Acknowledge Payment Field with airSlate SignNow

Improve your document workflow with airSlate SignNow

Flexible eSignature workflows

Instant visibility into document status

Simple and fast integration set up

Acknowledge payment field on any device

Detailed Audit Trail

Strict safety requirements

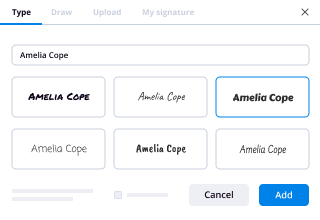

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

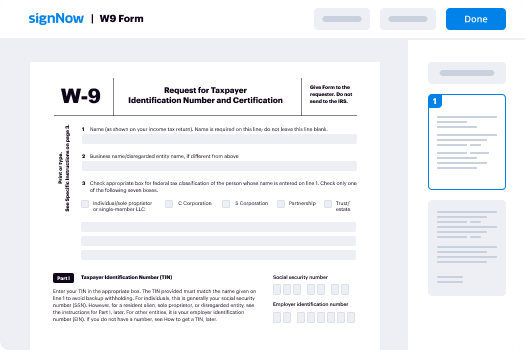

Your step-by-step guide — acknowledge payment field

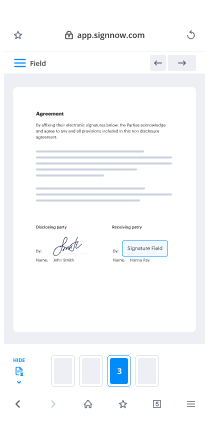

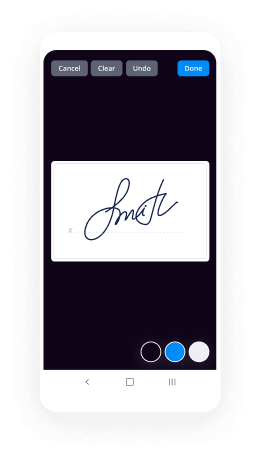

Adopting airSlate SignNow’s eSignature any organization can increase signature workflows and eSign in real-time, providing a greater experience to consumers and workers. acknowledge payment field in a few simple steps. Our mobile apps make operating on the move achievable, even while off-line! eSign documents from any place in the world and close deals in no time.

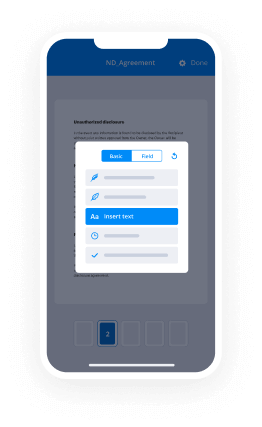

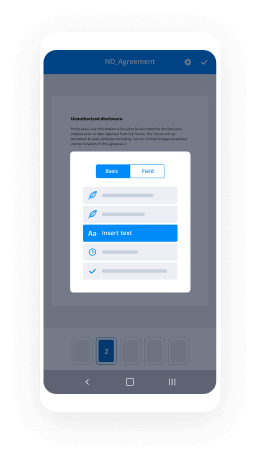

Keep to the step-by-step instruction to acknowledge payment field:

- Log in to your airSlate SignNow profile.

- Locate your record in your folders or import a new one.

- Open the document and edit content using the Tools menu.

- Drop fillable areas, type textual content and eSign it.

- Add several signers using their emails and set up the signing order.

- Specify which users will receive an executed version.

- Use Advanced Options to restrict access to the template add an expiry date.

- Tap Save and Close when done.

In addition, there are more enhanced capabilities open to acknowledge payment field. List users to your common digital workplace, view teams, and track teamwork. Millions of people all over the US and Europe concur that a solution that brings people together in a single holistic workspace, is exactly what companies need to keep workflows performing effortlessly. The airSlate SignNow REST API enables you to embed eSignatures into your app, internet site, CRM or cloud storage. Try out airSlate SignNow and get faster, smoother and overall more productive eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results acknowledge payment field with airSlate SignNow

Get legally-binding signatures now!

FAQs

-

How do you acknowledge a payment received?

Sample letter to acknowledge a payment received. We are writing to inform you that we have received your payment that was due last month. Thank you for remitting this payment to us. We acknowledge the receipt of Rs. -

What is the status of payment?

Payment Status. Pending \u2014 your payment has not yet been sent to the bank or credit card processor. Success \u2014 your credit or debit card payment has been processed and accepted. Complete \u2014 your checking, savings or other bank account payment has been processed and accepted. -

How do you respond to an outstanding payment email?

\u201cWe haven't received your invoice\u201d Or you can ask your client to send you an email acknowledgement upon receipt of your invoice. Either way, you'll have time to re-send your invoice, if necessary. You can also send a reminder email to your client one week before your invoice is due for payment. -

What does payment in process mean?

Payment processing is a general term that refers to how transactions are automated between the customer and the merchant. -

How do you write a payment confirmation email?

Dear @FirstName@ Thank you for the recent payment you have made to us for the sum of @PaymentAmount@. I hereby acknowledge receipt of payment which has been set against the following invoices. @PaidInvoiceList@ @EmailSignature@ -

Does processed mean paid?

Processing - means that we have initiated the pay transfer to the payment method you have on file. Processed - this means that your earnings were successfully sent to your payment method. -

How do I write a receipt of payment?

The name and address of the business or individual receiving the payment. The name and address of the person making the payment. The date the payment was made. A receipt number. The amount paid. The reason for the payment. How the payment was made (credit card, cash, etc) -

When you write paid in full on a check?

It's not unusual for people who owe money to negotiate down a debt to a lesser amount\u2014and while it's possible to do so by writing \u201cpaid in full\u201d on a check, it won't work unless you follow additional rules. And even then, the creditor can reverse course later and demand full payment. -

How do you politely ask for payment?

Are Prepared. Have all the relevant order information on hand. ... Ask to speak the person who placed the order. If dealing with a business it's crucial to talk to the person who placed the order and who has received the invoice. Be Polite and Friendly. ... Confirm Payment With Accounts. -

Is writing final payment on a check legally binding?

Short Answer: Beware checks with \u201cPayment in Full,\u201d \u201cFull and Final Settlement\u201d or similar language written in the memo line or endorsement area. When these \u201cPayment in Full\u201d checks are cashed, they are very often binding, and can eliminate your rights to recover under contract or the mechanics lien laws. -

How do I ask for advance payment professionally?

Ask for payment upfront. ... Ask for half (or partial) payment upfront. ... Offer 2/10 Net 30. ... Request payment before delivery. ... Send electronic invoices. ... Include payment options. ... Add late fees. ... Send an invoice reminder (before you even send the invoice) -

What does paid in full mean?

"Paid," or "paid in full," is the term applied to installment accounts, like car loans, after the last payment is made and you have completed repayment of the loan as agreed. ... Occasionally the terms are interchanged on accounts, but the underlying meaning is the same. -

How do you politely tell someone they forgot to pay you?

All in all, it may be that the person you loaned money to just forgot that they owe you. \u201cDon't assume the person is ignoring you,\u201d Woroch says. \u201cPeople get busy, and if someone forgets to pay you back, don't be on the attack right away. Give them a chance and call to politely ask for that money to be paid back.\u201d -

Does cashing a check mean acceptance?

The final requirement is that the check must be \u201caccepted.\u201d Typically a check is accepted by being processed for payment \u2013 that is, being deposited. ... So, too, does writing the debtor and advising that although you are cashing the check, you don't agree to it being payment in full. -

How do I write a confirmation letter?

In this letter, you should make sure to communicate the relevant information. The order of ideas is not airSlate SignNow. ... Start with the description of the item you sent. Mention the date and reason of sending that article. Express your concern. Ask the reader to inform you if or when he/she received the item.

What active users are saying — acknowledge payment field

Related searches to acknowledge payment field with airSlate airSlate SignNow

Acknowledge payment field

it's 2021 and the second round of stimulus checks are being sent out now with all this talk about the second stimulus payment also known as the economic impact payment many people who are eligible didn't receive their stimulus payment or received less than they were expecting at the time of this recording the irs is still sending out the second stimulus check of 600 but if you didn't receive either of the economic impact payments you could still be eligible to claim it on your 2020 tax returns in this video i'll go over the 2020 stimulus check eligibility reasons you may not have received it or received less than you were expecting and go over how you can claim for the recovery rebate credit on your 2020 income tax returns if you didn't receive either of the economic impact payments or you received less than you were expecting welcome to cpa explains please note everything on this channel is for informational and entertainment purposes only please contact your tax attorney or cpa for your specific tax questions in 2020 there were two economic impact payments the first one paid twelve hundred dollars to eligible individuals and five hundred dollars per dependent the second economic impact payment started being paid out in the beginning of 2021 and at the time of this recording is still being paid out the irs plans to have the second payment out by the middle of january but if you didn't receive either one of the payments or both of the payments or received less than you were expecting you are able to take the credit on your 2020 tax returns in the form of the recovery rebate credit the recovery rebate credit is treated like a refundable credit this means that this credit will reduce the amount of tax you owe in 2020 giving you a dollar for dollar reduction of your tax liability it's also refundable similar to the earned income tax credit or the child tax credit this means if the value of the credit goes beyond the tax liability it can result in a refund check so for example if your 2020 tax liability was twelve hundred dollars and you were due twelve hundred dollars from a stimulus payment but didn't receive it you'll be able to claim the twelve hundred dollar recovery rebate credit to offset your tax liability now if your tax liability was only five hundred dollars you would offset the 500 liability and received a difference as a refund so in this example you would receive 700 in the form of a tax refund before we go into an example of how to calculate our eligibility and claim a tax credit let's look at some reasons you may not have received a payment even if you are eligible one reason could be that your adjusted gross income in prior years made you ineligible for the payment but you qualify for the tax credit with your 2020 adjusted gross income the economic impact payment eligibility was determined using the latest tax return the irs had on file at the time the payment was made if you had not yet filed your 2019 tax return at the time of the stimulus payments the irs likely used your adjusted gross income using your 2018 tax return the recovery of rebate credit is determined using your 2020 adjusted gross income so if you were not eligible using your 2018 or 2019 adjusted gross income because you made more income in previous years you may still be eligible to claim the recovery rebate credit using your 2020 adjusted gross income this is especially true for anyone that was impacted during these times and had to go on unemployment or any business owner that was impacted and lost income during 2020. other reasons why you may not have received the payment could be that you were claimed as a dependent by someone else in previous years or your bank account information may not have been up to date in the irs system whatever the reason if you are eligible for the recovery credit for 2020 and didn't receive the economic impact payment you may be able to claim it on your 2020 tax return if this is the case we'll go over what you need to do to claim it as a tax credit on your tax return when filing the 2020 form 1040 on line 30 you'll see the recovery rebate credit line item this is where you'll calculate the amount that you are due as a refundable credit to calculate the credit we'll need notice 1444. anyone who received a stimulus check payment should have also received a letter in the mail notice 1444 stating the exact amount you received which will be used on this worksheet if you didn't receive any payment you may have not received the notice 1444 either but if you did receive a payment and don't have your notice 1444 available you can visit irs.gov account to find the amount of your economic impact payment now let's go over an example of a single individual who made 90 000 of income in 2020 making them eligible for the recovery rebate credit but someone who didn't receive an economic impact payment in the form 1040 instructions the irs provides us with a worksheet which helps us walk through the eligibility for how much we should have received as an economic impact payment so we can claim it on our tax returns form 1040. lines one through four just confirmed that you weren't a dependent and that you have a valid social security number on line five we're gonna put in the maximum amount of the first economic impact payment this would be twelve hundred dollars for single or head of household individuals or twenty four hundred for married filing jointly so for our purposes we're going to put in twelve hundred dollars on line five as part of the first economic impact payment individuals with dependents would receive five hundred dollars per dependent on line six we're going to multiply 500 by the number of dependents that we can claim on our form 1040. in our example this individual doesn't have any dependents so we're gonna leave this a zero line seven is asking us to add the amounts on lines five and six this would be the maximum amount of the economic impact payment not taking into account any phase outs due to the income thresholds line eight and nine of this worksheet are asking us about the second economic impact payment so on line eight we would put in the maximum amount that we would have received on the economic impact payment if we had received it which would be six hundred dollars the second stimulus payment allowed for six hundred dollars per dependent so on line nine we're going to multiply six hundred dollars by the number of dependents that we can claim on our form 1040. on line 10 we're just gonna add lines eight and nine to get the maximum amount of the second economic impact payment now that we've calculated the maximum amount of both of the economic impact payments we'll need to find our adjusted gross income from our form 1040 to reduce the payment by the income thresholds so in line 11 of this worksheet you'll put in the adjusted gross income which is found on line 11 of form 1040 or 1040sr in our example our individual had an adjusted gross income of 90 000 on line 12 we're just going to put in the amount shown below based on our filing status so in our example we're going to use the 75 000 which starts to phase out of the economic impact payment for any single individual making over 75 000 if your adjusted gross income is more than the amount shown on line 12 you'll subtract line 12 from 11. so in our example 90 000 minus 75 000 we're gonna have fifteen thousand dollar difference on line fourteen we're going to multiply that fifteen thousand by five percent this is going to give us the amount that we'll have to reduce to get our economic impact payment for anyone making over 75 000 so in line 15 we're actually going to reduce what we calculated as our first economic impact payment by that 750 dollars we just calculated in this example this individual is eligible for 450 dollars of credit on their 2020 tax return on line 16 we're going to put in how much we may have received on the first economic impact payment now in our example we didn't receive a payment but if you did you might want to refer to notice 1444 or your tax account information on the irs website for the amount to enter here if you received any amount from the first economic impact payment and it was less than the eligible amount that's calculated on this worksheet you're able to take that difference and claim it as a credit now if you got more than the eligible amount you're in luck and you don't have to pay back the difference now that was the credit for the first economic impact payment for the latest economic impact payment we're going to take that same process and on line 18 we're going to subtract line 14 which is the amount that we calculated as our threshold income amount minus line 10 which is the maximum amount we calculated as the second economic impact payment now here we'll see that we are over the threshold for the second economic impact payment so we're going to put in 0 on line 18. line 19 will be 0 2 since we didn't receive any payment and line 20 will be zero and finally on line 21 we're going to add lines 17 and line 20 which would be our recovery rebate credits for both of the payments and this is the amount that we can claim on our line 30 of our form 1040 or 1040sr to claim the credit so that completes this worksheet and this worksheet is essentially just walking you through the eligibility and the threshold income amounts for the economic impact payments the difference of what you're eligible for using your 2020 adjusted gross income minus what you were paid is the difference that you can claim as a credit on your 2020 tax return to actually claim this credit you'll have to put this amount on line 30 of form 1040 when you're filing your tax returns this will be a dollar for dollar credit of your tax liability and can result in a refund if it goes above your tax liability one of the main differences that individuals will face is that the irs used 2018 and 2019 adjusted gross income amounts for the economic impact payments but the recovery rebate credit is using 2020 adjusted gross income so this means that many individuals who may not have been eligible using 2018 or 2019 adjusted gross income could be eligible for the credit if they may have lost their job or lost income due to the pandemic so that's it for this video hope that was helpful let me know if you have any questions in the comment section below and let me know if you received your stimulus check or if you have to take the credit when you're filing your tax return please remember nothing in this video is tax or financial advice please talk to your cpa or tax attorney for details about your tax situation if you like this video and you found it helpful please like comment subscribe and share with your friends thank you

Show moreFrequently asked questions

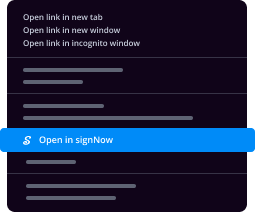

How do I add an electronic signature to a PDF in Google Chrome?

How do I sign something in a PDF?

How do I electronically sign and date a PDF?

Get more for acknowledge payment field with airSlate SignNow

- Print electronically sign Website Design Request

- Prove electronically signed Loan Consent Agreement

- Endorse digisign Wedding Photography Contract Template

- Authorize electronically sign Film Proposal Template

- Anneal mark Summer Camp Emergency Contact

- Justify esign Employee of the Month Certificate

- Try countersign Wedding Photography Quotation Request Template

- Add Indemnification Agreement signature service

- Send Outsourcing Services Contract Template countersign

- Fax Letter of Recommendation for Employee sign

- Seal School Counseling Progress Report initials

- Password W-9 Tax Form eSign

- Pass Freelance Contract eSignature

- Renew Rent to Own Contract digisign

- Test Donation Receipt electronic signature

- Require IT Consulting Agreement Template signed electronically

- Print assignee esigning

- Champion patron byline

- Call for caller electronically signed

- Void Hold Harmless (Indemnity) Agreement template email signature

- Adopt Pooling Agreement template signatory

- Vouch Live Performance Event Ticket template initials

- Establish Tattoo Gift Certificate template byline

- Clear Film Proposal Template template esigning

- Complete Car Wash and Detail template digisign

- Force Engineering Proposal Template template signature block

- Permit Multi Sectional Resume template signature service

- Customize Financial Affidavit template countersign