Boost Signatory Request with airSlate SignNow

Do more on the web with a globally-trusted eSignature platform

Remarkable signing experience

Reliable reports and analytics

Mobile eSigning in person and remotely

Industry polices and conformity

Boost signatory request, faster than ever

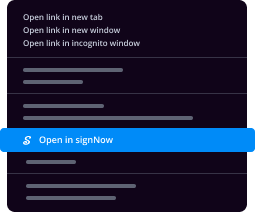

Helpful eSignature extensions

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

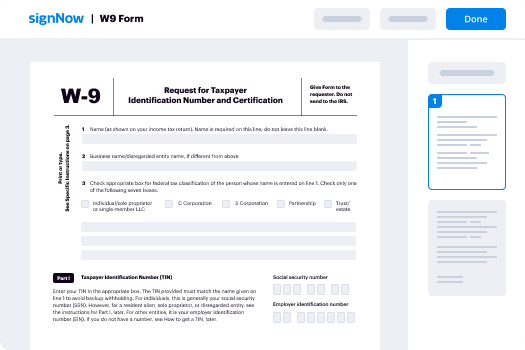

Your step-by-step guide — boost signatory request

Leveraging airSlate SignNow’s eSignature any business can accelerate signature workflows and sign online in real-time, supplying a better experience to consumers and employees. boost signatory Request in a few simple actions. Our handheld mobile apps make operating on the go achievable, even while off-line! Sign contracts from any place in the world and complete trades quicker.

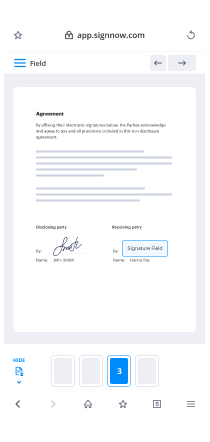

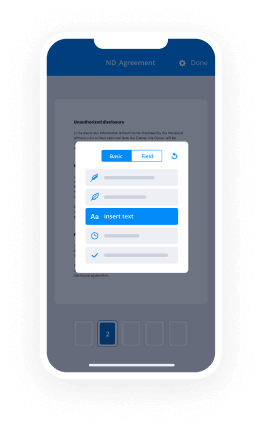

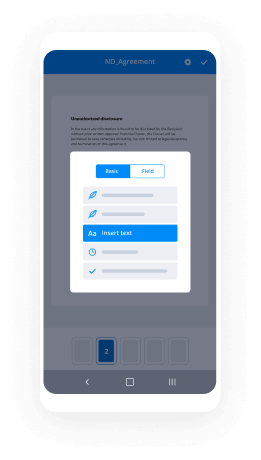

Keep to the stepwise instruction to boost signatory Request:

- Log in to your airSlate SignNow profile.

- Locate your document in your folders or import a new one.

- Open the template and edit content using the Tools list.

- Drag & drop fillable areas, add text and sign it.

- Add numerous signers using their emails and set up the signing sequence.

- Choose which users will get an signed copy.

- Use Advanced Options to restrict access to the template and set an expiry date.

- Click Save and Close when finished.

In addition, there are more extended tools open to boost signatory Request. List users to your collaborative workspace, browse teams, and track teamwork. Millions of consumers all over the US and Europe concur that a solution that brings people together in one unified digital location, is the thing that businesses need to keep workflows performing smoothly. The airSlate SignNow REST API enables you to integrate eSignatures into your app, internet site, CRM or cloud storage. Try out airSlate SignNow and enjoy faster, smoother and overall more efficient eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results boost signatory Request with airSlate SignNow

Get legally-binding signatures now!

FAQs

-

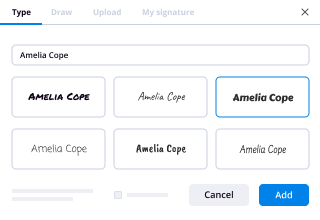

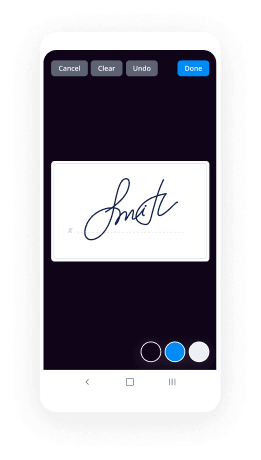

How do I create an electronic signature?

Draw your signature using your finger or a stylus. If you have access to a touchscreen, you can use your finger to create an electronic signature directly in your document. ... Upload an image of your signature. ... Use your cursor to draw your signature. ... Use your keyboard to type in your signature. -

How do I electronically sign a document in Word?

Suggested clip How to Add A Signature in a Word Document - YouTubeYouTubeStart of suggested clipEnd of suggested clip How to Add A Signature in a Word Document - YouTube -

How do I create a digital signature in Word 2016?

To add a digital signature line to your document, place the cursor where you want your signature to go. Go to the Insert tab and in the Text group click Signature Line. If you click the down arrow to the right of the Signature Line button, be sure to select Microsoft Office Signature Line. -

How do I create a free electronic signature?

Create an airSlate SignNow account. It only takes a few seconds. Upload your document to your account. ... Select who needs to sign your document. ... Prepare the document for signature. ... Sign the document or send it out for signature. -

How do I create a free electronic signature in Word?

Click the File tab. Click Info. Click Protect Document, Protect Workbook or Protect Presentation. Click Add a Digital Signature. Read the Word, Excel, or PowerPoint message, and then click OK. -

How do I create an electronic signature in PDF?

Open the PDF file in airSlate SignNow Reader. Click on Fill & Sign in the Tools pane on the right. Click Sign, and then select Add Signature. A popup will open, giving you three options\u2014Type, Draw, and Image. Once you're done, click the Apply button. Drag, resize and position the signature inside your PDF file. -

How do I sign a PDF electronically?

Open a PDF file and the airSlate SignNow tool. Open the Bodea Contract. ... Add recipient email addresses. Enter the email addresses of the people you want to eSign the document. ... Confirm form fields. ... Click Send. ... Manage documents sent for signature. -

How do I add a signatory to my bank account?

Call your bank to ask about their requirements for adding a signatory. The process varies somewhat from bank to bank. ... Fill out the information the bank requires. ... Have all relevant parties sign the form. -

What does it mean to be a signer on a bank account?

Authorized Signer Definition Typically, authorized signers can sign checks and withdraw or deposit funds without having to ask the owner for permission. However, any transactions made by the signer must be for you as the owner of the account. -

What is a co signer on a checking account?

Co-Signer. A co-signer is someone who agrees to be a partner with you on your bank account. For example, one of your parents can open the account, putting you on the signNowwork as the person who can make deposits and withdrawals. You use their good credit history to guarantee the account. -

How can I authorize someone on my bank account?

If you'd like to authorize someone else to handle money in your bank account, most banks give several options. You have the option to give the person financial power of attorney and specify which transactions they're allowed to make. Alternatively, you can change your account to give someone else access. -

Can I authorize someone to use my debit card?

Yes, you could \u201cauthorize\u201d another person to carry and use a debit card linked to your account. Since an authorized user would be able to withdraw money from your account at any time, be sure he or she is trustworthy and responsible before you provide a card. -

Can you have a bank account with 3 people?

Joint accounts most commonly have two account holders, but it is possible to have more. You can open a joint bank account with three people, four people, five people or even more. For checking accounts, each account holder will have their own debit card that will allow them to make purchases and withdraw cash at ATMs. -

Can 2 people have the same bank account?

Reasons to Have Multiple Accounts It is possible to have a checking account at more than one bank, and you may have specific reasons why you want to do this. For example, you may choose to keep your personal checking account open when you open a joint account with your spouse at a different bank. -

Can I add my dad to my bank account?

As your parents age, it may seem like a good idea to add your name to all of their bank accounts. ... However, depending on your situation, there may be some disadvantages to adding your name to all of your parents' bank accounts, in terms of Medicaid eligibility and creditors.

What active users are saying — boost signatory request

Related searches to boost signatory Request with airSlate airSlate SignNow

Boost signatory request

[Music] hi i'm emily jones i'm an associate professor at the bravatnik school of government and we're hosting a series of reflections on covert 19 public policy responses around the world i'm delighted to be joined today by david lubin david is managing director and head of emerging markets economics at citibank david welcome thank you great to have you with us so you've been watching financial markets very closely and really thinking through how this crisis is affecting emerging economies and developing countries could you just talk us through what exactly is happening and how this is affecting countries around the world okay so there's kind of two sudden stops that in the developing countries are facing one is a sudden stop in global economic activity that is unprecedentedly bad as you know it's the worst global recession since the 1930s there's also a sudden stop in capital flows um and if there's any good news uh in this crisis it's that the sudden stop in capital flows is not quite as bad as the sudden stop in economic activity and then that kind of raises the question why why has risk appetite returned why why aren't people just continuing to sell the south african iran or the brazilian real or the indonesian rupee why aren't these currencies or these bond prices continuing to collapse the first most important reason is the huge amount of policy activism on the part of the fed and other core countries central banks when real interest rates uh become very negative in the developed world historically that tends to push capital towards emerging markets um and the injections of liquidity by supporting asset prices in the u.s and in the euro zone and in japan by supporting asset prices in core countries that has kind of positive spillover effects on risk appetite towards developing countries so policy activism by the fed and other core countries central banks is the first reason why the capital flows story is not catastrophic but there are a couple of other kind of interesting reasons one is that because the economic consequences of this crisis are so awful there's a collapse in domestic demand and that collapse in domestic demand tends to reduce uh the current account deficit of of an emerging economy as the current account deficit goes down because imports have collapsed that means that the whole economy's need for foreign exchange has declined and so that tends to kind of stabilize the the balance of payments it stabilizes the capital account and therefore that sort of puts a ceiling on the endless you know rise in in the exchange rate um so it's not a very pleasant reason why capital flows have stabilized but you know arithmetically it helps to kind of stabilize things can you just explain to us why capital left in the first place so back in march when this the pandemic really started to take hold we saw this sudden exit of capital from emerging economies and it's interesting you say interventions by the fed and others have sort of stemmed stemmed it but why was it leaving in the first place um the the straightforward answer is risk aversion in other words you you get to a point where there's a huge injection of uncertainty about global growth about global policy making about balance sheets something that we're going to have to come back and talk to talk about in a lot more detail and the arrival of covert 19 injected just a huge amount of uncertainty huge amount of uncertainty about about all of those variables and that uncertainty reduces risk appetite and that's why you know the s p fell that's why um uh bond prices for american companies collapsed um and when you have a decline in risk appetite in the united states that creates very negative or in in developed countries that creates a negative spillover uh risk appetite in emerging economies that's very helpful and so am i right in thinking that and please correct me if i'm wrong here but on the initial outflows there were concerns that this was even they were even sharper than we saw in the financial crisis and that that's that's absolutely right it's interesting i mean in the first several weeks of the crisis up until late march it looked to me like what i said earlier was not true you know what i said what i was saying earlier was that you know the capital flow story is not unprecedentedly bad but the economic story is unprecedentedly bad four weeks ago well no maybe six weeks ago it looked like the capital flow story was also unprecedentedly bad and thank goodness that's been stabilized um and by oh and actually maybe maybe i should go back into because there's a couple other things that i wanted to mention this is a bit of a nerdy economics point that i want to make but it's actually very interesting and it has to do with some of the consequences of the fact that inflation is very low these days globally and inflation expectations are collapsing across the world and particularly across developing countries because a demand is collapsing and also you know imagine you're an oil you're an oil importing country the oil price has gone from 60 dollars a barrel to 20 something the decline in oil prices is hugely disinflationary for almost everyone and has knock-on effects on other prices you know the price of food is very closely connected to the price of oil because energy is an important input to the making of food so this is a hugely disinflationary crisis at a time when inflation is low anyway and the point that i want to make is that 10 or 20 years ago if a currency weakened in nominal terms let's say you know the the south african round went from nine round per dollar to 18 round per dollar in the old days the market market participants were unsure how to interpret that because the risk was always that the the competitiveness gains of a weakening currency would be doubled up by inflation in economics terms it's a difference between a nominal change in the exchange rate and a real change a real mean inflation-adjusted change but these days because inflation is so low it's much more likely that let's say a 10 nominal depreciation of a country's currency is more or less equivalent to a 10 real depreciation of that currency because inflation is not accelerated to gobble up yeah in this case and so the the exchange rate adjustment mechanism which is one of the things that you know countries rely on in a crisis like this to allow uh to allow their economy to kind of reflect the new equilibrium um that's in the global environment the exchange rate adjustment mechanism these days is much more efficient so it's working more of low inflation than it ever used to be then that boosts exports that means well no then we've got demand shocks that being the next thing i mean the idea that uh weaker exchange rate will boost exports under almost any circumstance is a weak is a weak idea the uh the sort of general conclusion of the economic literature is that export growth is not that sensitive to uh um to to currency movements and that's particularly true these days because nobody's buying anything so however cheap your currency is it doesn't really matter um but uh but the what when i what i really am thinking about when i talk about the efficiency of the exchange rate adjustment mechanism is that if a currency has lost enough value to reflect the changed global environment it's more likely that there will be investors wanting to buy that currency and so capital inflows uh become uh you know become more available and that's very helpful for a country that needs to finance its budget deficit fascinating that's its trade deficit yeah okay so then to sum up where we've got to so far we had this initial outflow with the sort of risk aversion that happened that's been then temp tempered by the inter activism of the fed and others putting liquidity into the system um it's also been tempered by we haven't had this sort of surge in inflation that we might have expected so the efficiency of the exchange rate adjustment so that gives us a picture there where developing countries are not facing the magnitude of outflow that we might have expected so what they are seeing is a slowdown in the other sectors the economy the demand shock because they're not able to then have the sort of exports yeah and i think one of the consequences of a low inflation and b is stabilization in capital flows that we've seen is that it's extremely hopeful or it removes an obstacle that central banks in developing countries might otherwise face what i'm trying to get at is that in a crisis like this in in a devastating economic crisis that has this awful humanitarian dimension the overwhelming obligation of a central bank in pretty much any country but particularly in the developing country is to make sure that interest rates are coming down you need to reduce interest rates not just in nominal terms but also in real terms in inflation-adjusted terms in order so that the central bank can avoid damaging domestic balance sheets you know the balance sheets of companies domestically the bunch of balance sheets of households domestically you know you know families that have uh household debt as interest rates come down that eases the burden on on on these balance sheets now that could have been a problem because sometimes a central the monetary policy that a central bank wants to conduct to meet a domestic objective can be in can kind of conflict with the central bank that with a monetary policy that a central bank needs to implement for an external objective right the domestic objective is to support domestic support domestic balance sheets in this catastrophic economic collapse but imagine there was a situation where capital was flying out of of the window of these countries in that in that environment what a central bank might need to do and we've seen this plenty of times in the past is to raise interest rates in order to make owning your currency more attractive yeah and and it would have been awful well this this dilemma this dilemma that i'm describing still exists in certain cases but it it's no way as bad as it might have been can you talk a little bit through i mean we've seen and it's reassuring that it's not as bad as it might have been there and i've seen some headlines that governments are worried about um spending too much because they're going to get downgraded so this is more of the sort of fiscal side but the investors will punish them and there'll be a sovereign ratings downgrade if they spend too much and i've heard that with reference to india and other countries yes um so the it's reassuring in a way that we don't have to worry about it so much on the capital outflows um but what about the risk of sovereign rating downgrade is that a real risk for countries oh it's a it's a huge risk um you're right you know there are you know countries divide up i mean emerging economies divide up between you know countries that have uh announced relatively generous uh social provision in the context of this crisis um brazil brazil for example or indonesia and countries like india and mexico uh on the other hand who have been whose fiscal policy response to this crisis is pretty stingy um to be honest regardless of what your policy response is the risk of sovereign downgrade is uh really really significant because the consequences of this crisis for debt burdens globally not just in developing countries but globally are just awful um the imf published its fiscal monitor uh last month in april and according to the imf the median increase in the emerging economy's debt to public sector debt gdp ratio will be nine percentage points um so you know going from an average of something like 55 percent of gdp to something like an average of 64 percent of gdp these are astonishing uh increases in public debt and they come against the background where public debt burdens have been rising in any case uh since 2008 because the economic consequences of the lehman crisis and also particularly since 2012 when uh the commodity boom ended and that's you know delivered a negative shock along with lots of other negative shocks that have been sort of in the mix of the global economic environment facing developing countries since then but basically the point is that the last 10 years have not been particularly friendly in terms of the external economic environment that that a developing country is confronted with and that's why uh for all sorts of reasons and that's why debt burdens have already been rising very sharply this crisis just kind of accelerates that problem uh very very dramatically and the risk of downgrades is is a very serious problem and in a way the last thing that the most important question on the other side of the of the health crisis is how are investors both domestic investors and foreign investors how are investors going to interpret these huge balance sheet deteriorations in developing countries one way of answering that question is to say well will they will they have a reason to think that these increases in in the debt gdp ratio are just temporary if you know if if these were just temporary uh shocks then maybe investors might see through them and not worry about them too much however i don't think there's a good case for optimism on this point partly because when i look at just you know if you look sweepingly at the history of public debt burdens in in developing countries the only time in in recent decades where you can see a meaningful decline in debt gdp ratios is between the years 2002 and 2007 which was a global economic boom yeah so if you can come up with an argument that there's going to be a global economic boom on the other side of this crisis i'd love to hear it but it's i personally i find it very difficult to be optimistic on that front wow so let's just can we sort of then think through for policymakers sitting in ministries of finance central banks in a developing country that was already facing debt problems perhaps now as an oil exporter has been hit by the fallen oil prices um they're now needing to roll out a social safety net for vulnerable people they have to bail out firms what are the kind of trade-offs that they're having to weigh up because on one hand there's a fear i guess of being punished by a sovereign downgrade on the other hand there's this desperate need to just increase spending um to adjust to the virus how how to weigh this up um i think that's a it's a very very good question and like most good questions very difficult to answer um i think that the approach should be weighted towards addressing the humanitarian crisis in other words you can't i think it's a mistake i think what mexico have done has done what india has done is arguably a mistake in other words if you're if you're fiscally i mean partly because if your fiscal response to the crisis in other words if you if you don't increase spending by much in response to the crisis not only are you failing in a humanitarian objective but you may also be failing in an in a kind of economic sense in the sense that one of the one of the functions of increasing public spending at the moment is to preserve the the kind of infrastructure of a recovery to make sure that labor markets don't completely collapse to make sure that firms are able to keep furloughed staff rather than to have to begin afresh on the other side of this crisis so in a way that arguably the more money you spend now the the better able you are to limit the damage uh and permanently that's a tough trade-off for governments to make though so there's a sort of spend now keep the economy in a position that it's able to rebound to recover and then you're able to service the debt yeah at the same time there is a concern that the the greater the debt burden the greater the risk of a sovereign downgrade the greater the interest rate is that then you're gonna have to pay on that debt so the really complicated trade-offs that govern yes yes i mean i think sometimes i mean my you know very kind of basic hunch is that the the risks of sovereign downgrades are uh obviously serious risks but you know the point is that the entire world has been losing credit worthiness over the last 10 years and it's not just emerging economies but developed countries that are also losing credit worthiness in fact you know one point worth making is that although as i said the public debt gdp ratio in the developing world is going up by nine percentage points this year according to that same imf fiscal monitor the public debt burden in the developed world is going up by uh 12 percentage points from a much higher base so you can say well maybe there's a kind of ugly contest where although the increase or the deterioration of emerging markets balance sheets is kind of scary well the deterioration of developed countries balance sheets is even scarier right and actually that might have that might contain the kind of seed of some good news for emerging economies because the bigger the debt burden in the developed world the more it is absolutely necessary for those countries for the us the uk and others to keep real interest rates very very low and as long as those real interest rates are kept very very low and negative that as i said earlier tends to help push capital towards emerging economies so the availability of financing for emerging econ economies may not disappear uh because of the the consequences of this crisis but the point that i was going to make is that my you know hunch is that investors have short memories and although the down you know a ratings downgrade may limit a country's access to external financing in the short run um that doesn't necessarily mean it's curtains forever particularly against the background where you've got this ugly contest where you know there are going to be a lot of you know a lot of developed countries suffering uh much more dramatic deteriorations in their balance sheets now it's a real master class there and sort of thinking through all of the different thank you i wanted to bring us on to a little bit to the international cooperation around this because we've seen it was vital getting us through the global financial crisis because um 2007.89 that whole period we've got these international institutions have been set up the imf the world bank um g20 was another important source of coordination so can you just talk us through what we've seen on the international coordination front and whether it's what we need and what what more we need if you like as well yeah um when as you ask that question i can think of two kind of broad categories of answer one is that i think i need to say something about the u.s china relationship and the other is about the sort of multilateral institutions that you that you raise um i don't think it's any a big surprise to anyone the us-china relationship is in a kind of state of collapse that collapse obviously was not brought on by the chronovirus crisis it was building uh not only buildings since donald trump came to the white house but building well before that um so this is a uh this is a deterioration in the relationship between the world's two biggest economies uh that uh makes any other kind of international cooperation much less likely and so the you know the catastrophic state of the us china relationship i think is a kind of overarching bit of bad news for for for cooperation generally um as far as the ins you know sort of global institutions are concerned i mean i i guess some of the bad news or some of the additional bad news comes from the fact that this us white house uh explicitly is not a fan of you know the united nations institutions i mean you know the trump is defunding the who and um the trump administration's support from the ayat for the imf is constrained and the imf uh becomes a very important uh kind of component of this puzzle because the imf is the world's lender of last resort so the question is in a crisis like this where debt burdens are exploding where capital flows are constrained um where emerging markets central banks are needing to reduce interest rates in order to satisfy you know domestic objectives you know uh uh avoiding damaging domestic balance sheets as i said um what role can these international institutions play the imf is constrained by a couple of things the idea of the ims sort of headline statement throughout this crisis is don't worry we've got a trillion dollars to lend trillion dollars a lot of money but actually it's not as good as it sounds for a couple of reasons one is that of that one trillion dollars about 200 billion dollars is is stuff that the imf has already committed to lend so this is not you know that one trillion is including you know not all of that one trillion is kind of additional money the more fundamental problem as i see it has to do with the traditional way in which the imf lends money the imf's traditional way of lending money is by is is relying on what's called conditionality so you know the imf goes to a country and says you know here's 15 billion but in exchange for this 15 billion dollars you have to tighten your belt and that belt tightening which you know i'm really oversimplifying uh but you know not badly that belt tightening um partly has the you know partly is needed because a country you know when you go to your lender of last resort you know you go to the imf because no one else wants to supply you with foreign exchange so you go to the imf that's you know happy to be the last resort then supplier foreign exchange but because the reason why nobody else wants to supply you with foreign exchange might be because your need for foreign exchange is so big so one of the effects of belt tightening one of the reasons for belt tightening is to restrict the whole economy's need for foreign exchange which is a you know can be a completely reasonable thing to do but the other another function that conditionality serves is that it acts as a kind of collateral for the imf's own loans so the imf you know when the imf lends 15 billion to a country it doesn't take physical assets as collateral in the way that your bank takes your house as collateral when you when you when you take out a mortgage conditionality acts as a sort of collateral in other words by the the leverage that the imf has over a country's economic policy in exchange for its loans help to ensure that the imf is going to get repaid and that's very important because the imf because it's the lender of last resort it's got to make sure that it gets repaid in other words it's got to preserve what's called its senior creditor status and and taking or using conditionality as this form of collateral helps to maintain the imf's ability to function as the lender of last resort if the lender of last resort finds that nobody's going to repay it then it's going to run out of its ability to be the lender of last resort and so this all makes sense under normal circumstances but of course these are not normal circumstances they're not normal because this is a humanitarian crisis and it would be absurd for a country to tighten its belt you know if this would reduce the impetus in a way said come you know come and take a loan from the imf in return you reduce your fiscal spending but actually right now it's precisely the opposite is what exactly exactly so the imf is stuck with a problem that either it it forgets about conditionality but doing that would create the risk that the the ability of the imf to get repaid might go down and that would sacrifice the ims role in the international financial system or it stays on the sidelines there's one kind of in-between thing the in-between thing is the i'm within this one trillion dollars the imf does have about 100 billion dollars of what's called or of what's properly emergency financing in other words it's not uh it's not linked to any conditionality there are two facilities one is called the rapid credit facility which is for very poor countries and one is called the rapid financing one the rapid financing instrument which is for everybody else and this is genuine genuine um emergency finance but the access that countries have to those facilities is limited so take a country like south africa for example you know south africa would normally have access or could have access to the rapid financing instrument but in year one you can only get a hundred percent of your quota at the imf um uh uh as a rapid financing instrument loan for for south africa that's for about four billion dollars it's not necessarily game-changing amounts of money uh and so there is still a lot of question uh questioning that you can you know pose about what role the imf can really play in supporting this to point crisis in a way the fed and the liquidity that's being provided by the fed there's a huge amount of support but again there's not that many countries so they're getting swap lines right so it's not the developing countries it's about the larger economy so in a way that's not a solution there's a difference that i think is useful between an operational shortage of foreign exchange and a fundamental shortage of foreign exchange if you've just got an operational shortage of dollars in others you've got dollar assets or you've got a currency that is kind of trustworthy enough for the fed to want to swap so you can get dollars by giving the fed either treasury bonds or your own currency you know in a country like korea or singapore where the fed is not you know not too unhappy about having korean one or singapore dollars but most developing countries have don't have operational shortages or foreign exchange uh they have fundamental shortages of foreign exchange and the swap line doesn't doesn't solve that problem can i just um take us on to the g20 and the questions are down around debt relief so we've seen quite a lot of discussion now about um removing both some debt payment moratorium so that governments don't have to service the interest that they already should be servicing at the moment in normal conditions but also as we think about this new debt that's being racked up how it's managed so where's the g20 come into this and what are your thoughts about the efficacy of g20 cooperation okay one one important distinction before i start answering is the distinction between total public debt a developing country's total public debt includes both debt denominated in its own currency and debt denominated in dollars for foreign exchange um so there's total public debt and then there's external debt which is just um i mean it's a bit of a venn diagram but the external debt can be the debt that a government owes in foreign exchange to foreign creditors but it can also include debt that the private sector in that country owes to foreign creditors in foreign currencies so just to clear that up um the g20 initiative is just dealing with public sector external debt so you know sort of that bit of insider venn diagram um and what the g20 was proposing is for um the the world's very poorest countries countries with the capital incomes below around 1200 a year um that there should be a suspension of debt service for the second half of of 2020. um it it involves a group of just under 80 countries um there are three problems that i can see one is to do with china one is to do with multilateral development banks and one is to do with private sector creditors so what the g20 said is you know we bilateral we're gonna you know forgive debt service um and we want multilateral development banks like the asian development bank or the african development bank or the asian infrastructure developer even asian infrastructure investment bank the new development bank all these development banks should be doing the same thing and they've all the g20 also asked private sector creditors to provide equivalent debt relief so the first problem the china problem is that although china is a signatory to the g20 statement china's negotiations with debtor countries tend to be in a separate room china is not a member of the paris club which is the group of uh which is the group of rich richish country governments as creditors it's not a it's never been a member of the paris club and so it tends to conduct its debt negotiations with countries to whom it's that money separately and that means that there's a lot of uncertainty about what china will be doing with uh in its negotiations with with developing countries that are borrowed from it the second kind the second problem with the multilateral development banks echoes what i was saying earlier about the imf multilateral development banks like world bank and the regional development banks that i mentioned are also senior creditors in the international financial system and the the multilateral development banks are all kind of worried that if they provide debt relief to these countries they will lose their uh credit ratings and that will make it more expensive for them to borrow money and so the whole system will become poorer as a result so how multilateral multilateral development banks are going to be involved in this g20 initiative as far as i understand it today is still unclear and for sure it's unclear how private sector creditors are going to be involved um the there's an institution in washington called the iif the institute for international finance which is a kind of i guess a sort of industrial association of global banks and global asset managers the iif kind of stepped up to try and coordinate um private sector debt relief uh to kind of match what what the g20 was doing and in in response to the g20s request but um the iif's ability to uh to to fulfill that role is constrained because nobody is you know this is all basically um use of the word please uh you know private sector creditors are are being asked you know please can you can you provide that relief alongside the g20s bilateral incentives then for a private sector to provide any debt relief is there any sort of self-interest or is this entirely an appeal to their outreach um there's absolutely no self-interest at all um and it's not i mean that that's one i mean that's that that's exactly the overall problem does that you know you're asking a bunch of people to kind of willingly lose money and no one will want to willingly lose money that's complicated by a couple of other um problems let's say you're a an asset manager and you've bought south africa angolan bonds or uh or zambian bombs your your ownership of those bonds is not so much for yourself you are investing other people's money and that creates what asset managers or and financial institutions describe as a fiduciary duty and so one of the constraints on on bondholders ability to say yeah sure you know we think that the you know the right thing to do is to provide debt relief to these countries um you know one one obstacle that they face this is genuine obstacle is that they promised to the people whose money they're looking after to look after it in as you know responsible as possible and although in other words that to make sure that the people whose money that they're investing get their money back so really think about what's that response what's the nature of that responsibility because if it's holding and preserving that financial asset you sort of find that if there's any sort of humanitarian use of that asset that's provided for in that contract or arrangement or not yeah i mean in theory you know so in a way what i'm describing the situation where the asset manager is a kind of agent not a principal absolutely and so one in theory one way of breaking through that that obstacle is that you find some way of getting the principles are you the people whose money the asset managers are investing by buying zambian bonds around golden bonds you get them to say yeah go ahead but presumably they need everybody's got us yeah so and then the the coordination problems and the sort of logistical difficulties become extremely extremely uh and just to be clear i mean why this is important is because actually the private sector holds a lot of developing country debt now right become a big player in this it's not that the majority of debt is owed to public sector no that's yeah that that's true that's true although you know the thing that i think there's a important distinction to make between very poor countries i.e the countries that are the recipients of the g20 initiative and other emerging economy emerging emerging markets is such an absurdly broad term it's it's a term that that is almost meaningless um i mean just to give you a kind of local example of how absurd it is the economist who is responsible for the analysis of zambia works for me as head of emerging markets economics but the economist that is responsible for uh for researching singapore also works for me so you know it's a the term emerging markets is a kind of catch-all for most of the world by this time yeah basically basically um and so its analytical value is is really very low so you know it's often important to kind of you know set up lots of little subgroups within this think about broad they're all differentially situated in the financial system i think you know i think the the case the case for debt relief for the 80 or so countries that are recipients of of ida uh lending is in other words the very poor countries is vastly different to the case for you know other countries that you would describe as developing countries like you know mexico or indonesia or middle-income countries as opposed to the real sort of ignoring ones brilliant so that was a fascinating discussion there dave thank you very much just wanted to ask just a couple of things about the sort of prognosis obviously debt workout and debt relief is going to be one of the things that's high up on the agenda anything else we should have a watch out for and be looking out for in this space as as this pandemic plays out and just final lessons and thoughts and reflections from you i think i mean i tend to be pessimistic as a person um and i i think there are a bunch of quite pessimistic questions to to ask oneself uh about the kind of global environment that developing countries are going to be facing on the other side of this developing countries growth was kind of supported over the last 30 years by aspects of globalization that seem to be under threat now and not just because of coronavirus but you know predating it the aspects of globalization that i'm thinking about are the value of trade liberalization in other words the ability that you can the the support to your growth that comes from reducing trade barriers and enjoying higher rates of export growth um and the simultaneously connected to that the um willingness and desire of firms to disaggregate their supply chains internationally so that the the core bit of globalization that was so helpful i think to many developing countries growth in the last couple of decades was that was the sort of deal where not a deal but a coincidence where trade barriers come down and as trade barriers come down long-term capital fdi comes in um though that that sort of nugget that core of the globalization story over the last 30 years that i think had a lot of benefit for developing countries is really threatened it's been threatened for several years now partly because global protectionism has been a phenomenon becoming more and more visible since 2012 2013 um and now also because the coronavirus crisis seems to have triggered a rise in economic nationalism that not only makes uh international coordination much more difficult going back to the point that we were discussing earlier about the us-china relationship but also means that the global the globalized economic framework the sort of norm that existed within the international order that trade liberalization and and a global expansion of supply chains was generally helpful to everyone that norm has been weakened by this crisis and and so i think the economic environment that developing countries face on the other side of this is really really uncertain i'm tough by the sound of it david thank you very much for this conversation fascinating one and a real tour of all complexities and importance of the global financial system at the moment and how it's playing out around the world so much much appreciated my pleasure take [Music] care

Show moreFrequently asked questions

What is needed for an electronic signature?

How do I sign and email back a PDF?

How do I sign a document with an electronic signature?

Get more for boost signatory Request with airSlate SignNow

- Print electronically sign Free Certificate of Achievement

- Prove electronically signed Salesforce Proposal Template

- Endorse digisign Loan Agreement Template

- Authorize electronically sign License Agreement

- Anneal mark Consulting Proposal

- Justify esign Demand For Payment Letter

- Try countersign Email Marketing Proposal Template

- Add Insuring Agreement electronically signing

- Send Housekeeping Contract Template mark

- Fax Promotion Acceptance Letter signed

- Seal Concert Press Release autograph

- Password Severance Agreement Template digital sign

- Pass Purchase Order initial

- Renew Real Estate for Sale by Owner electronically sign

- Test Creative Brief countersignature

- Require Intellectual Property Sale Agreement Template digital signature

- Comment undersigned signed electronically

- Champion heir electronic signature

- Call for patron digisign

- Void Privacy Policy template eSign

- Adopt Intercompany Agreement template eSignature

- Vouch Concert Ticket template autograph

- Establish Simple Receipt template electronic signature

- Clear Construction Proposal Template template signed electronically

- Complete Foster Application template electronically sign

- Force Articles of Incorporation Template template sign

- Permit Gala Reservation Confirmation Letter template electronically signing

- Customize Bill of Sale template mark