Sign Forbearance Agreement

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Excellent form management with airSlate SignNow

Gain access to a rich form collection

Create reusable templates

Collect signatures through links

Keep forms protected

Enhance collaboration

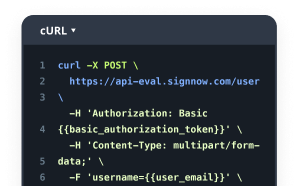

eSign through API integrations

Your complete how-to guide - forbearance agreement

At present, you probably won't find an organization that doesn't use modern technological innovation to atomize workflow. An electronic signing is no longer the future, but the present. Contemporary organizations with their turnover simply cannot afford to quit web-based platforms that offer innovative document processing automation tools, such as Sign Forbearance Agreement option.

How you can manage Sign Forbearance Agreement airSlate SignNow feature:

-

After you get to our website, Login or make your account if you don't have one, it will take you a matter of moments.

-

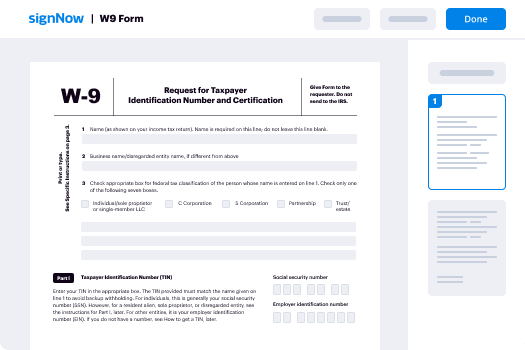

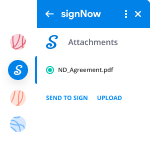

Upload the needed document or pick one from your catalogue folders: Documents, Archive, Templates.

-

Due to the cloud-structured storage compatibility, it is possible to quickly load the needed doc from favored clouds with virtually any gadget.

-

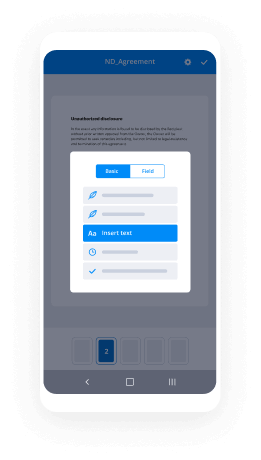

You'll find your data document launched in the advanced PDF Editor where you can make modifications before you decide to proceed.

-

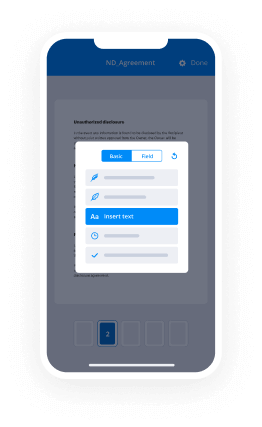

Type text, put in graphics, include annotations or fillable boxes to be done further.

-

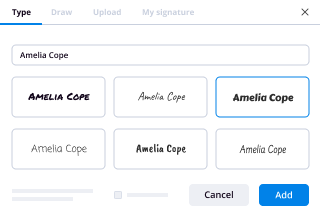

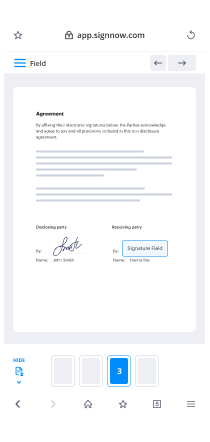

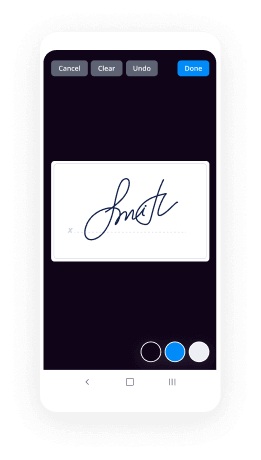

Use My Signature button for self-signing or place Signature Fields to deliver the signing require to a single or several individuals.

-

Apply the DONE button when finished to go on with Sign Forbearance Agreement function.

airSlate SignNow web-based solution is vital to increase the effectiveness and productivity of all working processes. Sign Forbearance Agreement is among the capabilities that will help. Utilizing the internet-based application nowadays is actually a necessity, not just a competitive advantage. Try it now!

How it works

Rate your experience

What is the forbearance agreement meaning

A forbearance agreement is a legal document that outlines a temporary arrangement between a borrower and a lender, allowing the borrower to pause or reduce their mortgage payments for a specified period. This agreement is typically used when the borrower is experiencing financial difficulties but intends to resume regular payments in the future. The document details the terms of the forbearance, including the duration, payment schedule, and any conditions that must be met by the borrower during the forbearance period.

Steps to complete the forbearance agreement meaning

To complete a forbearance agreement electronically using airSlate SignNow, follow these steps:

- Access the forbearance agreement template on airSlate SignNow.

- Fill in the required information, including borrower and lender details, payment terms, and duration of the forbearance.

- Review the agreement for accuracy.

- Send the document for signature to the involved parties using the eSignature feature.

- Once all parties have signed, securely store the completed agreement for future reference.

Key elements of the forbearance agreement meaning

Understanding the key elements of a forbearance agreement is essential for both borrowers and lenders. Important components include:

- Borrower Information: Details about the borrower, including name, address, and loan number.

- Lender Information: Details about the lending institution or individual.

- Forbearance Terms: Specifics on the length of the forbearance period and any changes to payment amounts.

- Conditions: Requirements that the borrower must meet during the forbearance, such as financial reporting.

- Consequences of Default: Information on what happens if the borrower fails to comply with the terms of the agreement.

Legal use of the forbearance agreement meaning

The legal use of a forbearance agreement is crucial for protecting the rights of both parties. This document serves as a formal acknowledgment of the temporary change in payment obligations and can be enforced in court if necessary. It is important for borrowers to fully understand their rights and responsibilities under the agreement, as well as any potential implications for their credit score. Always consider consulting a legal professional when drafting or signing a forbearance agreement.

Sending & Signing Methods (Web / Mobile / App)

When using airSlate SignNow, there are multiple convenient methods to send and sign a forbearance agreement:

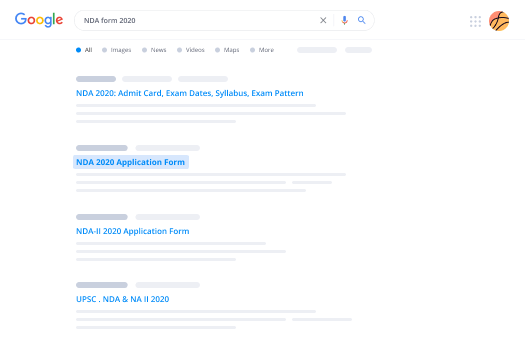

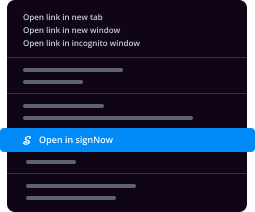

- Web: Access the airSlate SignNow platform through a web browser to upload, fill out, and send the document for signatures.

- Mobile: Use the airSlate SignNow mobile app to manage documents on the go, allowing users to fill and sign agreements from their smartphones or tablets.

- App: Integrate with other applications to streamline the process of sending and signing documents directly from your preferred software.

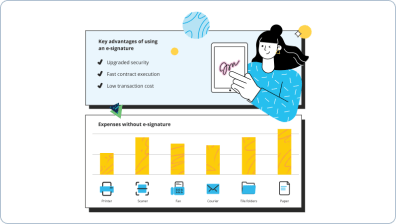

Digital vs. Paper-Based Signing

Choosing digital signing over paper-based methods offers several advantages for forbearance agreements. Digital signing is typically faster, allowing for quicker turnaround times on agreements. It also enhances security, as electronic documents can be encrypted and stored securely. Additionally, using airSlate SignNow facilitates easy tracking of the signing process, ensuring that all parties are informed of the status of the agreement. This efficiency can be particularly beneficial in time-sensitive situations.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What is the forbearance agreement meaning?

The forbearance agreement meaning refers to a legal arrangement between a lender and a borrower, where the lender allows the borrower to temporarily reduce or suspend payments. This agreement is often used in situations where the borrower is experiencing financial hardship. Understanding the forbearance agreement meaning is crucial for anyone considering this option to manage their debts.

-

How can airSlate SignNow help with forbearance agreements?

airSlate SignNow simplifies the process of creating and signing forbearance agreements. With our platform, you can easily draft, send, and eSign documents securely and efficiently. This streamlines the workflow and ensures that all parties can quickly understand the forbearance agreement meaning and terms.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to fit different business needs. Our plans are designed to be cost-effective while providing robust features for document management and eSigning. Understanding the forbearance agreement meaning can help you utilize our platform effectively to manage your agreements.

-

What features does airSlate SignNow offer for managing agreements?

Our platform includes features such as customizable templates, real-time tracking, and secure cloud storage. These tools enhance your ability to manage forbearance agreements efficiently. By leveraging these features, you can ensure that all parties involved understand the forbearance agreement meaning and adhere to its terms.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers seamless integrations with various software applications, including CRM and project management tools. This allows you to incorporate forbearance agreements into your existing workflows easily. Understanding the forbearance agreement meaning can help you utilize these integrations effectively.

-

What are the benefits of using airSlate SignNow for forbearance agreements?

Using airSlate SignNow for forbearance agreements provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that all parties can easily access and understand the forbearance agreement meaning. This clarity helps prevent misunderstandings and fosters better communication.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that your sensitive documents are protected. We use advanced encryption and authentication measures to safeguard your forbearance agreements. Understanding the forbearance agreement meaning is essential, and our security features help maintain the integrity of these important documents.

Forbearance agreement

Trusted eSignature solution - forbearance agreement

Join over 28 million airSlate SignNow users

Get more for forbearance agreement

- Explore Online Signature: sign file

- Explore Online Signature: sign file online

- Improve Your Google Experience: sign Google Doc

- Explore Online Signature: sign images

- Explore Online Signature: sign in images

- Explore Online Signature: sign in Pages

- Explore Online Signature: sign in paper

- Try Seamless eSignatures: sign in Word

The ins and outs of eSignature