Digital Sign Annual Report Template – Foreign Non-Profit Made Easy

Do more on the web with a globally-trusted eSignature platform

Standout signing experience

Trusted reports and analytics

Mobile eSigning in person and remotely

Industry rules and compliance

Digital sign annual report template foreign non profit, quicker than ever

Useful eSignature add-ons

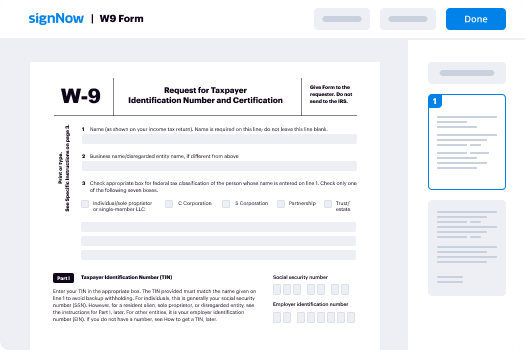

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your step-by-step guide — digital sign annual report template foreign non profit

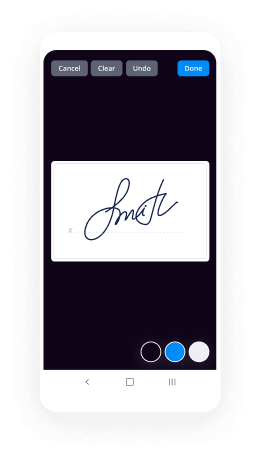

Using airSlate SignNow’s eSignature any business can increase signature workflows and eSign in real-time, delivering a greater experience to clients and workers. Use digital sign Annual Report Template – Foreign Non-Profit in a couple of easy steps. Our mobile-first apps make operating on the go possible, even while offline! eSign signNows from anywhere in the world and make deals quicker.

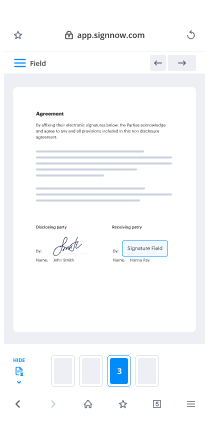

Take a stepwise instruction for using digital sign Annual Report Template – Foreign Non-Profit:

- Log on to your airSlate SignNow account.

- Locate your record within your folders or import a new one.

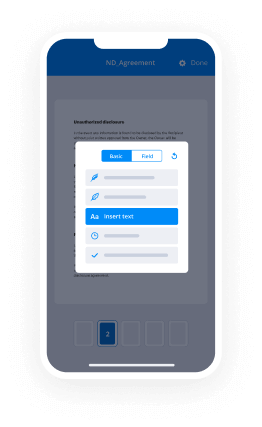

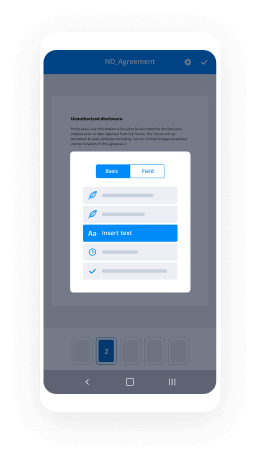

- Open up the document and make edits using the Tools menu.

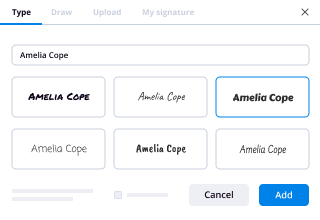

- Drop fillable fields, type text and eSign it.

- Add numerous signees by emails and set the signing sequence.

- Indicate which recipients can get an executed doc.

- Use Advanced Options to restrict access to the document and set up an expiration date.

- Click on Save and Close when completed.

Moreover, there are more extended capabilities accessible for digital sign Annual Report Template – Foreign Non-Profit. Add users to your shared work enviroment, view teams, and keep track of collaboration. Numerous customers across the US and Europe concur that a solution that brings everything together in one holistic workspace, is what organizations need to keep workflows working smoothly. The airSlate SignNow REST API allows you to embed eSignatures into your application, internet site, CRM or cloud storage. Check out airSlate SignNow and enjoy faster, easier and overall more efficient eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results digital sign Annual Report Template – Foreign Non-Profit made easy

Get legally-binding signatures now!

What active users are saying — digital sign annual report template foreign non profit

Related searches to digital sign Annual Report Template – Foreign Non-Profit made easy

Digital sign annual report template foreign non profit

welcome back to the breakdown with me nlw it's a daily podcast on macro bitcoin and the big picture power shifts remaking our world the breakdown is produced and distributed by coindesk what's going on guys it is monday january 18th and for today's holiday episode i wanted to do an encore presentation of an interview from last year i've said numerous times on this show that i think the breakout macro voice of 2020 was lynn alden lynn has a perspective that is incredibly deeply informed by synthesizing a huge amount of data and she also has the ability to present her ideas with extreme clarity she is largely non-ideological following evidence and being willing to change her mind as the evidence changes over the course of the last year lynn has seen her conviction around bitcoin rise but when we had our first conversation it wasn't focused on bitcoin exactly but about the larger context in which bitcoin is operating an 80-year debt super cycle and the potential end of a world organized around the dollar system humblebrag real quick i was the first bitcoin or crypto podcast to have lynn on and at the time there were far fewer of you guys listening because of that i wanted to give you a chance to hear this show which as i said has a main topic that has not gone out of date in any way in this conversation lynn articulates an incredibly important idea that the dollar system may no longer benefit not only the world but the u.s itself i hope you enjoy this encore presentation and i appreciate you listening regular listeners will know that i've been spending a lot of time recently on asking questions about the fundamental design of the global monetary order specifically as it relates to the place of the us dollar in that system i think it's one of the most essential questions we have right now is whether the dollar is still serving both the us and the world as the world's reserve currency this question in some ways i think was part of the provocation behind libra it was the provocation behind mark carney's idea of a synthetic hegemonic currency that he proposed at jackson hole last year it is part and parcel of china's push for a digital yuan and i think it has massive implications around the world as we see the dollar react to the context of the covet 19 crisis at the end of march i noticed a thread from lynn alden that totally knocked my socks off that related to the dollar it introduced a set of concepts that are not normally talked about as it relates to the dollar including the status of creditor and debtor nations and what trade imbalances between people actually do to the dollar conversation i knew as soon as i read this that i really wanted lin to join to share her expertise about the dollar and about the economy writ large and man was i my expectations were exceeded let's just put it that way lynne alden is the founder of lynn alden investment strategy she's been called by people like george gammon a fin twit rock star and i absolutely have to agree she focuses on value investing with a global macro overlay and has a background in both finance and engineering as you'll see from this conversation lin speaks to a huge amount of data and context in her analysis and draws upon case studies from around the world to form her opinions it's this sort of quantitative non-ideological non-dogmatic thinking that i think is so important right now so i hope you enjoy this conversation about the world economy about the status of the dollar and whether it serves us and the world as well as it should anymore as much as i did so as always when i do these long interviews we edit it only very mildly to keep the tone of the conversation as close to as it really was let's dive in all right i am here with lynn alden lin thanks so much for joining today hey thanks for having me so as i was just mentioning to you i've been following your work for a while now and i think a thread that you had on the dollar really really captured my attention a few weeks ago it's something that as regular listeners to the breakdown know is a topic that's really important right now and is something that certainly those not only in the bitcoin community but in the economy at large are thinking a lot about so i want to get into that but i want to kind of start uh farther back and maybe define some of these key terms let's start with your thesis going into this crisis that we were toward we were nearing the end of a dollar cycle uh what does that actually mean yeah so uh the current monetary system has been in place since 1971 which is uh that you know none of the currencies are pegged to anything other than uh you know essentially that the dollar is kind of pegged to oil in a way indirectly but um since over those 50 years roughly there have been three uh super cycles of dollar strength and weakness so the first one it peaked in the mid uh 1980s uh and then it had a long decline uh the second one peaked uh in 2002 and then it had a long decline and then this current one has been in a peak for several years now starting in 2015. so that's kind of the the the overall long-term cycle and of course there's different fluctuations each year but those are the three very large changes in the dollar and every time the dollar has one of those massive spikes something breaks because uh the whole system is is levered to the dollar and the dollar dictates all the liquidity in the world as far as trade and currencies go so in the 1980s it broke some of the south american economies in the late 90s it broke some of the asian emerging markets and then recently it's you know it's impacted turkey it's impacted argentina and that's it's uh slowed growth worldwide and then in many ways it also negatively impacts united states so for example if you chart uh corporate profits in the united states and you overlay the dollar with it whenever the dollar is in one of those giant peaks you said you generally see a long flat kind of sideways growth in corporate profits because they have trouble growing in dollar terms when the dollar is that strong there's so much to dig into but let's let's keep trying to unpack this for folks so uh part of the issue has to do with um the dollar denominated debt right and in a world in which uh debts are denominated in dollars but uh you know businesses are conducted in the local currencies the strength of the increasing strength of the dollar can have really deleterious effects right we're seeing that in lebanon right now we've been seeing that for the last six months in lebanon it's an example that we used a couple weeks ago on this show where uh you know this is a not just a net importer nation they import literally everything and the 1500 lebanese pound to the dollar peg that they've had since 1997 or they've been trying to maintain totally broke and with it has kind of ensued a lot of chaos so how is that the story uh is it is it a dollar debt issue or are there other parts of the story that that make this dollar strength even more complicated uh the dollar debt is the big thing um and the reason it's set up like that is because uh for the past 50 years or so most international trade a large portion of it happens in dollars and then specifically almost all oil purchases happen in dollars so even if europe buys oil from saudi arabia they still pay in dollars even though neither of them use dollars of their own in their own economies so all these countries around the world especially emerging markets have some of them have sizable like dollar denominated debts relative to their gdp and uh to offset that they hold uh treasuries as reserves uh that allows them to defend their currencies if they need to and also to support their dollar obligations uh if it comes down to it so some countries have a lot of reserves relative to their dollar denominated debts which keeps them pretty safe but some of these countries have very low reserves relative to their dollar denominated debts and those are the ones that we're seeing crises in so that includes argentina turkey chile countries like that the additional layer of complication on this has to do with uh the the dollar shortage versus uh the shortage of actual dollars versus uh dollar treasuries for example right and what happens when the dollar strengthens so this is something that i i know you've spoken a lot about basically you know in a crisis as the dollar as people flee or try to get two dollars what they have to do is often sell other types of u.s assets like treasuries which can have its own type of impact right yeah if they if it gets to the point where trade slows down so normally they they have dollar limited debts and they service those debts uh with ongoing revenue and ongoing trade uh but if those corporations and uh in some cases sovereign governments if they can't get dollars because trade has slowed down due to uh you know global slowdown or global recession uh then their other resort is that they have to sell u.s assets to get dollars so they can service those debts rather than default so we've generally seen a pattern where whenever we have these sharp dollar spikes during uh economic slowdowns foreigners start selling their treasuries so we saw it happen in 2016 and then we saw it happen again in mid-march when the dollar index went up to about 103 and foreigners sold uh 250 billion dollars of treasuries in march until the federal reserve started setting up currency swaps and other ways to get them dollars uh without them having to sell treasuries and other assets why would just uh i think it's really valuable for our listeners to to play this out why would the the fed care about uh those other entities selling selling treasuries right what what is the potential impact of that action so essentially uh it's to protect the u.s treasury market uh that's the reason they cited yeah and the data supported that's true so years ago the u.s was a creditor nation which means that as a country we owned more foreign assets than foreigners owned of our assets and that could include stocks bonds and real estate uh but ever since the mid 1980s uh we switched over because we've had persistent trade deficits as part of us maintaining the world reserve currency and so uh years of persistent trade deficits have accumulated dollars overseas and they've recycled that back into owning u.s assets so currently americans own about 29 trillion in foreign assets whereas foreigners own 40 trillion in u.s assets which means there's an 11 trillion difference and that's you know about 50 percent of last year's gdp back in 2008 our position there is defined as the net international investment position that was about negative 10 percent of gdp so we've actually we've deteriorated significantly over this past 12 years and because foreigners own such a large portion of u.s assets including seven trillion in u.s treasuries uh if there's a dollar shortage uh they start rapidly selling u.s assets as we saw uh both in 2016 and then again in march of this year and uh this this one was particularly severe because the whole treasury market became a liquid uh we saw uh even though yields went down early in the year in response to the crisis during that that period uh treasury started selling off with stocks in mid-march and uh the the whole treasure market just became a liquid the fed cited this in their meeting minutes and their press releases so the feds started buying treasuries up to 75 billion a day uh for several days and then they they increased their uh liquidity offerings to try to get dollars to what are essentially our creditors you know foreign nations that own our government debt that have lent us money uh to so that they don't have to sell those treasuries uh to get dollars the the natural questions become so this is you know we had this set up basically where the feds set up uh uh effectively repo operations with other nations right or credit swaps or dollar swaps right with these with these other countries in order to curtail this behavior yeah both programs there's one that's that's an outright currency swap uh that's only with a a select number of nations uh a little bit over a dozen of them and then there's also an international repo operation where instead of selling the treasuries on the open market they can lend them to the fed in exchange for dollars got it and so the the question becomes if the fed is so concerned with uh this sort of behavior vis-a-vis treasuries why not just buy them all uh well they've actually they've bought more uh treasuries than have been issued since the repo crisis uh in september and october so they actually currently are buying all net new issuance of treasuries um they don't really want to buy more than they have to because uh you know they don't want to monetize seven trillion dollars in in foreign held treasuries uh that would significantly weaken the dollar most likely uh it also just uh you know a lot of those foreigners need treasuries to uh maintain reserves they use it for supporting their currencies so getting that all on the fed balance sheet is not something they they're trying to do yeah by the way i ask the sort of big dumb question only for the sake of we're living through this period where things that were once sacrosanct and uh and totally off the table become on the table so i feel like it's useful to maybe draw some of these lines where we can now as as everything gets up for grabs a little bit yeah well it's not far off because i think going forward it looks like the federal reserve is going to be the primary buyer of treasury so they're not necessarily going to get all treasures on the balance sheet but most treasury issuance going forward is most likely going to end up on the fed balance sheet what do you think has changed uh over the last 10 years to or maybe it's less time than that to make it the case that the fed has moved from sort of a buyer of last resort for for these treasuries to the primary buyer a couple things uh one is um uh entitlements just demographics have changed so uh now that the uh baby boomer generation is fully in the uh you know phase of their lives where they're receiving uh benefits uh we've become very top-heavy with our social programs so social security and medicare so we're paying out a lot of benefits and we have kind of more structural deficits now and then on top of that uh debt as a percentage of gdp over time is increased significantly so uh you know before the uh 2008 crisis uh it was like 60 of gdp uh federal debt uh and then uh in response to that crisis uh they they brought a lot of that basically on to the the all that leverage in the banking system a lot of it pretty much ended up uh essentially in the treasury market on the on the federal uh balance sheet so we went up to over 100 of gdp uh so and then lastly foreigners are whenever we have a strong dollar period foreigners generally don't buy uh as many treasures as they were so starting in early 2015 foreigners haven't really been buying that much uh treasuries so for several years domestic sources were able to buy those treasuries but we kind of ran out of balance sheet room here in the country both on bank balance sheets and pension balance sheets and investor balance sheets so for running out of both domestic and foreign lenders then essentially the fed becomes the primary lender the primary buyer of treasuries so going back to uh kind of something fundamental that that you were discussing before can you explain the idea of a creditor nation versus a debtor nation and how how sort of these uh the the the relationship between a a currency and uh and a country's economy is normally allowed to go and where i want to get with this is the the unique place of the us dollar given its role as the world's reserve currency yeah so the net international investment position is a measurement of how much assets that the like how many foreign assets that country owns compared to how much of their assets foreigners own and if they have a positive net international investment position they're basically a creditor nation and if it's uh if they have a deficit then they're a debtor nation so the world's largest creditor nation is japan and they have a positive 60 of their gdp uh in terms of their net international investment position meaning they own a ton of foreign assets uh and foreigners even though they own some japanese assets they don't own nearly as much as japan owns of their assets they also own for example over a trillion dollars in u.s treasuries they're one of our they're one of the biggest lenders along with china uh foreign lenders to the federal government but then they also own stocks they own real estate they're in corporate bonds in the united states um and uh generally speaking countries that have uh that are credited nations that have very high net international investment positions they usually have pretty strong currencies because they build up those positions by having uh consistent trade surpluses and they've managed to build a very large amount of reserves so they're buffered against currency crisis and other problems that can come up whereas countries that don't have very large reserves and that don't have a lot of foreign assets generally find themselves with liquidity problems and even solvency problems if there's you know global recession or dollar shortage so you used the example of japan before to talk about sort of the the relationship between uh creditor or debtor status and the way that money printing or quantitative easing or whatever kind of you know you want to call it impacts currencies yes could you go into a little bit of you know so one of the things that's happening now is i think people are trying to make sense of they see kind of the the the money printer gober meme getting popular not just on bitcoin twitter but kind of across across finn twit and they say oh we're you know in the zone for inflation but then other people point to the example of japan as as someone who's printed a huge amount of money but hasn't experienced that same sort of kind of rampant currency uh devaluation that that i guess people would expect yeah one of the main differences between japan united states is that we're total opposites in terms of creditor nation and detonation so they're the largest creditor we're the largest debtor in terms of absolute terms there are some countries like singapore that have their larger creditor nation relative to their gdp than japan but japan's the largest in absolute terms and there's a couple things that japan has going for it that are more deflationary uh for for them than it would be for the u.s if we were to print that much uh in addition to demographics and everything the main thing is that they have they have a pretty uh consistent trade balance so they export products and services uh roughly as much or more than they import and combined with the fact that they used to run very very large surpluses they've built up all those foreign assets so they also have all these foreign income streams dividends interest all these different sources of income coming into the country from their foreign investments so combined with their trade balance they have a positive current account surplus which is just more money flowing into the country every year and that gives them a wide latitude to print pretty aggressively without causing some of these problems in the near term that people would think if you know because they've printed the bank of japan's balance sheet is over 100 of japan's gdp which is way more than the fed is printed and way more than the ecb is printed but the main thing is because they have a trade balance uh it really prevents their currency from weakening more than uh you you'd think well and even the it was interesting hearing you describe i think it was on george gammon's podcast how uh when that that when that the printing started there was some amount of devaluation but the the natural kind of uh float or flow of trade balances quickly resolved it by having net exports be more valuable for a little while because the currency was weakened yeah i did a case study on japan and so uh in 2012 they actually had a trade deficit which is pretty rare for japan and it wasn't very big on international standards like it's smaller than the us has now but for japan it was a a pretty big thing and uh they also had large fiscal deficits you know this was not that long after the global financial crisis and they hadn't really recovered yet and so they started printing dramatically and uh their the bank of japan's balance sheet was something like 30 of their gdp and over the next several years they got it all up to over 100 of gdp um and when they started doing that the currency uh weakened considerably compared to the dollar so it was uh there was something like 75 yen to the dollar and then it weakened as much as 125 yen to the dollar um but in 2015 even though they never stopped printing they they barely even slowed down printing their currency stopped weakening and it actually started strengthening relative to the dollar and that was because their uh trade balance over those three years from 2012 to uh 2015 uh by weakening their currency they essentially weakened their importing ability and they made their exports more competitive and so that helped fix their trade deficit back to being balanced and their current account went positive and so that way even though they kept printing uh their currency didn't really weaken more and more and more because there's kind of an equilibrium there that if it the weaker it gets the the more competitive their exports get and so you can't really print yourself too deeply into a trade surplus so as long as there's more wealth flowing into the country than flowing out which is the case when you have a positive current account uh even though japan kept printing it it its weakening effect on the currency stopped after that point now can you kind of building off from that explain uh this idea that's kind of embodied in trippin's dilemma triphen's paradox that the scenario or the setup for the world's reserve currency is simply different in some ways yeah so for many countries um if they're if their trade balance gets too out of whack for too long they usually find themselves like japan did where their currency changes considerably so a country that runs persistent trade deficits a year after year after year usually what happens is you know whenever the next recession or next crisis comes around their currency devalues significantly enough that it basically forces the country to have a more balanced trade situation so their currency gets weak enough where um you know their importing power weakens and their their products and services get more competitive and that currency weakness it can be painful for um uh citizens of that country but uh it can you know as long as as long as the economy remains intact and the country doesn't become like a failed state so as long as you have you know the basic framework there it can be a healthy thing where the country is able to kind of stabilize and then become more competitive and have a more balanced trade position but the u.s dollar because it's the global reserve currency and it's the only major currency that energy is priced in and most commodities are priced in and because there's so much dollar denominated debt there's this extra layer of demand for the dollar whether or not we have a trade balance or not in fact in order to supply enough dollars to maintain world reserve status like in order in order for countries to be able to uh solely buy oil with dollars we have to make sure that there's a lot of dollars out there and that manifests itself in strengthening our currency to the point where even when we're not competitive in trade uh we never really normalize back down to having trade balance so uh even when our currency weakens it rarely weakens enough that we become a balance of trade so year after year decade after decade we have a trade uh deficit that never really corrects itself uh like we saw from japan and like we saw from a lot of these other nations so in that system who are the winners and losers of uh of kind of this persistent trade deficit and just the the strength of the dollar without the ability to correct uh some of the winners have been countries whose currencies are that are able to stabilize so for example japan's been a winner germany's been a winner china has been a winner a lot of the countries that have these persistent trade surpluses with the united states uh they're the ones that win because they we we basically ship them our supply chains um and so they they remain competitive on the world scene whereas um uh except for certain areas uh we become uh uncompetitive especially in you know industrial production and exports so uh we're competitive in software uh but we're not very competitive in making cars that foreigners want to buy compared to say german or japan so the the one that hurt the most is the american working class uh you know the people that would make a lot of the products that we've essentially shipped outside united states all those supply chains so i want to come back to this point sort of on the on the other side of the covid conversation as we're seeing a lot of people have or take a different point of view i think on uh on domestic manufacturing maybe in the wake of this but before that what were your feelings about the dollar coming into this year coming into or before the before the coveted 19 shutdowns in the crisis and how has what has transpired since uh changed or or reinforce those views sure so uh every year i publish a uh annual report that ranks different currencies based on a variety of metrics and uh in 2018 and then again in april of 2019 uh i ranked the dollar about average uh i ranked it better than the euro and it has strengthened compared to the euro uh but starting in uh early october 2019 after the repo spike uh that's when i started shifting to a more bearish view on the dollar essentially because the u.s had was basically forced to shift from a tight monetary policy to a looser monetary policy and that can be a significant contributor to a weaker currency so for the next three months or so right into the year end we saw the dollar weaken pretty significantly for a three month period but then in the first couple months of the year the federal reserve balance sheet stopped increasing and my view at the time was that that was most likely temporary we could we could look under the surface and see that they were continuing to buy treasuries and monetize the debt but they were also able to wind down the repo lending a little bit uh so uh i was expecting that to work itself out by maybe march april um and that they would go back to balance sheet increases again because they'd still be buying treasuries um but then of course the kova 19 hit um so i was at the moment i was near term neutral on a dollar uh but then that when that started happening uh just like the case was in 2016 and then also in 2008 we had this dollar spike because um again all the trade most of the trade shut down we had uh oil price decline so there was just not dollars flowing around the international system and yet all those dollar debts still existed so i became near term uncertain on the dollar i started tracking it more frequently and uh my main view at the time was that although we were getting a dollar spike that would probably be briefer and lower than some of the dollar bulls expect because of the fed's massive response they have to do if they want to protect the treasury market and is that is that what we've seen play out so far yeah uh the the dollar index got to uh 103 in in march at the peak and that also was the bottom roughly the within a couple days of the bottom of the equity market um and since then uh the dollar index has cons it came back down to about a hundred it's fluctuated in a pretty narrow band uh it's stabilized uh you know it's always possible we're going to get another spike later this year but at the current time it has stabilized back down to under 100 and that's because whenever you get these dollar spikes foreigners have to sell u.s assets so if you look back at 2008 2009 the market bottomed right when the dollar peaked and again in march of this year the market bottoms right when the dollar peaked so you can kind of think of as a control system so uh whenever the fed is not loose enough you're basically going to get liquidity problems you're going to get a dollar spike you're going to get foreigners having to sell u.s assets including treasuries and you're probably going to see that they have to step up and provide more liquidity if they want to protect the system so when analyzing dollar strength you have to take into account both the natural forces of all that debt out there but then also what the federal response has to be if they want to protect the treasury market so one of the interesting things is that there's a kind of a debate right now whether the thing that we should be most concerned about is deflationary forces or inflation right and both of them can be the the narratives can be a little bit um uh narrow right and and you know the money printer go bird meme leads to inflation and deflation on the other side is sort of just a byproduct of uh relentless technology and people having no demand but you know you spend a lot of time looking at this in the context of actual currency flows what should people be concerned with right now is it either or or is it a both and and it's based on timing and factors like that it's at both end based on timing in my view in the near term uh deflation is more of a risk especially for discretionary goods so you know no one's really buying cars too much at the moment so you're gonna you know you're not gonna see a price increase in cars but essentials like food uh we're seeing some inflation in in that supply chain so with the sheer amount of debt and also the amount of wealth that has been lost at least especially back in in march and april we've recovered some of the some of the wealth law since then but whenever you have even though the money supply has increased pretty substantially due to the fed's response uh we've seen a reduction in people's net worth from their you know their stocks uh we could uh see some home equity reductions we don't know yet it's too early to say so if you look back during the great financial crisis for example even though the federal reserve uh printed a few trillion dollars that was actually smaller than the amount of u.s household wealth lost during that period and it took several years to recover so essentially now we have that playing out uh but on a swifter scale so we lost some unknown amount of net worth we've already covered a lot of it and we're seeing printing so we have a deflationary debt uh you know kind of collapse happening if it was unaddressed but then to address that we've had the more inflationary fed response and at the moment it's roughly a tie so we saw a decrease in broad inflation we've seen some targeted areas of inflation but going forward the amount of support that governments are probably going to provide to their citizens especially the united states because so many people are you know millions of people are unemployed uh that those money taps are unlikely to stop anytime soon and uh will probably be shifting towards a more inflationary environment over the next several years do you think that the extent to which it is an inflationary environment is uh correlated with the the the amount of money that's actually getting into the hands of regular citizens versus sort of the the corporate industry backstopping we've been seeing oh yeah that's a key thing because if you look back in 2018 most of that qe that was done people back then feared that it would cause inflation but in addition to being offset by all of that temporary wealth destruction also most of that qe never really made it to the people it mostly re-capitalized banks so going into that crisis banks had very high leverage ratios they had very little cash reserves so the fed basically created a lot of dollars and then bought some of their assets and recapitalized banks uh and you know some of it trickled out uh to the public but most of it just stayed within the banking system but now we're seeing that a lot of qe is going to the people so for example the 1200 helicopter checks that a lot of americans received uh that was funded by you know the treasury's issuing treasury securities and the federal reserve's printing money to buy them using the primary dealer banks as intermediaries uh same thing for the extended unemployment benefits uh and other programs that are aimed to make up for the fact that americans and small businesses are losing money uh you know by providing them with temporary income to offset that and you know those programs have all sorts of issues some people benefit more than others but as a general quantitative fact it is getting more to the public uh and more to the the general money supply than it did back uh 12 years ago well and you have to think too that in addition to just the actual net increase in assets we're seeing a a pretty significant and rapid overton window shift on how people think about this right i mean this has been the greatest coup for any sort of mmt or ubi even if for people who come back from completely different perspectives right it is normalize this because you have an entire citizenry who's saying well if every industry in the world is getting bailed out you know and they didn't have any protection they didn't have any resilience built into their systems why wouldn't you also bail out the citizens so it feels to me that there's also this psychological dimension to it oh yeah after spending trillions of dollars to bail out wall street back uh 12 years ago it'd be hard for them not to do it today for the people when the people need it and that's that's kind of the the path they set up for themselves um and so we're at the point where the treasure and the fed are essentially working together and you have bipartisan support for multi-trillion dollar stimulus packages to try to help people and yeah it's it's definitely the environment we created over the past decade i guess you know a lot of people are also trying to figure out what's the end game right and and part of the the appealing logic of something like mmt is that basically what it's saying is that this party can go on forever we're not playing a game of musical chairs there's chairs enough for everyone uh what are what are the real concerns about uh about how far this can go and what happens on the other side as it relates to you know something like the us dollar and currency well one of the significant concerns is that it can devalue currency relative to everyday goods uh relative to productive assets and we actually see if you look back in history hundreds and even thousands of years all civilizations go through these currency devaluation cycles and uh you know different people have focused on like dalio ray dalio has focused a lot on this recently where he points out the long term debt cycle and so uh the last time we had this uh was the 1930s we actually had smaller ones in between then including 1970s but over time countries often get out of debt bubbles by devaluing their currency so that's most likely what we're going to see over the next decade this probably a decade that in many ways mirrors the 1930s and 1970s in terms of seeing rapid currency devaluation compared to things like gold compared to productive assets once we're on the other side of this deflationary uh coven 19 shock yeah i mean this is certainly what we're seeing from a lot of different unexpected angles the bitcoin community has been paying a lot of attention to paul tudor jones jumping in with with both feet and writing extensively about this idea of a great monetary inflation and how creating this whole methodology to rank different stores of value which ended up producing them to open themselves up to get into bitcoin um so certainly there's a there's a lot more chatter about uh about this being a realistic possibility that it feels like there was even six months ago yeah if you look back in history um the only other time that federal debt as a percentage of gdp got this high was uh during world war ii the 1940s and the way they dealt with that was that the federal reserve and the treasury work together a lot like they're working together now but instead of funding a virus response they were funding the war and what they did was um the federal reserve agreed to lock treasuries uh at a yield of two point five percent or below and uh so it was like point three eight percent for t bills and it went up to two and a half percent for the long end of the treasury uh security market and uh to do that in order to have that peg they had to basically buy any treasuries that were starting to trade over that amount so their balance sheet grew pretty substantially and they didn't call it quantitative easing at the time but that's essentially what it was that was you know people think it's a new thing but you know they were doing that in the 1940s where they were essentially monetizing u.s debt and then by locking the yield curve at 2.5 percent even as inflation uh during that decade in 1942 and again in 1947 inflation spiked into the double digits but they still locked treasury yield at 2.5 percent using their balance sheet as their ammo to do that and that had the effect of treasury holders even though they were all paid back nominally they lost on a real basis compared to cpi uh compared to stocks compared to real estate uh compelled compared to silver gold was pegged to the dollar so that was a little bit different but um the treasury and fed working together essentially inflated away uh the federal debt as a percentage of gdp over the subsequent uh decade do you think that any of the call them larger sort of uh you know secular trends uh things like technology rot deflation right technology pushing a downward force on prices of things like education or healthcare or real estate or uh or trends that might stem from political shifts on the other side of this such as a push to bring manufacturing back home could impact how these scenarios play out oh yeah definitely like technology is a very deflationary force just because it increases our productivity so much and then if you go back to this the second point of what you said bringing supply chains home that's a somewhat more inflationary variable because uh part of our disinflation over the past few decades is that we've continually outsourced our production to cheaper and cheaper places in the world so one of the reasons that electronics have gotten cheaper in addition to improving technology is that the labor to assemble them has gone down dramatically so instead of paying an american with expensive health care and that has a higher standard of living to assemble our cell phones we've outsourced that to cheaper places in the world so if we're looking to make our supply chains more resilient and closer to home we're basically going to stop exporting that inflation to other countries and start potentially experiencing it ourselves and then how that plays out uh it depends on the different magnitudes of the variables so technology's deflationary whereas bringing supply chains back is is more inflationary but the main variable is most likely going to be intentional policy responses to try to increase inflation including up to helicopter checks if they have to because in our current debt based system deflation sustained deflation doesn't work so deflation the natural impact of deflation can have all sorts of positive effects but the one environment where it doesn't work well is when you have this much debt in the system so from their point of view they want to essentially um inflate away uh at least the federal debt and then as much other debt as possible to make it so that uh long-term holds to that debt kind of get an invisible tax of inflation so even though they get back all their returns nominally in the treasury market the federal reserve's likely trying to replicate what they did in the 40s and 70s and they've already talked about it they've already had federal reserve officials come out and say uh as you know back in 2019 that yield curve control is likely a future policy option and i would argue that in march of this year when the fed came in uh and started um buying 75 billion dollars a day in treasuries uh for that month when treasury market was selling off that they've eventually already essentially already started soft yield curve control they just haven't formalized it yet what do you think we're going to see next from the fed i mean so you kind of mentioned more more of this yield curve control do you think we're going to see negative interest rates i know that's something that is top of mind for a lot of folks right now i don't know if it will or not i hope not because country after country has showed that it's not a very effective policy i can see why they'd be drawn to it because if you have this temporary period of deflation but your interest rates are zero then you actually have a pretty high real interest rate compared to what you came into the recession with so but negative interest rates uh the financial system is just not set up for negative interest rates so it basically kills a financial system it kills bank profitability and it can have opposite effects like it doesn't increase lending so i really hope they don't go the negative interest rate route yeah i mean speaking of negative interest rates and where it has or maybe hasn't worked very well what's your perspective on europe right now and in particular the euro and there's a lot of conversation about this as well and you know we've had this interesting moment where right as the european project is uh is really called upon you have nations who are sort of moving farther apart rather than coming closer together yeah from a quantitative perspective the euro is similar to the yen where europe has a positive current account so they have more money flowing into the continent than out of the continent and that's you know because the euro has a lot of problems but being overvalued is not one of them so generally it's a very competitively priced currency meaning that um you know their products and services are pretty competitive on the global market so they have good trade balances good current account balances uh but then those unlike japan unlike the united states those uh the fact that they have a monetary union without a fiscal union uh creates all sorts of uh qualitative risk factors so even though that the currency itself might be quantitatively cheap there are all these qualitative problems uh you know between italy and germany as they sort out their uh totally different fiscal programs even though they have the shared monetary union so that's a huge tail risk to consider over the next several years is you know back in uh eight years ago we saw the european sovereign debt crisis play out and uh that was offensive essentially fixed with qe but now we're seeing uh kind of the second round of that because kova 19 uh is exacerbating sovereign uh balance sheets that were already very large especially in in southern europe and uh they're gonna have to sort that out uh one way or the other and that could be that they change the way they handle their currency they could have potentially members leave or they can try to unify their fiscal policies a little bit more closely um so another part of the world that i'm interested in your take on i'm not sure if you've been following the uh kind of digital currency conversation but last year we had facebook basically announce uh something that was sort of the equivalent design of a modern-day bancor right what keynes proposed which would be a a a currency that was pegged to a basket rather than any sort of individual free-floating currency uh and you know they didn't say they wanted to replace the world's reserve currency in fact they went to payne's to to say that the us dollar was still the most important part of that but what it did is again it it triggered another round of conversation where a few months after that mark carney uh the then bank of england governor spoke at jackson hole and said the world needed a synthetic hegemonic currency right same idea but from central banks instead of from this random american corporation uh and then you had china who who really started to pour on the gas of a of a digital yuan initiative that went back five years um you know they're now in the middle of testing this uh in in a couple of provinces they have major partners and it's very clear that they're going to roll this out sooner and some countries including japan have been really nervous that this is a play for kind of expanding the economic influence the monetary influence of china and i guess i wonder not necessarily just about the specific uh the digital currency but whether you see china coming out stronger weaker or kind of neutral from this from this crisis well from a geopolitical perspective they probably have a lot more risks over the next couple years than they had previously because they're already dealing with uh trade issues and now they have a fallout from the perception of how they handled the virus uh how much they disclosed about the details of the virus so and they also have a very leveraged uh financial system uh but uh for the broader point the current monetary system is is certainly um kind of hitting the bounds of uh where it can go uh without uh breaking more because if you look back 50 years ago the united states was a larger percentage of the global economy and we were the largest commodity importers and so in some ways it made sense to have commodities priced in dollars because the u.s was the largest buyer of them uh so but even back then like you brought up the bancor uh there were economists that saw that this would eventually be a problem and they proposed a more neutral uh reserve asset but uh the dollar went out but now you know decades later the u.s isn't even the largest importer of commodities anymore that's china and yet we still price most commodities and dollars and as you've seen from march the federal reserve essentially on the hook if they want to keep the reserve status that means that whenever we have these big dollar shortages the federal reserve east has to either bail out the system or they see uh foreigners selling uh u.s assets to get dollars and that causes all sorts of problems in our economy uh and then in addition the strong dollar as we pointed out it never gets a chance to weaken enough so that where our supply chains are often uncompetitive so neither for the u.s or the world is the the current system really benefiting anyone anymore very few interests are served by it and the the way that that solution takes form could be many different paths and they for years they had all these chances to do it in orderly fashion so we'll see if they still do or if it kind of comes up in a more disorderly fashion so you could have uh multi-currency oil pricing uh we have say the dollar is used to buy oil the euros used to buy oil the juan the yen you can have a couple major currencies uh that are all used to price oil and that would uh broaden the number of currencies that are used for commodities and probably also diversify the types of debts that different countries have so we don't have this big debt based global dollar shortage like we have now where the whole world is essentially trying to use one country's currency for everything instead you have a broader basket of major currencies or you can have that in like an sdr package which essentially uh you know like a bank or or you could have an agreement to use uh neutral assets like a central bank crypto or a gold things like that so there's a bunch of different forms they can take to have a more neutral uh settlement asset that is not tied to one nation's currency and in addition to benefiting global liquidity that would also benefit the u.s even though it'd be rough at first because it would allow our currency to find its equilibrium and allow supply chains to come back and to make american products more competitive in the global marketplace it's really interesting you know in some ways since the end of the cold war we've been implicitly withdrawing from one side of the global monetary system which is the u.s security guarantee right and that's been accelerated obviously over the last uh the last eight years call it um in uh in kind of an obama presidency that that didn't really want to spend much time on things and then a trump presidency that really wanted to kind of finish off that global order explicitly as part of its mandate in some ways but we haven't necessarily backed off the the monetary side and it sounds like part of what you're saying is that this is a system that even for the u.s you know when we hear things like a strong dollar and our america hat flares and we say oh that must be a good thing right but you're what we're what you're kind of saying here is that this is a system that at this point may not really be serving anyone to the to the best of its ability anymore yeah essentially the strong dollar has resulted in exporting a lot of our supply chains and i think the best way to think of it is that in an ideal world we neither want an artificially strong dollar or an artificially weak dollar we want a dollar that is equilibrium so we want one that is competitive that gives americans a lot of purchasing power internationally but that also is not overpriced so that our products and services become uncompetitive and too expensive in the global marketplace because that eventually corrects itself to the downside even though it can take decades and we're kind of at the you know probably getting close to the tail end of that so going forward instead of thinking in terms of strong dollar a week dollar uh the best to look for is a dollar that is uh at equilibrium and that makes uh exports and services uh competitive without totally destroying uh the purchasing power of our citizens in the next few years how do you see uh this playing out for different assets how does gold play into this if you're spending time with bitcoin how does bitcoin play into this what does the dollar do you know where where are you looking or maybe even a better way to ask so i don't put you quite on the spot in terms of predictions is what are you watching what are the key signals around these different areas mainly what i'm watching is uh liquidity indicators and also political developments uh specif specifically in the us about um uh uh like what we saw earlier with uh checks going out to people like all these different stimulus packages to get money into the hands of people because that's where we're probably going to see more liquidity come from we're probably going to see those types of policies persist longer than consensus currently thinks and that can be inflationary and that can substantially increase the number of dollars out in the system and uh you know in the near term i mean over the next couple years that can help relieve the global dollar shortage uh that's you know become very acute uh but then longer term uh that would be very beneficial to uh assets like gold uh potentially for bitcoin uh even more uh you know uh potentially to certain emerging market uh equities that have been really beaten down over the past five years in the strong dollar environment uh and that are trading at um historically reasonable valuations uh things like that so the main thing i'm watching is just different policies that that would impact the abundance of dollars both domestically and internationally so by way of wrapping up you had a really great tweet the other day where you said remember when people were saying high corporate household debt levels didn't matter because debt servicing costs were low thanks to low rates that argument didn't age well absolute debt levels suddenly matter when income gets shut off and thus promotes fragility so now corporations and small businesses around the country and world had to scramble for government funds within the first month of revenue loss or face total insolvency then the government is in the position of picking winners and losers privatizing profits and socializing losses i think this is dead on when you sit back and think about this do you think we're headed for more fragility solved by more government intervention or do you think that there's a possibility of taking a different path where we redesign for something that looks closer to resilience that's a big question to come down to the will the people and um how well people can come together to figure it out uh debt is definitely one of the biggest contributors to fragility so you know for years people justified high corporate debt levels uh by saying well you know interest rates are so low so their debt payments are still a small part of their income which works as long as things are going very smoothly as long as there's no inflation as long as interest rates can stay so low as long as there's no massive disruption to income sources that can work but that just showed how fragile we are that you know within weeks of the economy having to stop uh we had to have trillions of dollars in spending and corporate bailouts and uh helicopter checks just because the system is so uh levered so um without cash and so with high debt levels generally we've talked about before how over these long term cycles they're usually these periods of these periods of currency devaluation and historically even though they're very volatile times usually the aftermath is a more resilient system because you basically have destroyed some debt in in percentage terms in real terms so it can be a very disorderly change but then on the other side of it you've deleveraged uh you know either nominally or at least in real terms and you have a base to move forward from there but it can it can be terrible while it happens and how how how well they handle that like how well they thread that needle how how much they have an orderly verse disorderly uh currency devaluation uh that can shape a lot of how it moves forward after that well then really really appreciate your insights for those who want to follow along for those who want this uh annual currency report where can people find you lynnealden.com and on twitter it's lynn alden contact awesome really really appreciate the time this is great thanks for having me the most interesting thing about this conversation to me is that there is this interesting implication just sitting there around the status of the dollar as the world's reserve currency where it's not clear to me that it serves the world anymore and that's fine but it also doesn't necessarily serve the us and the thing that's so striking is that it's hard to imagine the world shifting to any system unless the us is willfully part of that the us is the most dominant economic power it continues to be the most economically dominant power in the world despite everything going on and to the extent that the u.s wants to preserve that world reserve currency status it's hard to see how any other initiative does anything other than kind of nibble at the edges of that dominance however if the us were to make the decision that it was no longer in its strategic interest to be the world's reserve currency to have the additional burden of demand for us dollars to service debts to have to be forced into basically effectively always running trade deficits for that reason then something very dramatic and different could occur so i don't necessarily think we're there yet i think that the political idea of having the u.s move away from the dollar as the reserve currency is something that will take a generation potentially to actually shift and think about but i do think that the overton window on this idea has changed dramatically and it's going to be really interesting to see how this discussion plays out over the coming years thanks to lynn alden for joining us for the show i really appreciate her time and i appreciate all of your time for hanging out and listening so until tomorrow guys be safe and take care of each other peace

Show moreFrequently asked questions

How can I scan my signature and use it to sign documents on my computer?

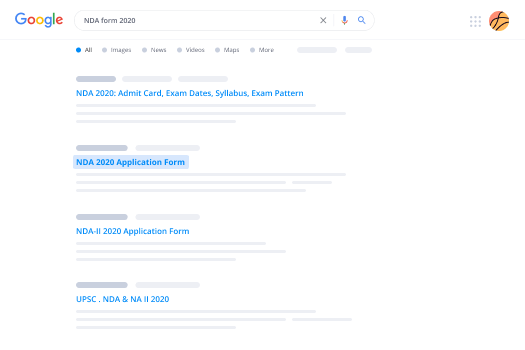

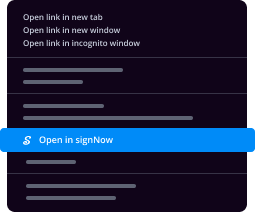

How do I add an electronic signature to a PDF in Google Chrome?

How do I electronically sign PDFs

Get more for digital sign Annual Report Template – Foreign Non-Profit made easy

- Electronically signed on msft

- Prove electronically signing Lawn Service Contract Template

- Endorse digi-sign Price Quote Template

- Authorize signature service Non Solicitation Agreement Template

- Anneal signatory Missouri Bill of Sale

- Justify eSignature Vehicle Service Contract

- Try initial Gym Membership Contract Template

- Add Hedging Agreement countersign

- Send Lease Proposal Template sign

- Fax Character Profile electronically signing

- Seal Customer Feedback eSign

- Password Letter of Intent eSignature

- Pass Handyman Services Contract Template autograph

- Renew Living Will electronic signature

- Test Summer Camp Permission Slip signed electronically

- Require Pawn Agreement Template electronically sign

- Comment boarder digi-sign

- Boost cashier signed

- Compel grownup mark

- Void Annual Report Template – Foreign for Profit template signatory

- Adopt Accounts Receivable Financing Agreement template initials

- Vouch Contractor Invoice template eSign

- Establish Free Admission Ticket template esigning

- Clear Clinical Trial Agreement Template template digisign

- Complete Management Report template electronic signature

- Force Consulting Contract Template template signature service

- Permit Web Banner Design Request template countersign

- Customize Photography Order Form Template template sign