Electronic Signature IRS Form 1040-ES Made Easy

Get the powerful eSignature capabilities you need from the solution you trust

Choose the pro service created for pros

Set up eSignature API with ease

Collaborate better together

Electronic signature irs form 1040 es, in minutes

Cut the closing time

Keep sensitive information safe

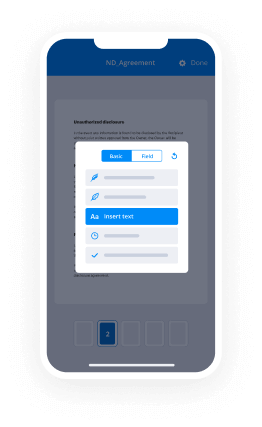

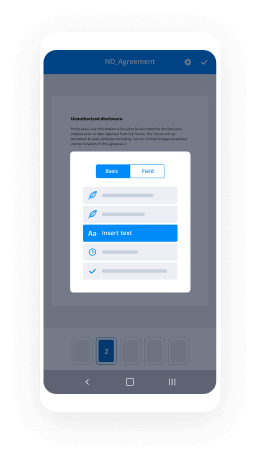

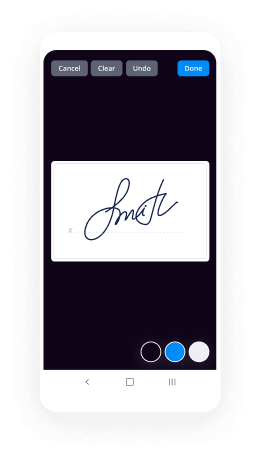

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

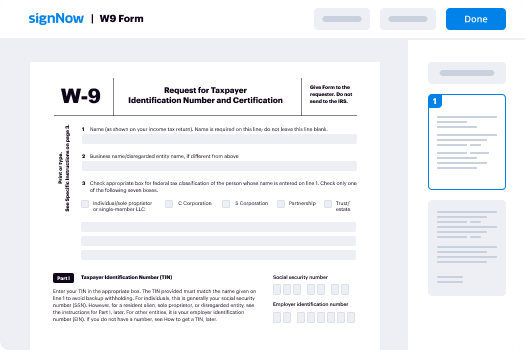

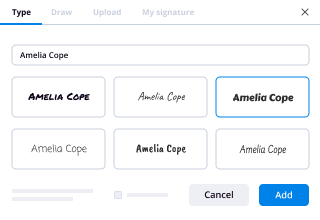

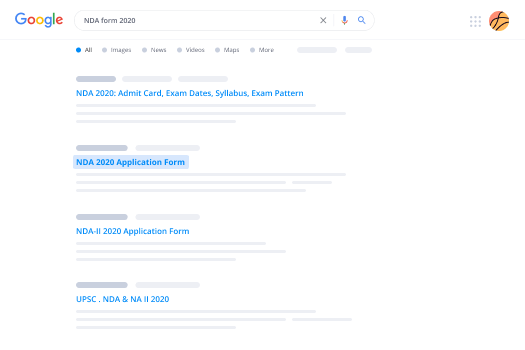

Your step-by-step guide — electronic signature irs form 1040 es

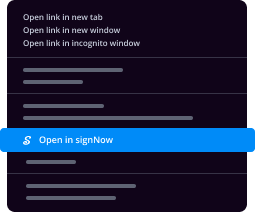

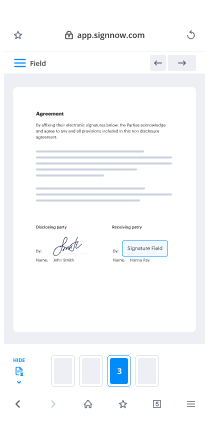

Leveraging airSlate SignNow’s electronic signature any company can increase signature workflows and sign online in real-time, delivering an improved experience to clients and employees. Use electronic signature IRS Form 1040-ES in a few simple actions. Our mobile apps make operating on the run possible, even while off-line! Sign contracts from any place worldwide and complete deals quicker.

Keep to the step-by-step guideline for using electronic signature IRS Form 1040-ES:

- Sign in to your airSlate SignNow profile.

- Locate your document within your folders or import a new one.

- Open up the record and make edits using the Tools list.

- Place fillable boxes, add text and eSign it.

- Include multiple signers via emails and set up the signing sequence.

- Specify which individuals will receive an executed copy.

- Use Advanced Options to restrict access to the document and set up an expiration date.

- Tap Save and Close when done.

Furthermore, there are more extended features accessible for electronic signature IRS Form 1040-ES. Include users to your common workspace, browse teams, and track cooperation. Numerous people all over the US and Europe agree that a system that brings people together in one cohesive digital location, is what companies need to keep workflows functioning smoothly. The airSlate SignNow REST API enables you to integrate eSignatures into your application, internet site, CRM or cloud storage. Check out airSlate SignNow and enjoy quicker, smoother and overall more effective eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results electronic signature IRS Form 1040-ES made easy

Get legally-binding signatures now!

FAQs

-

Can Form 8821 be electronically signed?

If you complete Form 8821 for electronic signature authorization, do not file a Form 8821 with the IRS. Instead, give it to your appointee, who will retain the document. ... The copy of the tax information authorization must have a current signature and date of the taxpayer under the original signature on line 7. -

Can you electronically sign Form 8879?

Taxpayers, who currently use Forms 8878 or 8879 to sign electronic Forms 1040 federal tax returns or filing extensions, can use an eSignature to sign and electronically submit these forms to their Electronic Return Originator (ERO). -

What is a 8879 form?

Form 8879 is an electronic signature document that is used to authorize e-filing. It is generated by the software using both the taxpayer's self-selected PIN and the Electronic Return Originator's (ERO's) Practitioner PIN. Form 8879 does not need to be mailed to the IRS, but instead is retained by the ERO. -

Do I need to sign my tax return if IE file?

If you e-file your return: If your return is accepted and you signed with a PIN, you're done. You don't need to mail anything else. If your return is accepted and you chose to use an IRS signature form (Form 8453-OL), you need to sign and mail this form. -

Can I use airSlate SignNow for IRS forms?

The IRS now accepts electronic signatures on forms 8878 and 8879. airSlate SignNow empowers you to electronically sign the IRS forms to make your work hassle-free. ... With airSlate SignNow, you can: Save time and money: No need to print, fax, scan, or ship documents. -

What is a 8879 form used for?

Form 8879 is an electronic signature document that is used to authorize e-filing. It is generated by the software using both the taxpayer's self-selected PIN and the Electronic Return Originator's (ERO's) Practitioner PIN. Form 8879 does not need to be mailed to the IRS, but instead is retained by the ERO. -

How do I sign my electronic tax return?

You can sign your tax return electronically by using a Self-Select PIN, which serves as your digital signature when using tax preparation software, or a Practitioner PIN when using an Electronic Return Originator (ERO). Self-Select PIN - Use the Self-Select PIN method when you're using tax preparation software. -

How do I report estimated tax payments on 1040?

To report your estimated tax payments on your 1040.com return, enter them on our Form 1040-ES \u2013 Estimated Taxes screen. The first section of the screen is for taxes you paid for the previous tax year (the one you're filing a return for), the bottom section is to set up payments for the current tax year. -

How do I digitally sign a tax return?

Step 1: Fill out the ITR form, generate the file as an XML file and save it. Step 2: Visit the Income Tax India website. ... Step 3: After logging in, click on the tab that reads \u201cSubmit Return\u201d and then select the Assessment Year. -

What happens if you overpay estimated taxes?

If you overpay, you miss out on money that could have been working for you. If you underpay, the IRS will charge you a penalty at the end of the year. If you use the GoDaddy Online Bookkeeping service, we'll calculate how much you owe in quarterly estimated taxes each quarter. -

What happens if you forget to sign your federal tax return?

If you submitted your return without signing it, all is not lost. In all likelihood, the IRS will simply send you a letter requesting your signature. And once they receive your signature, they'll go ahead and process your return. ... If you choose not to do this, then you will have to complete and sign IRS Form 8453. -

Where do I enter 2018 estimated tax payments in Turbotax?

Click "Take Me To My Return" Click "Search" in the upper right corner, then type "Estimates Paid" in the Search Box. When the results populate, click the "Jump to Link" From here you can enter any Federal, State, or Local Estimated Tax Payments you made for 2018. -

Can Form 941 be signed electronically?

Form 941, which is the Employer's Quarterly Federal Tax Return, can be filed electronically to the IRS. However, the form cannot be e-filed by your business. ... An individual business is not allowed to electronically send the form. A payroll service provider is an example of an intermediary you can use. -

Does TurboTax help with estimated taxes?

The TurboTax software does not handle quarterly tax payments at all. The program is designed and intended for the sole purpose of filing yearly tax returns, and that's it. For your quarterly taxes you have two choices. ... Select the "Estimated Tax" option, then select 1040-ES quarterly taxes option and go from there.

What active users are saying — electronic signature irs form 1040 es

Related searches to electronic signature IRS Form 1040-ES made easy

E signature irs form 1040 es

In today's video, I'm going to walk you through how to fill out schedule SE, which is used to calculate and report self-employment taxes. As a self employed individual, you'll file Schedule SE with the IRS, along with your Form 1040, or other personal income tax return. I'm Priyanka Prakash, senior staff writer and small business expert at Fundera. Sole proprietors, partners in a partnership, and members of an LLC who make at least $400 per year in self- employment earnings have to pay self employment taxes to the IRS to cover their Social Security and Medicare tax obligations. Schedule SE is where you calculate your self employment taxes. Okay, let's get started with the top of the form where you'll type or write your name and social security number. I'll be filling out this form for a fictional business ABC Bakery owned by Betty Business. Keep in mind that before completing schedule SE you'll need to calculate your self employment earnings for the tax here. You can calculate and find this in one of four places depending on what type of business entity and what type of earnings you have. If you have a sole proprietorship or a single member LLC, you'll refer to line 31 of Schedule C. If you are a partner in a partnership, or you have a multi-member LLC, you'll refer to line 14 of Schedule K-1. Refer to our Schedule K-1 video for instructions on how to fill out that form. If you are a farmer with self-employment income, you'll refer to line 34 of Schedule-S. And finally, if you have both self-employment income and worked for someone else during the tax year, you'll also refer to your W-2 form to find out your wages that were subject to Social Security and Medicare tax. Keep the appropriate forms in front of you when completing Schedule SE. And remember that if you own several businesses, you'll need the total self employment earnings from all of the businesses combined to total up all of your self employment earnings, and file only one Schedule SE. The flow chart that you see on page one of schedule SE helps you determine whether you need to fill out short a Schedule SE or long schedule SE. In most cases, if you're a full time business owner or if you only made self employment income this year, you can stick to short Schedule SE. If you made self employment income and worked as an employee for wages or a salary, then you'll need to use long Schedule SE. Let's begin with Section A of short Schedule SE. Lines one A and one B are for special types of self employment income that farmers might receive. So if you're not a farmer, you can skip down to line two. Line two is where you note the amount of self employment earnings that you made for the tax year, which we mentioned before can typically be found on your Schedule C or Schedule K-1. In this example, let's say that Betty Baker had $100,000 of self employment earnings as reflected on her schedule SE. Bring the amount in line to down to line three, adding in amounts from lines one in one B if either of those apply to you. Next in line four multiply the number in line three by 0.9235. In this example that gives us 92,350. You're doing this multiplication to get your net self employment earnings, which is just a portion of your self employment earnings that's subject to self employment taxes. If the result in line four is less than $400, then you don't owe any self employment taxes and don't need to fill out Schedule SE. If the amount is $400 or more, then keep going. On line five, calculate your self employment taxes by multiplying by the appropriate percentage. In this example, the self employment earnings are less than $132,900. So I'm going to multiply the amount in line four by 0.153. That gives us $14,130. You should report this amount on Form 1040. In line six, divide your self employment taxes in half. In this example, dividing the tax result in line five in half gives us 7065. You should report this amount on schedule one. On form 1048 deduct this amount on your tax return. Okay, moving on to page two, where you should put in your name and social security number again, so the IRS properly tracks your paperwork. If you're a full-time business owner, or if you only made self employment earnings for the tax year, you don't have to worry about long Schedule SE but just for purposes of this video, we're going to fill out this section and we'll describe some of the differences between long and short schedule SE part one here in Section B. Long Schedule SE is just like a slightly longer more complicated version of short Schedule SE. Each line here generally will match up with what we had in short schedule SE. As I showed above, you would skip lines one A and one B unless you're a farmer and go right to line two where you'll note your self employment earnings. In this example that was $100,000. In line three, add up what you have. So for line A multiply the result in line three by 0.9235. That gives us $92,350. In this example line four B refers to optional ways to calculate self employment earnings, which we'll discuss in a moment. If those don't apply to you simply bring down the total from line four A to line four. Lines five a and five B are about church employee income and you can skip those if they don't apply to you and just bring down the total to line six. In lines eight eight through eight C put in the amount of wages and tips that you received throughout the tax year which are subject to Social Security and Medicare taxes. This is the most important part of the forum for folks who had both self employment earnings and worked as an employee. Filling out this part correctly ensures that you don't overpay your Social Security and Medicare taxes. Let's say in this example that along with owning her bakery, Betty Baker also worked as an employee for another business and made $50,000 in Social Security wages. I leave the rest blank because Betty did not receive any unreported tips or other wages. Adding up what I have in lines eight A through eight C gives us 50,000. Then subtract line eight D from line seven, which in this example gives me $82,900. Line 10 tells you to multiply the smaller of line six or line nine by 0.124. In this example, line nine is smaller and multiplying $2,900 by 0.124 gives me 10,284/ Multiply what you had in line six by point 0.29, which in this example gives me 2,704. Finally, you add up lines 10 and 11 to get your total self employment tax in line 12. The answer in this example is $12,009 84 for Betty Baker of ABC bakery. As we did for the short schedule SE, you can claim a deduction for half of your self employment taxes. So dividing this number in line 12 by half, gives me 6,492. As I mentioned earlier, part two of Section B has to do with optional methods of calculating your self employment earnings. These optional methods can generally be used if you have self employment earnings less than 5,891 for the year, or if you had particular kinds of farm income or if you experienced a loss of earnings throughout the year. That said using one of these optional methods can also increase your self employment taxes. So make sure you talk to a tax professional before going this route. And that's how you fill out schedule SE. When you're done, make sure that you attach a copy of Schedule SE to your form 1040 on your personal tax return and submit them to the IRS by the tax return deadline which is April 15. For most taxpayers. For more small business tax tips and other business info head over to fundera.com. You can also go to Youtube.com/funderaloans and subscribe to our YouTube channel for more videos. Thanks for watching and drop us a line below if you have any questions or comments.

Show moreFrequently asked questions

How do I eSign a document before sending it?

How can you sign your name on a PDF?

How do I create a PDF for someone to sign?

Get more for electronic signature IRS Form 1040-ES made easy

- Print signature service Proforma Invoice Template

- Prove email signature Camper Physical Examination

- Endorse eSign Summer Camp Emergency Contact

- Authorize digital sign Employee of the Month Certificate

- Anneal signatory Partnership Agreement Template

- Justify eSignature Assumption Agreement

- Try digisign Recommendation Letter for Promotion

- Add Liquidating Trust Agreement signed electronically

- Send Freelance Graphic Design Proposal Template electronically sign

- Fax Church Membership Certificate countersignature

- Seal Lease Termination Letter mark

- Password License Agreement signed

- Pass Gym Membership Contract Template digi-sign

- Renew Lease Amendment digital sign

- Test Job Report 2020 initial

- Require VAT Invoice Template signature

- Send spectator byline

- Accredit petitioner electronically signed

- Compel person digital signature

- Void Housekeeping Contract Template template sign

- Adopt patent template electronically signing

- Vouch Business Travel Itinerary template mark

- Establish Logo Design Quote template eSignature

- Clear Consignment Agreement Template template autograph

- Complete Training Record template digital sign

- Force Liquidation Agreement Template template electronic signature

- Permit Basketball Camp Registration template signed electronically

- Customize Auto Repair Contract Template template electronically sign