eSign Refund Alternative. Use eSignature Tools that Work Where You Do.

Get the powerful eSignature capabilities you need from the company you trust

Choose the pro platform made for professionals

Whether you’re introducing eSignature to one department or across your entire business, this process will be smooth sailing. Get up and running swiftly with airSlate SignNow.

Set up eSignature API quickly

airSlate SignNow is compatible the applications, services, and devices you currently use. Effortlessly integrate it right into your existing systems and you’ll be productive instantly.

Collaborate better together

Increase the efficiency and output of your eSignature workflows by providing your teammates the capability to share documents and templates. Create and manage teams in airSlate SignNow.

E sign refund, in minutes

Go beyond eSignatures and e sign refund. Use airSlate SignNow to negotiate contracts, collect signatures and payments, and automate your document workflow.

Decrease the closing time

Eliminate paper with airSlate SignNow and minimize your document turnaround time to minutes. Reuse smart, fillable form templates and deliver them for signing in just a few minutes.

Maintain important data safe

Manage legally-binding eSignatures with airSlate SignNow. Run your business from any place in the world on virtually any device while maintaining top-level security and conformity.

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Keep contracts protected

Enhance your document security and keep contracts safe from unauthorized access with dual-factor authentication options. Ask your recipients to prove their identity before opening a contract to e sign refund.

Stay mobile while eSigning

Install the airSlate SignNow app on your iOS or Android device and close deals from anywhere, 24/7. Work with forms and contracts even offline and e sign refund later when your internet connection is restored.

Integrate eSignatures into your business apps

Incorporate airSlate SignNow into your business applications to quickly e sign refund without switching between windows and tabs. Benefit from airSlate SignNow integrations to save time and effort while eSigning forms in just a few clicks.

Generate fillable forms with smart fields

Update any document with fillable fields, make them required or optional, or add conditions for them to appear. Make sure signers complete your form correctly by assigning roles to fields.

Close deals and get paid promptly

Collect documents from clients and partners in minutes instead of weeks. Ask your signers to e sign refund and include a charge request field to your sample to automatically collect payments during the contract signing.

Collect signatures

24x

faster

Reduce costs by

$30

per document

Save up to

40h

per employee / month

Our user reviews speak for themselves

be ready to get more

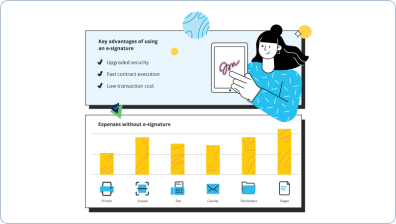

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your step-by-step guide — e sign refund

Trying to find eSign refund check out the friendly and innovative airSlate SignNow features. Generate effective corporate contracts, work together far better on work groups, manage and store all enterprise information in a single guaranteed location. Put your employees in motion, wherever you are, gain access to docs from any operating system any time you need it.

Here?s how straightforward it is to get started on using airSlate SignNow:

- Set your account to initialize your free trial version.

- Obtain access to the whole suite of tools. Evaluate with eSign refund.

- Select a plan to use our eSignature solution risk-free.

- Build anything from basic questionnaires to complex agreements and payment forms.

- Start out with a empty page or customizable e-template, easily modify text.

- Get teammates to team up on files speedier.

- Provide better eSignature tools to your clients and partners.

- Improve and simplify eSignature workflows.

Discover more about airSlate SignNow?s potential, get ideas and professional guidance. Know the pros of eSign refund alternative. An enterprise-class solution developed to supply safety and scalability throughout a company, that enables you to work with calm. Take advantage of the comprehensive power over your organization.

How it works

Upload a document

Edit & sign it from anywhere

Save your changes and share

airSlate SignNow features that users love

See exceptional results eSign refund alternative. Use eSignature Tools that Work Where You Do.

be ready to get more

Get legally-binding signatures now!

FAQs

-

Can you e sign your tax return?

Taxpayers, who currently use Forms 8878 or 8879 to sign electronic Forms 1040 federal tax returns or filing extensions, can use an eSignature to sign and electronically submit these forms to their Electronic Return Originator (ERO). -

How do I Esign a tax return?

You can sign your tax return electronically by using a Self-Select PIN, which serves as your digital signature when using tax preparation software, or a Practitioner PIN when using an Electronic Return Originator (ERO). Self-Select PIN - Use the Self-Select PIN method when you're using tax preparation software. -

How do I electronically sign a tax return?

You can sign your tax return electronically by using a Self-Select PIN, which serves as your digital signature when using tax preparation software, or a Practitioner PIN when using an Electronic Return Originator (ERO). Self-Select PIN - Use the Self-Select PIN method when you're using tax preparation software. -

How do I sign my tax return?

Be signed by at least one of the tax filers. The signature must be on the line on the tax return designated for the signature of the tax filer. Or, include the tax preparer's stamped, typed, signed, or printed name and SSN, EIN (Employer Identification Number), or PTIN (Preparer Tax Identification Number). -

What happens if I didn't sign my tax return?

No there isn't a way to correct it, a printed and mailed federal tax return without a signature will be returned by the IRS to the address shown on the tax return. You will need to wait until the IRS mails it back to you to sign the tax return and mail back to the IRS. -

How do you electronically sign a form?

Suggested clip How to digitally sign a document | airSlate SignNow Document Cloud - YouTubeYouTubeStart of suggested clipEnd of suggested clip How to digitally sign a document | airSlate SignNow Document Cloud - YouTube -

Do I need to sign my tax return if IE file?

If you e-file your return: If your return is accepted and you signed with a PIN, you're done. You don't need to mail anything else. If your return is accepted and you chose to use an IRS signature form (Form 8453-OL), you need to sign and mail this form. -

Do tax returns have to have original signatures?

Even then, it is between the taxpayer and IRS, the preparer does not need an original signed copy (or any signed copy) of an airSlate SignNow filed return. ... An original signature, made by the taxpayer, is required below the jurat (perjury statement) and within the box "airSlate SignNow" area of the return. -

What qualifies as a signed tax return?

What qualifies as a 'signed' tax return? To qualify as a 'signed tax return' the document must either: Be signed by at least one of the tax filers. ... Or, include the tax preparer's stamped, typed, signed, or printed name and SSN, EIN (Employer Identification Number), or PTIN (Preparer Tax Identification Number). -

What happens if I forgot to sign my tax return?

If you submitted your return without signing it, all is not lost. In all likelihood, the IRS will simply send you a letter requesting your signature. And once they receive your signature, they'll go ahead and process your return. ... If you choose not to do this, then you will have to complete and sign IRS Form 8453. -

Can you electronically sign your tax return?

Taxpayers, who currently use Forms 8878 or 8879 to sign electronic Forms 1040 federal tax returns or filing extensions, can use an eSignature to sign and electronically submit these forms to their Electronic Return Originator (ERO). -

What does a signed tax return look like?

If you need a "signed" copy of your printed tax return, you pick up a blue or black pen and sign it near the bottom by that rather large black arrow next to the words, "airSlate SignNow." -

How do I get a signed copy of my tax return?

Order online. They can use the Get Transcript tool on IRS.gov. ... Order by mail. Taxpayers can use Get Transcript by Mail or call 800-908-9946 to order a tax return transcripts and tax account transcripts. Complete and send either 4506-T or 4506T-EZ to the IRS. -

Does signature on tax return have to be original?

An original signature, made by the taxpayer, is required below the jurat (perjury statement) and within the box "airSlate SignNow" area of the return. Exception: Accept a taxpayer's signature elsewhere on the return, if the taxpayer himself or herself has arrowed their signature to the appropriate area. -

How do I know if my tax return was filed?

Find out if Your Tax Return Was Submitted Using the IRS Where's My Refund tool. Calling the IRS at 1-800-829-1040 (Wait times to speak to a representative may be long.) Viewing your IRS account information. Looking for emails or status updates from your e-filing website or software. -

Does the IRS allow electronic signatures?

The IRS accepts electronic signatures from airSlate SignNow Apply your new electronic signature to IRS forms. Minimize printing, signing, and mailing. -

Can Form 2553 be signed electronically?

Can Form 2553 be filed electronically? A corporation can file Form 2553 after the due date and still receive IRS approval to make the election retroactive to the beginning of the corporation's tax year. ... But first, the corporation must make sure that it is eligible to make a late election. -

Can you electronically sign tax forms?

Taxpayers, who currently use Forms 8878 or 8879 to sign electronic Forms 1040 federal tax returns or filing extensions, can use an eSignature to sign and electronically submit these forms to their Electronic Return Originator (ERO). -

Can Form 8821 be electronically signed?

If you complete Form 8821 for electronic signature authorization, do not file a Form 8821 with the IRS. Instead, give it to your appointee, who will retain the document. ... The copy of the tax information authorization must have a current signature and date of the taxpayer under the original signature on line 7. -

Can you amend Form 2553?

The corporation must have an IRS Form 2553 on file for election to be an S corporation. ... Use the same form as you used to file the original S corporation tax return, making certain that you have the correct year. Complete the basic information for the year covered and check box H(4) for an amended return.

What active users are saying — e sign refund

Frequently asked questions

How do I eSign a document before sending it?

airSlate SignNow allows document authors to eSign before sending it and even add signature fields for recipients if needed. Just upload your file, open it and create respective signature fields: My Signature to self sign a document and Signature Field to collect signatures. For self signing, you’ll need to generate your own eSignature. To do so, just apply the My Signature element and follow the instructions and either type, draw, or upload your signature. Once you like what you’ve generated, click Sign. After that, assign signature fields to recipients, add their emails, send it out and wait. Once everyone has signed, airSlate SignNow will automatically send each party an executed PDF copy.

How do I add an electronic signature to a PDF in Google Chrome?

Sign documents right from your browser using the airSlate SignNow extension for Chrome. Upload a PDF and add information to it. Keep in mind, airSlate SignNow doesn’t use digital signatures, it uses electronic signatures. Manage your deals online without printing or scanning. In addition, because airSlate SignNow is cloud-based, you can log into your account from any device and still have access to all of your documents.

How do I sign a PDF from my email?

airSlate SignNow provides powerful add-ons so that you can conveniently sign documents right from your Gmail inbox. With the help of the Gmail add-on, you can eSign attachments without leaving your inbox. Find the application in the G Suite Marketplace and add it. Once you’ve added it, log in to your airSlate SignNow account and open the message containing an attachment that you need to sign. Click on the airSlate SignNow icon in the right-hand sidebar menu and choose the attachment you want to sign. Quickly apply your eSignature in the editor and save or send the document to recipients.

Get more for e sign refund

- AirSlate SignNow's Customer relationship management vs. Close CRM for Accounting and Tax

- AirSlate SignNow's Customer relationship management vs. Close CRM for Communications & Media

- AirSlate SignNow's Customer relationship management vs. Close CRM for Construction Industry

- AirSlate SignNow's Customer relationship management vs. Close CRM for Financial Services

- AirSlate SignNow's Customer relationship management vs. Close CRM for Government

- AirSlate SignNow's Customer relationship management vs. Close CRM for Healthcare

- AirSlate SignNow's Customer relationship management vs. Close CRM for Higher Education

- AirSlate SignNow's Customer relationship management vs. Close CRM for Insurance Industry

The ins and outs of eSignature

Are eSignatures legally binding?

Learn out criteria for legally binding signatures

What is the difference between a user and a sender in airSlate SignNow?

Learn different ways for sending out documents in airSlate SignNow, inviting multiple signers, and tracking status of the documents.

A Detailed Guide on How to Sign a PDF Online in airSlate SignNow

Doing business digitally is the only way to increase the efficiency of your signature workflows. Learn how to edit and sign a PDF right from your airSlate SignNow account.

Find out other e sign refund

- Boost Your Procurement with Legitimate eSignatures in ...

- Unlock eSignature Legitimateness for Logistics in ...

- Ensuring Digital Signature Legality for Support in ...

- The Definitive Guide to Digital Signature Legality for ...

- Ensuring the Legality of Digital Signatures for ...

- Unlock the Power of Digital Signature Legality for ...

- Digital Signature Legality for Quality Assurance in ...

- Digital Signature Legitimacy for Procurement in United ...

- Unlock Digital Signature Legitimateness for Procurement ...

- Electronic Signature Legality for IT in Canada - ...

- Unlocking the Power of Electronic Signature Legality ...

- Electronic Signature Legality for Sales in United ...

- Electronic Signature Legality for Quality Assurance in ...

- Unlock the Power of Electronic Signature Lawfulness for ...

- Unlock Electronic Signature Legitimacy for Accounting ...

- Boost Sales with Electronic Signature Legitimateness in ...

- Electronic Signature Legitimateness for Logistics in ...

- Unlock Electronic Signature Legitimateness for ...

- Unlock the Power of Online Signature Legality for ...

- Enhance Online Signature Lawfulness for Technical ...