Create Motley EIN with airSlate SignNow

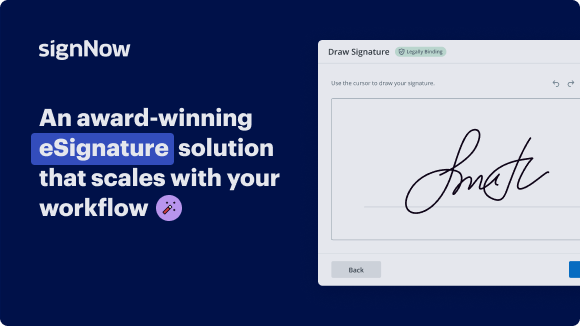

Get the robust eSignature features you need from the company you trust

Choose the pro service made for professionals

Configure eSignature API quickly

Work better together

Create motley ein, within a few minutes

Cut the closing time

Maintain important data safe

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your step-by-step guide — create motley ein

Using airSlate SignNow’s eSignature any business can speed up signature workflows and eSign in real-time, delivering a better experience to customers and employees. create motley EIN in a few simple steps. Our mobile-first apps make working on the go possible, even while offline! Sign documents from anywhere in the world and close deals faster.

Follow the step-by-step guide to create motley EIN:

- Log in to your airSlate SignNow account.

- Locate your document in your folders or upload a new one.

- Open the document and make edits using the Tools menu.

- Drag & drop fillable fields, add text and sign it.

- Add multiple signers using their emails and set the signing order.

- Specify which recipients will get an executed copy.

- Use Advanced Options to limit access to the record and set an expiration date.

- Click Save and Close when completed.

In addition, there are more advanced features available to create motley EIN. Add users to your shared workspace, view teams, and track collaboration. Millions of users across the US and Europe agree that a solution that brings everything together in a single holistic enviroment, is exactly what businesses need to keep workflows functioning efficiently. The airSlate SignNow REST API enables you to integrate eSignatures into your app, website, CRM or cloud storage. Try out airSlate SignNow and get faster, smoother and overall more productive eSignature workflows!

How it works

airSlate SignNow features that users love

Get legally-binding signatures now!

FAQs

-

How much does it cost to create an EIN?

You can get your EIN yourself for free. To apply for an EIN, all you need to fill out IRS form SS-4 or file online. The IRS does not charge any filing fees to get an EIN. -

Can you apply for an EIN number online?

You may apply for an EIN online if your principal business is located in the United States or U.S. Territories. The person applying online must have a valid Taxpayer Identification Number (SSN, ITIN, EIN). -

Can I get an EIN for free?

Generally, businesses need an EIN. You may apply for an EIN in various ways, and now you may apply online. This is a free service offered by the Internal Revenue Service and you can get your EIN immediately. -

Does it cost to get an EIN?

Applying for an Employer Identification Number (EIN) is a free service offered by the Internal Revenue Service. Beware of websites on the Internet that charge for this free service. -

Is Ein application public record?

To summarize, the information collected for obtaining an EIN number is not available to the general public. You can rest assured that there is no public IRS database, where your information can be retrieved. -

Can I apply for EIN number online?

You may apply for an EIN online if your principal business is located in the United States or U.S. Territories. The person applying online must have a valid Taxpayer Identification Number (SSN, ITIN, EIN). You are limited to one EIN per responsible party per day. -

Should I use my EIN or SSN?

The IRS uses the EIN to identify the taxpayer. EINs must be used by business entities--corporations, partnerships, and limited liability companies. However, most sole proprietors don't need to obtain an EIN and can use their Social Security numbers instead. Even so, you may want to obtain an EIN anyway. -

How much does it cost to file for an EIN number?

Applying for an Employer Identification Number (EIN) is a free service offered by the Internal Revenue Service. Beware of websites on the Internet that charge for this free service. -

Are EIN numbers public?

Your employer identification number (EIN), or FEIN, allows you to do business and report financial information to the Internal Revenue Service. However, an EIN number is a public record, making your company vulnerable to people who care less about your business. -

Is an EIN confidential?

No, EINs are not kept confidential and are a matter of public record. Therefore, it is important that you keep your EIN safe and secure to ensure that no one attempts to commit fraud by using your EIN. -

How long does it take to apply for an EIN online?

How Long Will It Take to Get an EIN? One benefit when applying for your EIN with the online application is that once you've completed it, you receive your number immediately. It can take up to 10 business days to receive your number if done by fax and four weeks by post. -

How do you create an EIN number?

To apply for an employer identification number, you should obtain Form SS-4 PDF and its Instructions PDF. You can apply for an EIN on-line, by mail, or by fax. You may also apply by telephone if your organization was formed outside the U.S. or U.S. territories. -

How can I get a free EIN number?

Apply Online at www.irs.gov. The Internet EIN application is the preferred method for customers to apply for and obtain an EIN. ... Apply By EIN Toll-Free Telephone Service. ... Apply By FAX. ... Apply By Mail. -

Can I use my EIN instead of SSN when applying for credit?

If you're applying for a credit card and the application asks for your SSN, you can usually substitute your EIN number without a problem. It's important to keep in mind that the credit issuer may still check your personal credit, even if you enter an EIN instead of a SSN. -

Is there a charge for an EIN number?

Applying for an Employer Identification Number (EIN) is a free service offered by the Internal Revenue Service. Beware of websites on the Internet that charge for this free service. -

Is Ein free?

Generally, businesses need an EIN. You may apply for an EIN in various ways, and now you may apply online. This is a free service offered by the Internal Revenue Service and you can get your EIN immediately. -

How can I get an EIN number quickly?

You can get an EIN immediately by applying online. International applicants must call 267-941-1099 (Not a toll-free number). If you prefer, you can fax a completed Form SS-4 to the service center for your state, and they will respond with a return fax in about one week. -

Can you look up someone's EIN number?

Finding Someone Else's EINYou can search for free in the SEC's Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system. That will give you plenty of information, including the company's EIN. The biggest challenge might be sifting through all the documents the SEC has on file to find one with the number. -

Can I get an EIN without an LLC?

Most new single-member LLCs classified as disregarded entities will need to obtain an EIN. ... A single-member LLC that is a disregarded entity that does not have employees and does not have an excise tax liability does not need an EIN. It should use the name and TIN of the single member owner for federal tax purposes. -

Is my ein linked to my SSN?

An EIN is to a business as a SSN is to a person. The IRS tracks your personal tax filings with your SSN, just as it uses your EIN to keep tabs on your business filings. ... Unless your business is a disregarded entity, you must use an EIN when filing a business tax return. -

Why can't I apply for EIN online?

One of the most common reasons you might find that you can't get EIN online is that your application comes back with a Reference 101 error. This often occurs because you have a conflict with your name on the application. Entity names must be unique. -

How do I look up a company's Ein?

To find the EIN of a public company, go to the SEC's Electronic Data Gathering Analysis and Retrieval (EDGAR) database, type the company name, and press "Search." In the search results, locate the correct company, and look through its filed documents for a Form 10-Q or Form 10-K. These forms provide the company's EIN. -

Can you apply for a EIN online?

You may apply for an EIN online if your principal business is located in the United States or U.S. Territories. The person applying online must have a valid Taxpayer Identification Number (SSN, ITIN, EIN). You are limited to one EIN per responsible party per day. -

How can I get a free Ein?

Apply Online at www.irs.gov. The Internet EIN application is the preferred method for customers to apply for and obtain an EIN. ... Apply By EIN Toll-Free Telephone Service. ... Apply By FAX. ... Apply By Mail. -

Can I use my EIN instead of SSN?

An EIN is an SSN for a business. For those operating a sole proprietorship, they can simply use their SSN for business tax purposes. If you want to form an LLC, hire employees, or establish business credit, you need an EIN. ... Only U.S. citizens and authorized non-citizens are eligible for an SSN and EIN. -

Can you use your EIN number instead of SSN?

You can use an EIN instead of an SSN on W-9. ... It is not possible to use an EIN for these purposes. Because lenders and credit rating agencies know the difference between an SSN and EIN, it reduces the potential of damaging your credit rating even if fraudsters can access your personal information. -

How can I get a free EIN number online?

Apply Online at www.irs.gov. The Internet EIN application is the preferred method for customers to apply for and obtain an EIN. ... Apply By EIN Toll-Free Telephone Service. ... Apply By FAX. ... Apply By Mail.