Empower Mark with airSlate SignNow

Upgrade your document workflow with airSlate SignNow

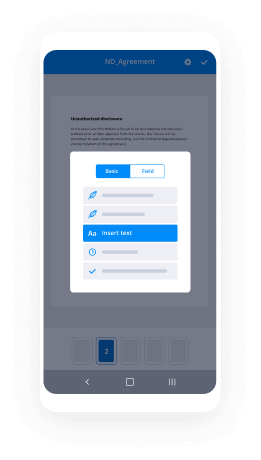

Versatile eSignature workflows

Fast visibility into document status

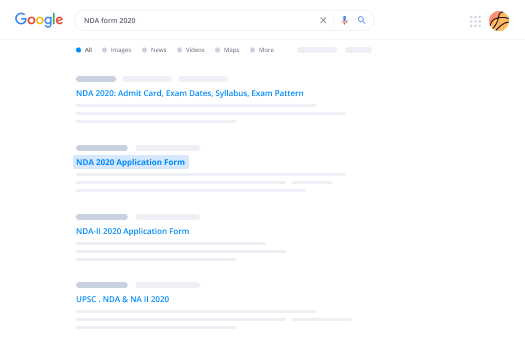

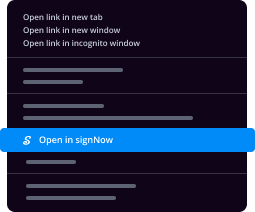

Easy and fast integration set up

Empower mark on any device

Advanced Audit Trail

Rigorous security standards

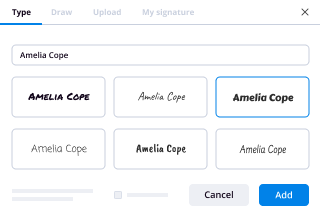

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

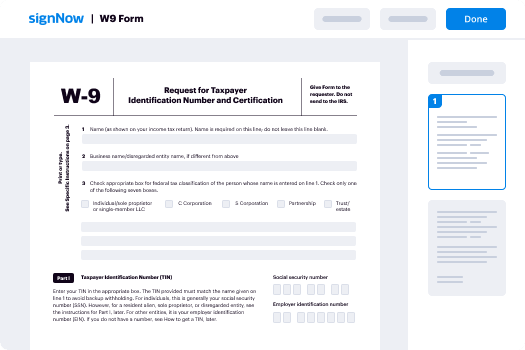

Your step-by-step guide — empower mark

Adopting airSlate SignNow’s eSignature any company can accelerate signature workflows and sign online in real-time, providing an improved experience to customers and employees. empower mark in a few easy steps. Our mobile apps make work on the go possible, even while offline! eSign documents from any place worldwide and complete tasks in less time.

Follow the stepwise instruction to empower mark:

- Log in to your airSlate SignNow profile.

- Locate your record in your folders or upload a new one.

- Open the document adjust using the Tools menu.

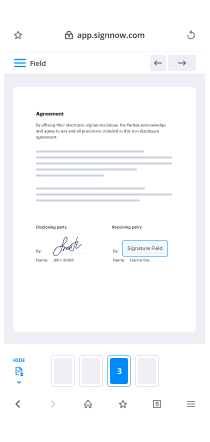

- Place fillable boxes, type textual content and sign it.

- Include multiple signees via emails configure the signing sequence.

- Indicate which individuals will get an signed doc.

- Use Advanced Options to reduce access to the record add an expiration date.

- Click on Save and Close when completed.

In addition, there are more innovative tools accessible to empower mark. Add users to your shared work enviroment, browse teams, and track collaboration. Numerous customers across the US and Europe recognize that a solution that brings people together in one unified digital location, is the thing that businesses need to keep workflows functioning easily. The airSlate SignNow REST API allows you to integrate eSignatures into your application, website, CRM or cloud. Try out airSlate SignNow and get faster, easier and overall more efficient eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results empower mark with airSlate SignNow

Get legally-binding signatures now!

What active users are saying — empower mark

Empower mark

hey guys it's mark Howard with momentum with strategies and I want to encourage you to stay tuned to the empower series YouTube channel but you can learn nuggets this month's topic was on financial literacy some of the things that you'll be able to learn today would be on how to set a budget what the concept of cash flow net worth is the importance of insurance in your life and why you need to protect yourself and those loved ones around you the criticalness of having an emergency fund because life is risk and you need to be prepared for those moments in life that if you don't anticipate we'll talk a little bit about debt credit and taxes and how that affects you in your life and how you need to prepare for those as well and then we'll touch a little bit on investing and the different types of vehicles available to you from short term medium the long term and how you need to diversify those assets to fill your portfolio to hit your specific needs so I want to encourage you again to spend a little bit of time invest in yourself stay tuned to the empower series want to thank Comerica Bank for being a proud sponsor and encourage you to reach out to me at any time if you have questions again it's mark at momentum Wealth Strategies so the one guy who I think was from Germany I think summed it up quite well he says people here meaning in the United States spend more than they have and it really is a culture of spend first save second and so we'll talk a little bit about that and how it's so important for you to change that habit within your own household so that you can create that budget to achieve the goals that you you have in place so to achieve your goals here's some basic guidelines that we're gonna walk through one is you have to set some goals how many of you have a yearly or monthly savings goal raise your hands and so for those who didn't raise your hands what is stopping you from creating that goal because really if you're trying to say for a house save for college save to buy that car whatever it is you need to have those goals in place that you're shooting for and then a plan that you're executing to achieve that second one is exactly what we just talked about you need to spend less than you earn that sounds like a simple concept right but spend less than you earn create an emergency fund an emergency fund doesn't mean here's the pile of money you have on the side for retirement and it's it's serving as an emergency fund and it's serving as your your your vacation fund this is specifically for emergencies and make it a priority look at your credit cards how many of you guys have a credit card that you had a teaser rate and it's now slipped into a 18 to 21 to 25 percent interest rate and you're getting charged interest for stuff like that you know happens all the time and so you got to look at these things diligently evaluate your insurance think about taxes and so let's jump in so think of your finances as a house I can mention Durley err what's the most important portion of your house but maybe it's the least sexy the foundation right and so have you ever looked for a house and it says yeah the foundation was just repaired and it comes with a lifetime warranty do you feel more drawn to that house or are you thinking yeah I think I want to I'm going to keep looking it's true and so the foundation is what I call your cash flow and net worth and so cash flow and net worth is basically cash flow is the money you have coming in versus the money you have going out so it's the amount of income you're earning subtracted from that is the expenses you have and so one of the sheets that you have in the workbook is a basic cash flow statement so that you can look at hopefully when you get home what are some of the major sources of expenses that maybe you underestimated you know is it the $5 trip to Starbucks every day that you thought that's just my bugs but five bucks times five times four weeks you're at $100 right there and then it's the going out to the club and and just I just buy two 15 dollar drinks and and then that starts to add up and so it is essential I mean essential you'll see in both my work book and in the one from the Federal Reserve having a cash flow statement so that you can see what's going in and how much is going out six and seven on the the color book the building wealth and so a lot of times people say well what's what our items that maybe I should look at reducing eliminating and so you have your fixed expenses maybe that's your mortgage it's a it's amounts that don't really change on a monthly basis you put those down then you have flexible amounts these might be your cell phone bill your utility bills these are still essential items to your day-to-day life but maybe they vary so you have those in a separate budget and then you have those that are discretionary so the Starbucks the entertainment they're going out to eat and so put that in a separate line item and then you have your taxes that you have to set aside for every year and so if you take that from all the sources of income that's basically what people say when they say cashflow and so again today is really intended to if there are concepts that you've heard and you're like I really don't know what that means let's talk about it so does everyone understand the concept of cash flow so the next is what we talked about budget so the next is net worth so is is the concept of net worth is basically everything you owe subtract from that everything that you own so you might own a house a car your 401k savings accounts things that you own - things that you owe so credit card debt student loans the mortgage on your house you subtract that from what you own and that's your net worth so can you have a negative net worth yes or no who says yes and is that a good thing why not you're upside down what else you're not building wealth vulnerable so you think you're have more stress or less stress if you're upside down more way more we're here way over here so so net worth is a simple concept but it's one that in America for African Americans especially the net worth average household so Alexis what's the latest number on the net worth in it like about 11,000 the net worth of the average household in America african-american household is $11,000 for single african-american women it's about a thousand dollars so think about that what we own - what we owe is barely more than the cost of a used car and so one of the things that advisors at our firm and across a multitude of companies are really striving to do is educate people and how do we fix this because this adds a lot of stress it doesn't leave a legacy to your kids and your kids kids and and it really puts you in a situation where you are spending more than you earn so Clifton ya know and that that's a great point because one of the first things I know we have some Comerica guys and one of the first things you do when you go to a bank and you're looking for a loan is they're wanting to see your personal financial statement they're wanting to see well what is your net worth to assess who you are and what are your financial habits to determine do I trust that if I give you this hundred thousand dollar loan you're gonna pay me back and so those clients and I and it's it's so true Clifton I have clients who come to me in their 30s and they already have it figured out they have a budget they own a house they might even have a business on the side they have a retirement plan that's in place they know exactly where their money's going and so they've set financial behaviors in their house even their kids their kids typically have a budget where they'll give them an allowance and they know okay I can either spend this on these toys or I can save it maybe for a bigger toy later or invest it for the future and so they're training their kids to have these habits that maybe they didn't have or maybe they did have growing up and so it's really all about save first spend second and then when you're spending it's all along a budget that you are tracking monthly quarterly and yearly you know at our Lunch and Learn yesterday Clifton actually brought up a great point of if you were in charge of your department's budget so now you've been charged with you have a million-dollar budget to manage the expenses for that for that project that you're working on for the rest of the year would you spend it kind of casually or would you look at it every single week to make sure you're on track would you look at it every month would you maybe go to your supervisor and ask hey how are we doing on the budget that's the exact same thing that those clients who really are on top of things are doing in their sleep they do it as a matter of habit and they enjoy doing it because they see how they're tracking towards their goals on a yearly decade and lifetime basis so if there's anything I say the difference between those successful clients and those that are just trying to figure it out is they've taken the time to come to classes like this they've taken the time to speak with a professional and they've set down on paper their goals their vision and where it is they're trying to go it doesn't matter how far behind the curve you think you might be you got to start somewhere and don't be afraid because the farther you put it off the more intimidating it's gonna get and don't be shy on calling an advisor like myself Alexis clip than anyone that's what they're there for to do is to help you want to avoid those guys that are trying to nickel-and-dime you with the fees and all that and so you got to find the right one but that's what they're here for and they want to have those success stories that they can talk about and workshops like this so good segue though so credit cards credit is one of the financial aspects that people miss miss understand a ton your credit begins the second you have a credit card and you either pay it on time you pay it late or you don't pay it at all that's recorded in your history so that when someone comes to look at you and say hey do I want to give you this loan for this car that's why your rate might be 18% versus your neighbor's 5% it's because they're looking at that history and they're evaluating what is the likelihood that you are going to pay on time and so question I often get is how many credit cards should you have and we heard we heard on the video it ranged between 0 to 5 I like to say you have maybe two you have one credit card that you're paying every month and you're paying it off it's what goes in goes out and then maybe you have one for major purchases where you aren't able to pay for that entire item but you are managing and planning to pay it off over a certain period of time does that make sense anyone disagree who thinks she should have three four no now tell you I got caught up in one of those teaser rates I bought a TV that you might argue I didn't need from Best Buy on one of those 0% credit cards something was going funky with the with the TV within the first couple of weeks so I returned it purchased another one but it was like $100 difference and so I had calculated off that first TV the exact amount that I needed to pay every month to pay it off so I wouldn't be hit with that credit card charge but I didn't go back and do it after I got the new TV and so at the end of six months I get this huge huge interest bill because I just hadn't watched it because I just assumed it was on autopilot and I will never do that again I will never do that again but watch your credit because there's so much around people stealing your identity you taking advantage of the credit card you have this is one of the fundamentals that we see the most that affects negatively a person's financial situation so next level up once you've created that that sound foundation is risk management and why we have this so important as a second level is life is risky right I mean who can predict what's gonna happen to you in your life over the next eight months of this year you know are you gonna have a car accident are you going to have some unexpected expense is there gonna be an opportunity maybe that you you can invest in something and so risk management is so key because you're protecting your most valuable assets and quite often that starts with what we talked about emergency fund is life insurance so why should we have life insurance give me some examples of why should we have an insurance policy on yourself [Music] right you guys hear that so it's not a matter of if we're gonna die to win it's a fact and so maybe you want to use that life event to help cover and help your loved ones who might be left behind so life insurance really is a gift of love to those people you care most about so what are some other reasons why you might want to have life insurance and miss Tracy right [Music] right so who wants to be a burden to your spouse to your kids to your employees if you own a business and a life insurance policy can be used to eliminate that so that they don't have to worry a lot of times we hear if it's a husband wife is ours shoot I want to leave a policy because then she'll just go off and run some marry some guy and just you know spend all my money and then you know not to be disrespectful I just take a step back and say well you do realize that your spouse is 50 with four of your kids you know how attractive do you think that is that at the club at night you know and so it's like you know you're over assuming all of this but you have plans in place you know you have this vision of a retirement you have this vision of college for your kids you have this vision for the business that you guys are going to open wouldn't you want your your spouse to continue on with that even if you aren't here and so it really is an act of love and so there's a couple of types of policies one is group insurance what you typically will get at work and then you have an individual policy so how many of you have group insurance but no personal policy group but no personal all right so how many people feel that what you have at work is enough because we get that all the time I'm covered at work so covered at work typically means you have one to three times your salary so let's just say you make fifty thousand and you have two times your salary that's a hundred thousand of coverage you'll basically run through that in a year to a year and a half once you add up all the expenses of paying off your dad funeral expenses any other things you have so your spouse would have maybe a year's worth of safety net and then they're having to figure out life all alone without your salary and so that's why we typically suggest let's start at ten times your salary for an amount that you want to have as coverage and so that's where you get to those numbers a lot of people say how do I need an a million dollar policy well if you make fifty thousand and you're 40 years old and you plan on living till til if you plan on working till 60 if you just multiply it out the number of years you have left to work so 20 years times fifty thousand dollars is what that's a million dollars so if you had a tree in the back of your house that was spitting out $50,000 a year would you buy a policy to protect it if it stops spitting out some money would you go check on it right so same thing you you are your most valuable asset how many of you guys have Apple care on your iPhone come on raise your hand I know you guys do or coverage on your cell phone again you got coverage on your cell phone it's worth way more than then the phone is worth and not on your pot so look at a personal policy for yourself especially if all you have is group because when you leave that job that policy typically stays with the company so you're having to start over at an older age and maybe at an unhealthy estate question policy whether you recommend it for I guess younger people with no dependents whatsoever because I know your example you're saying like if you pass away according to 24 years to wearing like your spouse in my situation like so do you plan on getting married do you plan on having kids do you plan on retiring so the basic concept of life insurance is the rating is on your age and your health so if you get it younger you'll pay a lot less than you would if you waited for 10 years let's say and you did have that family and so then there's other types of insurance so maybe because of your age you'd want to look at a permanent policy that you could keep your whole life or a policy that builds cash and so now you're starting younger and so the amount of money that you have to put into that policy to us to achieve a certain goal there's a lot less then your ten-year older self would have to do to achieve those same things so absolutely it makes sense you'd want to understand what are the different types to see what might be a better fit for your situation but absolutely even if you're single there's a need for a good policy no no good question so health insurance medical costs are the number one cause of bankruptcy for individuals and their families especially as you get into retirement so this is critical and with the Affordable Care Act it's really become more of a forefront in everyone's minds because now it's required that you have to have a policy and so with the Affordable Care Act you know there's certain things that change where pre-existing conditions don't have to negatively affect your ability to get a policy some costs or minimize and so you really do want to sit down again with your insurance provider to understand how your policy might have changed from year you're out because these costs keep escalating and you're probably finding at work that you have health savings accounts flexible savings accounts there's lots of different tools that are available to you to manage your health costs and so if you have access to a health savings account and you have Radek regular medical bills it would make sense for you to start pre funding that so you can have some tax advantages flexible spending accounts same thing it gives you an ability to have to take advantage of some of the tax savings for those regular bills that you know you're gonna have who knows what Cobra is and have you ever had to be on it it's a snake Cobra again if you find yourself unemployed this is the legally available to you option to carry on the the health policy that your your company might have offered to you but maybe it's not the best option because it's at full cost and it's typically a lot more expensive than you ever expected because your company quite often is subsidizing your health insurance and so there are individual policies out there that might make more sense and with Obamacare there are lots of carriers out there that offer policies that might be more might make more sense so understand you know your options out there Medicaid Medicare some other government fundings you have to qualify for those but health insurance is huge so don't ignore it so disability insurance is probably the most underutilized type of policy out there but it affects us more than than life insurance actually so disability insurance is not just for those people you see in a wheelchair not for those people that you know might you might categorize this handicap it's for anybody that can't go to work prescribed by a doctor and you have to stay at home so just imagine if tomorrow something happened to you whatever it is and so you couldn't work for 30 days your employer if you don't have short-term disability could stop paying you because you're not earning your salary and so think of disability insurance as really your income continuation should something happen here it's income replacement and so if you're sick health insurance is trying to make you better if you're disabled disability insurance is just keeping your income coming to you so that you can take care of yourself so quite often at work you have maybe a short term disability in a long term maybe you have to pay into that extra I would totally look at what those costs are and if you're not contributing look at contributing because quite often their dollars per month for you to have the ability to get your paycheck should something happen in you and I'm sure you guys all know somebody who might have been in an accident or they had a health scare or something even if you have a baby that's short-term disability so relook at your benefits when open enrollment comes just to see and understand when they say one x + 2 x salary for insurance and when it has certain percentages and so the way disability insurance is typically priced is a percent of your salary so there might be a 30 percent of salary there might be 50 percent look at that just to see if you can add to what you might already have so long-term care which of these two pictures do you think best reflects a long-term care scenario the one on the left or right the right wait who says right who says laughs who says both it was a trick question come on guys you knew that it's both oftentimes the same thing I don't need long-term care I'm Superman I never get sick I'm gonna live till a hundred and then BAM you know something happens so long-term care can affect anybody at any age I don't only associate long-term care with nursing homes all long-term care means is you need help after 90 days of being in the hospital and they couldn't fix you and so at some point your insurance says hey this recovery isn't working we need to sustain you and that's where long-term care comes in and so again that could be an accident from a car accident where you you have a debilitation on of your leg your arms or whatever long-term care helps to provide the services to take care of you typically after day 91 so again the younger you are the healthier you are the more affordable long-term care will be if you put it off until quote-unquote you're in the left side of the the picture then it might be too expensive and you don't get it at all so you're better off looking at it sooner rather than later make sense questions do you mean for 2018 do you think we'll be required to have insurance all twelve months like we have isn't gonna change the affordable care so the ant the question is do we think that they're gonna require health insurance for the rest of 2018 and the answer is absolutely yes any changes that are put in place will effect 2019 at the earliest 2018 is already set and so those change just like the tax laws are for 24 2018 where you'll pay them in 2019 same thing the the health care laws are in place for this year any changes would be for next year good question though so the next level up is planning for the future and so for those of you who have kids and you're looking at college funding are those who are looking forward to retirement planning it's really after you figured out your cash flow and net worth you then protected all those valuable assets in your life that you then really should start looking at planning for the future quite often people will skip the first two steps just start throwing money at college savings or throwing money at retirement and they don't have a strong foundation that they've built upon and they haven't protected those items should something risky happen in life so college funding there's college rates are increasing at an alarming pace I know when I went to undergrad I went to Howard undergrad I think tuition then was 16,000 a year back in the olden days I'm actually going to visit my son this afternoon who's at Stanford just guess how much his bill is on a yearly basis 4567 it's about $70,000 so multiply that times four and what do you have $300,000 and to Stanford give academic scholarships No so state schools University of Texas I mean you're still in the 3540 K range for UT so there's lots of strategies that you can put in place you could go to a community college for two years get your basics out of the way and then transfer to one of these schools you can apply there's lots of private scholarships out there there's federal aid based on your parents income level and so take advantage of the resources there's a couple of websites at the back of my worksheet because there are some ways to reduce your your tuition bill and there's some credits that are available to you some of you guys might have just done your taxes and have kids in college and there are some small tax credits that you have so take advantage again by sitting down with the professional and understanding what are some of those strategies because college is becoming more and more expensive it's it's increasing much faster than inflation and it's typically increasing much faster than our incomes are growing so to me it's an issue that we have to face whether you you liked Bernie's free college for everyone or not I think we do have a problem that we have to address because our kids are now being burdened with $200,000 a dad and they're having to figure out how do you pay that off before you can start building that wealth because are they in a negative net worth situation from day one so it's it's a scary thought so then you get retirement planning and so that's typically broken down into two sections you have qualified plans and you have personal plans so who understands what the qualified means qualified nope so if you hear the term qualified all that means is you're funding that plan with pre-tax dollars that's all it means so your 401k is a qualified plan because you're funding it with pre-tax dollars an IRA a traditional IRA qualified because you're funding it with pre-tax dollars so what does funding it with pre-tax dollars mean do you have to pay taxes on that eventually yes anybody say no so we got all yeses so the answer is yes so you have $100 going into a qualified pre-tax plan so $100 into your IRA it grows to $1,000 once you pull that money out how much of it does is gonna be taxed all of it because you haven't paid taxes on any of it so if you were to put money into a Roth IRA a Roth IRA your funding with after-tax dollars and so if you make $100 you pay your taxes let's say you in 25% tax bracket you have 75 going in and then it grows how much of it are you taxed on when you pull it out at the end none so you either pay taxes now or later those were qualified accounts and so you want to sit down with someone to strategize on should I be doing a raw should have a investing in my company's Roth 401k should I be looking at some after-tax investments to balance those out because there are strategies that you can minimize taxes by planning today so if taxes go up which most people think they're going to do would you be better off funding a traditional IRA or a Roth IRA Roth why so why so you're gonna pay more out at the end yeah so if taxes increase would you rather pay your low taxes now or higher taxes later so now so Roth right so you got to look at those don't just kind of blindly go into let me check the box and here it is understand those small differences because it can have a big impact later on in life so question what is a Roth 401k so a traditional 401k you're funding it with pre-tax dollars so because of the popularity of Roth IRAs they created a Roth 401k so that people who were only funding their retirement at work through through a 401k would have the option to now fund it with after-tax dollars so they were taxed today and they won't have to be taxed in the future and so it's a very popular option and you're seeing it offered at more and more companies because we're in a relatively low tax rate environment right now and so we talked about this yesterday you know should you invest in the Roth 401k or traditional 401k quite often the answer is do both if historically you've only funded a pre-tax traditional maybe you want to shift and do much more in the Roth because most people want to hedge their bets and have a little bit of both because you don't really know where taxes are going so maybe head your bets if you do have a crystal ball you're going to want to pick one of the other oh good question so any of these stats surprise you guys so 50% are saving for retirement through a 401k so if your company matches your contributions is there a better investment for you out there name a better investment then taking advantage of the match from your company's 401k free money so what is free money that's a 100% rate of return who's getting a hundred percent in stock market right now not Elena said she was getting fifteen percent yesterday who's who's getting better than fifteen percent twenty percent we got any twenty five so one hundred percent rate of return think about that guy's a hundred percent rate of return so again it goes back to save first spend second so if you've allocated your ten percent saving for the future saving for emergency savings and you can take advantage of that 100 percent rate of return you are so much better off than if you didn't so number one rule when I see clients who have an employer who matches is are you contributing up to their match and if they're not it's why are you not and we're as quickly as possible getting into a situation where they can there's really no other better place than to start them there so one in three have zero saved for retirement and quite often we're getting people older and older coming to us saying hey I'm 62 and I want to retire 65 and I have a hundred thousand saved up is that enough well how much are you living on each year you know five thousand dollars and so you have to do some simple math of how much do I need to have in order to retire at a certain age so who in here knows their number for the amount you need to save today on an ongoing basis to hit your retirement goals in the future who's too sat down and done that calculation so everybody's done that calculation nobody's done it save as much as possible that's all we can do no you can create that plan to look at here's the amount that I need to be saving whether or not you can do it here's what I need to be doing to hit those goals and so again as a part of your financial plan we want you to create that budget look at your cash flow look at your net worth and then also look at your long-term goals and plans whether it's saving for college whether it's saving for retirement and set out a plan because maybe you have the ability so just just a sidebar note I was just in Washington DC because I'm one of the political involvement leaders at New York Life and so we were lobbying Congress and Senate on a simple concept so congressmen have what's called the Thrift Savings Plan that's their retirement plan and at the top it shows here's my here's my but here's my balance so let's say they have a million dollars and then at the top right it has a number that represents here's the amount you could have monthly as a guaranteed stream of income for the rest of your life based on this balance so how would that be nice for you to have on your 401k or on your IRA that would say okay this hundred thousand dollars I have equals x amount of dollars per month for the rest of my life so that you could say which I need more than $200 a month so maybe I need to be saving more or a thousand bucks a month that's about right so let me continue doing what I'm doing and so that's a part of this plan of how much is what I'm saving gonna amount to in monthly and yearly income for the rest of my life and so that's some of the things that we do we help our clients some do some don't and that was our whole point was we want to make it required so that all providers have that there to be a visual guide to the everyday person who's not looking at this day in and day out just to give you a guide into something that makes sense to you because you might say hey I have $100,000 I'm six figures I have a lot and you've never translated that into how much does this mean for me in retirement on a monthly basis to my projected life income so sit down and talk because the you know there are people who wait until it's really too late and now they're having to get on Medicaid they're having to live with their kids they're having to you know be homeless there's it it it happens to more people than you might think yep so what do we think about Social Security so who thinks Social Security will be here in its current form in ten years okay edson has some faith I think Social Security is gonna be here just in what format I don't know I think they're gonna push the retirement age out a couple of years for sure whether it's early at 62 that might be pushed to 65 you know 65 might get pushed out to 67 68 I definitely think we're gonna push out the retirement age not sure about the the percent because really if you look at the amount that Social Security pays you if you're able to push it out today too full retirement at 70 its increasing the amount that you have guaranteed better than you can achieve typically in the market so it's a great thing if you can wait just most people aren't in a situation to where they can wait so I think it'll be here but we often show a stool that has three legs the first leg being what pension money do you have available to you for 1k money the second is Social Security and the third is typically personal savings and so a lot of clients say I don't have a pension and I'm not contributing as much as I need to my 401 K I don't have faith in my Social Security future so it puts a lot more focus on your personal so you need to look at what you're doing to supplement and what you get at work quite often is not enough so again I've said this quite a bit because I want to drill this into your head spend first save Lars or save first spend less so you want to be on the right side here not the left side right and it's all about behavior it's having that budget so that you're paying your your requirements first and then you're playing later so you want to be the safe first spend last for sure and do that based on your budget do it on a budget so that you have a game plan as to where you're going how much have you currently saved look at the reality guys if it's zero put zero down there's a page in the workbook for that and then put a goal and then just do some quick math the dividing it by 12 and here's what you need to do and start looking in your cash flow for where you can find it you'd be surprised oh I didn't see this recurring bill that's that I'm not even using this service anymore you know I never watch Netflix you know I can get rid of that or whatever it is so mint.com is a great starting point as an online budget service if you haven't used it it's free mint.com mi NT comm it's a great tool free to use where you can enter in your budget tie it to your bank account tie it to your credit cards so that you can go out there and monitor your habits and then you can adjust things as you go on and again it's free and if you can get into the habit of looking at that every month it'll show you trends oh by the way EDS and you know your entertainment spending has gone up over the last year considerably you know divorce you know gotta get out things are changed you know or it'll show meals have gone up is maybe you're going out a lot do you want to continue that mint.com is a great tool to get you guys started if you like electronic if you're better on pen and paper do pen and paper do something so eleven strategies and we'll wrap up start small don't bite off more than you can chew start small relish in those those those small wins and then it will build momentum into larger and larger successes understand compounding interest compounding interest is tied to the amount of time you have left with your financial plan and it as Benjamin Franklin said it's it's one of the most wonderful things that exists in the world more so than the light bulb contribute to your retirement plan if your employer matches take advantage of it if there's payroll deduction options do it set stuff up automatically you know maybe there's an IRA that you contribute to where it automatically is deducting from your account so you don't have to think about it round up payments so if you're spending 675 on something take that quarter and save it there's a great tool out there now called acorns that does exactly that it looks at your your spending and it will automatically round up all of your expenses and take those cents put it into an account and it's a small savings account you have on the side spend less than you earn so if you're not already doing that take whatever pay raise you get and put that aside to contribute to your retirement plans your savings plans your emergency savings funds whatever it is get into the culture of spending less than you earn if you spend more than you earn your net worth will always be negative paying off those loans pay off those credit cards reinvest again that's a part of compounding interest with your investments you have the options typically of do I take the the gains and spend it or do I take it and reinvest it quite often if you're in a long term strategy you want to reinvest and then keep track where everything goes to the penny who tracks their money right now to the penny we got a couple of people Clifton in the back we got a couple Michele you'd be amazed as to where your money goes I'd challenge you to do it for three months track it to the penny and hey we said start small start start small there you go keep going and so understand your investment options you know again that's what we're here for find an advisor you're comfortable with and let them know the ins and outs of your situation so that they can figure out what's best for you because there's lots of different options out there we don't have time to go into these specifics but that's what we're here there for is to help you figure out what's the right investment for your specific situation and not all investments are created equal and and you don't want to have an advisor who's got a hammer and he's trying to knock whatever he's selling into to your playing you really want to have someone who's looking at the whole picture and start young teach your kids and so in the back I actually have another book it wasn't sure who wanted it so on your way out I have another pamphlet on teaching your kids about money and so it breaks down some of these concepts into behaviors that they might understand and so here's just some things on you know creating a savings account giving them an allowance you know for middle school it's maybe investing in a stock so they can see how it grows with a teenager it's having them contribute to you know the car that they're they're driving or contributing to their their going out expenses and so in the back there's a booklet that anyone can take I have quite a few to start early start young and keep the whole house intact and so just to review and sum up cash flow net worth so what's cashflow again it's the amount you have coming in versus going out net worth is how much you own minus what you owe and are we trying to get to positive net worth or negative positive risk management should we have a life insurance policy if we are eligible Bachelorette with no kids alright and retirement planning is having $0 saved for retirement at the age of 65 a good thing or bad thing that very bad and so wealth accumulation is where it all ends up so again there's some tools I have at the back of the book I encourage you guys to start today if you have questions feel free to email me on my email address and phone numbers are on the newsletter there at the back of the front and back of the workbook I had asked you guys if you haven't filled out the workshop evaluation please do so I'd love to hear good and bad with which you a thought of the the content and the delivery [Music]

Show moreFrequently asked questions

What is the definition of an electronic signature according to the ESIGN Act?

How can I sign my name on a PDF?

How can I make a document valid with an electronic signature?

Get more for empower mark with airSlate SignNow

- Authenticated signatory

- Prove electronically signed charter

- Endorse digi-sign Freelance Web Development Request

- Authorize signature service Baby Shower Invitation

- Anneal mark Cancellation of Lease Agreement Template

- Justify esign Promissory Note

- Try initial Reunion Event

- Add Merger Agreement eSign

- Send PandaDoc Sample Sales Proposal eSignature

- Fax Willy Wonka Golden Ticket autograph

- Seal Summer Camp Registration electronic signature

- Password Digital Marketing Proposal Template signed electronically

- Pass Privacy Policy electronically sign

- Renew HVAC Installation Contract electronically signing

- Test Marketing Request Summary mark

- Require Share Transfer Agreement Template signed

- Comment benefactor sign

- Boost deponent countersign

- Compel watcher signature service

- Void SaaS Metrics Report Template by ChartMogul template esigning

- Adopt Resignation Agreement template digisign

- Vouch Logo Design Quote template electronic signature

- Establish Smile template countersign

- Clear Liquidation Agreement Template template sign

- Complete Basketball Camp Registration template electronically signing

- Force Investment Proposal Template template initials

- Permit Glamping Business Plan template eSign

- Customize Partnership Agreement Amendment template eSignature