Back Form Sign with airSlate SignNow

Improve your document workflow with airSlate SignNow

Flexible eSignature workflows

Instant visibility into document status

Easy and fast integration set up

Back form sign on any device

Comprehensive Audit Trail

Strict protection requirements

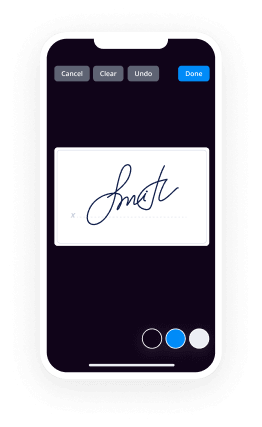

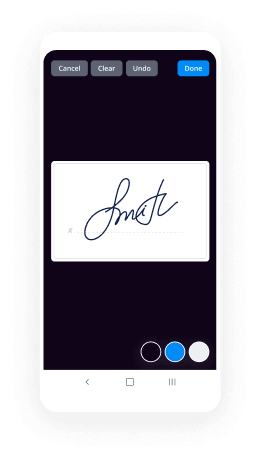

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your step-by-step guide — back form sign

Using airSlate SignNow’s eSignature any business can speed up signature workflows and eSign in real-time, delivering a better experience to customers and employees. back form sign in a few simple steps. Our mobile-first apps make working on the go possible, even while offline! Sign documents from anywhere in the world and close deals faster.

Follow the step-by-step guide to back form sign:

- Log in to your airSlate SignNow account.

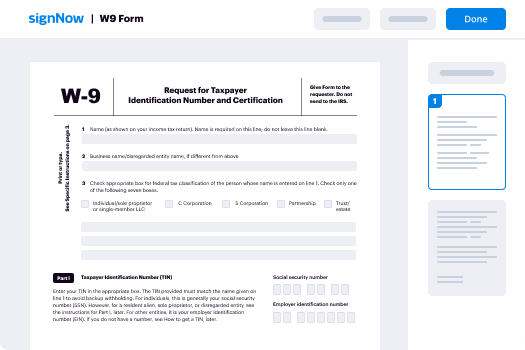

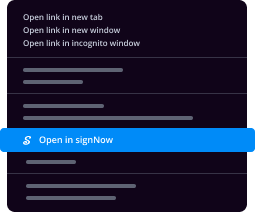

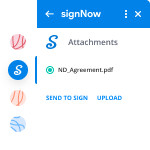

- Locate your document in your folders or upload a new one.

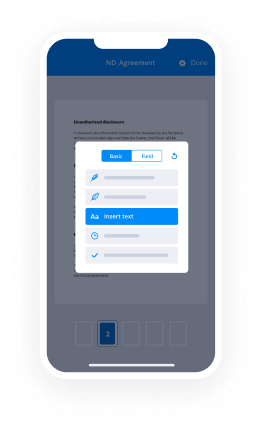

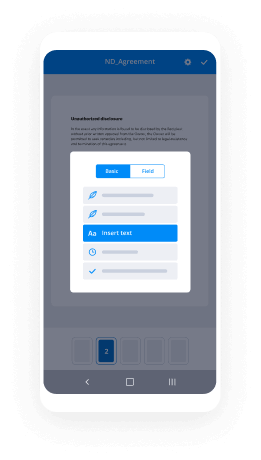

- Open the document and make edits using the Tools menu.

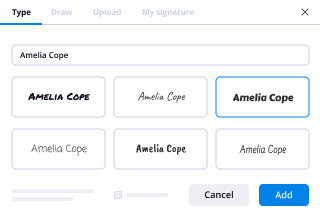

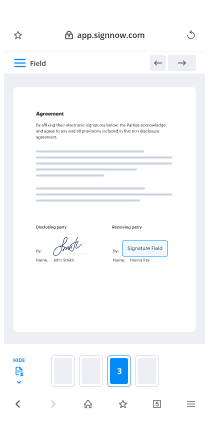

- Drag & drop fillable fields, add text and sign it.

- Add multiple signers using their emails and set the signing order.

- Specify which recipients will get an executed copy.

- Use Advanced Options to limit access to the record and set an expiration date.

- Click Save and Close when completed.

In addition, there are more advanced features available to back form sign. Add users to your shared workspace, view teams, and track collaboration. Millions of users across the US and Europe agree that a system that brings people together in a single cohesive digital location, is the thing that enterprises need to keep workflows performing efficiently. The airSlate SignNow REST API allows you to integrate eSignatures into your application, internet site, CRM or cloud storage. Check out airSlate SignNow and get faster, smoother and overall more productive eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results back form sign with airSlate SignNow

Get legally-binding signatures now!

What active users are saying — back form sign

Related searches to back form sign with airSlate SignNow

Back form sign

jj the cpa here hope you're doing well on the employee retention tax credit so here's the thing normal procedure for 2020 and backed up with what the irs came out with that i don't think the world discovered until last night but you will report your retroactive tax credit all in fourth quarter now there's a couple of ways to go about that but what i want to address is if you have not filed form 941 for fourth quarter bam nicely done file your form 7200 asap that's the normal procedures which is you file a form 7200 before you file a form 941 but then here's the key on your form 941 that you're filing after you file the form 7200 you have to report your wages that qualify for the employee retention tax credit and then you show what your tax credit is and then there's a separate line item that shows that you filed a form 7200 and you took the credit there and so it should have a zero net effect on the form 941 that you're filing after you file form 7200 where there will be a hiccup is if you file form 7200 and even though you may file it before form 941 all fourth quarter here well if you don't reflect the wages and the credit and what you reported on the form 7200 as your credit well then you're going to have to file a 941x and the irs will probably later say hey timeout what you filed for this credit but you never told us anything about it the second thing i'll just put in this is that the normal procedure is and in the link i'm going to give you the irs says we're just following normal procedures they're not coming out with anything new or special on how to address the retroactive tax credit other than they're indicating what is literally written into the consolidation act the stimulus act but here's the second thing if you filed a form 941 for fourth quarter you can't file a form 7200 for fourth quarter your only option there is to file a form 941 x now in this link i'm going to give you it indicates that you can go back if you want and amend each quarters but you're allowed to just amend your fourth quarter form 941. now when you amend the form 941 which is a 941x you will indicate on there the information from your originally filed form 941 and then you'll say or you'll indicate and report well but here are my employee retention tax credit qualified wages here is my tax credit which is fifty percent up to ten thousand dollars of wages in the year of 2020 again qualified wages being during the time period that you would qualify for the credit and then you would say not saying you would report here is then the tax credit right 50 percent now you have not and you cannot and you should not file a form 7200 for fourth quarter 2020 if you filed form 941 for fourth quarter so let me just be real clear because i get this is kind of back and forth minorly confusing you go all the way back if you already filed form 941 for fourth quarter and you didn't file a form 7200 okay and you filed a 941 for fourth quarter and you didn't indicate anywhere the employee retention tax credit and let me be more clear if you haven't told the irs anything about your employee retention tax credit okay and you filed your 941 then here's your remedy you file a 941 x and just what i had indicated here a couple of 30 seconds ago which is on the 941x you then say here are the wages here's my credit and then on that form 941x you indicate do you want a refund or do you want that credit in essence refund carried to the next quarter so i would assume you'd want to check it get the refund be prepared that when you file a form 7200 it seems as though and typically you're going to get that money very quickly because the form 7200 is designed to be very quickly reactive and get you a check within 10 days that form 7200 you can only fax it in as it relates to the form 941x well it's an amended return it's a slower and go in essence now the irs may set up a special division to process 941 x's amended returns because there's probably going to be millions but i want to go back to what i said at the very beginning just to be sure if you've not filed form 941 for fourth quarter okay now today is the 26th of january okay if you've not filed fourth quarter 941 you can file the form 7200 you should asap and if you file the form 7200 right which is your credit then i don't know just make it a little bit a window right well form 941 is not due until monday february 1st because the 31st the official due date is on the weekend so you have till monday the first so if you can if you're able to not a big deal if you can't but if i'm in your circumstances and i'm filing a form 7200 a day because it should get you or your client the money quicker then if i'm filing on the 26th or the 27th you know what i'm going to pause for two days and file that form 941 on the first now i will tell you this okay if you read carefully this is possible don't recommend it don't don't don't count on it okay but when you read it indicates that form 7200 needs to be filed on or before february 1st february 1st is also when form 941 is due now you may have the irs send you a letter back and just say hey you know you file the 7200 the same day you filed the form 941 february 1st and so here's what you'll have to do which may be a 941x right so the benefit of form 7200 is you're going to get your money quicker as i understand it but given that both have the same due date here's my point i think the real key here with the irs is that when you file a form 7200 for fourth quarter retroactive all the ertc any other credits all the way back uh to march 13th on the ertc all the way back to april 1st on the sick leave and family leave credits as long as you report that information on the form 941 for fourth quarter that's what i think is actually more important to the irs i don't know that it's going to get down to you know kind of a horse race right per se even though if i'm me i'm going to fax that 7 200 right and then i'm going to submit a 941 even if it's like five minutes apart meet the technicality but i don't think it's going to come down to a racehorse i think a racehorse finish i think what it's going to come down to is that if you filed a form 7200 and you filed it on it before february 1st and you file the 941 right on or before february 1st as long as that form 941 is going to reflect the wages that you're using to achieve the credit and what you reported on the form 7200 i think that's more what matters okay so don't hear me as you know kick your feet up and just file both on february 1st i just think that technically i think it probably could work for those of you that are like oh my gosh it's the 28th or it's the 29th or it's the 30th or it's the 31st i am going to leave this video up in through june because this works for those that are filing for first quarter 2021 this video works for those that are filing in second quarter 2021 because you may hit those same circumstances with the retroactive in 7200 before the 941. so i'm real big on summing things up again if you haven't filed form 941 i recommend you form you file form 7200 for fourth quarter you get the money quicker if you don't want to go the extra step then on your form 941 for fourth quarter that you haven't filed yet you can just reflect the wages and indicate it's a refund i just think the money won't come as quick i actually don't have any proof of that other than just what i know right but if you have already filed form 941 for fourth quarter your only remedy is to file a form 94 941 x so as a courtesy uh in the link here and if you don't mind i'll tell you this i'm doing an employee retention tax credit seminar i'll have a link to it it's dirt cheap but anyways if you sign up for the seminar you'll get immediate access to all of my links and tables and worksheets in excel and examples and all that good stuff and then you know i have a private video in there on why do i think tons of businesses qualify for this and i break it down going through the law for those of you that might be interested in that detail but as a courtesy while i will put a link to that seminar i'm also going to put a link to what the irs came out with which just basically says hey reported in fourth quarter which we knew because it was already written in the law and then i'll put in there um just for your benefit a link to the form 7200 a link to form 941 if you're just wanting to see it and uh and then a link to the form 941x and the landing pages i'm going to give you all be to the irs and it should be that it includes the form and the instructions to take a look at that and then i'll tell you this okay if you're in a panic no worries okay no worries worst that happens here is you just don't get your check as quick okay because the great thing about the irs is that you can always amend the return on a tax return on a on a payroll tax form honestly i probably should just look because it but it's like two years okay it's certainly 30 days it's certainly 90 days it's certainly a year okay so if you're in a panic right now because your payroll company is not sure what to do or you're not able to get somebody to help you directly it'd be better to not attempt this one at home okay because this stuff gets technical as you can already tell it'd be better to go okay if i got a file of form 941x i don't got to file that by february 1st i got time that would be kick your feet up for a couple days don't ruin your weekend come back get the help that you need file that form 941x okay so no worries on this you will get your money and uh so anyways check out the seminar and i'll tell you this the the link uh you know if i if you made it to here listen to me for 30 more seconds but the link that i'm going to give you goes to a landing page and you actually see everything that i'm going to give you uh by attending the seminar and you have immediate access to all these links and information some of the links i'm given right in the body of this but these are just links to the irs and then like i said there's a private video that if you buy it so you can go the landing page and you're going to see everything you get for ninety seven dollars uh it's a two hour seminar with some q a i'll probably go a couple hours on q a and then there'll be also a link if you just wanna sign up for it and just see a summary of it and sign up so it is limited uh we just announced it this morning oh i've got it on this phone i don't know last i looked it seems like we're about a third full and we just we didn't even do any big announcements on it so anyways you might check it out if you made it to here and then if you made it to here i bet i've provided a little bit of value do me a favor click it subscribe i don't make any money off of it but i like to see the numbers go up i'm a cpa makes me feel good and it lets me know i'm putting out good information uh for you and then if you know somebody that could be helped i don't think i've ever said this in a video but if you know anybody that could be helped by this forward it on or forward on my channel because the whole point of my channel is to help i'm a practicing cpa and what you're hearing is in essence what i'm telling my clients and in theory you're just listening in all right hey thanks for tuning in love it if you subscribe subscribers turn on your notifications if you would i'm gonna be going live here soon do some q a and then don't you ever forget you've never met a cpa quite like me hey have a great day

Show moreFrequently asked questions

How can I electronically sign a read-only PDF that is not editable?

How can I insert an electronic signature into a PDF?

How can I sign emailed documents?

Get more for back form sign with airSlate SignNow

- Create Lease Extension Agreement signature block

- Create Lease Extension Agreement signed electronically

- Create Lease Extension Agreement email signature

- Create Lease Extension Agreement electronically signing

- Create Lease Extension Agreement electronically signed

- Create Pet Addendum to Lease eSignature

- Create Pet Addendum to Lease esign

- Create Pet Addendum to Lease electronic signature

- Create Pet Addendum to Lease signature

- Create Pet Addendum to Lease sign

- Create Pet Addendum to Lease digital signature

- Create Pet Addendum to Lease eSign

- Create Pet Addendum to Lease digi-sign

- Create Pet Addendum to Lease digisign

- Create Pet Addendum to Lease initial

- Create Pet Addendum to Lease countersign

- Create Pet Addendum to Lease countersignature

- Create Pet Addendum to Lease initials

- Create Pet Addendum to Lease signed

- Create Pet Addendum to Lease esigning

- Create Pet Addendum to Lease digital sign

- Create Pet Addendum to Lease signature service

- Create Pet Addendum to Lease electronically sign

- Create Pet Addendum to Lease signatory

- Create Pet Addendum to Lease mark

- Create Pet Addendum to Lease byline

- Create Pet Addendum to Lease autograph

- Create Pet Addendum to Lease signature block