Check Signature Data with airSlate SignNow

Get the robust eSignature capabilities you need from the solution you trust

Choose the pro platform made for professionals

Configure eSignature API with ease

Collaborate better together

Check signature data, within minutes

Cut the closing time

Maintain sensitive data safe

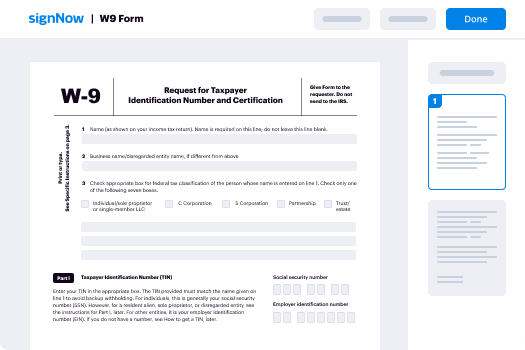

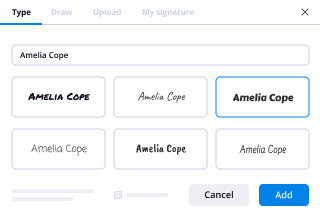

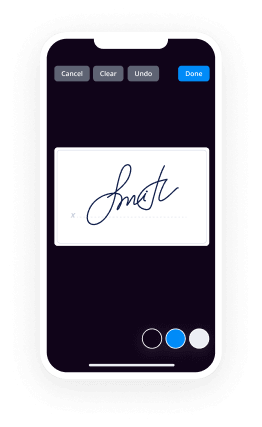

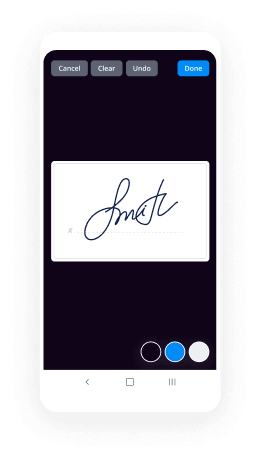

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your step-by-step guide — check signature data

Using airSlate SignNow’s eSignature any business can speed up signature workflows and eSign in real-time, delivering a better experience to customers and employees. check signature data in a few simple steps. Our mobile-first apps make working on the go possible, even while offline! Sign documents from anywhere in the world and close deals faster.

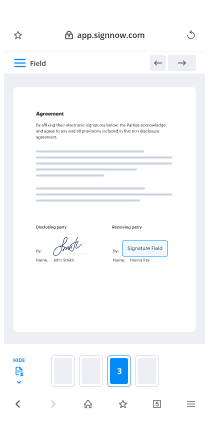

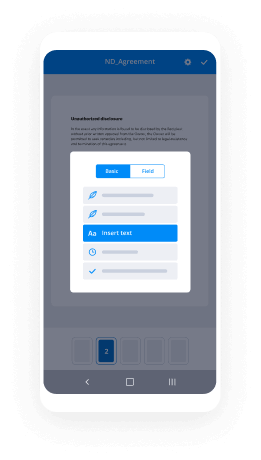

Follow the step-by-step guide to check signature data:

- Log in to your airSlate SignNow account.

- Locate your document in your folders or upload a new one.

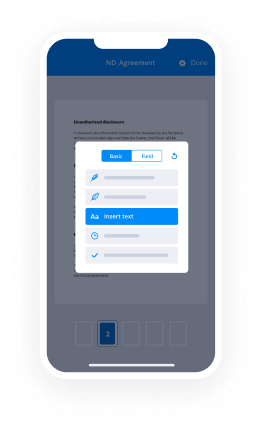

- Open the document and make edits using the Tools menu.

- Drag & drop fillable fields, add text and sign it.

- Add multiple signers using their emails and set the signing order.

- Specify which recipients will get an executed copy.

- Use Advanced Options to limit access to the record and set an expiration date.

- Click Save and Close when completed.

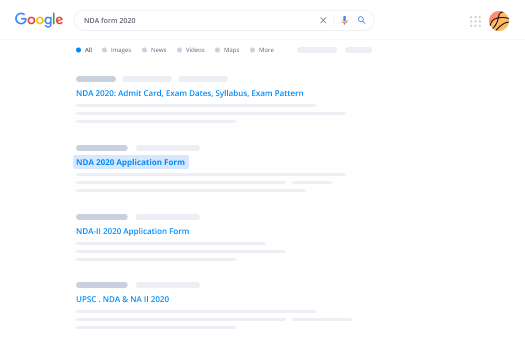

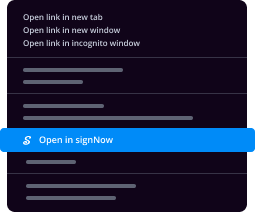

In addition, there are more advanced features available to check signature data. Add users to your shared workspace, view teams, and track collaboration. Millions of users across the US and Europe agree that a system that brings people together in one holistic digital location, is the thing that companies need to keep workflows working efficiently. The airSlate SignNow REST API enables you to integrate eSignatures into your app, website, CRM or cloud storage. Try out airSlate SignNow and enjoy faster, smoother and overall more efficient eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results check signature data with airSlate SignNow

Get legally-binding signatures now!

FAQs

-

What is a data signature?

Similarly, a digital signature is a technique that binds a person/entity to the digital data. This binding can be independently verified by receiver as well as any third party. Digital signature is a cryptographic value that is calculated from the data and a secret key known only by the signer. -

How do I convert my signature to digital signature?

0:00 1:24 Suggested clip How to Add a Signature to Any Electronic Document - YouTubeYouTubeStart of suggested clipEnd of suggested clip How to Add a Signature to Any Electronic Document - YouTube -

How do I check my signature?

From a Windows operating system: Right click the file the main executable file (.exe), select Properties > Digital Signatures. Under Signature list, select the Signature, and click Details. You will see information regarding the Code Signing certificate that was used to sign the executable. -

How do I verify an electronic signature?

Set your signature verification preferences. ... Open the PDF containing the signature, then click the signature. ... For more information about the Signature and Timestamp, click Signature Properties. Review the Validity Summary in the Signature Properties dialog box.

What active users are saying — check signature data

Related searches to check signature data with airSlate SignNow

Check signature license

chapter 4 check fraud types of check fraud checks are subject to forgery and fraud because they are physical items that can be altered easily checks remain the type of payment most vulnerable to fraud attacks which accounted for 37% of the fraud committed against bank deposit accounts and remain responsible for the highest dollar amount in fraud losses according to Ernst & Young more than 500 million checks are forged annually with the losses totaling more than 10 billion dollars in the United States alone and the average fraud scheme lasts 18 months before it is detected methods used by criminals to obtain financial information include stealing financial institution information checks statements receipts and getting consumer information from merchants insiders and bank employees according to research by the Association for financial professionals the most prevalent check fraud method is counterfeiting by altering the MICR line on the check other methods of counterfeiting checks included using a fake company name altering payee names and altering dollar amounts forged signatures or endorsements drawn on a closed account banks are bound by the regulations of their home country historically the responsibility for detecting forgery has been placed on the bank there are several common types of check fraud forgery forgery can take place a number of ways when an employee issues a check without proper authorization criminals will also steal a check endorse it and present for payment at a retail location or at the bank teller window in addition the criminal may also use forged personal identification counterfeiting and alteration counterfeiting could either mean wholly fabricating a check using readily available desktop publishing equipment consisting of a personal computer scanner sophisticated software and high-grade laser printer or simply duplicating a check with advanced color photo copiers alteration primarily refers to using chemicals and solvents such as acetone brake fluid and bleach to remove or modify handwriting and information on the cheque when performed on specific locations on the cheque such as the pay's name or amount it is called spot alteration when an attempt to erase information from the entire cheque is made it is called cheque washing paper hanging this problem primarily has to do with people purposely writing checks on closed accounts as well as reordering checks on closed accounts they may do this on their own account or on the closed accounts of others cheque hiding check kiting is opening accounts at two or more institutions and using the float time of available funds to create fraudulent balances this broad has become easier in recent years due to increasingly competitive banking practices it has been estimated that the annual losses due to cheque fraud are in the billions of dollars and continue to grow steadily for the consumer the amount of inconvenience and anxiety caused by resolving problems with the account local merchants as well as possible repercussions with credit bureaus can be considerable now that you have a good understanding of check forgery and fraud let's discuss...

Show moreFrequently asked questions

How do you generate a document and apply an electronic signature to it?

What is an electronic signature when it comes to Word?

How do I eSign scanned documents?

Get more for check signature data with airSlate SignNow

- Draft signature block conclusion

- Draft signature block resolution

- Draft signature block test

- Draft signature block corroboration

- Draft signature block trial

- Draft signature block standard

- Draft signature block filing

- Draft signature block attempt

- Draft signature block substantiation

- Draft signature block invite

- Draft signature block link

- Draft signature block annex

- Draft signature block copy

- Draft signature block envelope

- Draft signed electronically acceptance

- Draft signed electronically admission

- Draft signed electronically affirmation

- Draft signed electronically approval

- Draft signed electronically authorization

- Draft signed electronically consent

- Draft signed electronically confirmation

- Draft signed electronically endorsement

- Draft signed electronically evidence

- Draft signed electronically verification

- Draft signed electronically authentication

- Draft signed electronically disclosure

- Draft signed electronically adoption

- Draft signed electronically choice