Create Motley Required with airSlate SignNow

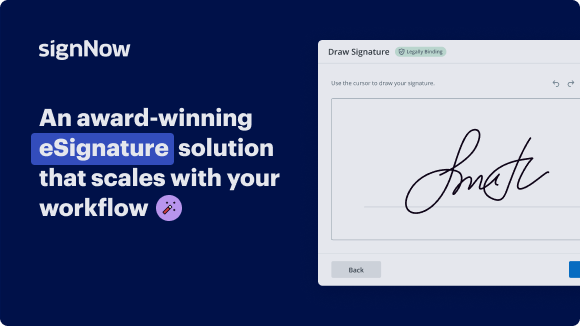

Get the robust eSignature capabilities you need from the solution you trust

Select the pro service designed for pros

Set up eSignature API with ease

Collaborate better together

Create motley required, within a few minutes

Reduce your closing time

Keep important data safe

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your step-by-step guide — create motley required

Using airSlate SignNow’s eSignature any business can speed up signature workflows and eSign in real-time, delivering a better experience to customers and employees. create motley required in a few simple steps. Our mobile-first apps make working on the go possible, even while offline! Sign documents from anywhere in the world and close deals faster.

Follow the step-by-step guide to create motley required:

- Log in to your airSlate SignNow account.

- Locate your document in your folders or upload a new one.

- Open the document and make edits using the Tools menu.

- Drag & drop fillable fields, add text and sign it.

- Add multiple signers using their emails and set the signing order.

- Specify which recipients will get an executed copy.

- Use Advanced Options to limit access to the record and set an expiration date.

- Click Save and Close when completed.

In addition, there are more advanced features available to create motley required. Add users to your shared workspace, view teams, and track collaboration. Millions of users across the US and Europe agree that a solution that brings everything together in a single holistic enviroment, is exactly what businesses need to keep workflows functioning efficiently. The airSlate SignNow REST API enables you to integrate eSignatures into your app, website, CRM or cloud storage. Try out airSlate SignNow and get quicker, smoother and overall more productive eSignature workflows!

How it works

airSlate SignNow features that users love

Get legally-binding signatures now!

What active users are saying — create motley required

Related searches to create motley required with airSlate SignNow

Create motley required

[Music] welcome to tree focus podcast dives into a different sector of the stock market every day I'm your host Vincent Shen it's Tuesday September 4th hope everyone at least stateside enjoyed their holidays and long weekend we're excited to kick off this week for industry focus but on the last consumer retail show a new fool next cycle and I talked about the upcoming event bright IPO and we plan to follow up on the discussion today with coverage of one of its major competitors Live Nation we're gonna put that episode on ice just until next week so that I can welcome fool.com contributor the incline into the studio I'm always a pleasure when you're in town and you stopped by Fallujah cute in Haven thanks for having me really great to see you I know that you have coca-cola on your mind so they announced a big deal last week this was stomach it's very rare we're surprised usually we have a bunch of ideas mapped out if something by so-and-so or this one while we knew this coffee company cost it was for sale we did not have coca-cola on our radar as a purchaser yeah so it's been about I was looking in through my notes I think it's about been about two years at least since we really looked at coca-cola and today we're gonna hone in on this five billion dollar deal they did for cost of coffee and then we're also gonna just look at how the company has transformed in the past few years to close out but I'm gonna let you start things off so to provide the context to our listeners coca-cola spending with the conversion 5.1 billion dollars and this is going to be a push for them into coffee hot beverages also brick-and-mortar which is something we're definitely gonna talk about cuz that's a first for Coke but what does the deal look like exactly so this is basically coca-cola saying what areas of the beverage market the non-alcoholic beverage market do we not serve yeah and coffee was a glaring hole so they would go into a business let's call it a restaurant and they would say to the restaurant we can serve you coca-cola products and they and we could serve you energy drinks and we could serve you iced teas at all whatever your Mick we can meet it and they go oh great now what's your coffee platform and theirs anyway we don't have a copy platform this lets them take a well-known brand in parts of the world and they can bring that brand to the US especially in situations where the brand is in the the Sailing point where it's really being able to meet the need you know a restaurant generally they might tell you they brew Starbucks coffee but that's not usually a selling point in a you know nice steak house it just says they have cappuccinos this allows coca-cola to add that business and that's a huge opportunity for the company because it already has relationships across retail and restaurant and all these other spaces it also puts coca-cola into the retail business as you mentioned which it's about 3,800 stores with about 60% of them in the in England in the United Kingdom yeah I'll stop you there because we have a lot to talk about with that brick-and-mortar operation by just want to add some context for what you it's a really good point in terms of you know they have this big opening with hot beverages essentially that the company doesn't really address quite as much especially when it comes to coffee and we're looking at a category when you look at global coffee tea that's particularly strong that category has seen some of the stronger growth rates I think 6% last year and this is a five hundred billion dollar market at least and it's a hedge against declining soda sales and you know coke has done some interesting things to shore up like the diet coke business the skinny cans the different flavors but long-term trend says that market will probably continue to get smaller as you know healthier choices Coffee is a growth market it just makes sense yeah addressable market for the company and the presentation materials to provide for this deal takes it from something like 800 billion dollars to one and a half trillion dollars so it's massive and I'll stress that at the moment coke only operates in the ready-to-drink segment in turn when it comes to coffee and within that it only has about 15 percent market share so if you look at the broad category you know coca-cola is looking to to jump essentially from a two percent market share to the additional opportunities that we'll talk about with Costa Coffee and the last thing I mentioned there that I wanted to mention in terms of the seller an interesting company it's Whitbread they're an English company they're basically parting with this entire division to focus on their hotel and restaurant businesses crazy thing you know we talk about coca-cola being this historic company at least three United States founded I think in the in 1892 or something like that I saw that Whitbread founded in 1742 it's always puts things in perspective being such a much older company and it tends to be the case for a lot of these European businesses but there's gonna be the standard shareholder and regulatory approvals that are required for a deal like this coca-cola and Whitbread they expect to deal the deal to close in the first half of 2019 and cokes gonna fund the transaction from the 20 billion dollars of cash that they have on hand before we look more at the strategy though for how Coke is gonna essentially leverage the assets and the brand here I'll talk a little bit more specifically in terms of what the company's getting so let's get into that the brick-and-mortar apparatus that they have you so there's really four pillars to the business sure there is a huge vending machine business 8200 cost to Express terminals which we were joking about this upstairs that in the United States coffee vending is like an old-school gross hot chocolate and soup come out of the same this is a very high-tech like you would see it like a tech company like a Microsoft there are coffee vending machines or you could dial up exactly what you want well and good analogy for within coca-cola you know they have these freestyle vending machines right this is like coffee it's very much a coffee version of the freestyle machine where you get sort of the barista led flavors and you do see these at some you know convenience stores but you could get the real barista experience from machine where you're pushing the buttons that is a much bigger thing in the rest of the world than it is in the United States but it is a huge opportunity they're also getting the coffee bean business which is literally the ability to go to restaurant and sell them not ready to drink beverages you're buying the beans you're brewing them maybe you're intentionally differentiating yourself from having Starbucks or one of the brands they're also getting 3,800 retail stores in 32 country that yep 32 countries and about half of those are franchised and half of those are company-owned they are also getting a huge loyalty program which is actually something coke also doesn't have any real experience in because you're generally not buying coca-cola from coke there's no program where if I drink a 12-pack every day I get free stuff teddy bear or whatever and they sometimes have those contests for you know you look under the cap and they have to do they generally have to do that stuff with their partners yes so it's a now they'll have the ability to not just you know have a direct relationship with a certain percentage of consumers they also have 3800 stores that they can test products in or that they can you know run a promotion or see if people want you know different things so it's a really different business for them but mostly you know they're taking on about 16,000 employees and they're they're just getting entry to something that they didn't do that they have all the apparatus in place to sell yep so these thirty hundred or so locations you mention 32 countries they're focused in Europe Africa the Middle East in Asia the biggest markets about 60 percent in the United Kingdom Utley the UK and then also in China and keep in mind that cost stuff both for you and I not a brand that were as familiar with but in the UK it is the number one coffee brand they have thirty five percent market share when it comes to coffee houses there so this is just a name that hasn't quite made it across to the US and one of the things that was talked about at the press conference on this or the the media call is that this is a brand that our has already proven it can be a winner so this isn't like some underdog coke isn't buying a brand no one's ever heard of and trying to make it something and that's me and so that's something management said they specifically wanted to do they wanted to get the leader in this space within this market and to branch it out rather than try and go in and organically build up something from the ground level and that's kind that will speak to how that's been their strategy really broadly for the company in terms of the brands that they're really focusing on so you mentioned the Express system and I'll add that you know these earning machine 8,200 units out in the market at least within the UK they generated about 20% of revenue for the business so pretty significant and overall I want to get into some financials for acosta coffee revenue for the business came in at one point seven billion dollars with about three hundred twelve million dollars in EBIT da and the top line has grown 12.5 percent annually over the past four years so and almost nine out of every ten dollars revenue for 2018 came from the UK where had again has by far the most stores and those Express machines so next up I want to get into more detail talking about what Co can do with this coffee business and how investors should think about the company more broadly going forward so remember that we've talked a little bit about this so far coca-cola tapping into the retail footprint tapping into the cost to expressman a machine system the distribution of these roasting ground beans into restaurants and cafes where coca-cola products are already going like you mentioned and ready-to-drink beverages there's more to their to that it's really you have to almost look at the United States and the existing coaster markets and markets that have some cost of knowledge separately because in the US Coke has said were not going to open a bunch of retail stores there's a there's a saturation point with Starbucks and and other players there what can do is they can go to every company that they already sell coca-cola products to and say would you like our coffee too it'll be cheaper for you and easier for you than having whoever you use now sure so that's an immediate advantage it can also go to every convenience store where it has freestyle or freestyle as in a lot of restaurants plays Pizza for example has freestyle and a coffee machine would be very logical there so they can go to them and say hey do you want this this becomes a very easy add on sale and coke also has the ability to do it in a way that benefits your business I used to run a giant retail store and we carried polar soda instead of coke because polar gave me the cooler as long as I signed a two-year contract so the big stand-up machine the local coke guy wanted $1,000 or whatever it is upfront I paid for it either way it was just a question of did I pay for it over X amount of orders as you know a slightly higher price or did I pay for it up front coke has the ability to go to every wallah and say which have coke freestyle machines and say hey put in our coffee machine mm-hmm so that part of the business in the u.s. can be very quick growth in the rest of the world where they already have some market knowledge they can do that part too and they could also ramp up the expansion and the adding shops and adding kiosks especially where the kiosk business is understood in Europe and in the u.s. coffee kiosks are not yet a thing and I know that management has wanted people to see that the costs are not as just single brand but it has this platform right because of the four pillars that you've talked about Roldan when it comes down to you know you're essentially powering Costa with the scale and the distribution expertise that coca-cola very much has and then with the retail storefronts too in terms of we're talking about before the show newer products experimentation you have this direct feedback now it's from the storefronts from the Starbucks model mm-hmm you know so Starbucks buys Teavana or their their juice brand which is escaping my but my memory what the name of it is but you go into a Starbucks and they figured out which Teavana teas they'd sell packaged which ones they sell fresh made and they tested all of that generally starting in Seattle and moving to Chicago for the US and then they roll it all out so there's no mystery to them when they put a product into stores as to how well it's gonna sell for the most part coke will now be able to do that they'll also be able to gauge things like if I give out free samples of this to people like it that's really valuable market research to be able to say you know what the UK does not like cherry iced tea or whatever it happens to be on the level this market does so they can really now have this consumer lab and it's important they're keeping all of the retail management so if this is not coke going we've never done this let's do it no they are buying a ready-made company and they are going to be involved but they're going to let the existing people be in charge yeah they stress that you know this is a coffee strategy not a retail strategy which allows you know the management on the cost aside to continue kind of forging their own path there and essentially coca-cola's management doesn't have to answer the tough questions of you know you guys have zero retail experience what are you gonna do and there's definitely it makes sense there for them to maintain some of that pear chef there's also a brand strategy here in the u.s. coke is not going to go to you know Croaker's and say let's put Kosta on the shelf next to Starbucks Dunkin Donuts McDonald's all they're ready to drink coffee because you don't know what it is so what will likely happen first is you'll see Kosta in restaurants in other places where you don't have a choice where Coke has sort of done the strong-arming then when you start to know the brand it will make sense to roll it out and ready to drink packaging and you've tried it you're familiar with it maybe you like it better than you like the package Starbucks so this becomes really sort of a multi-year multi prong strategy yeah I'll say that's great it's kind of a great description of how they're gonna approach this is gradual process and company actually lays out an idea they kind of give you an idea of what their attack plan is you know first they want to build the cost of brand right and they're thinking about that through their retail locations and also taking advantage of that the pretty large loyalty program based to have five point four million members start working off of that and then second they're gonna start integrating kosta into you know the cocoa Kohl's very large distribution network and again they're gonna offer more products like you've said to restaurants cafes whatever it may be and that they're once they've kind of made some progress with that they want to start thinking about launching Kosta and ready to drink form and then in at-home products and you know beyond that you know the company can really start with cold or hot ready to drink coffee and then they can branch into these other categories for at-home products and there's also related products too like hot tea and cocoa so a lot of paths that the company can take is actually really surprised how much they talked about hot ready to drink mm-hmm hot ready to drink isn't a category it's a category in like Japan and a couple of places that have sort of innovative beverage technology but think about it you can't we don't have those cans you open and it's hot so that's actually something they talked about having to innovate and having to create sort of new ways and that's a category that who knows what the potential is you know the vending machine potential of getting a a self heating coffee could be enormous sure so you know this optionality means that the company ultimately has to in will tailor its approach by market you know we talked about in the u.s. they don't need cost these cost of coffee stores there's there's plenty of I think they said that for you may be kind of to get the brand out there it's kind of a flagship thing but whereas in Asia where the coffee culture is still very much developing there's definitely the potential for them to open more stores in that market and then within that context kind of more in the operations side I'll just mentioned that cost has a new roasting facility in the UK pretty provides almost all of a coffee call everything sells except for some of their Indian their Indian market and there's capacity to expand that you know under Coca Cola's management so moving on last last comments that I'll mention for the deal and should have something to add is around the valuation so the so in terms of the process for how this deals came together like I've seen both management teams mentioned that it was a pretty quick process and the price tag paid has garnered a little bit of attention during the investor call 16 times EBIT ah I compare that to another deal recently in the beverage space which is PepsiCo because they recently took over SodaStream some people have complained some investors have been unhappy because that was this huge premium they bought it at some of their big they're the highest price that SodaStream has been trading at almost 20 25 times Eva da so what we're seeing here definitely some expensive deals in the beverage industry in terms of the opportunities that the Giants are going after I think it's because there's there's some sharks out there you know and we've taught we've done whole shows on JB or dab or whatever you want to call sure which is a holding company that owns a billion coffee brand some you've heard of some you haven't they own Panera Bread I own some equity in what used to be Caragh that's now Kerrigan dr. pepper so they were probably a player here we don't know that but even if they were just sort of sniffing it's very easy to go to Coke and say well if you don't pay our premium we don't want to sell to these guys but they're buying and it's very likely that that was out there yeah all right so just talking about coca-cola more broadly now it's just providing some context for how this deal fits into their strategy going for you there's been a lot of changes with the company so ultimately you see coke pursuing this capital light models where they can be the puppet master pulling the string on brand management and marketing and then they've tried to move away from having to deal as much in terms of the operations with manufacturing and bottling because of the heavy capital expenditures that that requires and a lot of the other expenses that come with that business so for example in 2017 coke completed the reef franchising efforts of its us bottling operations there are also some big efforts ensuring up the bottling operations and big markets like China and Japan and in addition to those reef ranch rising efforts there's also some big changes in terms of the product portfolio to address health concerns right sugar content they've killed a lot of what they call zombie brands that are just not performing well and with that hundreds of sk used in certain markets there's been new leadership with james quincy as a CEO they also have a chief growth officer that they've added so a lot of shifts there as well and what that ultimately means if you're looking at coca-cola as an investor is you know their top line is shrinking no doubt about it because of these efforts but at the same time with this kind of asset like business model their profitability is getting stronger and stronger and so there's a give-and-take there and the way the company sees its kind of product brand strategy is to become the number one or number two leader by market or product because that brings in the most profitability and the best returns for the company I have a quote from Quincy the CEO where he basically says it's better to be the leader in half of world than number three in all the worlds from a scale and profitability point of view this again speaks to why they picked up Kosta right a big distance Ecola exactly so the you know this this latest deal with Kosta it makes sense that maybe they have a dominant name in the tome UK market and something that's very strong in Europe and it's branching out from there and taking that strength and cut and molding it into their system and it's a brand that could plausibly become the number two in the United States in some of these categories it is not going to be the number two coffee house it could absolutely be the number one or number two restaurant brand it could become the number one or number two convenience store brand ready to drink ready to drink I think is harder because that is much more if you're looking at labels it is about brand name if you want a nice hot cappuccino and they put this glorious looking machine in you're not probably gonna think who made the beans you're gonna think I want a barista made coffee and this is the closest I can get I worried about their ability for a long time to put out cost a bottle next to a Starbucks and a McDonald's this this is an area you know we you saw the Starbucks Nestle deal which is all about ready to drink and expanding this is a space that everybody is targeting Dunkin Donuts has rapidly and those are very big names Kosta has proven it can be a name but it's gonna take a while in the US until it is a name yeah so the last thing is in a new brand and the with the retail storefronts a big part of that too is just the ability to experiment you mentioned examples from Starbucks the chief growth officer position I think that's really interesting that he talks about experimentation during a I think it was a June presentation he said as of the first quarter of 2018 coca-cola has increased its number of experiments 30% with the volume from those products up 32% the coffee is basically this whole new playground now for them to see what works what doesn't and again I think this is a really interesting deal for coca-cola just because you think about their dominance in these not non-alcoholic beverages right it does make sense you've essentially opened up the entire additional market that coffee and hot beverages provide and coffees also become a bit like craft beer I'm not sure how big a coffee guy you are but I'm a pretty big coffee guy hmm if a new coffee house opens up in my neighborhood I am going to check it out and I'm gonna try three or four different things before I make a decision on whether that becomes part of my rotation there's a certain anti Starbucks where not that you don't like Starbucks but you've been there a thousand times so when they're in a market when they're when they're you know opening in China where there's thousands of Starbucks and acosta comes in your coffee aficionado is going to say try it in a way that doesn't work necessarily in fast food or other places where just because it's new so the product is good and it's proven that people like it based on that's gonna give it sort of an ability to grow in markets where they don't have to supplant someone they just have to take a piece of the business so maybe there'll be a strong number to a lot of places and that doesn't exist there's you know the US has a whole bunch there's a lot of fragmentation across the rest of the world yeah definitely and that's something they speak to for coffee I'll leave listeners then last comment for this deal and the potential that you always have to remember when you're dealing with a company of this scale and experience when it comes to beverage beverage is a reason why it's the market leader coca-cola has their distribution system they get about 2 billion drinks into the hands of customers in 200 countries every single day now you're just adding this new you know what they consider a platform to the mix and I I'm really excited to kind of see what not only Coca Cola's gonna do with this but I'm kind of experiment excited with the other deal like PepsiCo SodaStream see how that works out we're definitely gonna follow up on this it's been too long since we've talked about kind of the majors in beverages any last thoughts for me then I don't know we're going for coffee but if fools thank you for listening dan thanks for being here thanks for having people in the program may own companies discussing the show and The Motley Fool may have formal recommendations for against any stocks mentioned so don't buy or sell anything based solely on what you hear during the what [Music] you [Music]

Show more