Byline Affidavit of Residence Made Easy

Do more on the web with a globally-trusted eSignature platform

Standout signing experience

Trusted reporting and analytics

Mobile eSigning in person and remotely

Industry regulations and compliance

Byline affidavit of residence, faster than ever

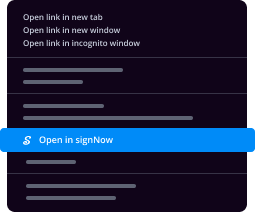

Useful eSignature extensions

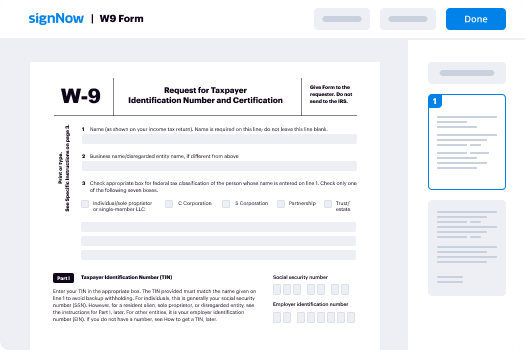

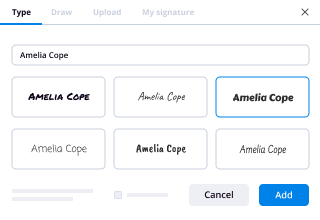

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your step-by-step guide — byline affidavit of residence

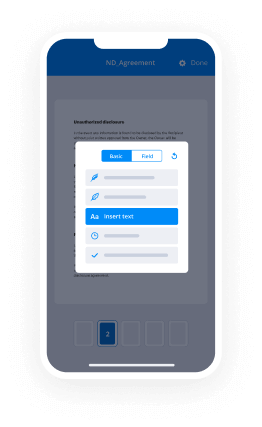

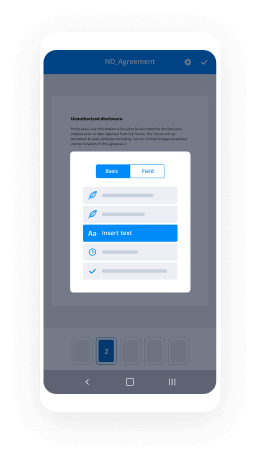

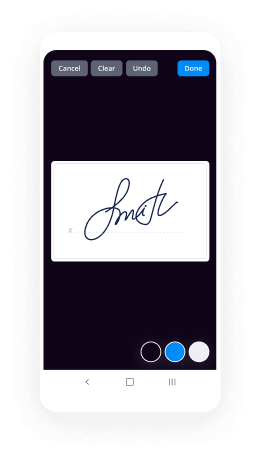

Adopting airSlate SignNow’s eSignature any business can accelerate signature workflows and sign online in real-time, delivering an improved experience to consumers and workers. Use byline Affidavit of Residence in a few simple actions. Our mobile apps make work on the move achievable, even while off-line! Sign documents from any place worldwide and close up deals faster.

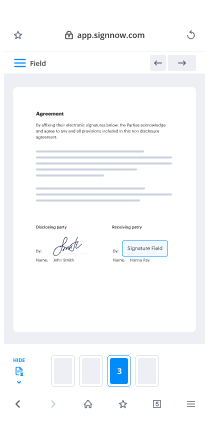

Take a step-by-step instruction for using byline Affidavit of Residence:

- Log on to your airSlate SignNow profile.

- Find your document within your folders or upload a new one.

- Access the document and edit content using the Tools menu.

- Place fillable fields, type text and eSign it.

- Add several signers using their emails and set up the signing sequence.

- Indicate which users can get an completed version.

- Use Advanced Options to restrict access to the record and set up an expiration date.

- Tap Save and Close when done.

In addition, there are more enhanced features open for byline Affidavit of Residence. List users to your common digital workplace, view teams, and keep track of collaboration. Numerous consumers all over the US and Europe agree that a solution that brings everything together in a single cohesive enviroment, is what organizations need to keep workflows performing smoothly. The airSlate SignNow REST API enables you to embed eSignatures into your app, website, CRM or cloud. Try out airSlate SignNow and enjoy faster, smoother and overall more efficient eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results byline Affidavit of Residence made easy

Get legally-binding signatures now!

FAQs

-

How do I write an affidavit of residence?

Full legal name; Full address; Facts surrounding the residence; Document name and if applicable, number verifying the ID of the affiant; and. Reason the Affidavit is needed. -

How do I get an affidavit for address proof?

Have a Look, How to Get it: STEP 1 \u2013 At our Legal Documents Menu, Select Affidavit \u2013 General Affidavit. STEP 2 \u2013 Select Address Proof Affidavit and Fill the provided Form (designed securely to capture your data). STEP 3 \u2013 Review the Details filled in the Form and if Satisfy, Click on Add to Cart and Place the Order. -

How can I get proof of address quickly?

A lease or mortgage statement. A bank or credit card statement. A utility bill. A government benefits statement. A pre-printed paystub or tax form. An insurance policy or premium bill. -

How do you write a proof of residence for an affidavit?

To write a letter for proof of residence, type "Affidavit of Residence" at the top of a blank page and center the text. Beneath that, write the date, your name, address, phone number, and email. -

How do you write an affidavit?

Title the affidavit. First, you'll need to title your affidavit. ... Craft a statement of identity. The very next section of your affidavit is what's known as a statement of identity. ... Write a statement of truth. ... State the facts. ... Reiterate your statement of truth. ... Sign and airSlate SignNow. -

How do you write a letter saying someone is living with you?

To write a letter showing proof of residence for a tenant, ask the tenant who you're addressing the letter to and what specific details to include. Open the letter with a simple salutation like, "To Whom It May Concern," and state that you're writing to verify that the tenants live on your property. -

What does DMV accept as proof of residency?

Examples of acceptable documents to prove California residency are: rental or lease agreements with the signature of the owner/landlord and the tenant/resident, deeds or titles to residential real property, mortgage bills, home utility bills (including cellular phone), and medical or employee documents. -

What is residence affidavit?

Affidavits are documents used to declare facts in writing and can either be used as support documents or as evidence in Courts. An affidavit for proof of address or simply affidavit of residence is a document is that is used to legally prove a person's address. -

What is a form of residency?

Examples of acceptable documents to prove California residency are: rental or lease agreements with the signature of the owner/landlord and the tenant/resident, deeds or titles to residential real property, mortgage bills, home utility bills (including cellular phone), and medical or employee documents. -

What is Texas residency affidavit?

The applicant must use this affidavit to support their claim of residency or being domiciled in Texas. ... For individuals who are non-family, provide copies of two acceptable residency documents and the signed affidavit. -

What is a signNowd affidavit supporting residency?

The proof of residency letter, also known as an 'affidavit of residence', is a sworn statement that a person resides at an address. ... Notary Acknowledgment \u2013 It's recommended to have the proof of residency letter signNowd if there is no supplemental evidence (i.e. utility bill, paycheck stub, drivers license, etc.) -

How do I prove residency if I live with my family?

Bank Statements. Document description: Preprinted account statements from your bank. ... Court Letters. ... Government Documents. ... Income Tax Statements. ... Lease Agreements. ... signNowd Affidavit of Residency. ... School Records. ... Vehicle Registration. -

What is a signNowd proof of residency?

The notary proof of residency letter is a sworn statement claiming residency by an individual, or on behalf of an individual, and signed in the presence of a notary public. Due to the nature of notarization, the letter may be subject to State perjury laws if there are any false claims made on behalf of the claimant. -

How do homeless people prove residency?

To get an ID card, most states require multiple proofs of identity or permanent residence, such as utility bills, Social Security cards or birth certificates. Some states require proof of homelessness, such as a letter from a social services agency.

What active users are saying — byline affidavit of residence

Related searches to byline Affidavit of Residence made easy

Byline affidavit of residence

hi everyone my name is serena mohan i am the director of public programming and events for the preservation resource center i want to thank you all for being here for this class um we've been doing these classes three times a week while everyone's stuck at home covering a wide variety of historic preservation topics and we are so so so glad that so many people have been interested in tuning in and learning more about preservation um so thank you i also see that there are a number of members in our audience thank you to our members you guys are what keep us going you keep preservation going but you also your support and your membership is what keeps the preservation resource center going so thank you to our members um if you're not a member yet please consider becoming a member we uh we we love new people to join us in our mission of of preserving historic new orleans um architecture and neighborhoods and um we love we would love to have you you also get with your membership home delivery of our incredible award-winning magazine preservation in print so please please please if you join today you'll get the june issue in your box um next month uh we also have incredible merchandise available visit prcno.org to check out our new t-shirts and our incredible coffee table book um i would also like to give a shout out today to steven richard parnes who is sponsoring our online classes um he is an amazing supporter of the prc and he is making this possible we're going to keep it going through this month um at least and doing free online programming for you guys so thank you um stephen for your support um if anyone else out there is interested in supporting this programming and helping us continue to do it please reach out to katie feyard who's our development director um you can reach her you can see her her email on the screen kfayard prcno.org um she would be happy to talk to you about sponsoring our online classes um or supporting any of the other work that the prc is doing during this time um so a few issues um of logistics if you are uh joining us through the zoom webinar platform um you'll notice that you don't have video or a mic so um you're sort of muted and but you're present we do want to hear from you if you have questions please please do ask there is a q a button at the bottom of your screen um so type your questions in there if we don't i'll be moderating and asking the questions of becky making sure that we keep things going if i don't ask your question right away um i'll probably get to it later there'll be time for q a toward the end of this session um so um just be patient with us we'll get to all of your questions if you're having technical difficult difficulties feel free to send me a message in the chat function and i can try to help you through it i've been learning a lot more about zoom as we do all this so i can try to help you walk through any technical difficulties um if you are watching us on facebook thank you for joining us this way if you have questions the best way to do it is through zoom but obviously the prc is here to be a resource so reach out to us let us know what your questions are if we can't answer you today in real time um still let us know what your questions are we can either answer them or get you in touch with the right professionals who can answer your preservation questions and your questions about this very important tool um in the preservation world that becky lambert is going to talk to us about today becky is the program administrator for the restoration tax abatement program um with louisiana economic development and so she's she's an expert on this she's going to really talk to us about the nuts and bolts of the program so without further ado i'm going to turn this over to becky um becky give me one second and i will let you share your screen okay becky you can go ahead and share your your um your powerpoint and uh the stage is yours okay hello everyone so happy to see you uh in sort of a a digital world um i actually don't see you but i will be speaking with you today about preserving cucumbers and tomatoes oh oh wait that's the other one for tomorrow no this is regarding the restoration tax abatement program and i thank sarah for giving me the opportunity to speak on behalf of the state of louisiana louisiana economic development the business incentives division that allows us to help companies and individual homeowners to receive property tax abatement on the improvements they make to eligible structures and let me ask a little housekeeping right here should i be seen or should just the presentation be seen right now you're fine right now if you're comfortable we can see you um you just can't see me okay that's fine with me so if anyone has any problems with me speaking uh loud enough or clear enough please you know let us know so we can make this the right experience for you and if you do need any preserving recipes let me know i'll try to get those out to you all right so uh first question and you can just kind of think about this but you know has anyone used the restoration tax abatement program for any projects in the past and it doesn't really have to be a verbal answer but i asked that because if you have you uh you're ahead of the game for a lot of people who have missed the boat because they learn about it after they've done the project and that's uh the after they've done a project and they haven't notified the state of what they want to do is one of those too bad so sad there is no going back and and you know recreating it changing the start date or anything once a project has completed and then the other portion of that is on the tax rolls there is no going back to get a benefit for the period or contract period so the most important thing is to make sure that you learn enough to be able to ask more questions and you'll have my number and i'm going to suggest a few other numbers for your local resources including sarah because it's us on the ground they're helping you i am the state uh program administrator but we also have another state administrator for another program that i don't manage but i i will tell you about her and then there are the people on the ground in orleans parish and if you aren't already aware orleans parish has the vast number of applications for this program far greater than any other parish around east baton rouge parish and shreveports are distant seconds and thirds so um orleans by the nature of the fact of the eligibility uh areas you have um a lot of geography in orleans that is qualified so and again and if you don't know if you are not i'll give you the resource to that as well so thank you again for coming today and uh i'll get started telling you about the program and i really have just a few slides because i really want to focus on the things i know oh i should have said i've been working with this program for over 10 years i have 25 years experience working in economic development for the state as a project manager for major uh business projects and then of course working with these incentive programs and i've worked with a number of them is uh also so i i have experience but i have a lot to learn there's always something new to learn and any any sharing of tips that anyone wants to provide me to share on to pass on i'm open but anyway the purpose of the program and i'm gonna use my glasses a little bit is uh actually to provide property tax abatements and abatement means not paying for the expansion restoration improvement and development of existing commercial structures and or owner occupied struck residences existing i can give you i have a lot of examples uh throughout this just last week someone was so proud to provide me with an advanced notification which i'll talk about in a minute as the first document that is is submitted to the first step that's submitted was so proud in the project description to say that we have just completed run re building a new blah blah on a site that had a decayed uh prop you know building and now we're going to revitalize this area a few words in there just through the toe the whole thing out it was we there is no abatement available for new buildings for this program it has to be improving what's existing okay and there are four four critical sections in that expansion restoration improvement in development you may have a and i'm going to elaborate on those just a little bit and they they're almost self-explanatory but expansion means you might have a thousand foot building and you add a couple of uh rooms to it and you end up with a 1500 square foot building that's an expansion without doing a whole lot more you're expanding you may be putting a few more offices or bedrooms or whatever restoring goes into the historic preservation portion because you're going to a lot of times try to restore to its original purpose and original style and improvement is is making as sometimes this is not a repair program such as if you you had a hurricane and you had damages to your roof and some of your shingles and columns and things you know other damages happen that's repair that is not in its that is not this program yes you may be doing some repairs uh overall when you get into the project but this is not a repair program so if if you do a building permit and it it describes it as that you know repair of blah blah i will have to question that and you know question that with you and say are you doing any type of expansion restoration redevelopment is the fourth one the redevelopment is taking um the old bone ford dealership and turn it into a high level residences and anything else they can convert it to something else all the warehouses that have become something different so um that's it these are the qualifying districts of the restoration tax abatement program and just recently back in july of last year the one of the districts was expanded to include something and i'm going to go into each one the downtown development district is is pretty clear and understand there are boundaries the city the parish is fully aware of exactly where the start and end borders are in the city for the downtown development district there's usually downtown development district commission and board etc and yes of course we know there's one in ones but they are very instrumental in helping you to know what their requirements are with downtown development but it does qualify you i don't care if the building was was erected two years ago it can be a new building but it cannot be an unbuilt building at the time of the application but so in the downtown development district or an economic development district and that is created by the city council or as it says in the statutes the local governing authority so anytime you read that and you hear local governing authority that's who it is that is the body that that votes on what's happening in their district or their parish the economic development district can literally be carved out of an area that does not that is not currently an eligible district in order to stimulate economic development activity and that could be to open up at the at the port to open up an area for expanded uh business opportunities and some vacant space along there you know that has you know many warehouses we're having to use they can revitalize an area they also have opportunity zones and economic development an opportunity zone does not have to be voted on by the board but but we um are by the authority but it's kind of added into the economic development district eligibility and if you don't know what that is and i'm not a pro an ex an expert on this but it is a federal program for investors to receive a benefit back for the investment they make and you can use you can apply for opportunity zones and and i'm going to leave it at that because i don't want to profess to to know more about it but you can that's why i didn't didn't even put a link to it because there could be different links and i could be missing the one that you really need to know but you can go right online and uh you know enter in opportunity zones and you can get a resource listing of things to tell you but any of you who are investors or knowing or representing investors will more than likely know about this legislation that passed last year any units any applications received after then can qualify for an opportunity after the july 1 regular session and then the last one is the historic district and this includes properties that are in the historic districts of the uh the city or the property is not necessarily in a historic district but the the building itself is historic in nature and you've applied or or it's listed on the national register of historic places and the little byline underneath i say contact allison saunders she's in another department within the state with the department of culture recreation and tourism she has been working as a director of this department and is directly involved with the preservation and historic preservation um programs that they have she has actually spoken uh at the with serena and me and a couple times at your location explaining the program but it is a rebate program or i mean a percentage about 20 percent i think it is or 25 of your investment on the qualified investment you can get back unlike the restoration tax abatement program it's not a refund or credit to your taxes it's actually not being assessed the value the tax value on that investment portion so it's saving money definitely but one this this one with historic preservation actually puts money back in your pocket that you you spent to do the project but if and if any of you know about the historic nature of improvements it can be very tedious and daunting and sometimes disappointing when you can't find the right knobs that they say that you have to have uh becky let me let me interject for one second we um we actually did a one of these online classes with um some tax credit professionals so if anyone is interested in learning more about that if you don't um have this information yet you can go to our website prcno.org and view the recording of that class um it is definitely something the prc is going to continue to try to disseminate information about so we do have a little bit more information about that if anyone has any questions about it feel free to email me anytime okay that's good thank you very much uh there um there's so many um examples that can come up that it's hard to list everything but in our oh and you said the the website and stuff we have a wonderful website you would go to louisianaeconomicdevelopment.com and select the incentives tab and from that you scroll down and you find restoration tax abatement and we have more details about all the statutes about the program are there you know if it's a little bit cumbersome to work with you know not having worked with the specific programs that's what i'm here for i can help you through any part of the process that you need to to be able to get started to submit your documents okay eligibility and we have talked a little bit about it but i'm going to go over a little bit it requires becky before you start that we actually we had a question about uh location someone was wondering if properties in cultural districts are eligible very good question thank you and the arts district uh anything that could be um you know call anything called a district isn't necessarily an eligible district for this program in fact the framed map behind serena behind serena is a map of a lot of the geographic boundaries of the downtown area and the mayor's office of economic development uses an expanded version of that and they have it sort of and colors onto where you can see the different types of districts and anytime an applicant or a potential applicant is looking to use this program they get and they can be referred to tracy jackson who is the the local me i mean she she manages rta program on the ground and she prepares all applications and this and the the steps that an individual has to take in order to participate in the program and the first one is submitting an advanced notification the second portion of that phase is submitting an application just giving you a heads up on that i'm going to talk a little bit more on that in a few minutes okay so but i have tracy's phone number if anybody wants it um conveniently the number her number is 504-658-4955 it's 504-658-4955 and her name is tracy jackson in the mayor's office of economic development and while you're writing i'll give you another name of lisa ross lisa ross r-o-s-s at the same 504-658-1324 five five oh four six five eight thirteen twenty four lisa is the real estate appraiser in the assessor's office who works directly with retention restoration tax abatement questions and evaluating things okay so um so that's what i have tracy she's in new orleans a contract is valid for five years with an option to renew four or five years that option is subject to local governing authority approval and the local governing authority has guidelines regarding the restoration tax abatement program that are set by the city council tracy jackson has them and when an applicant submits an advance notification as the first step tracy then begins her process of steps to be able to get all of the required documentation and information and payments that they need on the local level because what you have to provide for the state is in the statutes what you have to provide to the city is within their guidelines of the council for you know managing things um uh i'm trying to think oh for one thing uh equal opportunity contractors they have to meet those guidelines of equal opportunity or they don't qualify by the locals now how would a company know that they go and submit an advance notification to the state i don't know that they don't have a contractor so there's a little bit of a gap there where there's an uncertainty and i always encourage everyone to contact your local person which would in this case would be tracy to find out number one if you're in a qualified district to uh any other questions you have that would or or if you would qualify because of the type of business or what whatever you're doing and i'll get a little bit more in detail about some of their exceptions if um we have transfers of ownership available a company can change can sell the property to a new owner and a contract if still active can can remain in place until the the life of the contract expires but the city may not allow the transfer if it's not meeting the guidelines of of ownership like for instance a restaurant selling to a restaurant a restaurant selling to an amusement park or converting something into something else turning a beauty salon into a restaurant they will more than likely not approve it within the guidelines they don't want to do that now there are some exceptions for existing businesses that have already used the program and they're in the second phase and renewal but those are the types of little idiosyncrasies that you really need to know um tracy you know even if you don't apply right now tracy can send you the couple of sheet guidelines and you can see right away if there'll be an um an obvious roadblock for you um fees are non-refundable so i try to make you aware of everything that i can and i have no problem with you calling me or sending me an email my contact information is behind is on the last page of this that's what my job is to make sure that i make it as smooth as possible for you to get the benefits that you're applying for so i said there are two steps there's an advanced notification and that is 250 dollars whether you're a business or residential applicant that is basically a notice to the state and also because it's public record to anyone who's a contractor or anything else so that they can look for business opportunities so you put in but it's also notifying the state it's a time stamp for instance becky we're going to do a project we're going to start in september september 15 and it's going to go for and the period is up to 24 months but it could be one day if you're just building a dog house i guess but um it's gonna you know you're gonna give me parameters to start and stop a construction period and um so you submit the information and then after a little while you find out you haven't no you haven't submitted anything yet then you call me back and say oh i'm wrong they already started construction and it started a month ago so i need to change the date we need to back the data no go and this is all electronic in this database whatever the current day's date is is the soonest that your construction can begin anything that happened prior to then you have to determine first of all if it even is construction uh but if it is other the expenses that you have if it is you're not able to use that portion of the amount that you've invested as part of your investment you're not going to get an abatement on that so then you have to look at your investment and say how much of my investment is within this correct time period i'm just i start to think of something and i'll get back to it okay i've had several instances where buildings as you know in new orleans if you're a commercial building you could be connected to uh the uh the building next to you either as a firewall or or you know just connected uh there's a there was a church near in the marigny that became an event center and they had a church they had the priest living quarters they had an outside kitchen there were four different buildings well they the only thing that was oh and when they applied they it was one project to them they bought the property and they were you know redeveloping it into something else but the buildings were not attached except for the church to the priest house and i'm not saying it correctly but so it was connected by an existing walkway those two buildings were able to be claimed be applied for together the other two buildings the outside kitchen and i don't remember the name of the other building but those two had to be applied for separately and as it ended up being someone they they found out that the investment in one of them was very minimal and they would not have probably received the benefits that they wanted that would have been greater than what they were paying to make a separate application but that's one simple example no matter whether it's called you call it project abc if you have an apartment unit a complex that has eight separate units i mean and it may have 24 apartments per building each building is a separate application okay i had um 23 houses in east baton rouge parish that was all part of their improvement project in the mid-city area in baton rouge are revitalized in effort that each one had a separate application it still was a benefit to them but you know they said well why can't we do it all together it's the same owner it's the same this is because because the rules say that way and so you know that's the way it works and if you if you have questions about that i'm more than happy to to look at it and see if there's something that we're missing or something i can help you and i think i said this earlier property taxes have been paid on the improvements the tax abatement is not available um the rules say application needs to be filed before construction begins that application can be interpreted as the first step of the application process which is the advanced notification because the rules say an advance must be filed prior to beginning the project and then a slight word change says and an application is due before construction begins in some programs that works well because they have enough time in between and they get to apply for the pro for the program after it's been completed because of local governing authority requirement to be involved in improving they they need to approve the project as quickly upfront as possible but because you submitted an advanced notification the date on that advance will carry you through into the application and typically if an if the assessor who also has access to the database and stuff if the assessor knows that an advanced notification has been filed they will more than likely not put that improve that property on your tax bill for the improvements that you say you're going to make on estimated on the advanced notification but if you don't submit the advance and even if it's before um you know you're not untimely you know you're you still have time to do it but if during your tax year you get your tax bill and because nobody knows any different you would have two choices to pay the bill and not apply or pay under protest and ask for or three or ask for deferment but that is between you and the assessor's office so just make sure that as soon the the key is as soon as you know you're going to do a project that might benefit from tax incentives with this program that's when you apply now you have up to two years to do the project but if you end up having to change the dates then you will make the change and you know the start and end date and when i say i started to say we'll change the date a few years ago we went 100 into a new database called fastlane we did some online submissions of the advanced notification and some some programs were more advanced than others but now all of our primary incentive programs are on the website and they are applied by the individual applicant or consultant to the applicant and they are submitted online paid online and signed online with these signatures it was a big learning curve for some and many times people that are personal resident residential owners may only apply for this one time for that purpose but there are companies that have different properties and they may be doing this program these programs more than one time and consultants some of them make their livings on applying and managing tax incentive programs for companies and so they get really familiar with how they have to process so if you're any one of those and you know want to know how to set yourself up with a profile and set up the the application this would be a whole new class for me to teach how to use fast lane and i'd probably miss half of it because there's all kinds of little you know little things to it but i try to save everyone any money that i can for uncertainty so that's why i appreciate serena allowing me to to speak today the next step of the first of the process in applying is the application for personal residences that are lived in by the owner there is no minimum fee so depending on the size of your investment if it's a forty thousand dollar or four million dollar investment and it's all it's a calculation your fee is based on the calculation and not a minimum on the other hand businesses have a minimum 500 fee up to 15 000. okay so i have not it's not been unusual that i've seen a 71 application fee for a property it just depends it's based on the millage rate the investment amount the number of five years and a few things so uh and once it's pro once it's rated with a factor with a factor number of .005 uh we calculate it all out it comes out to your feet okay and again remember these are non-refundable so ask you questions up front before you you submit it and sometimes it gets a little bit frustrating if someone is just not reading a little bit online but i i'm the first one to admit i didn't design the the program i had input in some of the wording of you know how to you know explain the program but there are some places where people don't understand a few things about how to manage the application or how to get to a certain stage i've learned enough about it to try to do some troubleshooting and i think it would be satisfactory if uh if you need me i think you'll get by with it pretty easily okay contracts can be transferred like i said to a new owner for the remainder of the period if approved by the locals and owner occupied residences are allowed if improvements are at least 25 percent of the assessed value um i'm going to give you an example of that because someone said oh my goodness well we've already torn down we had to do a whole lot we had decay we had this and we're going to we're redesigning and uh you know we only have you know i don't know if we have at least 25 percent uh of remaining uh in the assessed value uh an example of of what happened with something with them using the percentage was the and helped remind me the name was it barnes and noble serena was it barnes and noble on st charles neoturo it was um it was the you're talking about the funeral home that became a bookstore that's now the fresh market correct now it's a fresh market but when when um the funeral home was bought by an investor to build a bookstore on they said they were going to tear it down to the ground and some smart person in uh city in the city government said wait wait i think we need to find out about how this program works and fortunately they did in time they literally tore down the whole interior of the building and only left the exterior the majority i mean all of the exterior walls some interior but the facade the the outside walls and the foundation and it was determined by the assessor's office that they had met the 25 rule so they were able to get property tax abatement for five years and they were able to renew and they because they sold to another company um they ended up transferring the ownership so it was a win for the city because it was you know a revitalization of that area and i know a lot of people like the grocer there as well okay and by the way the saenger has used this and many other prominent large companies but what i love especially is when residents can can do a lot to their homes and get the benefit of it i've said a bunch of these things but the advanced notification as i said and the application they're kind of together you submit online the application is reviewed by me and then it is transmitted electronically to the local governing authority for review for additional local requirements and for city council vote to um provide a resolution in support of the project or not and the resolution comes from the city council after they have the the applicant has met the terms locally and once i get a resolution it is my trigger to set up your application for the board of commerce and industry to vote on it and approve a contract a contract is then electronically prepared and transmitted to the applicant representative who is the business signatory of the contract or of the app application so one person one person within the company or one person that's a private owner who can sign legal documents and because you may have someone representing you to apply and stuff they can apply but they can't sign for you so a contract will go out to that person and then once the signatory signs it goes through another part of the process all the way to the governor's office and although there's not a strict requirement for you know the governor's office gets it today and in seven days they have to release it sometimes and especially in light of this covid19 things get delayed unexpected but if any time someone is expecting to get the contract in order to to verify to their investors or to avoid paying additional taxes or anything uh you know we can confirm that it has been approved by the board of commerce and industry and that we're waiting for the the um the final stages of the actual signed contract so that's oh and so you have a contract for five years and from that period i missed one thing telling you about the benefit that you receive is property tax abatement on the improvements only so your tax bill is still going to come and the there are two portions to a tax bill there's the structure or improvement section and then there's a land section so you're taxing both land is never available so that portion of your tax bill is going to continue to be billed and if there are any increases during this period of time when the land value would be changed you can have an increase in value of the land assessment during this period but property the building or structure improvements those all the same intertwining words the amount that you were assessed the year before construction begins is the amount that will stay for five years and if renewal happens for another five years and you will only be taxed on what the amount was at that period otherwise there's no benefit if they keep raising it up so i've had several times when people said well my tax bill went up because yes you it happened to have been a land assessment year and i had nothing to do with any of that but once they understood then it you know and it was clear so um i wanted to make sure you understood about that then there are two two other documents that are addendums to the contract and they are the affidavit of final cost and the project completion report they are typically filed after the contract is signed but depending on timing these documents can actually be sent in anytime the project is completed the affidavit of final cost tells us the actual final investment cost versus the estimated amount that you made on the advanced notification or the app and the application the project completion report gives us the actual start and end construction dates before that again it was estimated this actual date gives us these actual dates gives me and then the assessor the knowledge of when the project actually took place and to determine if it met the parameters of 24 months or less and also um for the year that your property tax exemption will take will start because with orleans starting with their tax year starting august 1st in most cases the next year the next year after august 1st is when the um the abatement will start okay then uh there's a renewal the renewal can be filed up to six months before or six months after the current rules uh statute say that so we legally try to give every benefit of doubt so when a when a contract is getting ready to expire july 31st 2024 an applicant can submit a renewal online pay the 250 fee and um let's see six months before so that would be i think january january uh first i think the year before so you know you have um our february first excuse me six months before six months after you have no problems okay um i think i just have yes that's my contact information there but i'm open to any questions that i can answer for anyone uh regarding your particular investment don't make me go to that preservation page so becky we do have a question um someone would love to get a little bit more um information from you about um they're saying uh because the projects require dbe participation and a living wage payroll certification from the contractor it can sometimes be difficult for smaller projects or um individual homeowners to utilize this can you talk to people a little bit about those particular requirements and um how how that type of certification works what's required of participants in the program with regard to those particular um requirements i have some limitations about what i can you know what i can explain because it's handled right you know it's based on federal guidelines and it's the way the local government allows you know these projects to take place i have seen some disappointments in some individuals who did not understand this disadvantaged businesses thing if you can verify or validate that you can't use them because of the specific nature of the of the the expertise that's needed or the product that's needed you know there is an opportunity to explain and to request an exception and stuff but the state does not get involved with local governing authority determinations your best asset is um tracy jackson she's the one that she's a she's a lovely lady to work with she's a real asset to the community as well as lisa ross but tracy has been working with the rta program a couple years longer than me so we we have a good working relationship and i try to make sure that she's aware of any questions a company has or individual homeowner has if there seems to be you know a possibility of them not qualifying and i try to connect them that way but i can't really help as much as i'd like to on the disadvantaged part i i think it's my own opinion i think it's a little difficult to meet sometimes but um that's the way that the city does it and permanence i had someone just send me one today saying my application is ready i've submitted it and as soon as the parish lifts uh opens up the permit office i'll get you the permit well guess what it's not ready and you know i can make a note i can know to uh i can contact the assessor but really it's every assessor knows that's going on i said the permit office you know everyone knows that they've had to delay some scheduling excuse me i thought i'd shut that off but um i would just you know whatever contact you can make by email most people are working i'm working remotely most people are working remotely from at least someone in those offices and i would contact oh i want to go back to the construction the start of construction construction defined is when there's a change to the structure um when they wait when yes when the structure be when there's building beginning demolition is not construction discovery is not destruction construction and nor are legal services getting to that point such as architectural design whatever else my point about that is that sometimes people think that they've missed the boat by not filing on time when in fact they've got a little leverage there when they can actually determine whether or not it actually qualified as construction so you know you can even look up definitions of what is construction versus you know demolition or whatever but uh orleans parish actually helped me to know about that when i first started with this program and that saved several companies from not being able to apply because they had learned about it later than you know they wanted to but so anyway just make sure that it's actual construction and not preparing to construct also on sites only buildings are considered part of an investment only the improvements to the buildings and or anything that goes to improve the building for instance you might have plumbing that goes outside of the building but it the purpose of the plumbing is to give you plumbing in the building but if you have landscaping if you have lighting in the parking lot or you have you poor blacktop for your parking lot anything that is not attached to the building and is not an integral part of the building is not considered part of the investment that you're making for the benefit of property tax abatement and make sure that when you're making when you're estimating your investment that you think about it you don't even though you may get a tax break on what you spent up front uh like i mean a tax break on what you spent realize that if you're if you're adding into your investment that you bought styrofoam cups and whatever's for you're working for your work crew you don't want to be paying property taxes on that after the contract expires because you've decided it was part of the investment anything that you had would have as value of your home for property tax assessment is the same thing you don't want to be charged and also for what is considered building and machinery there's hardly any i mean machinery and equipment there are three sections on the application that um that ask you for an amount to equal out the total estimate investment and one is building and machinery and equipment only for manufacturers who actually have a production line and they may have to bring in equipment that has to be secured to the foundation or things like that that don't that aren't going to be you're not going to take a copier with them and go somewhere if it's not movable and it's part of the structure then it's considered machinery equipment in most cases you're not going to have that with a resident residential even if it's an hvac or an elevator or anything that seems to be big equipment even if it's renting equipment that's all part of your building materials because that will come up when you're trying to figure out what to do and the other is on the jobs we ask you to put the number of new job the existing jobs if your business and the payroll the annual payroll for that and then we ask you for the new jobs that are created directly by the company that's applying for the benefit of that structure not by um the if you're building a multi retail unit or a mixed use unit it's not the total number of new jobs you're going to have throughout the whole building for different uh companies it's relating to the specific purpose of that application okay that gets confusing sometimes but because there are confusing questions and stuff we have a method to give you an opportunity to apply and if there's something that needs to be questioned we will i'll send you something called an information required email from fastlane and it allows you to respond and make changes and this is a very um transparent type of program because it it makes the applicant understand i mean the applicant has control of the information that they're entering and sometimes of some a lot of the information regarding data and stuff i don't have any control over changing things the applicant has to make the changes and so that's a big difference between the manual method and the electronic method there's more uh interaction between all parties okay so i i kind of scattered myself a little bit at the end when i i think i missed a few things i kind of keep a little outline to myself but uh just when i think i've got it all covered and i'll say oh doggone i forgot about that so uh if you need anything uh any other have any questions that you'd like we actually do have another question that just came in um someone is interested in learning a little bit more about um properties where um they may have been gutted so they're asking um if interior interior demolition or gutting is considered preparing to construct that is considered preparing to construct and because you're really not building back your tearing down so you know i'm sure there could be any some kind of circumstance that would be considered construction if while you're tearing down i'll give you an example i i flooded in 2016 and i did what a lot of people did i broke down a couple of walls well that i was making improvements while i was repairing renovating doing everything together but um that's just an example things can can be you can have dual things like i had construction going on when i was also doing demolition because that after they started construction i said hey would y'all mind telling me what it would what we could do with this so if you're if part of your plans in the beginning and they had to do all the clean out and all that all that time that was involved with that and god bless america is over but um um that was all pre-construction so that might help you so great one more question in the same vein um this person's asking if a house has already been gutted but all of the exterior finishes are intact could it still be eligible for the program well what are you wanting to improve what are you doing you said it's been gutted so that means you're ready for construction and if you're ready for construction you have to put your start date when construction is did the start date before did did construction start before today if it did then you would put today's date may 4th may 4th may 4th as your first day of construction because the computer the fastlane program will not let you predate so it will only allow you to put may 4th or beyond so that would be your first day construction if i understood your question great um i don't see any more questions right now so if anyone has them send them now otherwise becky thank you so much for doing this um as always if anyone has any questions about anything after this please feel free to email me at s mohan s-m-o-h-a-n prcno.org and i can certainly connect you with becky i think you guys all have her contact information it was on one of your slides um that's why but if you guys need any more information about this program please do contact us the prc wants to be here to help becky obviously knows about the program um so uh if you need anything let us know and hopefully we will see you all in another class becky thank you so much for doing this thank you again again to steve steven richard parnes for um sponsoring our online classes and we will see you guys at the next one thanks everyone i appreciate you attending thanks becky

Show moreFrequently asked questions

How can I scan my signature and use it to sign documents on my computer?

How can I have my customers electronically sign a PDF quickly?

How can I virtually sign a PDF file?

Get more for byline Affidavit of Residence made easy

- Electronic Signature and Records Association, digital sign

- Prove electronically signing Construction Proposal

- Endorse digi-sign Power of Attorney

- Authorize signature service Event Management Proposal Template

- Anneal signatory Medical Claim

- Justify eSignature Letter of Recommendation Template for Coworker

- Try initial Medical Invoice

- Add Trademark Assignment Agreement mark

- Send Event Photography Proposal Template signed

- Fax Photography Gift Certificate digi-sign

- Seal Summer Camp Evaluation digital sign

- Password Articles of Incorporation initial

- Pass SaaS Metrics Report Template by ChartMogul signature

- Renew Home Inspection Services Contract countersignature

- Test Transfer of Pet Ownership digital signature

- Require Forbearance Agreement Template electronically signed

- Comment subject signature service

- Boost grownup signature block

- Compel attester electronic signature

- Void Promissory Note Template template eSignature

- Adopt Liquidating Trust Agreement template autograph

- Vouch Article Writing Invoice template digital sign

- Establish Free Marriage Certificate template signed electronically

- Clear Redemption Agreement Template template electronically sign

- Complete Scholarship Application Confirmation Letter template countersignature

- Force Recruitment Proposal Template template electronically signing

- Permit Auto Repair Work Order template mark

- Customize Cleaning Service Contract Template template signed