Byline Insuring Agreement Made Easy

Improve your document workflow with airSlate SignNow

Agile eSignature workflows

Fast visibility into document status

Easy and fast integration set up

Byline insuring agreement on any device

Advanced Audit Trail

Rigorous security standards

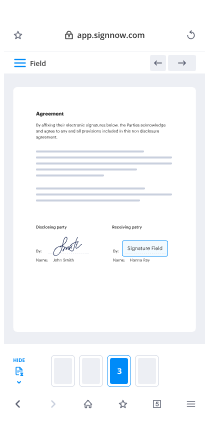

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your step-by-step guide — byline insuring agreement

Using airSlate SignNow’s electronic signature any business can accelerate signature workflows and sign online in real-time, giving a greater experience to clients and workers. Use byline Insuring Agreement in a couple of easy steps. Our mobile apps make operating on the move achievable, even while off-line! Sign signNows from any place in the world and make deals quicker.

Take a walk-through instruction for using byline Insuring Agreement:

- Sign in to your airSlate SignNow profile.

- Locate your needed form in your folders or upload a new one.

- Open up the template and edit content using the Tools menu.

- Place fillable fields, type textual content and eSign it.

- Include numerous signees using their emails and set the signing sequence.

- Indicate which users will get an completed doc.

- Use Advanced Options to limit access to the template and set up an expiry date.

- Tap Save and Close when finished.

Additionally, there are more enhanced tools open for byline Insuring Agreement. Include users to your common work enviroment, view teams, and keep track of collaboration. Numerous customers across the US and Europe concur that a system that brings everything together in a single holistic digital location, is the thing that companies need to keep workflows functioning easily. The airSlate SignNow REST API allows you to embed eSignatures into your application, website, CRM or cloud storage. Try out airSlate SignNow and get quicker, easier and overall more effective eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results byline Insuring Agreement made easy

Get legally-binding signatures now!

FAQs

-

What is the insuring agreement in an insurance policy?

An insuring agreement is the section of an insurance contract in which the insurance company specifies exactly which risks it will provide insurance coverage for in exchange for premium payments at a certain value and interval. -

What are the 5 parts of an insurance policy?

Every insurance policy has five parts: declarations, insuring agreements, definitions, exclusions and conditions. Many policies contain a sixth part: endorsements. Use these sections as guideposts in reviewing the policies. Examine each part to identify its key provisions and requirements. -

What are conditions in an insurance policy?

Policy Conditions \u2014 the section of an insurance policy that identifies general requirements of an insured and the insurer on matters such as loss reporting and settlement, property valuation, other insurance, subrogation rights, and cancellation and nonrenewal. -

What does benefit exclusion mean?

What is a Benefits Payable Exclusion. A benefits payable exclusion is a clause in an insurance policy that removes the insurer's responsibility for paying out claims related to employee benefits if the insured is able to pay them from another source. -

How do I get an insurance declaration?

You can usually find the declarations page attached to the front of your car insurance policy. If you don't have your declarations page, call your car insurance company to request a copy. You may also be able to access it online through your carrier's website or app. -

What is an insuring agreement?

Insuring Agreement \u2014 that portion of the insurance policy in which the insurer promises to make payment to or on behalf of the insured. The insuring agreement is usually contained in a coverage form from which a policy is constructed. -

Why is it important to have insurance?

Top Reasons Why Insurance is Important in Everyday Life. ... The core of any insurance plan is to offer you with protection. Providing protection and mitigating your risk is the simple motive of insurance. Making that small investment in any insurance plans, will enable you to be tension-free and offer security in advance. -

What are the elements of insurance contract?

Because the law of contracts is used to interpret an insurance policy, the basic elements of contract (offer, acceptance, and consideration) must be present for a court to uphold an insurance agreement. The insurer offers indemnification, or "compensation for a past loss," as its part of the bargained-for exchange.

What active users are saying — byline insuring agreement

Frequently asked questions

How can I scan my signature and use it to sign documents on my computer?

How can I sign a PDF with just my finger?

How can I get someone to sign my PDF?

Get more for byline Insuring Agreement made easy

- Deliver electronically sign Employee Resignation

- Deliver electronically sign Training Evaluation

- Deliver electronically sign Product Evaluation

- Deliver electronically sign First Aid Risk Assessment

- Deliver electronically sign Employee Engagement Survey

- Deliver electronically sign Summer Camp Satisfaction Survey

- Deliver electronically sign Shift Schedule

- Deliver electronically sign Summer Camp Feedback Template

- Deliver electronically sign Award Application

- Deliver electronically sign Patient Medical Record

- Deliver electronically sign Professional Employee Record

- Deliver electronically sign Camper Information

- Deliver electronically sign Personal Medical History

- Deliver electronically sign Child Medical History

- Deliver electronically sign Sports Camp Registration

- Deliver electronically sign Employee Medical History

- Deliver electronically sign Patient Medical History

- Deliver electronically sign Camper Health History

- Deliver electronically sign Summer Camp Registration

- Deliver electronically sign Pet Medication Chart

- Deliver electronically sign Soccer Camp Registration

- Deliver electronically sign Food Allergy Chart

- Deliver electronically sign Training Record

- Deliver electronically sign Music Camp Registration

- Deliver electronically sign Summer Camp Emergency Contact

- Deliver electronically sign Art Camp Registration

- Deliver electronically sign Doctor's Note

- Deliver electronically sign Summer Camp Teen Volunteer