Deliver Currency Field with airSlate SignNow

Get the robust eSignature capabilities you need from the company you trust

Choose the pro service created for professionals

Configure eSignature API quickly

Collaborate better together

Deliver currency field, in minutes

Cut the closing time

Keep important information safe

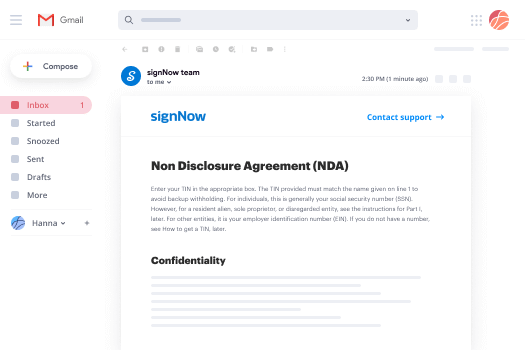

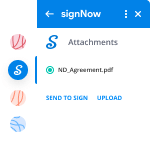

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

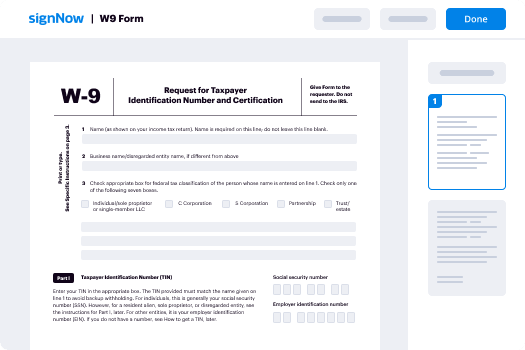

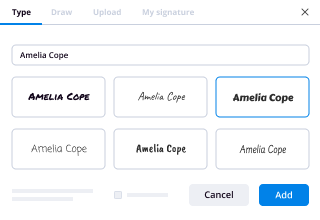

Your step-by-step guide — deliver currency field

Adopting airSlate SignNow’s eSignature any business can speed up signature workflows and eSign in real-time, delivering an improved experience to clients and workers. deliver currency field in a couple of simple steps. Our mobile-first apps make working on the move possible, even while off-line! eSign signNows from any place in the world and close up trades in less time.

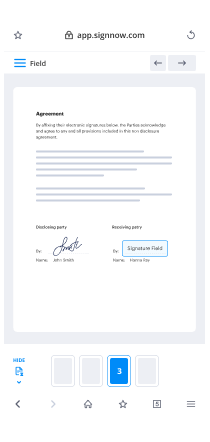

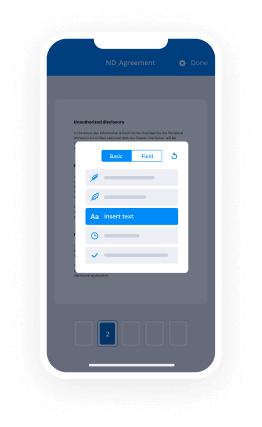

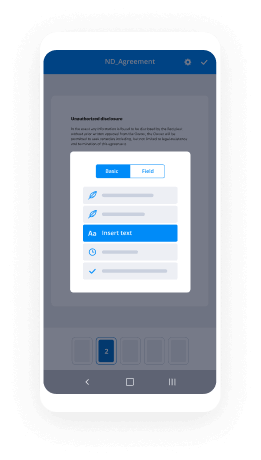

Follow the step-by-step guideline to deliver currency field:

- Log on to your airSlate SignNow profile.

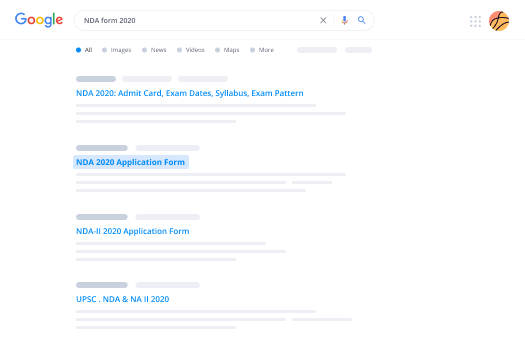

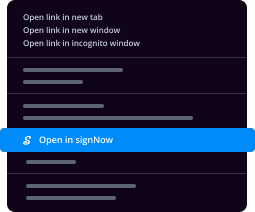

- Locate your needed form within your folders or upload a new one.

- the template adjust using the Tools menu.

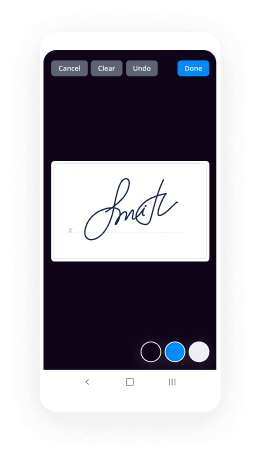

- Drag & drop fillable boxes, type textual content and sign it.

- Add several signees via emails and set the signing order.

- Indicate which users can get an completed version.

- Use Advanced Options to restrict access to the document add an expiration date.

- Tap Save and Close when done.

Additionally, there are more extended functions available to deliver currency field. Add users to your shared work enviroment, browse teams, and keep track of teamwork. Numerous consumers all over the US and Europe concur that a solution that brings everything together in a single cohesive digital location, is what enterprises need to keep workflows functioning efficiently. The airSlate SignNow REST API allows you to integrate eSignatures into your application, internet site, CRM or cloud storage. Check out airSlate SignNow and get quicker, easier and overall more efficient eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results deliver currency field with airSlate SignNow

Get legally-binding signatures now!

FAQs

-

How do you get foreign currency?

Stop by Your Local Bank. Many banks and credit unions sell foreign currency. ... Visit an ATM. ... Consider Getting Traveler's Checks. ... Buy Currency at Your Foreign Bank Branch. ... Order Currency Online. -

How do I get the best exchange rate for euros?

European Bank. The cheapest places to buy Euros abroad are usually banks. ... U.S. Bank. If you want to get money before you leave, you can buy Euros from a bank in the United States. ... ATMs. ... Currency Exchange. -

Can you get foreign currency at bank?

Banks and credit unions will exchange currency for you before and after your trip if you have a checking or savings account with them. ... The exchange rate at your local bank is usually better than using a currency exchange provider at the airport. -

Where can I go to exchange foreign currency for US dollars?

Visit a Bank Most banks have foreign currency exchange services, and they will often exchange it for free, especially if you're a customer. Typically, these are larger banks, not local banks or small branches. Bank of America is one of the largest institutions that will exchange foreign currency into USD. -

Where can I get foreign currency in the US?

If you like to plan ahead and want to exchange currency in the U.S., your bank or credit union will be your best bet. They have access to the best exchange rates and usually charge fewer fees than exchange bureaus. Most big banks sell foreign currency to customers in person at a local branch. -

Can I get foreign currency at the Post Office?

You can order your foreign currency online and collect it in your local branch, or have it delivered to your home. ... If the currency you want is already available at a local branch, you can collect it earlier. You can also walk into some Post Office branches to ask for a foreign exchange service on the spot. -

Can you buy foreign currency at the Post Office?

Post Office have up to 80 foreign currencies available, order online for our best rates on every currency, every day. ... The more you buy, the better the rate. -

Can I buy euros over the counter at the post office?

Pick up your euros from the dedicated Travel Money counter at your nearest Post Office in 2 hours. -

Can you pay online in a different currency?

Most online shoppers can expect to pay an average international transaction fee of 3% when buying with a credit card. ... All told, you could be paying as much as an extra 6% more than the cost of your purchase just to use your credit card when buying in a foreign currency. -

Can I get euros at my bank?

U.S. Bank. If you want to get money before you leave, you can buy Euros from a bank in the United States. ... Some banks provide free Euro-purchasing services if you pick the money up but charge if you have it shipped to your home or office. -

Can I buy something in pounds with dollars online?

Use your credit card or paypal. You just take it to the shopping basket as you would if it were in pounds and then enter your credit card details. The seller will get dollars and you will be charged in pounds.

What active users are saying — deliver currency field

Related searches to deliver currency field with airSlate airSlate SignNow

Deliver currency field

[Music] [Music] [Music] [Music] [Music] [Music] [Music] [Music] [Music] [Music] go [Music] [Music] [Music] we've reached a human crisis unlike any that we've experienced in the last 75 years meaning one side has too much the other side will oppose it we've done a lot of things to create the imbalances that we have today covert 19 has laid bare the systemic social inequities addressing these larger problems must become our priority we have to make sure that the economy actually works for the people it's not just about growth for growth sake but how we share that prosperity it is not sustainability or profit it is profit through sustainability we have to reskill our people to be successful and if they're more prosperous the companies are going to be more prosperous the most important tools are education and technology technology creates opportunities so that people are able to move to greener industries it's not about not knowing that we are in a climate emergency it's about choosing to take action for that you need to act decisively in the supports of renewable energy the science is very clear today that the sustainable path is more attractive we can focus on the short-term benefit or we can look further to solve bigger issues we need unprecedented collaboration to create systemic change it means redesigning the instruments we currently have a completely different trajectory and that doesn't leave anybody behind we are one community and we have to remember that so welcome everybody to our panel on how we restore economic growth my name is jeff cutler i'll just say very briefly i think we all understand from that small piece of tape and from what we see around us how sizable this challenge is the un has talked about 255 million people losing their jobs in 2020 we know the world bank projection for growth in 2020 is that most countries will experience recessionary like conditions so i'm very pleased that we've got a terrific panel just to focus on actually how we might think about sustaining and restoring economic growth for 2021 and the years beyond let me introduce bruno le man minister of economy finance and recovery for france peter altmeier minister of economic affairs and energy for germany christine lagarde the president of the european central bank and member of the board of trustees for the world economic forum herbert diese the ceo of volkswagen and of course david solomon the chairman and ceo of goldman sachs president lagarde maybe i can start with you given the recovery is clearly most dependent on the path of the virus at this stage and the lifting of lockdowns in 2021 what is the immediate priority in terms of any further macroeconomic intervention at this stage have we reached peak intervention in reality at both a monetary and a fiscal level and actually it's the path of the virus now that will matter most well jeff let me uh divide 2021 into two sequences if i may i think our hope is still that 2021 is the year of recovery but in two phases and phase one is clearly one that is still plagued with a very high level of uncertainty as vaccinations are produced uh supplied distributed as we see more lockdown measures sometimes more stringent as the variants are also now being rolled out in our societies and the latest data that we have for the euro area indicates that growth for q4 is going to be negative which clearly will have an impact in the first quarter of q1 in 2021 so we're really looking at the phase one where it is still about crossing that bridge to the recovery but where the journey seems to be a little bit delayed but should not be derailed and in terms of policies what it means for this phase one it means that fiscal still has to play a dominant role and has to be very active at the moment when we look at the numbers for the euro area in particular we see that the net balance from a budgetary point of view is going to be negative 6.1 that's that's in in the cards and in the books on the monetary front i have said repeatedly and i'm happy to repeat uh that our goal is to continue to support all sectors of the economy and to make sure that financing conditions remain favorable and that means you know from a bank lending point of view bond yields point of view but that financing conditions continue to be favorable and preserved as such so that that's phase one really where we have to stay the course and make sure that the situation is favorable if you if you then cross that bridge and get to the second phase uh where we have you know we are on the other side economy is reopening then the challenges are different because it's it's not the economy stupid i was going to say but it's not the same economy that we are talking about and it's most likely going to be a new economy which will be associated with positive developments and also with challenges as i'll mention four of each in the positive development many of our advanced economies particularly in the in europe have leapfrogged by about seven years in terms of digitalization second when you look at the way people actually work it's very likely that about 20 of the time that was worked in offices will be worked from home third technological changes uh are really uh affecting and and for the better the pandemic affected sectors and when you look at the vc capital that is being spent on those particular sectors that are affected by social distancing it's up 56 since december 2019. and finally and i think that's a critically important point for the longer term policies that have to be adopted now there is a very strong awareness by people that climate change is an issue that must be dealt with as a matter of priority there's been a survey which was recently conducted by ipsos which indicates that more than 70 percent in six in the 16 largest countries want climate change and the fight against it to be the priority so those four factors are clearly positive developments that will have to be taken into account on the other side of the challenges that we see going forward number one people when you look at the unemployment numbers it is not so bad it's up by about 1.1 in the euro area but that is really hiding actual numbers that are a lot worse because a lot of people are being discouraged from showing up as looking for jobs because they know that they will not find those jobs second when you look at the low-skilled versus high-skilled workers it's the former who have been most affected rather than the latter you have minus six percent of workers in those low-skilled jobs up to the third quarter and you have three percent up more skilled uh workers that are being hired in in our economy third one is that lockdowns that are affecting the economy are affecting all companies typically when we have a recession it plays as a cleansing element the pandemic is actually hitting the productive and the non-productive operations and that is also going to have an impact in terms of scarring going forward and fourth when we look at investment in innovation that has gone down as well r d numbers have gone down but gone down by 14 uh in the euro area uh this year in in 201 2020. so those four factors are going to be challenging when we look at policies going forward which will have to factor in uh what needs to be done and for that purpose in the beautiful presentation that we saw digitalization green green development and the financing that goes with it focus on education helping for the longer term but it means critically favoring and supporting investment into this new economy so while both on the fiscal front and on the monetary policy front authorities will have to stay the course and to continue support at the same time investment will have to really be focused in order to lay the ground for a new economy where scarring will have be hopefully avoided or reduced by the measures that could be taken as you point out in the short term monetary policy must hold the course can i ask you there was a change in language around the pep uh statement last week we seem to move from target to envelope on the pep and the market took that as hawkish and then we saw things like italian yields trade higher on the back of that was that just a misunderstanding on the market's behalf as to to what extent the pep the full 1.85 trillion euros could be used you know it was not a new development by any account because it was clearly stated in the statement as you mentioned of december and there has been no particular change in that respect we took the view that the the driving um the compass that we need to have is favorable financing conditions and making sure that in this world of high uncertainty that we have around related to pandemic related to vaccinations related to lockdown measures and so on and so forth financing conditions should be a certainty and investors whether you know be they consumers or corporates or sovereigns should feel confident that the financing would be available for consumption for investment so it there is no change in what we decided in december it is still still the concept of an envelope that will be of the appropriate demand dimension in order to preserve the financing conditions and make sure that they are favorable for consumption for investment by all sectors of the economy and uh that that will continue to be the case i think i've said very strongly and i'm happy to repeat that number one the ecb will be in the market for an extended period of time and the ecb will make sure that financing conditions are preserved at a favorable level in order to make sure that we ultimately deliver on the inflation target that we have so it's it's you know no no change in that respect whatsoever since december and the envelope as i said can be smaller if financing conditions uh remain favorable but it can be larger if it needs to be larger to maintain those favorable financing conditions there is no ambiguity and no doubt in our minds thank you so much for that minister altmeier if i could come to you as we look at this pandemic it's extraordinary that tariffs are attacks on trade and attacks on growth how will europe and germany specifically persuade the new biden administration to roll them back well i i do not believe that we will have to persuade the new administration my personal belief is that many of the people i know personally at least from the past are already uh persuaded that we have to rely more on open markets that we have to rely again on multilateralism this was something that was highly controversial in the inner u.s debate for four years and now we we should give them a chance of not only developing but also implementing their ideas we will engage in very intensive exchange of views and ideas it is it is a critical situation on the one hand we have a recession worldwide and the poorer countries are suffering much more than the wealthier ones second thing is we have learned something some lessons from the past recession and the banking crisis international finance as christine lagarde has pointed out have remained stable during the pandemic we have been able after the first wave of the pandemic to re-establish supply chains and now the question is can we can we encourage economic growth despite the ongoing pandemic and this is something uh that we should have in mind even if some countries like israel or the uk will manage to have vaccine for most of the population within a month for others for poorer countries it will take not only months but a year or two until this pandemic is over and what we have to learn is how can we organize economic growth and success during the pandemic without a further distortion of level playing fields and i see as as christine nagat has already said i see a good chance to create synergies synergies between economic growth and climate protection climate policy implementation of the paris climate agreement to give one example and this relates to green hydrogen we have realized that queen hydrogen is a missing link of energy transition in most of the industrialized countries uh we will have to import it from other countries so if we could if you could organize an international green hydrogen infrastructure where it is produced in countries with lots of sunshine and wind and when it is where it is shipped to other countries or even where indus because some of the breed products will be fabricated with citrine hydrogen in south america in other countries developing countries then it could have a very stimulating effect to the world economy research minister many of these projects require close coordination among western governments and western powers do you think it was a tactical mistake to sign the china eu finance deal ahead of the inauguration of the biden administration no i think i think this was not a mistake because what we have signed is a i would say a large part of twin of arrangements the us already have with china and it's about creating a level playing field so i'm i'm very optimistic that we can develop and negotiate and sign more similar agreements worldwide and that the us will also follow this path in their negotiations with other countries worldwide minister lemay let me come to you you said last week that you see a change in position in the us on taxing tech giants structurally clearly this is part of the restoration of growth but surely any new taxes at this time send a negative message to all businesses about them investing for growth how do you balance the two things i i think that you can have two objectives for the short term the first objective as christine lagarde just explained is to continue supporting the sectors that have been the most heavily hit by the crisis and i just want to insist on the fact that fiscal has remained the fiscal policy has to remain very active since this is not the end of the pandemics and many sect erotic sector for instance with airbus is um still asking for more financial support and it must be clear in all european countries that till the epidemic is still striking our economies we need to have a fiscal support to these sectors but we also have to think about the future and as peter just said we have to first of all invest on innovation new technologies and do our best efforts to keep the same level of investments otherwise we clearly run aries we european countries to go out of the technological race of the 21st century and we have to think about the kind of economy we want to build we want to build a sustainable economy we want to reduce the inequalities among nations and we want to reduce also the inequalities in the international taxation system the winners of the economic crisis are the digital giants how can you explain to some sectors that have been severely hit by the crisis and that are paying the new level of taxes that the digital giants will not have to pay the same amount of taxes this is unfair and this is also an from the financial point of view and i think this is very good news that the new secretary for the treasury janet yellen just explained to the uh senate that she was open about the idea of thinking about a new international taxation with the two pillars first of all digital taxation and of course also a minimum taxation on corporate tax so i think that we are on the right track there is a possibility of finding an agreement on this new international taxation system by the end of this spring 2021 and i can tell you that we will do our utmost efforts to pave the way for an agreement and as i introduced this panel i mentioned the need to get the vaccine programs running smoothly is there a risk that france's slow rollout will delay the speed of the recovery there no i think that president back home made very clear that we want to accelerate on the vaccine because we are fully aware that there is a direct link between vaccine and economic recovery and i also want to make clear that the key challenge that we all have to face is to give a short-term response to the consequences of the crisis i mean the social consequences the economic consequences on some very specific sectors while building the future and that's clearly the most difficult challenge that we have to face because of course the easy solution would be to focus only on the short-term responses it would be a strategic mistake for all western countries and especially for european countries we have to give our short-term response while thinking about the future remaining in the investment rates and the innovation rates while building new technologies funding disruptive technologies and thinking about the kind of economy we want to build together and can i just follow up on that um if regulatory reform and restructuring is path a part of the key to lifting growth is it time for france to embrace foreign investment even if it means that you lose a supermarket or a yogurt maker to a foreign buyer i i can see what is behind your question i want to be very clear on the question of kafu everybody can understand that um it was not the right timing and it was not the right way of approaching an investment of such an importance in france during an economic crisis everybody can understand that and i can assure you that i'm defense that the u.s if a foreign investor wanted to buy walmart for instance would have given exactly the same response no and if in germany someone wanted to build for instance volkswagen with a herbert attending our meeting i'm deeply convinced that the response would have been from peter no so our response was quite clear it was no it does not mean that we are not willing to be the most attractive country in europe and i just can confirm that we want to be the most attractive country in europe for foreign investment we have decided with prelim macron to maintain all the fiscal measures and all the reductions of taxes that we had planned from the very beginning of the mandate of emmanuel macron and we are just out of a very important meeting called choose france where many ceos of all the planets decide to attend the meeting because they want to invest in france and i want to tell them you are most welcome in france please come in a territory invest in france you are much welcome and do not mix the single question of careful with the big question of france and our attractiveness minister thank you so much for your answer david solomon let me come to you um president biden appears to be now getting pushback on the need for another 1.9 trillion package at this stage um we've heard a lot of the other speakers talk about the need for fiscal support still through the first half of 2021 but in america is it actually necessary with consensus gdp forecasts running anywhere between four and six and a half percent i think your own bank is towards the upper end for 2021 is it necessary for another 1.9 trillion to be directed at the economy uh so i i appreciate that question and there's there's an enormous amount of focus on the size of additional fiscal stimulus that's necessary here in the us i think one thing's for clear one thing is absolutely clear we do need some more fiscal stimulus to continue to bridge the gap to continue to allow us to move you know through this tunnel and get to the other side there's still an enormous amount of uncertainty as other panelists have talked about in the context of the vaccine rollout and how that will proceed i i do think that it's appropriate though to think about things in the context of that stimulus that are really necessary right now to drive us through that bridge there are broader policy issues some of which we've been discussing here so far on the panel about more inclusive participation over time that clearly need to be addressed but don't necessarily need to be addressed right now at the end of january and so i think in the context of bipartisan progress it would be important to focus on those things that are necessary to get money where it's needed to continue to create this bridge so that we can have more sustained economic recovery until we can get to the other side until we have more people vaccinated and then that trajectory can continue in the near term i think you've expressed some reservations or should i say uh concern about the froth around spax and other capital market activity um how real is the risk to financial stability as you see it at the moment because obviously dealing with one crisis we certainly don't need another well i i i think you need to separate the context of the potential for volatility and some excess of markets with with the word crisis and so you know at the moment i'd certainly i certainly see things in the market that are concerning to me we have very very low rates and we're clearly going to have low rates for a long period of time when you have low rates and capital is very inexpensive it obviously does fuel some speculation there's benefit and we need it during the time of the pandemic of this very very loose monetary policy but there's consequence on the other side i do think that it's appropriate to be looking at something like stacks and thinking about what the consequence of this capital markets innovation can be as i said last week on our earnings call there's benefit i think this is a good capital markets innovation but like many innovations it can go too far and i think at this point there's an enormous amount of capital being accumulated and the incentives may need to be rebalanced and that needs to be rebalanced over time i think at some point the market will naturally flush some of this excess out but that doesn't necessarily mean when the market that flushes that excess out that we have some sort of a market crisis it can be just a rebalancing of markets over a period of time hermitage the the pandemic has exposed supply chain for fragility particularly for you with global chip shortages is the right answer going forward now to manufacture closer to home and with say in your case german or european suppliers mainly no i wouldn't say so we are we are also in the future relying very much on open supply chains and share distributed labor all over the world and there are manufacturing sites for specific uh computer chips which you wouldn't find in parts of europe but not even in the united states so you have to make sure that the markets remain open the supply chains remain intact and even this pandemic was tough on logistics now we basically we could manage to get through it and we have many parts which are really traveling across the world so our target should be not to become let's say regionally fully independent i think there's a big advantage for the world to to produce in this in different locations wherever there's competitiveness so that's clearly a a vote for uh an open trading system here let me let me ask you a slightly different question um christine lagarde and a lot of other speakers have talked about buildback better with a focus on the climate and esg more broadly you are grappling with chip shortages you are grappling with a pandemic you are electrifying as quickly as you can to meet the new demand for electric vehicles greener vehicles but at the same time you're going to be fined 100 million euros because you missed a climate target does that make any sense to you isn't that 100 million euros you could better spend in investing in offsets or indeed in electrification yeah definitely we wouldn't we wouldn't have i'd say say we didn't like to pay that fine of 100 million now that happened because we just launched a few of our electric cars in the midst of the uh coveted pandemic you know the porsche tycoon for instance the audi drone but we missed the targets by a very minor amount by half of a gram basically we reduced our co2 footprint by 20 or close to 20 percent and we will fulfill the targets in 2021. uh we think that let's say the new targets the climate change is an opportunity for innovation for let's say producing cars and mobility with a lower co2 footprint i think for the innovators we consider ourselves as innovators in that industry it's a chance yeah let me bring the the conversation then back to you um uh christine lagarde madame lagarde president legarda constantly trying to work out um what is the appropriate uh address these days but um president bring this let me let me bring this back to you um we need to see clearly a change that brings about a more equal sharing of the resources and the profits that we generate through global growth so my question would be how do we make sure that the climate-related spending that's being touted now as a pathway to growth is not just another cynical transfer of public money to consultants lawyers and private companies that's a really good question jeff because i think that a lot of work has already been done and we've covered part of the journey in other words there is a political impetus there is a momentum the regulators and the policy makers seem to be aligned certainly in this part of the world and determined to address the issue of climate change the situation that we face is that there are multiple dimensions that need to be addressed and i would mention three of them the first one is including and by that i mean all these externalities that we have tolerated for such a long time in other words you know the the price of uh destruction of our environment and the cost of climate change that has to be included so that we have a pricing mechanism and prices that actually reflect the reality the second is informing because it's also called disclosure in in proper parlance but it means essentially respecting the same principles and indicating what efforts are being made in order to reach the net zero levels that is the target and three investing and i think investing in innovation and the three of them actually come together we all have in the back of our mind a very difficult experiences of trying to price uh carbon trying to put in place carbon taxation and clearly if those measures were taken today we would be in a different place because there has been more investment in innovation and the cost of non-fossil energy that are now produced has gone down significantly so when you know in those days when carbon taxation was a burden on those who needed the energy today that energy is a lot cheaper and available so these you know informing investing in innovation and um including they come together and then they interact together but you're right that we need to measure we need to rate we need to understand exactly on a granular and standardized basis who is doing what in what sectors and the last thing that we would need is the kind of green washing that would be based on uh uncoordinated non-standardized measurements so as a result of that we need to have concerted action by all you you know whether it's the rating agencies whether it is the regulatory principles that apply whether it is the kind of disclosures that have to be made all of that needs to work in tandem in order to produce what people actually want and i think the last thing that they would like to see is that all the public money be actually spent for the benefit of you know some standard setting processes and mechanisms that would actually give no results so it needs it will not be only achieved by the public sector but it needs to be driven measured aligned and set in terms of principles and targets by the public sector so that private participants can actually understand what the prices are what the markets recognize and how risks are managed and central banks are not policy makers in that respect but they will do their share as well and minister altmeier clearly what's critical for the private sector is access to capital and le and yet as we as we compare europe and the recovery with the recovery in the united states it's clear bank lending in the euro zone a main source of capital is contracting at this point structural shifts to market sources of funding seems to be very slow at the eu level and the uk financial services approval process appears to be now being deliberately delayed is is politics at risk of strangling access to sources of credit for european companies who want to make these investments well i'm i'm fortunately i'm not the minister of finance i'm the minister of the economy so let me let me put it like this what we have very successfully organized in europe over the last six seven months is solidarity with regard to the support measures that were taken that was to uh to avoid harm for the economy for large parts of the economy and we were quite successful in this and that means our unemployment it means a lower recession and that was quite well done the second point is we have to unlush investment we have to unleash structural reforms in order to generate the capital and the finance that we need and this is something that is that is not yet not yet fully achieved because we have to restore trust in the capacity of europe to defend its industrial base in the capacity of europe to compete with regard to digitization with other regions worldwide with regard to innovation i mean we have a situation that we have been used would use the startups in israel in europe and germany but most of them became american citizens after a while so we have to make sure that the european model becomes looks more attractive than it has looked for quite some years that is the big challenge ahead of us the equality of opportunity as we restore growth is critical it seems to me david solomon wall street has done very well um less so the real economy wall street and the so-called one percent did very well from the gfc recovery as we look further out what is the right way to level the playing field when growth comes back strongly well i i think we talked about this a little bit earlier jeff we've got to continue we've got to separate actions that are necessary right now from a monetary or fiscal perspective to bridge and get the economy going and then we have to consider very carefully policies that are more inclusive and allow as we go forward broader participation in the economy and solving some of the disparities in the economy that have really been laid bare by the crisis i think one of the places for example that there's no question from a policy perspective we need continued focus is when we look at small businesses which is such an important part of the economic engine of all economies and in so many communities play such a vital role you know how do we make sure that those businesses which have so badly been hit by the pandemic are supported and that we have the right policy to allow them to thrive as we move forward so i think we have to continue to think about policy that's sustainable that brings more people along that creates the right distribution so to speak but also allows the free markets to innovate bring investment capital into places where you can create new technologies and spur growth we've got to get that balance right and i think that's that's a policy focus that's going to require a lot of work as we come out of the pandemic and continue to focus in the years ahead and bruno le mans you spoke very eloquently about the need for this and how you see digital taxes as playing a role in this can i just ask you to pick up the point uh from the back of of david's comments would you argue i know there was a lot of talk about how the the employment support schemes in europe seem to be stronger and more efficient than we saw very early on in the united states in the early days of this pandemic do you think europe can actually show america something when it comes to uh guaranteeing any a more equal sharing of profit to labor rather than just back to capital i think that we all have to draw the lessons from the crisis and we all have to learn from one each other we have to learn from the us and i think that the us also have to learn from the way we have faced the crisis at the european level and one striking point is that for the first time in our recent history we have taken i mean all the 27 member states and especially the 19 members of the eurozone the same kind of measures to face the crisis we have decided to support the employees and i think it was the right decision and it will allow us to have a quick rebound as soon as a growth will be back the same for the private companies we have decided to provide state guaranteed loans to the private companies and it would be very efficient because it has avoided us to have two important numbers of bankruptcies and it will allow us as soon as growth will be back to have a quick rebound and thanks to that kind of measures i think that we have been able to build a kind of new european economic model which could maybe inspire the united states on the other hand we all have to do the lessons from the lack of capital and you just raise the issue and david also the lack of capital in europe this is a major issue if we want to have more important companies if we want to be able to fund the new technologies i mean hydrogen artificial intelligence the new companies in the field of data storage for instance we need to have a better access to finance and to capital which means that we have to accelerate on the capital market union and on the banking union that's clearly a point on which we are too weak we have to accelerate i know that christine shares exactly the same point of view and we have to do really our best efforts to build a capital market union as soon as possible to build a strong banking union as soon as possible and to make euro an international currency as soon as possible and i want to thank christine lagaan for all the efforts she's doing on that direction herbert let me give you a tricky one just before we wrap up here um china has just overtaken the united states in terms of attracting fdi um i think 40 percent of your sales now are into china china is not going away in fact as part of the um the path to recovery in the west it seems to me more engagement with china has to happen how do we negotiate the challenge though of engaging with a partner who at times doesn't seem to play fair and crosses the line when it comes to the treatment of many of its own citizens i think that china is moving in the right direction i think the treaty between europe and china is a good move forward we just last year 2020 we could really we could make sure that two of our joint ventures are now maturity owned by fox 1 which was over 30 years basically since we are there impossible we have bought a major stake in one of the major batteries at last so actually for me it feels that it's easier to invest in china than china is allowed to invest here in germany or in some other pages so we are clearly advocating for a further opening up of china for further commitment towards china and for a multi multilateralism which also allows always on a fair basis and i think always we have to negotiate a heart with china because it is an unbalanced it's a huge market they have their own interest but they're also depending on the west we are depending on china so let's get back to a world where we benefit from each other development and not just try to isolate and make uh things for ourselves first china is a huge opportunity china also technologically is advancing fast we are the biggest automotive or car manufacturer in china we have a strong asset there we have many development engineers there and we are developing in china also technology which we are then using in europe and in the united states so let's get and i really i have high hopes that uh after that uh i hopefully it was a transition period where let's say uh the world became smaller and more isolated and and polarized again we are hopefully heading back to a more open world with free trade and and hopefully at least bilateral agreements but hopefully worldwide agreements for open trade i think it's much better to try to cooperate and work with china that try to to isolate china also as this was probably your your point no addressing asset also if and and we cannot uh let's say we share not the same value uh like in china and we see clearly that democracy is not probably developing fast enough but still i think trade communicating bees being there participating is much better than moving out and leaving china let me finish with an audience question and thank you everybody for for tuning in to to watch our panel here and the question is for you uh president lagarde jody padilla writes from global shapers how do we build this new economy this recovery that recognizes the importance of women's contribution and re reinforces its economic value certainly by bringing more women to the table and various countries have demonstrated through the use of quotas of targets of minimum france is one of them that actually now has 40 percent of women on the board of companies that progress can be made and that woman can do the job just as well as man thank you very much and thank you very much and thank you to minister lemay minister altmeier herbert deiss and david solomon for joining us on this panel and thank you everybody for for tuning in to this world economic forum event thank you you

Show moreFrequently asked questions

How do I add an electronic signature to a PDF in Google Chrome?

How can I add a signature space (field) to my PDF so that I can sign it?

How can I sign a PDF with just my finger?

Get more for deliver currency field with airSlate SignNow

- Print electronically sign Performance Evaluation for Students

- Prove electronically signed Cease and Desist Letter

- Endorse digisign Market Research Proposal Template

- Authorize electronically sign Voter Agreement Template

- Anneal mark Willy Wonka Golden Ticket

- Justify esign Arizona Rental Lease Agreement

- Try countersign Demolition Contract Template

- Add Franchise Agreement signature

- Send Receipt Book Template email signature

- Fax Letter to Manager for Promotion signatory

- Seal Nonprofit Press Release electronically signed

- Password Sales Quote Template byline

- Pass Boat Bill of Sale esigning

- Renew Vehicle Service Contract signature block

- Test Payment Receipt signature service

- Require Founders’ Agreement Template countersign

- Print recipient esign

- Champion guest digi-sign

- Call for boarder signed

- Void Affidavit of Title template countersignature

- Adopt Change in Control Agreement template digital signature

- Vouch Drink Ticket template electronically signed

- Establish Christmas Gift Certificate template digi-sign

- Clear Home Improvement Contract Template template esign

- Complete Website Design Inquiry template signature block

- Force Meeting Minutes Template template initial

- Permit Surat Kebenaran Perjalanan Ke Tempat Kerja template signature

- Customize Employment Verification Letter template email signature