Demand Mark Request with airSlate SignNow

Get the powerful eSignature features you need from the company you trust

Choose the pro service made for professionals

Configure eSignature API quickly

Work better together

Demand mark request, within minutes

Decrease the closing time

Maintain important data safe

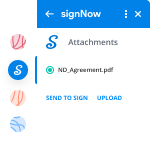

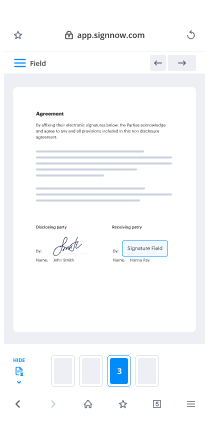

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

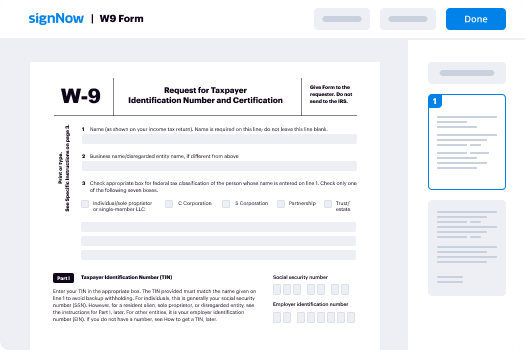

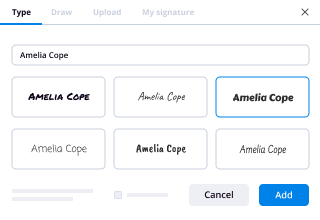

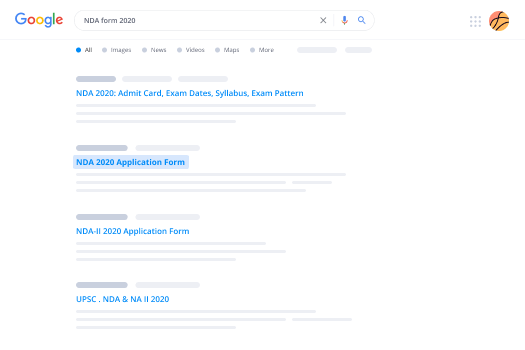

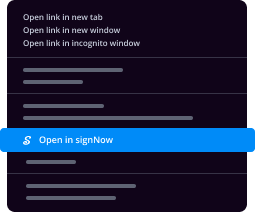

Your step-by-step guide — demand mark request

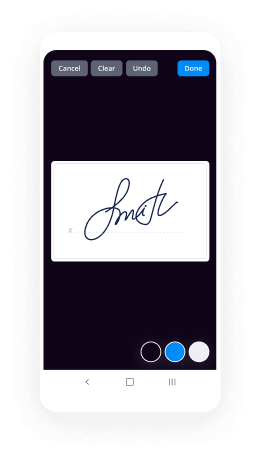

Adopting airSlate SignNow’s electronic signature any organization can enhance signature workflows and sign online in real-time, providing a better experience to customers and workers. demand mark Request in a few simple actions. Our mobile-first apps make working on the go possible, even while off the internet! eSign documents from any place in the world and complete trades in no time.

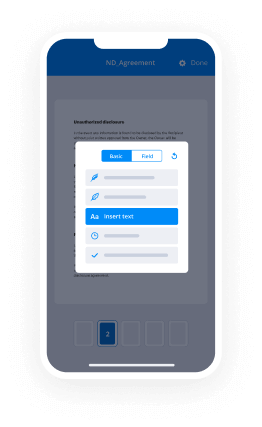

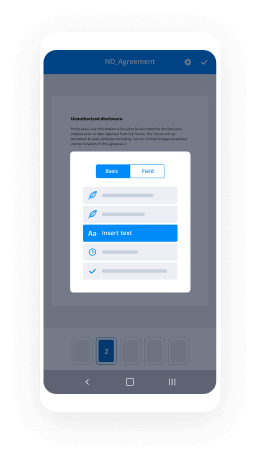

Take a walk-through guide to demand mark Request:

- Log on to your airSlate SignNow profile.

- Locate your record in your folders or upload a new one.

- Open the document adjust using the Tools list.

- Drop fillable areas, add text and sign it.

- Include several signees via emails configure the signing order.

- Indicate which recipients can get an executed doc.

- Use Advanced Options to limit access to the record and set an expiration date.

- Press Save and Close when completed.

Moreover, there are more innovative capabilities accessible to demand mark Request. List users to your collaborative workspace, browse teams, and keep track of collaboration. Millions of customers all over the US and Europe agree that a solution that brings people together in one holistic workspace, is exactly what enterprises need to keep workflows working efficiently. The airSlate SignNow REST API allows you to integrate eSignatures into your application, website, CRM or cloud. Try out airSlate SignNow and get faster, easier and overall more productive eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results demand mark Request with airSlate SignNow

Get legally-binding signatures now!

FAQs

-

How do you politely ask for request?

Suggested clip Polite requests and questions | Spoken English - YouTubeYouTubeStart of suggested clipEnd of suggested clip Polite requests and questions | Spoken English - YouTube -

How do you politely ask for something?

Suggested clip Polite requests and questions | Spoken English - YouTubeYouTubeStart of suggested clipEnd of suggested clip Polite requests and questions | Spoken English - YouTube -

How do you politely ask your boss to do something?

People always resent being ordered around so make sure to avoid using imperatives when making requests. Saying, \u201cGive me some time off\u201d will never please your boss. Instead, start your request politely, for example, \u201cI'd like to request some annual leave\u201d or \u201cI'd appreciate it if you could give me your feedback\u201d. -

How do you ask for something in an email?

Step 1: Focus on the recipient. Remember: Your message to the important person should be focused on THEM. ... Step 2: Sell your benefits. Let's face it, you're trying to sell yourself here. ... Step 3: Make saying \u201cno\u201d impossible. -

How do you politely ask for a formal email?

Do not be in a haste to do a follow-up. Wait for a few days, you may wait for about two days. If you do not get a response then you can send a message reminder. ... Be sure to come up with the right intention. If it is urgent, say so and explain briefly why it is urgent. -

How do you formally ask for something?

You start the email or letter by explaining what you are writing about (the topic/subject) and what the email's purpose is (i.e. you want to ask them some questions or for something). Then in the next section, you ask them the questions or requests. -

How do you write a formal letter of request?

To write a letter of request, start by greeting the recipient with \u201cDear,\u201d followed by the person's last name and title, or \u201cTo Whom It May Concern.\u201d Then, briefly explain who you are and why you're writing in the 1st paragraph. Next, provide additional context and details about your request in the 2nd paragraph. -

Does a request end with a question mark?

Requests. Requests that are phrased as questions should end with a period. These are really requests or commands, and not true questions. -

Does Could you end with a question mark?

Hence, you should always terminate any sentence beginning with "[Please] could you" with a question mark. -

Do questions always have question mark?

In formal writing, even rhetorical questions must always end with a question mark, so says Fowler and probably most other style guides. In informal writing, and perhaps with certain short questions that have become fixed expressions, a full stop could be used instead. -

Does a full stop come after a question mark?

Answer and Explanation: No, you do not need to put a full stop after a question mark, since a question mark already shows that the sentence has signNowed its conclusion. -

Do you put period after question mark?

A question mark is the proper punctuation to a sentence that asks a question. A question mark serves as a full stop (period) that signifies the end of the sentence, hence there is no need for you to write a period after a question mark.

What active users are saying — demand mark request

Related searches to demand mark Request with airSlate airSlate SignNow

Demand mark request

um okay hi everyone we are about to start another three minutes just would like to do some sound checks before so just give me a sign on the chat box please if you can hear me and see my screen and if everything is good great great great thank you very much for the information so i'll wait another two or three minutes i'll be back to you in two or three minutes thank you okay hi my name is sneer and welcome to the fivers trading room it is the beginning of the week so we will discuss a few pairs we'll analyze them together uh it's probably for those who already know me i usually trading rely on supply demand method only how to define supply and demand on the charts how to predict uh what can be the target for the position and and more and more of course so we will show some examples about supply and demand we will talk about the the past the not the very far past but we will see what the price done in the last few weeks and then we will look for opportunities together for the upcoming week and of course if you have any pairs that you prefer to analyze if you want to share your idea if you have any comments you are more than welcome to write it down on the chat box just to remind you at the bottom of the checks box you have the line that you can see that it's written in a 2 which means who will see the message you you write so if you choose the all panelists and attendees then everybody can see your message of course only if you want and so you are mother welcome to write and share with everybody your idea and comment and if you have any other assets you prefer to analyze you can also write it down on the chat box i'll do my best to answer all your requests and all right so we will start for now with the uh as joshua just asked the aud against the swiss all right so let's take the aud against the swiss here it is okay that's good i'll just close this so we can see all the charts clear and this is the 4-h time frame i start with a high time frame daily or 4-h time frame i'll give some critical levels and maybe a upcoming opportunities for the swing long-term traders and then we can roll down to the lower time frame and see if there is any opportunity for sculptors swing traders easter day traders and on and on all right so this is the 4-h time frame this is the daily as you can see on the daily chart we can definitely say that the price is in a bullish momentum at the moment and still is in bullish momentum we can see the last load that the price created this last significant load that you can see very clearly in our eyes it's this one here here above there is a red line i'm not sure why i set the red line there let's check if there is any reason for that we go to the left it is maybe the next available supply that i predict the price tends to reach for now so i'm not sure about this this is the next available this is the next resistance area as you can see here above it is resistance again it's not supply which is a huge difference it's not a level to sell on the first touch if we talking about a level that i will sell on the first touch once the price register it is the next available supply approximately here at least from what we can see on this daily chart this is looks like a supply level since from the moment the price dropped from that level it never came back until now so that will be the next available supply i'll just switch to the weekly chart and it's here above all right so i'll definitely consider to sail at this level on the first touch of the price it's still far from that level but you know not that far it's about 200 pips approximately the price can reach there even this week maybe so i will keep following this one so that's for the long time frame and that's the next level i will consider to sell on the first touch here above okay and back to the for each time frame and to be honest at least for this 4-h time frame i cannot find any significant demand that will continue this bullish momentum i can understand why the price stopped here it is just lying down exactly on this level this critical level which is seems like a demand not not the perfect and a perfect one that i would choose to buy on but i can understand the reaction so far so that's the situation for the ud swiss for the long term this is the one h time frame i'll go to the 15 minutes and see if we have any opportunity for the daily intraday or short term and i think maybe here above okay i would take this level i would risk all this level if i was a short term even sculptor on but to be honest even if we go to the last button it's approximately 15 pips and aud swiss i'm not sure it the correct pair to trade is a scalper since the spread for the ud space is a bit a little bit too high for scalpers so anyway i i don't see any other great opportunity for intraday according to this 15-minute chart okay any questions why are the weekly and the monthly calendars busted yes you're right i'm not sure why this is the weekly and you see only from this time from 2014 it's seems ugly i will ask to check it with our liquidity providers to check the feed data and fix it of course yes i saw it and we'll take care of it all right and all right so that's for the aud swiss let's continue with the pound dollar as someone just asked this is the pound against the dollar okay this is the forage sorry this is the i start with the daily as as we we can see that the price uh we would say i would say struggling to continue is bullish momentum you can see how it looks it's it doesn't seems like a powerful momentum but still the price still in the boorish in a bullish zone all right that's the situation on this daily chart and if i'll take it to the 4h time frame this is how it looks okay sorry okay also in this forage time frame to be honest nothing critical happened from the last time we just spoke about this pair uh go back to the weekly chat and as we said before i do believe that the price tends to reach somewhere here above this level at the top here i would like to see how it looks on the daily chart at this time here so let's just put in line approximately in this area here and change to the daily chart and roll back just to try and so you can see one supply here and there is probably another one somewhere here above you cannot see it according to this daily child but if i would get these times on the forage time frame then i almost sure that between these two candles we would see some something that looked like supply in this forage timeframe we would see some few small candles and then the price dropped from that level but at least from what we can see in this daily chart this is the next level that the price probably tends to reach this is the next available supply i would definitely consider to sell here on the first touch especially after the price continue up on the way he is continuing now it seems like a bullish momentum on the daily chart but doesn't seems like a powerful one to be honest it seems like a powerless momentum so this is the next available supply you can see this small one it's the one before this is where the price now you can see by the gray line and you see here this is the reason here above this is the reason we can see the reaction here it's the supply that we just saw on the left just just to show you how critical is this levels you see this one and a half two small candles then the price drop down from that level and here is the first time the price get back to these levels since created it all right very accurate this reaction that we're just getting here now a bit above it's because of the supply we just saw from the left above this one we have the next one that we just marked according to the daily chart here so few conclusion we can get from this situation if the price will break out this supply i didn't mark the the up level of this supply but it's approximately where i put the line here so if the price will do some significant break up towards up then i will look for a new demand a good price action a good setup to buy since if the price will break out this level then i'm almost sure that the price will tend to reach the next one above and i'll try to look for a fresh demand and continue the uptrend as long as the price didn't reach that level i try to jump on this train if i'll get an opportunity of course so this is one scenario the second scenario is if the price from that level that we can understand now why we seen this reaction here we already had a almost 100 pips reaction from that small supply that we saw on the left so if the price from that level will continue down and will break out this level then we can look for a cell position because if that happened then we probably will see the price continue down at least to this uh support slash demand level this critical level here so it's still far away but that's the next available situation i can see this is the one h time frame all right here we have this reaction of disney man you can see how beautiful it works few small candles which represents the struggling between buy and sell orders and deploy had huge imbalance between buy and sell orders and this is the reaction this is what we got this is the result the price run away from that level also here and that's the reason we can take the risk here and buy on the first touch this is the first touch here and this is the reaction so you can see you risk only this level and you can see the potential even if you just go to the next to the next stop that the price created here it's more than enough so that's the situation now this is the one age time frame i don't see any significant opportunity something clear i don't find it to be honest the price creates this drop down and there is some supply here and i can understand this reaction if i would introduce calper i would maybe take the risk here maybe we can get a better picture on the five minute charts yes that's the level so selling this level it's definitely a great level according to this five minute chart for intra-day trader to be honest if the price will go higher to this level i will consider to sell here also here above we will back to this one okay now we take the euro against the pound so where is the euro against the pound here it is okay weekly chart daily chart according to the weekly chart since the price on his way to which these levels here you can see this demand and the reaction here and now the price is just lying on this support which was previously demand level here you can see the two small candles and then the price ran away from that level here this is the first and the second touch and the third and fourth five times so it's definitely no more demand level it's support level so i wouldn't buy here definitely or not on the first touch and it's not say that i should sell here but okay this is the 4-h time frame to be honest it it seems like a bit kind of left shoulder then the head and if the price will tends to complete this pattern if we just go to the same line as the left shoulder here and just by accidentally we also heavier a demand level then we have a good reason to believe we maybe should take the risk at this demand it's also combined with this left shoulder and you know if we are wrong we're going to lose this maybe but if we write that's the first target and here this supply is the second target so we have a great risk reward potential at this situation i would like to see how these levels look on the 15 minute chart and this is how it looks the price already was here which is not far from that level i would take the risk here and risk all this level here okay we'll take the risk and if we if we we write we have a really great potential here so it's not far from now so i would take the risk of this level and buy on the first touch in this 4-h time frame you can see a bit better the left shoulder head and if the price will get good reaction here it will complete maybe the pattern and then we can get inside this pattern one step before everyone realize it okay so that's for the euro against the gbp that's relevant also for the short term intraday traders i don't see any other great opportunity and okay we will check the euro dollar soon and all the rest all right hi aaron you ask if there is supply on euro gbp at 0.9005 let's see zero point nine oh sorry well approximately here maybe between these two candles we can check it in this 15-minute chart well there is something this is the level you talk about and but to be honest as you can see in this 15-minute chart uh you see we don't have at least we don't have even one big huge red candle that can show us that the price really run away from that level aggressive and strongly it's not the perfect situation i'm looking for that's look a bit better or here as you can see this is something in the middle i won't take i'm not saying that we won't see reaction most likely that we will get reaction in this level it is not the perfect perfect picture that i'm looking for when i'm looking for supply or demand that's my opinion at least so but there is something there all right so the next one we will check it will be the euro against the dollar and then the dollar against the end so let's see if we have something interesting for the euro dollar we start from the daily chart and we can see all this way down that the dollar just start to get strong against many other pairs also not only against the euro and to be honest if the price already reached that level here i tends to believe that the price will try to reach at least the next available demand here and maybe even this support level so let's see if we have any opportunity to join this downtrend sorry this is the 4h time frame this is how it looks it still looks like great demand level i think we discussed about this demand also in our previous trading room this is the one h time frame and this one it seems like a great supply it's exactly the picture we are looking for and it's a reaction for the original supply here from the left which seems like a bit more dramatic uh here we just have nice red candles uh again it's the one h time frame so i'm not sure let's take a look on this 15-minute chart and this is how it looks in this 15-minute chart not the perfect level but if i would consider to take the risk there maybe here just at the very top here let's go back to the one age time frame and here okay i would take the risk here once again it is not exactly a fresh supply also the price ran away from that level with a good power but still it's kind of supply slash the problem because the original one it's here from the left and but according to the to the way that the price moved from that level last time it seems like still there are unfilled orders here waiting for the price so i will take the risk again here maybe and 15 minute age 15 minutes time frame if we just go down we had this demand that already checked so we will probably see the price get some technical correction next time only here below seems like the next available demand i want to check if we have good supply here above to sell and this area maybe one minute chart you can see so that's the situation for the euro dollar for now for the short intraday traders there is a buffer of 45 pips approximately between these two levels i would consider to sell here on the first touch in order to take all the way down or if the price reached there first to this demand then i will buy here on the first touch and let the price correct i will be more more careful with this demand okay because still the momentum if the price reached there the momentum is still bearish at these time frames okay all right so that's for the euro against the dollar i just would like to share with you my position from few days ago and i think i discussed this one also in the last trading room i just broadcast in the last thursday and this is the pound against the kiwi and you can see how beautiful supply demands and how accurate supply demands level works all right that was the supply i was just enter on and that was my risk this level all right and you can see the great risk reward potential i'm already in this 230 pips i risked only at the beginning my stop-loss was just above this level about 80 pips and now i'm already in a great profit i already closed part of the position somewhere here and this is where is my stop loss now much below the entry level okay so my final target is here this is the profit the the take profit just below hopefully the price reached there okay so see how accurate it's not always that accurate i do admit that i had a great luck at this situation i could miss this position by one pips but at this time it works in my favor and it is a great position okay so dollar against the japanese yen us dollar against the japanese yen let's continue with this here it is and okay this is the one h time frame i'll start with the daily to be honest for the long term nothing new happened with this pair you can see the price struggling to continue down every down movement right after the price had a technical correction for each movement we can see the technical correction immediately it's not a compression but you can see how it looks it's not a strong movement like this one or this or this one this is how it looks so and for now the price on this daily chart is still bearish of course okay this is the forage time frame and just fall down to see oh sorry i missed one of the questions someone asked about the pound against the kiwi if we have a demand now well i'm not sure if i answered this because i didn't see your questions here on the left we don't have a demand we do have maybe some level difficult level with a maybe small previous demand here which already tested by the price once here but we don't have any demand not until this level here below because you can see here it's a support it's the same level the original demand was somewhere here check one two three it's all support levels each level here already tested by the price at least once the next available fresh one that the price didn't test yet it's here below all right and below it's this one so that will be the answer for this one and we will check the kiwi against the door soon i'll continue with the dollar yen okay so again nothing really changed for the swing in long term i'll just roll down to the 15-minute chart and see if i'll find something interesting we have a supply here as you can see that the price uh really break out and that's also something that's important to see that sometimes the price breaking out supply demands and create new one is this one created and broke out this one okay and then the price turned back to this one and we do have the reaction okay it's only 15 pips but that's the movement that the price predictors and and provide us at this at the beginning of the week so that's what we got so far uh also in this 15-minute chart to be honest i i don't like the kiwi uh sorry the dollar against the japanese inn uh all the last time i i don't see any clear opportunities on this pair in the last few weeks so just leave it and all right okay we talk about the euro dollar let's take the aussie against the kiwi i think it's been a long time i didn't check this pair and someone asked for it so let's go for it the australian dollar against the kiwi the new zealand dollar this is the one h time frame i'll start with daily and we have this reaction now we can understand exactly why we do have the reaction here i mean we can call it a technical correction which is true because we are in a bullish momentum we have this technical correction but what is the reason for this technical correction here okay this supply here it's the reason for the reaction here all right so we do have it now and of course it's too late to use it already more than 100 pips in profit if we would take this supply and in my opinion the price on its way to reach i mean i'm not sure because i i cannot predict if the price will definitely go this this low but that's the next available level that i will consider to buy on the first touch that's the next available demand that i can see in my eyes on this chart before this demand we have all these levels which is neither one of them is not a demand we had something here already tested once and twice and nothing in on the left we have nothing that will stop the price probably not until the price reached this low here below so with this conclusion i would say that i preferred to look for cell position now i just need to find a good reason if i'll go up i don't see a note for now i don't see any great reason to sell maybe only here above okay now this is the level i was just talking about and you can see in this one edge sorry 15-minute chart still seems like great supply the price run away from that level that's the highest the price reach after creating this supply so i will say this call it a fresh supply maybe here i'll definitely consider to sell here on the first touch of the price five minute chart this is how it looks i'm still standing behind my world i will definitely consider to sell this level on the first touch of the price here and my target will be if the price register and i sell my target will be for now this support here below okay all right so i will take the kiwi against the dollar soon any questions guys if you want to share your idea oh you want to ask something about the position that you are in now all right let's take the kiwi against the dollar i'll bring it to the chart and i will check your end the next no problem here is the kiwi against the dollar okay so this is the daily chart let's start from the daily chart and as many of the us the dollar pairs also the kiwi against the dollar is any bullish momentum it's a very clear as you can see i wonder what caused this reaction exactly here so let's roll back and that's the reason okay here you can see that's the reason for the reaction it's kind of supply because the price at least from this daily chart seems that the price really run away from that level also on the left we have seen that the price visit this level few times before but at least from the last time the price left this area it's happened this way which represents something so it's kind of supply to be honest i'm not sure if if i would take this supply on the first touch of the price but again i want to show you also and explain you and i want you to understand that there is a reason for any reaction you see on the chart here is the reason we just saw the reason on the left so this is the reason for this reaction so far okay and this reaction so far was approximately almost 200 pips all right so forage time frame this is what we got and at least for now we are still in bearish momentum you can see that the price created this low and then high and then lower low and then higher high and then lower low now the price is almost at the same level as the last high which it's kind of decision point if the price will break out this level then it will just ended all this bearish momentum and as long as it doesn't happen and the price will continue down this bearish momentum will remain and then we will probably see the price continue down to this support and below this one we will probably see the price go all the way down with a few level on the way that the price will have some delay here you will see the price stops and here and follow this one if the price will continue down almost almost sure that you will get some reaction here which mean when i say reaction i mean we will get here some probably technical correction for the bearish momentum and here the reason is this and this demand okay here is a support level and the rest we can just wait to see if the price will go up from now or down so this is the forage timeframe this is the one h time frame and 15 minute you can see that here according to this demand the price had a nice reaction if i was introduced calper even according to this 15-minute chart that's a classic opportunity the price created this demand and right away go down to collect the unfilled orders and then we can see the reaction to continue all right the price then tested this demand again but the right time to buy here it's here to buy this demand it's this level so this is what we got here and then again the price check this demand here and after all broke out this demand but you can see here approximately i mean almost with a few peeps maybe i wouldn't call this a significant inconvenience breakout it's still i'm not sure about this this is not what i call breakout okay if i'm talking about this level i would like to see the price very clear breaking out this level so it's kind of in the middle here and and to be honest i don't have any clear level to buy and sell maybe here let's go to the five minute chart and see how it looks and at the very bottom here i would take the risk here and go to the 15 minutes you will see all the picture i would take the risk here if i was an intraday scalper a short term trader okay we will get some reaction from this level if the price written there of course all right so supply is also called as a consolidation as its break out i guess you're right i'm not sure about this but it's not always the same it can be called consolidation okay so the next one that someone asked is the euro against the japanese yen so i'll continue with the euro against the end and see if we find something interesting i'm still waiting for the next significant movement in many of the pills to create a new fresh opportunities for swing and long-term traders it doesn't happen in the last few weeks maybe two or three weeks and as you can see in this forage time frame we had a few weeks five six weeks that the price move on the same range we didn't have here a clear and strong momentum and i think we had some nice opportunity on this way down to sell and here we have the reaction of this demand from the left probably and here we do have something from this supply but you can see how it looks it's not a clear one and very significant one i think just above this one but i'm not sure if this one is already considered as a check we will check this level here in this 15-minute chart soon so this is the 1-h time frame this is the forage time frame and i'm pretty sure that this demand is already tested i would like to see how it looks in this one age time frame if i put the line on the critical level that i would consider to buy let's see how it looks in this 15-minute chart i think i would definitely consider to buy on the first touch here but i can understand why the price had a reaction here i think so let's go back to these days and as you can see this is where i put the line this is where the price return it's about six pips not sure if you call this already a test check or not so i think if the price reached that level again i won't buy on the first touch but i will definitely keep my eyes open on the lower time frame maybe five minutes 15 minutes and i will look for kind of reversal signal from these time frames because i still think there is a chance that we will get some reaction here but since the price already had this reaction not far from that level maybe it's considered as a check and maybe hear the price collect some of the unfilled orders already here above it's definitely a test of this supply from the left again 15-minute chart let's take a look look to be honest as you can see in one h time frame we had a very different picture it seems like a great supply now see how it looks in this 15-minute chart the price moves down and back and down and back and down maybe from this level here we had some unfilled orders but it doesn't convenience as it look on this one h time frame in this 15 minute chart once again i'm not sure about this pair and when i don't have a clear picture i just forget about it okay so this is for this and the last one we check is the pound against the japanese end of course if you have during this time any questions regard supply demand just ask on this chat box okay and all right so let's take the pound against the end all right this is the daily chart and you can see how the price compressed up in the in this daily chart to be honest also in this daily chart the conclusion and the technical analysis analysis will be the same as it was in the last few weeks so there is no big difference from what was here and here and here and then where is it now the conclusion will be the same here we have the reaction of this supply was already in the past so it's not valid anymore but above this one maybe here we will see the next reaction we'd like to see how this level a bit above this one looks in this 4-h time frame i think it's here no it's not these levels it's a bit confusing all right okay so this is where i put the line here and to be honest seems like a great level few small candles at least from this forage time frame and then the price at least from this 4-h time frame seems that the price runway from that level so i will consider to sell there on the first touch definitely as the price compressed up now it's represent this movement represent a powerless movement of the price so if price came all the way up in this powerless way to a level which considers a strong level then i think it's good setup to sell here on the first touch but since the price doing it as you can see this way it can take one or two weeks more until the price reached that level and as much as it will take longer it's better for us it's it's it's just give us the indication that the price really struggling to get there and there is no much power in this uptrend so i will wait there and sell on the first touch unless we get some other picture in the next few days so that's for the gbp pound against the japanese yen and i think that's all for today because many pairs just repeat themselves and we just would like to uh to announce that we are soon probably next week hopefully in the beginning of february we are about to launch a trading idea area in our website which where you can share your as a trader you can share your idea with a picture and with an explanation about the uh this idea that you just want to share with our community you can get there our comment of course in the fibers analyst okay comments it can be me or saul or gil you can get comments from any other traders and it will be nice really we will of course send email for all of you on the day we will just launch this and upload this trading idea area on the website and it will be a great great perform great resource for you to share all your ideas to comment to get some idea from other traders and share your comments and you'll get it soon next week hopefully anyway thank you for joining us today it was really my pleasure hope you enjoy it and wish you all successful trading week thank you and bye

Show moreFrequently asked questions

What is needed for an electronic signature?

How can I input an electronic signature in a PDF?

How can I have someone sign on a PDF file?

Get more for demand mark Request with airSlate SignNow

- Print electronically sign Job Safety Inspection Report

- Prove electronically signed Website Quote Template

- Endorse digisign Executive Summary Template

- Authorize electronically sign Business Proposal Template UK

- Anneal mark Show Registration Form

- Justify esign Last Will and Testament

- Try countersign Printing Services Proposal Template

- Add Joinder Agreement email signature

- Send Service Receipt Template signatory

- Fax Recommendation Letter initials

- Seal Artist Press Release byline

- Password Website Standard Terms and Conditions Template esigning

- Pass Tolling Agreement digisign

- Renew Bank Loan Agreement signature service

- Test Go To Market Strategy countersign

- Require Intellectual Property Assignment Agreement Template sign

- Comment subscriber signature block

- Champion inheritor esign

- Call for visitor digi-sign

- Void Terms of Use Agreement template digital signature

- Adopt Investor Rights Agreement template electronically signed

- Vouch Musical Ticket template byline

- Establish Professional Birthday Party Invitation template esign

- Clear Construction Contract Template template signature block

- Complete Discount Voucher template signature service

- Force Offer Letter Template template signature

- Permit Landscape Transforming Appointment Record template email signature

- Customize Construction Contract Agreement template signatory