Can I Sign Delaware Banking Profit And Loss Statement

Contact Sales

Make the most out of your eSignature workflows with airSlate SignNow

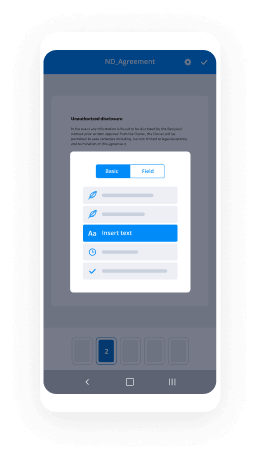

Extensive suite of eSignature tools

Discover the easiest way to Sign Delaware Banking Profit And Loss Statement with our powerful tools that go beyond eSignature. Sign documents and collect data, signatures, and payments from other parties from a single solution.

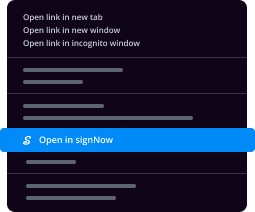

Robust integration and API capabilities

Enable the airSlate SignNow API and supercharge your workspace systems with eSignature tools. Streamline data routing and record updates with out-of-the-box integrations.

Advanced security and compliance

Set up your eSignature workflows while staying compliant with major eSignature, data protection, and eCommerce laws. Use airSlate SignNow to make every interaction with a document secure and compliant.

Various collaboration tools

Make communication and interaction within your team more transparent and effective. Accomplish more with minimal efforts on your side and add value to the business.

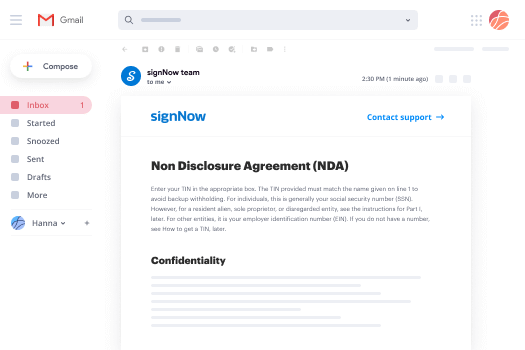

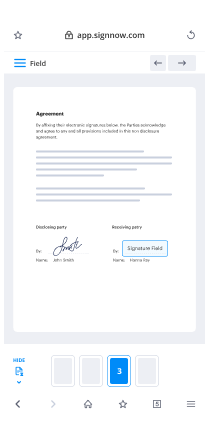

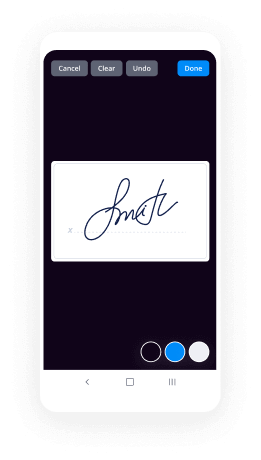

Enjoyable and stress-free signing experience

Delight your partners and employees with a straightforward way of signing documents. Make document approval flexible and precise.

Extensive support

Explore a range of video tutorials and guides on how to Sign Delaware Banking Profit And Loss Statement. Get all the help you need from our dedicated support team.

Industry sign banking alaska profit and loss statement mobile

Keep your eSignature workflows on track

Make the signing process more streamlined and uniform

Take control of every aspect of the document execution process. eSign, send out for signature, manage, route, and save your documents in a single secure solution.

Add and collect signatures from anywhere

Let your customers and your team stay connected even when offline. Access airSlate SignNow to Sign Delaware Banking Profit And Loss Statement from any platform or device: your laptop, mobile phone, or tablet.

Ensure error-free results with reusable templates

Templatize frequently used documents to save time and reduce the risk of common errors when sending out copies for signing.

Stay compliant and secure when eSigning

Use airSlate SignNow to Sign Delaware Banking Profit And Loss Statement and ensure the integrity and security of your data at every step of the document execution cycle.

Enjoy the ease of setup and onboarding process

Have your eSignature workflow up and running in minutes. Take advantage of numerous detailed guides and tutorials, or contact our dedicated support team to make the most out of the airSlate SignNow functionality.

Benefit from integrations and API for maximum efficiency

Integrate with a rich selection of productivity and data storage tools. Create a more encrypted and seamless signing experience with the airSlate SignNow API.

Collect signatures

24x

faster

Reduce costs by

$30

per document

Save up to

40h

per employee / month

Our user reviews speak for themselves

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

A smarter way to work: —how to industry sign banking integrate

Trusted esignature solution— what our customers are saying

be ready to get more

Get legally-binding signatures now!

Related searches to Can I Sign Delaware Banking Profit And Loss Statement

Frequently asked questions

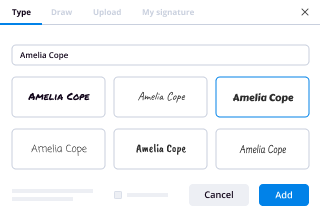

How do you make a document that has an electronic signature?

How do you make this information that was not in a digital format a computer-readable document for the user? "

"So the question is not only how can you get to an individual from an individual, but how can you get to an individual with a group of individuals. How do you get from one location and say let's go to this location and say let's go to that location. How do you get from, you know, some of the more traditional forms of information that you are used to seeing in a document or other forms. The ability to do that in a digital medium has been a huge challenge. I think we've done it, but there's some work that we have to do on the security side of that. And of course, there's the question of how do you protect it from being read by people that you're not intending to be able to actually read it? "

When asked to describe what he means by a "user-centric" approach to security, Bensley responds that "you're still in a situation where you are still talking about a lot of the security that is done by individuals, but we've done a very good job of making it a user-centric process. You're not going to be able to create a document or something on your own that you can give to an individual. You can't just open and copy over and then give it to somebody else. You still have to do the work of the document being created in the first place and the work of the document being delivered in a secure manner."

How do you write and sign on a pdf?

(I know this is an old question on the internet, but I'm not sure where else to ask.) I'd be interested in learning what you use."

This question is actually a bit more complicated than it looks. I'd actually start with this one: What's the best way to get your book published? And in order to get your book published, what are the different ways?

Let's start with what the authors do.

What's the best way to get your book published?

There are two ways to get your book published:

Publishing your book through a traditional publisher

Publication through a self-publishing service

These services are pretty different in what they offer.

Traditional Publishers

Traditional publishing is a publishing technique that has been in place for hundreds of years. Traditional publishing is an industry that produces books, usually for a fee. The main difference between the two types of publishing methods is their approach to book marketing.

Traditional publishing methods focus on selling books directly to bookstores, which will usually be the first place a book will be sold.

Traditional publishers tend to charge less than self-publishing services, and their marketing strategies tend to be geared towards marketing the book to bookstores.

Traditional publishers will take a lot more time and effort to develop their book marketing strategies than a self-publishing service will have. They will often be trying to sell their book through traditional channels before any direct-to-store marke...

How to obtain an electronic signature from my client?

If your contract is in a document called a "contract for services", then you must provide your client with an electronic signature in order to enforce the contract. Your contract should include a "legal signature", a legal document that has been written to the specifications in the Code of Civil Procedure. You need a legal signature to legally bind your client to a contract. The signature will be in legible lettering, which must be no less than 8 points. It should be written on legal stationery, printed on paper with ink, and signed by the person named on the paper.

Your legal signature should be legible. For example, if you sign your contract "Jane Smith", then the words "Jane Smith (Signature)" should be legible in the presence of a person who is at least 8 years of age and familiar with the English language. If you are signing electronically, use a computer program which automatically types characters at the bottom left and right corners of the paper to print the signatures.

You must write your client's legal signature on the back of the contract. However, since your contract is in a "contract for services" form, you do not have to supply an original signature in this form. The signature may be printed on the back or printed directly on the computer printed document, if the signature is legible.

If you are signing electronically, you should print a copy of the signature and place it on the side of the original contract, in an area which will not be visible to the pers...

Get more for Can I Sign Delaware Banking Profit And Loss Statement

- How Do I Electronic signature Wisconsin Legal LLC Operating Agreement

- Electronic signature Colorado Real Estate Business Letter Template Easy

- Help Me With Electronic signature Wisconsin Legal LLC Operating Agreement

- How Can I Electronic signature Wisconsin Legal LLC Operating Agreement

- Electronic signature Wisconsin Legal LLC Operating Agreement Free

- Can I Electronic signature Wisconsin Legal LLC Operating Agreement

- Electronic signature Colorado Real Estate Business Letter Template Safe

- Electronic signature Wisconsin Legal LLC Operating Agreement Secure

Find out other Can I Sign Delaware Banking Profit And Loss Statement

- Maryland property management package maryland form

- Maryland annual form

- Maryland bylaws corporation form

- Md professional corporation form

- Maryland a corporation form

- Sample transmittal letter for articles of incorporation maryland form

- New resident guide maryland form

- Satisfaction release or cancellation of deed of trust by corporation maryland form

- Md cancellation 497310593 form

- Maryland satisfaction certificate form

- Maryland deed trust 497310595 form

- Partial release of property from deed of trust for corporation maryland form

- Partial release of property from deed of trust for individual maryland form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy maryland form

- Warranty deed for parents to child with reservation of life estate maryland form

- Warranty deed for separate or joint property to joint tenancy maryland form

- Warranty deed to separate property of one spouse to both spouses as joint tenants maryland form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries maryland form

- Warranty deed from limited partnership or llc is the grantor or grantee maryland form

- Maryland trustee form