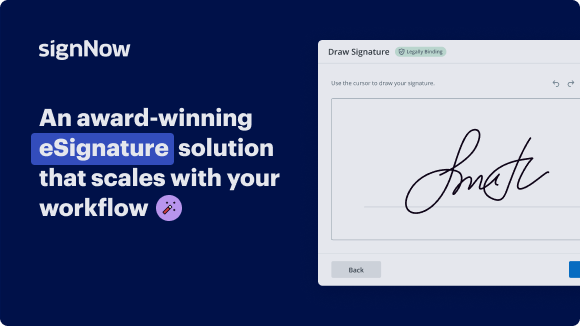

Add Tax Sharing Agreement eSign with airSlate SignNow

Upgrade your document workflow with airSlate SignNow

Flexible eSignature workflows

Fast visibility into document status

Easy and fast integration set up

Add tax sharing agreement eSign on any device

Advanced Audit Trail

Rigorous safety standards

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your step-by-step guide — add tax sharing agreement eSign

Using airSlate SignNow’s eSignature any business can speed up signature workflows and eSign in real-time, delivering a better experience to customers and employees. add Tax Sharing Agreement eSign in a few simple steps. Our mobile-first apps make working on the go possible, even while offline! Sign documents from anywhere in the world and close deals faster.

Follow the step-by-step guide to add Tax Sharing Agreement eSign:

- Log in to your airSlate SignNow account.

- Locate your document in your folders or upload a new one.

- Open the document and make edits using the Tools menu.

- Drag & drop fillable fields, add text and sign it.

- Add multiple signers using their emails and set the signing order.

- Specify which recipients will get an executed copy.

- Use Advanced Options to limit access to the record and set an expiration date.

- Click Save and Close when completed.

In addition, there are more advanced features available to add Tax Sharing Agreement eSign. Add users to your shared workspace, view teams, and track collaboration. Millions of users across the US and Europe agree that a system that brings people together in one cohesive workspace, is the thing that organizations need to keep workflows performing smoothly. The airSlate SignNow REST API allows you to integrate eSignatures into your application, internet site, CRM or cloud storage. Check out airSlate SignNow and enjoy quicker, smoother and overall more effective eSignature workflows!

How it works

airSlate SignNow features that users love

Get legally-binding signatures now!

What active users are saying — add tax sharing agreement eSign

Related searches to add Tax Sharing Agreement eSign with airSlate SignNow

Download document history with all eSignature events

[Music] drakey sign allows you to streamline your workflow and make the process of signing the tax return more convenient by allowing your clients to sign their tax returns digitally forms that support these signatures include consent forms efile authorization forms due diligence forms various bank documents and more efile authorization forms can also be signed for business packages and for states too if the state supports it Drake a sign is fully integrated with Drake tax and Drake documents and it's easy to incorporate into your existing workflow once signed these signatures are authentic tamper proof and securely bound to the signed documents the process you use depends on whether your client is signing in person or remotely a sign in person requires a signature pad a sign online requires a secure file Pro account plus an additional fee for each signature events a sign online is available only for the 10/40 let's first review a signing in person when your client is in your office to sign forms a sign in person requires a signature pad using a signature had to sign forms essentially eliminates the need to print sign and scan which saves everyone involved valuable time Drake supports topaz signature pads and beginning with Drake tax 2019 we're also supporting script health signature pads to set up a signature first install it following the manufacturer's instructions preparers can also apply digital signatures to documents by saving a signature in the software called a rubber stamp for a batch application to set up a rubber stamp for a preparer go to setup printing be signature set up each preparer is listed select a preparer and click sign to open the signature capture window you can also do this from preparer setup go to setup prepares and double-click the preparer name to open the Edit preparer window click setup signature to open the signature capture window sign the pad and save the signature [Music] in the return signature options section select 88-79 pin signature uncheck alternative electronic signature this preparer can now use the stored digital signature to sign documents such as the 88-79 now you are ready to create the signature documents let's look at the process for Drake a sign in person with a signature pad first create a PDF with these signature fields open the tax payers tax return to apply the preparers rubber stamp to the 88-79 enter a date on the pin screen but leave the er o--'s pin signature blank next go to view print from the document tree on the left side of the window select the forms to sign you can select all the return documents just the documents to be signed or go to sets and choose the EF signature set click fine from the view print mode toolbar to open the electronically sign return dialog box where signature options are chosen choose sign now if the taxpayer is in front of you ready to sign choose sign later...

Show more