Redline Term Sheet Template with airSlate SignNow

Do more on the web with a globally-trusted eSignature platform

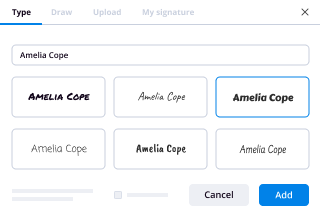

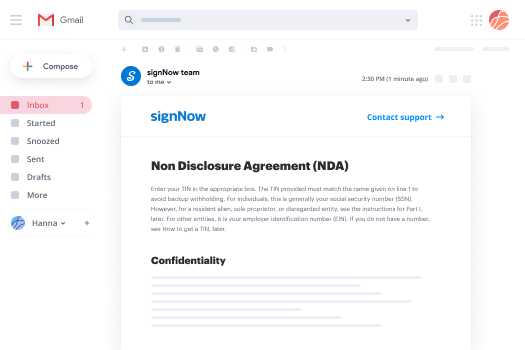

Remarkable signing experience

Robust reports and analytics

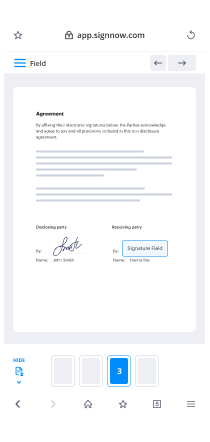

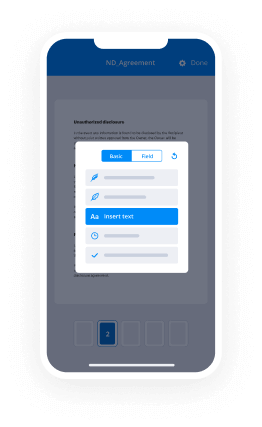

Mobile eSigning in person and remotely

Industry polices and compliance

Redline term sheet template, quicker than ever

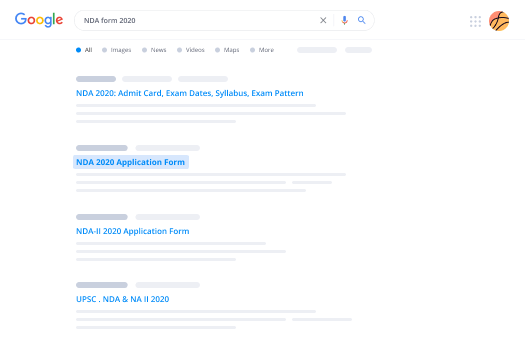

Useful eSignature add-ons

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

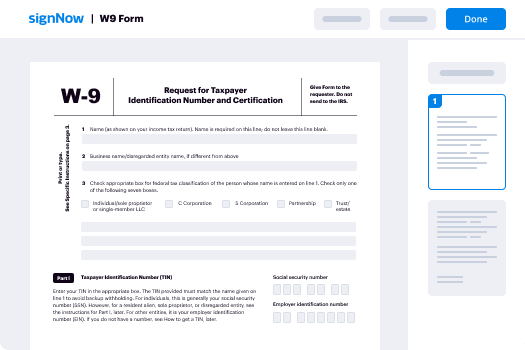

Your step-by-step guide — redline term sheet template

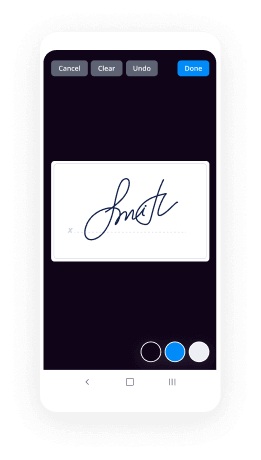

Adopting airSlate SignNow’s electronic signature any company can increase signature workflows and sign online in real-time, providing an improved experience to consumers and staff members. redline Term Sheet Template in a couple of easy steps. Our mobile apps make operating on the go possible, even while offline! Sign signNows from any place in the world and close up tasks in no time.

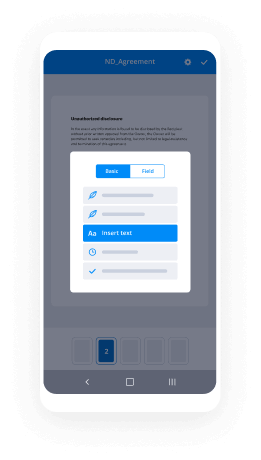

Keep to the walk-through guide to redline Term Sheet Template:

- Log in to your airSlate SignNow profile.

- Find your record in your folders or upload a new one.

- Open up the document and edit content using the Tools menu.

- Place fillable boxes, add textual content and eSign it.

- Add numerous signees via emails and set up the signing sequence.

- Choose which users will get an signed version.

- Use Advanced Options to restrict access to the document and set an expiration date.

- Click Save and Close when finished.

Additionally, there are more innovative functions available to redline Term Sheet Template. List users to your collaborative digital workplace, view teams, and keep track of teamwork. Millions of people all over the US and Europe concur that a system that brings everything together in one holistic workspace, is what enterprises need to keep workflows working easily. The airSlate SignNow REST API allows you to integrate eSignatures into your application, website, CRM or cloud. Check out airSlate SignNow and enjoy faster, easier and overall more efficient eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results redline Term Sheet Template with airSlate SignNow

Get legally-binding signatures now!

FAQs

-

How do you redline a document?

Redlining a document involves marking changes or revisions made to a document typically using a red or colored pen to highlight the changes made. This is often done in legal or business documents to track changes made by multiple parties. -

What does it mean to redline a contract?

Redlining a contract refers to the act of marking off any clauses or terms within a legal document that are not acceptable and need to be removed or amended before the final signing process. airSlate SignNow is an innovative electronic signature solution that helps businesses increase productivity while streamlining document workflows. With features like flexible signing options, audit trails, and automated reminders, users can save time, impress customers, and maximize their ROI with ease. airSlate SignNow's user-friendly interface makes it the perfect choice for SMBs and mid-market businesses looking to stay ahead of the curve. -

What is a redline version of a document?

A redline version of a document is a marked up document that shows changes made between different versions. This can be helpful to track changes, compare versions or to review edits made by multiple contributors. airSlate SignNow is an electronic signature solution that simplifies document workflows for companies, saving time and increasing productivity by eliminating the need for manual signatures. With high-volume eSignature features, businesses can impress customers by quickly sending and signing documents, while also saving money and maximizing ROI. Trust in airSlate SignNow's expertise to customize eSignature workflows and improve your business operations. -

What is a redline in legal terms?

In legal terms, a redline refers to a type of document markup that highlights changes made to a previous version. This is often used when drafting contracts or other legal agreements to clearly show any revisions or additions made during the negotiation process. airSlate SignNow is the ideal electronic signature solution for small and medium businesses, offering high-volume eSignature features to increase productivity and save money. With customizable workflows, users can easily send and eSign their documents, impress customers, and maximize ROI. Let airSlate SignNow help you move fast with everything you need for your document workflows, while ensuring the security and legality of every signature. Join the countless businesses who trust airSlate SignNow for their electronic signature needs. -

How do you Blackline in Word?

airSlate SignNow is an electronic signature solution that enables companies to boost their productivity, impress their customers, and save money while maximizing ROI. With high-volume eSignature features, users can streamline their document workflows and sign any document, anywhere, on any device. Whether you're a small business owner, a manager, or an employee accountable for documents, airSlate SignNow can help you move fast and stay ahead of the competition. Choose airSlate SignNow and experience a customizable eSignature solution that truly fits your needs. -

How do I print a redline in Word with comments?

airSlate SignNow is the ultimate solution for electronic signatures that empowers SMBs and Mid-Market companies to accelerate their document workflows. With airSlate SignNow, you can easily eSign and send documents for signatures, making the process faster, smoother, and efficient. Impress your customers with the professional look of your documents while you save money and maximize your ROI. With airSlate SignNow, you'll experience game-changing features that make an impact, like using smart fields, creating custom templates, and gaining total control over your document workflows. It's time to move fast and stay ahead with airSlate SignNow's customizable eSignature workflows. -

How do you compare two contracts?

When comparing two contracts, airSlate SignNow can make the process fast and easy. With high-volume eSignature features, users can impress customers, save money, and maximize ROI. Whether you're a small business owner, manager, or employee accountable for documents, airSlate SignNow's customizable eSignature workflows can increase productivity and streamline your document workflows. Trust in airSlate SignNow's expertise and move forward with confidence. -

What is the difference between Redline and Blackline documents?

airSlate SignNow is the electronic signature solution you need to speed up your document workflows, impress your customers, and save money. With high-volume eSignature features, you can easily send and sign your documents from anywhere. By maximizing ROI, airSlate SignNow allows managers and employees to streamline their daily business operations and increase productivity. Take advantage of our customizable eSignature workflows and boost your business to a whole new level. -

How can I compare two legal documents?

To compare two legal documents, airSlate SignNow is the ideal electronic signature solution. With its high-volume eSignature features, users can streamline their document workflows, impress customers, and save money while maximizing ROI. As citizens with small or medium businesses, managers, and employees accountable for documents, airSlate SignNow's customizable workflows and efficient eSignature solution will help you move fast and stay ahead of the game. Try airSlate SignNow today and revolutionize the way you handle legal documents! -

What does it mean to redline a document?

Redlining a document means to make revisions, corrections, or changes using a red pen or highlighting tool. In modern times, this is often done digitally through editing software. -

How do I redline comparison in Word?

With airSlate SignNow's high-volume eSignature features, users can easily redline and compare documents in Word to streamline their document workflows. This increases productivity while also impressing customers and saving money, maximizing ROI. As a trusted electronic signature solution, airSlate SignNow is here to help small/medium businesses, managers, and employees accountable for their documents. Let airSlate SignNow handle your customizable eSignature needs, so you can focus on growing your business confidently and efficiently. -

What is a redline in finance?

A redline in finance refers to a specific change or edit made to a legal document, such as a contract or agreement. It is usually indicated by marking the text in red to show what has been added, removed, or modified. airSlate SignNow streamlines the document workflow process through its high-volume eSignature features, allowing users to sign and send documents electronically with ease. This boosts productivity, impresses customers, and saves money while maximizing return on investment. With airSlate SignNow, users can confidently manage their documents and focus on growing their business. -

How does Compare work in Word?

airSlate SignNow is an ultimate electronic signature solution that enables businesses to send and eSign their documents quickly and easily, while increasing their productivity and saving time and money. With its high-volume eSignature features, users can streamline their document workflows, impress customers and stakeholders, and maximize ROI. Whether you're a small business owner, manager, or employee accountable for documents, airSlate SignNow is the perfect solution to help you stay organized, efficient, and compliant. So why wait? Try airSlate SignNow today and experience the power of customizable eSignature workflows.

What active users are saying — redline term sheet template

Frequently asked questions

How can I make documents so that someone else can electronically sign them?

How can I have someone sign on a PDF file?

How can I use my phone to sign a PDF?

Get more for redline Term Sheet Template with airSlate SignNow

- Email signature agreement

- Email signature proposal

- Email signature Accounts Receivable Purchase Agreement

- Email signature Merger Agreement

- Email signature Management Agreement

- Email signature Letter of Undertaking

- Email signature Resignation Letter

- Email signature Interior Design Proposal Template

- Email signature Website Standard Terms and Conditions Template

- Email signature Car Rental Agreement Template

- Email signature Non Solicitation Agreement Template

- Email signature Travel Agency Agreement Template

- Email signature Memorandum of Agreement Template

- Email signature Pharmacy Services Agreement Template

- Email signature Residential Landlord-Tenant Agreement Template

- Email signature Independent Contractor Agreement Template

- Email signature Exclusivity Agreement Template

- Email signature SEO Agreement Template

- Email signature NDA Template

- Email signature Freelance Recruiter Agreement Template

- Email signature Proforma Invoice Template

- Email signature Car Wash Proposal Template

- Email signature HVAC Contract Template

- Email signature Solar Panel Installation Proposal Template

- Email signature Architecture Firm Proposal Template

- Email signature Employment Contract Template

- Email signature Temporary Employment Contract Template

- Email signature Termination Letter Template