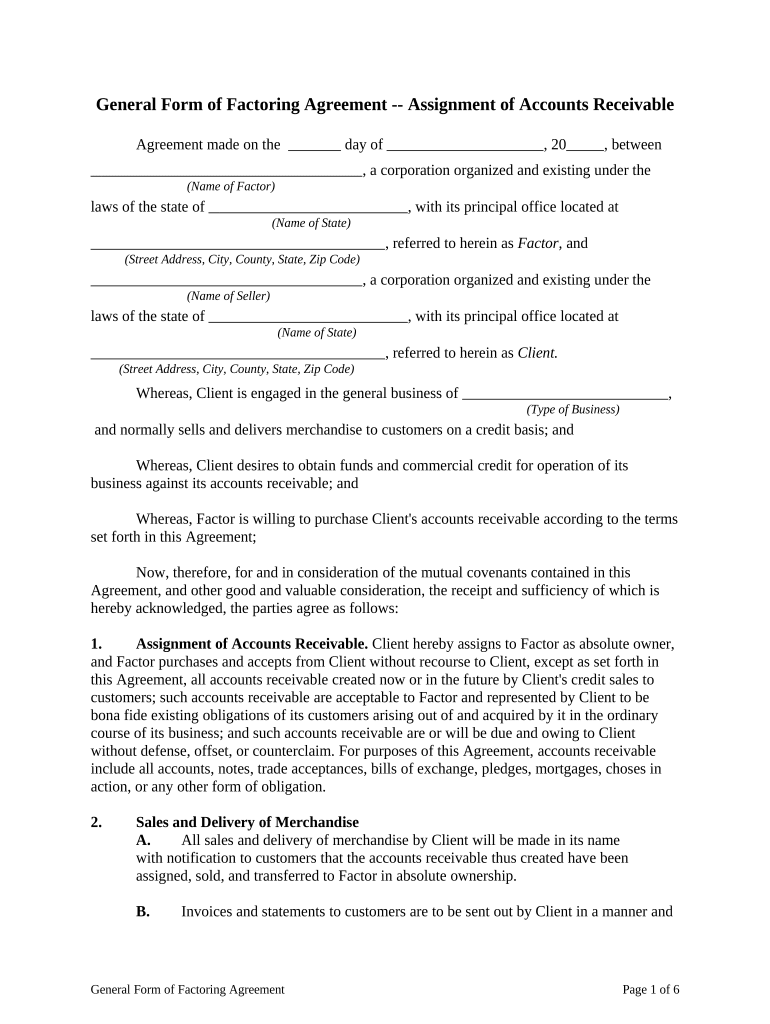

General Form of Factoring Agreement -- Assignment of Accounts Receivable

Agreement made on the day of , 20 , between

, a corporation organized and existing under the

(Name of Factor)

laws of the state of , with its principal office located at

(Name of State)

, referred to herein as Factor, and

(Street Address, City, County, State, Zip Code)

, a corporation organized and existing under the

(Name of Seller)

laws of the state of , with its principal office located at

(Name of State)

, referred to herein as Client.

(Street Address, City, County, State, Zip Code)

Whereas, Client is engaged in the general business of ,

(Type of Business)

and normally sells and delivers merchandise to customers on a credit basis; and

Whereas, Client desires to obtain funds and commercial credit for operation of its

business against its accounts receivable; and

Whereas, Factor is willing to purchase Client's accounts receivable according to the terms

set forth in this Agreement;

Now, therefore, for and in consideration of the mutual covenants contained in this

Agreement, and other good and valuable consideration, the receipt and sufficiency of which is

hereby acknowledged, the parties agree as follows:

1. Assignment of Accounts Receivable. Client hereby assigns to Factor as absolute owner,

and Factor purchases and accepts from Client without recourse to Client, except as set forth in

this Agreement, all accounts receivable created now or in the future by Client's credit sales to

customers; such accounts receivable are acceptable to Factor and represented by Client to be

bona fide existing obligations of its customers arising out of and acquired by it in the ordinary

course of its business; and such accounts receivable are or will be due and owing to Client

without defense, offset, or counterclaim. For purposes of this Agreement, accounts receivable

include all accounts, notes, trade acceptances, bills of exchange, pledges, mortgages, choses in

action, or any other form of obligation.

2. Sales and Delivery of Merchandise

A. All sales and delivery of merchandise by Client will be made in its name

with notification to customers that the accounts receivable thus created have been

assigned, sold, and transferred to Factor in absolute ownership.

B. Invoices and statements to customers are to be sent out by Client in a manner and

General Form of Factoring Agreement Page 1 of 6

on forms approved by Factor. Factor has the right and privilege to send such invoices or

statements to customers, if it so chooses, with cost of stationery and postage charged to

the account of Client. All invoices are to be clearly marked in a manner specified by

Factor, giving full notification to the customer that the account is payable to Factor at its

office at the address set forth above.

C. Factor has the right to institute and maintain actions in its name or

otherwise to collect such accounts. Those actions based upon Client Risk accounts shall

be at the cost of Client. Client Risk Account shall mean any account with amounts or

invoices which, taken together with those amounts or invoices already existing, exceeds

the limit of credit established by Factor with respect to that customer.

3. Credit Approval

A. Sales and deliveries are to be made only with the written approval of Factor's

Credit Department.

B. If, in the sole opinion of Factor, a customer's credit becomes impaired before the

actual delivery of merchandise to the customer, Factor shall have the right to withdraw

approval of any order taken from such customer.

C. Factor shall also be entitled to exercise a seller's right of stoppage in transit,

replevin, or reclamation. Any merchandise so recovered shall be dealt with, as between

Factor and Client, as returned merchandise.

D. Client further sells and assigns to Factor all merchandise, represented by

receivables purchased by Factor that may be returned by customers. Client further assigns

and transfers to Factor all its title or interest in the merchandise represented by such

receivables and all its rights of stoppage in transit, replevin, and reclamation. Any

merchandise so recovered shall be treated as returned merchandise.

E. Factor shall not be liable to any person or in any manner for refusing to approve

the delivery of merchandise sold, as set forth in this Agreement.

4. Assumption of Credit Risks

A. On all accounts receivable accepted and purchased by Factor, except those

receivables termed Client Risk Accounts, Factor will assume any losses resulting from

insolvency of the customer. Such assumption of credit risk shall go into effect upon

delivery and acceptance without dispute of the value and quality of the merchandise.

B. Client agrees that it shall adhere strictly to the credit limits established by Factor.

C. Factor, at its option, may advance money against accounts or invoices exceeding

the established credit limit with full recourse against Client.

D. If an unadjusted claim or dispute delays for more than days the

payment of an account when due, Factor's assumption of the credit risk is cancelled, and

General Form of Factoring Agreement Page 2 of 6

the amount may be charged back to Client as of the date of the original credit.

E. Client will report to Factor all rejections and returns of merchandise and

customer's claims immediately upon learning of those matters, and will promptly adjust

all claims and disputes with customers. Should any returned merchandise come into the

possession of Client, it will be turned over to Factor unless the amount credited to Client

by reason of the sale of such merchandise is repaid or otherwise secured to Factor in a

satisfactory manner. Factor shall have the right to sell the returned merchandise at private

sale, and if the amount received from such sale is less than the amount advanced on

invoice represented by the merchandise, then Client shall be charged with such

deficiency and Factor shall have full recourse against Client for such deficiency.

5. Purchase Price

A. Client will provide Factor with an assignment of receivables, satisfactory to

Factor, together with the original or true copies of invoices or statements, as may be

specified by Factor, conclusive evidence of shipment, or other instruments or papers that

Factor may require. The purchase price is to be the net amount of the receivables

accepted by Factor, calculated on the most favorable terms given to each customer, less

Factor's commission equal to % of the net amount of all such receivables.

(Number)

Net amount of receivables means the gross amount of such receivables less any discount

or allowances of any nature.

B. Factor shall pay Client, or credit Client with the purchase price of such

receivables, less any moneys remitted, paid, or otherwise advanced by Factor for the

account of Client or reserves, at the average due date of such receivables, which average

due date is to include days for collection. Interest on any moneys remitted,

(Number)

paid, or otherwise advanced by Factor before the average due date is to be charged at the

rate of % per annum on the unpaid balance and is to be payable at the close

of each month. Such interest rate may be increased or decreased as the parties may agree

from time to time.

C. Factor will remit to Client on request, and shall have the privilege of remitting at

any time, the proceeds of sales as they are made, or any amount standing to Client's

credit. However, to protect Factor against possible returns, claims, allowances, expense,

or other items properly chargeable to Client's account under and pursuant to this

Agreement, Factor may reserve an amount equal to % of the net amount of

receivables, which amount is considered reasonably necessary to cover such

contingencies. Such reserve account shall never be less than % of the

outstanding receivables. Within days following the close of each month,

(Number)

Factor will make an accounting to Client regarding the reserve account and, on all

receivables that have been completely collected, will remit to Client the reserves held on

such receivables, less deductions by customers, and any unpaid compensation, charges,

or expenses.

General Form of Factoring Agreement Page 3 of 6

6. Book Entries. Immediately on the purchase of an account by Factor, Client will make

appropriate entries upon its books disclosing such purchase, and will execute and deliver all

papers and instruments and do all things necessary to effectuate this Agreement.

7. Amounts Owed to Factor

A. Amounts owed by Client to Factor for commissions, interest, or otherwise are

considered as advances against Client's sales and are chargeable to Client's current

account at any time, at Factor's option.

B. If, at any time, Factor shall be required to pay any state, federal, or local sales or

excise tax on sales or services performed under and pursuant to this Agreement, the

amount of the tax so paid by Factor shall be charged to Client's account.

8. Rights under Client’s Contracts. Client warrants and agrees that all the rights and

privileges existing under the contractual Agreements with its own customers and patrons whose

receivables are being purchased by Factor, are transferred to Factor, and further agrees to provide

Factor with a copy of such contracts or Agreements.

9. Warranty of Assignment. Client further warrants that none of the accounts being sold to

Factor have previously been sold or assigned to any person, firm, corporation, or other entity,

and will not be sold or assigned at any time during the term of this Agreement.

10. Warranty of Solvency

A. Client warrants its solvency. If Client receives any checks, drafts, notes,

acceptances, other moneyed instruments, or cash in payment of any of the receivables

assigned to Factor under and pursuant to this Agreement, such payment will immediately

be turned over to Factor in its original form.

B. Factor, or other persons as it may from time to time designate, shall have the right

to endorse all instruments in Client's name or otherwise.

11. Profit and Loss Statement

A. Client will submit to Factor, at Factor's request, a monthly profit and loss

statement signed by an officer or employee of Client on behalf of and as the act of Client

within days after the close of each month, covering the business for the

(Number)

month immediately preceding the statement. In addition, Client will furnish Factor a

semiannual balance sheet on Client's business, accompanied by a profit and loss

statement from the beginning of Client's then-current fiscal year. Such semiannual

balance sheet and accompanying profit and loss statement shall be prepared by an

independent, certified public accountant that has no pecuniary interest in Client's

business.

B. All the books, records, accounts, corporate records, bank statements, and records

of deposit of Client, as well as any other financial records maintained by Client, shall be

General Form of Factoring Agreement Page 4 of 6

open to inspection by Factor, and any accountant or auditor designated by Factor, for all

purposes and at all times during normal business hours at Client's main place of business.

12. Power of Attorney. Client appoints , or

(Name of Representative of Factor)

any other person whom Factor may designate, as Client's attorney-in-fact with power to receive,

open, and dispose of all mail addressed to Client; to notify postal authorities to change the

address for delivery of mail addressed to Client to an address that Factor may designate; to

endorse in Client's name any notes, acceptances, checks, drafts, money orders, and other

evidences of payment or collateral that may come into Factor's possession, to sign Client's name

on any invoice or bill of lading relating to any account, on drafts against debtors, assignments

and verifications of accounts, and notice to debtors; to send verifications of accounts to any

debtor; and to do all other acts and things necessary to carry out this Agreement. All acts of such

attorney or designee are ratified and approved, and such attorney or designee shall not be liable

for any acts of commission or omission, nor for any error of judgment or mistake of law or fact.

This power, being coupled with an interest, is irrevocable while any purchased account shall

remain unpaid.

13. Breach of Warranty. If any warranty or covenant in this Agreement, express or implied,

shall be broken or violated, whether caused by the act or the fault of Client, a debtor, or others,

Factor shall be entitled to recover from Client or Client's guarantors the damages consequently

sustained, including, but not limited to, all attorney's fees, court costs, collection charges, and all

other expenses that may be incurred by Factor to enforce payment of any account, either as

against the debtor, Client, or its guarantors, or in the prosecution or defense of any action or

proceeding related to the subject matter of this Agreement.

14. Termination. Either party may terminate this Agreement as to future transactions on

days' written notice.

(Number)

15. Waiver.

A. Factor's waiver of a particular breach by Client of any covenant or warranty

contained in this Agreement shall not be deemed to constitute a waiver of any subsequent

breach.

B. Factor's failure at any particular time to exercise a right or privilege granted to it

in this Agreement shall not be deemed to constitute a waiver of that or any other right or

privilege.

16. Severability. The invalidity of any portion of this Agreement will not and shall not be

deemed to affect the validity of any other provision. If any provision of this Agreement is held to

be invalid, the parties agree that the remaining provisions shall be deemed to be in full force and

effect as if they had been executed by both parties subsequent to the expungement of the invalid

provision.

17. Governing Law. This Agreement shall be governed by, construed, and enforced

General Form of Factoring Agreement Page 5 of 6

in accordance with the laws of the State of .

(Name of State)

18. Notices. Any notice provided for or concerning this Agreement shall be in writing and

shall be deemed sufficiently given when sent by certified or registered mail if sent to the

respective address of each party as set forth at the beginning of this Agreement.

19. Attorney’s Fees. In the event that any lawsuit is filed in relation to this Agreement, the

unsuccessful party in the action shall pay to the successful party, in addition to all the sums that

either party may be called on to pay, a reasonable sum for the successful party's attorney fees.

20. Mandatory Arbitration. Any dispute under this Agreement shall be required to be

resolved by binding arbitration of the parties hereto. If the parties cannot agree on an arbitrator,

each party shall select one arbitrator and both arbitrators shall then select a third. The third

arbitrator so selected shall arbitrate said dispute. The arbitration shall be governed by the rules of

the American Arbitration Association then in force and effect.

21. Entire Agreement. This Agreement shall constitute the entire agreement between the

parties and any prior understanding or representation of any kind preceding the date of this

Agreement shall not be binding upon either party except to the extent incorporated in this

Agreement.

22. Modification of Agreement. Any modification of this Agreement or additional

obligation assumed by either party in connection with this Agreement shall be binding only if

placed in writing and signed by each party or an authorized representative of each party.

23. Assignment of Rights. The rights of each party under this Agreement are personal to that

party and may not be assigned or transferred to any other person, firm, corporation, or other

entity without the prior, express, and written consent of the other party.

24. Counterparts. This Agreement may be executed in any number of counterparts, each of

which shall be deemed to be an original, but all of which together shall constitute but one and the

same instrument.

25. In this Agreement, any reference to a party includes that party's heirs, executors,

administrators, successors and assigns, singular includes plural and masculine includes feminine.

WITNESS our signatures as of the day and date first above stated.

(Name of Factor) (Name of Client)

By: By:

(P rinted Name & Office in Corporation) (P rinted Name & Office in Corporation)

(Signature of Officer) (Signature of Officer)

General Form of Factoring Agreement Page 6 of 6