Page 1 of 12

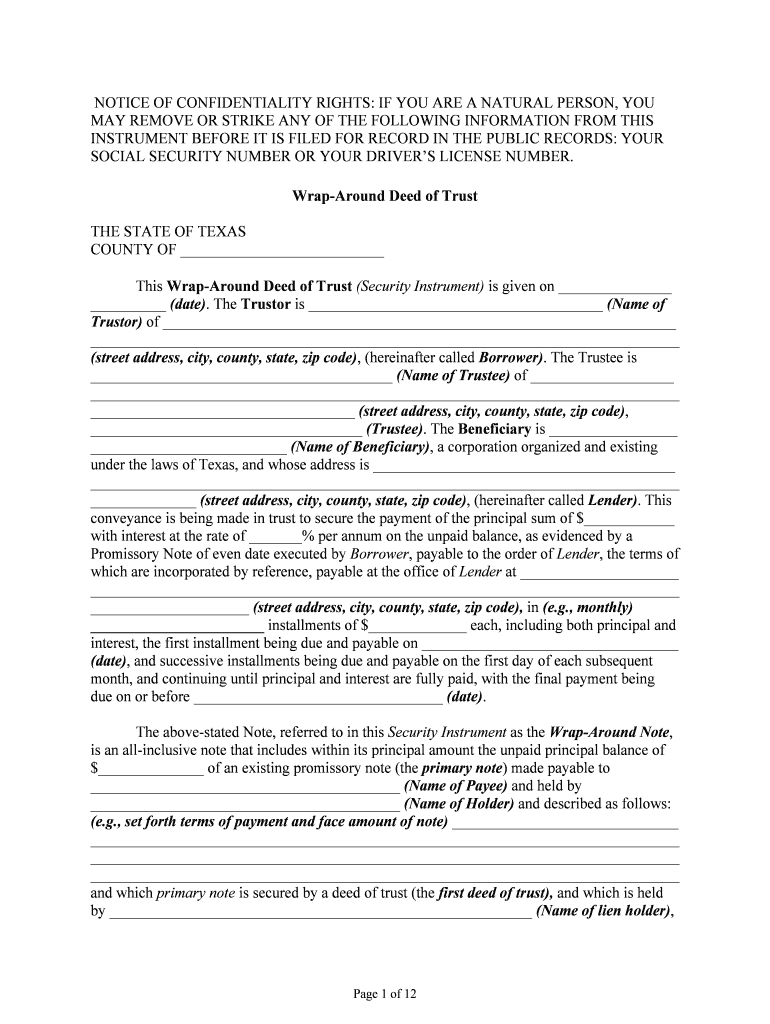

NOTICE OF CONFIDENTIALITY RIGHTS: IF YOU ARE A NATURAL PERSON, YOU

MAY REMOVE OR STRIKE ANY OF THE FOLLOWING INFORMATION FROM THIS

INSTRUMENT BEFORE IT IS FILED FOR RECORD IN THE PUBLIC RECORDS: YOUR

SOCIAL SECURITY NUMBER OR YOUR DRIVER’S LICENSE NUMBER.

Wrap-Around Deed of Trust

THE STATE OF TEXAS

COUNTY OF ___________________________

This Wrap-Around Deed of Trust (Security Instrument) is given on _______________

__________ (date). The Trustor is _______________________________________ (Name of

Trustor) of ____________________________________________________________________

______________________________________________________________________________

(street address, city, county, state, zip code) , (hereinafter called Borrower) . The Trustee is

________________________________________ (Name of Trustee) of ___________________

______________________________________________________________________________ ___________________________________ (street address, city, county, state, zip code),

____________________________________ (Trustee). The Beneficiary is _________________

__________________________ (Name of Beneficiary), a corporation organized and existing

under the laws of Texas, and whose address is ________________________________________ ____________________________________________________________________________________________ (street address, city, county, state, zip code) , (hereinafter called Lender). This

conveyance is being made in trust to secure the payment of the principal sum of $____________

with interest at the rate of _______% per annum on the unpaid balance, as evidenced by a

Promissory Note of even date executed by Borrower, payable to the order of Lender, the terms of

which are incorporated by reference, payable at the office of Lender at _____________________

___________________________________________________________________________________________________ (street address, city, county, state, zip code), in (e.g., monthly)

_______________________ installments of $_____________ each, including both principal and

interest, the first installment being due and payable on __________________________________

(date) , and successive installments being due and payable on the first day of each subsequent

month, and continuing until principal and interest are fully paid, with the final payment being

due on or before _________________________________ (date).

The above-stated Note, referred to in this Security Instrument as the Wrap-Around Note ,

is an all-inclusive note that includes within its principal amount the unpaid principal balance of

$______________ of an existing promissory note (the primary note) made payable to

_________________________________________ (Name of Payee) and held by

_________________________________________ (Name of Holder) and described as follows:

(e.g., set forth terms of payment and face amount of note) ______________________________

__________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

and which primary note is secured by a deed of trust (the first deed of trust), and which is held

by ________________________________________________________ (Name of lien holder),

Page 2 of 12

(the first lien holder ), that covers the property described in Exhibit A attached hereto and made

a part hereof, and which first deed of trust was recorded on ______________________________

(date) , in Book _________ at Page _________ in the office of the Official Recorder of

_______________________________ (Name of County), Texas. This Security Instrument

further secures to Lender:

(a) the repayment of the debt evidenced by the Wrap-Around Note with interest, and all

renewals, extensions, and modifications;

(b) the payment of all other sums, with interest, advanced under Section 8 to protect the

security of this Security Instrument; and

(c) the performance of Borrower's covenants and agreements under this Security

Instrument and the Wrap-Around Note as well as the first deed of trust and the timely payment of

the primary note.

For these purposes, and other good and valuable consideration, the receipt and

sufficiency of which is hereby acknowledged, Borrower irrevocably grants and conveys to

Trustee, in trust, with power of sale, that certain property located at _______________________

______________________________________________________________________________ ___________________________ (street address, city, county, state, zip code), and being more

particularly described as follows:

(Insert Legal Description Here)

__________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Together with all the improvements now or to be erected on the property, and all easements,

rights, appurtenances, rents, royalties, mineral, oil and gas rights and profits, water rights and

stock and all fixtures now or to become a part of the property. All replacements and additions

shall also be covered by this Security Instrument. All of the foregoing is referred to in this

Security Instrument as the Property. Borrower covenants that Borrower is lawfully seized of the

estate conveyed by this Security Instrument and has the right to grant and convey the Property

and that the Property is unencumbered, except for encumbrances of record. Borrower warrants

and will defend generally the title to the Property against all claims and demands, subject to any

encumbrances of record. It is expressly understood between the parties that this is a Wrap

Around Deed of Trust being wrapped around that certain existing first deed of trust.

Borrower and Lender covenant and agree as follows:

2. Primary Note, First Deed of Trust and Wrap-Around Note A. As to the underlying or primary indebtedness secured by the first deed of trust,

there exists no default or any event that would constitute an event of default under the terms of

the primary note or the first deed of trust and the information set forth above with respect to the

first deed of trust and the primary note that it secures is accurate and correct in every respect.

Page 3 of 12

B. Borrower will pay directly to the holder of the Wrap-Around Note the

installments of principal and interest required by the terms of the Wrap-Around Note and will not

make any payment directly to the holder of the primary note or request any release, partial

release, amendment, or other modification of the primary note or first deed of trust without the

prior written consent of Lender.

C. On receipt of such payment and from the proceeds of the same, Lender shall pay

each installment of principal and interest on the primary indebtedness at least _____ days before

it becomes due and payable and shall submit evidence of the payment to Borrower before the

due date.

D. If Lender fails to make such payments on the primary indebtedness when due and

payable and furnish evidence of such payment to Borrower as provided in the preceding

paragraph, Borrower may, at Borrower’s option, elect to:

i. Make such payments on the primary indebtedness and deduct such

amounts from the amount of the installment due on the Wrap-Around Note;

ii. Continue to pay the full amount of the installments on the Wrap-Around

Note and, in the event Lender fails to make such payment within _____days of the due

date, make written demand on Lender for reimbursement of any such payments made by

Borrower to Lender. Should Lender fail to reimburse Borrower within ____days after the

receipt of such demand, Borrower shall have the right to declare the Wrap-Around Note

and this Security Instrument, to be null and void, in which event Lender agrees to return

the Wrap-Around Note to Borrower and to execute, acknowledge, and deliver a release of

this Security Instrument.

E. If an event of default occurs in the first deed of trust, Lender agrees that on receipt

by Lender of any notice of default given by the holder of the primary indebtedness pursuant to

the primary note or pursuant to the first deed of trust securing same, Lender shall immediately

send to Borrower a copy of same, or if Lender becomes aware of any event of default, Lender

shall immediately notify Borrower of the event of default, and Borrower may, at Borrower’s

option, perform any act required in any form or manner deemed expedient to cure the event of

default.

F. Borrower shall have the right at any time to prepay the primary indebtedness.

G. Lender shall not, without securing the prior written consent and approval of

Borrower :

i. Alter, renew, rearrange, restructure, or refinance the primary indebtedness

or modify the primary indebtedness or the first deed of trust;

ii. Permit the holder of the primary indebtedness to alter, renew, rearrange,

restructure, or refinance the primary indebtedness or modify the primary indebtedness or

Page 4 of 12

the first deed of trust securing the same;

iii. Take any action, or authorize any action to be taken, that would have the

effect of increasing the total amount of the primary indebtedness; or

iv. Request or accept any extension, postponement, indulgence, or

forgiveness of the primary indebtedness. In the event of any such request, Lender, at

Borrower’s option, shall grant Borrower a corresponding extension, postponement,

indulgence, or forgiveness under the Wrap-Around Note.

H. Any proceeds of condemnation or insurance policies required to be kept in force

under this Security Instrument, shall be payable to Lender and the holder of the primary

indebtedness "as their interests may appear," and such policies shall be kept by Lender and

Lender agrees that its interest in the policies or the proceeds of the same are inferior and

subordinate to the interest of the holder of the primary indebtedness. To the extent the proceeds

of condemnation or the insurance policies are paid to the holder of the primary indebtedness,

Borrower shall be entitled to a credit on the Wrap-Around Note equal to the amount of such

payment of proceeds.

I. Any reference contained in this Security Instrument, as to the right of Borrower to

pay any sum owing on the primary indebtedness shall not constitute an assumption of personal

liability by Lender for any such payment, and shall not in any way modify the obligation of

Lender to the holder of the primary indebtedness.

2. Payment of Principal and Interest; Prepayment and Late Charges Borrower shall promptly pay when due the principal of and interest on the debt evidenced

by the Wrap-Around Note and any prepayment and late charges due under said Note.

3. Funds for Taxes and Insurance A.If required by written notice from Lender to Borrower, and subject to applicable

law or to a written waiver by Lender, Borrower shall pay to Lender on the day (e.g., monthly)

__________________ payments are due under the Wrap-Around Note, until the Note is paid in

full, a sum (the Funds) equal to one-twelfth of: (a) yearly taxes and assessments that may attain

priority over this Security Instrument; (b) yearly leasehold payments or ground rents on the

Property, if any; (c) yearly hazard insurance premiums; and (d) yearly mortgage insurance

premiums, if any. These items are called Escrow Items. Lender may estimate the Funds due on

the basis of current data and reasonable estimates of future Escrow Items. The Funds shall be

held in an institution the deposits or accounts of which are insured or guaranteed by a federal or

state agency (including Lender if Lender is such an institution). Lender shall apply the Funds to

pay the Escrow Items. Lender may not charge for holding and applying the Funds, analyzing the

account, or verifying the Escrow Items, unless Lender pays Borrower interest on the Funds and

applicable law permits Lender to make such a charge. Borrower and Lender may agree in writing

that interest shall be paid on the Funds. Unless an Agreement is made or applicable law requires

interest to be paid, Lender shall not be required to pay Borrower any interest or earnings on the

Funds. Lender shall give to Borrower, without charge, an annual accounting of the Funds

Page 5 of 12

showing credits and debits to the Funds and the purpose for which each debit to the Funds was

made. The Funds are pledged as additional security for the sums secured by this Security

Instrument.

B.If the amount of the Funds held by Lender, together with the future (e.g.,

monthly) ___________________ payments of Funds payable prior to the due dates of the

Escrow Items, shall exceed the amount required to pay the Escrow Items when due, the excess

shall be, at Borrower's option, either promptly repaid to Borrower or credited to Borrower on

(e.g., monthly) _____________________ payments of Funds. If the amount of the Funds held

by Lender is not sufficient to pay the Escrow Items when due, Borrower shall pay to Lender any

amount necessary to make up the deficiency in one or more payments as required by Lender.

C. On payment in full of all sums secured by this Security Instrument, Lender shall

promptly refund to Borrower any funds held by Lender. If under Section 20 the Property is sold

or acquired by Lender, Lender shall apply, no later than immediately prior to the sale of the

Property or its acquisition by Lender, any funds held by Lender at the time of application as a

credit against the sums secured by this Security Instrument.

4. Application of Payments Unless applicable law provides otherwise, all payments received by Lender under

Sections 2 and 3 shall be applied: first, to late charges due under the Wrap-Around Note; second,

to prepayment charges due under the said Note; third, to amounts payable under Section 3;

fourth, to interest due; and last, to principal due.

5. Charges and Liens

Borrower shall pay all taxes, assessments, charges, fines, and impositions attributable to

the Property that may attain priority over this Security Instrument, and leasehold payments or

ground rents, if any. Borrower shall pay these obligations in the manner provided in Section 3,

or if not paid in that manner, Borrower shall pay them on time directly to the person owed

payment. Borrower shall promptly furnish to Lender all notices of amounts to be paid under this

Section. If Borrower makes these payments directly, Borrower shall promptly furnish to Lender

receipts evidencing the payments.

Borrower shall promptly discharge any lien that has priority over this Security Instrument

unless Borrower: (a) agrees in writing to the payment of the obligation secured by the lien in a

manner acceptable to Lender; (b) contests in good faith the lien by, or defends against

enforcement of the lien in, legal proceedings which in the Lender's opinion operate to prevent the

enforcement of the lien or forfeiture of any part of the Property; or (c) secures from the holder of

the lien an agreement satisfactory to Lender subordinating the lien to this Security Instrument. If

Lender determines that any part of the Property is subject to a lien that may attain priority over

this Security Instrument, Lender may give Borrower a notice identifying the lien. Borrower shall

satisfy the lien or take one or more of the actions set forth above within (e.g. 10) ______ days of

the giving of notice.

6. Hazard Insurance

Borrower shall keep the improvements now existing or to be erected on the Property

Page 6 of 12

insured against loss by fire, hazards included within the term extended coverage, and any other

hazards for which Lender requires insurance. This insurance shall be maintained in the amounts

and for the periods that Lender requires. The insurance carrier providing the insurance shall be

chosen by Borrower subject to Lender's approval which shall not be withheld unreasonably.

All insurance policies and renewals shall be acceptable to Lender and shall include a standard

mortgagee clause. Borrower shall promptly provide Lender with copies of all policies and

renewals. If Lender requires, Borrower shall promptly give to Lender all receipts of paid

premiums and renewal notices. In the event of loss, Borrower shall give prompt notice to the

insurance carrier and lender. Lender may make proof of loss if not made promptly by Borrower.

Unless Lender and Borrower otherwise agree in writing, insurance proceeds shall be

applied to the restoration or repair of the Property damaged, if the restoration or repair is

economically feasible and Lender's security is not lessened. If the restoration or repair is not

economically feasible or Lender's security would be lessened, the insurance proceeds shall be

applied to the sums secured by this Security Instrument, whether or not then due, with any excess

paid to Borrower. If Borrower abandons the Property, or does not answer within (e.g., 30) ____

days a notice from Lender that the insurance carrier has offered to settle a claim, then Lender

may collect the insurance proceeds. Lender may use the proceeds to repair or restore the property

or to pay sums secured by this Security Instrument, whether or not then due. The (e.g., 30)

_____ -day period will begin when the notice is given.

Unless Lender and Borrower otherwise agree in writing, any application of proceeds to

principal shall not extend or postpone the due date of the (e.g., monthly) _________________

payments referred to in Sections 2 and 3 or change the amount of the payments. If under Section

20 the Property is acquired by Lender, Borrower's right to any insurance policies and proceeds

resulting from damage to the Property prior to the acquisition shall pass to Lender to the extent

of the sums secured by this Security Instrument immediately prior to the acquisition.

7. Preservation and Maintenance of Property; Leaseholds Borrower shall not destroy, damage, or substantially change the Property, allow the

Property to deteriorate, or commit waste. If this Security Instrument is on a leasehold, Borrower

shall comply with the provisions of the lease, and if Borrower acquires fee title to the Property,

the leasehold and fee title shall not merge unless Lender agrees to the merger in writing.

8. Protection of Lender’s Rights in the Property If Borrower fails to perform the covenants and agreements contained in this Security

Instrument, or there is a legal proceeding that may significantly affect Lender's rights in the

Property (such as a proceeding in bankruptcy, probate, for condemnation, or to enforce laws or

regulations), then Lender may do and pay for whatever is necessary to protect the value of the

Property and Lender's rights in the property. Lender's actions may include paying any sums

secured by a lien that has priority over this Security Instrument, appearing in court, paying

reasonable attorney's fees, and entering on the Property to make repairs. Although Lender may

take action under this Paragraph, Lender does not have to do so.

Any amounts disbursed by lender under this Section 8 shall become additional debt of

Borrower secured by this Security Instrument. Unless Borrower and Lender agree to other terms

Page 7 of 12

of payment, these amounts shall bear interest from the date of disbursement at the Wrap-Around

Note rate and shall be payable, with interest, on notice from Lender to Borrower requesting

payment.

9. Inspection

Lender or its agent may make reasonable entries on and inspections of the Property.

Lender shall give Borrower notice at the time of or prior to an inspection specifying reasonable

cause for the inspection.

10. Condemnation The proceeds of any award or claim for damages, direct or consequential, in connection

with any condemnation or other taking of any part of the Property, or for a conveyance in lieu of

condemnation, are assigned and shall be paid to Lender.

In the event of a total taking of the Property, the proceeds shall be applied to the sums

secured by this Security Instrument, whether or not then due, with any excess paid to Borrower.

In the event of a partial taking of the Property, unless Borrower and Lender otherwise agree in

writing, the sums secured by this Security Instrument shall be reduced by the amount of the

proceeds multiplied by the following fraction: (a) the total amount of the sums secured

immediately before the taking, divided by (b) the fair market value of the Property immediately

before the taking. Any balance shall be paid to Borrower.

If the Property is abandoned by Borrower, or if, after notice by Lender to Borrower that

the condemnor offers to make an award or settle a claim for damages, Borrower fails to respond

to Lender within (e.g., 30) _______ days after the date the notice is given, Lender is authorized

to collect and apply the proceeds, at its option, either to the restoration or repair of the property

or to the sums secured by this Security Instrument, whether or not then due.

Unless Lender and Borrower otherwise agree in writing, any application of proceeds to

principal shall not extend or postpone the due date of the payments referred to in Sections 2 and

3 or change the amount of those payments.

11. Forbearance by Lender not a Waiver Any forbearance by Lender in exercising any right or remedy shall not be a waiver of or

preclude the exercise of any right or remedy.

12. Successors and Assigns Bound; Joint and Several Liability; Cosigners

The covenants and agreements of this Security Instrument shall bind and benefit the

successors and assigns of Lender and Borrower, subject to the provisions of Section 18.

Borrower's covenants and agreements shall be joint and several.

13. Loan Charges If the loan secured by this Security Instrument is subject to a law which sets maximum

loan charges, and that law is finally interpreted so that the interest or other loan charges collected

or to be collected in connection with the loan exceed the permitted limits, then: (a) any such loan

charge shall be reduced by the amount necessary to reduce the charge to the permitted limit; and

(b) any sums already collected from Borrower that exceeded permitted limits will be refunded to

Page 8 of 12

Borrower. Lender may choose to make this refund by reducing the principal owed under the

Wrap-Around Note or by making a direct payment to Borrower. If a refund reduces principal, the

reduction will be treated as a partial prepayment without any prepayment charge under the Wrap-

Around Note .

14. Legislation Affecting Lender’s Rights If the enactment or expiration of applicable laws has the effect of rendering any provision

of the Wrap-Around Note or this Security Instrument unenforceable according to its terms,

Lender, at its option, may require immediate payment in full of all sums secured by this Security

Instrument and may invoke any remedies permitted by Section 20. If Lender exercises this

option, Lender shall take the steps specified in the second paragraph of Section 18.

15. Notices Any notice to Borrower provided for in this Security Instrument shall be given by

delivering it or by mailing it by first class mail unless applicable law requires use of another

method. The notice shall be directed to the property address or any other address Borrower

designates by notice to Lender. Any notice to Lender shall be given by first class mail to

Lender's address stated in this Security Instrument or any other address Lender designates by

notice to Borrower. Any notice provided for in this Security Instrument shall be deemed to have

been given to Borrower or Lender when given as provided in this Paragraph.

16. Governing Law; Severability This Security Instrument shall be governed by federal law and the law of the jurisdiction

in which the Property is located. If any provision or clause of this Security Instrument or the

Wrap-Around Note conflicts with applicable law, the conflict shall not affect other provisions of

this Security Instrument or the Wrap-Around Note which can be given effect without the

conflicting provision. To this end the provisions of this Security Instrument and the Wrap-

Around Note are declared to be severable.

17. Borrower’s Copy Borrower shall be given one conformed copy of the Wrap-Around Note and of this

Security Instrument.

18. Transfer of the Property or a Beneficial Interest in Borrower

If all or any part of the Property or any interest in it is sold or transferred (or if a

beneficial interest in Borrower is sold or transferred and Borrower is not a natural person)

without Lender's prior written consent, Lender may, at its option, require immediate payment in

full of all sums secured by this Security Instrument. However, this option shall not be exercised

by Lender if its exercise is prohibited by federal law as of the date of this Security Instrument.

If Lender exercises this option, Lender shall give Borrower notice of acceleration. The notice

shall provide a period of not less than (e.g., 30) ______ days from the date the notice is delivered

or mailed within which Borrower must pay all sums secured by this Security Instrument. If

Borrower fails to pay these sums prior to the expiration of this period, Lender may invoke any

remedies permitted by this Security Instrument without further notice or demand on Borrower.

19. Borrower’s Right to Reinstate

Page 9 of 12

If Borrower meets certain conditions, Borrower shall have the right to have enforcement

of this Security Instrument discontinued at any time prior to the earlier of: (a) (e.g., five) ______

days (or such other period as applicable law may specify for reinstatement) before sale of the

Property pursuant to any power of sale contained in this Security Instrument; or (b) entry of a

judgment enforcing this Security Instrument. Those conditions are that Borrower: (a) pays

Lender all sums that then would be due under this Security Instrument and the Wrap-Around

Note had no acceleration occurred; (b) cures any default of any other covenants or agreements;

(c) pays all expenses incurred in enforcing this Security Instrument, including, but not limited to,

reasonable attorney's fees; and (d) takes such action as Lender may reasonably require to assure

that the lien of this Security Instrument, Lender's rights in the Property, and Borrower's

obligation to pay the sums secured by this Security Instrument shall continue unchanged. On

reinstatement by Borrower, this Security Instrument and the obligations secured by it shall

remain fully effective as if no acceleration had occurred. However, this right to reinstate shall not

apply in the case of acceleration under Sections 14 or 18.

20. Acceleration; Remedies Lender shall give notice to Borrower prior to acceleration following Borrower's breach of

any covenant or agreement in the first deed of trust or this Security Instrument (but not prior to

acceleration under Sections 14 and 18 unless applicable law provides otherwise). The notice

shall specify: (a) the default; (b) the action required to cure the default; (c) a date, not less than

(e.g.30) ______ days from the date the notice is given to Borrower, by which the default must be

cured; and (d) that failure to cure the default on or before the date specified in the notice will

result in acceleration of the sums secured by this Security Instrument and sale of the Property.

The notice shall further inform Borrower of the right to reinstate after acceleration and the right

to bring a court action to assert the nonexistence of a default or any other defense of Borrower to

acceleration and sale. If the default is not cured on or before the date specified in the notice,

Lender at its option may require immediate payment in full of all sums secured by this Security

Instrument without further demand and may invoke the power of sale and any other remedies

permitted by applicable law. Lender shall be entitled to collect all expenses incurred in pursuing

the remedies provided in this Paragraph, including, but not limited to, reasonable attorney's fees

and the costs of title evidence.

If Lender invokes the power of sale, Lender or Trustee shall give notice of the time,

place, and terms of sale by posting and recording the notice at least _____days prior to the sale

as provided by applicable law. Lender shall mail a copy of the notice of sale to Borrower in the

manner prescribed by applicable law. Sale shall be made at public venue between the hours of

(time) ___________ and (time) __________, on the first (day of week) ____________________

in any month. Borrower authorizes Trustee to sell the Property to the highest bidder for cash in

one or more parcels and in any order Trustee determines. Lender or its designee may purchase

the Property at any sale.

Trustee shall deliver to the purchaser a Trustee's deed conveying indefeasible title to the

Property with covenants of general warranty. Borrower covenants and agrees to defend

generally the Purchaser's title to the Property against all claims and demands. The recitals in the

Trustee's deed shall be prima facie evidence of the truth of the statements made in them. Trustee

shall apply the proceeds of the sale in the following order: (a) to all expenses of the sale,

Page 10 of 12

including, but not limited to, reasonable Trustee's and attorney's fees; (b) to all sums secured by

this Security Instrument and the first deed of trust; and (c) any excess to the person or persons

legally entitled to it.

If the Property is sold pursuant to this Section 20, Borrower or any person holding

possession of the Property through Borrower shall immediately surrender possession of the

Property to the purchaser at that sale. If possession is not surrendered , Borrower or such person

shall be a tenant at sufferance and may be removed by writ of possession.

21. Lender in Possession On acceleration under Section 20, or abandonment of the Property, Lender (in person, by

agent, or by judicially appointed receiver) shall be entitled to enter on, take possession of, and

manage the Property and to collect the rents of the Property including those past due. Any rents

collected by Lender or the receiver shall be applied first to payment of the costs of management

of the Property and collection of rents, including, but not limited to, receiver's fees, premiums on

receiver's bonds, and reasonable attorney's fees, and then to the sums secured by this Security

Instrument and the first deed of trust.

22. Release On payment of all sums secured by the first deed of trust and this Security Instrument,

Lender shall release this Security Instrument without charge to Borrower. Borrower shall pay

any recordation costs.

23. Substitute Trustee Lender, at its option and with or without cause, may from time to time remove Trustee

and appoint, by power of attorney or otherwise, a successor Trustee to any Trustee appointed

under this Security Instrument. Without conveyance of the Property, the successor Trustee shall

succeed to all the title, power, and duties conferred on Trustee in this Security Instrument and by

applicable law.

24. Subrogation

Any of the proceeds of the Wrap-Around Note used to take up outstanding liens against

all or any part of the Property have been advanced by Lender at Borrower's request and on

Borrower's representation that such amounts are due and are secured by valid liens against the

Property. Lender shall be subrogated to any and all rights, superior titles, liens and equities

owned or claimed by any owner or holder of any outstanding liens and debts, regardless of

whether the liens or debts are acquired by Lender by assignment or are released by the holder on

payment.

25. Partial Invalidity

If any portion of the sums intended to be secured by this Security Instrument cannot be

lawfully secured by this Security Instrument, payments in reduction of such sums shall be

applied first to those portions not secured by this Security Instrument.

26. Waiver of Notice of Intent to Accelerate

Page 11 of 12

Borrower waives the right to notice of intention to require immediate payment in full of

all sums secured by this Security Instrument except as provided in Section 20.

The undersigned Borrower and Lender accepts and agrees to the terms and covenants

contained in this Security Instrument effective the __________________________________

(date).

__________________________________________

Name of Lender

_________________________________________ By: ________________________________

(Printed name) ____________________________________

(Printed Name & Office in Lender)

_________________________________________ ____________________________________

(Signature of Borrower) (Signature of Officer)

THE STATE OF TEXAS

COUNTY OF ___________________________ The foregoing instrument was duly acknowledged before me on ____________________

___________ (date) by ________________________________________ (Name of Borrower).

__________________________________________

Notary Public, State of Texas

[Seal]

Name Printed__________________________________

Commission Expires____________________________

Page 12 of 12

THE STATE OF TEXAS

COUNTY OF ______________________________

This instrument was acknowledged before me on ________________________________

_____________ (date), by ________________________________________ (Name of Officer),

________________________________________________ (Title of Officer) of

___________________________________________________ (Lender), a

___________________________________ (Name of State of Incorporation) Corporation, on

behalf of such Corporation.

____________________________________

Notary Public, State of Texas

[Seal]

Name Printed_______________________________

Commission Expires_________________________