Fill and Sign the 27 Printable State of Texas Gift Deed Forms and Templates Fillable

Practical advice on finalizing your ‘27 Printable State Of Texas Gift Deed Forms And Templates Fillable ’ online

Are you weary of the trouble associated with handling paperwork? Look no further than airSlate SignNow, the premier eSignature platform for individuals and businesses. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign paperwork online. Utilize the extensive features embedded within this user-friendly and cost-effective platform and transform your method of document management. Whether you need to approve forms or gather signatures, airSlate SignNow manages it all smoothly with just a few clicks.

Follow this comprehensive guide:

- Sign into your account or initiate a free trial with our service.

- Click +Create to upload a document from your device, cloud, or our form library.

- Open your ‘27 Printable State Of Texas Gift Deed Forms And Templates Fillable ’ in the editor.

- Select Me (Fill Out Now) to set up the form on your end.

- Include and assign fillable fields for others (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

Don’t fret if you need to work with others on your 27 Printable State Of Texas Gift Deed Forms And Templates Fillable or send it for notarization—our solution offers everything required to complete such tasks. Register with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

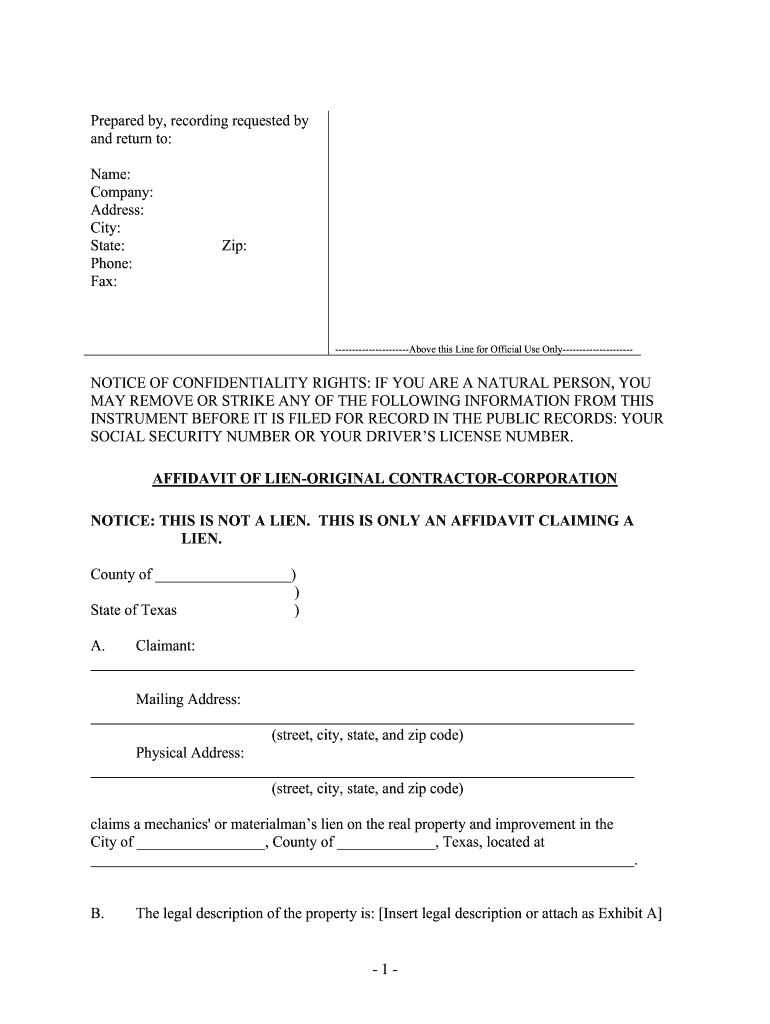

What is a Texas gift deed form?

A Texas gift deed form is a legal document used to transfer property ownership as a gift without any exchange of money. This form is essential for ensuring that the transfer is recognized by the state of Texas. Using a Texas gift deed form helps avoid potential disputes and clarifies the intent of the gift.

-

How do I create a Texas gift deed form using airSlate SignNow?

Creating a Texas gift deed form with airSlate SignNow is simple and efficient. You can start by selecting a template or creating a custom document, then fill in the necessary details. Once completed, you can easily send it for eSignature, ensuring a smooth and legally binding transfer.

-

What are the benefits of using airSlate SignNow for a Texas gift deed form?

Using airSlate SignNow for your Texas gift deed form offers numerous benefits, including ease of use, cost-effectiveness, and secure document management. The platform allows you to track the signing process in real-time and store your documents safely in the cloud. This ensures that your gift deed is handled professionally and efficiently.

-

Is there a cost associated with using airSlate SignNow for a Texas gift deed form?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be budget-friendly. Pricing plans vary based on features and usage, allowing you to choose the best option for your needs. Investing in airSlate SignNow for your Texas gift deed form can save you time and resources in the long run.

-

Can I integrate airSlate SignNow with other applications for my Texas gift deed form?

Absolutely! airSlate SignNow offers integrations with various applications, enhancing your workflow for managing a Texas gift deed form. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to streamline your document management process.

-

What features does airSlate SignNow offer for managing a Texas gift deed form?

airSlate SignNow provides a range of features for managing your Texas gift deed form, including customizable templates, eSignature capabilities, and document tracking. These features ensure that your documents are completed accurately and efficiently, making the process hassle-free.

-

How secure is my Texas gift deed form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. Your Texas gift deed form is protected with advanced encryption and secure cloud storage, ensuring that your sensitive information remains confidential. You can trust that your documents are safe while being processed and stored.

The best way to complete and sign your 27 printable state of texas gift deed forms and templates fillable

Get more for 27 printable state of texas gift deed forms and templates fillable

Find out other 27 printable state of texas gift deed forms and templates fillable

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles