Digi-sign Volunteer Certificate Made Easy

Get the robust eSignature capabilities you need from the solution you trust

Select the pro service created for professionals

Configure eSignature API quickly

Work better together

Digi sign volunteer certificate, in minutes

Reduce your closing time

Maintain sensitive data safe

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

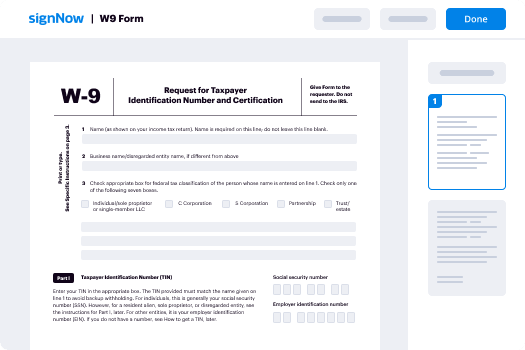

Your step-by-step guide — digi sign volunteer certificate

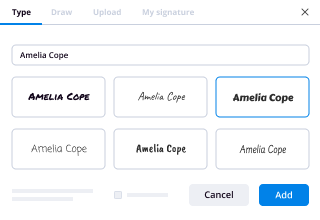

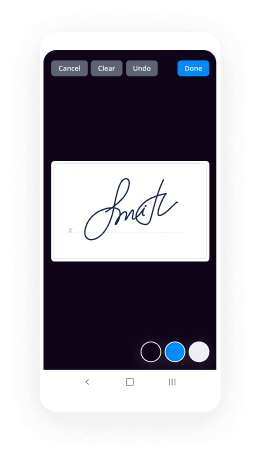

Using airSlate SignNow’s electronic signature any organization can enhance signature workflows and sign online in real-time, supplying an improved experience to clients and employees. Use digi-sign Volunteer Certificate in a few easy steps. Our mobile apps make operating on the go feasible, even while offline! eSign contracts from anywhere in the world and make trades quicker.

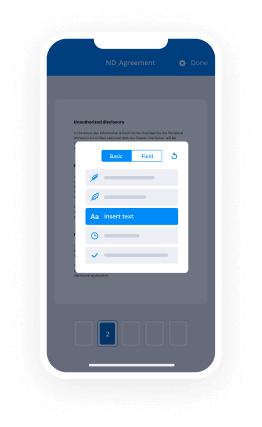

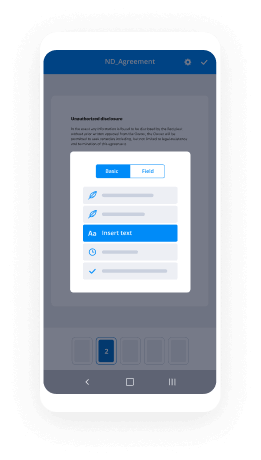

Keep to the stepwise guideline for using digi-sign Volunteer Certificate:

- Log in to your airSlate SignNow account.

- Find your document in your folders or upload a new one.

- Open the record and make edits using the Tools list.

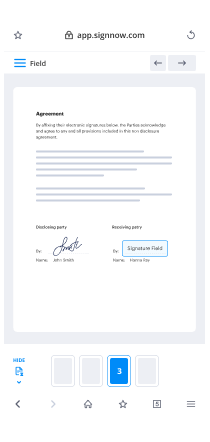

- Drag & drop fillable boxes, add textual content and sign it.

- List numerous signees via emails and set up the signing sequence.

- Choose which recipients will get an completed doc.

- Use Advanced Options to reduce access to the record and set up an expiration date.

- Click Save and Close when finished.

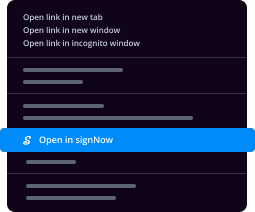

Moreover, there are more extended functions available for digi-sign Volunteer Certificate. Include users to your shared digital workplace, view teams, and keep track of cooperation. Millions of consumers across the US and Europe recognize that a system that brings everything together in one unified work area, is what organizations need to keep workflows working effortlessly. The airSlate SignNow REST API enables you to embed eSignatures into your application, website, CRM or cloud storage. Try out airSlate SignNow and get quicker, smoother and overall more efficient eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results digi-sign Volunteer Certificate made easy

Get legally-binding signatures now!

FAQs

-

How can I get my digital signature certificate?

Open the file that contains the certificate you want to view. Click File > Info > View Signatures. In the list, on a signature name, click the down-arrow, and then click Signature Details. In the Signature Details dialog box, click View. -

How do I sign using digital ID?

In Acrobat, click the Edit menu and choose Preferences > Signatures. ... Select Digital IDs on the left. Click the Add ID button . Choose one of the following options: ... Click Next, and follow the onscreen instructions to register your digital ID. -

How do I sign a PDF digital ID?

Suggested clip How to Sign a PDF with a Document Signing Certificate - YouTubeYouTubeStart of suggested clipEnd of suggested clip How to Sign a PDF with a Document Signing Certificate - YouTube -

How do I do a digital signature in airSlate SignNow?

Choose the Fill & Sign tool from the airSlate SignNow dashboard and open the document you need to sign. Click the Sign tool, then Add Digital Signature. Please note that digital signatures must be enabled by your airSlate SignNow administrator. Select cloud-based digitial ID certificate, then click Apply. -

How do I create a digital signature?

To add a digital signature, open your Microsoft Word document and click where you'd like to add your signature line. From the Word ribbon, select the Insert tab and then click Signature Line in the Text group. A Signature Setup pop-up box appears. Enter your information in the text fields and click OK. -

Where do we use digital signature?

Where can I use Digital Signature Certificates? You can use Digital Signature Certificates for the following: For sending and receiving digitally signed and encrypted emails. For carrying out secure web-based transactions, or to identify other participants of web-based transactions. -

Where are digital ID files stored?

You can find a certificate digital-ID created in Acrobat in the /User/[username]/AppData/Roaming/airSlate SignNow/Acrobat/11.0/Security directory. If the signature has an image file it is stored in a file called appearances. -

How do I find my digital ID?

On the Tools menu, click Trust Center, and then click E-mail Security. Under Digital IDs (Certificates), click Get a Digital ID. Click Get an S/MIME certificate from an external Certification Authority, and then click OK. -

How do I know if a digital signature is working?

Suggested clip Checking the Digital Signature of Windows Executables - YouTubeYouTubeStart of suggested clipEnd of suggested clip Checking the Digital Signature of Windows Executables - YouTube -

How do you check if a document is digitally signed?

Open the document in question. Locate the bar directly beneath the horizontal menu toolbar. Look for a red medal or ribbonlike icon. This icon indicates that the document has been digitally signed. -

What is digital signature and how it works?

Digital Signature is a process that guarantees that the contents of a message have not been altered in transit. When you, the server, digitally sign a document, you add a one-way hash (encryption) of the message content using your public and private key pair. -

How digital signature is created?

To create a digital signature, signing software -- such as an email program -- creates a one-way hash of the electronic data to be signed. The private key is then used to encrypt the hash. The encrypted hash -- along with other information, such as the hashing algorithm -- is the digital signature. -

How can I do digital signature?

Click the link. ... Agree to electronic signing. ... Click each tag and follow the instructions to add your digital signature. Verify your identity and follow the instructions to add your digital signature. -

How can I make my signature?

Suggested clip How to design your own amazing signature - YouTubeYouTubeStart of suggested clipEnd of suggested clip How to design your own amazing signature - YouTube

What active users are saying — digi sign volunteer certificate

Related searches to digi-sign Volunteer Certificate made easy

Digi sign volunteer certificate

but before that we got to do a little housekeeping so today's webinar webinar is sponsored by zoho um i don't know if if you're familiar with zoho that's awesome if you're not go ahead and head over to zoho.com we have over 50 plus applications that can help with any business needs and today the speakers from the zoho side will be from the zoho uh finance partner team and if you would like to become a partner or learn more about the partnerships or find an accountant go ahead and head over to soho.com cpa and there you'll be able to find more information and actually speak to one of us to kind of see if you're a good fit for the partnership and if you have any questions today let's go ahead and go over what showtime and the presentation um software looks like if you go and look at the left hand side you can see the questions section the chat section you if you would like to go ahead and the chat section is for you to communicate with us saying if you can't hear us or see anything on the screen and if you go in there now you kind of see people telling us where they're from like kimberly said she's from florida and the question section is where you would need to write a question directly to the zoho team or avalara you can ask anything related to um zoho or avalaire or really any question if you would like but let's try to keep it towards uh zoho or avalara and we have someone in here who can help answer any avalara question his name is evan owens i'll introduce him here in a second and we have the zoho team as well in this webinar we'll be will qualify for one cpe credit in order to receive your cpe credit you have to attend the entire session and you need to answer three out of the four polling questions and i'm going to go ahead and launch an example of a polling question this doesn't count towards it but this is just an example and i just want to really know how everyone's doing today if you see it kind of just pops up on your screen you're able to answer and i can actually show the results of the answer so a lot of people it seems they need more coffee which is interesting so do i and i just had a full glass so it's funny but yeah and also uh in order to receive the cpe credit you have to stay and answer the evaluation at the very end and anyone who doesn't want to receive anyone who's here not to receive the cpe we do appreciate you fill out the evaluation be so we can learn what we did wrong and what we did right on these webinars and it helps us with future webinars and the last thing i wanted to touch on is this session will be recorded so don't worry it'll be sent to you and that seems to be our number one question in the beginning of the webinar so let's introduce the team uh first i'll introduce everyone on the zoho side and um a little i'll go and talk about me my name is nathan rogerson i'm over here on the marketing team at zoho for the finance apps and my background is in um accounting i've been doing accounting for over five years and um i was an accounting advisor so i really know this topic is very you know it's something that i struggled with whenever i was accounting by advisor definitely in the early years whenever you don't even understand sales tax and as i started to get used to it um definitely in texas i got a hold of it but whenever i would deal with companies outside of texas it got a little bit more stressful and i'm really happy to be here for this webinar to learn more about it and so we can share the world word with other businesses out there and accountants and i wanted to introduce the zoho team so valor can you hear me okay yeah if you want everyone absolutely good everyone val steed i'm a cpa accountant background and very thrilled to be here uh been in the accounting technology industry for about 35 years so many years involved with many different companies and organizations very thrilled to be driving kind of spearheading a direction toward accountants bookkeepers cpas cas pretty much the whole accounting profession if you will and thrilled today very thrilled to have such a great guest speaker from avalara because this is a very important topic today something i've spoken on for many years and just thank you for being here i think you won't regret today so thank you and tala can you hear me okay yeah i can hear me okay yes tell i can hear you fantastic so good morning everyone thank you so much for joining today's webinar my name is tala bakar i'm a program manager here for zoho finance partner program i've been at zoho for almost five and a half years now and you know for those who have been with us for a while you've noticed the vast improvement and new applications that we've launched in the last just even one or two years um and the avalor integration is a really really important part of the finance apps so we're really happy to have avalor with us today um just wanted to also mentioned uh reiterate what nathan mentioned earlier about becoming a zoho partner so all of us work on the zoho partner team and you're probably wondering why there's so many faces on a single webinar it's kind of this interesting podcast style we've been doing in the past where we have a featured speaker who has kind of all of the brains behind the presentation but we kind of bring the questions and so um we aren't going to be all jumping in at the same time but just wanted to let you know why we have so many but thanks so much for joining and uh we look forward to seeing you um throughout the today's session and on future sessions yeah we try to stay out of each other's hair but sometimes we get we're very passionate about what we're talking about so hopefully today we can keep everything streamlined and so let's introduce uh evan owens he's over there on the avalara team and he's a strategic alliance manager and uh evan can you hear me okay i can okay awesome if you want to just do a quick intro and then we can get to scott sure yeah um so as nathan mentioned i'm a strategic alliance manager which uh in simplest terms means that i'm responsible for uh the success of our partnership with uh with avalera and zoho and have been working with zoho for the last three years so i'm excited to have a chance to share share what we do with all of you okay awesome thanks evan and he'll also be over there in the questions panel answering answering avalaric questions and so let's go ahead and introduce scott who is the presenter of today and um scott he has over you know years and years 10 years of just south dakota sales tax division and i'm sure he's going to be um able to share a lot of information with sales tax uh scott can you hear me okay i can hear you very well thank you okay cool could you go and give us a little introduction of yourself sure thank you appreciate that i i we don't have enough time for me to do a good job of introducing myself but yeah i'll do the short version i am i do government relations and and tax policy for avalara been here for seven and a half years prior to that i did uh seven years as the executive director of a thrink of a thing called the streamlined sales tax and that is a you know what is now 20 year old organization of state government local government and uh the private sector to try to make sales tax simpler and more uniform at the only time in the history the united states where business and states have sat down looked at what makes tax complicated and actually implemented solutions to that prior to that i spent 10 years 10 years running the south dakota sales tax south dakota sales tax is the broadest and um most inclusive sale well not not the broadest there's three states that that argue has the broadest sales tax south dakota hawaii new mexico and and i had the pleasure of doing south dakota's uh tax everything so they tax accountants if you were a cpa in south dakota you'd have a sales tax license and you'd be collecting sales tax from your clients if you're a cpa in florida who has clients in south dakota you need to think about the wayfarer decision to see whether or not the wayfarer decision makes you a taxpayer in in south dakota uh the folks from accounting today were kind enough to make me one of the top 100 most influential people in 2018 and 19 and uh i spent a lot of time talking to accountants um because that's how we get this whole business issue resolved yeah thank you for that scott so today we're going to talk about sales tax obviously and that's you know something i've done my in my entire career and it was all done by accident i never went to college for tax learned it all on the job learned it by making mistakes learning by listening to people who did understand it and tried to get them to to make me as as educated as they were we're going to talk about why it matters why the sales tax is an important thing for state government local government talk about economic nexus that's a phrase that you need to memorize economic nexus uh why sales tax are complicated it's that's a week-long conversation right there we'll talk about a little bit about consumer use tax which is another reason why it's complicated and then talk about how to make this whole process work a little bit better why tax compliance matters it's easy it's a huge portion of state and local budgets this slide is just talks about state government tax we were to have the you know the the effect that sales tax has on local revenue this would be a much bigger portion of total state local tax revenue nearly 47 percent of state revenue is from sales tax and that includes selective sales taxes like the tax you would pay if you registered a car nearly every state has a tax on i think every actually i think every state does a tax on when you buy a car uh it doesn't always work like a sales tax sometimes it's collected by the governor directly when you registered it you know you go to the county courthouse and you want to drive and you want your license plate that's when you pay the tax some states like tennessee where i live it's collected by the dealer but this is an important part of state budgets and it is because of that they are very serious about implementation and enforcement of that tax now i never use this slide when i'm talking to my friends in state government they don't think of themselves as needier and greedier and the the pandemic we could have added needier greedier and desperate to that first line there because today states are quite concerned about how their budgets are going to be impacted by the expenses associated with pandemic and then the effect on tax collections because of the pandemics you know devastation of of our economy so this is why states care about it in compliance is not optional if you listen to a secretary of revenue or a commission or revenue somewhere talk about how he or she manages their sales tax they talk about a voluntary tax system there's nothing voluntary about our tax system it is mandatory it is a choice that you get to avoid going to jail so when we think when you hear some tax administrators or some legislator talk about the voluntary tax system we have the united states remember it's voluntary only if you don't want to go to jail otherwise this is an involuntary tax system those laws make this a a an obligation on everybody that is making sales earning income in the united states things in the last 20 years there has been an explosion of ways the states have come up with to try to get people to collect their sales tax all this is just on the one side the other side of the of the chart is the things that businesses do that creates obligations for them add new geographies or products i'm i'm glad you said that you you you you understood texas because if all you understand is texas frankly or any state you're going to be shocked when you start to look around what other states do and geographies means you open a store you have employees you have a warehouse new products there you know there's a there's a rule in sales tax that all tangible personal properties subject to sales tax unless specifically exempt but who the heck knows what's specifically exempt so when you add a new product and it's tangible you know it's a cup it's a glass it's a book you kind of have that you see you know in the back of your mind that all tangent personal properties subject sales tax specifically exempt you have to ask yourself where in the world am i exempt you can't answer that question unless you are actively understanding what states are doing and what they have done and because much of this stuff has been around for a long time obviously the last thing that you want to be a trigger for your tax challenge is a sales tax audit and i hope that the end of this presentation you you feel like you're a little bit better prepared for sales tax audit because that's really the whole point of understanding tax compliance is to be able to do it so well that you don't care if you get audited hey scott before we continue i'm going to go ahead and launch the first poll question and just for a reminder if you would like to receive a cpe credit for this uh webinar you have to answer three out of the four uh polling questions and kind of scott on on that back slide um i think it is interesting whenever i was talking to you know a bunch of small businesses back in the day well not it was like a couple years ago um it was just so crazy to see the amount of businesses that weren't do handling sales tax properly and it was really just an eye-opener to me that hey this is just a business on its own to help businesses with sales tax because they can do their own accounting but sometimes they just can't really you know grasp the sales tax fully well and you know and i it's it's unfortunate because you know the the education system we have around the world for accountants is amazing for accounting it's hard to find an accounting program in the united states i can't speak for the rest of the world but it's really hard to find an accounting program in the united states where they talk about sales tax or if you do it's part of a a you know an introductory class on taxation and you you know there's a you know it's broken into thirds and the thirds are the federal income tax you know the state income tax and then other state taxes and that other state taxes is immense it covers every i mean the number of types of taxes that exist at the state level vastly exceed the number and type of taxes at the federal level definitely so everyone answered the poll so you can go ahead and continue thank you very much okay there's another phrase you need to understand and it's nexus it's a word the word nexus means connection it in this situation it means you have enough of a connection with the state that the state has the right to make you do things we used to live in a world where that was a physical presence test 1967 the united states supreme court in a in a case versus national ballistas versus illinois said that illinois couldn't make national bellassas collect the illinois use tax because national ballistas wasn't physically present inside of illinois and that set this bright line that limited a state's right to tax and not right a state's authority to tax someone or impose the tax collection obligation on someone depended on whether or not that person was physically present inside the state for 50 years later all that was accomplished was a 50 year long fight of the definition of physically present what does it mean to be physically present in this little in the gray boxer you see some of the things that have that occurred in the last 50 years that states and businesses went to court over almost every one thing on in that slide or in in that gray box are one or two and sometimes 20 different court cases in where states have tried to say leasing real property is the same thing as owning real property having an agent in the state is the same thing as having an employee in the state attending a trade show might mean physical presence if you well it always means fiscal presence but it might not mean you have a collection obligation because it's a function of what the trade show is are you making sales there are you actually talking about you know your products are you talking about science you're talking about you know did your hr staff attend a trade show on hr in a state you know lots of court cases around the country on whether or not that hr person's attendance at an hr trade show in a state created enough of a connection with that state for that state to be able to tax then the sales that the corporation made all that changed two years ago when the states convinced the supreme court to take up again the question of nexus they did that in a case called south dakota vs wayfair case decision was issued on june 21st 2018 the court was looking at a law that south dakota passed la south dakota's law said that anybody who made more than one hundred thousand dollars in gross sales in the soft code in a calendar year or more than 200 separate transactions had to give a license and collect sales tax soda said i mean literally one long sentence and the court took this case and what we discovered after the fact was they didn't really want to rule on the merits of the law that's out to go to past they really wanted to get rid of the physical presence test that they created in 1967 they wanted to say we made a mistake and they literally did say that the the bell assessed decision in 1967 was wrongly decided they just literally got rid of the physical present restraints that they had imposed upon states remember this was a restraint on states it was an opportunity for business business could conduct any kind of business they wanted to inside of a state and not have to collect sales tax as long as that as long as activity wasn't physically present inside that state so the result was an immediate flood of legislation around the country where other states looked at what south dakota did and adopted nearly exactly the same law we would be in better position today had they adopted exactly the same law but it's nearly and so what we have today is this new obligation to collect sales tax based solely on sales so we used to live in a world where a business could plan what they needed to know about a state sales tax because they planned where they're going to be physically present you knew you're going to open up the store in a state and you had you should have known when you opened that store in the state that that was going to create a physical presence and an obligation to collect sales tax so you got to plan for that you got to prepare you got your accounting team got to understand and was given time to understand the sales tax differences between that state and all the other places you did business in now we live in a world where your customers decide you're going to collect sales tax and arguably it's the very last customer that you have that throws your sales in that state over whatever states that space threshold is south dakota's 100 thousand dollars in gross sales so you're selling and you're selling you're selling to south dakota and you don't really care and then all of a sudden you make a sale to somebody and that is the sale that puts you over a hundred thousand dollars in that year in south dakota that customer of yours decided what you need to know about south dakota that person pushed you over a threshold that now requires you to have a sales tax license and to start collecting sales tax and before you can do that you have to understand what makes south dakota different than wyoming and what makes wyoming different from hawaii today we have 43 states that have adopted this same law or one nearly like this law there's a little um we need to do this as a a poll question someday there's five states that don't have sales tax new hampshire oregon montana alaska and delaware they go by a an acronym and that's called nomad so when you hear the word nomad and you're thinking sales tax and who in the heck would ever think of nomad and thinking about sales tax but if you hear those two things together they're talking about new hampshire oregon montana alaska and delaware you see we have an asterisk by alaska and that's because there's no state sales tax in alaska but there's a hundred and ten cities and boroughs in alaska that do have a sales tax and they formed a a remote seller sales tax commission it's operated by the alaska municipal league of all things and each of those cities are slowly adopting an ordinance that's exactly like what south dakota adopted by statute so these ordinances that are being implemented in alaska cities and boroughs say that if you make more than a hundred thousand dollars in sales in alaska you have to talk sales tax in the cities that have adopted the ordinance so we color alaska blue because it they they believe they have the authority to do this and it's just crazy complicated two states with the sales tax that haven't done this are missouri and florida they have their own individual reasons why they haven't done it yet but they talk about it all the time so i talked i said i said that these states nearly adopted the south korean law well there's some differences in the what they adopted that's really critical one is they don't all have the same dollar threshold it's five hundred thousand dollars in california and texas it's 250 000 in alabama 250 000 in connecticut but in connecticut you have to have 200 sales so it's 250 000 in sales and 200 retail transactions whereas in alabama it's just 250 000 in sales north dakota it's 100 000 in sales the rest of the country is pretty much what did what south dakota did 100 000 in sales and 200 separate transactions a separate transaction is an invoice doesn't make any difference if the invoices for a dollar or a million dollars are whether it's for one product or a million products in invoices of transaction you'll see that we have kansas highlighted here kansas has taken a very aggressive in in some people's minds radical approach to this concept of a threshold they have one at all so in kansas the rule and this was done by rule this is not done by the legislature because the legislature and the governor can't agree on what to do but the governor has some authority so the governor did what she thought she had the right to do their rule is if you make a sale in kansas you have an obligation to collect sales tax and they make no apology for saying if california wants to have 500 000 that's their choice we in kansas don't have one so if you make a sale in kansas you have to collect our sales tax and they just they just sent a press release out a couple weeks ago talking about all the money they're collecting with their economic nexus threshold obligation on retailers around the country so remember this slide because this is one reason why sales tax is complicated the different thresholds in the states and there's more to this slide than than i have time to talk about today let's talk about some of the other things that make sales tax complicated what are your challenges what are your clients challenges unable to keep up with any tax laws and jurisdictions 45 states in the district of columbia and puerto rico plus the cities and boroughs alaska have a sales tax in addition there's about 12 000 or so local governments in the united states that have sales tax now the good news is the majority of those the administration is done by the state so any south dakota has 270 cities with a sales tax you file one return you don't have to file 270 returns now what makes it complicated is the difference in the way they're imposed it's really easy to have incorrect tax calculations in a state like south dakota because the local taxes are cities and city boundaries change not only that the historical tool used by businesses to manage the tax rate has been a zip code and you know if if you're old enough you you you and most you probably aren't you remember that night digit zip code is a relatively new thing for the longest time we had five digi zip codes and that's all there was then the post office created a nine digit zip code solely to help them manage the mail more efficiently they didn't create it for sales tax purposes they didn't create the five digit zip code for sales tax purposes state of south dakota 270 cities with the sales tax there are two five digit zip codes that are wholly inside a city limits in south dakota so if you use a 5g zip code all your clients do to collect sales tax you've got almost no chance of being right except in the rare instance when the customer is in one of those two five-digit zip codes that's wholly inside a city limits in south dakota otherwise i mean i i lived in pure south dakota for a long time which is the state capitol it's right on the missouri river right smack dab in the middle of the state 13 000 people because the missouri's river is right there and there's another city on the other side the zip code the 5g zip code stops at the river now there's a semi-circle of addresses where that five-digit zip code is used by the post office to deliver mail many of them are outside the sydney limits appear so if you're relying on a five-digit zip code to collect sales tax in peer south dakota you've got like a 45 chance of being wrong because you're going to charge city sales tax to someone who lives outside the city but has a peer south dakota address with a peer south dakota five digit zip code managing exempt certificates if you make lots of sales and and the all of these things are immensely more complicated today because of the wayfarer decision all these things have always existed there's not a thing on here that wasn't there before the wayfarer decision all these things are everybody's problem now because of the wayfarer decision because customers drive where somebody has to understand sales tax all the complexity that exists in the in the in the state and local sales tax system united states is open for everybody we all now have to know the five digit zip code boundary in pier south dakota just a little slide to give you some just some frightening concepts 152 million mailing address united states i said 12 000 jurisdictions you know a lot of those the the the rules are the same inside that the local government as they are inside the state but not always and you have to know what that difference is tens of thousands of rates that's really where the big difference is you know 100 270 cities in south dakota with sales tax almost all of them have a two percent sales tax rate but they don't all have a two percent sales tax rate 131 000 fuel tax scenarios you know most of us don't spend any time in the fuel tax business it is unbelievably complicated millions of products and service exemptions the previous slide we talked about how managed and exempt certificates gives a a cost driver it is an immense cost driver because you know in the old days in the physical presence days you know that was one of the things you had to know when you opened a store now with wayfair wherever you make a sale and wherever you where that marginal sale is that puts you over threshold that's when you have to care about exemptions you don't care if your customers are exempt if you're not collecting sales tax who cares when you have to collect sales tax you then have to care when your customer is exempt you have to care when the product's exempt you have to care if they've given you the right piece of paper that you use to defend yourself in case of an audit there's a some another thing that you absolutely have to remember customers never get audited sellers get audited 100 of the liability that's associated with sales tax errors is on the seller in this country hey uh scott before we continue i'm going to launch the second poll question and um yeah that would be very interesting if the government would go after the customer for sure i think that would comment to folks excuse me nathan jump in and remind everyone please put your questions in the question area and not in the chat area that allows us to track it and also put multiple answers and just please do that thank you but yeah so it looks like almost everyone's answered but but yeah you honestly are making this uh you know some somewhat terrifying in some situations if you are selling products and you're in multiple states and everything for sure it is a um very good business to be in uh-huh if you're helping people with their sales tax uh for sure scott these things change all the time citibank i mean this is an exam this this is this is the slide that we use when we teach new employees at avalara you know we try to in this especially the sales people we said okay you're talking to somebody who who you know thinks they may need they got a sales tax problem yeah maybe i do maybe i don't well you just ask him you make sales on colorado yeah we do so the these two addresses are a block apart from each other they both had the same five-digit zip code and the sales tax result couldn't be further apart it's just an amazing and you know colorado is it is a you know in many ways classic example of complexity but kansas and missouri and texas are all equally as is is complicated and there isn't any uh any real way of knowing how to do this if you don't have this kind of a map okay you know there was a question scott florida and i'm not seeing any thresholds on florida are you familiar with florida and what they're doing on the thresholds i'm looking back at a terry beckert site that i posted and i don't see florida thresholds that's uh uh it's you have to remember the map of the states that have done this florida's not it florida hasn't done this so there is there is no threshold so there's no threshold in kansas missouri and florida so we have no idea we pretty much gotta be collecting sales taxes no no no i'm sorry let me finish here so kansas there's no threshold because they just don't care but you have to collect there in missouri and florida they don't have a threshold because they never passed this law so there is no sales tax collection obligation in missouri and florida for remote sellers in those two states you have to be physically present so physical nexus rules apply oh yes they they apply and there's a there's an important thing to remember when you're thinking about the difference between physical presence and economic presence remember economic presence is driven by your customers and it's all sales physical presence is driven by you you've done something inside that state that gives them the authority to impose a collection obligation on you well and this new economic nexus does not replace physical nexus you know both you can have both that's right they they can overlay on top of each other that's right that's right the the thing to remember about physical presence is the very first sale that you make once you create a physical presence is when you should have collected sales tax so if you if you have a sales person that's in florida and you're not collecting sales tax sales people are physical presence the state if they find that salesperson they find that you have physical presence they can make you go back to the day that salesperson entered the state and this could be years and make you pay all that sales tax that you should have collected from your customers so physical presence is it's it's absolutely critical people understand what they're physically present because those are the sales where there's a serious look back and it's a very financial burden look back under economic nexus when there's a threshold you're going along and you're making sales and you as long as you have an exceeded state's economic nexus threshold you don't have a collection obligation it's only after you've exceeded the threshold that you have a collection obligation and the sales that you made that got you to the threshold those don't count so if you as long as you're always under under a state's economic nexus threshold and they remember they vary none of the sales you make in the state are are the kind of sales that they can audit you for and make you pay the tax on okay so some of the things that make sales tax complicated uh other than all the things we talked about is the obviously the nature of things are you a contractor that's selling and installing are you a retailer that sells a warranty along with the thing that you sold me most states tax warranties some states don't tax warranties if the warranty is taxable then the products that go into fulfilling the warranty aren't taxable what if you bought the warning in tennessee the repair was done in kansas all those things make this process immensely complicated exemption certificate so i kentucky has 17 different exemption certificates every time the legislature creates an exemption the kentucky department of finance creates an exemption certificate and it is their expectation that when the seller makes a sale to someone who's claiming their exempt because of this new law the legislature passed that that seller have that new exemption certificate and it can be very costly to not have an exemption it it takes away it's always costly not to have an exemption certificate because there's a you know we talk about having a salesman use tax audit when states talk about if you get a notice of intent to audit from a state and they're going to talk to you about sales and use tax when they're talking about sales they're talking about your exempt sales they're going to look at your tax sales just long enough to know that you know what sales tax rate to charge they're going to go into great depth and great detail on the sales you didn't charge sales tax on those are the sales where historically they know people make mistakes and they're going to want to see all your exemption certificates they're going to check to see whether or not those exempt tickets are still valid and valid can mean lots of different things valid can mean it is exactly correct sometimes they say okay you're right you got 90 of the right information we're good we'll move on almost always in an audit they give you time to get the exempt certificate it is hard to get exemption certificates for sales exempt sales you made three years ago to somebody whose business doesn't exist anymore these are real time decisions you have to make you've got a customer that wants to buy what you're selling they tell you they're exempt from sales tax and you want that sale they don't want to give you a certificate because they don't have one i'll get you don't worry i've got one i'm going to put it in the mail tomorrow you'll get it and you make that sale and you forget the fact that they told you they were gonna put it in the mail and the auditor comes in three years from now and you think oh that's right joe was gonna give me that certificate i better call joe well joe got rich and moved to france joe doesn't care that you got audited that exemption certificate doesn't exist and the state's going to make you pay that tax yeah scott it's like chasing down at 10.99 oh oh yeah it's exactly like 10.99 yeah you know the people um die and you don't get 1099s from the dead and you don't get exempt certificates from the dead mm-hmm that's why it's critical to get these things at the time of sale have a process in place that allows you to collect those things i know that so i i told you the sales tax side of a sales news tax audit well the use tax side is where the real money is you know when when the state calls you and tells you that they want to audit you they're going to look at three things they're going to look at your sales and they're going to divide them between taxable and exam they're going to spend all their time on the exam then they're going to look at your purchase invoice they want to know what you've bought because they know that you're likely to have bought something from someone who wasn't licensed and didn't charge you sales tax the consumer use tax is the tax that exists in every state that has a sales tax the difference is that the sales tax is imposed upon the seller the use tax is imposed upon the buyer so when someone doesn't charge you sales tax for something that you've a business input something that you've bought that you need to operate your business you have a legal obligation to calculate that tax and send it to the state it's a self-reported tax well the states know people don't do that and it's this is where all the money comes in from a sales and use tax audit they look at your purchase invoices they look to see whether what you know they they divide them between the ones that were tax charged and divide them that weren't where there was no tax charge they'll look at the ones where the taxes charged to make sure that that person was licensed the seller was licensed once they figured out that that person was actually licensed then that they're done with that one they spent all their time on the ones where there was no tax charge very much like the sales tax sign of it they spend all their time looking at the sales you didn't charge sales tax on they spend all their time on the use tax looking at the purchases that you made where you weren't charged sales tax and they'll that they will just keep a running list of the of the amount and they they will add those all up they'll multiply that times the the use tax rate which is always the same sales tax and they'll send you a bill for that tax today they're also yeah i got one for you i really think we ought to talk about this drop ship issue uh jeffrey deployment asks why do some of my vendors charge sales tax when drop shipping to my customers even though i do not meet the nexus rules for that state isn't it wrong because they are charging tax on my purchase price and not on my sales price uh the the the answer to that question was in the question right i didn't meet the economic nexus threshold so there's seven states out there and california's the most aggressive but there's seven states out there that say if the drop ship company is physically present inside the state now this and this may change with economic nexus i'm guessing i guess it's true yeah so what they're saying is because the drop ship company has a requirement it is has has it as nexus with the state they're going to make that person the tax collector if the retailer isn't now in theory if i were a drop shipper um no no so what here's the bad news the way to avoid having the drop shipper charge your sales tax is to get a license in those states collect the sales tax and then you'll be able to give that top shipper a legitimate resale certificate so the only way to avoid that is to pick up the work yourself now that you're in in in in because of economic nexus that whole dynamic is changing and so it's really easy for for a drop shipper today to say well if you don't want me to charge a sales tax get a license you know if you exceed the threshold you probably have to have a license anyway so yeah now this is a this is a historical tool used by states to get some sales tax on every transaction to the extent they could lay their hands on somebody so use taxes i think that you owe uh why did i we've talked about why auditors love use tax it's easy money it i did a survey five years ago eighty percent of the tax collected in the sales news tax audit came from use tax now wayfair has changed all that because in theory wayfarer done wayfarers created more tax collectors so there should be less use tax that's owed because there's more people collecting sales tax the challenge for buyers is these folks that are now collecting sales tax may not have any idea what they're doing they're charging you sales tax on stuff that isn't taxable they're ignoring the resale certificates you've sent them they're ignoring the exemption certificates you've sent them they aren't charging you your sales tax they're charging you their sales tax so with the wayfarer decision in theory eliminate some of the burden on on buyers to pay use tax but at the same times increase the burden on buyers to manage the right tax that they get charged this is just a little chart that we put together to scare people go ahead and lock your poll questions please do thank you yeah sorry and you can continue okay i was going to look at her questions there so how do you make this easier it's hard to make it easy these are the things you have to do to collect sales tax you have to determine where you have the nexus where am i physically present where do i have economic nexus you have to register sometimes it's very easy there's the organization that i used to work for the streamline sales tax they've got a registration system allows you to register in 24 states at one time takes five minutes to be registered for sales tax purposes in 24 states the rest of the country is a little bit more complicated uh you have to know what rate to charge which means you have to know what jurisdiction your customers in and you have to know what the jurisdiction boundaries are and you have to know whether or not that state taxes what you are selling which means you have to know the difference between a product and a service you have to know what each state's definition of the difference between product and service you have to track and manage your sales tax and then you have to file a return and make a payment which these days of course is all is all uh electronic no one wants paper these days and it's it's very frustrating so obviously we can help with that we're in this business all the things that i've talked about and frankly a lot more are built into have attacks they're all there for the the purpose of allowing you to automate your your sales tax collection or a or non-sales tax collection when it comes to managing your exempt certificates all these things uh are are it's physically possible today to outsource them frankly uh meaning that this is all relatively new uh you know all of the last 20 years has has the concept of outsourcing your sales tax compliance caught up to the old concept of outsourcing your payroll i mean adp has existed for a long time and businesses have long long outsourced their payroll compliance to uh to a to a third party just in the last few years have that is that same concept applied to sales tax and this is just a little chart that we use to explain the five things i said you need to be able to do first of all you have to figure out how you're gonna manage your exemptions it can be very complicated because uh one of the one of the complexities i didn't talk about in on that picture of the map that had the thresholds they don't all use the same starting point they don't all use some of them it's gross sales some of it's taxable sales some of it's retail sales some of its gross sales less resale so there's a lot of places in this country today where a business has to have a sales tax license because that state uses gross sales regardless of the little taxable sales that that company has so you make you can have five thousand dollars for the taxable sales into south dakota that you have to have a license for collect sales tax on if you make a hundred and five thousand dollars in sales into south dakota you can have a hundred thousand dollars that are exempt sales five thousand are taxable you have to have a license and manage the five percent that's five thousand but you still have to be able to manage and prove to the state when they audit you why the first hundred thousand weren't taxable you have to do tax calculation that's all about rates and boundaries and returns fort hit there's you know i didn't spend much time talking about uh how complicated colorado is other than the you know the map i showed you but there are 70 cities in colorado that administer their own sales tax they each have their own return they each have their own method of payment and they each have their own tax rules um the same thing applies in louisiana and alabama and certainly the same in alaska it can be very complicated um if you're someone who's physically present in in in every home rule jurisdiction in colorado you could file 71 different sales tax returns every month and all this needs to be done in less than a second because this stuff doesn't fit inside modern retailing if it can't all all those things happen in less than a second and uh in it i don't want to say it's easy because it's not easy but it is physically possible to do and all the things you have someone who comes in and wants to buy something from you and it goes all through the process and you get to you get to the right answer every time so let's go to questions so scott if you go ahead and click on that question section you can see the questions thank you evan there's one for you on pricing there per transaction i want to check on that one i'll jump in now and i'm just typing another response now so i'll go to that one next i'm i'm responding to the one about um uh well it looks like you already answered it just collecting attacks from every customer without considering rules of physical presence or threshold is that legal um i guess since we're talking about it i'll just say that's uh not recommended for one thing you're you just raised your prices close to 10 um and also customers will revolt and uh you know insist on being repaid for that um but i guess the other caveat to that is if you do collect money um that was not needed to be collected by all means please don't keep it make sure it gets permitted because if you keep it you've broken the law so um anyway scott if you want to add anything to that no you you answer that uh right so let me tell you nebraska in nebraska it's a felony to collect sales tax dollar sales tax license yeah now you gotta have a sales tax license right follow state rules right he's got just one thing if you'd like to show the attendees one of the questions from the question panel you can project next to it and it'll pop up for everybody oh really now volunteer seller let me put that site up hold on or uh scott you might want to put that side up and by the way sst streamlined sales tax organization is still out there and a real important thing part of what they do is the volunteer seller uh option which if you're worried about all this you can go in and you know volunteer seller in those sites as well so let me just not answer csp scott i was no i didn't but i'm gonna do that right now so thank you um and trish i'll get to your question here just as soon as i'm done with the streamlined sales tax so the streamlined sales tax was created to make things simpler and more uniform and you know they did a lot of really good things um but not every state's a member so what might be uniform and simple is only uniform and simple in you know 23 24 states it's not simple in all 45 states it's not a uniform in all 45 states so you still have there's still the rest of the country out there that that creates you know additional complexity so one of the but even well we realized early on i was one of the people who started it we realized right off the bat that it was impossible to completely eliminate all the things a retailer has to do and all the things retail has to do so what we did was we came up this idea of called of a certified service provider our goal was to completely outsource sales tax compliance or to give retailers the ability to outsource and it's a public-private partnership and the private part of it is that it's it's companies like avalera that are doing the actual work the public side of it is two things the one is the states certify the accuracy of our answers they look at the tax answers that avalara gives to its customers and tells us before the answer is given what we need to do to make that sure it's right answer so using a certified service provider the answer the tax answer you get should be exactly the same answer the state would give you if you'd ask them the second thing that the states do in the the public side of this partnership is they pay for it yeah so they what they do is and we did we just signed a new contract with sst starts on january 1. we're now in our seventh this is a seventh contract that that avalaras had with with the streamlined sales tax governing board and it it what it does is those states those 24 states that remember that will pay avalera to provide this service to a retailer if the retailer meets the definition of a volunteer and volunteer is less than fifty thousand dollars in payroll or property in the state so if you all you do in the state is make sales you have no payroll you have no property you're the perfect person for this the certified service provider program so i want to talk about patricia's question here for a second you know um i said that you know if you if you have physical presence somewhere or you have economic presence somewhere and you haven't got a license and started collecting sales tax yet you need to have a long conversation with your cpa yeah about how to do this in a way that minimizes your past exposure all the states in the country have a thing called a voluntary disclosure process vda volunteer disclosure pardon me and what it is this is a way for your cpa to represent you anonymously in front of a state so your cpa fills out this form describes the type of business you're in you know and all the things that a state would need to know to feel comfortable that they're given the right answer and what they'll do if they agree to that and the states have to agree to this the states will say okay we're i know you've been doing business at state for 11 years we're gonna limit the look back to three years we're gonna waive the penalty and we're gonna cap the interest at eight percent or twelve percent it's a really important process that your cpa can help you with that gets you to a spot where you can with a straight face go to your boss and say okay we should have been collecting sales tax in this state we didn't and we're gonna oh if they find us they're going to make us pay sales back to the beginning of time plus penalty and interest if we do this vda we can limit our look back and we can maybe eliminate the penalty and limit the amount of interest that we that we're charged it's a really important thing to do but it's the kind of thing you want to have professional advice for because these things vary a little bit state to state and you have to really make sure you get your your eyes crossed in your your t's crossing your eyes dotted hey scott i'm going to go ahead and launch the fourth polling question which is one we're just asking if you would like a free economic nexus consultation from avalara and um kind of on the same note of what he was saying and it's just very important if you don't fully understand to have some someone kind of guide you or just help you point you in the right direction for sure and also i wanted to mention that if you missed a polling question you can click on the poll polls tab and answer any questions you missed so i want to answer ed's question here how does action taxation apply when you have a business registered in a tax exempt state like delaware and the physical business located in attack state uh where you're located is irrelevant right both both under physical presence and economic presence legally the states can require a seller located in belarus to collect their sales tax now practically it's hard for a state to enforce its tax cola in a foreign country but legally they have the right to do this and so obviously if you're being located in the state that doesn't have a sales tax helps you not at all when it comes to your collection obligation in a state where you've created a physical presence or in a state where you have economic presence and this this is one of the frankly states that live in the nomad states you know the state selling sales tax they're almost always perfect candidates for the csp business they're not physically present anywhere so they're perfect to go to the sst states and say hey i'm gonna start collecting a sales tax but i don't wanna pay for it is there any other questions you see in there scott yeah that could answer because we're i'm gonna right close on time guys yep i'm gonna do this one right here so remember um these thresholds are a state space state specific and they are literally threshold so they're like i think you're you're stepping over a door you're not in the house until you've stepped over the door so when you go over the threshold that's when your rules change that's when you that's when you have an obligation so you make a hundred you make ninety nine thousand dollars in sales in the south dakota in 2019 you don't collect sales tax in 2020. you make 99 000 sales in south dakota in 2020 you don't collect sales tax in 2021 unless sometime in 2021 you go over a hundred thousand dollars in sales and once you've once you've done that then your obligation to collect sales tax starts now if if we're trying to remember physical presence is different if you have physical presence you have to collect sales tax on the very first sale you make once you've created physical presence yeah well thank you know thank you scott for kind of going through all this sales tax information and i know for me personally it helped me out a lot and helped me understand that i didn't know as much as i thought i knew and if you would like to be contacted by avalara directly um here's evan owens contact information he'll be able to help you out and connect you with the right people out there and also i wanted to point out that um avalaire provided us some helpful handouts if you go in there you'll see that there's a 2020 mid-year sales tax changes form and there's also a brochure kind of explaining a little bit more about avalera there's a few other handouts um there's their website and also the zoho partner link as well and i just wanted uh some closing message um message um if you would like to receive the cpu stay till the end i'm going don't close out of the um the webinar i'm going to end the session and then you can uh answer the evaluation then and then from there um you'll receive your cpe later today or tomorrow and scott i really appreciate everything you've done today it's been great it's been a great uh webinar and i'm sure it helped out a lot of people and pointed them in the right direction well thank you very much it's it's we value our our relationship with zoho and we really thank you for this opportunity it was it was really great and uh val do you have any closing messages uh just a comment that uh this is recorded you're gonna get a link to the materials and recording and i posted a few times out there the economic nexus rules from a little tiny url that we created years ago so and it's current cherry becker keeps it current so uh that's a nice little listing too so thank you for being here and take this very seriously folks each state and even there's multiple agencies within each state you've got to look into this this is a nightmare waiting to happen for you thank you all right thank you everyone thanks everyone have a good day

Show moreFrequently asked questions

How can I allow customers to eSign contracts?

How do I sign documents in PDF format?

How can I get others to sign a PDF file?

Get more for digi-sign Volunteer Certificate made easy

- Initials on chromebook

- Prove electronically signing Profit Sharing Agreement Template

- Endorse digi-sign Liquidity Agreement

- Authorize digital sign Restaurant Receipt

- Anneal signatory Food Service Contract Template

- Justify eSignature Grant Proposal Template

- Try initial Service-Level Agreement Template

- Add Employee Matters Agreement signature

- Send Game Development Proposal Template email signature

- Fax Pet Adoption Application signatory

- Seal Summer Camp Letter to Parents electronically signed

- Password LLC Operating Agreement byline

- Pass Settlement Term Sheet Template esigning

- Renew Quitclaim Deed signature block

- Test Vehicle Service Order signature service

- Require Convertible Note Agreement Template countersign

- Comment heir eSignature

- Boost company eSign

- Compel vacationer initials

- Void Residential Roofing Contract Template template countersignature

- Adopt solicitation template digital signature

- Vouch Formal Itinerary template electronically signed

- Establish Free Movie Ticket template digi-sign

- Clear Exclusivity Agreement Template template esign

- Complete Product Launch Press Release template signature block

- Force Proforma Invoice Template template initial

- Permit Dog Shot Record template signature

- Customize Term Sheet Template template email signature