allowing users to easily create, send, and eSign documents online. With its user-friendly interface, businesses can manage mortgage assignments efficiently, reducing paperwork and saving time. This digital solution enhances accuracy and compliance in the assignment of mortgage.

-

What are the benefits of using airSlate SignNow for assignment of mortgage?

Using airSlate SignNow for the assignment of mortgage offers numerous benefits, including faster processing times and reduced administrative costs. The platform ensures secure document handling and provides a clear audit trail for all transactions. Additionally, eSigning eliminates the need for physical signatures, making the process more convenient.

-

Is airSlate SignNow cost-effective for handling assignment of mortgage?

Yes, airSlate SignNow is a cost-effective solution for managing the assignment of mortgage. With flexible pricing plans, businesses can choose a package that fits their needs without overspending. The savings on printing and mailing costs further enhance the overall value of using airSlate SignNow.

-

Can I integrate airSlate SignNow with other tools for assignment of mortgage?

Absolutely! airSlate SignNow offers seamless integrations with various tools and platforms, enhancing your workflow for the assignment of mortgage. Whether you use CRM systems or document management software, these integrations help streamline processes and improve efficiency.

-

What features does airSlate SignNow offer for the assignment of mortgage?

airSlate SignNow provides a range of features tailored for the assignment of mortgage, including customizable templates, automated workflows, and real-time tracking. These features ensure that all parties involved can easily access and manage documents, leading to a smoother transaction process.

-

How secure is the assignment of mortgage process with airSlate SignNow?

The assignment of mortgage process with airSlate SignNow is highly secure, utilizing advanced encryption and authentication measures. This ensures that sensitive information remains protected throughout the document lifecycle. Users can trust that their assignment of mortgage documents are handled with the utmost security.

Assignment of mortgage

Trusted eSignature solution - assignment of mortgage

Join over 28 million airSlate SignNow users

Get more for assignment of mortgage

- Try Seamless eSignatures: upload signature to Word

- Explore Your Digital Signature – Questions Answered: ...

- Start Your eSignature Journey: verified electronic ...

- Explore popular eSignature features: virtual document ...

- Explore popular eSignature features: virtual sign

- Explore popular eSignature features: virtual signature ...

- Improve Your Google Experience: virtual signature for ...

- Explore popular eSignature features: virtual signature ...

The ins and outs of eSignature