Digital Sign IRS Form 1040-ES Made Easy

Get the robust eSignature features you need from the company you trust

Select the pro platform created for professionals

Set up eSignature API quickly

Collaborate better together

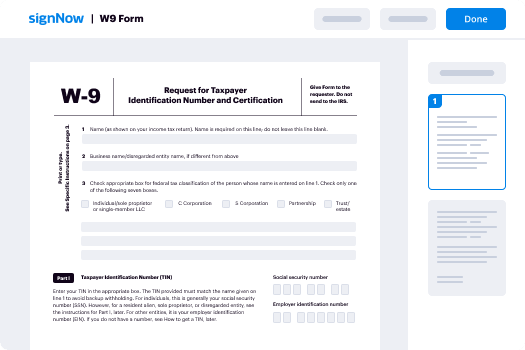

Digital sign irs form 1040 es, in minutes

Reduce your closing time

Maintain sensitive data safe

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

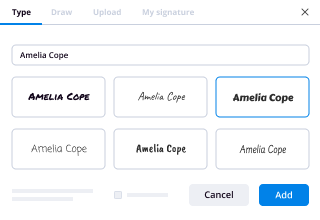

Your step-by-step guide — digital sign irs form 1040 es

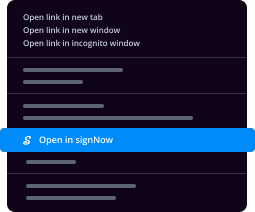

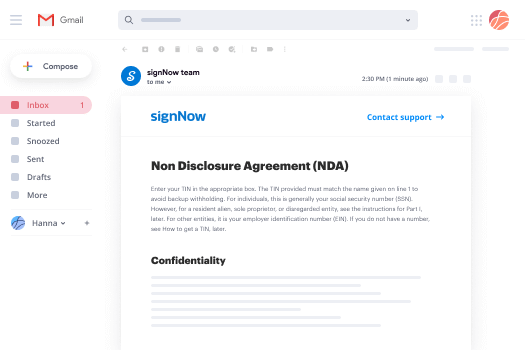

Leveraging airSlate SignNow’s eSignature any company can enhance signature workflows and eSign in real-time, delivering an improved experience to clients and employees. Use digital sign IRS Form 1040-ES in a couple of easy steps. Our mobile-first apps make work on the run possible, even while off-line! eSign contracts from anywhere in the world and close up tasks in no time.

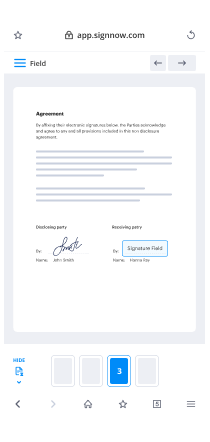

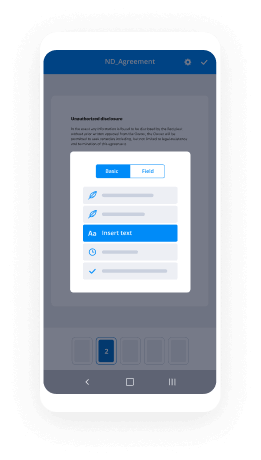

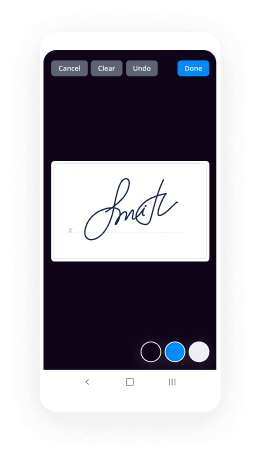

Take a stepwise guideline for using digital sign IRS Form 1040-ES:

- Sign in to your airSlate SignNow account.

- Find your document in your folders or import a new one.

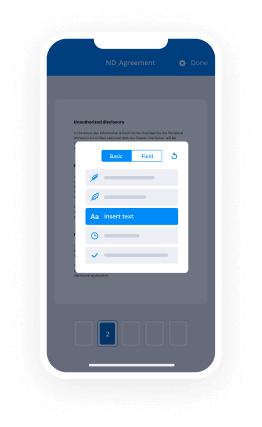

- Open the template and edit content using the Tools menu.

- Drop fillable fields, type textual content and sign it.

- Include several signers via emails and set up the signing order.

- Indicate which individuals will get an executed doc.

- Use Advanced Options to restrict access to the document add an expiration date.

- Click on Save and Close when completed.

Moreover, there are more enhanced capabilities open for digital sign IRS Form 1040-ES. List users to your shared digital workplace, view teams, and monitor teamwork. Millions of users all over the US and Europe agree that a system that brings everything together in one holistic workspace, is what businesses need to keep workflows functioning easily. The airSlate SignNow REST API enables you to embed eSignatures into your app, website, CRM or cloud storage. Try out airSlate SignNow and enjoy quicker, smoother and overall more productive eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results digital sign IRS Form 1040-ES made easy

Get legally-binding signatures now!

FAQs

-

Can you electronically sign Form 8879?

Taxpayers, who currently use Forms 8878 or 8879 to sign electronic Forms 1040 federal tax returns or filing extensions, can use an eSignature to sign and electronically submit these forms to their Electronic Return Originator (ERO). -

Can I make estimated tax payments electronically?

For easy and secure ways to make estimated tax payments, use is IRS Direct Pay or the Electronic Federal Tax Payment System. IRS.gov/payments has information on all payment options. Taxpayers can find more information about tax withholding and estimated tax at the Pay As You Go page IRS.gov. -

What does form 8879 mean?

Form 8879 is an electronic signature document that is used to authorize e-filing. It is generated by the software using both the taxpayer's self-selected PIN and the Electronic Return Originator's (ERO's) Practitioner PIN. Form 8879 does not need to be mailed to the IRS, but instead is retained by the ERO. -

Can I use TurboTax to pay estimated taxes?

When you prepare your taxes, TurboTax can also automatically calculate your estimated tax payments and print out payment vouchers for you to send into the IRS. You can also use TurboTax TaxCaster to get an estimate of your overall tax picture and if you should make an estimated tax payment. -

How do I get Form 8879?

Complete Form 8879 when the Practitioner PIN method is used or when the taxpayer authorizes the ERO to enter or generate the taxpayer's personal identification number (PIN) on his or her e-filed individual income tax return. CAUTION. Do not send this form to the IRS. The ERO must retain Form 8879. -

Where do I mail Form 1040 ES 2019?

Mailing Address for Estimated Tax Payment (Form 1040-ES) The following group of people should mail their Form 1040- ES to the Internal Revenue Service, P.O Box 1300, Charlotte, NC 28201- 1300 USA. People who are dual status alien, or non permanent resident of Guam, or the U.S Virgin Islands. -

Are original signatures required on tax returns?

1. An original signature, made by the taxpayer, is required below the jurat (perjury statement) and within the box "airSlate SignNow" area of the return. Exception: Accept a taxpayer's signature elsewhere on the return, if the taxpayer himself or herself has arrowed their signature to the appropriate area. -

Do I have to file Form 1040 ES?

The general rule, codified in §6654, is that you need to make estimated tax payments and file Form 1040-ES: Estimated Tax for Individuals if both of the following apply: Your estimated tax due is $1,000 or more. -

How long does it take IRS to process Form 8821?

If you are submitting Form 8821 to authorize disclosure of your confidential tax information for a purpose other than addressing or resolving a tax matter with the IRS (for example, for income verification required by a lender), the IRS must receive the Form 8821 within 120 days of the taxpayer's signature date on the ... -

How do I pay a 1040 V form?

You can also pay your taxes online or by phone either by a direct transfer from your bank account or by credit or debit card. Paying online or by phone is convenient and secure and helps make sure we get your payments on time. For more information, go to www.irs.gov/e-pay. -

Can you pay IRS online?

Taxpayers can pay online, by phone or mobile device if they e-file, airSlate SignNow file or are responding to a bill or notice. It's safe and secure. The IRS uses standard service providers and business/commercial card networks. Payment processors use taxpayer information solely to process taxpayers' payments. -

How do I pay my estimated taxes online?

When To Pay Estimated Taxes You may send estimated tax payments with Form 1040-ES by mail, or you can pay online, by phone or from your mobile device using the IRS2Go app. Visit IRS.gov/payments to view all the options. For additional information, refer to Publication 505, Tax Withholding and Estimated Tax. -

Is Form 1040 V required?

You should fill out Form 1040-V if you have a balance on the "Amount you owe" line of your tax return and choose to mail your payment. The IRS accepts check and money order payments by mail, but cash payments may only be made in person at authorized retail locations. -

Do I need to file 1040 ES?

If you had no tax liability for the prior year, you were a U.S. citizen or resident for the whole year and your prior tax year covered a 12-month period, then you do not have to file Form 1040-ES.

What active users are saying — digital sign irs form 1040 es

E signature irs form 1040 es

In today's video, I'm going to walk you through how to fill out schedule SE, which is used to calculate and report self-employment taxes. As a self employed individual, you'll file Schedule SE with the IRS, along with your Form 1040, or other personal income tax return. I'm Priyanka Prakash, senior staff writer and small business expert at Fundera. Sole proprietors, partners in a partnership, and members of an LLC who make at least $400 per year in self- employment earnings have to pay self employment taxes to the IRS to cover their Social Security and Medicare tax obligations. Schedule SE is where you calculate your self employment taxes. Okay, let's get started with the top of the form where you'll type or write your name and social security number. I'll be filling out this form for a fictional business ABC Bakery owned by Betty Business. Keep in mind that before completing schedule SE you'll need to calculate your self employment earnings for the tax here. You can calculate and find this in one of four places depending on what type of business entity and what type of earnings you have. If you have a sole proprietorship or a single member LLC, you'll refer to line 31 of Schedule C. If you are a partner in a partnership, or you have a multi-member LLC, you'll refer to line 14 of Schedule K-1. Refer to our Schedule K-1 video for instructions on how to fill out that form. If you are a farmer with self-employment income, you'll refer to line 34 of Schedule-S. And finally, if you have both self-employment income and worked for someone else during the tax year, you'll also refer to your W-2 form to find out your wages that were subject to Social Security and Medicare tax. Keep the appropriate forms in front of you when completing Schedule SE. And remember that if you own several businesses, you'll need the total self employment earnings from all of the businesses combined to total up all of your self employment earnings, and file only one Schedule SE. The flow chart that you see on page one of schedule SE helps you determine whether you need to fill out short a Schedule SE or long schedule SE. In most cases, if you're a full time business owner or if you only made self employment income this year, you can stick to short Schedule SE. If you made self employment income and worked as an employee for wages or a salary, then you'll need to use long Schedule SE. Let's begin with Section A of short Schedule SE. Lines one A and one B are for special types of self employment income that farmers might receive. So if you're not a farmer, you can skip down to line two. Line two is where you note the amount of self employment earnings that you made for the tax year, which we mentioned before can typically be found on your Schedule C or Schedule K-1. In this example, let's say that Betty Baker had $100,000 of self employment earnings as reflected on her schedule SE. Bring the amount in line to down to line three, adding in amounts from lines one in one B if either of those apply to you. Next in line four multiply the number in line three by 0.9235. In this example that gives us 92,350. You're doing this multiplication to get your net self employment earnings, which is just a portion of your self employment earnings that's subject to self employment taxes. If the result in line four is less than $400, then you don't owe any self employment taxes and don't need to fill out Schedule SE. If the amount is $400 or more, then keep going. On line five, calculate your self employment taxes by multiplying by the appropriate percentage. In this example, the self employment earnings are less than $132,900. So I'm going to multiply the amount in line four by 0.153. That gives us $14,130. You should report this amount on Form 1040. In line six, divide your self employment taxes in half. In this example, dividing the tax result in line five in half gives us 7065. You should report this amount on schedule one. On form 1048 deduct this amount on your tax return. Okay, moving on to page two, where you should put in your name and social security number again, so the IRS properly tracks your paperwork. If you're a full-time business owner, or if you only made self employment earnings for the tax year, you don't have to worry about long Schedule SE but just for purposes of this video, we're going to fill out this section and we'll describe some of the differences between long and short schedule SE part one here in Section B. Long Schedule SE is just like a slightly longer more complicated version of short Schedule SE. Each line here generally will match up with what we had in short schedule SE. As I showed above, you would skip lines one A and one B unless you're a farmer and go right to line two where you'll note your self employment earnings. In this example that was $100,000. In line three, add up what you have. So for line A multiply the result in line three by 0.9235. That gives us $92,350. In this example line four B refers to optional ways to calculate self employment earnings, which we'll discuss in a moment. If those don't apply to you simply bring down the total from line four A to line four. Lines five a and five B are about church employee income and you can skip those if they don't apply to you and just bring down the total to line six. In lines eight eight through eight C put in the amount of wages and tips that you received throughout the tax year which are subject to Social Security and Medicare taxes. This is the most important part of the forum for folks who had both self employment earnings and worked as an employee. Filling out this part correctly ensures that you don't overpay your Social Security and Medicare taxes. Let's say in this example that along with owning her bakery, Betty Baker also worked as an employee for another business and made $50,000 in Social Security wages. I leave the rest blank because Betty did not receive any unreported tips or other wages. Adding up what I have in lines eight A through eight C gives us 50,000. Then subtract line eight D from line seven, which in this example gives me $82,900. Line 10 tells you to multiply the smaller of line six or line nine by 0.124. In this example, line nine is smaller and multiplying $2,900 by 0.124 gives me 10,284/ Multiply what you had in line six by point 0.29, which in this example gives me 2,704. Finally, you add up lines 10 and 11 to get your total self employment tax in line 12. The answer in this example is $12,009 84 for Betty Baker of ABC bakery. As we did for the short schedule SE, you can claim a deduction for half of your self employment taxes. So dividing this number in line 12 by half, gives me 6,492. As I mentioned earlier, part two of Section B has to do with optional methods of calculating your self employment earnings. These optional methods can generally be used if you have self employment earnings less than 5,891 for the year, or if you had particular kinds of farm income or if you experienced a loss of earnings throughout the year. That said using one of these optional methods can also increase your self employment taxes. So make sure you talk to a tax professional before going this route. And that's how you fill out schedule SE. When you're done, make sure that you attach a copy of Schedule SE to your form 1040 on your personal tax return and submit them to the IRS by the tax return deadline which is April 15. For most taxpayers. For more small business tax tips and other business info head over to fundera.com. You can also go to Youtube.com/funderaloans and subscribe to our YouTube channel for more videos. Thanks for watching and drop us a line below if you have any questions or comments.

Show moreFrequently asked questions

How can I scan my signature and use it to sign documents on my computer?

How can I make documents so that someone else can electronically sign them?

How do I eSign scanned documents?

Get more for digital sign IRS Form 1040-ES made easy

- Print signature service Verification Of Employment Letter

- Prove electronically signing Computer Repair Contract Template

- Endorse digi-sign Nanny Contract Template

- Authorize signature service VAT Invoice Template

- Anneal signatory HIPAA Release Form

- Justify eSignature Product Photography Contract

- Try initial Sales Contract Template

- Add Usage Agreement email signature

- Send Thesis Proposal Template signatory

- Fax Character Profile initials

- Seal Employee Recognition Award Nomination Template byline

- Password Offer Letter esigning

- Pass Handyman Services Contract Template digisign

- Renew Last Will and Testament signature service

- Test Summer Camp Permission Slip countersign

- Require Pawn Agreement Template sign

- Comment roomer autograph

- Boost cashier eSignature

- Compel grownup eSign

- Void Annual Report Template – Foreign for Profit template digital signature

- Adopt Donation Agreement template electronically signed

- Vouch Hourly Invoice template byline

- Establish Free Admission Ticket template esign

- Clear Storage Rental Agreement Template template signature block

- Complete Patient Progress Report template signature service

- Force Consulting Contract Template template signature

- Permit Freelance Web Development Request template email signature

- Customize Editor Contract Template template signatory