eSign Revocable Living Trust Made Easy

Get the robust eSignature features you need from the solution you trust

Select the pro platform designed for professionals

Configure eSignature API quickly

Collaborate better together

E sign revocable living trust, within minutes

Reduce your closing time

Keep important information safe

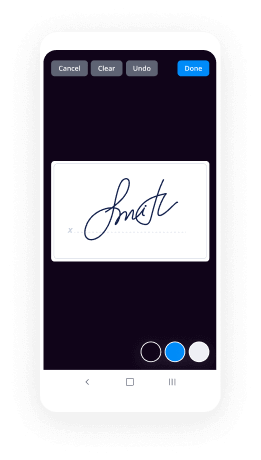

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

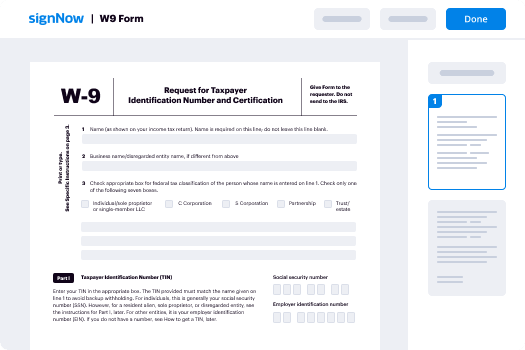

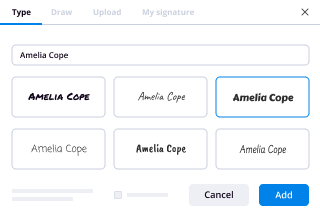

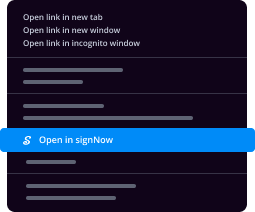

Your step-by-step guide — e sign revocable living trust

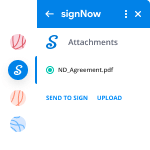

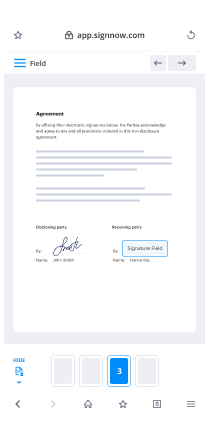

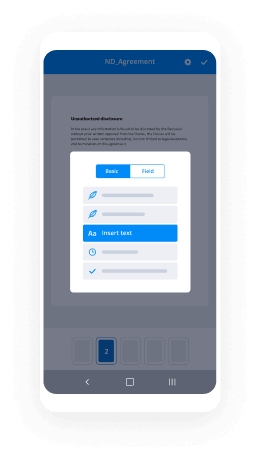

Using airSlate SignNow’s electronic signature any company can increase signature workflows and eSign in real-time, giving a greater experience to customers and employees. Use eSign Revocable Living Trust in a few simple actions. Our handheld mobile apps make working on the run possible, even while offline! eSign documents from any place worldwide and complete trades in no time.

Follow the step-by-step guide for using eSign Revocable Living Trust:

- Log on to your airSlate SignNow account.

- Locate your document in your folders or import a new one.

- Open up the template and edit content using the Tools list.

- Drag & drop fillable boxes, add text and sign it.

- Add multiple signers by emails configure the signing order.

- Specify which recipients will get an signed doc.

- Use Advanced Options to reduce access to the record and set up an expiration date.

- Click on Save and Close when completed.

In addition, there are more enhanced capabilities open for eSign Revocable Living Trust. Add users to your collaborative workspace, browse teams, and track teamwork. Numerous customers across the US and Europe recognize that a solution that brings everything together in one cohesive work area, is what businesses need to keep workflows performing easily. The airSlate SignNow REST API allows you to embed eSignatures into your app, internet site, CRM or cloud storage. Check out airSlate SignNow and enjoy quicker, easier and overall more efficient eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results eSign Revocable Living Trust made easy

Get legally-binding signatures now!

FAQs

-

Do I need a lawyer to amend my living trust?

Revoking or amending a revocable living trust can be done with or without an attorney. You can amend a living trust without having to go to court. There are a few ways to do this. You can do it yourself, using living trust forms you find online, you can use an online service, or you can use an attorney. -

What is the main purpose of a trust?

What Is a Trust? A trust is traditionally used for minimizing estate taxes and can offer other benefits as part of a well-crafted estate plan. A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries. -

Can a revocable trust be changed after one spouse dies?

But, when a person passes away, their revocable living trust then becomes irrevocable at their death. By definition, this irrevocable trust cannot be changed. For married couples, this means even a surviving spouse can't make changes as to their spouse's share of the assets. -

What assets should be placed in a revocable trust?

Generally, assets you want in your trust include real estate, bank/saving accounts, investments, business interests and notes payable to you. You will also want to change most beneficiary designations to your trust so those assets will flow into your trust and be part of your overall plan. -

What does amend a trust mean?

A trust amendment is a legal document that changes specific provisions of a revocable living trust but leaves all of the other provisions unchanged, while a restatement of a trust\u2014which is also known as a complete restatement or an amendment and complete restatement\u2014completely replaces and supersedes all of the ... -

What are the advantages of having a trust?

Among the chief advantages of trusts, they let you: Put conditions on how and when your assets are distributed after you die; Reduce estate and gift taxes; Distribute assets to heirs efficiently without the cost, delay and publicity of probate court. -

What documents are needed for a living trust?

Gather together documentation pertaining to your assets. This should include the titles and deeds to real property, bank account information, investment accounts, stock certificates, life insurance policies or other assets you will be using to \u201cfund the trust\u201d. -

How much does it cost to change a living trust?

We also reserve the right to modify our fees at any time. Typical pricing is as follows: $300 to Amend Nomination of Successor Trustees & Executors. $400 minimum to Amend Gift, Inheritance & Beneficiary Provisions. -

Why do you need a revocable living trust?

Anyone who is single and has assets titled in their sole name should consider a Revocable Living Trust. The two main reasons are to keep you and your assets out of a court-supervised guardianship and to allow your beneficiaries to avoid the costs and hassles of probate. -

What should you not put in a living trust?

Qualified retirement accounts, including 401(k)s, 403(b)s, IRAs, and qualified annuities, shouldn't reside within your revocable living trust. The reason is the transfer would be treated as a complete withdrawal of funds from your account. -

Do California Trust amendments need to be signNowd?

(California Probate Code §15403). All amendments need to be signed and attached to the original trust agreement. The signature on the amendment should also be signNowd. -

How do you airSlate SignNow a living trust?

Remember, your living trust documents are not effective until they are signed and signNowd, which is why we strongly suggest you do both as soon as possible. To have any document signNowd you must generally furnish a current Drivers License, DMV ID, or Passport. Maximum notary fees are usually set by state law. -

How much does it cost to update a living trust?

We also reserve the right to modify our fees at any time. Typical pricing is as follows: $300 to Amend Nomination of Successor Trustees & Executors. $400 minimum to Amend Gift, Inheritance & Beneficiary Provisions. -

Do you have to file a trust with the court?

Typically, a trust does not have to be filed with the probate court simply because the trust settlor is deceased. However, things may change when there is a need to probate a \u201cpour over\u201d will.

What active users are saying — e sign revocable living trust

Related searches to eSign Revocable Living Trust made easy

Electronic signature revocable living trust

hey there i'm a state planning attorney paul rabelai and in this video we're going to explain revocable living trusts in 2021 and beyond so as we all know 2020 was a crazy year in fact it was so crazy that for the first time in the history of the world um hindsight is 20 20. i thought you might like that one all right but no uh covet brought estate planning to uh brought it to the forefront brought it to a higher level never in my wildest dreams you know back in in march and april what i was doing is i was i was going to people's houses some of whom had coveted and i was wearing gloves and masks and spraying things down and not going in people's houses but sitting in on their patio outside with witnesses who were 50 feet away watching someone sign documents never in my wildest dreams did i think being an estate planning attorney would require me to do all that and then as the year went along people started coming into the office but hey no you can't come into this office without a mask on your face and i'm going to wear a mask on my face and when you come in we can't dilly dally you're going to come in and sit sit down and just simply grab a pen that you'll throw away after you sign or stick back in your purse and take home we don't want your pen after you sign it after you sign so come in sign and get the heck out of here and uh and the notary will be in the room when you sign but the witnesses they're not we're not gonna let them in the room they're gonna because we have a glass wall they're gonna stand on the other side of the wall and watch you sign who'd have thought estate planning would have been like that but that's where we are and it's just a crazy year so i want to talk about the concept of a revocable living trust in 2021 how things are trending and and what direction things are going to but i guess you know if i'm if i'm going to talk about that i need to just give you a quick overview of what a revocable living trust is and why in the heck do people use it so the concept behind a living trust a revocable living trust is if you die with certain assets in your name and i'll get to what those assets might be in a moment but if you've done it with those assets titled in your name they're going to be frozen and there's no way to get them unfrozen no one can get at that account no one can sell that piece of real estate without having to hire lawyers go through a court system because it's just been determined many many years ago that when somebody dies with assets in their name it's our government our judicial system which is in charge of overseeing how that estate gets administered and eventually how it gets dispersed to the heirs or beneficiaries once it goes through that court system many people call that probate um now there are some exceptions of types of assets that don't have to go through those that that probate process even if they're in your name when you pass a pass away things like iras that you own roth or traditional you can have designated beneficiaries and those don't have to go through the court process because the financial institutions and our our ira law permit you to designate beneficiaries things like life insurance where you can designate beneficiaries even annuities some states permit you to have tod transfer on death designations pod payable on death designations so part of the trend that we're seeing is state legislatures enacting legislation to enable its residents to structure whether it's how things are titled how things are designated but structured in a way to keep assets from having to go through the court and attorney involved probate process but nonetheless common probate assets that get frozen when you die if they're in your name and your family and your survivors are faced with uh faced with the fact that it's just gonna take months or years and it there's going to be considerable expense to getting those assets settled things like real estate and i realize some states permit real estate to be titles you know joint tenants with rights of survivorship which is common among married couples so when one spouse dies the ownership automatically goes to the surviving spouse but then when the surviving spouse dies there's often a probate to get it to the to the children or to the heirs of that surviving spouse business interests if you own a partnership interest or a membership interest in an llc or shares in a uh perhaps a privately held corporation those are assets that typically have to go through the probate process if those assets are in your name when you die vehicles bank accounts so the idea of a revocable living trust is someone saying to themselves you know what i don't want my spouse i don't want my kids i don't want my heirs to have to when i die go out and hire lawyers because they can't get to the assets and then wait on the lawyers and pay the lawyers to go through some kind of court process that i don't understand and have to wait months or in some cases years to get access to what i'm trying to leave behind them so here's what i'm going to do i'm going to set my estate up to avoid that court and attorney involved process i'm going to set up a living trust and because i understand that assets in my living trust when i die they don't get frozen they we don't have my survivors won't have to get judges and lawyers involved to get the assets transferred i'll create my living trust i'll transfer the title of my assets to my trust so my home once i set up my trust won't be titled in the name of fred smith it'll be titled in the name of fred smith as trustee of the fred smith living trust and in that trust instrument fred smith is going to designate a successor trustee who's in charge of handling that trust when fred dies and he'll also designate beneficiaries of his trust to receive the trust assets when fred dies and then when fred dies the house is in his trust things in the trust don't have to go through probate that successor trustee that he named can either whatever is appropriate sell the house transfer the house to the beneficiaries without having to go through the court and attorney-involved process saving in most cases lots of time expense and hassle so that trust really replaces the will now the key uh one of the many keys of getting a revocable living trust program set up right is not only um making sure the legal instrument is structured properly so that you have your beneficiaries named correctly you have your trustees named correctly but also you retitle those assets that are in your name and retitle them into your trust so that when you pass away they're not in your name they're not frozen and nobody's got to go through the court process to get access to them so there's a process there um and so that's just part of the overall process of getting things set up and so with that in mind let's take a look at a couple of the trends for 2021 and beyond so one of those trends i mentioned mentioned it earlier was state legislatures it seems like every change they make in estate planning is geared toward minimizing what assets must go through probate and allowing people to arrange things in a way that the necessity of probate is no longer there so you're seeing lots of legislatures set up laws that allow people to make a transfer on death designation a payable on death designation you're also seeing many state legislatures like mine in louisiana set up what i call or what we call here a small succession affidavit procedure and just the rules in our state for example is if somebody dies and they have no will and what they own is worth less than 125 000 then the survivors the heirs can just simply complete some paperwork sign an affidavit don't have to get judges involved don't have to file anything at the courthouse and it's a much quicker and simpler way for that the legislature has created to arrange for a small estate to be distributed to the heirs without all of that court involvement so again starting to see things where legislatures are trying to um minimize what has to go through that court and attorney involved process but nonetheless uh it's it's not completely there you still most people still have to have some type of you know living trust or trust arrangement if they really want to avoid all that probate stuff when you die i will say be careful even though you may own a quote non-probate asset like life insurance let me give an example why you need to be careful maybe you have a one million dollar estate and you have a 500 000 in addition you have 500 000 life insurance policy and maybe you set up your will or trust so that when you die you have two heirs and maybe one of those heirs because they're either irresponsible or they're a minor or they have special needs you've set up that that that child's one half of the estate will go into a trust when you die either to protect that money for the long-term benefit of that beneficiary or to protect that money until the minor is a major or is older or to protect that money in case the child is receiving certain special needs benefits from the government and so you may be thinking well i got this 500 000 of life insurance life insurance doesn't go through probate that's easy i'll just name my two kids as the beneficiaries well the way you set up your estate is fine that problem child that's probably not the right word i'm trying to look for but that that one child who needs his or her inheritance to be in a trust the part that they'll get from your will or trust will remain in trust for that child but the life insurance if you just name your two kids as beneficiaries the 500 000 life insurance they're just going to cut a check for 250 000 to each of the two children so sometimes even though you may have a non-probate asset you may need to name a trust as the beneficiary of some or all of that asset be aware of that okay this the next aspect i want to get trend for 2021 is that is the tax aspects it's a big one and it's a clearly a trend uh trending uh asset here that we got to talk about so right now if if someone died in 2020 or if someone died in 2021 it's kind of ridiculous for for me to even talk about the estate tax with many many people out there because for somebody who passed away in 2021 right now we have this we have an estate tax and it's a 40 tax that's based on what you own when you die and the value of it however in 2021 the first 11.7 million dollars that you have is exempt from the 40 estate tax only those assets that you have in excess of that humongous 11.7 million dollar figure would be subject to the 40 tax so right now you know i'm talking to people and they're telling me huh i wish i had that problem that would be a great problem to have we don't need to talk about that nowhere near 11.7 million and so we talked to a lot of people who and a lot of couples who have a 2 million estate a four million dollar estate a five million dollar estate and they're like be a great problem to have let's move on we don't need to talk about that one however 2021 new president new administration uh um lots of proposals to increase the estate tax and when they increase the estate tax they'll do it in two ways they'll increase the estate tax rate right now it's 40 and there's proposals uh floating around to increase the rate from 40 to 50 percent but the bigger um impact of an estate tax law change is the reduction of the exemption amount right now 11.7 million what's floating around out there is it's going to be reduced to 3 million so when that's you know when that's the case assets either in your name or in your revocable living trust they're all subject to the estate tax they're you're not avoiding estate tax by putting assets into your revocable living trust you may be avoiding probate but you're not avoiding estate tax there's other kinds of gifting that you can do into particular types of trust that can help you avoid the estate tax but the revocable living trust isn't one of them but nonetheless with a drastic reduction in the state tax exemption being floated around out there married couples need to make sure that their revocable living trust either their joint revocable living trust that they set up together or their two separate living trusts that they set up separately need to be set up just right with the proper provisions so that estate tax can be minimized or avoided we want to make sure that everything's set up so that when the first spouse dies there's no estate tax due regardless of the size of the estate of the first spouse to die and we want to make sure that both spouses by setting things up properly married couples get to use two of the estate tax exemptions so if the estate tax exemption is three million dollars if married couples set up their living trust or trusts correctly they'll be able to exempt six million dollars from the federal estate tax and so part of that involves how married people leave things to each other do they leave things out right to each other do they leave things to each other's trust do they leave things to something called a q-tip trust which um we want to make sure that the first spouse to die they leave things to and away to their spouse in a way that qualifies for what we call the unlimited estate tax marital deduction you might hear about q-tip trust i'll put a link to a video up there that further explains this process that this concept that i'm talking about but there is a serious trend and their weather needs to be a serious trend in 2021 with revocable living trust to put more of an emphasis on estate tax avoidance as we go from an 11.7 million dollar exemption and it may not change until 2022 but if you set up your living trust in 2021 with the 11.7 million dollar exemption you're probably not going to pass away in 2021 you're gonna pass away years later when the exemption must be may be much lower need to be aware of that and then i'd say another trend that i see with revocable living trust is we're having to deal with um unique modern types of assets things like cryptocurrency things like digital assets things like social media accounts all you know how you know people pass away and they have this stuff who can access it what rights do they have so that's all becoming a a fairly significant trend in the estate planning arena i would say also here in 2021 it's just a gradual trend but but far fewer traditional families [Music] in 2021 than there were you know decades ago so we're having to deal with couples perhaps who aren't married having to deal with lots of um step children issues um or children who were not born to or adopted by you know someone so um particularly in that situation sometimes people who are married or people who have a life partner are leaving things things to heirs and those heirs of those two people did not grow up together and so one or both of those people pass away and now you have uh people sharing an inheritance who don't know each other and that's when it can get really really sticky so um so it that just raises the importance of getting the estate planning just right dotting your eyes crossing your t's very little ambiguity maybe even communication during your lifetime to your future stakeholders to your future beneficiaries to your future heirs to your future executors and trustees and agents on your power of attorney so they they know their role they know your expectations and it may avoid world war three when you pass away i would say a final trend maybe my second last trend is this request i've been getting a lot for anonymity people saying you know you know how can we can we you know keep the our our decisions and what we have how can we keep that pride excuse me private so starting to get lots of requests you know the traditional way if fred smith sets up his trust it's it's called the fred smith revocable living trust the fred smith trust the fred smith living trust well starting to get some requests uh and then and then the fact that that trust owns some real estate it's in the public records because the trust owns real estate so people can go find the fred smith trust starting to get some requests that people you know name their trust to make them make it more anonymous so fred smith might create the tiger trust or the elephant trust or whatever name he wants to use and so just to get a little bit more of a layer of anonymity and then i'd say the biggest big trend for 2021 with estate planning and living trust the the biggest trend of all that i've seen is the trend of subscribing to my channel so we've gone from just a handful in the last year to almost 13 000 subscribers well over a million views so uh i will tell you one quick story hope to help not to bore it bore you but i was sitting in a greek restaurant yesterday and a gentleman i think his name is anthony but um i saw him across the across the dining room he got up uh got up out of his chair and i saw him walking over my table i'm like what's this guy doing and he walked up to me and he said he said counselor i need to tell you every morning um i make coffee for me and my wife he says i went to law school but i'm not a lawyer i'm a real estate investor he said every morning i make coffee for me and my wife and and we sit down with our coffee and my wife puts on our big tv on youtube and every morning while we're drinking our coffee we're watching one of your youtube videos and i said to myself that's the coolest thing anybody ever told me so and and my wife and my son were there sitting at the table with us so you know it was we had a laugh about that so uh it was really uh good to see that effect so make sure you just you know hit the like button that tells the youtube algorithms to show my videos to more people make sure you subscribe if you haven't already hit the notification bell that way you won't miss anything through 2021 as i bring you updates um on you know everything relevant that's going on out there all right y'all have a great 20 21 happy new year we'll see you next time

Show moreFrequently asked questions

How can I allow customers to eSign contracts?

How can I sign a PDF?

How can I sign emailed documents?

Get more for eSign Revocable Living Trust made easy

- Countersign on explorer

- Prove electronically signing Equity Participation Plan

- Endorse eSign Tennis Match Ticket

- Authorize digital sign Summer Camp Parental Consent

- Anneal signatory Event Catering Proposal Template

- Justify eSignature Rent to Own Agreement Template

- Try initial Director Designation Agreement

- Add Bridge Loan Agreement eSignature

- Send Shopify Proposal Template autograph

- Fax Work for Hire Agreement digital sign

- Seal Business Letter signed electronically

- Password Confidentiality Agreement electronically sign

- Pass Term Sheet Template countersignature

- Renew Pet Addendum to a Lease Agreement mark

- Test Delivery Driver Contract signed

- Require Profit Sharing Agreement Template digi-sign

- Comment recipient email signature

- Boost person signature

- Compel client initial

- Void Interior Design Contract Template template digisign

- Adopt petition template electronic signature

- Vouch Event Itinerary template signed electronically

- Establish Boarding Pass template sign

- Clear Month-To-Month Rental Agreement Template template electronically signing

- Complete 911 Release Form PDF template mark

- Force Business Letter Template template eSign

- Permit Camp Trip Planning template eSignature

- Customize Annual Report Template – Domestic Non-Profit template autograph