Countersignature Form W-4 Made Easy

Improve your document workflow with airSlate SignNow

Flexible eSignature workflows

Instant visibility into document status

Easy and fast integration set up

Countersignature form w 4 on any device

Advanced Audit Trail

Rigorous safety requirements

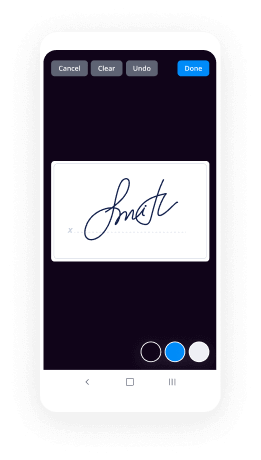

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

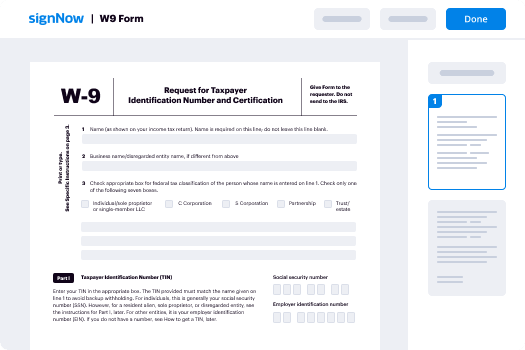

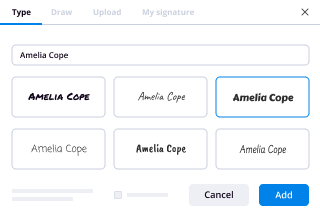

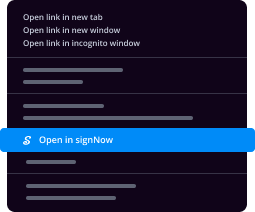

Your step-by-step guide — countersignature form w 4

Using airSlate SignNow’s electronic signature any organization can speed up signature workflows and eSign in real-time, giving an improved experience to consumers and workers. Use countersignature Form W-4 in a couple of easy steps. Our mobile apps make operating on the move possible, even while off the internet! Sign signNows from any place worldwide and close up tasks faster.

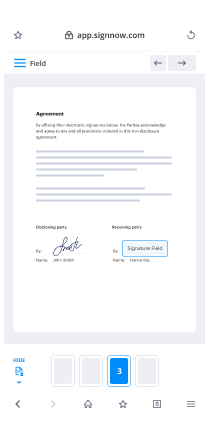

Take a stepwise guide for using countersignature Form W-4:

- Sign in to your airSlate SignNow account.

- Locate your record within your folders or upload a new one.

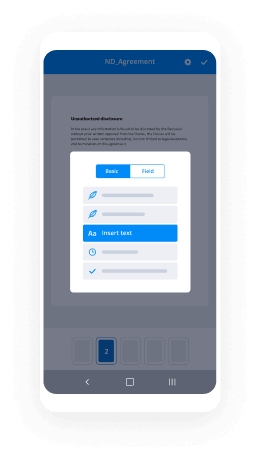

- Open up the template and make edits using the Tools list.

- Drag & drop fillable boxes, type textual content and sign it.

- Include multiple signers by emails and set up the signing sequence.

- Indicate which recipients can get an executed copy.

- Use Advanced Options to limit access to the template add an expiration date.

- Click on Save and Close when finished.

Moreover, there are more enhanced capabilities available for countersignature Form W-4. List users to your shared workspace, browse teams, and monitor cooperation. Millions of consumers all over the US and Europe recognize that a solution that brings everything together in one holistic digital location, is what businesses need to keep workflows functioning easily. The airSlate SignNow REST API allows you to embed eSignatures into your app, website, CRM or cloud storage. Check out airSlate SignNow and get quicker, smoother and overall more productive eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results countersignature Form W-4 made easy

Get legally-binding signatures now!

FAQs

-

Can you electronically sign w4?

A lack of signature definitely makes a W-4 form invalid; therefore, have it signed before being part of a company. Nowadays, federal documents like W-4 can be completed and signed electronically, as long as the procedures for valid eSignatures are followed. -

Can I electronically sign a w4?

A lack of signature definitely makes a W-4 form invalid; therefore, have it signed before being part of a company. Nowadays, federal documents like W-4 can be completed and signed electronically, as long as the procedures for valid eSignatures are followed. -

Is it better to claim 1 or 0?

If you put "0" then more will be withheld from your pay for taxes than if you put "1"--so that is correct. The more "allowances" you claim on your W-4 the more you get in your take-home pay. Just do not have so little withheld that you owe at tax time. -

Does the IRS allow electronic signatures?

The IRS accepts electronic signatures from airSlate SignNow Apply your new electronic signature to IRS forms. Minimize printing, signing, and mailing. -

Is it better to claim 1 or 2 if single?

Claiming two allowances You are single. Claiming two allowances will get you close to your tax liability but may result in tax due when filing your taxes. You're single and work more than one job. Claim one allowance at each job or two allowances at one job and zero at the other. -

Does the IRS use airSlate SignNow?

The IRS now accepts electronic signatures on forms 8878 and 8879. airSlate SignNow empowers you to electronically sign the IRS forms to make your work hassle-free. ... With airSlate SignNow, you can: Save time and money: No need to print, fax, scan, or ship documents. -

What happens if I claim 0?

If you claim a \u201c0\u201d on your W-4, you're taking the safe route. This means that your employer will withhold the maximum amount of federal income tax per paycheck, meaning your net take home will be less. But the flip side is that claiming a \u201c0\u201d usually means receiving a nice refund at the end of tax season. -

Do I claim 0 or 1 on my w4?

If you put "0" then more will be withheld from your pay for taxes than if you put "1"--so that is correct. The more "allowances" you claim on your W-4 the more you get in your take-home pay. Just do not have so little withheld that you owe at tax time. -

How do I fill out a new W 4 form?

Step 1: Enter your personal information. ... Step 2: Complete if you have multiple jobs or two earners in your household. ... Step 3: Claim Dependents. ... Step 4: Other Adjustments. ... Step 5: Sign your form. -

How do you complete the new W 4 2020?

Step 1: Enter Personal Information. ... Step 2: Multiple Jobs or Spouse Works. ... Step 3: Claim Dependents. ... Step 4: Other Adjustments. -

Should I fill out a new w4 for 2020?

Most workers aren't required to file a new W-4 form with their employer in 2020\u2014but you might want to anyway. ... However, if you start a new job after 2019, you'll have to complete a new W-4 form. -

Is the w4 changing?

If you were exempt in 2019 and want to reclaim your exemption for 2020, you need to submit a new Form W-4 by February 17, 2020. Likewise, if you claim an exemption for 2020, you'll need to submit another W-4 form by February 16, 2021, to keep it next year. -

Are there new federal withholding tables for 2020?

Like past years, the IRS released changes to the income tax withholding tables for 2020. In addition to new wage brackets, there are airSlate SignNow changes to how employers will handle tax withholding. These changes are in response to the Tax Cuts and Jobs Act of 2017. -

How do I fill out a w4 single 2020?

Suggested clip How to fill out W4 SINGLE 2020 W-4 - YouTubeYouTubeStart of suggested clipEnd of suggested clip How to fill out W4 SINGLE 2020 W-4 - YouTube -

Do I have to claim dependents on w4?

The number of allowances you claim on your W-4 doesn't have to match the actual number of dependents or family members you have on your tax return. There could be other reasons, such as side income, for you to reduce the number of allowances you claim.

What active users are saying — countersignature form w 4

Related searches to countersignature Form W-4 made easy

Ldss 4826 2018-2019 Form

today I'm gonna talk about the w-4 for 2019 the paper version I'm finally gonna do the paper version before I do the online version and stay to the end because if you're doing the paper version you're definitely missing out on reducing your overall tax liability and really controlling your taxes if this is your first time at our channel or you haven't subscribed click on the subscribe button at the bottom my name is Travis sickles certified financial planner with sickle under financial advisors after all this time I finally figured out how to get this to work on my iPad so we're gonna go through today and let's begin so this is the w-4 for 2019 now if you don't have it I'm gonna show you where the link is right here and you can just go to it it's IRS gov for slash Form w-4 and if you go there you can get yourself a copy of the w-4 and follow along now the directions here at the top give you a brief overview of how to fill out the w-4 but I do want to point out now at the very top of the first page are the directions on how to start and fill out the w-4 but I do want to point out that they make a reference to the online version the online calculator numerous times and there you have it the w-4 app it's right there it's right here and it is also right here as well probably somewhere else as well probably in a few other places I can find it maybe not but the w-4 the app is right there I highly recommend to do the app because it makes it so much simpler and it's why would you do to any other way but anyways let's go ahead and continue so the section down here is the only part the only portion that you're going to give to your employer in fact the IRS doesn't even get this page only your employer does and they're just going to take this information to make sure that they give it to payroll who is then going to process it and give you the correct withholdings it's all your basic information but we will come back and fill out sections five six and seven those are really the three main parts that we're going to fill out everything else here is just your information so let's go ahead and scroll down a little bit further now this is the page that you want to start with this is the personal allowances worksheet so what the personal allowances worksheet let's go ahead and get started on line a enter one for yourself so we're gonna start here line a enter one for yourself go ahead and put a 1 put one right there then we're gonna go ahead and look at line B enter one if you will file as married filing jointly in this scenario that we're gonna run today I am going to do it as married filing jointly so let's put a 1 there if you're not married filing jointly put 0 or leave it blank it doesn't matter this is this sheet is only for your reference that's that's the only reason that you're gonna have this you're not going to turn this in line see enter one if you will file as head of household we will not so we're just going to go ahead and put a line put a 0 put whatever you want on line D enter 1 if any of these 3 applies so the first bullet is you are single we are not or married filing separately we're not that either and have only one job well in our scenario we'll have only one job so I'll underline it just for reference and we'll put a 1 now if you had multiple jobs you would put 0 the second line there is you're married filing jointly have only one job and your spouse doesn't work now let's take a look at line D enter one if you're single or married filing separately and have only one job none of those apply to us so we're gonna go to the second one or you're married filing jointly have only one job and your spouse doesn't work so for our example that's one we'll check off because we are married filing jointly will have only one job and our spouse doesn't work so we're gonna put a 1 there in the third if neither of those applied and you look at the third bullet your wages from a second job or your spouse's wages or the total of both or $1,500 or less then you would again put a 1 there but we're not so we're just going to move on for this example we're not going to have any children so child tax credit we're gonna skip that but if you do have children and you do want to fill this out and your total income just read the it's if your total income will be less than seventy one thousand two hundred and one dollars enter for for each eligible child now since we're married filing jointly and if it's a hundred three thousand three hundred and fifty one right there if married filing jointly if it's that number or less enter for for each eligible child so if you have to be children go ahead and enter 12 to 8 and if you have one child enter four and for this example we're going to enter zero because we're not gonna have any children in this example so child tax credit that's what you would do there now as you can see in that second bullet the amount that you could take for the child tax credit decreases the more money you earn so if you earn over the seventy one thousand two hundred and one but less than seven hundred and seventy nine thousand fifty dollars or this threshold right here if you're married filing jointly which is a hundred and three thousand to three fifty one two three hundred and forty five thousand eight hundred and fifty then you're only going to enter in two for each eligible child so it's two four six so on and so forth and if it's your incomes even higher than that if it's one hundred and seventy nine fifty one to two hundred thousand or for married filing jointly three hundred forty five thousand eight hundred and fifty one to four hundred thousand so four hundred thousand is the child tax credit phase out the complete phase-out at four hundred thousand enter one for each eligible child if you make over four hundred thousand dollars as a household married filing jointly then you do not qualify for the child tax credit and you would enter in zero as you can see in the next bullet if you if your total income will be higher than two hundred thousand or four hundred thousand if married filing jointly and there's zero so we're just going to enter zero because again for this example no kids now for wine F credit for other dependents now if you do have other dependents go ahead and enter in line F four credits for other dependents if not go ahead cross it off put zero move on now we're gonna take a look at line g-- o-- their credits now this is a big one if you do have other credits you're gonna want to take a look at this i'm not going to go into in this particular video let me pull up some of the credits that you can consider if you're looking for items for line G so here's the 2018 version for the worksheet 1-6 and I'm gonna see if I can zoom in here if you're taking a look you could see the child tax credit child for other dependents credits for the elderly or disabled credits for children and dependent care expenses education credits adoption credits foreign tax credits retirement savings contribution credits that's three that's the savers credit and nine we have earned income credit or a premium tax credit for health care so you have all these different credits that can make adjustments to your overall income and change the outcome of your w-4 so you want to take a closer look at the other credits but for this example I'm not going to go through those other credits and if we jump down so I'm going to put a line there if we jump down to line H this is where we're going to put our answer so we're going to add this up and we have three so we have one here two here three there there you go line 3h now this next section is deductions adjustments and additional income worksheet now the big thing that changed here was the standard deduction increase to twenty four thousand four twenty eighteen and now you can see that it's twenty four thousand four hundred for 2019 that's married filing jointly and you can see what it is for singles and head of household so these standard deductions increase significantly in the 2017 tax cuts and Jobs Act so much that I think if the number is like 19 million less people are gonna have to file or itemize their deductions so it's really simplifying the whole process now if you're still one of those people who are gonna itemize then you want to fill out this section otherwise skip it and go on if you're not going to itemize so if you don't have over twenty four thousand four hundred dollars and itemized deductions then you're just going to take the standard deduction so now that we have our answer on line H we can go back up here and we can fill this section out so we're going to go ahead and put our name so I'll put Travis circle your social security numbers your zero 0 - 0 0 - 0 0 0 0 and your home address 1 2 3 this street Tampa Florida 3 3 6 so it's you now for section 3 you want to check off that we're married married filing jointly of course if you're singles check that off and in line 5 that's where you want to put our answer so we are going to head and put number 3 3 is the amount of allowances that's lying 5 6 is any additional amounts you want withheld from your paycheck for this example we are not going to withhold anything additionally because we're putting in a number 3 therefore the allowances now remember with allowances when you're talking about allowances the higher the allowances the bigger your paycheck because we're withholding less so we're putting less aside for taxes now this doesn't actually change your tax liability at the end of the year if you're paying it now or at the end of the year that number is going to be exactly the same and for line 7 since we have an for line 7 since we will have to withhold we're just gonna go ahead and put a line there because we are not exempt so go ahead and sign it put the date and then put an 8 9 and 10 these boxes down here 8 9 and 10 you're either you or your employer can fill those out just give it to your employer they're probably gonna put the home office address the date you started employment and their AI n the employers AI n is basically the same as your social security it's just for the business so they will have that if you do not so don't worry about it that's all you need to do just cut it right here rip it off you can make a copy for your records but give this to your employer and they'll be able to make the adjustment in order to make sure that your withholding the correct amount now I did the paper version and I didn't go into the two jobs worksheet because we only had one job in this example which I can do for another video but the thing that you want to understand it's going through this it only goes over the amount of allowances it doesn't give you any idea of what your tax liability is actually going to be or the size of your paycheck that you're going to get which you can estimate from the online version so let me go over the 2019 version really quickly if the online version and you're going to see that it's going to be the same but it's going to give us a little bit more information so married filing jointly no dependents click continue and I'm just going to zoom through this so you can see we're gonna put a hundred and thirty thousand for the income no bonuses and I'm gonna put one thousand four hundred and seventy-six for the withholding is your a date you can get that from your pay stub so if it's done correctly that's what it'll be otherwise put whatever the withholdings are and it will give you an accurate answer click continue we're taking the standard deduction now you can see right here there's your three allowances same amount as before but here's the extra information we know that our total tax liability is going to be fourteen thousand nine hundred and forty nine dollars or that's the estimate based on the information that we put into the calculator so if we did have other credits or other deductions like 401ks IRAs or all those other credits I talked about before that's going to adjust the amount that's needed for the withholdings and this is a much quicker way to do it so if you just do the paper version you're only going to get the answer you're not going to get the actual tax liability and that is a huge benefit because if you can figure out how much your taxes are going to be and what your paycheck is going to be then at that point you can take some of that money and you can pay off debt or you can save it there's other things that you can do with the extra dollars that you're getting in your paycheck rather than getting a huge refund at the end of the year so if you're making these adjustments the online calculator is the best way to do it and that's exactly what the IRS says so anywhere that you're reading online they're adding to it all the time they want you to do the online calculator because it's way easier to do and especially as your situation gets more complicated then the calculator becomes even more valuable and more power if you want to see other versions let me know in the comments down at the bottom and if you've enjoyed this video be sure to subscribe and leave your comments down at the bottom Music you Music

Show moreFrequently asked questions

How can I eSign a contract?

How can I legally sign a PDF?

How do you add a signature to a PDF?

Get more for countersignature Form W-4 made easy

- Print signature service Service Invoice

- Prove electronically signing Job Proposal Template

- Endorse digi-sign Accounting Proposal Template

- Authorize signature service deal

- Anneal signatory Party Rental Contract

- Justify eSignature Rental Receipt Template

- Try initial Proforma Invoice Template

- Add Incentive Agreement esigning

- Send Security Proposal Template digisign

- Fax North Carolina Bill of Sale electronic signature

- Seal Performance Review Self-Assessment Template countersign

- Password Construction Contract sign

- Pass Computer Repair Contract Template electronically signing

- Renew Sublease Agreement eSign

- Test New Transcription Project Form eSignature

- Require Car Lease Agreement Template autograph

- Comment person countersignature

- Boost boarder electronically sign

- Compel subject signed electronically

- Void Auto Repair Contract Template template signature block

- Adopt bill template signature service

- Vouch Medical Invoice template countersign

- Establish Tourist Transport Ticket template signatory

- Clear Volunteer Agreement Template template initials

- Complete Theatre Press Release template eSign

- Force Roofing Proposal Template template byline

- Permit Pet Grooming Registration template esigning

- Customize Promissory Note Template template digisign