Countersignature Investment Plan Made Easy

Get the powerful eSignature features you need from the solution you trust

Select the pro platform designed for pros

Configure eSignature API quickly

Work better together

Countersignature investment plan, within a few minutes

Decrease the closing time

Maintain sensitive data safe

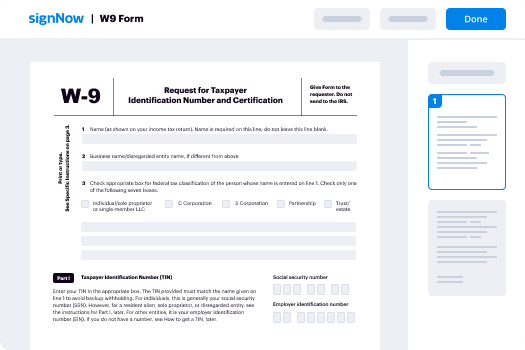

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

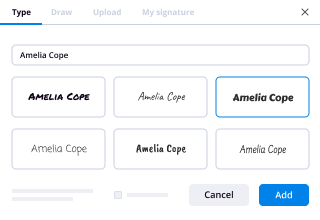

Your step-by-step guide — countersignature investment plan

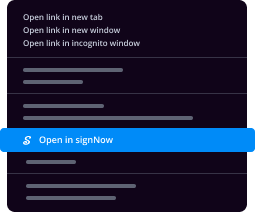

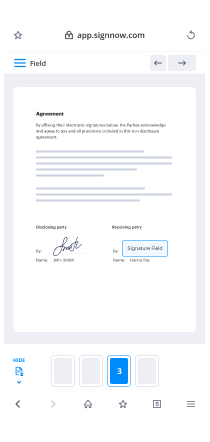

Leveraging airSlate SignNow’s eSignature any company can accelerate signature workflows and eSign in real-time, delivering an improved experience to consumers and employees. Use countersignature Investment Plan in a few simple steps. Our handheld mobile apps make work on the run achievable, even while offline! Sign signNows from any place in the world and close trades in less time.

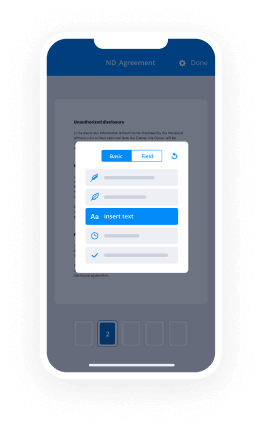

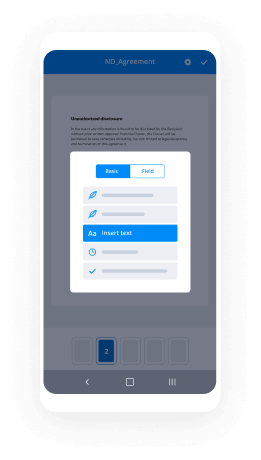

Keep to the walk-through guide for using countersignature Investment Plan:

- Log in to your airSlate SignNow profile.

- Locate your needed form within your folders or upload a new one.

- Open the document and make edits using the Tools list.

- Drag & drop fillable areas, add text and eSign it.

- Add several signees by emails and set the signing sequence.

- Specify which users will receive an signed copy.

- Use Advanced Options to restrict access to the template and set up an expiry date.

- Click Save and Close when finished.

Moreover, there are more extended functions open for countersignature Investment Plan. Add users to your shared workspace, browse teams, and monitor cooperation. Millions of people across the US and Europe concur that a solution that brings everything together in a single unified workspace, is what businesses need to keep workflows performing efficiently. The airSlate SignNow REST API enables you to embed eSignatures into your app, internet site, CRM or cloud storage. Check out airSlate SignNow and get quicker, easier and overall more effective eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results countersignature Investment Plan made easy

Get legally-binding signatures now!

FAQs

-

How do I make an investment plan?

Set specific and realistic goals. For example, instead of saying you want to have enough money to retire comfortably, think about how much money you'll need. ... Calculate how much you need to save each month. ... Choose your investment strategy. ... Develop an investment policy statement. -

What does it mean to countersign a document?

Countersigning means writing a second signature onto a document. For example, a contract or other official document signed by the representative of a company may be countersigned by his supervisor to verify the authority of the representative. -

What is an investment plan?

An investment plan is part of a comprehensive financial plan that maps out an investing strategy to help you meet your long and short term goals, such as retirement or buying a house. -

How do you countersign a passport photo?

He or she must write the following on the reverse of one of the two photographs you have. 'I airSlate SignNow that this is a true likeness of [title and full name of adult or child who is getting the passport]. ' They must then sign and date the photo underneath the statement. -

How do you accept investments?

Treat them as if they were strangers. Forget for the moment that your investor is a friend or family member. ... Debt may actually be better than equity. If someone "lends" you money, you only have to pay it back, with interest. ... Tie all payments to your cash flow. ... Consider nonvoting stock. -

Do you need someone to countersign passport?

You'll need to get someone else to sign your application form and passport photo if you need the following: First adult passport; First child passport; ... Renewal of a passport if your appearance has changed and you can't be recognised from your existing passport.

What active users are saying — countersignature investment plan

Related searches to countersignature Investment Plan made easy

Countersign investment plan

hello and welcome to gen z finance i'm an older gen z here on youtube documenting my financial journey today's video is an overview of my 2021 investing plan and strategy so let's get right into it before we begin obligatory disclaimer i am not a financial advisor nor do i claim that the following strategy is even the absolute best way to invest for you or even myself i am simply sharing what my current plan is even though i know it is imperfect and incomplete first here is an overview of what i am trying to accomplish in 2021. my gross income is 60 000 and i plan to invest at least 30 thousand dollars currently the plan involves maxing out my hsa and roth ira but not my 401k however depending on any bonuses or raise or just other non-full-time w-2 income that i receive i may be able to max the 401k out as well next i am going to share my basic investing strategy i almost exclusively invest in index funds or indexed etfs particularly the total u.s stock total us bonds or total non-u.s stock indexes the second component to my strategy is to invest early and often and automate the process as much as possible and that's really my investing strategy everything else is built around these two main pillars i did want to mention though that i do have a couple of individual stocks currently less than one percent of my net worth and the goal is that these continue to be no more than three percent of my total net worth as i really want most of my money invested in indexes here you can see an overview of my monthly investing schedule so the accounts in white are completely automatic and the ones in black involve more manual effort by me you can see my employer-sponsored plans including my 401k at my full-time job and then my fica alternative plan at my part-time job will have new investment contributions every two weeks automatically invested my roth will be added to once on the first of every month and then i hope to get into my hsa investment account at least two times a month and manually invest the newest contributions into that account for my m1 finance brokerage account i do have auto invest turned on and since they do allow purchases of fractional shares all i really need to do for that is manually send money into that account every month the amounts and days that i invest in there will probably vary just based on how the month is going with my income spending and any unforeseen expenses so that's why it can't be completely automatic i just need to have a little bit more say in what is being sent into that account to be invested every month so on this slide is the breakdown of how much i will be investing into each type of account you can get a good sense of where i'm investing my money but the vast majority is in tax advantage accounts whether that's my 401k hsa ira although i will have almost 3 500 invested in the taxable brokerage at least i like this amount because i do like the freedom and flexibility investing in non-retirement accounts gives you now switching gears a little bit i want to quickly show you what my current asset allocation is at the end of 2020. so previously we were looking at where and what type of account my money was invested in and now we are looking at the type of asset my investments are in you can see i am heavily invested in u.s stocks and this happened mostly by accident although i think for a 23 year old it's actually not that bad to be so heavily invested in stocks again pretty much all of this is an indexes of each type of asset so it's the us total stock market the total international stock market and then the total bond market i also wanted to mention that this graph is from a spreadsheet i am using made by millennial money honey here on youtube and instagram there will be a link to her website where i got the spreadsheet down below and i find it really helpful so check that out as well so i used that same spreadsheet to show actually what my target allocation is i'm still pretty heavily invested in u.s stocks with this target allocation but it would have 15 international stocks and then 5 bonds i think this is fine for a young investor with my personal risk tolerance and timeline but i did want to clarify that i'm still working on finding my quote unquote perfect or ideal asset allocation obviously over time my target will change particularly with how much i want to enhold in bonds but i believe this is what i will be aiming for for the next couple of years so if this is where i want to be how will i get there well that is what rebalancing is for and where i had to do a bit more thinking to really figure this out so if you are unfamiliar with rebalancing here's a quote from investopedia and the definition that they give and i will also be leaving more resources down below in the description box for you to check out but pretty much i have two options to get to my target allocation option one is to sell the asset that i am overweight in which in this case would mean selling some of my u.s stocks and then using that money to buy in the assets that i am underweight in international stocks and bonds or option two which is the method i will be using this year is to just buy less u.s stocks than my target allocation would traditionally recommend that i buy and then buy more of the international and bonds so that overall my bonds and international stocks are increasing up to the target that i have set for them this method usually takes longer than the traditional selling rebalance method and also involves paying more attention to future contribution allocations but i'm okay with doing more of the work and i'm actually going to walk you through exactly how i figured out all of this stuff and my strategy for this year so here is my 2021 contribution amounts by the three main asset types i will be buying again keep in mind that my target allocation is eighty percent u.s stocks fifteen percent international stocks and five percent bonds so you can see i'm actually planning on eight percent of my investments to be bonds for 2021 so again i am over buying in one of my assets that i am currently underweighted on this allocation probably won't get me exactly to my target but it will definitely bring me a lot closer to it than i am today and really i don't expect my allocation to ever be 100 perfect just due to market fluctuations so i would just like to see my allocation a bit more balanced than it currently is and i think that this plan will definitely help me get there this graph now shows both asset allocation and asset location by breaking down how much i will be investing in each account and what assets i will be purchasing in those accounts as well bonds are represented by the blue u.s stocks by the dark green and international stocks by the light green i tried to follow general advice on which asset types are best kept in specific types of accounts for instance bonds are commonly recommended to be kept in pre-tax accounts before putting them in taxable or roth accounts at least that's what i was reading i'll leave some more links and resources that i used for this down below so that you can look into this as well if you're unfamiliar with it but as you can see i will be purchasing us stock indexes in all of my accounts and will keep international stocks in my roth ira in brokerage i actually found somewhat conflicting or unclear information on where to keep international investments so i'm putting the majority in my roth and just a little bit in my brokerage for now let me know down below if you invest in international stocks and where in your portfolio do you keep them because i'd be really interested in hearing how people handle this as promised here is a little behind the scenes of how i come up with the specific dollar amounts in each account and asset type that i'm going to contribute to so i created this small spreadsheet and listed out all of my accounts and how much i expect to put into each account for the year which is what you see under the goal and targets over on the right hand side kind of i then assigned those dollars to a specific asset type and divided the total amount invested in each asset type by my 30 000 investing goal to see my overall asset allocation and percentages which are those percentages that you see on the bottom row so hopefully that explanation makes sense but it was pretty easy to make this spreadsheet and it allowed me to quickly see the impact of what would happen if i changed how much i was investing in any particular account so this screenshot shows a similar spreadsheet except this is specific to my 401k only since i am investing in both my pre-tax and raw 401k i can actually make specific contribution allocations for both types of accounts and i wanted to have different types of investments in each account so that's why i use this spreadsheet so for my 401k overall 68 will be invested in a large cap us stock fidelity index fund nine percent will be in a medium cap fund and nine percent will be in a small cap u.s stock fidelity index fund finally roughly 14 will be in bonds but again that only makes up about eight percent of my entire investing plan so this is specific to what is going to be going on in my 401k and here is the final chart i have for y'all this shows my overall 2021 investing by tax treatment so including my pre-tax 401k fico alternative plan in my hsa almost 59 of my investments will be made in pre-tax accounts 30 will be in roth accounts and i currently plan on 11 being in my taxable accounts i am pretty happy with 89 of my investments being in tax advantaged accounts and i think sometimes people forget that even a taxable brokerage account can still have favorable tax treatment and i do believe that it is an important account and an important piece of anyone's portfolio or investment plan which is one reason i'm investing in it before i even completely max out my 401k now i just want to say that this is my current investing plan returning viewers might know by now that i have a tendency to make a plan and then change it the next week the most likely changes that could happen is that i end up investing more either into my 401k or brokerage or perhaps both and that would definitely change the amounts that i would have invested in each account that i've presented in this video but that might not change the overall asset percentage or allocation that much at the end of the day and as i'm stating here i'm going to re-evaluate my 401k percentages during q1 so exact numbers might change but the general approach will be consistent if i feel like i have way more extra cash flow at the end of every month i might increase my 401k so that i don't invest too much outside of tax advantaged accounts and so make sure you're subscribed to my channel if you're not already so that you can stay up to date with any changes that i do make throughout the year as i respond to changes in my situation that concludes everything i wanted to discuss in this video on my channel i do bi-weekly budget with me is using ynab i also track my monthly spending savings and net worth updates as well as do videos like the one you are watching now discussing investing or other fire related topics please make sure you like comment and subscribe for more and follow me on instagram at zenio finance i hope you all are staying safe and healthy as always and that you have a good rest of the day

Show moreFrequently asked questions

How can I eSign a contract?

How can I legally sign a PDF?

How can I send a contract via email with an electronic signature attached?

Get more for countersignature Investment Plan made easy

- Print signature service Auto Repair Invoice

- Prove electronically signing Termination Letter Template

- Endorse digi-sign Exclusive Distribution Agreement Template

- Authorize signature service attachment

- Anneal signatory Home Remodeling Contract

- Justify eSignature Building Quote Template

- Try initial Car Receipt Template

- Add Incentive Agreement signed

- Send Security Proposal Template digi-sign

- Fax North Carolina Bill of Sale esign

- Seal Performance Review Self-Assessment Template initial

- Password Construction Contract signature

- Pass Computer Repair Contract Template email signature

- Renew Sublease Agreement digital signature

- Test Power of Attorney Form electronically signed

- Require Car Lease Agreement Template byline

- Comment person countersign

- Boost boarder signature service

- Compel subject signature block

- Void Auto Repair Contract Template template autograph

- Adopt bill template digital sign

- Vouch Medical Invoice template initial

- Establish Tourist Transport Ticket template electronically sign

- Clear Volunteer Agreement Template template countersignature

- Complete Theatre Press Release template digital signature

- Force Roofing Proposal Template template mark

- Permit Pet Grooming Registration template signed

- Customize Promissory Note Template template digi-sign