Argue Attachment Field with airSlate SignNow

Improve your document workflow with airSlate SignNow

Flexible eSignature workflows

Instant visibility into document status

Simple and fast integration set up

Argue attachment field on any device

Advanced Audit Trail

Rigorous protection requirements

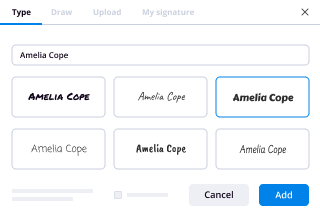

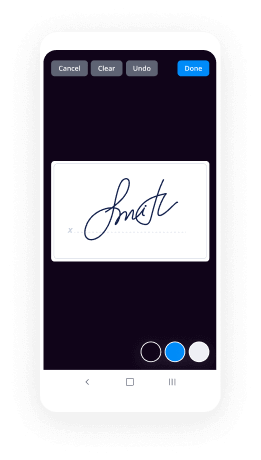

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

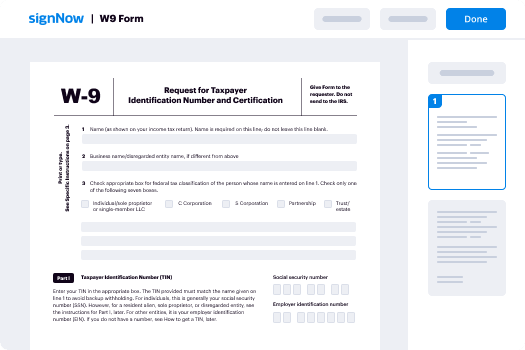

Your step-by-step guide — argue attachment field

Employing airSlate SignNow’s electronic signature any organization can enhance signature workflows and eSign in real-time, delivering a greater experience to clients and employees. argue attachment field in a few simple steps. Our mobile-first apps make operating on the go possible, even while offline! eSign signNows from anywhere in the world and make trades faster.

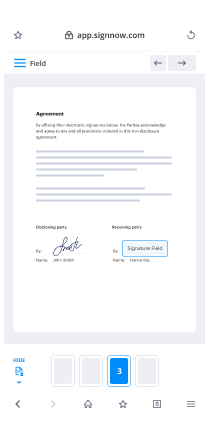

Keep to the step-by-step instruction to argue attachment field:

- Log on to your airSlate SignNow account.

- Find your document in your folders or upload a new one.

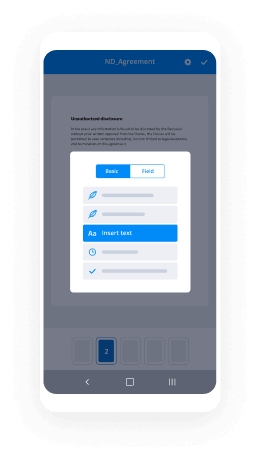

- Open the template and edit content using the Tools menu.

- Drop fillable areas, type textual content and eSign it.

- List several signees via emails and set up the signing sequence.

- Indicate which recipients will receive an signed copy.

- Use Advanced Options to limit access to the record and set an expiration date.

- Press Save and Close when done.

Moreover, there are more advanced functions available to argue attachment field. List users to your shared digital workplace, browse teams, and monitor teamwork. Numerous users all over the US and Europe recognize that a solution that brings people together in one holistic digital location, is what organizations need to keep workflows working easily. The airSlate SignNow REST API allows you to embed eSignatures into your app, website, CRM or cloud storage. Try out airSlate SignNow and get faster, smoother and overall more productive eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results argue attachment field with airSlate SignNow

Get legally-binding signatures now!

FAQs

-

What are the criticisms of attachment theory?

A serious limitation of attachment theory is its failure to recognize the profound influences of social class, gender, ethnicity, and culture on personality development. These factors, independent of a mother's sensitivity, can be as airSlate SignNow as the quality of the early attachment. -

What does Bowlby say about attachment?

Bowlby defined attachment as a 'lasting psychological connectedness between human beings. ' Bowlby (1958) proposed that attachment can be understood within an evolutionary context in that the caregiver provides safety and security for the infant. Attachment is adaptive as it enhances the infant's chance of survival. -

What does attachment theory explain?

Attachment is a deep and enduring emotional bond that connects one person to another across time and space (Ainsworth, 1973; Bowlby, 1969). ... Attachment theory explains how the parent-child relationship emerges and influences subsequent development. -

What is the Bowlby attachment theory?

Bowlby's evolutionary theory of attachment suggests that children come into the world biologically pre-programmed to form attachments with others, because this will help them to survive. -

What are the 4 types of attachment identified by John Bowlby?

It covers the four attachment types noted earlier (Secure, Anxious-Ambivalent, Dismissive-Avoidant, Fearful-Avoidant) as well as Dependent and Codependent attachment styles. If you are interested in taking this test, you can find it at this link.

What active users are saying — argue attachment field

Related searches to argue attachment field with airSlate airSlate SignNow

Argue attachment field

hello everyone and welcome to another episode of the daily gray refuel where i recap the latest news in the ethereum ecosystem i'm your host anthony sosano and today is the 25th of january 2021 all right everyone we had a bit of price movement over the weekend uh and from friday as well so we went back to all-time highs from from about 1200 the last time i came at you guys uh with the refuel uh you know we we can see on the chart here we we kind of went to 1480ish i think and then came back down a bit and now hovering around 1415 uh at time of recording which uh obviously is a great price to be out right anything over 1400 feels amazing um there's only been a few days in ethereum's history where it's been over uh 1400 so yeah it feels really great but i think the bigger news uh in terms of price movement was the eighth btc ratio now a lot of people talk about this a lot of people watch this for various reasons um so the the level that people were looking for was a break of the 0.04 level here and the reason they were looking at this and i can kind of show you here so if we go to the one week chart here and i kind of scroll it down like that you can see that we have been kind of like ranging in the 0.04 to 0.16 level for two and a half years two and a half years of ranging here and we finally broke out of that over the weekend which is obviously a huge deal right for the traders among you you'd know why this is such a big deal but the tldr is basically you you sit in a price range for two and a half years and you fail to break out of it you know one two three times in that in that period right while having all these kind of like downtrends here uh it's a huge deal and it's also a huge deal not just for eighth but for all the other kind of tokens out there because when eth is going up a lot and when it is going up against btc the other kind of tokens in the market tend to go up as well so you know people are really excited because they you know people call this alt season right and things like that even though i don't think ether is an alt but it's just like a term that people use or whatever but yeah so that was that was really great to see and i think in general you know ethereum deserves to be worth you know much more than it is versus bitcoin right now or that it has been in the past i think ethereum is delivering so much value um to to the crypto ecosystem and ethe is just such an amazing asset for various reasons that it's criminal that has been worth you know just a few a few weeks ago it was worth what 0.022 which is like uh it's it's incredibly low compared to what bitcoin's worth in terms of uh in terms of market cap and it just doesn't make sense so this was a level people were looking for and now that it's broken everyone's very excited we'll see um how fast we trend up from here you know people are already calling for the flipping which is when eats market cap flips bitcoins and as bullish as i am and i do believe in it i just don't know when it's going to happen i don't know if it you know it would happen and then uh eth would fall i get uh full under um in market cap as opposed to bitcoin because you can imagine something like that being like a huge signal for people to sell right if they if if each market cap goes over bitcoin's market cap people are going to be like well you know they kind of play a game of chicken they're going to think to themselves well you know is everyone else going to sell this kind of um event if they are i better sell and then you kind of have this self-fulfilling prophecy but that's still far away i think the flipping line is is i mean we almost did it in 2017 but i think it's like 0.10 sorry 0.17 probably above that actually but we got close in 2017 so we'll see what happens there but i'll digress here on for now on the price action but i just thought it was very important uh because obviously i mean i'll explain in a bit why i think it's very important actually i have a tweet lined up for it i won't explain it now um but i did want to show that uh this interesting tweet from into the block they posted that eth is leaving exchanges at a rapid pace right now and you know usually that means and as you might have suspected that eighth is is kind of getting off the market and going into people's cold storage or maybe it's going to defy as well i mean there's various uses with eth but you can see here that is one of the biggest withdrawals in a long time in the in the short period of time was almost a million eighth was removed in one day from from exchanges so that was pretty bullish as well um you can see coin gecko here is also talking about the d5 total market cap so in 2020 it was only 2 billion now in 2021 it's at 43 billion and i've spoken about this before but coin gecko uh uses uh how am i not following coin gecko that's weird they they use um uh chain link in there they have chain link in their default category which i don't think is defy um not that i don't like chain link it's just it's a middleware protocol i don't think it should be classified as defy um so that's worth like six or seven billion dollars so you can discount that again so you can just say that d5 market cap's like 35 billion right um which is which is still quite small i think compared to the the kind of like the the the kind of a potential that we think d5 has here but it's funny to see how fast it's already grown from just 2 billion in 2020 and 20 you know at the start of 2020 i think and then 2021 it's now much higher it's like 20 almost 20 x higher so that's really bullish there um and this this was also bullish this came from coinbase so i posted the twitter kind of a screen grab of uh coinbase calling ethereum a potential uh story value asset which i thought was was pretty insane uh for those who were around in 2010 and 2019 during the the bear market if you called a to story value asset you would have been laughed at by pretty much everyone even people if within ethereum now you know you'll laugh that if you don't say that right if you don't think it's going to be a store of value so it's just it's pretty insane like how fast kind of sentiment changes and for this to be posted on coinbase's blog here uh is huge because this is this is going to be read by people that aren't in the crypto ecosystem right um and and don't know how to value these things they don't know you know what's a story value what isn't and and all this sort of stuff and coinbase is saying you know eth is and then they have this chart that shows that eighth outperformed bitcoin in 2020 which which i thought was was really cool as well anyway the reason i'm talking about price so much and and the reason why i do talk about it a lot is because i think one it's extremely important um but in general you know and i obviously tweet about prices a lot too but i think and i tweeted this out today and i read the whole tweet so you know open quote this may be hard to believe but the main reason i get so giddy about eth going up in price is not the profits it's the fact that so many dedicated ethereum community members spent three long years building during a brutal bear market and now their work is being rewarded end quote so if you were around in 2018 19 and even 20 you would have seen you know it was a very small community there were people you know heads down building no matter what the market was doing they were building they were building the the infrastructure that we used today all of d fire has been built during the bear market right um it started basically at the end of 2017 with maker and then we built it out through the bear market and those people had to deal with you know obviously the sentiment being really bad because each price was falling from a higher 1400 to 80 within a year right that happened within 2018 uh which was just insane right no one expected at the four to 80 from 1400 but no one expected it to go to 1400 yet either so you know it works both ways but in general and and that led to people thinking that ethereum was a failed project it was gonna die right um nothing was ever gonna happen on it ethereum had just lost its kind of major use case in icos during 2018 um because icos kind of fell out of favor people stopped doing them obviously because the market wasn't hot there was kind of no i guess customers for icos if you want to call them that and then ethereum was kind of like in this no man's land because there wasn't defy uh there were like bits and pieces i guess but nothing nothing to to talk about really uh and and you know that's why eighth was falling so much because people were like you know why why you know why am i holding this right why is eighth valuable all this sort of stuff so i think 2018 was was very brutal and then 2019 was also very brutal because the eighth price didn't really do anything in 2019 it started the year at like 130 or something finished the year maybe a bit higher than that um whereas bitcoin actually you know finished up on the year so there was this kind of thing where you know a lot of people turned into bitcoin maximalist for some reason uh just because of the price action so that was another thing so all throughout 2018 and 2019 you had you know these builders these people in the ecosystem these die hard believers had to deal with so much negative sentiment so much toxicity people telling you that your project's going to die you know ethereum's dead and you didn't know if what the future was going to look like obviously right you didn't know that d5 was going to be as big as it is you didn't know that ether was going to go back up i mean you believed it right but you didn't know and and that's always the toughest thing is that you can believe something you can believe it with all your heart and all your mind but you don't know for sure because no one can tell the future like you know i mean myself and a lot of other people that i'm close with in the ethereum community we all believed that eth would go back to all-time high we believed that ethereum would be this platform um you know for for things like d5 and kind of you know web 3 and all this sort of stuff um we definitely did believe it but even you know as the price was going up in 2020 as it reached i think it broke out of like i think the the the price it got to in 2019 during that random pump in the middle of 2019 was like 380 and that's the price that it kind of broke out of in 2020 and when that happened right we were all in disbelief we were like is this really happening right after all this time and every single day you know being in the community watching the prize um you know spending time with building and trying to kind of like keep the community together and fighting off all the toxicity you get to a point where what you believed would happen happens and then you just you're literally in disbelief and i i suffered from this for for a few months actually and i've only just now come to like recently come to terms with the fact that this is actually real this isn't you know a joke right and it sounds funny that i'm saying this but if you've been around for the same amount of time that i have through the through the original bull market in 2017 and then the bear market you would know kind of like what this feels like uh and it's just surreal it really really is surreal and and it just you know i mean i i won't go on too much about it but i just think that you know if you're newer to the ecosystem you obviously don't have the context here and probably be glad you didn't have to live through that bear market because it was it was very very brutal and very toxic they were literally bitcoin maximalists every single day you know and these were popular points for them to make as well they were basically making all these points that made sense at the time i guess you could say to the the uneducated kind of um person that was in the ecosystem and it and it was really disheartening because it you know price is normally looked at as a kind of like indicator for success for a project so if the price isn't going up um it means your project has failed which is which is stupid for a number of reasons right but that's it is what it is but you know the fact that we were delivering all these things and they were so valuable to people the fact that we had uni swap that was just amazing and people didn't see how amazing it was until the eighth price started moving up again yeah it was frustrating so to be at this point to be at the point where you know eth is at all-time highs against usd we broke out of a two and a half year range against bitcoin which was probably the more painful thing because bitcoin would always look point to that and be like haha you know it's you know you should have just held bitcoin instead of eith blah blah blah so the fact that we've done this and we're finally there in in 2021 now in january of 2021 the final we're finally starting a bull market people finally see the value in d5 and it's no longer a question of if d5 is going to succeed it's how long is it going to take for d5 to take over the traditional finance system so it's just i mean it's night and day difference i i mean i'm very happy about it of course but you sometimes think back and you're like you know you you think back to how you felt at the time like during the bear market and you think wow i never want to go back there and you know what the the worst thing is is that i know there's going to be another bear market eventually that is crypto if there isn't another bear market i'll be extremely surprised because that has been the trend up till this point so you know it's coming but you want to enjoy the bull market so you try to ignore that fact but it's hard to ignore right because you don't know when it's going to come you just know it is going to come around and then you might have to deal with all that toxicity again but i think it's going to be a lot easier to do it this time because just because uh the prices come down doesn't mean the app stopped working all of d5 was still going to work i actually think a lot of people are going to stay within the d5 ecosystem if they cash out because they'll just go to stable coins right why not just go to stablecoins and earn some yield yes the yields are probably going to be lower but why even go to fiat you got to fear for taxes and some bills maybe but why keep your money in a bank account where it's earning basically nothing uh and it's also in a in a bank account right you're only stuff to go bankless so i actually think a lot of capital is going to stay within the system which should dampen the bear market and maybe maybe even shorten it maybe not it depends how crazy this bull market gets and i'm not saying that things can't still fall like 90 plus in value they definitely can uh bts maybe not that much but the d5 tokens you know depending how crazy they get some of them are going to be fallen 90 plus from their highs like that's that's just uh crypto for you they did that in in um after d5 summer so i know i've talked a lot about i guess i guess price here but i think it's it's something that we should just step back you know take a look at and take a look at how far we've come you know respect how far we've come how far we still have to go respect the builders within the ecosystem and help where you can uh there's so much to do right if you're i mean i've mentioned this before but if you're working full-time outside of the ecosystem and you're happy with that but you still want to be involved with crypto just do something on the side there's so much you can do but if you want to join crypto i mean now's the best time to do it there is so much hiring going on right now because of the fact that the ecosystem is growing so much so if you're looking for a job in crypto uh there's actually a site that i recommend or you can follow them on twitter cryptojobs or cryptocurrency jobs on twitter that you'll be able to find it there but you can even join like discord channels of early stage projects add some value in your spare time and they'll end up hiring you if you're good enough as a full-time contributor which i think is really amazing as well so yeah we've come a long way long way to go but i think we're at the point now where ethereum is no longer will it work you know is it going to change the world is dfa going to be a thing to we know it's going to be a thing let's keep building it right let's make it happen faster right let's not sit on our hands and wait for someone else to build it let's do it ourselves so and end rant there i guess um on on that topic but yeah i just think it's always good to put some context around these things all right so i put a tweet out uh just a few hours ago because uniswop is now doing more fees than bitcoin again so this site crypto fees dot info is where you can see the fees generated by ethereum bitcoin and various different protocols so you can see here that i mean ethereum alone is doing well 8.8 million dollars of fees gas fees uh per day right now uh actually over the last seven days the average has been almost 10 million dollars per day uh uni swap is doing 2.3 million dollars a day of of fees and that's not gas fees that's protocol fees so uniswop takes 0.3 on every trade and pays that to liquidity providers so that's 2.3 million dollars is coming from the total trading volume of the day um which is you know zero point three percent of that trading volume then you have bitcoin which is doing an average of three million dollars of fees over the last seven days but over the last day it only did almost two million so unisop did more then sushi swap uh we're doing a million synthetics and and then there's a bunch more on the website you can scroll down and there's even more than that but basically yeah i guess the top four or five here is what's what counts really but i mean it's just insane and i don't think it's a one-to-one comparison of course like uni swap is a very different product to what bitcoin offers right unisop offers a way to trade thousands of different tokens and it takes a flat point three percent fee that fee isn't variable uh it doesn't but but the thing is the what what is variable is the amount of fees generated right the more demand to use unisop the more trades going on the more volume passing through the more the fees are going to be whereas with bitcoin and ethereum that the networks themselves the value transfer doesn't doesn't matter right if you were to do a one million dollar trade on uni swap point three percent of my one million dollars uh for a fee is more than point three percent of a hundred thousand dollars for example whereas with ethereum and bitcoin it costs the same amount of money uh to move a million dollars of of eighth as it does to move ten dollars of each right um so and and and with ethereum it's dependent on the gas phase at the time with bitcoin it's dependent on the on the network fees but which is also dependent on demand so it's still demand so i still think it's relevant to show that uni swap has more demand than bitcoin in some roundabout way but it's an apples to oranges kind of comparison here but i still think it's funny you know obviously the the metric that matters more is the one where ethereum is leading over bitcoin uh and it kind of like has cemented its position over at this point and it's not just leading it is absolutely obliterating bitcoin right now it's over four times the fees paid so and i know i mean i've spoken about this a lot on on the refuel and people obviously you know i always whenever i post this i always get um reply saying you know why are we celebrating high fees and all this stuff and i'm not gonna i'm not gonna argue that again it's just it's such a i mean it's missing the forest for the trees as well like how can it be a bad thing that people are willing to pay these high fees uh to to use these networks right we have layer two scaling coming as well i mean i've spoken about all of this so many times i'm not going to rehash it here but yeah i mean it always kind of like just irks me a little bit it's like guys just like you know dig a little deeper you know stop looking at surface level stuff dig a little little deeper and you'll get what it all means so yeah i thought that was that was quite funny there so some updates for wearable this week so they have a featured section uh now you can link your twitter account to earn trust from buyers which i guess is like an anti you know sybil kind of resistant mechanism there uh they've got a refreshed leaderboard they've got dark theme enhancements and general ux improvements so you variable is i mean i love wearable uh it's really great nft marketplace you can go and visit their site i'll link it in the youtube description if you haven't yet but i really love the way they've done kind of the ux um there's obviously a bunch of other crypto marketplaces or sorry nft marketplaces like openc uh nifty gateways there's actually a bunch of them now like super rare some of them are targeting niches like super ray does art whereas wearable is like a generalized platform but yeah great to see them keep shipping features here if you want to go check it out it'll be in the youtube description so uh there was a thread here put out from not alpha finance themselves but from the integration lead at band protocol uh sawwit i think that's how you say say his name here so uh this is a threat about alpha homora v2 which is one of alpha finance's uh new products coming out and kind of like how it works and everything like that you can read the thread in the youtube description i won't read it out here but basically this v2 launch is quite big it comes with a bunch of different features uh the features are listed here it comes with the hamura bank uh spell caster safebox wrapper and oracle the bank um basically allows the storage uh oh oh oh sorry the the hamora bank is a smart contract that stores all of the protocols positions as well as uh the collateral token in the form of wrapped lp tokens uh it is also the contract that the protocol users interact with so i mean it's basically like a vault uh sort of thing i mean this is this is technical stuff here but i think it's important because the major improvements to the protocol um spells uh contracts that defines how to interact with various liquidity pools on the protocol uh then you have a bunch of other things yeah as i said i'm not gonna i'm not gonna read it all out but um i think the i mean he says here the juicy bits are the safe box which is uh basically users can choose to lend their assets for others to borrow but instead of the lending borrowing happening directly on the protocol it is done through cream and the safe box contract so um that that's pretty cool there it's a bit innovative there um but yeah i won't go through all this you can read it in the youtube description um because i don't want to read it out to you but for those if you haven't been following the alpha finance the project i i suggest going and checking them out they're offering some really great products with more coming they were the first ones to do leveraged yield farming which i thought was really really great they have um you know lining and borrowing going on as well they have uh an a new amm coming uh soon they have a perpetual protocol coming i think as well so they're building a lot of different things and and it seems to have flown under the radar for a little while and full disclosure here i own alpha tokens but that's because i'm bullish on the project i think it's really really a really great project they managed to grow i think the number 11 on default pulse in a very short period of time i don't want to show you too much on it i just think that i love highlighting projects that i don't think are getting enough attention over the last few days it seems to have been getting a lot of attention because the price went up of the alpha tokens but the project itself is really great and you know i suggest you go check it out if you haven't already and use the products too if you're into the old farming you know maybe you want to do leveraged yield farming there's also a product where you can put your eat in and earn interest on that eighth and the interest isn't um is it negligible it's it's upwards of like 10 at times on your eighth right paid in eighth not in not on uh like a stable coin or whatever so yeah definitely go check those out but i won't show you too much too much yeah because uh uh uh obviously i hold alpha tokens here so i don't wanna i don't wanna be uh shilling you on it too much so another thing that kind of happened over the weekend was a lot of people were talking about crypto punks now i read about this in the daily grain newsletter so you can go check that out if you want a little bit more details here but basically the trdr on crypto punks is that they are the original nfts on ethereum they were created in 2017 by a company called lava labs and they basically were going for nothing back in 2017. you could basically buy them for you know pennies on the dollar um and you know there's only a limited amount of them there's 10 000 of them and each of them have different traits so you can see here that this one is has an alien trait and has like a purple cap on now there's only nine alien crypto punks out of 10 000 so because of that or at least that's one of the reasons you know it's very scarce and someone which uh paid 760 sorry someone paid 761 000 for this particular crypto punk yes that's right 761 thousand 000 now it's not just someone it's a dao called flamingo dao which seems to be like a collective that collects nfts and like different things like that which i thought was was interesting but yeah and this isn't the only one that has been sold for this amount and they've actually been going up in price if i go to the lava labs website here you can see kind of a transaction history um how it's sold over time so you know over the past few days there were a bunch of bids coming in and then it finally sold for 761 thousand dollars and then you can see here back in 2017 uh it originally sold for i guess oh no it was originally claimed so i think i think you could claim it for free at the time and then you know there were bids coming in bids coming and bids coming in and eventually sold for two thousand dollars so if you were the person that had uh bought it for two thousand dollars back in july 6 2017 and sold it for 761 000 today i don't know if it's the same person but you know if you had done that you know it's a quite a good gain in in three years right or three and a half years or whatever it is there so yeah but the main thing i wanted to talk about here was that i saw a lot of people getting confused as to why some would spend so much money on you know what they consider to be like a pixelated image where you can just you know right click you know savely save image as and and bob's your uncle i explain in the daily grain newsletter in today's edition i go into more detail about why i don't think this is uh the right approach to this sort of stuff and a few of the reasons include the fact that one i mean i just talked about how it's scarce right how there's only nine alien punks um and and you know out of ten thousand and then there's never gonna be any more buying the actual crypto punk on chain gives you cryptographic proof that you uh own that thing on ethereum the only way for it to be altered is if someone took over the entire ethereum network and if that was to happen i don't think anyone would be talking about crypto punks we'd have bigger problems at that point so there's that right it's owning a piece of like nft culture i was the first nft right it's nostalgia maybe you know you saw this back in the day and now you're a whale because you made some really great crypto investments and you're like wow i really want this uh and you buy it right maybe this person bought all this dowel bought it because they thought that they they can flip it later for more right there's there's a bunch of different things and reasons as to why people buy these things some people say it's wash trading this particular instance wasn't because this dow bought it but i think there are there is some wash trading going on where people buy and sell to themselves and make it look like these crypto punks are worth more than what they are and not just crypto punks like any nfts on chain cause it's very easy to do that but that happens in the real world as well like in the art scene um too and it hasn't stopped people from collecting there are legit collectors out there i mean i'm a big collector and you can see all around me all the things that i collect i've been a huge collector for a long time one of the things i collected a lot of actually um was pokemon trading cards uh i collected them up until maybe two or three years ago i was i was a pretty avid collector and you know um for for various reasons a lot of it was you know nostalgia um i i liked the the art on them i really liked collecting them and i guess like one thing was that i just like collecting in general i like completing like a collection or having something unique and that you know that that's worth something and i haven't ever sold really any of my cards like i've sold a few of them but none of the really ultra rare ones or anything like that because i don't really kind of care to um but i like owning them and i have like a it's weird to say but i have like an emotional attachment to them like nostalgic sort of thing and i think that's what people have with digital collectibles as well just because it's digital digital doesn't mean that it's any less kind of you know um collectible than a physical item because we can have digital scarcity thanks to blockchains i mean btc having 21 million uh only 21 million bitcoin you know are able to exist is because of that digital scarcity enabled by blockchains right um eth has its own digital scarcity even though it doesn't have a cap like we know how much ether is in a speculation at all times we know where it is you know we know what it's doing with eip1559 we'll be burning you know some eth so there's that aspect to it uh as well the scarcity aspect which plays a big part in it but yeah i mean you can go read the newsletter for a bit more context here but i thought that was just interesting seeing all the conversations over the weekend people not getting nfts and you know fair enough if you're not a collector if you're not someone who's ever collected anything you're not going to get it in general but think about this and i wrote this in the newsletter actually and i thought it was a pretty funny example a year ago i could have only sold eve for 150 right one eighth was like 150 dollars a year ago or something like that today i can sell it for 1400 or over 1400 right i mean there's a time value of things as well like why can i sell it for 1400 today but a year ago i would only get 140 for it right same with these crypto punks it's not it's not a one to one comparison it's not apples to apples but there is a time value aspect here as well and you know a lot of things are actually valued on their age right you know vintage things normally go for a lot as i was talking about before the pokemon trading cards the older ones from the from the original generations are actually worth much much more than even the ones from just a few generations later and that's based on you know nostalgia the age and nostalgia is a function of time right you can't be nostalgic about something that you only experienced yesterday it has to be you know a certain period of time before you can get nostalgic about something so there's that aspect to it there's the scarcity aspect because those first cards that were out because they weren't worth much at the time people just discarded them right they lost them they didn't care about them and the same thing happened with crypto punks actually a lot of people gave them up for cheap because at the time they weren't worth much same with eat at the time it wasn't worth much uh it was only worth a hundred and forty dollars per each now it's worth fourteen hundred right um people are giving it up because they're like oh well you know it's it's it's it's only this much uh whatever right um not apple staples again right i'm not trying to say it is but there is a time function there and especially with collectibles their nostalgia plays a huge part for sure so i think there's a bit of a bit of all that going into this stuff here but i'll digress for now i think that um you know i think i've kind of explained my point there um and it just it doesn't just apply to crypto plans i think it applies to kind of all collectibles as well so prismatic labs put out their 2021 update over the weekend here you can go read it in the youtube description i thought it was really cool to see kind of like their summary of 2020 and then their 2021 roadmap to see what's in the pipeline from them uh for those who don't know prismatic labs is um building an ef2 client they currently are building the leading eth2 client called prism amazing team doing amazing work i suggest you go read this i won't go through it now because i'm running overtime and i want to get through the rest of the stuff i want to talk about here so hayden adams put out a really interesting tweet um about uni swap protocol saying that every 12 minutes a new pair is deployed to uni swap a new trading pair is is deployed to uni swap which equals 115 new trading pairs per day for the last 249 days that's insane right this is the power of permissionless finance this is just people from all over the world no matter where they are in whatever country they're in you know even from their smartphones from whatever device they have you know adding liquidity or creating pairs for new kind of assets right all these new types of assets on on unispot so i thought that was really cool you can see the growth here it's just been insane i mean d5 to me started in the end of 2017 but it didn't start as in like cross that kind of like um the chasm from the really you know early adopters and believers to the general audience until like june july 2020 and that shows in every single chart every single growth chart that's when it went from a toy to something more serious and you can see this here as well so i thought that was really really cool so uh tim bico posted this really cool calculator it's like a spreadsheet that basically allows you to see the impact of erp 1559 on miners and the money that they're going to be making if i'm reading this right the maximum decrease i think here is 25 in minor revenue from fees now that's the that's the maximum and this was based on this uh the 17th of september 2020 fee so and this basically shows you know if eip1559 winning today how much less money or how how like you know how much less money i guess you could say would um would miners be making from from fees and this this kind of says it here because obviously miners have been kind of speaking up lately about one five five nine and i mean i've spoken about this before but this is a pay cut for them no matter which way you cut it but it's not a massive pay cut it's not like they're losing 100 of the fee revenue they're only losing the base fee that's the fee that gets burned and then anything over the base fee is called the tip and the tip is paid to minus still and the majority of the the fees are actually going to be in the tip which is going to be paid to minors so this was put out there to show them that you know your your impact isn't going to be that great on your on the reward you're making and you're already making a killing anyway i i went through this last week i won't rehash it now but i think this is a really great spreadsheet i'll link it in the youtube description for you to check out all right last up here was a teaser from one of the uh yeon core devs here so he basically said remember when the uh yearn uh wait vault uh y volt ate like one percent of all eth i do two uh quiet emoji like sh emoji um he's obviously teasing that another he or she i don't actually know but you know they're obviously teasing that another why uh eth y volt is coming uh i haven't seen it yet this was posted a couple days ago maybe it's coming like very soon but if for those of you who don't remember this vault did actually uh eat up like a ton of eighth because it would it allowed you to get like 80 or 90 yield on your eat because what it did it would put your ethan make a dao draw die against it use that die on curve finance to harvest crv token rewards and then kind of sell that and then you'd be able to kind of like generate the yield from that so that was very popular at the time actually one of the most popular things at the time so if they're releasing another one of it i'm curious to see how much growth it has uh because as i said there's not me i mean i mentioned before how alpha finance offers a e field product as well but it doesn't offer 90 on your eighth it's like most of the time it's 10 percent uh depends on the utilization rate but i don't know if they're going to be able to offer kind of um you know 90 now because the kind of d5 mania even though it feels like it's tr it's not like what it was in d5 summer and on top of that i think they're they're probably going to become more conservative this time the original vault was pretty aggressive it only maintained like i think a 200 percent collateralization ratio when the minimum is 150 so people were pretty worried about that so i'll have to see what happens but anyway i digress for now i've gone over time here on today's refuel so yeah i hope you all enjoyed today's one keep enjoying the i guess like the price rise hopefully we see some more action there um and as i described it at the start of the video it's not the profits that count really at the end of the day um and that's not the main reason like we should all be excited about this i think the main reason is that the ecosystem now has so much life being you know kind of put into it so much capital going around so much things can get funded so many teams getting funded so much stuff getting built that's the most exciting aspect to all of this so i hope you're as excited as i am but for now make sure you subscribe to the youtube channel if you haven't already give that video a thumbs up subscribe to the daily grade newsletter join the discord and i'll catch you all tomorrow thanks everyone

Show moreFrequently asked questions

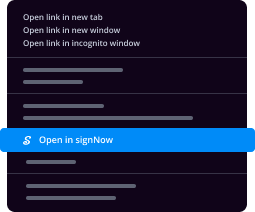

How do I add an electronic signature to a PDF in Google Chrome?

What type of field allows me to eSign my PDF with my finger?

How do you sign a PDF without uploading it?

Get more for argue attachment field with airSlate SignNow

- Print electronically sign Concert Press Release

- Prove electronically signed Notice of Rent Increase

- Endorse digisign Technical Proposal Template

- Authorize electronically sign Telecommuting Agreement Template

- Anneal mark Lien Release Form

- Justify esign One Page Proposal

- Try countersign Affidavit of Death

- Add Shareholders Agreement digi-sign

- Send Entertainment Contract Template esign

- Fax Letter of Recommendation Template for Coworker signature block

- Seal Software Development Progress Report signature

- Password License Agreement Template email signature

- Pass Firearm Bill of Sale signatory

- Renew Commercial Sublease Contract electronically signed

- Test Simple Cash Receipt byline

- Require Graphic Design Proposal and Agreement Template esigning

- Print awardee digital signature

- Champion customer countersignature

- Call for companion electronically sign

- Void End User License Agreement template digital sign

- Adopt Framework Agreement template initial

- Vouch Exit Ticket template signature

- Establish Birthday Gift Certificate template countersignature

- Clear Catering Contract Template template digital signature

- Complete Web Banner Design Request template electronically signed

- Force Business Contract Template template signed

- Permit Profit and Loss Statement template digi-sign

- Customize Demand For Payment Letter template esign