Can I Sign New York Banking PPT

Contact Sales

Make the most out of your eSignature workflows with airSlate SignNow

Extensive suite of eSignature tools

Discover the easiest way to Sign New York Banking PPT with our powerful tools that go beyond eSignature. Sign documents and collect data, signatures, and payments from other parties from a single solution.

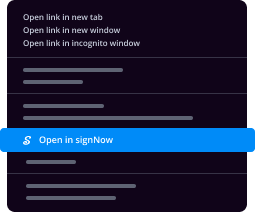

Robust integration and API capabilities

Enable the airSlate SignNow API and supercharge your workspace systems with eSignature tools. Streamline data routing and record updates with out-of-the-box integrations.

Advanced security and compliance

Set up your eSignature workflows while staying compliant with major eSignature, data protection, and eCommerce laws. Use airSlate SignNow to make every interaction with a document secure and compliant.

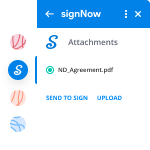

Various collaboration tools

Make communication and interaction within your team more transparent and effective. Accomplish more with minimal efforts on your side and add value to the business.

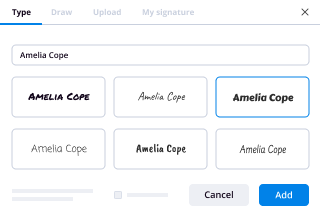

Enjoyable and stress-free signing experience

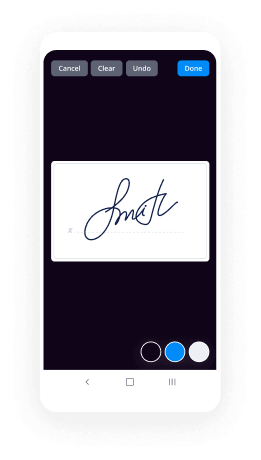

Delight your partners and employees with a straightforward way of signing documents. Make document approval flexible and precise.

Extensive support

Explore a range of video tutorials and guides on how to Sign New York Banking PPT. Get all the help you need from our dedicated support team.

Industry sign banking california ppt now

Keep your eSignature workflows on track

Make the signing process more streamlined and uniform

Take control of every aspect of the document execution process. eSign, send out for signature, manage, route, and save your documents in a single secure solution.

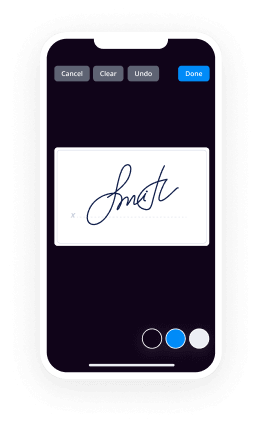

Add and collect signatures from anywhere

Let your customers and your team stay connected even when offline. Access airSlate SignNow to Sign New York Banking PPT from any platform or device: your laptop, mobile phone, or tablet.

Ensure error-free results with reusable templates

Templatize frequently used documents to save time and reduce the risk of common errors when sending out copies for signing.

Stay compliant and secure when eSigning

Use airSlate SignNow to Sign New York Banking PPT and ensure the integrity and security of your data at every step of the document execution cycle.

Enjoy the ease of setup and onboarding process

Have your eSignature workflow up and running in minutes. Take advantage of numerous detailed guides and tutorials, or contact our dedicated support team to make the most out of the airSlate SignNow functionality.

Benefit from integrations and API for maximum efficiency

Integrate with a rich selection of productivity and data storage tools. Create a more encrypted and seamless signing experience with the airSlate SignNow API.

Collect signatures

24x

faster

Reduce costs by

$30

per document

Save up to

40h

per employee / month

Our user reviews speak for themselves

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

A smarter way to work: —how to industry sign banking integrate

Trusted esignature solution— what our customers are saying

be ready to get more

Get legally-binding signatures now!

Related searches to Can I Sign New York Banking PPT

Frequently asked questions

How do i add an electronic signature to a word document?

When a client enters information (such as a password) into the online form on , the information is encrypted so the client cannot see it. An authorized representative for the client, called a "Doe Representative," must enter the information into the "Signature" field to complete the signature.

How to difitally sign pdf with touchscree?

This feature should be available on the new Mac OS X version aswell.

Thank you for all the time you have for testing this version.

Please let me know if you encounter any issue

How to electronically sign a locked pdf?

To sign a pdf in electronic form, you need to use a program that allows you to enter a password and to use a computer to convert the page into a format that can be opened by a PDF reader.

What is Adobe Acrobat?

Adobe Acrobat is a software program for converting and reading Adobe document(s). It is a free software that is included with a number of commercial software packages.

It is important that your pdf reader has this software. If you have problems reading pdf files, read this: How PDF files can cause problems for computers.

How to get Adobe Acrobat?

There are a number of places that you can get it:

Download it for the latest available version.

You may also be able to obtain it from Adobe's download center. Download it for the latest available version. You may also be able to obtain it from Adobe's download center.

You can purchase it on the Adobe site. Adobe has a number of programs on sale that may be useful for converting and reading Acrobat files.

Is it possible to download PDF files without Adobe Acrobat?

It is possible, although there are some problems when trying to do this. If you try to read pdf files without Adobe Acrobat it will most likely not work. However, PDF files that you have downloaded and saved in your web browser can be read without Adobe Acrobat. Read more on this topic: The differences between ePub and PDF files.

Adobe Acrobat and Microsoft Office

If you are using Microsoft Office or some other Office software, the file format used m...

Get more for Can I Sign New York Banking PPT

- Sign New York Charity Business Plan Template Easy

- Sign New York Charity Business Plan Template Safe

- Sign New Mexico Charity Letter Of Intent Easy

- How To Sign New York Charity Business Plan Template

- Sign New Mexico Charity Letter Of Intent Safe

- Sign New Mexico Charity Agreement Online

- Sign New Mexico Charity Agreement Computer

- Sign New Mexico Charity Agreement Mobile

Find out other Can I Sign New York Banking PPT

- State real property report maryland department of planning planning maryland form

- Maybe you should use python form

- Suny cortland application cortland form

- Price gouging is good for us limitedgovernment form

- Application instructions for doing business in china an emerging www2 binghamton form

- Sas documentation form

- State immigration laws add to employers39 hiring burdens form

- Important reset form

- Authorization for use or disclosure of patient health information

- Invention summary and confidential non abc news form

- Authorization to disclose protected health information use this form to authorize tufts health plan to use or disclose your

- 825 5th st humboldt courts ca form

- Team industries inc form

- Chapter two general provisions and distribution of lasuperiorcourt form

- Contract and grant disclosure and certification form procurement uark

- Authorization for disclosure of health information health msstate

- Medical release form csu chico csuchico

- Access request blue cross and blue shield of minnesota form

- Download application pdf transbay center transbaycenter form

- Full legal name coverageforall form