Pharmacy 101

Your Pharmacy Benefits Guide

This guide can

help answer your

questions and

clarify some

pharmacy terms.

05.03.376.1 A (9/10)

�Pharmacy glossary of terms

You may find yourself asking questions about your health care coverage. What

is a copayment? How do I know what drugs are covered? What should I ask

my doctor when he or she writes me a new prescription? This guide can help

answer your questions and clarify some pharmacy terms. If you have any other

questions, please visit www.aetna.com. Or call Member Services at the

toll-free number on your Aetna ID card.

Annual Notice of Change

Closed formulary

Deductible

A letter sent to members in certain plans

that tells them about any upcoming changes

to their prescription drug plan. The letter is

sent at the end of every year and affects

drugs in the next plan year.

A prescription benefits plan that does not

cover drugs on the Aetna Formulary

Exclusions list without a medical exception.

The amount you pay for prescriptions

before your health plan begins to pay.

For example, your plan might have a

$1,500 deductible.

Benefit

The percentage of the negotiated cost of your

prescription drug you pay after you have

finished paying your deductible. Your health

plan pays the rest. For example, you might

pay 10 percent of the negotiated drug cost.

The services, drugs and products covered by

your health benefits and health insurance

plan. This word is also used to describe your

health plan in general.

Brand-name drug

A drug that is marketed under a specific

trade name by a drug-maker. In most cases,

these drugs are still under patent protection.

This means that the drug-maker is the only

manufacturer of this medication.

Chronic condition

A condition that lasts or keeps coming back

over a long period of time. These conditions

may be treated with maintenance medications.

Coinsurance

Complex chronic condition

A chronic condition that may require you to

take specialty medications. Examples are

medications used to treat rheumatoid

arthritis and multiple sclerosis.

Copay/copayment

The dollar amount you pay for your

prescriptions after you have finished paying

your deductible. For example, your plan might

say that you pay $25 for brand-name drugs.

Aetna is the brand name used for products and services provided by one or more of

the Aetna group of subsidiary companies. The Aetna companies that offer, underwrite

or administer benefits coverage include: Aetna Health Inc., Aetna Health of California

Inc., Aetna Health Insurance Company of New York, Aetna Health Insurance Company

and/or Aetna Life Insurance Company (Aetna). In Maryland, by Aetna Health Inc., 151

Farmington Avenue, Hartford, CT 06156. Aetna Pharmacy Management refers to an

internal business unit of Aetna Health Management, LLC. Aetna Specialty Pharmacy

and Aetna Rx Home Delivery respectively refer to Aetna Specialty Pharmacy, LLC and

Aetna Rx Home Delivery, LLC which are subsidiaries of Aetna Inc. Each insurer has sole

financial responsibility for its own products.

Dependent

A family member who is covered by

your plan. It can be a child, spouse or

domestic partner.

Drug

A natural, live, or man-made ingredient

used to treat an illness. “Medication” is

another commonly used term.

Drug tiers

Tiers are coverage levels. Often, tiers

have different out-of-pocket costs.

Depending on your plan, you might see

the tiers grouped by generic, brandname, preferred or non-preferred drugs.

Exclusion

A drug, product or service that is not

covered by your plan.

�Flexible Spending Account (FSA)

Health Savings Account (HSA)**

Open enrollment

A way to set aside money to pay for your

health care or prescriptions while saving

money on taxes. Money is taken from your

paycheck and placed into a fund. You can

use the fund to pay for health care costs

throughout the plan year. FSAs have a time

limit. This means the money must be used in

the same plan year.

Part of a health plan that helps you pay for

prescriptions and other health care costs.

You and your employer can put money into

this account. Or you can save money in the

account for future health care costs. The

account grows interest.

The time period when you can make

choices about your health plan coverage

for the next year.

Formulary

Also known as the “Preferred Drug List.”

It is a list of medications preferred by Aetna

prescription benefit plans. The Preferred Drug

List is not a complete list of medications

covered under the benefit plan. Some benefit

plans may not cover certain medications on

this list, such as contraceptives, infertility

drugs and diabetic supplies.

Generic drug

A “copy” of a brand-name drug. It has the

same basic ingredients that a brand drug

does. Plus, the FDA has found that it is just

as safe and effective as the brand drug.

Generic drugs usually cost less than brand

drugs, which means you may save money

by choosing generics.

Health Reimbursement

Arrangement (HRA)*

Part of a health plan that gives you money to

pay for prescriptions and other health care

costs. Your employer puts money into a

fund. You can use the fund to pay out-ofpocket costs, like your copays, or

deductibles. Unused money is rolled over

and can be used in the next plan year.

ID card

The card you get that shows you are a

member when you join a health plan.

Show it to your pharmacist to access your

prescription drug benefits.

Limitations

Restrictions put into place based on the

coverage options chosen by the plan

sponsor. They define what the benefit plan

does or doesn’t cover or things that must be

done before something is covered.

Mail-order pharmacy

A convenient service that lets you get

medications through the mail. Aetna Rx

Home Delivery® is the name of Aetna’s

mail-order pharmacy. Often you can save

money by using a mail-order pharmacy.

Maintenance medications

Prescription drugs that are taken on a

regular basis. These drugs help treat chronic

conditions like high blood pressure.

Medicare Part D

A Medicare Prescription drug benefit.

*HRAs are currently not available to HMO members in IL and Small Group members in FL.

**HSAs are currently not available to HMO members in IL and CA.

Open formulary

A prescription benefits plan that

covers all eligible prescription drugs.

Out-of-pocket costs

Any costs that you must pay a portion

of for your health care. Copays,

coinsurances and deductibles are

examples.

Out-of-pocket maximum

A limit on the costs you must pay for

covered services after you meet your

deductible. Your plan pays 100 percent

of the costs of covered services for you

after you reach this amount. The limit

usually comes up yearly.

Over-the-counter drugs

Drugs that can be bought without a

prescription. They are not covered under

most prescription benefits plans. Aspirin,

ibuprofen, Prilosec OTC and cold

remedies are examples.

Participating pharmacy

A pharmacy that has a contract with

your health plan. You can use a

participating pharmacy to fill your

prescriptions.

�Pharmacy network

Specialty medications

Precertification

Each participating pharmacy belongs to a

pharmacy network. A network is a group of

pharmacies that has a contract with your health

plan. A network pharmacy provides services at

a special reduced rate for our members.

Drugs taken for complex chronic conditions

like rheumatoid arthritis or HIV. These drugs

are most often injected, given through an IV

or taken by mouth.

A process in which you must get prior

approval before certain drugs or services

are covered.

Prescription

Instructions given by a doctor or other

health care provider that directs the care for

a patient. Prescriptions may include direction

for the patient, caregiver, nurse, pharmacist

or other therapist.

Prescription drug

A drug that is regulated by the Food

and Drug Administration that requires

a prescription before it can be bought.

The term is used to separate it from

over-the-counter drugs, which don’t

require a prescription.

Retail pharmacy

A community pharmacy where you can

order and pick up prescription drugs.

Rx

A symbol that means “prescription” or

“pharmacy.”

These drugs can cost more and require more

monitoring than other types of drugs. And they

may not be available at retail pharmacies.

Specialty pharmacy*

A type of pharmacy that dispenses specialty

medications. Aetna Specialty Pharmacy® is

the name of Aetna’s specialty pharmacy. It

delivers specialty medications by mail and

offers in-depth patient support from a

team of nurses and pharmacists.

*� etna Specialty Pharmacy and the Specialty

A

Pharmacy Network may not be available to

California HMO members. Talk to your doctor

about the appropriate way to get the specialty

medications you need. Doctors may have

agreed to dispense and administer drugs to you

themselves. Or they may write a prescription so

you can fill them at any participating retail or

mail-order pharmacy you choose.

Quantity Limits

Limits placed on drugs so that they are

not taken in amounts that are higher

than recommended by medical

guidelines or the Food and Drug

Administration.

Step-therapy

With this program, trying one or more

prerequisite drugs is required before

other medications will be covered.

Therapeutic duplication

This happens when two drugs of the

same type are prescribed at the same

time. Rarely are two drugs from the

same category necessary to treat a

medical condition. Taking these drugs

at the same time may be harmful to

your health.

�Aetna terms

Aetna Formulary Exclusions List

Aetna Rx Home Delivery

The part of a prescription benefits and

insurance plan that names drugs that are

only covered if you have a medical exception.

Aetna’s mail-order pharmacy. Members may

be able to order up to a 90-day supply of

maintenance medications at a time.

Aetna Pharmacy Management

Aetna Specialty Pharmacy

The division that manages Aetna prescription

benefits and insurance plans.

Aetna Specialty Pharmacy is available for

members to fill their specialty medications. It

provides self-injectable, infused, compounded

and select oral drugs. Patients also get

in-depth support throughout their treatment.

Aetna Preferred Drug List

Also known as a “formulary.” This is a list of

medications preferred by Aetna prescription

benefit plans. The Preferred Drug List is not a

complete list of covered medications. Some

plans may not cover certain medications on

this list, such as contraceptives, infertility

drugs and diabetic supplies.

Secure Member Website

Visit www.aetna.com and log in to your

secure member website, Aetna Navigator®.

You’ll find tools and resources to help you

learn more about your pharmacy benefits

and claims.

�Pharmacy benefits in action

Pharmacy — the most accessed

health benefit

Chances are you use your pharmacy benefits

more than any other part of your health

plan. You may need to take medication every

day for high blood pressure. Or you may

need to pick up antibiotics for your child’s

ear infection. Either way, when medical

issues come up, you may need prescription

drugs. When this happens, you need to

consider a few things:

� hat should you know about these

W

medications before you get them

from a pharmacy?

■

� ow should you take your medication?

H

By mouth? Before bed? With food?

■

� hould you get your prescriptions through

S

the mail?

■

� hould you get a generic drug?

S

■

� re you paying the lowest possible cost?

A

■

As you can see, understanding how your

benefits work is important to know how

to get the most out of them.

What prescription drugs are

covered?

Many Aetna prescription drug plans offer

coverage based on our Preferred Drug List

(also known as a formulary). Depending

upon the benefit plan, the Preferred Drug

List may provide different levels of coverage

for preferred and non-preferred drugs. The

Preferred Drug List includes both generic

and brand-name drugs. The list is regularly

reviewed and may change in response to

new drugs to the market, medical guidelines

and information from the Food and Drug

Administration and drug-makers.

To see what your plan covers, log in to

www.aetna.com. Then look for Medication

Search. From there, you can enter the name

of a brand-name or generic drug. You can

see if your drug is covered, the tier your drug

is on and if a generic equivalent is available.

What should you do if your

doctor prescribes a medication

that isn’t covered by your plan

or is too costly?

When your doctor gives you a

prescription, ask him or her a few

questions about it.

■

� hat does this drug do?

W

■

�s it right for you?

I

■

� ould a generic be appropriate?

W

■

�s there a less costly alternative?

I

Choosing a medication on a lower tier

or a generic drug may help save you

money. If your plan has one, you may

want to bring a copy of your Aetna

Preferred Drug guide to your doctor’s

office. That way, you can see if the drug

is covered. Ultimately, decisions about

your care are up to you and your doctor.

Are generic drugs right for me?

Generic drugs can help you get more

for your health care dollars. They are

generally less expensive than brandname drugs, but they do the same job.

That’s why we encourage you and your

doctor to consider generic medications

whenever possible.

Generic drugs are approved by the FDA

to be as safe and effective as their

brand-name counterparts. They have

the same active ingredients in the same

dose. The difference is that they may be

another size or color.

�What do I have to do at the

pharmacy to get the generic

version of a drug?

Most pharmacies can substitute a generic

drug for a brand-name drug. In fact, many

will make the switch automatically, unless

your state law says they can’t.

However, your doctor may have written

“DAW” on your prescription. This stands for

“dispense as written.” It means that the

pharmacy can’t give you a generic drug

instead of a brand-name one without calling

your doctor. Your doctor may do this if he or

she believes that the generic medication is

not right for you.

How can I find out how much a drug

will cost?

Most people like to know how much their

medication is going to cost them before they

get to the pharmacy. If you have Internet

access, you can use our Price-A-DrugSM tool

on your secure member website to find out

your estimated medication costs. Log in at

www.aetna.com and click on “Prescription

Drug Costs”. From there, enter the name of

your prescription and your dose. The tool

will also show you how much you could save

by using our mail-order pharmacy.

If you don’t have access to the Internet, you

can always call Member Services. The

toll-free number is on your Aetna ID card.

How do I start using Aetna Rx Home

Delivery?

There are a few ways to get

started:

Aetna Rx Home Delivery is a convenient,

cost-effective way to get your medications

through the mail. And it might be part of

your plan. To start taking advantage of

Aetna Rx Home Delivery, just follow these

easy steps:

■

� ill out a Patient Profile Form. Then

F

send it in along with your prescription.

Visit www.AetnaSpecialtyRx.com

and click “Enroll” to access this form

and directions to submit it; or

■

� sk your doctor to fill out a

A

Medication Request form. Then ask

him or her to fax it with your

prescription to 1-866-FAX-ASRX

(1-866-329-2779). Doctors can visit

www.AetnaSpecialtyPharmacy.com

and click “Find our forms” to access the

needed form; or

■

� o transfer a prescription to Aetna

T

Specialty Pharmacy, have your current

pharmacy call our pharmacy toll-free

at 1-866-782-2779. Or, ask your

doctor to call or fax in your specialty

prescriptions to us.

� tep 1: Ask your doctor for a prescription

S

for each maintenance medication you or a

family member is taking (typically a 90-day

supply).

■

� tep 2: Complete and mail an order form

S

and new patient registration form, along

with your new prescriptions and method

of payment, to Aetna Rx Home Delivery.

■

� r: Have your doctor fax your prescriptions

O

to Aetna Rx Home Delivery.

■

For forms, mailing information and telephone

numbers, please go to www.aetna.com

and log in to your secure member website,

Aetna Navigator. Or call Member Services

toll-free at the number on your Aetna ID card.

How do I start using Aetna Specialty

Pharmacy?

If your plan includes Aetna Specialty

Pharmacy, you can get specialty medications

through the mail. You can also get support

from nurses and pharmacists for your

complex condition 24 hours a day, 7 days a

week.

What online tools can I use to

manage my prescription drug

benefits?

Your secure member website has many

different tools to use to take care of

your family’s prescription drug needs:

■

� enefits Summary Look through

B

—

your prescription benefits to find out

what’s covered.

� laim Search — Locate drug claims

C

and cost information in one place.

■

� rice-A-Drug — Find cost

P

information with just a few clicks.

■

� edication Search — Look up

M

coverage information about your drug.

■

� ind A Pharmacy — Enter your ZIP

F

code to find a participating pharmacy

near you.

■

� martSourceSM — Find personalized

S

information about your conditions,

treatments and costs.

■

�The term precertification means the utilization review process used to determine whether the

requested service, procedure, prescription drug or medical device meets Aetna’s clinical criteria for

coverage. It does not mean precertification as defined by Texas law, as a reliable representation of

payment of care or services to fully insured HMO and PPO members. Step-therapy and precertification

may not apply in all service areas. For example, step-therapy and precertification programs do not

apply to fully insured members in Indiana. Step-therapy is also not available for fully funded groups

in New Jersey. California HMO members who are receiving coverage for medications that are added

to the precertification or step-therapy lists will continue to have those medications covered for as

long as the treating physician continues prescribing them, provided that the drug is appropriately

prescribed and is considered safe and effective for treating the enrollee’s medical condition.

This material is for information only and is not an offer or invitation to contract. Health benefits

and health insurance plans contain exclusions and limitations. Aetna Rx Home Delivery and

Aetna Specialty Pharmacy refer to Aetna Rx Home Delivery, LLC and Aetna Specialty Pharmacy,

LLC respectively. Aetna Rx Home Delivery and Aetna Specialty Pharmacy are licensed pharmacy

subsidiaries of Aetna Inc. that operate through mail order. Aetna HealthFund HRAs are subject

to employer-defined use and forfeiture rules and are unfunded liabilities of your employer. Fund

balances are not vested benefits. Investment services are independently offered through JPMorgan

Institutional Investors, Inc., a subsidiary of JPMorgan Chase Bank. For Small Group, investments are

independently offered through HealthEquity, Inc. Aetna receives rebates from the manufacturers of

many drugs, including many that are on the Preferred Drug List. These rebates do not reduce the

amount you pay for an individual prescription drug. However, they help control the overall costs

of prescription drug coverage. Your pharmacy benefit provides coverage for many drugs that are

not on this list. Also, in some cases, if you need to pay a percentage of the cost of the drug or an

amount to meet a deductible, your costs may be higher for a “preferred drug” than they would be

for a “non-preferred drug.” You can find out more about the terms and limitations on your plan by

reading your plan documents. You can also contact Member Services.

Policy forms issued in OK include: HMO OK COC-5 09/07, HMO/OK GA-3 11/01, HMO OK POS

RIDER 08/07, GR-23 and/or GR-29/Gr-29N.

Information is believed to be accurate as of the production date. However, it is subject to change.

For more information about Aetna plans, refer to www.aetna.com.

05.03.376.1 A (9/10)

©2010 Aetna Inc.

�

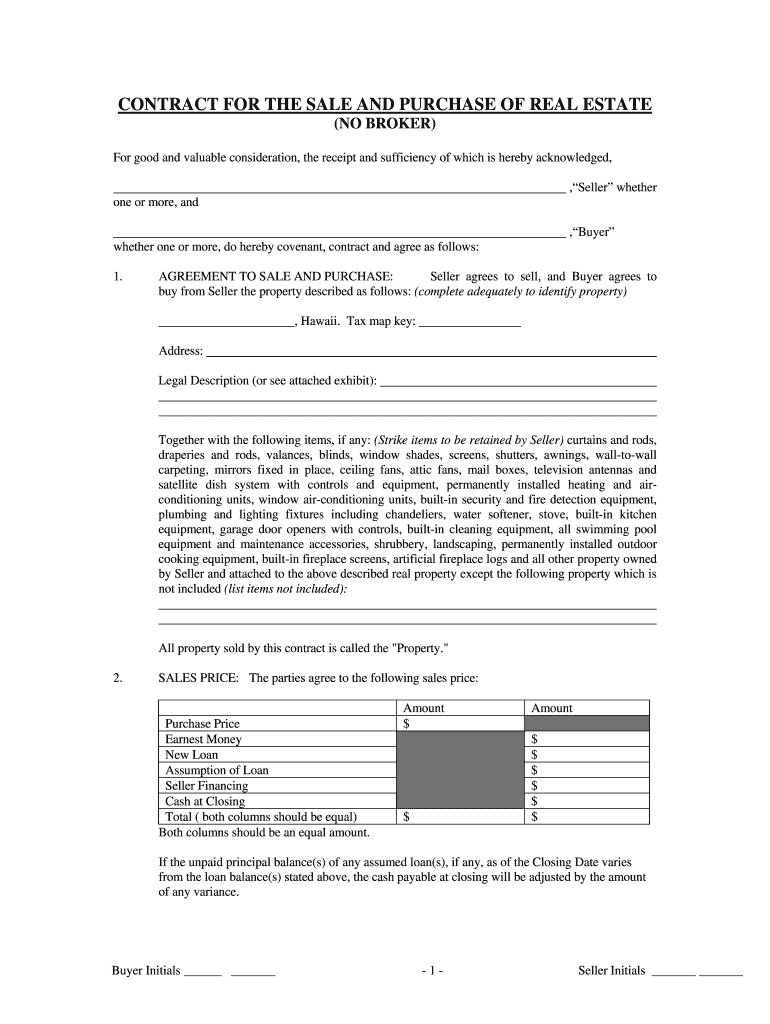

Useful tips on finishing your ‘Sale Land Agreement Form For Hawaii’ online

Are you fed up with the burden of handling documents? Look no further than airSlate SignNow, the premier eSignature solution for individuals and small to medium-sized businesses. Bid farewell to the tedious routine of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Leverage the comprehensive tools available in this user-friendly and affordable platform and transform your method of document management. Whether you need to authorize forms or gather signatures, airSlate SignNow manages it all effortlessly, with just a few clicks.

Follow this detailed guide:

- Sign in to your account or sign up for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form library.

- Access your ‘Sale Land Agreement Form For Hawaii’ in the editor.

- Click Me (Fill Out Now) to set up the document on your end.

- Add and allocate fillable fields for others (if necessary).

- Continue with the Send Invite options to request eSignatures from others.

- Download, print your version, or convert it into a reusable template.

Don’t be concerned if you need to collaborate with your colleagues on your Sale Land Agreement Form For Hawaii or send it for notarization—our platform provides all you require to achieve such tasks. Register with airSlate SignNow today and enhance your document management to new levels!