Fill and Sign the Form 592 B Resident and Nonresident Withholding Tax Statement with Instructions Form 592 B Resident and Nonresident Withholding

Useful tips for completing your ‘Form 592 B Resident And Nonresident Withholding Tax Statement With Instructions Form 592 B Resident And Nonresident Withholding’ online

Are you fed up with the burden of handling documentation? Explore airSlate SignNow, the premier eSignature solution for both individuals and businesses. Say farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the comprehensive features included in this intuitive and cost-effective platform to transform your document management strategy. Whether you need to authorize forms or gather electronic signatures, airSlate SignNow manages it all efficiently with just a few clicks.

Adhere to this detailed guide:

- Sign in to your account or create a free trial with our service.

- Hit +Create to upload a file from your device, cloud storage, or our template library.

- Access your ‘Form 592 B Resident And Nonresident Withholding Tax Statement With Instructions Form 592 B Resident And Nonresident Withholding’ in the editor.

- Select Me (Fill Out Now) to prepare the document on your end.

- Insert and allocate fillable fields for others (if necessary).

- Proceed with the Send Invite options to request eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

Don’t be concerned if you need to collaborate with others on your Form 592 B Resident And Nonresident Withholding Tax Statement With Instructions Form 592 B Resident And Nonresident Withholding or send it for notarization—our platform has everything you need to complete such tasks. Register with airSlate SignNow today and enhance your document management to new levels!

FAQs

-

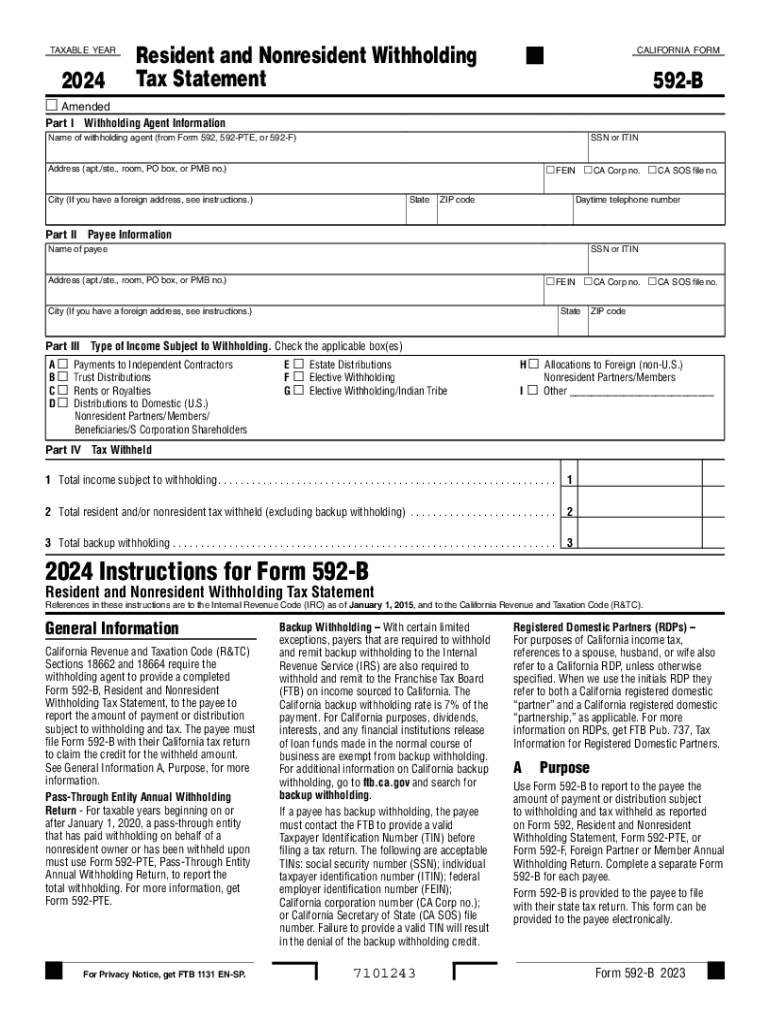

What is the Form 592 B Resident And Nonresident Withholding Tax Statement?

The Form 592 B Resident And Nonresident Withholding Tax Statement is a document used by payers to report amounts withheld from payments made to nonresidents in California. This form is essential for compliance with state tax laws and must be filed with the California Franchise Tax Board. Understanding the Instructions For Form 592 B is crucial for accurate completion.

-

How do I complete the Instructions For Form 592 B?

Completing the Instructions For Form 592 B involves several steps, including gathering necessary information about the payee and the amounts withheld. The instructions provide clear guidance on how to fill out each section, ensuring compliance and accuracy. It's important to follow these instructions closely to avoid any penalties.

-

What features does airSlate SignNow offer for managing Form 592 B?

airSlate SignNow offers a user-friendly platform for sending and eSigning documents, including the Form 592 B Resident And Nonresident Withholding Tax Statement. With features like customizable templates and real-time collaboration, you can streamline the process of completing and submitting your withholding tax statements efficiently.

-

Can I integrate airSlate SignNow with my accounting software for Form 592 B?

Yes, airSlate SignNow offers seamless integrations with various accounting software, making it easy to manage your Form 592 B Resident And Nonresident Withholding Tax Statement. This integration allows for automatic data transfer and simplifies the workflow, ensuring that your withholding tax filings are accurate and timely.

-

What are the benefits of using airSlate SignNow for tax statements?

Using airSlate SignNow for your Form 592 B provides several benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows you to send and sign documents electronically, which speeds up the process and minimizes errors associated with manual filing of the Resident And Nonresident Withholding Tax Statement.

-

Is there a cost associated with using airSlate SignNow for Form 592 B?

Yes, there is a cost associated with using airSlate SignNow, but it is an affordable solution that scales with your needs. Pricing plans vary based on features and usage, making it accessible for businesses of all sizes looking to manage their Form 592 B Resident And Nonresident Withholding Tax Statement effectively.

-

What support options are available for users of airSlate SignNow?

airSlate SignNow provides robust support options, including live chat, email support, and extensive online resources to help with your Form 592 B. Whether you have questions about the Instructions For Form 592 B or need assistance with technical issues, the support team is ready to assist you.

Find out other form 592 b resident and nonresident withholding tax statement with instructions form 592 b resident and nonresident withholding

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles