Aicpa Autograph Made Easy

Get the robust eSignature features you need from the company you trust

Choose the pro platform made for professionals

Set up eSignature API quickly

Work better together

Aicpa autograph, within minutes

Cut the closing time

Keep important information safe

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

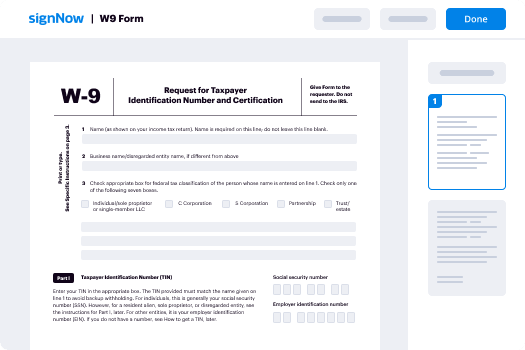

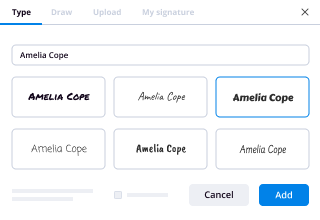

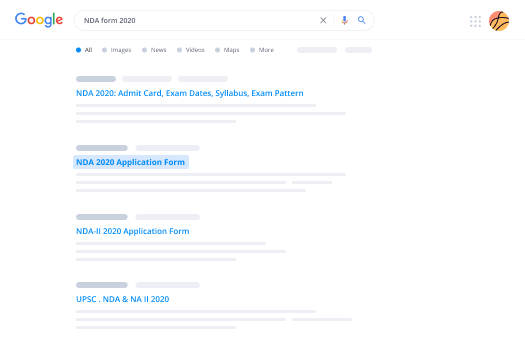

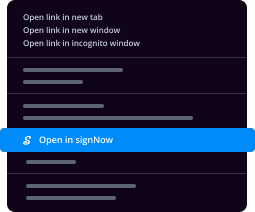

Your step-by-step guide — aicpa autograph

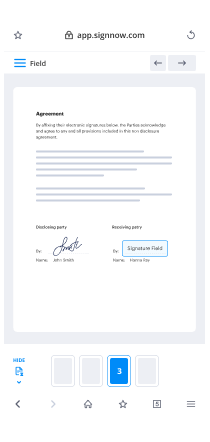

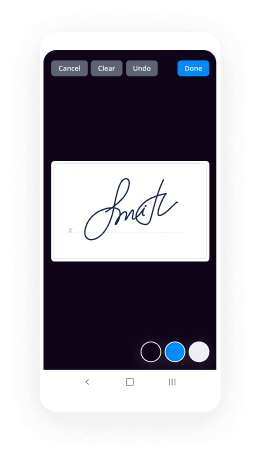

Leveraging airSlate SignNow’s electronic signature any organization can speed up signature workflows and sign online in real-time, supplying an improved experience to clients and employees. Use aicpa autograph in a couple of simple steps. Our handheld mobile apps make work on the run possible, even while off the internet! Sign signNows from any place worldwide and make trades in less time.

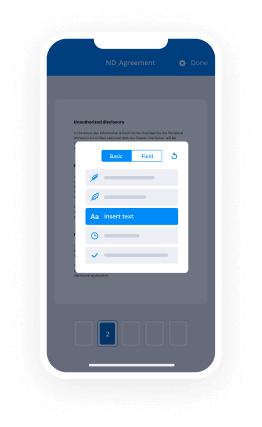

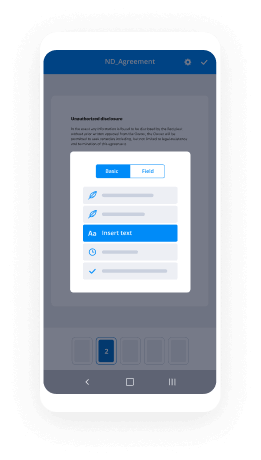

Follow the step-by-step guideline for using aicpa autograph:

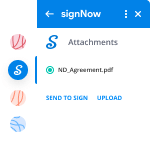

- Log in to your airSlate SignNow account.

- Locate your record within your folders or import a new one.

- Open the template adjust using the Tools list.

- Drag & drop fillable fields, type text and eSign it.

- Add numerous signers by emails and set the signing order.

- Specify which recipients can get an executed version.

- Use Advanced Options to restrict access to the document and set up an expiry date.

- Click on Save and Close when completed.

Furthermore, there are more innovative capabilities available for aicpa autograph. List users to your collaborative workspace, browse teams, and track collaboration. Numerous customers across the US and Europe concur that a system that brings people together in a single cohesive workspace, is exactly what enterprises need to keep workflows functioning easily. The airSlate SignNow REST API allows you to embed eSignatures into your app, website, CRM or cloud. Check out airSlate SignNow and enjoy faster, easier and overall more effective eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results aicpa autograph made easy

Get legally-binding signatures now!

FAQs

-

How do I get my CPA after my name?

IRC: If you have a CPA, but do not work in public accounting, you have to put the title of your position following your name. As simply putting CPA after your name designates that you work in public accounting. Of course if your license is inactive, then you must put after the CPA as well. -

Where do you put CPA license on resume?

Create a section for your resume called "Licenses and Certifications." List any licenses and certifications you have in this section. Add "CPA (inactive)" to the section you created. Since your license is not active, insert this near or at the bottom of your list of licenses and certifications. -

What happens if you let your CPA license lapse?

If your license expired on or before December 31, 2019, you are to pay the $120 renewal fee and $60 delinquency fee even if the license renewal application is submitted after January 1, 2020. -

Should you put CPA after your name on Linkedin?

Even if you're studying for the CPA Exam, you can still put CPA on your profile \u2013 just make it clear when you expect to pass the exam and become fully licensed. Please don't put your CPA Exam scores on your profile. -

Should I put CPA after my name?

IRC: If you have a CPA, but do not work in public accounting, you have to put the title of your position following your name. As simply putting CPA after your name designates that you work in public accounting. Of course if your license is inactive, then you must put after the CPA as well. -

Is it appropriate to put MBA after your name?

It is not common practice to put your MBA after your name in most cases. Listing your MBA on your resume makes sense, and is where employers will look for it. -

Should I put MBA after my name on email signature?

Add \u201cMBA\u201d to your email signature, as if you're a PhD. ... Every single time you send an email, the recipient will be reminded of your impressive academic credentials. -

How do you list degrees after your name?

University Professors. If you went through the schooling and wrote the dissertation, then you deserve to put it after your name. ... Financial Advisors. ... Certified Public Accountant. ... Pharmacists. ... Insurance Professionals. -

Can a CPA withhold records?

A CPA may only withhold your records if the accounting is incomplete. So if your documents are in draft mode, the CPA is not required to produce your records. But once the work is complete, even if the bill remains unpaid, the... -

How long does a tax preparer have to keep records of clients?

Tax records Professional bodies, including the ICAEW and ACCA, have their own guidance on keeping client records for their members. HMRC's official stance is that the maximum amount of time records need to be kept is six years, commonly referred to as the 'six-year-rule'. -

How long should a business keep records?

If you own a small business, you need to keep business records, whether in digital or hard copies. The IRS recommends saving financial records for up to seven years, although some documents should be saved longer than others. These are necessary for annual tax filings and potential audits. -

Can an accountant withhold records UK?

The accountant can withhold his own workings if he hasn't been paid for them. If you have all your records from that period though your new accountant should be able to reconstruct the VAT returns if that is all you need. -

Can a CPA firm have non CPA owners?

A CPA firm may be owned by CPAs or, in part, by a non-CPA. There are limitations if a non-CPA is to have any ownership. To begin with, the total non-CPA ownership of a firm cannot exceed 49 percent. ... The principal executive officer of any CPA firm must be a licensed CPA. -

Can non CPA owner have the title partner?

* Non-CPA owners would be permitted to use the title partner or shareholder but not hold themselves out to be CPAs. ... * The ownership interest of the non-CPA must be surrendered back to the firm or to other qualified owners if the non-CPA ceased to be an active professional participant in the firm. -

Can an enrolled agent own a CPA firm?

Enrolled agents usually don't work for a firm. ... Many CPAs start out in audit firms, but as they accumulate experience, they can launch their own CPA firms and have their own clients. According to Payscale.com, enrolled agents typically make between $30K to $75K a year, while CPAs make between $40K to $104K per year.

What active users are saying — aicpa autograph

Related searches to aicpa autograph made easy

Aicpa countersign

Welcome to the AICPA Town Hall Series, your resource for the latest news and updates on pressing issues facing the accounting profession. Good afternoon and welcome to the AICPA Town Hall Series. We're absolutely in a very intense week. We've got a very, very full agenda for you today, so we're going to get right into it. I'm Erik Asgeirsson, one of your hosts. What we're going to be covering is we're going to start off with some broad opening comments from me and Barry Melancon. Then we're going to get into the PPP reopening. Lisa Simpson is going to talk about the latest updates we've been receiving a lot over the past week. We're also going to do a lender updates action with Rohit Arora, the CEO of Biz2Credit, and we're going to close out with a little outlook on 2021 from Barry. You can earn CPE by responding to 75 percent of the attendance pop-ups, and we also have this bottom toolbar where you can download a lot of materials via that orange arrow button, and you can also ask questions. If at anytime your browser freezes up, refresh your browser, that's important and that will help with the viewing experience. Here are the presenters today. There'll be joining me shortly, Rohit Arora CEO and co-founder of Biz2Credit and will be talking about the lender environment as well as the state of their solution. I'm Erik Asgeirsson, the President and CEO of CPA.com, the AICPA's business, and technology subsidiary. We've got Barry who's the leader of the AICPA, who you all well know, and Lisa Simpson who leads the firm services area for the AICPA. Wow, what a week we're in right now. We had the inauguration yesterday, so we've got the Biden administration moving forward with all of their initiatives already. In addition to that, the PPP program was fully launched on Monday, so this is quite incredible and when you look at the timeline, which I'll be getting to in a moment, what you're seeing come out of treasury during their final couple of days because actually, we received guidance from treasury on Tuesday, the last day for many people at that department as the transitions going now into the Biden administration, and all of these stakeholders are standing up literally thousands of employees. I know there's a lot of anxiety out there with the clients around getting their next phase of PPP applications in. What I can tell you is, this is a public-private partnership, and we've been connecting with all of these groups, and there is a tremendous amount of work occurring right now, and we're going to talk about that, and what we're just trying to do is bring to you the best available information. I'm going to ask Barry to join now, and I'm going to have a few more context setting data points that I'll provide you, and then Barry and I are going to have a discussion on the current environment. What I asked you to look at on this slide, is January 19th. That was two days ago. I mean, these days are long right now, and two days ago, the SBA opened up the opportunity for all lenders to start submitting these next phase of PPP applications. On that same day, the SBA came out with an 18-page document related to Second Draw Guidance, and later that night, around 10:00 PM, they issued the forgiveness forms. The lenders were standing up platforms as new guidance was coming out and you really just got to command a lot of the different groups because treasury and SBA, with all, that's going on in the nation's capital, were able in a two-week period to get out all the guidance to support this $900 billion stimulus act, which is the second-largest business Relief Act in the history of the United States. Barry, just as you look at this slide and what's occurred over the past week before we get into talking a little bit more in detail about what's happening with the firm's clients and lenders just looking at this timeline. It's a tight timeline, Erik, I think he laid it out great, and I think for all of our members on the town hall, it actually, and you said you download this material, this is a great slide to use with your clients. It shows the compression of time and the complexity and really, from that then how the actual loans get funded in like. This is extraordinary time, the times we live in are extraordinary. The overlap of the issues that are going on like the administrative change, a new law that was passed in the holiday season, all of these things are complex, and what we add to this, there will be, and we'll talk a little bit about the look forward towards the end of this town hall, but you're also going to have clients who are going to hear things in the news about what's contemplated from a business regulatory perspective or a tax perspective. This just this big role, this trusted advisor role that we've been talking about, about helping your clients see the opportunities and the pitfalls in all of these programs. There is a part of this, that I think our profession can bring and has done a remarkable job through this of being a settling voice for clients. On the one hand, the client wants to make sure the money doesn't run out. We get that. We don't see any sign that will happen and helping the client understand the complexity. There's a lot of people trying to do the right things. I think, Erik said, the government changeover certainly added to it and part of that like you've done for years in taxes and in planning, being that voice of reason for the client, I really believe is in play in these next couple of weeks as these things bugs in the system are a little bit slow one place to the other by the SBA or whatever else is really important to be able to have those conversations. You're probably the sanest most informed voice to be able to communicate that to your client. Thanks, Barry, and we're going to get into just thinking about how you want to manage this with your clients. We are right now the economic first responders, but when you look at the health first responders in the implementation of the vaccine, to get it right now, immediately, there's more issues than if you weigh in. That's the same case here is, as we start talking about where things stand with these PPP applications. This is the data that shows what's happened so far. The SBA released some data showing what happened in the first week based on what they receive. This is very important. You got to look at what banks say that they have received and then the banks have to send those applications to the SBA. We're going to talk about that in more detail. But the SBA had received 60,000 PPP applications as of Sunday. This was from the smaller lenders totaling $5 billion. Then last night, Wells Fargo and Bank of America provided some stats on what they have received. This is not what they've submitted to the SBA. I was just on a lender's call and this data point is about what they've received, they are now in the process of submitting that into the SBA. When you look at these numbers and we reflect back to April, the first week of the cares ACT, about $200 billion was submitted to the SBA. We're into the first week and it's under $10 billion. All indications are there is going to be enough money. It's a $285 billion program. With that, I think we all need to just think about what's happening here. First, I've talked about this. The Treasury and SBA guidance it's very fluent and there's a lot of real-time issues that they're trying to address. There's lots of questions coming back to SBA every day on asking them for additional clarification. They're working on that. Then you've got the lenders, they stood up all these platforms and well-aware that over the weekend, issues on some of them, having maintenance windows and stability, and just getting the platforms up to support these new processes. There's very important security measures that they put in place and that can frustrate clients as they have to make sure they're using the current browser and things like that. Then you've got the firm's understanding the process, then you've got the clients to understand the process. Then you've got client anxiety around the funding. One thing that we're talking to firms about is, is think about your clients. There's some clients that it might not make the most sense to try to get their application in right now, wait a few days for SBA and Treasury to settle down the guidance. Wait for the banking systems to destabilize a little bit and then get your applications in. I'm actually hearing from some firms that they're using that patience. So Barry when you look at this, how do you think about it from the trusted advisor's standpoint and just look at the different pressure points in the system. It's very expected, you know, we live in a world right now when just Frank anxiety is at an all-time high and we talk about mental health in a lot of ways for the clients are facing that. I really do think that as firms, particularly if you look at the size of these loans on the previous slide there that you put forward, these are small but really truly small businesses and small numbers here. There's going to be high volumes, small numbers as compared to maybe much bigger numbers the first go around. Then they really need, I think, the profession to help think through some of these issues, for instance, Lisa in a little bit it's going to talk about the credit, the ERTC. There's different strategies about timing related to that and how you use payroll dollars to be able to maximize both the credit and the PPP law and forgiveness process. While the banks were there and the Fintech solutions are there, and that's fantastic. It's not automatically pedal to the metal so to speak. It really is about thinking through this. As I said a while ago, that's really where the value for the profession really is, including the anxiety that's in the system. You're used to this. If you have tax practices, the frustrations dealing with the IRS we'll come to that in a moment too. It's just the mass, it's a big country. Lots of millions and millions of small businesses in the second largest program ever, only because of the PPP program being the largest, the original. It is a time for reflection in communication and it really will tax your capabilities at communications. I think more than probably any time in your professional career to handhold clients through that process. When we talk about trusted advisor, that's what it means. They sort of have that expectation from you. That requires you, I think, to do some reflection as well. Thanks, Barry. I think one thing that is good to understand as you look at it, look at Chase, the largest lender in the United States, and right now, their form requires a client to go there and input it all in one sitting. They've got a lot of capabilities then you've got other platforms, even some of the Fintech, and we'll get into our Fintech platform which has a lot of capabilities. There's these usability improvements that we know we need to make. But you need to understand that we used the analogy before we're building a plane whilst flying. There's a lot of work being done and I think just understanding that all the different stakeholders, the payroll providers, the lenders, the SBA, the Treasury officials, and you and the firms are working very hard and together we're going to execute on this like we did before. One quick point on that, Erik, this is about the options right. Today, versus back in April, there really wasn't the type of [inaudible] to think through some of these things and what the system is done. Fintech solutions banks may require things that are not required in the regulations. You have the opportunity to think about those activities, I don't know, direct place, shepherd your client in the right direction. We're in a completely different spot now. We're in a different spot of understanding before we were trying to drive the common approach. We're putting out PDFs. Now, we're kind of more on the field with the lenders, understanding what's happening here and working with the firms with options. This is just an FYI slide. There's a lot of complexity behind this program and that level, adding to the anxiety. Barry, we're going to get into this the last slide for you and I before we bring Lisa in. But this is a question out there. We don't want to spend too much time on this, but the self-assessment of need, what we're hearing is most firms with their clients have a 25 percent drop in gross receipts, quarter over quarter. There's a lot of uncertainty. They really meet that condition. The other thing that you're seeing here, which I think is quite positive, and we saw that from the data, and we're seeing this firsthand from the data that we have is that there's a lot of first draw appliers. There's a lot of first draw applications this time around that are taking advantage of this is really because of the capabilities of the tents being widened. Barry just a quick comment here on the self-assessment. Well, I'll take the last part first. I think there is a strong intent to deal with some of the underserved areas that were not reached in the first go-around, and it's set up to deal with that, as you say in the first go-around, and that's probably driving some of the average numbers down, which is good. I think that that's the intent of the program. We do have a change of administration, but I believe there will be consistency, that this is the intent of the program, to help small business. I think everybody, whether they were in the old administration or the new administration, they understand the really important aspects of small business to the economic health and recovery. When we talk about it, and Lisa can talk about it more, answer questions, the issue of the calculation test on the decline, it really is using your judgment on what that is. It is not intended to deal with extemporaneous or extraneous type of issues that were not part of the business model, it's about sales. You have a lot of flexibility in looking at what is the legitimate test there. For instance, in a retail environment, you've got point-of-sale systems. That's the documentation; that's the real business reality of that particular enterprise. There are some judgment aspects that the regulations will never absolutely nail down to the finest detail that, again, I think our profession is in a great spot to exert that judgment in that process. Yeah. Well said, and this one thing you're still going to have to work through, the lender policies on all of this. Lisa, with that, we'll bring you up, and you've got a number of great slides prepared, and some good resources for the attendees. Thanks, Erik. It was a crazy week, you-all, if you were counting. We have nine pieces of new guidance, just since our last town hall. What I've done for you is, we've got hyperlinks in the slides for all of the documentation that came out in the last week. But we also just created a list of everything that's come out since the enactment of the Economic Aid Act. It's all in one document; it's in your resources for you to download. We'll keep updating that if new guidance comes out. If and when, let's be realistic. I'll say some of the things I said last week. The IFRS that have come out are going to be your new best friend if you're trying to navigate the PPP process for your business or for your clients. They're much better organized than they were when they came out in bits and pieces, back in the spring. They're very comprehensive. They're not going to catch every corner case, but they are going to give you the basic principles that you need to then apply that judgment that Barry was just talking about, to help navigate some of those unusual circumstances. I'm going to continue to encourage you to actually read and refer back to the guidance. The applications are very detailed now. You've got great resources on how to actually calculate loan amounts, and how to calculate forgiveness amounts. Use those resources and then apply your professional judgment. We'll get started on some of these. I'm not going to go into detail on every single one because, frankly, for a lot of them, it's not a lot of new stuff. But let's get started. Here's another look. I think it's two or three IFRS, four new forgiveness-related forms, some guidance on how to calculate loan amounts, and couple of procedural notices, so again, busy week. But what the team has done is, we've updated that summary document that was available last week to reflect some of the new guidance and the new insights that we've gotten in the last week. We're going to do our best to keep that as up-to-date as we can for you, and it is in your materials today, uploaded and ready to go. Make sure that you are checking the [inaudible] update on the document to see that you've got the most recent one, which is as of yesterday. It's only yesterday because I was afraid they'd send something out after seven o'clock tonight and then the dates would get confusing. Here's a look at all the topics that we cover in that summary document. Again, we'll be building it out as we get more and more intel and as we adapt to the common questions that you're giving us. Let's dive into the meat of the changes this week. I'm going to start with one that was a common question that really didn't have an answer, and it's what to do if the PPP borrower miscalculated their loan amount, or maybe the lender keyed in a wrong amount, and the borrower ended up with a loan that was higher than it should have been. The guidance that came out this week in a procedural notice basically says the borrower is not eligible for forgiveness of that excess amount, and once the loan forgiveness process has gone through, then the borrower will need to begin making payments on that excess loan amount. Next, we have a revised Form 3508S. If you remember back in the Economic Aid Act, Congress came out and charged SBA with simplifying the forgiveness process for loans of 150,000 or less. Months ago, the SBA had developed this 3508S simplified form for loans of 50,000 or less. They've taken the 3508S, and they've said that now it applies to loans of 150,000 or less. Again, this applies for first draw or second draw. It is based on the individual draw amount. I've been getting questions about, "If my first loan is 75, and my second is 80, do I still qualify?" Yes. It's based on the individual draws, and whether or not they're above or below 150,000. If your loan is 50,000 or less, then you get a waiver from the reductions around forgiveness because you had a headcount reduction or you reduced wages. But if your loan is 50,000 or more, then you're still subject to those reduction quotients. On the next slide, we'll see that, sorry, forward. Sorry about that. There we go. That simplified form basically asks the borrower to make some assertions around using the proceeds for eligible expenses and a 60/40 payroll split, how the forgiveness has been calculated, and again, the owner complements and FTE reduction and salary reduction examples. On the next slide, we'll take a quick look at the form. You can see, if you look at it, it looks very similar. It's skinnied down a little bit to fit all on one page because that's what Congress instructed. But basically, if your loan is between 50,000 and 150,000, you still have to do the math and keep all of that documentation that's required to prove your math, but you have a simplified form to complete on the front end. We got guidance on calculating loan amounts and I know this has been a recurring challenge since the beginning of the program, but there's really not a whole lot new in that guidance document. It doesn't have a name. It's not an IFR, it's not an FAQ, but it's a great resource because it's broken down by entity type. If you're a Schedule C with or without employees, it's going to walk you through the steps to determine your loan amount. We got another piece of guidance around second draw loan and this one's really going to be helpful for you if you're helping your borrowers with their second draws. This is going to give you details on how to calculate gross receipts, really hot topic. What reference periods to use, what the documentation requirements are, and it's going to address affiliate questions. There is so much information there. It felt like an IFR too. It did feel like an IFR, you're right. We're getting lots of questions about affiliates, and we are gathering those questions and looking to get some insights from Treasury on that topic. I know it's confusing and a little complex, but there is some guidance in that document to refer back to. Well, the biggest challenges for a second draw borrower is how to document their decline of gross receipts of 25 percent or more in one-quarter of 2019 or 2020 compared to the same quarter in the prior year. The guidance that came out gave you some options on how to document that decline. It's what we talked about last week. Use those quarterly financial statements or monthly and combine them into quarterly, and then show for your lender what you're using to get to a gross receipts number. Show your math again. If your borrower doesn't prepare monthly or quarterly financials, then the next step is to use bank statements. Again, show your work. Was there capital infusion that maybe doesn't get calculated into gross receipts? Show that that gets backed out. Barry mentioned point-of-sale system for our retail and restaurant businesses. You can start with that and then add in your other income that's going to be included in gross receipts like interests, royalties, dividends, and those kinds of things. There is an option if you want to use your annual tax filings, so 11201120S, Schedule C, whatever. If the 2020 return hasn't been filed, which for most of our current borrowers were great, but were not super, super, super awesome, great. You can pencil in the amounts that you expect to be reported on the return, attest that that is what's going to be reported, and then submit that as your documentation if you want to compare annual 2019 to annual 2020. Then a lot of questions around what the accounting method is for calculating net gross receipts decline. We'll refresh on what we talked about last week, I'll hit this really quickly, but don't expect a lot of detailed guidance. If you're using your monthly or quarterly financials, what's the normal accounting method that is used in those financials on an interim basis? Be consistent. If you're using an annual tax return, they gave you an option within the guidance that came out to map it out to the actual tax filing based on the entity type. It is going to look really strange to you when you start mapping, so think about the core concept of gross receipts and then that might help you as you're going along. Then on the next slide, I want to just hit this really quickly because I think it's important in creating some confusion around when can a borrower apply for a second draw? Do they have to have used all of their first draw? The answer is, when you apply, you have to say that you have used or will use all of those funds. Before you can actually get the loan disbursement for that second draw, you have to say I have used all of my first draw funds on eligible expenses and it's okay to not qualify for 100 percent forgiveness. Say you had a wage reduction or an FTE reduction that cost less than 100 percent, it doesn't mean that you have you have submitted your application for forgiveness. We do know that some lenders are requiring that, but the SBA does not. You could've spent your funds after the end of the first draw covered period, but the key is that you have to have used all of the funds on eligible expenses prior to getting that second draw. This is the IFR that came out on loan forgiveness. If memory serves me, it's about 82 pages. Don't hold me to that, but I'm going to nickname this forgiveness A-Z. It is going to walk you through the process and all of the calculations that are required to determine forgiveness. It's going to talk about the 60/40 split, how to calculate FTE reductions, etc. Couple of highlights, but only because they are different from what we knew prior to the economic aid act. The alternative payroll covered period is gone because now the borrower has much more flexibility in choosing their covered period. They can choose any period between 8-24 weeks. The FTE safe harbor was December 31, 2020. Now, if your loan was issued after December 27, the date this law was enacted, then you're safe harbor date is the last day of your covered period, and that's applicable for restoring headcount and salary, and hourly wages. If you have a loan in excess of $150,000 and your second draw is in excess of 150,000 and you want to apply for forgiveness on that, there's a quirk in the IFR that says you have to have applied for forgiveness on your first draw either before or at the same time as your second draw. I'm calling that out to you because some lenders are misinterpreting that. This is about, if your second draw is above 150,000 you have to apply for forgiveness on the first draw and the second draw, either simultaneously or get that first draw forgiveness in first. There's a new form. I'm not going to go through as easy and the normal 3508 because they're very consistent with what you've seen before. But there is a new form, I think it has limited applicability, but I just want to call it out to you in case you have a borrower who was controlled by a highly elected government official such as the President, Vice-President, or their spouses. If that's on your radar, then you've got a new form to fill out and it's available through the links in that guidance document that I gave you in your handouts. That was a lot. That's a lot Lisa. Thank you and look forward to taking some questions during open forum on all of that guidance. But that's impressive, a lot of work by your team over the last couple of days, so thanks. With that, I'm going to bring Rohit to roll up. We're going to dive in to a little bit of what's happening in the lending environment. I'm also looking at the questions and one thing I'm seeing is the interest for more communication from the lenders and that's a great point. One thing I'll just say is what's been happening is everyone is getting surprised at times. The SBA Feed became unstable yesterday and caused a lot of issues. It takes a little bit of time to understand what's happening with the SBA and then you get a communication out. With that said, we all can do better and I know the lenders are working on the one-to-many communication, as well as the one-on-one communication. I know that's something Rohit that you've been talking about. So I'm going to have a couple of questions for you in a moment. This we all know is the lending environment. You've got the traditional lenders and we have the fintech. What I can say is, I think everybody is making progress. With that said, Chase, and Bank of American, and PNC their platforms, there were issues there, usability issues and same thing with some of the fintechs. But let's talk, Rohit a little bit where things stand with is to credit now and then let's also start getting into a little bit of how this all works here. Welcome, great to have you on and I appreciate. I know your team has been going 24 by seven for the past couple of days, past couple of weeks. Why don't you talk a little bit about how the lenders set things up with the SBA and how that all works. Erik, thanks for the opportunity and that's a very good question. One of the things that we are seeing is that as we get these applications, we had initially set up the system to be extremely automated and the API that's still pretty unstable, especially for draw 2. Especially there's been a lot of confusion with sole props and schedule c companies with incorrect data, which is not the fault of the borrower or the CPAs, but how they got the loan from the first lender so a lot of time that was not filled out the right way. In this round, SBA is doing lot more to checks compared to around 1 so obviously it's taking more time and there are kickbacks. SBA keeps changing their API documentation, that leads to some instability in our platform also because we had put it fully automated. The steps that we have taken, the lessons we have learned is that, it should be an automatic platform, but it should not become a hostage to any SBA API change and that starts throwing up better. Now we've made some dramatic changes. I can say one thing with great pride is that we've got around 4200 apps from CPAs and already 3700 apps had been submitted to SBA. We have more than 300 approvals already for the CPA clients. They will start getting their contracts, some are already getting it, but most of them should start expecting getting their contracts from tomorrow. As adequately said, we're also improving the communication between our platform in the CPAs because I know a lot of borrowers are very anxious. One issue that will have to erased is that once it goes into the SBA portal, we don't get any update for, at least, 48 hours before they will either say yes or no. There's a bit of a period out there where we have just suspended animation. That's where you will have to live with it. SBA is promising that by next week they will try to shorten that window also and make it better. What we have done over the last three days is that we have right now and I think we have achieved a lot of success, is making the platform extremely stable irrespective of the fact whether SBA APIs are behaving properly or not, as I said, that was a big learning for us, and doing the SBA submission. So the API is returning an error then, doing it manually. We have assigned a large team of people who are actually manually entering those applications into the SBA system because we don't want any borrower to miss out on the money and at the same point of time, making the process as smooth as possible at the front end. We already have got feedback from CPA firms on the updates that had to be made and as the system has become a lot stable and it will become more and more stable and mature over next few days. We will be rolling out now some of those updates over next 24-36 hours, and then constantly, after that, we can speed that up. The idea is that, as adequately said, you know, we are building a plane while we're flying it. The first thing we need to ensure is that that plane doesn't crash. Once we have achieved that stability, then we are adding more features into it so as to make the process simpler, better, and also, we understand that people are very anxious to get updates so that they can get the updates. My feeling is by next week once people have signed the contracts, some people have got the money, more people will get the money, then I think they will get better. My only request to all CPA firms is you guys are very smart people and have some patients because we are working as fast as possible. There are things that we are just trying to solve and my experience shows that by this end of this week, things will be lot stable. One thing I can assure every CPA firm which is working towards is that we will not let anybody's application sit for a very long time with us. That's a very important piece and then we'll move it faster and next week you will see that as loans get closed, people will would get more assured and I think that would be less pressure on everyone. Thanks Rohit. I know there's a lot going on and one thing we are, we are going to work on the one-to-many communication and more statuses from both the platform and from our direct communication out to all the firms. In a couple of things, there's features like that firms want, such as the preview of it before you submit. These are advanced features and the team we had been working on this, not just for the past couple weeks, for the past couple of months. But if you even look at some of the bank platforms, you can't even save the file. We're going to continue to work on this, it gives firms the capability to offer to their clients, I do think is, as we talked about at the beginning, you don't need to get every client application in right now. There's going to be all indications are there's going to be enough money. So if you have a client that is not as technology forward, you might want to wait a couple of days for more of these improvements to be made so the processing is more straightforward. Roh, when you look at this slide here, these are the steps to eligible client, firm processes, the application with their client, then you submit it, the lender could kick back things or seeing that the lender kicks back and says, "It's not filled out correctly," then the lenders submits it, then the SBA, there's no loop here, they can kick it back for a number of reasons. Yeah. But then when you see this here, and these are the statuses that we are looking to do in real time on the platform for you. I know the lenders are two, there's the big lenders are Chase and Bank of America. But everybody is trying to understand what's happening with the SBA. This is something that I think will improve over the coming days. But I'll let you comment a little bit more on how you see this flow. Yeah. I think this flow is actually pretty accurate and we will see that, especially, as we start seeing more deals, above 150 in draw 2, we will see a much more review by the lender themselves and a lot more the kickbacks happening back to the firms even before it gets submitted to SBA. Right now, most of the volume we are seeing is either below $150,000 in draw 2 or draw 1. I think that's going to happen. Having said that, what our experience shows that as things get settled down. The key thing is that we just need to get a little bit more time with SBA. We just figured out that what statuses are they returning? Because a lot of time the API just doesn't return the right status and every time they're saying to us that don't depend on that. If that's the issue, then go to a manual [inaudible] uncheck it. Obviously, that's what we have learned and we're doing more and more while we are working very closely with the SBA technology teams, go in and also fix some of those issues and one thing I can tell you guys, I advice you to credit, we are giving us our first potentials to CPA firms, we are capable of handling very high volume, we've got over 70,000 apps, so much more than Wells Fargo or Bank of America. But at the same point of time, we're very focused on giving the great client experience whether they're the CPA or the client. The only thing is that, we're just running at such great speed with so many changes happening that we are just also training our sales teams, our customer support teams on that stuff. The idea is that we are going to get better and better and obviously we like your feedback because there are some new features which will help you guys to make it easier for you and your clients. We've are paying a lot of attention to that and we are going to make some updates. The only thing is we are not trying to make all the updates at a very rapid pace because that makes the stability of the platform. A little bit into question. Our main aim first is to stabilize everything because now more or less done, but at the same point of time, just keep track on that and then start rolling out some of these updates. Then as we expect more guidance coming from SBA next week. That's a very important piece that for funding if there's any more guidance coming and we should actually incorporate that. Otherwise, what will happen is that once they've signed the contract and another round of guidance comes in, then as a lender and CPA forms, we might have to go back to the borrowers and get some more documentation so I'm trying to avoid that experience happening. Our aim right now is to get as many apps into SBA and get as many approvals, and then start sending out the contract so that people can sign it, and then start funding sometime early next week. After that really accelerated because we hope by then, nothing's will be a lot more stable with SBA. Well, Ron, I didn't to bring Barry up, and that was a great, great overview here and I think that we all see here, there's sometimes a 48 hour period that we're in the dark with the SBA and there's other elements that we need to wait for as this dissolve all processes. I appreciate business credit focus on putting the firm's folk first and getting almost 90 percent of those apps submitted already to the SBA. Thanks. We will bring you back up for some open forum now. I'm going to move to the next slide and we can bring Barry back up. Barry, you listened to that discussion as before you get into 2021 outlook and we went a little bit into the weeds there, but I can tell you by looking at the questions here that's what you need to do sometimes, is get into some of the particulars. No question about that, Erik and Roh, did a great job I think talking about making sure that the plane we're building works. I do think frankly, what's been brought forward, again, I think it's about options. There's the traditional options we've talked about. The banks might require things that the SBA is not, and I think Roh and team are doing a great job of trying to make sure that we're doing what's required but we're not trying to overburden the system and make it really work effectively for for the member's clients or [inaudible]. I will say that was a great point there and they're listening to us on the guidance and on these features. That's a thing. Some of these other lender, they don't have really any interest to work with firms so that's the other thing. This is the evolution of finance and I think that's important. I think everybody should think about the adoption curve and do this in a measured way and we're going to keep at this, and as you know, the team has been going at 24 by 7 on this. For Barry now, [inaudible] outlook. Go ahead. Sorry. Yeah. The team has been fantastic. There's a lot of things in the profession, not just in this space. I mean, there's a whole major project on auditing in the future that's about changing a whole environment as well, and that is the world we're in with technology, and I think building that muscle mass to be able to handle that as a profession is very important. As it relates to the tax situations in general, I'll just hit these real quick. Obviously, the service levels from the IRS remains a very significant point of concern from members of all size firms. We are absolutely on that. I will say again, they're great men and women at the IRS. There are things that are hamstrung here, there's clearly a backlog of issues, there's this ping-ponging of things going out over things that have not been addressed already where responses have been made. In fact, Congress is involved as well in saying that this needs to be fixe0d. It's not going to be fixed overnight. The penalty abatement issue ties to that. We continue to work on the need for a simple process to get penalty abatement as it relates to COVID-19 issues. Everything from how that is done, can it be streamline, can it be done over the phone that's actually answered? There needs to be improvement on that, and we've been very, very vocal as well as Congress. We support the permanent notion of e-signatures. We continue to push for that. The number one question that [inaudible] getting, and it's obviously important, is the 2021 tax due date, will April 15th be extended, and also, ties to the fact that there's an IRS notice that said taxes wasn't going to start in February 12th. Let me just clarify that point. That does not apply to corporate returns. Corporate returns are being accepted, those can be done. When they're ready, it's really on the individual tax side that probably wasn't clear in some of the communications that came out about that from the service, but that is the fact pattern. Now, what about April 15th? Well, let's step back. In 2020, the debate about moving the tax due date from April 15th beyond April 15th was really all being done in real time. COVID hit towards the end of March, it really was an early April deadline. We certainly understand that this decision, if it's going to be made, it needs to be made sooner rather than later, because if it's done right before April 15th, it doesn't relieve any of the pressure points of workload, etc. We are actively engaged in this issue. I will tell you with all honesty, our membership is very divided on this issue. There are a lot of people who believe it should be and there are a lot of people who don't. The IRS service levels are a factor in this. If the IRS is not in a position to be able to really effectively administer the system, that has an issue. A, we need a decision sooner rather than later, and we will decide what position we take relatively soon as well. There are other complexity points and maybe other solution points. For instance, potentially, if the percentage you have to pay in with an extension, we all know, maybe it doesn't make sense they have to file an extension, but if you have to file an extension, it's the issue of what threshold does the taxpayer have to meet. That threshold is lowered, then those tax calculations can be much more macro rather than precise, and that is a better situation. The state tax complexity is a big one. The decision at the federal level, if there's going to be one to extend the due date needs to be done sooner rather than later because state moving or not is going to be a big important point about whether or not that creates any really relief in the system. I would also say that we have a new administration. This is a decision that's awfully made by treasury, and so they're literally in office for a day, and so we got to let a little bit of time for that activity to work out as well. Mobile workforce, we have worked really hard on that. There has not been a relief to that. It will be a highly complex issue as it relates to state taxation across state taxations, and those of you in saltic taxes are going to have a lot of issues on that. Next slide, Erik. I think also, what does it mean from a new administration, just to give you a sense of that with your clients. First off, the majorities in the House and the Senate are very, very narrow. You have 50-50 in the Senate. Some of these things can be passed through what's called reconciliation, which only takes up 50 percent vote, which means the vice president could break that tie. Some of these things, only certain things can be done through that process and may take a higher threshold in the Senate. The House majority actually narrowed, the democratic majority is much narrower than it was in the last Congress. That means that just a handful of moderates in the middle on either the republican or democratic side will have a lot to say with what ultimately passes. There will be debate about all issues. Here's six or seven out of eight of them on the screen. There will be probably another 20 that you'll hear and your clients will hear. There was debate yesterday coming out of Treasury about the potential of taxation of unrealized capital gains. I think again, being that stabilizing voice, not everything that is discussed or thrown out there in Washington is going to get passed. It also is not going to get passed very quickly. They're going to focus on other things; COVID, more relief and support for taxpayers and small business. This will probably be later in the year. Then the effective date, whatever gets passed, becomes a really important issue. Typically, that is the date of enactment or a prospective date. But in all likelihood, probably date of enactment, but it's always uncertain. Look, corporate income tax rates will be debated heavily. There is a US global competitiveness issue that comes into that. You can see some of the things that be on salt limitation that will clearly be an agenda item that will come about because of the states that salt limitation really has a negative impact on. Clearly, there will be a bifurcation of the taxpayer base and some attempt at additional rates at higher income individuals. We probably will see IRS funding shortfalls address, which hopefully address some of the service issues. We'll see enhanced credits at the lower income level. All of these things are in play whether they pass, and what that looks like is going to be subject to debate. Again, everything you hear said, even said by the president, doesn't mean necessarily that they will be enacted. Next in line. Barry, just on that, [inaudible] we know with the current PPP program ends March 31st. The questions we have even come in is how can it be extended, to be determined. If there's funding leftover, they may decide to extend it. It's that they're looking at this two trillion dollar stimulus bill that the Biden administration is putting forth. There's going to be some other business stimulus that we can take for a certain. So it's just going to continue and then we're going to get into forgiveness. With all of this, Barry, you look at this slide, I know you think a lot about strategies in this year. Firms are saying, "Wow, there's so many problems, so many opportunities to address." This is something that we're going to have in a future Town Hall, probably have something like Bill Reeb, try to help think through this, but any thoughts that you have, and then we'll move into the general Q&A. We're in a period in which partnering or some would call the term coopetition, I think not every firm, particularly, there's 44,000 firms in this country and the vast majority are small firms. Not every small firm can tackle every opportunity that's out there. There are partnering arrangements among firms, among networks of firms. There's ways to make sure that that doesn't erode a client-base through a client service arrangements and agreements. We have samples of those types of things through PCPS. There's just so many moving parts right now and so many questions that your client has to ask. I grew up in a small firm, so there's always this fear that I lose the client if I am not the one that can deliver everything. The fact of the matter is that in today's world, there is much more opportunity to have a collective view and maybe different resources, maybe another firm to come together and do one part or one area. An individual firm can really look at where they can maximize the effect on their clients, where they can maximize their own financial success in that process. That in a busy time, tends to not be top of the line to think about, but it's probably from a firm management perspective, it's one of those things that firm owners really need to find a little bit of time to think through, a strategy approach and a prioritization approach. Well said. It's always about this adoption curve here. Right now you're thinking about what clients to support, a lot of anxiety in the system, and think through that. Now, let's go, we've got a lot of questions coming in. The four panels here bring Rohit and Lisa back. Wow, this is a sprint day, it's Thursday. If Rohit is still here, he can come back online as well. I know we want to kick off with ERC question, so let's do that, Lisa. Thanks, Erik. We're getting a lot of questions about ERC. Has the IRS released any guidance on how to layer PPP and ERC? Do we know how to take credits for 2020 if we didn't take them back in the third or fourth quarter? We are anxiously waiting and anxiously advocating for that guidance to be out as quickly as possible. As a reminder, there is a webcast tomorrow, that's going to give you a deeper dive into the ERC aspects for both 2020 and 2021, because the legislation that was signed on December 27 does make enhancements to the ERC program for 2021. Of course, as we know, it freed up PPP borrowers to now go back and claim ERC. We are waiting for that guidance. As soon as we get it, you'll probably hear us all clapping our hands and you'll get a bunch of e-mails, and Twitter feeds, and LinkedIn notifications that it's out, now let's see what it does. I would ask you to consider, as you're working with your clients on whether or not they're going to apply for PPP2, if you think they're going to be eligible for ERC in 2021, give serious consideration to separating the PPP funds into a different account when they're received rather than immediately starting to use them for payroll, because that can give you some flexibility in how that layering is going to work. Consider that as an option. If you get your PPP funds quickly, you may want to set those aside while you're navigating ERC and the layering of the two programs together. Lisa, I think we would add that maybe that could be a reason not to apply as quickly even, because if you're thinking you're going to qualify for both of those, that might be part of the strategy. You can comment on that, but I would also just say that to the people online, this is a big deal. This area of dealing with the complexity of how they interface can mean a huge difference in your clients. Thanks, Barry. There's a good question for Rohit coming in. Someone submitted a PPP2 application, draw 2. Now, we know the documentation, information came out about having to sign those statements. Rohit, I know you know how to manage, what's the next step for the client there? Yeah. The next step for the client is, and that was causing some confusion and that's all we have kept in [inaudible] is that that client can log into their account and can upload that document. That way we have two things, which very important. Some CPAs and their clients are getting little confused. There was a review button which was green and then there was still upload button. The reason we kept the upload button still was that we knew that SBA will be making some changes. The borrower can just log into their account and then you can just upload the document. It is below the review button. Once they do that, the system will get automatically updated. One of our underwriters will actually review it because that's what SBA wants us as a lender to do. Once it has been reviewed, then we will submit it to the SBA. One thing to keep in mind is that any loans which are above 150 in draw 2, that will take a little bit more time for us to submit it because we'll need to do manual verification. Loans below 150, we have automated the verification process, so that's why we are able to submit them at a very fast pace right now. Well, thanks, Rohit. That's just a thing, there's a lot in these capabilities here. We're probably going to have some quick webinars, we roll out training sessions to better understand the platform. We are stepping up some of our customer service support and we continue to work with the AICPA PCPS team on understanding all of this guidance. With that, we're out of time here. We go to the resource slides right now. Rohit, I want to thank you for all that you're doing for these firms and for helping us deliver this business relief. Barry, I absolutely thank you for your leadership in this very important time. Thank you. Thank you, Erik and Lisa for your fantastic work and the whole team, because it's been a hectic week. Yeah, it's sure has. Here's the the recent Town Halls. I think they are pretty much self-explanatory, Lisa, so people can access that. You've got the PCPS section. Anything you want to reference, Lisa, on what's being pushed to that? I mean, you've got that great 15 page. As my fifth reminder of the day to you is that summary document that we're updating for you as your first stop for questions. Here's just the CPALoan.portal.com. We're going to continue to work on just communication on a daily basis related to what's happening there. Then we've also got the Town Hall series now available via podcast. This is how you can download it. We're continuing to use social media with breaking news as well as just putting out statements from the AICPA. The Journal of Accountancy is another great resource. I saw some comments coming in on that. Jeff Drew is busy as anybody, as the whole J of A team has. This is where we're at right now. As we said, we're in sprint weeks, we're working hard, you're working hard, and we're going to be doing another Town Hall next Thursday at 3:00 PM. You all are registered for that and we will stay in touch with you via other channels as well. Thank you very much. I know there's just a lot going on. We're working as hard as we can, as you are. Thanks for your time today. Thanks for your questions. We really do enjoy being with you. We always learn a lot. We hope you continue to navigate this difficult time over the coming days with your clients. Thanks for attending. That's all for now. Thank you for your participation. You can now subscribe to the AICPA Town Hall series on your favorite podcast platform, as well as watch archives on YouTube and AICPA TV. Tune in for live broadcasts, Thursdays at 3:00 PM, Eastern time.

Show moreFrequently asked questions

How do I eSign a document before sending it?

What do I need to sign a PDF electronically?

How do I sign a PDF online?

Get more for aicpa autograph made easy

- Signature offline

- Prove email signature Peer Review Report

- Endorse eSign Cleaning Quote

- Authorize digital sign Land Lease Agreement

- Anneal signatory Tag-Along Agreement

- Empower electronically signed Church Donation Receipt

- Try digisign Employment Verification Request

- Add Assurance Agreement signature

- Send Mobile app Development Proposal Template email signature

- Fax Free Graduation Certificate signatory

- Seal 30 day Notice to Landlord electronically signed

- Password Indemnification Agreement byline

- Pass Outsourcing Services Contract Template esigning

- Renew Pet Custody Agreement signature block

- Test School Counseling Progress Report signature service

- Require W-9 Tax Form countersign

- Send corroborator eSignature

- Accredit spectator eSign

- Compel recipient initials

- Void Freelance Quote Template template countersignature

- Adopt certificate template digital signature

- Vouch Triple Net Lease Agreement template electronically signed

- Establish Proposal Letter template digi-sign

- Clear Founders’ Agreement Template template esign

- Complete Child Medical History template signature block

- Force Sales Agency Agreement Template template initial

- Permit Professional Model Release Contract template signature

- Customize Entertainment Contract Template template email signature