Decline Signatory Template with airSlate SignNow

Upgrade your document workflow with airSlate SignNow

Flexible eSignature workflows

Fast visibility into document status

Easy and fast integration set up

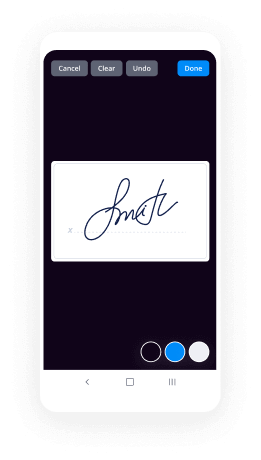

Decline signatory template on any device

Detailed Audit Trail

Rigorous safety standards

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

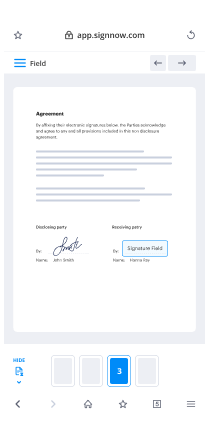

Your step-by-step guide — decline signatory template

Adopting airSlate SignNow’s eSignature any company can speed up signature workflows and eSign in real-time, giving an improved experience to consumers and employees. decline signatory template in a couple of simple steps. Our mobile apps make operating on the go achievable, even while offline! eSign signNows from anywhere in the world and close up trades in no time.

Take a step-by-step guide to decline signatory template:

- Sign in to your airSlate SignNow account.

- Find your document within your folders or import a new one.

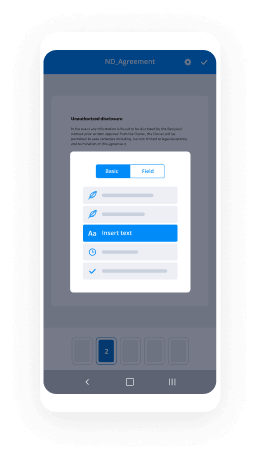

- Open the record and make edits using the Tools list.

- Drag & drop fillable fields, type textual content and sign it.

- Add numerous signees using their emails and set up the signing order.

- Indicate which individuals will receive an executed copy.

- Use Advanced Options to limit access to the record and set an expiry date.

- Tap Save and Close when completed.

Furthermore, there are more advanced tools available to decline signatory template. Include users to your shared workspace, view teams, and keep track of collaboration. Numerous customers across the US and Europe concur that a system that brings everything together in one cohesive digital location, is what businesses need to keep workflows performing effortlessly. The airSlate SignNow REST API allows you to integrate eSignatures into your application, website, CRM or cloud. Try out airSlate SignNow and enjoy quicker, smoother and overall more efficient eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results decline signatory template with airSlate SignNow

Get legally-binding signatures now!

FAQs

-

How do I reject a document in airSlate SignNow?

Decline to sign. Complete signing. Contact the sender and ask them to Void/Cancel the document. You can simply "reply to" the email notification to contact the sender of the document. -

How do I sign a document in airSlate SignNow?

Open the airSlate SignNow "Completed" email. Copy the multi-character security code at the bottom of the email, go to www.airSlate SignNow.com, and click Access Documents. Paste the security code from the airSlate SignNow Completed email, and click GO. The document that you signed opens. -

How do I get an airSlate SignNow account?

Create a free account and create your signature. Upload any document. Your signature can be dropped anywhere. Email your signed document. Access signed documents anytime in the cloud. -

Does airSlate SignNow automatically send reminders?

Using airSlate SignNow, envelope senders have the ability to send reminders and set when envelopes will expire. Reminders are a particularly useful airSlate SignNow feature. ... Now, with airSlate SignNow, that process can be automated and we will do all the reminding for you. To set up reminders, check the box to the left of \u201cReminders Enabled.\u201d -

Can you send an airSlate SignNow link?

You can also add hyperlinks to the "Message" section when creating an Envelope in airSlate SignNow, though adding text code to create the hyperlink is required, rather than clicking an icon to create the hyperlink. If an Envelope is created within airSlate SignNow, these are specific to the Recipients to whom they're addressed. -

What is airSlate SignNow authentication?

Electronic signature authentication requires users to prove their identity. airSlate SignNow comes with many authentication options including email, SMS, and knowledge-based questions. ... airSlate SignNow's electronic signatures offer the following authentication options: Knowledge-Based Authentication (KBA) Access Code Authentication. -

Is airSlate SignNow accessible?

airSlate SignNow's ability to provide a screen reader friendly, accessible document is dependent on the senders providing an accessible document for the signing process. ... Creating a document using Microsoft Word is one of the best ways to create a document when using airSlate SignNow. -

Where are airSlate SignNow documents stored?

Apart from providing the highest level of encryption for your documents, airSlate SignNow documents are stored in secure server infrastructure hosted in our ISO 27001, and SSAE 16 data centers. -

Does airSlate SignNow track IP address?

airSlate SignNow includes geolocation information (appearing in the form of the IP address) in the Certificate of Completion as part of the full audit trail of a document, though this is not required. ... ' The envelope History link is displaying a map of the geolocation based on IP address. -

How do I get rid of airSlate SignNow?

From the airSlate SignNow App, tap the Menu icon, tap Account, and then tap MANAGE PLAN. Tap CANCEL, then tap Yes to confirm the cancellation. Don't worry, you will not lose access to your completed documents or any documents currently routed for signature. -

How do I delete airSlate SignNow?

Individual account \u2013 Administrator \u2013 with the option to "Edit Plan" under Go to Admin | Billing and Usage: Only New airSlate SignNow Experience accounts will have the option to close the account in the web application. Visit https://app.airSlate SignNow.com/auth. Select the Account Profile Menu | Go to Admin. -

What happens when you delete an airSlate SignNow?

Deleting an airSlate SignNow envelope removes it from your Sent or Drafts folder and places it in the Deleted folder. ... Note: If you are not a signer on the envelope, the envelope will only appear in your Sent folder. Click to highlight the desired envelope, then click the Actions button. Click Delete. -

Can you change your signature at any time?

As Gil Silberman says, you are free to change it arbitrarily whenever you want. So the practical answer is: you'll want replace your State Driver's License/ID card with your new signature, and then go to every bank where you have an account and update your signature on their records. That's probably it. -

Can you change your signature Canada?

You can change your signature any time you want. Just apply for the new license or card etc. and use the new one. -

When you change your name do you need to change your signature?

It is your wish whether you want to change your signatures in lieu of the change in the surname. It is not compulsory to change your signatures after your marriage. You can retain your maiden signatures. Signature is a mere writing of a person in order to identify the person.

What active users are saying — decline signatory template

Related searches to decline signatory template with airSlate airSlate SignNow

Decline signatory template

okay hello everybody um thanks for joining us today i've got sushil on the um presentation with us because i know that um a lot of people are going through their idol or eidl uh loan process and some people are getting uh declines and maybe they don't think that it was right or they did messed up the application or a lot of reasons why people want to apply for reconsideration so we're going to go through that today as well as answer a couple of questions or a lot of questions however many you have at the end of the call to show thanks again for joining us i appreciate it i know we a lot of people have watched your video and appreciate all the information you share thank you rhoda for having us okay all right so by now everybody knows who you are and uh well if not sushil is the public information officer with the sba um out of the sacramento office and has been working with the sba for how many years now sushil uh going on i think this year is eight eight okay great 18 years eight okay good all right let's get into this okay so the first question is how will people find out if they were denied it's usually via email and on the application on i believe on page two or page three of the application there is a place for business email address and a personal email address you're going to put that in that is a form of communication between the sba and the applicant and that's how they would know okay all right and about um how long does it take for them to find out if they were denied is it instant or is it taking like a processing time of longer than that you know as as much as i'd like to say instantaneously that's not the answer uh i've seen as as little as a week for the whole process to be done documented funded money in the bank account and i've seen as long as four to five weeks for some sort of communique to come back so somewhere in between is probably a happy medium so when you submit the application you'll get an application receive message from a.gov address and soon thereafter you'll get a email saying that your application's denied or they want some more information things along those lines okay so whatever email address you put into the system when you applied that will be how you get your denial um and if you haven't heard anything in a few weeks you know check your spam i know that a lot of times when i do applications and things it ends up going to spam because i have my filters sets pretty strict so make sure and check your spam filters so you're not missing anything if you have those strict filters on like a lot of people do matter let me take the time really quick to enlarge my powerpoint presentation for something else that i used it for and uh demonstrate what i'm referring to do you want me to make you the presenter just run for brief seconds so i could share my screen and show you what i'm looking at okay i'm gonna make you the presenter camera there i am share and if you look if you look right closely see that email address i'm on tab number three the business owner's information here's the email address okay another reason why an application gets turned down is see this when i'm circling ownership percentage yeah it's gotta add up to 100 if it's not it'll get kicked back here's the other area the business email address i was referring to it's got to be filled out otherwise it gets kicked out and this is the beginning right here is the beginning of the application you pick one of your um businesses make sure that you mark off each one of them start entering your information who you are what you are your ein number email that i was telling in the middle of the actual application package followed by this area right here and if you fill those correctly you're all you're in a good situation with us i can have a screen right back to you okay and so if you let's hang on let's go back to the ownership percentage for just a second because if you have um 50 ownership will it automatically give you the way to add the second owner or you'll have to add that into the comments section or how does that work it actually gives you an option so if you only put road as you okay or you only put susheela z on her it'll prompt the uh it'll prompt the entrance or the data entry person to put roida's name in a lot of applications i'm saying for reconsideration is exactly for that i mean you'd be surprised how many people are not listing the complete ownership percentage not sure why but it's got to add up to 100 percent 100 you need to put that in there okay um all right that's great we have a question yeah we can have a question uh on the uh ein number a lot of people are sole proprietorships and don't have an ein number do they substitute their social security number time for i'm sorry yes sir yes sir okay okay i can't see sure oh i'm here okay i just can't see you on your camera but oh sorry okay i don't know why i turned it off sorry about that oh okay great great all right so let's see here okay so ownership not adding up to a hundred percent that's the number one reason for decline and so if they what we'll go into the what to do um if that's your decline reason let's look at the um another reason for it's not declined economic injury is not sustained um are you seeing that as a common decline reason or tell me about this decline low credit score is one of them the uh the 100 is another one um then you see you know uh if nothing adds up you know all the information is submitted doesn't add up here's another example the letter that's sent which is the one that you're looking at might be the one where someone enters three different times their cost of goods sold that's another area that we're seeing so in other words you've got revenue right below on the application cost of goods sold then it'll have revenue and then cost of operations if you're not a manufacturer so whatever strange reason certain applicants are entering the cost of goods sold three different times so guess what you end up happening you have a loss which was never the case so then instead of us pointing out that they made a mistake we don't know what the mistake is we'll ask for their tax return we'll ask for a cost of goods sold statement we'll ask them to submit all that information so we can do a full underwriting and that's the type of form that you'll see economic injury not substantiated so if you notice okay it says here unfortunately we're unable to approve or unable to substantiate your business if you disagree with the decision you may request reconsideration what do you need to submit gross revenues cost of goods solds tax information and assigned forty problem six so for the folks on this call who are very familiar with the forty five of six yes it's basically a tax form for the periods that we're asking to confirm usually three years sometimes there's a little less applicants may have already submitted yep exactly and sign it date it submit it to us email it or mail it um okay and would a just a p l suffice or or no that's not good well no as a matter of fact if you take a look uh gross revenues costs are good sold for the last 12 months so your financial statements would be required however you as you very correctly pointed out send a corresponding balance sheet and income statement to to match it up it really is very helpful okay i'm pulling up the 4506 let's see here we can do this here's the 4506 can everyone see that um it's just really asking for basic information and it allows the sba to get a tax transcript script return from the irs so that they can verify information um sushil i think if you can comment on this it's not going to put you at risk for an audit or something like that those are two different departments in the irs and i know a lot of people like i don't want people talking to the irs i don't trust the irs i get it but this is really something that you're going to have to do so that the sba can get the information from the irs if you don't sign this and you then they can't verify any information and it's not um allowable in that number six transcript requested enter the tax form number here you're going to want to put in your business tax return however you file your business taxes you're going to put if you're a sole prop you're going to put the 1040 if you're a corporation so i forgot to turn my phone off um [Music] hang on i got ringing in my ear um if you're a corporation you're going to put 11 20 there on number six and so uh make sure you do that uh so that they know what transcript they can request um and then as you see no go ahead i'm sorry i apologize oh and then i was going to say in section 9 you want to make sure that you put the year um that they're allowing would you say 2018 in 2019 or just 2019 is fine 2018 2019 and make sure that you're consistent if your tax return is a fiscal year versus a calendar year adjust it accordingly right and then there was another section customer file number should they put their sba loan number there or no don't just leave it blank yep okay so fill out your name as on the joint return current name previous address any of those things it's pretty self-explanatory except for maybe the transcript requested and the year period so it should be easy remember to sign it and i definitely had yep sign and dated i've definitely seen that without that information so um you'll need that okay perfect let's close it now another way to another way to uh to help understand the 4506 t is it's not only a form of verification it's a form of truing up data so if i theater wrote i'm making 120 000 and my tax return shows 90 000 we're gonna be using the ninety thousand dollars or vice versa you know a lot of times folks are need are in need of true enough information so that's quite important to make sure that both sets of data match up that's where we are able to throw up the values banks use it all the time fintechs use it all the time and so does the sba right and that's another good point um i know that i see a lot of businesses who work in cash and they say well but my my tax returns say this but really i do a lot of cash business and it's not reported we can't use that it really is going to be based on your tax returns correct i uh in my commercial banking days back in 2012 went back all the way to 1986 over 26 year period i can tell you i i came across so many cpas and business owners that would really state this these are my books actually and guess what uh my tax return shows this well i took an aggressive write down well you know preparing one set of books for taxes taking their right down and then wanting the most rosy picture for lending is a common practice even today but it's got to be true it's got to be congruent it's got to be trued up the same set of values have to be used what's good for the goose is good for the gander right and i have also seen people go back and file amended returns depending on certain things and this would be something to talk to your accountant about is if you want to file an amended return and look at paying those penalties and and things like that that's a nuance that you could get into but it is going to be based on the tax return not your side books correct all right let's look at another one if i can get back into here perhaps perhaps a play on words not your side books your alternative set of books right right that's right so um decline unverifiable information um maybe this is a little bit what we were going i have seen this they couldn't verify the bank account number or they couldn't verify certain information this was maybe more on a ppp but talk to us about the another decline information this one unverifiable information you know uh social security number doesn't is is left out or is transposed um the business is not current with the secretary of state finance so when we love a business search it doesn't show up um because we'll do that because we're only filing you know um you see she wants for up to 500 000 anything below 25 000 is unsecured so we do a business search so a lot of these things won't come up so between your name and the way you've pulled out the application there's a missing dba there's a different secretary of state filing when all these things add up and we can't even get off the ground as to who we're lending to and who's our borrower it'll kick out an unverifiable information information or in this case a uh a letter give you a small example i had an applicant that has been waiting for funding for now almost three weeks and sba kept telling them there's something wrong with your bank account information the person finally sent in their copy of the avoided check and their company name was and i'll use our name for example it'll say sushil and rhoda incorporated and in our checkbook it is spelled out a nd from the application for whatever reason the amber sign sign is put in yeah system kicked it out okay system kicked it out because even though it's hand it is very specific it's seeing an an amber sand sign and and instead of a so the system is that particular uh if there is a banking information where there's a comm and a dot so you know you kick it out uh if it's rhoda you know from finance agents comma inc period if one of those commas is missing it'll kick it out because once the money leaves the sba there's no way for it to get back so much rather be on the side of not sending it out instead of sending it out and having a loss for the borrower and for the sba huh okay it's very particular yeah definitely typos or or things like that but you know in i guess the good news of that it seems like that if you apply for the um reconsideration which we'll get into that may be something that's easy to overcome and it'll be like once it gets in front of a person's eyes they can kind of correct it and and get you the uh loan or you're like well they're it's not the same so is there a question there that i missed yeah is are those are those types of declines easy to overcome and a reasonable person can say oh well it's the same business we'll just correct the application and make everything match absolutely i i nod my head vigorously uh to say yes of course okay and then i know um someone else i was talking to um for whatever reason their cpa missed the filing deadline for their 2018 returns and so they got declined if they file the tax returns and become current or they pay whatever they need to pay for the secretary of state and then show they are current with that information can they be reconsidered or those are the types of mistakes that you can't overcome no no no the idea is to put as much money on the streets as possible okay another way of saying that eloquently is we're looking to lend money no one benefits if we don't lend money so the idea is if there are satisfactory credit history if there's cash flow evidence the eyes are dotted and t's across for the most part the money is yours it's really the volume of information coming in given the pandemic along with the reluctance to get it right while there's a reluctance i have no idea i found a lot of folks saying this is what i gave you what i got can't do that if it's insufficient for us to make a decision that's where it is well i never got the letter well let me send you a copy the letter and then the information comes in piecemeal those are all things that delay the process yeah i mean working in loan processing and things like that let me reiterate that piecemeal portion having a complete package is very important because every time you open a file you sort of have to re-familiarize yourself with it and then you are missing a piece and so you have to stop and you go back and ask for that piece you get the one piece in and then you have to you re-look at it and it's very time-consuming so being as thorough as possible is is definitely a good thing i mean you're you know very successful in the world of sba 78504 and all the other items that you your company works on you know exactly what i'm referring to when i say i need a complete package and when you're working with the volume that you're working with uh not only is it time consuming it also takes time away from another deal that's got a complete package and we're not going to be scrambling for it because if the applicant themselves chooses not to send it in for whatever reason it's on them and we can't proceed any further because it's the law right and and you know i also will advise people if you have a bullet list like this go through and as you attach files and you email them to this email address label the files that way if they're saying bank account information is not verifiable don't leave the file labeled whatever you scan it at it's very helpful to name the file properly if you're sending in a picture of your driver's license label it wrote a phlegm driver's license if you have your tax returns label it 2019 tax return for sushil and whatever it's very helpful and helps with it's it just is very helpful as someone who processes loans to get an organized application help the person say yes to you that's exactly right well said because we're involved in the same line of work i'm packaging i'm packaging i'm on the economic injury disaster loan side you're on the 78504 sb world side so my god it's just words to the wise uh more and more importantly save time nomenclature is important send a complete package in and if you have sent a complete package and as i mentioned there was an applicant from oklahoma seven days start to finish got funding seven days i mean incredible that's how quickly it turned out to be right all right uh next reason for uh decline withdrawal request by applicant um why would this be happening okay no they they were through the request yeah so so another way of saying that politely is that we as the institution did not get a tommy response and usually that time frame is 14 days so i send wrote out okay sorry 14 14. so i said wrote an email 15 days ago today is the 13th so july 31st i sent an email to herod july 31st i reminded her on 7th of august today is the 13th i haven't heard back from her so my inclination is that she's disinterested so i i withdraw the file keep your place in line send you an email saying answer a request we are withdrawing it because you're you're complicit by not answering and that's called a withdrawal and then we give you six months to come back to provide the information that you didn't get a chance to provide in the 14-day period this prevents the scale dating of the application doesn't mess up the pipeline and make sure that everybody gets due consideration on a timely basis okay that's pretty self-explanatory um i sent this to you i send this to you for the email address picture down here this is email right mm-hmm and then sorry i was gonna say the davises established it's gotta be prior to the decoration date your ownership's got to be prior to that your business activity cannot be prohibited those are the other reasons why you're going to turn down i had a situation where a business owner was getting funded from the vc's venture capitalists we can't lend to them okay they already have a source of funding and the fact that they chose not to land on a twelve percent basis and they want us to borrow three percent they're in the lending business they can choose to get that from vcs okay um what are a couple other um industries that are forbidden another example would be a real estate speculation so rhoda and i are buying land together we haven't built anything on it yet it's hard to incur a loss when it's real land okay it's hard to it's hard to incur laws when you just started doing a construction loan and the property is not interproducing yet there's no civilization there is no stabilization rate there is no occupancy it can't be any type of loss per se the fact that the bank stopped lending to you is not evident enough for an economic injury that is purely speculative business that you were telling the bank that if i did this this and this you would have this this and this that in itself is not something we can lend against okay gambling that's another one we can lend to political lobbying is another example we cannot lend to chambers of commerce that in the political lending business we can lend to okay trying to think of would you lend to a vape shop or a pot shop or any of these other sin industries gentlemen's club uh no gentlemen's club no um on a side note i never knew why that was called a gentleman's club would be that as it may uh pop club no um because pots you know um is a federally banned substance even though it's legal in california colorado washington if you name a few states but uh anything of a prairie and sexual nature is not good anything that's banned by the feds is not good for lending money against so those are very clearly uh those industries which are a no-no okay but the non-profits churches that's okay because um correct yeah and the way we approach that is faith-based organizations fbos okay something big very good if it's a mosque or a synagogue or something like that right that's a good plan okay all right here we are how do i request a reconsideration i know this was a big one the email is here p-d-c-r-e-c-o-n-s at sba.gov probably the fastest and most efficient way to do it or you can um write a letter the paper and snail mail kind right in my humble opinion email it if it doesn't bounce back that's your evidence that they received it and keep that handy once they do accept it formally you'll get a formal acceptance email okay stating that we've got an error we've got your application i'm starting to work on it okay so will they get a an auto reply or it may be quiet for a while okay auto reply and then another one a little lip file later right and your you started saying it may be quite a while i'll take the quiet out and i'll take the while out and fill it in with you'll get a response okay okay um and then we're going to go through here like what would be a good sample reconsideration letter you know anything that we need to do to overcome the decision-making by the sba right so if i were to be turned down for um a low unsatisfactory credit history i need to list in there why i had the low credit score if you know it what was driving the little credit score in other words package that together into something more subjective called unsatisfactory credit you see citibank this happened american express this happened now car loan does happen uh divorce medical stuff bankruptcy things along those lines list the reasons what drove them satisfactory credit score that would be an example of it another example of an unverifiable information and it was listed there you know pick those items that contributed to the unverifiable information copy of a driver's license a copy of the tax return evidence of who we are what you are send that in so depending on the reason for the decline customize the letter overcomes the decision made by the cpa by the sba right and uh you know another thing is is make it easy again think about the processor and their loan volume and if you the email on your application is your business email write the reconsideration from that email so they have a way to link the file don't use your personal email use the same email that's on your application so it's easier to link here's a sample one make sure you include your application number i'd probably put that in the subject line along with your business legal name and then title reconsideration so application number sushil and rota reconsideration and then put this information in here um the application was being denied to poor credit i believe i should be eligible for the idol because and then say my credit sa has suffered since february 15th i have missed payments for x y and z prior to that my credit was a 620 and i have whatever attached are the submission files to my documents i don't know what you could submit there maybe you know the dates of your missed payments or why you missed them or my son fell out of a tree and i had to either make my credit card payment or pay his medical bills all of the things that happen put that in there or if you have your tax returns attached attached are my 2019 business tax returns and a p l and balance sheet year-to-date to show the economic injury and do that and then put your phone number again in the bottom of the email all right okay that's here how long does reconsideration take i heard on the side of being optimistic i listed two or three weeks probably in the long run it's probably three weeks okay pandemic i think everybody's tired of hearing the word pandemic um pandemic yeah it's hard to cope exactly right and so basically volume is what's driving the turnaround time back to what we talked about earlier we have a complete package there they are i mean there are forms which are being filled out and when it comes to the signature and the date it's not there it's a rodents of shield don't sign rodents or shield guess what we can't do anything with it yes you filled out the application but it looks like the underwriter may have filled it out right so a lot of what i have seen where people have asked to listen to my assistants whether it be congressional offices elected offices and say some shield would you take a look at these applications what's driving this equation it clearly is the notations or lack thereof mischeck a missed a copy of a driver's license say miss tax return and miss 45 was 16. i missed form get it unsigned i mean just the basic stuff because nobody wants to fill out paperwork nobody wants to be asked questions after they fill it in and of course when you add the the the stress level associated with this pandemic they don't want they want them to deal with it they don't want they don't want to touch them more than once right yeah take the time to fill it out take the time to do it right review it save the file as you mentioned and then run with it give us something to work with right i try and remind people i know it's going to take an hour or two and you're very busy but it could be 30 000 and if i made 30 000 for two hours of work i would uh you know i'd work a lot more keep your eye on the prize when you're working through some of these things absolutely look you know we all want the end of the day to lend money feel good about it right we just need your help because we can't do it all okay um now we're gonna hop into some questions that we had from the previous one when we were talking about the idle portal um people still haven't received funding it's been five weeks six weeks um how what's the best way to follow up on that one eight hundred number take a look at the example that i took about your check book matching the title on your application do you have that 800 number memorized so we can give that to people yep it's on that previous slide that you had on uh but uh but i'll give it to you again is 800. six five nine two nine five five if you go further up towards the the copyrighted letter right there oh here it is eight hundred six five nine two nine five or email disaster customer service at sba.gov that's correct okay great and you know something that simple when it's when it gets to funding and they're ready to fund and you haven't got no money it's very simply an issue with the bank the bank has rejected i've seen copies of text messages emails from the bank saying yes your direct deposit was this was was uh returned because there was a factual error from bank of america capital one so many different banks so when i say that um it's not the sva not wanting to deposit the money the banks are returning the money because they don't want to hold on to that money because they don't know if the customer is really uh the ultimate recipient so they're kicking it back the sba i see okay it actually gives you a tracer number projector number on the ach and it says rejected you'll see the deposit and you see the money actually going back and was because instead of saying sushila and wrote a flum incorporated period it just says rotoflame ink period so shields left out or vice versa or the period is gone or the ink is gone our name doesn't show it just shows up as xyz incorporated great very particular and it's not to say that this isn't frustrating for you as the small business owner but you just if you're the bank you gotta you gotta watch out and you gotta dodge your eyes and cross your t's and if it's not then unfortunately they can't accept it so everyone understands the frustration and that it's very particular um but just go through it and and jump through the hoops a little bit uh unfortunately and try and figure out what's going on if you get a rejection i don't i'm sure as a business owner you have a business banker that you can contact and maybe get more information if you're not understanding why and say why did you reject this if you can't get all of that information but i understand that that would be frustrating if you think the money is coming and then it's blocked so um you know the bank wants you to get money too they want you to have your business survive but they gotta be careful as well the end customer has a lot at stake and if there's a common theme that we're seeing in this call in this presentation is good data yields good results let it be uh uh dotted and crossed quicker that's done you get your money these barriers the so-called barriers that exist is there to protect the institution and ultimately the borrower okay um i didn't get invited to the portal um and loan then got declined if somebody misses their invitation can they re um cast a new email for the invite to the portal kind of getting into when we were talking about the forgivable advance um versus me calling it a grant right um and if they get declined for the loan do they have to pay back that forgivable part no okay um update on processing times we kind of went through um if they decide not to take the loan not that they don't get declined can they still keep the forgivable portion yes okay um can you apply for two different businesses yes of course okay so on that to go into it a little more you would need two applications with different eins to go back to and really hash this out you make sure you've got the business name properly on the application and make sure that both applications have their different cogs their different operating costs make sure that you keep those numbers correct so that you can qualify but yes you kind of qualify just make sure you've got two applications right so separate id yeah yeah numbers right um can you increase the loan amount yep we went into that uh just apply through that email address um the pdr recons or whatever it was at sba.gov okay good and then um i think this is kind of going back to your other point one of the comments was said that the loan officer says you can't request an increase maybe it wasn't too soon and let me parse those words a little bit loan officer is going to say unfortunately it increases not available okay and that's their way of saying that washington way up the food chain decided that they were going to make money he's available for all not for some so they reached that ceiling for that particular business owner which are few and far between generally speaking my experience has been requested for the most part the money is yours i have seen situations where the business didn't get as much in which case we suggested that we shut their banks to uh get their loans and credit increase i'll give you an example a small example let's talk into a person in southern california your neck of the woods um they had a lot they had their request they wanted a hundred thousand hundred i'm sorry they had needed 200 000 for their working capital they only got 150 right and they didn't want to sign the loan documents to make a long story short and when i finished talking to the owner the owner said i'm going to ask a few more questions so and so forth they had five and a half million dollars as the bank owner credit untapped oh so a lot of times business owner chooses not to tap their existing lines for whatever their reason happens to be and tap the subsidized bank line of credit hours is not a lot of credit it's an installment loan there's no deferment i mean there's deferment for 12 months the bank doesn't have a deferment our repayment is 30 years they have to rest their line every 30 days depending on the conventional line so it becomes more of a arbitrage between him and i got the money but i don't like the terms versus i don't have the money so our job as as an sba as the lender of last resort especially an economic injury is to make sure that we do our part the expectation is that the customer does their part the applicant does their part and the person says you know i guess i can do without the fifty thousand i got a five million dollar line sitting here on tap and when i asked what the interest rate was was four and a half percent why did they want to use that i was just three point seven five why didn't they want to use that line because they need to start making payments the following month minimum payments at four half we don't have to pay hours for at least 12 months so if they became the product terms again right so there's that balance there's that balance the person completely understood they said look i understand i'm blessed enough to have family and and untapped bonds of credit whereas somebody else might need an extra 50 i get it i appreciate your explanation right yeah that's an important point some business owners right now really don't have access to other capital and they need this money and you have to remember that rather than there's only so much at the end of the day we're trying to give it to everyone but yeah some people are really hurting right now and they don't have options and here's the other part and that you hit the nail on the head 170 billion dollars later give or take is what the money the idle funds have amounted to people still don't see live at the end of the road because they rightfully don't see it one number two we're talking about small businesses and the definition of small business you can look up the cfr 123.2 of the definition small businesses and literally when you have a 5 million line the subsidy that the sba's idle program provides it's clearly not needed if you've got five men in line untapped lines but that's not my place to call it right okay um let's open it up uh let me see if we i know we've got some people on the call i'm gonna unmute everyone and open it up for questions today was i good on that i mute all i pressed it if you have a question uh now is your moment to shine um try to undo everyone if you have a question make sure you unmute yourself any questions or was the information that thorough hey great job guys no really appreciate it i had to have a list of questions that they could answer i know a big one um was that i've had multiple people ask about how to request reconsideration so i appreciate you putting that slide up there with the email information as well perfect thank you andy any other questions comments has anybody talked to anyone who has a situation that maybe we didn't cover yes yes mr felt i know this is a popular question that he's used to but uh people still want to know is there any additional information on the up to ten thousand dollar grant being reactivated i'm sure thank you is expired in the 11th of july and until congress reappropriates we don't have a program to tap into any other questions nothing from marcy and nothing from his flavors yeah good are you a was that a no you can't get anything more if somebody only got 10 000 but yet their uh their economic impact was greater than that um they got it a couple of months ago there's no way right now to get any more because that turn that time for them to apply for more has expired is that correct it's correct okay um maximized 1000 per employee with no more than 10 000 so you have 15 employees you only got 10 000 anyway and the if you have not taken advantage of the economic injury disastrous loan program i would suggest that you apply for that um because clearly as you very correctly point it out ten thousand dollars is not due world of good when your working capital needs multiple credit numbers go ahead jim sorry the amount that you're given is or loaned is based on the credit report is it based on the entire credit report or just primarily the fico score so god no that's just a small subset of a larger equation as you know jim very well credit score just measures your willingness to pay ability to pay is measured by the various metrics that we commercial lenders and sphere lenders take the time to score and grade so the combination of the two is what we're looking at so one set of circumstances never is the cure all for a larger situation yep that's the way we do it so i totally understand that you're right although there are a few things out there that just go on credit score and they wanted me to ask so is it also last year's profit shown on your tax returns yes sir very much so terrific thanks very kindly and then i think last time sushil you said there was some logarithm they were doing based on naik's codes and things like that to help um for the loan amount so that they could automate the process more is that still how they're underwriting to based on nades the rapid you know this is called the rapid system and yes and they've got on the back end they've got the next code that drives the revenue and the working capital and stuff like that and they don't tell me what it is i do know that generally speaking when you look at uh for example i'm just gonna make this number up one one one one it happens to be the restaurant industry for example within that restaurant industry it'll break down all kinds of different subsets if the annual revenue uh maximum there is eight million dollars and the customer comes back and says working capital department is 2 million clearly the math doesn't add up so that's how the system is set up to filter out the requests on hand versus what's realistically capping me okay good information any other questions comments um i don't want to trivialize anyone with this remark and i say that because sometimes it's how the person might perceive the information coming out we're lenders we're all lenders you're a lender i'm a lender banks are lenders money is green the only key difference is this money comes from our taxpayer subsidy all of us so there's a balance that needs to be struck between lending money and preserving taxpayer money we wouldn't lend an organization that was already on its way out for whatever reason and code with me and put them out or hurricane me and put them out or while firming and put them out so the metrics of lending don't change it just so happens because this taxpayer subsidized and the government has approved us for a certain type of term structure fixed interest rate no prepayment penalty no cost to borrow uh no cost to apply so on and so forth it makes us a preferred lender in a world where there is no demand post disastrous there's no bank in their right mind would want to lend at a time of acute distress because they don't know how they're going to get repaid so the government becomes the last resort like the fed so if you look at from that prison all we're trying to do is is lend money to people for a great deal of need what do we need in in its place documentation timely complete concise so that we can lend you the money up to our statutory maximums right yeah you know as you look at going into the five c's of credit the conditions right now don't make it very amenable for anyone to lend so yep it's a good point and jim could appreciate this remark jim i'm going to i want to solicit your opinion for a second why do you think the fred the treasury is back stopping i mean the federal reserve is backstopping the treasury why is your main street lending facility these are unprecedented times for people wanting to know the markets are functioning they want to know that there is a market for capital access that's where they come to us and rest of it you know read through your wall street journals and your barons and your position papers on different things but we're in president thomas and we're trying to do our part a small part in helping the small business get on his feet yeah that's these are excellent points that um we need to keep in mind as we're going through this um does anybody have any other comments or questions that they want to put in here i'm cognizant of the time don't want to keep you too much longer any other comments or questions all right sushil i will give you the last word um as we move out and um i thank you again for joining us i will uh put the um our email if you have other questions for follow up in the uh description box and we had a lot of comments um on the other show sushi last word your uh institution your folks have done a tremendous job of giving us air time and focus and exposure we appreciate the opportunity to work with you and the economic injury disaster loan program is one small part a larger package of loans and capital access that the government is offering to help businesses stay in business and provide the necessary liquidity needed in the form of subsidized money we appreciate the opportunity and i'm sure we'll be falling soon again and if there are other questions that we need to cover for the reconsideration world i'm here to phone call away an email i appreciate you perfect thank you thank you everybody have a good day uh you've got the email address thank you very much for your time and we'll be in touch thank you thank you thank you everyone for joining thank you thank you all so much sushi welcome

Show moreFrequently asked questions

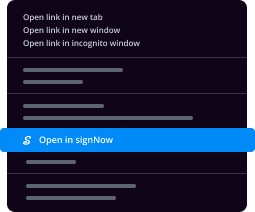

How do I add an electronic signature to a PDF in Google Chrome?

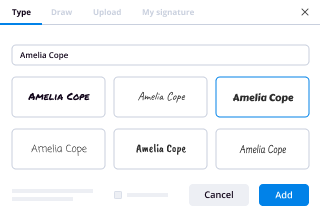

How can I set and save an electronic signature?

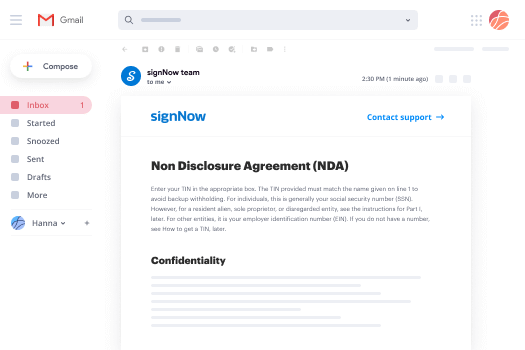

What can I use to eSign a document?

Get more for decline signatory template with airSlate SignNow

- Esign image

- Prove electronically signed Contractor Invoice

- Endorse digisign Non-Disclosure Agreement (NDA)

- Authorize electronically sign Inbound Marketing Proposal Template

- Anneal mark Website Design Inquiry

- Justify esign Baptism Invitation

- Try countersign Itinerary Planner

- Add Sales Agreement initials

- Send Plumbing Contract Template eSign

- Fax Customer Service Recommendation Letter eSignature

- Seal Web Development Progress Report digisign

- Password OPM 71 Form electronic signature

- Pass Leave of Absence Letter signed electronically

- Renew Simple One Page Lease Agreement sign

- Test Rent Receipt electronically signing

- Require Tripartite Agreement Template mark

- Print successor countersign

- Champion renter signature service

- Call for collector signature block

- Void Non-Disclosure Agreement (NDA) template byline

- Adopt Contribution Agreement template esigning

- Vouch Children's Concert Ticket template digisign

- Establish Silent Auction Gift Certificate template signature service

- Clear Service Contract Template template countersign

- Complete Marketing Request Summary template sign

- Force Web Design Proposal Template template signatory

- Permit Restaurant Application template initials

- Customize Revocation of Power of Attorney template eSign