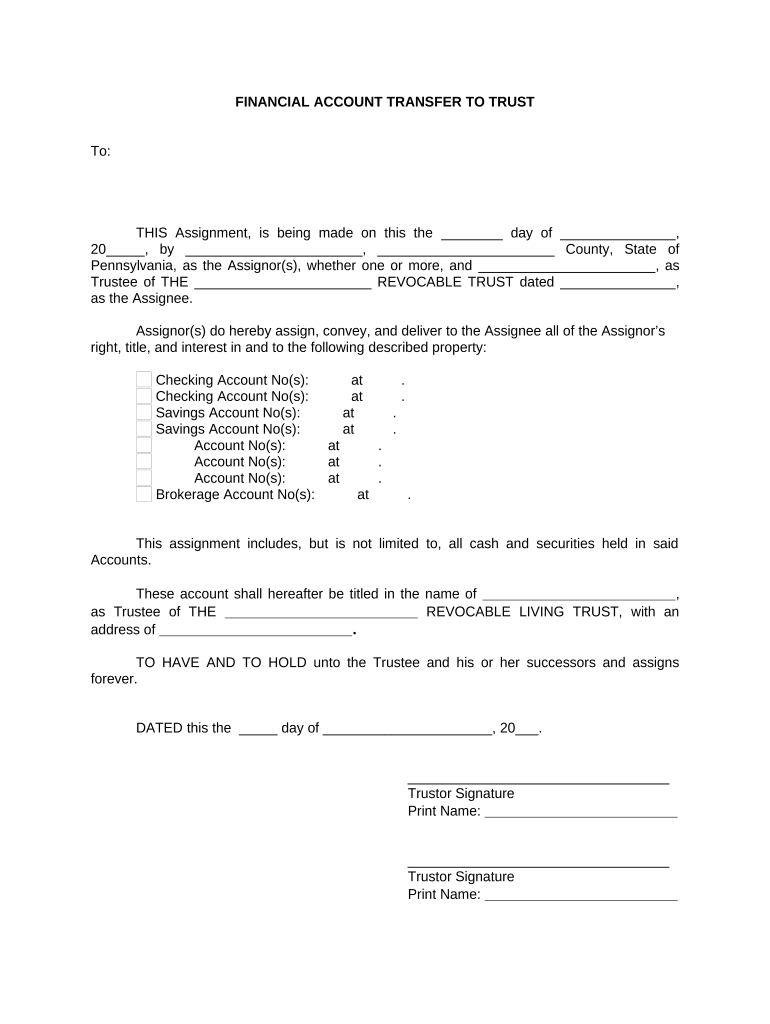

Fill and Sign the Financial Account Transfer to Living Trust Pennsylvania Form

Practical advice on setting up your ‘Financial Account Transfer To Living Trust Pennsylvania’ online

Are you fed up with the inconvenience of handling paperwork? Your solution is here with airSlate SignNow, the premier electronic signature platform for both individuals and businesses. Bid farewell to the tedious routine of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documents online. Utilize the robust features incorporated into this user-friendly and cost-effective platform and transform your document management strategy. Whether you need to authorize forms or collect signatures, airSlate SignNow manages everything with ease, requiring just a few clicks.

Follow this step-by-step guide:

- Access your account or register for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Open your ‘Financial Account Transfer To Living Trust Pennsylvania’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for others (if required).

- Proceed with the Send Invite options to solicit eSignatures from others.

- Save, print your version, or turn it into a multi-usable template.

No need to worry if you need to collaborate with your team on your Financial Account Transfer To Living Trust Pennsylvania or send it for notarization—our solution has everything you require to accomplish such tasks. Register with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What is the process for a Financial Account Transfer To Living Trust in Pennsylvania?

The process for a Financial Account Transfer To Living Trust in Pennsylvania involves drafting a trust document, designating your financial accounts into the trust, and then updating account ownership through your financial institutions. It's essential to ensure all relevant paperwork is correctly filled out to avoid future complications. Using airSlate SignNow can streamline the signing process for these documents.

-

How does airSlate SignNow facilitate the Financial Account Transfer To Living Trust in Pennsylvania?

airSlate SignNow simplifies the Financial Account Transfer To Living Trust in Pennsylvania by providing a secure platform for eSigning and managing trust documents. Our user-friendly interface allows you to quickly send, sign, and store all necessary documents electronically, ensuring a seamless transition into your living trust.

-

Are there any costs associated with using airSlate SignNow for Financial Account Transfer To Living Trust in Pennsylvania?

Yes, while airSlate SignNow offers a free trial, there are subscription plans available that cater to different needs for handling documents, including those related to Financial Account Transfer To Living Trust in Pennsylvania. The pricing is competitive and provides excellent value for the features included, such as unlimited eSigning and document storage.

-

What features does airSlate SignNow offer for managing Financial Account Transfer To Living Trust documents?

airSlate SignNow provides a range of features for managing your Financial Account Transfer To Living Trust documents, including eSignature capabilities, document templates, and secure cloud storage. These features enhance efficiency and ensure that all your trust documents are organized and accessible whenever you need them.

-

Can I integrate airSlate SignNow with other software for my Financial Account Transfer To Living Trust in Pennsylvania?

Yes, airSlate SignNow offers integrations with various software tools, enhancing your workflow during the Financial Account Transfer To Living Trust in Pennsylvania. You can connect with CRM systems, cloud storage services, and other applications to streamline your document management and eSigning processes.

-

What are the benefits of using airSlate SignNow for Financial Account Transfer To Living Trust in Pennsylvania?

Using airSlate SignNow for your Financial Account Transfer To Living Trust in Pennsylvania provides numerous benefits, including time savings, enhanced security, and ease of use. The platform allows you to complete transactions quickly and securely, ensuring that your financial accounts are safely transferred into your living trust.

-

Is it safe to use airSlate SignNow for Financial Account Transfer To Living Trust documents?

Absolutely, airSlate SignNow prioritizes security for all your documents related to Financial Account Transfer To Living Trust in Pennsylvania. We use advanced encryption and security protocols to protect your sensitive information and ensure that your eSigned documents are legally binding and secure.

The best way to complete and sign your financial account transfer to living trust pennsylvania form

Find out other financial account transfer to living trust pennsylvania form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles