Add Bridge Loan Agreement Autograph with airSlate SignNow

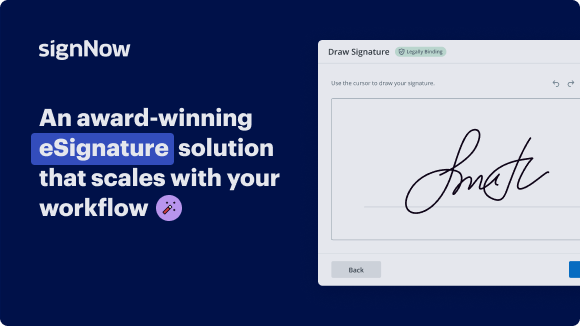

Upgrade your document workflow with airSlate SignNow

Agile eSignature workflows

Instant visibility into document status

Simple and fast integration set up

Add bridge loan agreement autograph on any device

Advanced Audit Trail

Strict safety standards

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your step-by-step guide — add bridge loan agreement autograph

Using airSlate SignNow’s eSignature any business can speed up signature workflows and eSign in real-time, delivering a better experience to customers and employees. add Bridge Loan Agreement autograph in a few simple steps. Our mobile-first apps make working on the go possible, even while offline! Sign documents from anywhere in the world and close deals faster.

Follow the step-by-step guide to add Bridge Loan Agreement autograph:

- Log in to your airSlate SignNow account.

- Locate your document in your folders or upload a new one.

- Open the document and make edits using the Tools menu.

- Drag & drop fillable fields, add text and sign it.

- Add multiple signers using their emails and set the signing order.

- Specify which recipients will get an executed copy.

- Use Advanced Options to limit access to the record and set an expiration date.

- Click Save and Close when completed.

In addition, there are more advanced features available to add Bridge Loan Agreement autograph. Add users to your shared workspace, view teams, and track collaboration. Millions of users across the US and Europe agree that a system that brings people together in one cohesive workspace, is the thing that organizations need to keep workflows working easily. The airSlate SignNow REST API enables you to integrate eSignatures into your application, website, CRM or cloud storage. Check out airSlate SignNow and get quicker, smoother and overall more effective eSignature workflows!

How it works

airSlate SignNow features that users love

Get legally-binding signatures now!

What active users are saying — add bridge loan agreement autograph

Related searches to add Bridge Loan Agreement autograph with airSlate SignNow

Add Bridge Loan Agreement autograph

commercial rehab bridge loans not only we do multifamily and single-family one to four we're also very big into the commercial bridge loan rehab loan program hey guys it's Angelo Christian with another great edition of real estate insider coming to you now talking about commercial rehab bridge loans not only we do multifamily and single-family one to four we're also very big into the commercial bridge loan rehab loan programs actually we're talking about a forty seven unit that we did in Chicago where we actually did to rehab it was an abandoned run-down a multi-family apartment complex is a forty seven unit and we gave our client our sponsor the cash back there to actually rehab the property owned it free and clear he reached out to us he bought her on a tax lien foreclosure sale and he actually was free and clear the Aza's value was a three hundred thousand he needed about three hundred ninety seven thousand dollars for repairs but look how big the ARV was so this is an awesome opportunity so this this client purchased this property tax lien foreclosure from the city of you know Chicago for three hundred thousand dollars right it was free and clear he paid cash for it and he got a contractor to do the job the bid was for three hundred ninety seven grand but look how high had jacked up the ARV so this thing had already over 1.8 million dollars of value so that's about 1.2 million of embedded equity in this property just by having him fixed this up so he's a millionaire you know overnight by investing into this remember that the key to the art of the deal is finding the deal finding the opportunity here look how big that equity spread is so he can lease this out he can flip it you can do so many things whenever you do a bridge loan because there's no prepayment penalty you're not stuck in an or he can refinance a convert to a long term fix if you want to if you want to keep it at lease out there's 47 units so let's go through the math we can actually see what this looks like so really cool if he did lease it out let's just say that he got the the funds to fix it if he leased it out and he's charging $1,000 a month for each unit there's 47 units he has 47,000 a revenue revenue okay the loan to us is only four hundred thousand and it's hard money but it's a short-term loan the payment to us our payment was forty four hundred per month that's a fully amortized forty years thirteen percent Interest thirteen percent rate now this has you know no prepay but he's gonna refinance and get off of this and he could even take more cash out and go by hisses this is amazing deal because this is the payment to us right now but now that the thing is worth one point eight million okay he could take out pay us off our four hundred thousand and there will be the take out lender to give him the long-term fixed and let's say he wants to take out another three hundred thousand in cash which this client actually did his new loan was for seven hundred thousand and we gave him a 30-year AM loan six and a half percent rate because now he's got you know it's fixed up it's stabilized he can convert to a long-term fixed he couldn't he couldn't do it his the property wasn't stabilized before so he couldn't go to a long-term fix now he's got three hundred thousand in cash out to go buy another deal he kept that he kept the unit he kept the property so he has the forty seven thousand a month in revenue come in and this is how you get rich guys okay I'm trying to show this to you because this is so powerful it's actually it's crazy but you look at this and what he's done is is uh what he's been able to pull off his new payment forty four hundred plus taxes the escrow on this he's probably got another 3,000 a month so paying seventy four hundred dollars a month okay collecting forty seven thousand bought a old building sat on it for a couple years fixed it up now he could always flip this thing later on but there's deals like this all over for shopping centers office buildings office parks multifamily that are maybe a little older or gutted they need to be rehabbed we do commercial rehab now we have some requirements we like to have the deal be at least a million dollars or higher so a million dollars plus you know that's really where we play as a million dollars in hire so this is you know really cater to if you're a larger investor we love commercial private money bridge loans so if you're out there and you purchased a property and it's not stabilisers messed up or you don't have the best of credit don't worry we have private hard money for you to get you the cash just like this client had a five hundred credit score didn't matter now we charge them thirteen percent interest but hey he became a millionaire by doing this deal if he wasn't already alright because on the hard money there's no credit there's no income it's an asset-based loan but it gave him the the funding the power to be able to fix up the property and we managed the escrow for the disbursements for the rehab but then after that was done he had a property worth 1.8 million dollars I know there's an investors that are watching us if you're out there we'd love to talk to you call my office if you have a property that you're trying to do that you already own though this was a refinance you already own the building so you can do this on purchases too typically if you do it on purchases though you have to put you know twenty to thirty percent down if you're trying to do a rehab so this was for a refinance because he actually already own the property but he could keep this for the rest of his life in his portfolio collecting forty seven thousand dollars a month in rent or he can flip it and then you know make a million dollars on the deal if someone else buys it for 1.8 million so that's a really really cool thing on commercial rehab bridge loans will also be your take out lender to convert the loan to a long-term fixed if that's what you want loan has no prepayment penalty so you can flip it and have someone else come and pick it up if you want to do - it's up to you you could use someone else as the takeout lender but this is a really good example and actually while I was talking you probably what I want you to see in some of the pictures is the before and the after looking what this thing looked at before and and look at what it looks like after the huge transition this thing was a dump and what he turned it into so really really cool awesome investment and if you're out there and you have you have one maybe you're sitting on that you want to rehab and it's worth at least a million dollars or more we'd love to talk to you to get you the funding for your bridge loan you can reach out to my office at eight three two four three one six three three one that's Angelo Christian we are your investment lender for life so eight three two four three one six three three one if you'd like to see more subscribe to our YouTube channel push this out to any savvy investors that you know that are looking to do either rehab loans bridge Fannie Mae multifamily Senior Living blanket loans we love to do blanket loans too so call us at eight three two four three one six three through and let us hook you up and boost your Noi thank you so much for by [Music] you

Show more