Countersign Deposit Agreement Made Easy

Improve your document workflow with airSlate SignNow

Agile eSignature workflows

Fast visibility into document status

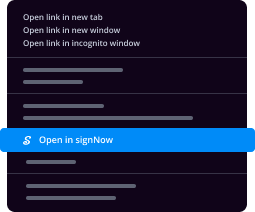

Simple and fast integration set up

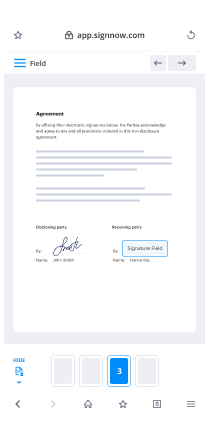

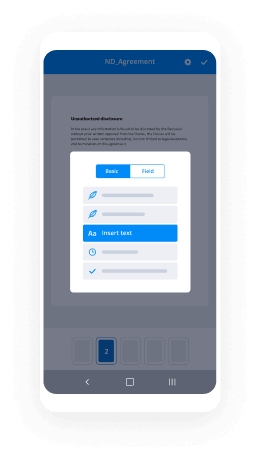

Countersign deposit agreement on any device

Comprehensive Audit Trail

Rigorous protection standards

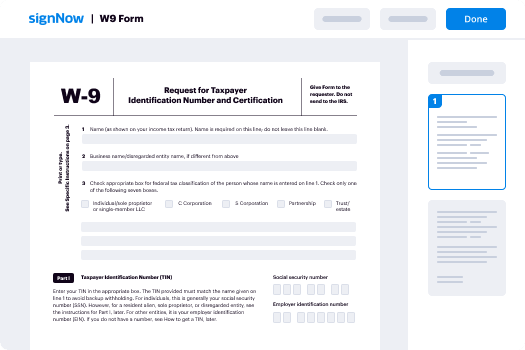

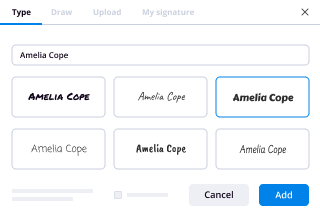

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your step-by-step guide — countersign deposit agreement

Employing airSlate SignNow’s eSignature any business can accelerate signature workflows and eSign in real-time, giving an improved experience to consumers and employees. Use countersign Deposit Agreement in a couple of easy steps. Our mobile-first apps make work on the move possible, even while off the internet! Sign documents from any place worldwide and close up deals quicker.

Take a step-by-step guide for using countersign Deposit Agreement:

- Log in to your airSlate SignNow account.

- Find your document within your folders or upload a new one.

- Open the record adjust using the Tools menu.

- Drop fillable fields, type text and eSign it.

- Include several signees using their emails and set the signing sequence.

- Indicate which individuals will get an executed doc.

- Use Advanced Options to reduce access to the record and set up an expiration date.

- Tap Save and Close when finished.

In addition, there are more extended features open for countersign Deposit Agreement. Include users to your shared digital workplace, view teams, and track cooperation. Numerous customers all over the US and Europe agree that a solution that brings everything together in a single cohesive enviroment, is what enterprises need to keep workflows functioning effortlessly. The airSlate SignNow REST API allows you to integrate eSignatures into your app, website, CRM or cloud. Check out airSlate SignNow and get quicker, smoother and overall more efficient eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results countersign Deposit Agreement made easy

Get legally-binding signatures now!

FAQs

-

Do you have to sign the back of a check to deposit it?

In order to deposit or cash a check, you first need to endorse it. ... Blank endorsement: A blank endorsement is made by signing your name on the back of the check. You must sign it exactly the way it appears on the \u201cPay to the Order of\u201d line. -

Why is it important to sign a contract?

In business, contracts are important because they outline expectations for both parties, protect both parties if those expectations aren't met and lock in the price that will be paid for services. -

Can you deposit a check without a signature on the back?

No endorsement: You don't always have to endorse checks. Some banks allow you to deposit checks without a signature, account number, or anything else on the back. ... For extra security, you can still write \u201cfor deposit only\u201d in the endorsement area. -

How do you write a countersign letter?

Understanding Countersignatures The first party reads the document and signs it if they agree to the terms of the agreement, the second party then countersigns the document by providing their signature confirming their agreement with the terms of the contract. -

Do you have to sign the back of a check for mobile deposit?

\u201cFor Mobile Deposit Only\u201d must be written legibly below your signature. Unfortunately, if you deposit a check through our mobile app without a signature or this endorsement, the check may be rejected and the deposit will be removed from your account. -

How do you countersign a picture?

Your countersignatory should write the following on the back of one photo: 'I airSlate SignNow that this is a true likeness of [title and full name of adult or child who is getting the passport]. ' They must add their signature and the date under the statement. -

How do you endorse a check for deposit only?

Write "For Deposit Only" on the top endorsement line. This restrictive endorsement ensures that the check's funds can only be deposited in a bank account in your name. If someone finds your check, they won't be able to do anything with it. -

How do you countersign a passport photo?

Once the person has agreed to countersign your passport photo, it's simple. All they have to do is write on the back of the photo the following: \u201cI airSlate SignNow that this is a true likeness of [the applicant's title and full name].\u201d With that done all they need to do is provide their signature and the date, and it's done. -

Can I deposit a friends check in my account?

Generally, if the check is endorsed "For Deposit Only" with your account number below, your friend will have no problem depositing it on your behalf with a teller. Your friend should not sign your name on the check -- that's against bank policy and possibly the law. A deposit endorsement is sufficient. -

What happens if a contract is not signed?

The answer is yes. It is important to be aware that when agreeing to a written contract, it does not need to be signed by both parties to be legally binding. ... This case highlights that even if a contract says it has to be signed to be binding, if it is unsigned it may still have a legally binding effect. -

Can you cash a check that's not in your name?

To cash a check that's not made out to you have it signed over in your name, by the person it's made out to. It must say "Pay to the order of NEW PERSON" then signed underneath. -

How do you countersign?

Suggested clip How to Countersign the Application Form and Photo - YouTubeYouTubeStart of suggested clipEnd of suggested clip How to Countersign the Application Form and Photo - YouTube -

How do you endorse a check over to someone else?

Suggested clip How To Endorse A Check To Someone Else - YouTubeYouTubeStart of suggested clipEnd of suggested clip How To Endorse A Check To Someone Else - YouTube -

Where do you sign on a contract?

When signing a written contract, an individual should sign the contract in the appropriate place by signing their full name as set out in the body of the document or with their full first name or initial followed by their surname. -

How do you countersign a PDF?

Open your PDF document. Switch to Edit Mode by selecting the Edit icon in the toolbar. Click the Signature icon . In the Sign PDF dialog box, choose to Include "X" or to Include Sign Line.

What active users are saying — countersign deposit agreement

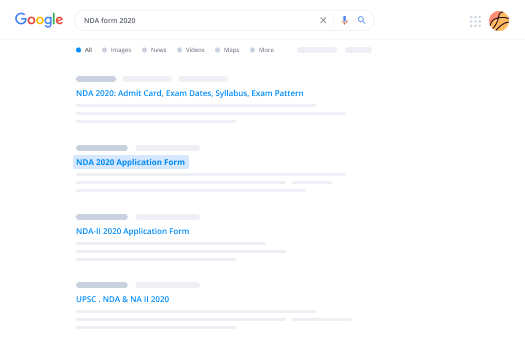

Related searches to countersign Deposit Agreement made easy

Draw countersign

hi guys and welcome to another episode of eternia blogger law for the everyday laymen today we continue with law or negotiable instruments and we'll be talking about the rules on checks so if you like my videos and you want to see more please hit the subscribe button also please remember that this is only for educational purposes and is not a substitute for proper legal advice or for studying and understanding the law okay now what our checks a check is simply a bill of exchange drawn on a back payable on demand or it is in written order addressed to the bank or persons carrying on the business of banking by a party who has money in their hands requesting them to pay on presentment to a person named in that cheque or his order or to better pay a sum certain in money okay so since its act is a bill of exchange the rules on bills of exchange will apply to checks however there are differences no each egg is always drawn on a bank a bill of exchange may be drawn on an individual or a back a check is always payable on demand when a bill of exchange may be payable on demand or at a fixed or determinable future time okay a check is drawn against a previous deposit of funds well this is not necessary for the bill of exchange okay a check doesn't have to be presented for acceptance but in a bill of exchange there are instances when a bill of exchange has to be presented for acceptance a check is usually intended for immediate payment and the bill of exchange is intended for circulation know as an instrument of credit okay he check when it comes to the death of his drover know the death of a drover with the knowledge of the back revoke the authority of the bank to pay the check okay but in a bill of exchange even if roll dice it does not revoke the authority of the drawee to pay the check must be presented for payment within a reasonable time after its issue paid which is usually 180 days or six months okay well a bill of exchange should be presented for payment within a reasonable time after its last negotiation and what is a reasonable time we take into account the nature of the instrument the usage of trade or business and the circumstances of the case okay now if a check is not presented within a reasonable time after its issue then the drawer is discharged to the extent of the loss caused by the delay okay it becomes a stable check no and in case of a bill of exchange if it is not presented within a reasonable time after last negotiation then the the drawer is totally discharged okay again in the check only to discharge only to the extent of the loss caused by the delay and in bill of exchange total discharge of the drawer and finally when a check is accepted or certified the drawer and endorsers are discharged from liability but when able of exchanges accepted the Drover's and endorsers the drawer in the endorsers made me still liable okay now there are different types of checks now let's take them up one by one different types of checks there's what is called a memorandum check no and it is simply a check given me by a borrower to a lender for the amount of a short loan no with the understanding that it is not to be presented at the bank huh okay but it will be redeemed by the maker himself when the loan falls due okay this understanding is evidenced by the writing of the word memorandum memo or even mem they on the check now we also have a cashier's check okay and this is a check drawn by the cashier of a bank in the name of the bank against the bank itself payable to a third person they note it is a primary obligation of the issuing bank and accepted in advance upon each one's so it is really the box unchecked and it may be treated as a promissory note with the bank as the maker thing it operates as an assignment of funds no but this is subject to the rule in Knoblauch on I'll talk about this later okay some cases have held it's an assignment of funds but the prevailing rule is that it is not okay so if the check is drawn by a bank upon another bank it's now called a bank draft okay now another kind of check is the managers check the it's run by a by the manager of a bank in the name of the bank itself payable to a third person okay it's similar to a cashier's check now as to the effect and its use but by issuing it the bank assumes the liabilities of an acceptor under Section 62 of the negotiable instruments though okay we also have what is known as a traveler's check okay and it is simply one which the holder signature must appear twice first the signature must be effect at the time of the issuance of the traveler's check and second there must be a counter signature affixed in the presence of the payee before it is paid otherwise if there is no counter signature it is incomplete okay the purpose of a traveler's check is to provide the traveler with a safe and convenient method by which to some supply himself with funds no pay in almost all parts of the world can a traveler stay back came without the hazard of carrying money on his person the bank issuing the instrument has the right to refuse to pay it when it does not bear the countersign agreed upon and the owner of the check has the right to insist that it shall not be paid if it's not very silent now we also have the certified check no this is simply one which wears on its face and agreement whereby the drawee bar no meaning the back against whom a check is drawn undertakes to pay it at any time at any future time now when it is presented for payment ok so how do you know it's certified there is the word certified stamp on the check and the purpose is to enable the holder to use it as money ok it enables persons who are not well acquainted with each other to quickly close business transactions why because the holder of that certified check knows that he can compel the drawee by 2n cash it so it avoids the delay of receiving counting and passing large sums of money from hand to hand take note under Section 186 where the holder of a check procure set to be accepted or certified that drawer and all endorsers are discharged from liability ok so that's one of the effects now all the other effects the first under section 187 certification is equivalent to acceptance ok it is the operate operative act that makes banks liable a second under Section 188 if the certification is obtained by the holder then it discharges the person secondarily liable on the check ok the feeling is that the money of the drawer beaded with the drawing band no is taken from his control and appropriate and already for the payment of the check ok so it is as if the holder has drawn the money redeposit a bit and taken a certificate of deposit for it no but take note that the rule is only for the holder if the certification is taken by someone else like let's say the drawer no then the secondary part is not discharged okay because the holder has not yet received a man okay next effect no under Section 189 is that certification operates as an assignment of funds of the drover in the hands of the drawee to the holder create an assignment or transfer okay and forth know the payee or the holder becomes the depositor of the drawee Bank with the rights and duties in such a situation no finally the drover may not issue a stop payment order once that check has been certified okay so what is the certification of check no so the moment that check is certified the funds cease cease no cease to be under the control of the drawer and they are no longer his okay it's the same as if the bank had paid the money on the check so the funds represented by the check are now transferred okay from the credit of the drawer to that of the PE by the holder ope or the holder no so the P here is the holder now becomes a depositor of the drawee Bank with the corresponding rights of such person no another kind of check is the cross-check no and this is very important now cross-check is one which bears across its face two parallel lines not run diagonally usually on the upper left side so there is two there are two lines on the upper left side of the check and crossing can be done either especially or generally when a check is crossed specially know the name of a particular bank or company is written or appears between the parallel lines no so there's something written there the either the name of particular Bank or a company okay in which case the drawee Bank must pay the check only upon presentment by such bank or company now when it is crossed generally okay only the words and company know are written between the parallel lines or when nothing at all is written in between the two lines in the upper left corner they two parallel lines now okay okay in such a case no the check is crossed generally take the drawee Bank must be the check through the intervention of some Bank so in actual practice the check with other check which is cross generally is deposited with a bank by the holder where he keeps an account and then the band takes charge of the collection but if it is cross especially he deposits it with the bank indicated between the parallel lines gurren langan know in in crossing the cheque generally deposit the holder can deposit in the backward here's a deposit he has a deposit you know no but if it's crossed especially don't lock asunder Casula know the bank which is written between the cross lines okay so it's just BP is the only in behind okay in both cases of crossing generally or crossing especially a cross-check can only be deposited and it cannot be converted into cash they know that that's important know so the purpose of crossing a cheque is to ensure payment to the payee particularly when it is when the cheque is sent by mail or entrusted to an agent no but the crossing of the cheque just putting the two parallel lines it does not destroy negotiability meaning even if the cheque is cross you can still negotiate it further take can pass from hand to hand no but just take note that the cross-check cannot be in cash but may only be deposited with the bank okay it may be negotiated on the ones to a person with an account with the bank and this is the most important thing to remember in case of a cross check no the crossing of a cheque serves us a warning okay buthow it serves as a warning to the holder that the cheque has issued for a definite purpose and he must inquire if he received the check pursuant to this purpose otherwise he does not inquire that he is not a holder in due course why because the effects of crossing a check relate to the mode of payment meaning that the door had intended the check for deposit only by the rightful person namely the payee named there him okay so take note no take note that a check whether managers check or cashier's check they're not legal tender huh hey it's very important they're not legal tender an offer of a check in payment of a debt is not a valid of valid tender of payment and it may be refused by the creditor take please the video oblique or no a check does not operate as an assignment or transfer of funds of the drover to the holder it is simply and ordered by the drawer to pay the amount on the check upon presentment of such check up to the amount of the funds that the depositor has with the bank okay why because the relationship remember the relationship between the bank and the depositor is one of network and creditors the banks adapter the creditor is the depositor and therefore it's governed by the provisions on simple loan no please just watch my discussion on a simple loan okay it's a I have all series on credit transactions please feel free to watch that okay and finally please just remember not to remember your habla con that a check will only produce the effect of payment when it is encashed my series on habla con is likewise complete please just watch that as well not specifically the rules on payment in the extinguishment of okay now when we talk about the collection of checks no this is how it works so on the checks due date no a holder of the check may either proceed directly to the drawee Bank and present the same for payment or he can deposit in the deposited check in his own back no he I do this no and when I received checks no I can either go to the bank that that off the check law let's say the check is BPI I can go to BPI in a bit and gosh or I can just go to my own bank that's a video and then I'll deposit it in my account okay I can do that No so if I deposit it in my bag well it's it's video okay then that back video is known as the depository bar or the collecting bank okay and it is only after the check has been cleared and collected from the drawee Bank but the final credit is made in the pay the Possible's account meaning in my account okay so again let's say the upper a person owes me a debt and then he pays me with a check a BP I check okay and then I can either n cash the check at BPI or I can go to my bank video and deposited in my account okay if I deposit in a deposit a check in my account then the beach the bath that video will now be known as the depository bank or collecting bank and BPI will be the drawee Bank okay be the oldest of collecting back because it will collect the funds from the drawee which is BPI take the drawer in that case is the person who made the check for me and the draw the draw e is the is the disability I know the bank from which he asks to pay me so my back again video is depository or collecting back draw me back is BPI and the drawer is the person who made the check for me now I mentioned clearing now and cleaning of checks is important though so how does it work know when a check is sent to the Clearinghouse know in the Philippines it's the Philippine Clearing House corporation or BC HC okay so when I check you sent to the Clearinghouse the collecting bank acts as the agent of the depositor okay the collecting back does not become the owner of the amount covered by the check okay because the that is only being collected from the drawee Bank for the principal who is the depositor no and those who are transit checks with banks know or have experience going to box for with that checks no they will be aware of the one day clearing system provided that the check is deposited before the cutoff time in the bank know which is under the check image clearing system the CICS which allows for electronic presentment and processing of cheques what does this mean this just means that depositors who transact with banks that are compliant with the CICS can now withdraw the the funds know against their validated check deposits on the next day one day clearing system learn okay before it used to be three to five days now one day system okay this system also provides for enhanced security No so there are certain rules that must be followed because the transactions are no more secure no the check should be sufficiently funded of course no you should fill up the check using dark colored ink and you cannot use pencil or something that can be erased like a reasonable in okay also no erasers are allowed no even if you countersign no I an experience like this where someone tried to pay me and they erased are they we struck out with a line a certain part of the check and put their signature before that was accepted but nowadays the bank will not accept them okay so even if the alterations are signed this will result in the refusal of the check okay also you should end the amount in words no 1000 pesos only with the word only okay and do not stay Paul do not crumple do not fold the checks why because it will be read and electronically okay and crumpling etc may interfere with them so as a general rule if a battery fuses to pay a check even if the funds are sufficient the payee or the holder of the check cannot sue the bank huh pay the patient if the bank doesn't want to pay the payee cannot sue the bank ky remember your oblique own there is no privity of contract or there is no contractual relation between the payee and the drawee Bank the payee should instead sue the drawer because it is the drover that is ultimately liable to the payee and if the drawer is meant to pay then the remedy of the drawer is to sue the bank okay but there are situations when the banks may validly refuse to pay the check okay first is if the bank is insolvent second if the drawers deposit is insufficient okay or he has no account with the band No okay those two instances in particular you know and there are involved in VP 22 or the bouncing cheques law I'll make a separate video and god no okay or when the account has been closed as I said no or if the account has been garnished why because the bank has no obligation to make a partial payment on the check no even if let's say the robber makes a check for a certain amount and the funds are insufficient the mark has no obligation to make partial payment no why because the holder of the check cannot be compelled to surrender the check to the bar they and the bank will have no evidence that it paid that amount nor it will have no vulture they will not be able to cancel the check because it does not have it in its possession they another case when a bank may validly refuse to pay on the check now is when the drawer is insolvent and proper notice is received by the bank ok another situation is when the drawer dies and proper notice is received by the bank another situation is when the drover has countermanded be man another situation is when the holder refuses to identify himself no usually you're asked to give IDs no another station where the bank may validly refuse to pay is when the back has reason to believe that the check is a forgery and finally in the back can refuse to pay if the check is still or post-dated no of course if it's post dated it's not yet you because the date has not yet arrived but now let's talk about stale checks okay so what's a stale check the check is simply one which has not been presented for payment within a reasonable time after each issue this other rule is no a check must be presented for payment within a reasonable time after it's issue or the drover will be discharged from liability then on to the extent of the loss caused by the delay that's section one eighty six I mentioned this earlier know so remember even if the check is presented for payment within a reasonable time after it's issue the drover will be discharged if he is not given notice of dishonor within the prescribed period so this still check know this stale check is a valueless thing no it does not have any value it should not be paid and what is a reasonable time in common banking practice it is 108 days or six months okay and if it is past update the check is stale and backs will normally not be such a check without first consulting the depositor or drover okay so that's it for the rules on checks no and I'll be making a separate video on batas Pambansa bilang 22 or the bouncing checks law okay so please just wait for that so I hope you may have picked up a thing or two and I hope you see you soon guys okay bye

Show moreFrequently asked questions

How can I eSign a contract?

How do I add signature elements to my PDF so that my recipients can sign it?

How can I eSign a form or contract in Word?

Get more for countersign Deposit Agreement made easy

- Print signature service Standard Lease Rental Agreement

- Prove electronically signing Vendor Agreement Template

- Endorse digi-sign Corporate Governance Charter

- Authorize digital sign Modern Employment Application

- Anneal signatory Month-to-Month Rental/Lease Agreement

- Justify eSignature Security Proposal Template

- Try initial Exclusivity Agreement Template

- Add Succession Agreement esigning

- Send Salesforce Proposal Template digisign

- Fax Current SSY Agreement electronic signature

- Seal Employee Performance Evaluation Template countersign

- Password Advertising Contract sign

- Pass Cease and Desist Letter Template electronically signing

- Renew Room Rental Agreement eSign

- Test Car Service Receipt eSignature

- Require Memorandum of Agreement Template autograph

- Comment successor countersignature

- Boost renter electronically sign

- Compel collector signed electronically

- Void Motion Graphics Design Contract Template template signature block

- Adopt testament template signature service

- Vouch Photography Invoice template countersign

- Establish Travel Booking Request template signatory

- Clear Website Development Agreement Template template initials

- Complete Artist Press Release template eSign

- Force Home Repair Contract Template template byline

- Permit Veterinary Surgical Consent template esigning

- Customize Statement of Work Template template digisign