Endorse Age Field with airSlate SignNow

Do more online with a globally-trusted eSignature platform

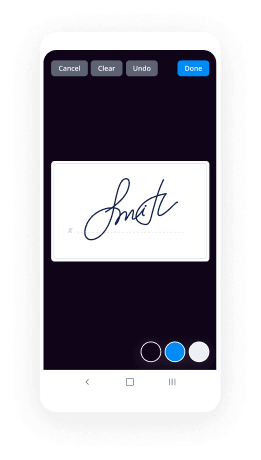

Standout signing experience

Trusted reporting and analytics

Mobile eSigning in person and remotely

Industry regulations and conformity

Endorse age field, faster than ever before

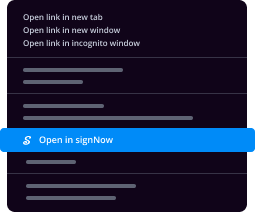

Helpful eSignature extensions

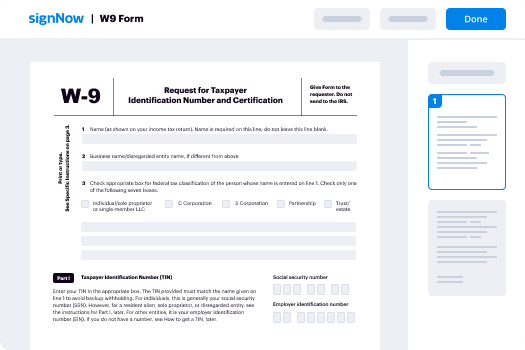

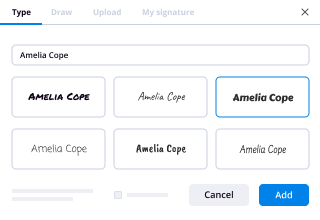

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your step-by-step guide — endorse age field

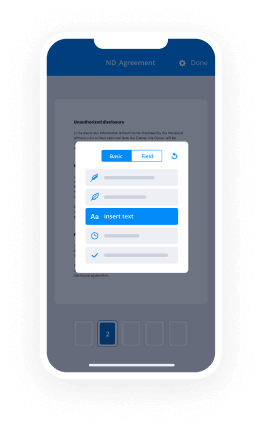

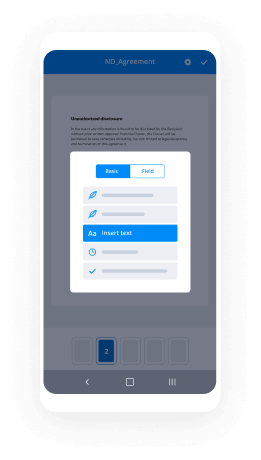

Employing airSlate SignNow’s electronic signature any company can accelerate signature workflows and eSign in real-time, providing a greater experience to consumers and staff members. endorse age field in a couple of easy steps. Our handheld mobile apps make work on the move possible, even while off the internet! eSign contracts from any place worldwide and close up trades in no time.

Keep to the walk-through guide to endorse age field:

- Log on to your airSlate SignNow account.

- Locate your document in your folders or import a new one.

- Open up the document adjust using the Tools list.

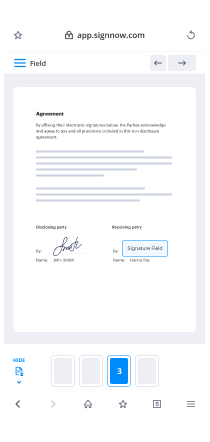

- Drop fillable boxes, type textual content and eSign it.

- Include several signees using their emails configure the signing sequence.

- Choose which individuals will receive an signed version.

- Use Advanced Options to reduce access to the template and set an expiration date.

- Press Save and Close when completed.

Moreover, there are more advanced functions accessible to endorse age field. List users to your shared digital workplace, browse teams, and keep track of collaboration. Numerous people all over the US and Europe recognize that a system that brings people together in a single holistic enviroment, is what organizations need to keep workflows functioning smoothly. The airSlate SignNow REST API allows you to integrate eSignatures into your app, internet site, CRM or cloud. Try out airSlate SignNow and enjoy quicker, smoother and overall more productive eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results endorse age field with airSlate SignNow

Get legally-binding signatures now!

FAQs

-

How do you get a special ed endorsement?

Completing special education coursework can lead to an endorsement on your teaching certificate. A number of colleges and universities offer 5-year programs in which you complete a teacher training program at the undergraduate level and then move on to the fifth year of special education training. -

What is an endorsement on a teaching license?

A teacher endorsement is an ad-on statement that appears on a teacher certification. Before obtaining a teaching endorsement, individuals must complete a teacher certification and obtain a license. From there, teachers may choose to take additional education courses to complete a teaching endorsement. -

How do you get a teaching endorsement in Illinois?

Start Your Teaching Endorsement Today Contact an enrollment specialist to receive program and registration information. * For details on earning a Professional Educator License, visit Licensure and Endorsements at NLU. For further details on licensure and endorsements, visit the Illinois State Board of Education. -

How do I add an endorsement to my Tennessee teaching license?

If you hold a current, valid Tennessee Teacher license with one or more secondary academic endorsement area(s) you can add another secondary endorsement by passing the required Praxis specialty area test(s). -

How do I get my special education certification in NJ?

They must first meet the criteria for a Certificate of Eligibility, including verification of pedagogical skills, a minimum of a bachelor's degree, passage of New Jersey educator exams and (for subject area endorsements) sufficient and relevant coursework in a core subject area. -

Can you get hired as a teacher without certification?

Once you've completed your alternative teacher certification program, you can then apply with the department of education in the state you want to teach in for a teaching role. ... If you're interested in teaching in a rural or inner-city school, you can also get hired without formal education training. -

How long does it take to get a teaching certificate in NJ?

The New Jersey Department of Education sponsors a state-run alternate route to teacher certification . Participants who complete 24 hours of formal instruction are issued a Certificate of Eligibility, and then undergo a minimum of 200 hours of formal instruction accompanied by mentoring from more experienced teachers. -

What does it mean to be endorsed in a subject area?

A "major" is the curriculum within an academic department that leads to a degree. An "endorsement" lists the courses that are required to receive certification to teach a particular subject. ... A Secondary Education applicant must have one qualifying endorsement to meet certification requirements. -

What is a teaching induction certificate?

(1) Summary: The Induction certificate is part of Georgia's tiered teacher certification system that provides a statewide structure for the professional development of early career educators and educators new to the state of Georgia and assures the effectiveness of these educators by: (a) confirming an individual has ... -

What is an endorsement in teaching?

A teacher endorsement is an ad-on statement that appears on a teacher certification. Before obtaining a teaching endorsement, individuals must complete a teacher certification and obtain a license. From there, teachers may choose to take additional education courses to complete a teaching endorsement. -

What is required for a teaching certificate?

As a result, the requirements for earning a teaching certificate vary by state. The process typically requires passing knowledge and skills tests such as the Praxis series of exams, completing an approved teacher education program, earning at least a bachelor's degree, and passing a background check. -

How do I become a reading specialist in Ohio?

Candidates complete appropriate internship experience (minimum of one year) including a school-based practicum in a professional development activity supporting colleagues in the continuous improvement of literacy curriculum, instruction and assessment, including diagnostic reading/writing and clinical experiences. -

What is a math endorsement?

Math Endorsement. The Math Endorsement, added onto an existing license, results in licensure to teach Middle School Math (Grades 5-8). The Math Endorsement is optional for students earning a professional teaching license. -

What can I do with a reading specialist degree?

More literacy specialist opportunities Other literacy specialist jobs include adult education instructor, literacy coach, education researcher, education writer, literacy assessment and curriculum, developer, writing center coordinator and writing tutor. -

How do I cash an endorsed check?

If you receive a check payable to cash, deposit it like you would any other check. Endorse by signing the back with your account number, and deposit with your bank or credit union. 8\ufeff If you prefer to cash the check (instead of depositing it to your account) you may have to go to the bank that the funds are drawn on.

What active users are saying — endorse age field

Related searches to endorse age field with airSlate airSlate SignNow

Signature block annual report template domestic for profit

all right good morning everyone and welcome to thirst Savings Plan post-service withdrawals this is a one-hour webinar my name is Randy Urban I'll be your host and the presenter today will be our Vella Collins when I hand things over to our L in just a second we will open up the chat section to provide some information on downloading slides and audio issues for those folks and then I'll open up the Q&A panel later on into the webinar for you to submit questions related post service withdrawals and I'll assist Arbella in writing in written answers to those questions and then we'll have some Q&A at the end time permitting so with that said I will hand things over to our Ellen letter take it away from here good day everyone Thank You Randy as Randy stated my name is Val Collins I and a TSP training a me a John specialist Randy and I are both employees of the federal retirement thrift Investment Board a small independent agency and we are federal employees as you are so we are here to provide education not advice so we welcome your question but unfortunately we cannot tell you what to do or advise you on what you are doing so today's presentation will be on full service withdrawals meaning we will not be discussing contributions investment options death benefit all of those topics have their own webinars and we encourage you to enroll in those webinars as well for additional information so I'm ready to get started hopefully you have been able to view the screen before you giving you instructions on how to download the slides once randy has opened up the Q&A box if you still have any questions on getting those slides he'll be more than happy to answer your question so let's get into your savings plan full-service withdrawals post service as Wendy alluded to a moment ago is simply withdrawing from your TSP now after you have separated from service whether that be retirement or just regular separation whether you are civilian or uniformed services these are the rules pertaining to withdrawing your money from TSP this is a disclaimer which is simply saying what I mentioned before that we don't give advice advice is what you need we encourage you to reach out to a trusted advisor whether it be in the tax field legal field or a financial advisor we also do not endorse or promote any other products or services or third parties so if you come across information from someone about TSP please be sure to double check where that information is coming from if it is not coming from us it is not it has not been endorsed and this is our privacy notice when it comes to GSP webinars so in short let's get started the difference between TSP and your pension your TSP is considered a defined contribution plan and that's because the ending balance that you're using or planning to use for retirement is based upon the contributions that you have made while you have been employed those contributions based upon your investment decisions you there you bore the risk associated with making those contributions and so that your role or our role because I am a federal employee with the TSP account as well so my objective is to make contributions in a way that I will have an ending balance that world but we get through retirement the difference between your TSP and your pension is your pension is at a defined benefit plan and essentially the employer and for us that's the federal government they make the decisions regarding our pension they determine how that is being invested behind the scenes to sure that when we do get to retirement there is a source of lifetime income there available to us so that's the difference between the two before moving forward we do not have any information regarding your pension if you have questions related to your pension you will either need to reach out to OPM office of personnel management or your HR or payroll department at your proposed at your particular agency to ask questions about your pension this is strictly about TSK and we don't have any information about social Social Security either so Social Security you will need to reach out to your you can contact social security.gov or go to their website sign up with the user ID and password and then you can get information from Social Security as well so again our main topic of conversation will be around the TSP contribution considerations if you are separating from service in the middle of the year you need to be aware of what the contribution limit is for making contributions to TSP and other defined contribution plans such as 401 K and 403 B the IRS is responsible for setting these limits and these limits cover all three of those such those sectors right so if you leave federal government service and in mid years as an example and you go to work for the private sector that may have a 401 K the contributions you've made to TSP and the contributions you've made to the 401 K with in next year's period January 1 to December 31st cannot exceed 19,500 which is this year's limit or if you're eligible to contribute towards catch-up it cannot exceed the $6,500 limit so those are combined the only thing that is separate from your TSP is the 457b plan which is a retirement plan for state and local government employees so if you separate from federal service and you've contributed 19:5 to your TSP account and in the same year you go to work for the state of Maryland you can contribute another nineteen five to their 457 B account so the moral of this particular slide is to ensure that you do not exceed the contribution limits that have been set forth by the IRS if you are a participant who has both a civilian TSP account and a uniformed services TSP account once you have separated from service either one or the other you are permitted to combine both of those accounts so let's say for example you are retired from the Army and now you're planning to work for the federal government as a civilian employee because you have retired from uniformed services you can combine that with your civilian TSP or once you separated from service from both you can combine those accounts keep in mind that if you have any tax exempt money's in your uniformed services account those monies will not be able to be transferred to your civilian TSP account they must remain separate in your uniformed services account to ensure that you keep the tax exempt status so there's no deadline on when you can combine these accounts it's completely up to you but we would advise that you make those choices before you reach the age of 72 because at that time you will have to take a required minimum distribution from both accounts so again you do have that option to combine your TSP account if you are uniformed services and civilian employees loans and separation from Federal service excuse me so this is how this is going to work this is only if you have an outstanding loan at the time that you separate from service so once you separate from service your agency will send TSP your separation codes for most of us that separation code will be an S for separation some of you the separation code may be a P P is for public safety employees that would be your law enforcement air traffic controller firefighters once we receive that separation code it will update your TSP account to a separated status if you have an outstanding loan at that time you will receive information in the mail to you about your options when it comes to that outstanding loan once you separate from service you can no longer make any contributions but you will have up to 90 days to settle that loan that loan has to be settled before you can take any withdrawals so you'll have several options coming to you if you have an outstanding loan will be a notice entitled intent not to replace if you do not have the funds or you don't want to repay that loan then you can sign that notice and return it back to TSP and that outstanding balance will be reported to the IRS and you'll have to pay taxes on those monies or you can pay a portion and have the other portion report it to the IRS or you can pay it off completely by sending in a check money order or cashier's check or if you do nothing at all at the 90-day period from your separation you will have that outstanding balance reported to the IRS so let's say for example I separate some service prior to separating from service I took out a TSP loan of $10,000 I get to separation I now owe $2,000 I separate from service I can either sign the notice that says you still owe $2,000 do you want this to be reported to the IRS if I sign that notice that $2,000 will be reported to the IRS as income and I'll have to pay taxes on it or I can say you know what I have $1,000 so I will write a check or submit a money order or cashier's check for $1,000 and I will submit the notice to say that I'm not going to repay the other $1000 and to have that report it to the IRS or if I do not need to access my TSP accounts immediately upon 90 days if I do nothing that $2,000 will be automatically reported to the IRS and I will receive a 1099 in the mail the following year so that when I do my taxes I can report that $2,000 as income so do you have to take your money out as soon as you separate from service absolutely not there is no deadline of when you have to take your money out the only the only requirement is required minimum distributions when you reach the age of 72 and we'll talk about that in short order so delayed withdrawal if you leave your money in your TSP account it will still continue to grow based upon how you have it invested so you will have access to all of our investment options the five core funds CSI F&G and the lifecycle fund so you will still be able to read Aversa Phi or rebalance your account at your convenience also you will still be assessed the very low fees that we have assessed currently so currently we all pay 42 cents for every 1000 dollars to participate in TSP you would still pay those same fees as your account is still being managed you will still also even if you were uneven once you separated from service you cannot make any more contributions but you will still be allowed to transfer money into your TSP account so it's Randi stated earlier that many of you have different plans everyone has a different plan for when they separate from service but if you decide to move on to another career or another job and you participate in that job 401k plan then once you separate from that other job if you still have your TSP account open then you can transfer that 401k into your TSP account or let's say for example you separate from service and you're going through all of your paperwork and you discover an old IRA from years ago even though you have separated from service you can still transfer in that traditional IRA into your TSP account as long as you have $200 as a minimum in your TSP account it keeps your account open once you have less than $200 in your account your account will be closed and the only way to get another TSP account is to log in to USAJOBS that go and apply for a new job with the federal government so if that's not your intent then these are your options this is your option to keep your account open it's very important for those of you who are preparing for separation and even for those of you who are not in the in the immediate future that you set up a user ID and password has this is the only way that you will be able to request a withdrawal from your TSP account by logging into your TSP account and going through the TSP withdrawal option which will take you step-by-step on requesting a withdrawal from your account and we're going to go over the options that you have available to you when you separate from service so the first options were the only options when you separate from service there are three of them first is a single withdrawal a single withdrawal is simply that you need to get out a certain amount of money from your TSP account and you can do that minimum every 30 days so that would require you to log into your TSP account 30 days or longer to request a single withdrawal then you have the option of installment payments consider this as a stream of income this is when you are saying based upon what my need is in retirement this is what I will require from my TSP account and this is how frequently I will require these monies whether it be monthly quarterly or annually and then the third option is a life annuity we currently contract MetLife is our annuity provider and this option is for someone who wants a guaranteed income in retirement meaning that there is no little to no fluctuation to that amount and it's giving you a guaranteed source of income or you can do a combination of all three so let's talk about that in more detail with your single withdrawal upon separation you are permitted to take a lump sum withdrawal every 30 days if you want to there's no limit to how many how often this can be and while you are receiving a stream of income you can still log in and request a single withdrawal as well the mum is $1,000 the maximum is all of your account balance you have the choice to whether or not you want to withdraw that money from your traditional TSP your Roth TSP if you have one or pro rata pro rata simply means a proportional distribution from both traditional and Roth or you can take those monies and transfer them over to an IRA or another eligible employer plan like one of the fours 401k for 3 V 457 B if eligible so as an example let's say for I plan to separate some service I am 63 years old and I want to make a withdrawal to take care of that honey-do list that I have not been able to get to so I'm going to withdraw $10,000 from my TSP account that would be done as a single withdrawal and then let's say two months later I want to go on a trip all of the restrictions have been lifted we have a cure the world is alright again so now I'm able to travel and I want to take that opportunity but I need some money so I am going to log in and complete a single withdrawal for my trip so again each time you want a single withdrawal you will need to login to your TSP account to make that request and you have to do that minimum you can do that a minimum of every 30 days so let's talk about a stream of income there's two choices on getting a stream of income $6 in life expectancy installment payments based on $6 simply means that you as the participant have decided upon how much you need and how frequently you need it whether it's monthly quarterly or annually the minimum once you set up $6 payments is $25 whether it's $25 a month $25 a quarter or $25 a year you can change your direct deposit information at any time and if you set yourself up on a stream of income and you get to the point where you want to or need to withdraw your entire account balance you're welcome to do that at any time in addition to that you can start stop change anytime that you want to so for example I will need three hundred dollars a month to supplement my income when I get to retirement I'm getting $300 a month and I realized that you know actually I need $500 a month I can log into my account and change from three hundred to five hundred let's do the opposite I'm getting $1,000 a quarter okay so that $1,000 a quarter so I need that more frequently I need to get three hundred and fifty dollars a month as opposed to $1,000 a quarter I can log in and change that at any time or I can say you know what I don't really need a stream of income but once a year I need to pay my mortgage taxes so I'm going to set up an annual payment to come to me every October in the amount of three thousand dollars to pay my taxes and so you can do it that way as well and still be able to take lump sum payments from your account on an as-needed basis so that's how installment payments on fixed dollar works installment payments based on life expectancy it simply means that we add TSP we're going to calculate those payments for you and so those payments the way we calculate those payments will be based upon your account balance as of December 31st of the previous year of your request and using a factor that is provided by IRS tax tables and I'll show you that in a moment those payments will adjust on an annual basis because again it's going to depend upon what your account balances as of December 31st you are able to change your tax withholding you can change your direct deposit information however if at any time you decide to change from life expectancy to fixed dollar that means you have converted from life expectancy to fixed dollar and you will not be able to go back to life expectancy so let's say for example my life expectancy payments are giving me three hundred and thirty seven dollars a month but I actually need four hundred and fifty dollars a month once I log into my TSP account and change that to four hundred and fifty dollars a month that's telling TSP then now I'm in control of how I want to request those amounts and so life expectancy has now been ended and I will be making the choices when it comes to changing those amounts and the same with fixed dollar if I'm getting a stream of income based on life expectancy and I want to cancel out or cash out my entire TSP account I'm welcome to do that at any time so let's take a look at how life expectancy works this is a table that we receive from the IRS this is what we use to calculate those payments so again it's based upon your account balance as of December 31st of the previous year and it's divided by the distribution period we have put an approximate percentage next to that just to show you the impact that it could have on your your TSP account so let's say for example again I'm 63 years old and I want to set up payments based on life expectancy as of December 31st of the previous year I had two hundred and fifty thousand dollars in my TSP account so if I take two hundred and fifty thousand and divided by twenty two point seven that's going to give me a factor of eleven thousand thirteen dollars so that is one lump sum I can say I want to get that out for a year then TSP will send out eleven thousand dollars out to me for four as an annual payment but let's say I want to get out monthly payments TSP will take that eleven thousand thirteen dollars and divided by 12 for monthly payment and that's going to give me a payment of approximately nine hundred and eighteen dollars a month okay so that's what I was what I will get at the age of 63 so let's say for example at age 64 my account balance is now two hundred and forty thousand dollars yes I did take out eleven thousand dollars but I still have my account diversified the market did fairly well so I did not I had some earnings that will that have brought my account up a little bit so two hundred and forty thousand divided by the factor is now twenty one point eight on an annual basis that's eleven thousand nine dollars or on a monthly basis that would be nine hundred and seventeen dollars so essentially a dollar less than what I received the previous year okay and then your account balance at December 31st will not only include or even not only deduct what you're taking out on a monthly basis but any lump sum or partial payments that you've taken out during the course of that year as well so as I stated earlier you have the option to decide where to pull those monies from whether it's all from traditional TSP which is pre-tax contributions Roth TSP which is after-tax contributions or pro rata which is a combination of both so with pro rata let's assume that I have again two hundred and fifty thousand dollars in my account sixty percent of it is traditional forty percent of it is raw I want to get out a thousand dollars a month if I choose the pro rata option that means I will get six hundred dollars from my traditional and four hundred dollars from my raw I can change that at any time if I choose to do so always remember that when you are withdrawing from traditional you will be responsible for taxes on both the contributions and earnings if you are withdrawing from Roth as long as you meet the requirements of having your Roth for five years or longer and you are over over the age of and you are fifty nine and a half or older there are no taxes on the earnings you will all you have already paid taxes on the Roth contributions so there are no taxes again on the contributions that we're talking just strictly about the earnings here's calculators that we have on our website we have eight calculators on our website and those calculators are designed to give you the assistance that you need to manage your TSP account two calculators in particular when it comes to withdrawing from your TSP account is the TSP payment an annuity calculator and the TSP installment payment calculator the TSP payment at annuity calculator is designed to give you a rough estimate it of how long your account balance is going to last depending on what your option is so you will have to answer some questions to figure that out and the calculator will walk you through those questions how old you are what your account balance how much do you need how frequently do you need it etc the TSP installment payment calculator is designed to give you an idea again of how long your account balance is going to last and what your possible tax consequences will be based upon your installment request whether those installment payments will last less than 10 years or 10 years or longer and we'll talk about that in more detail in this slide okay so we talked about lump sum distributions we talked about the single withdrawal and we talked about the final withdrawal following a series of installment payments we did not talk about age based because that is a withdraw that is taken while you're still employed and we do have a TSP webinar on in-service withdrawal so definitely check that webinar out but anytime you take a lump sum withdrawal you have the ability or the option rather to transfer or roll those monies over to another IRA or employer sponsored plan but if you decide to take those monies as income 20% will be withheld for federal income taxes if you set yourself up or an installment payment that will last less than 10 years or have your account balance running out in less than 10 years then those payments are eligible to be transferred or rolled over as well or if you're getting those payments on a frequent basis or an installment basis then those payments will be not only an installment basis but if those monies are coming to you directly you will have 20% withheld from for taxes so as an example I have let's assume I have $100,000 in my TSP account and I want to get an annual payment of $20,000 a year but that means my TSP account is going to run out in five years so each $20,000 20% will have to be withheld from that and for federal income tax because it's going to run out I'm going to run out in less than ten years so installment payments that last 10 years or longer or installment payments that are based on life expectancy those two options are not eligible for transfer or rollover but you do have the option of how federal income taxes are withheld default withholding is married with three dependents but you can either change that or you can wave having taxes withheld and just pay the taxes if there are any view when you do your taxes and you receive your 1099 form from TSP so installment payments for 10 years or more again I have $100,000 in my TSP account and I'm getting out five thousand dollars a year five thousand dollars a year is roughly four hundred and sixteen dollars a month because that's going to last me about 20 years then I'm not eligible to transfer a rollover those monies but I get to decide how I wish to have federal income tax withheld so let's look at this example a little bit more detail when it comes to ten years or longer or less than 10 years so always remember that whether it's monthly quarterly or annually each option will follow that 10-year rule so let's say for example we're on a monthly basis and my account balance is a hundred five thousand dollars and I want to get out eight hundred dollars a month well if I take a hundred and five thousand and divided by eight hundred that's going to give me an approximate number of 132 payments and so that exceeds 120 payments which is 10 years and so as such I can either have my withholding be married with three dependents or I can wait my withholdings and say you know what do not withhold any taxes because I need that actual $800 a month so let's assume that that's what I do that goes on for about a year and I decide to change my withholding or change the amount that I want to withdraw because I realized that $800 is not enough I actually need eight hundred and fifty dollars a month so I log into my TSP account and I change from $800 a month to eight hundred and fifty dollars a month the chest that I get afterwards after making that change is six hundred and eighty dollars I'm shocked and the reason why it's less is because I did not take into consideration that my account balance has dropped already so I don't have a hundred and five thousand dollars in my account anymore I have a hundred thousand dollars in my account when I make that change and as such 850 divided by 100 100 thousand divided by 850 gives me a hundred and seventeen and a half payments which is less than ten years so because it's less than ten years 20 percent is withheld from that 850 and I get a check for 680 fortunately I can always log back into my TSP account and make a change so that I can increase my patrol amount higher so that I can get what I actually need for retirement so there's a lot of flexibility but you have to be careful about that 10-year rule the third option you have for withdrawing from your TSP account is the TSP life annuity and as I stated earlier TSP currently contracts MetLife as its annuity provider this option is for someone who wants a guaranteed source of income keep in mind that if you opt to transfer all or a portion of your TSP account into the annuity portion with MetLife you are then locked into that request it's irrevocable you cannot come back out so this is an option for you there's three types of annuities single life annuity joint life with spouse joint life with other survivor the joint life they have the benefit of having a survivor benefit attached to it keep in mind that these survivor benefits do not work as you probably are familiar with survivor benefits so for example you have the option of a 50% survivor benefit or 100% survivor benefit let's assume I'm married I have in my TSP account two hundred thousand dollars and I'm going to take a hundred thousand dollars and use that to purchase an annuity with MetLife I'm going to choose the 50% survivor benefit that $100,000 is going to calculate to give me $1,000 a month so because I have a survivor benefit of 50% that means that if I die my spouse's benefit will reduce to $500 gives the difference between the TSP annuity with meant like if you if your spouse dies and you have the 50% benefit then your payment will drop to $500 as well or by 50% so again it works a little bit differently than you're probably used to or familiar with a survivor benefits working but be very mindful of that every option single life in the joint life's have the option of level payments that means that that $1,000 that I'm getting that's what I'm going to receive for the rest of my life increasing payments means that there is a Cola attached to the payment and that's available for single life annuities and joint life with spouse and that's payment that Cola payment is a two percent increase that is given on an annual basis cash refund is available across the board and that simply means that if I should die before receiving everything that I've used to purchase the annuity then my beneficiary or my survivor will get a check for the difference so again I purchased an annuity for a hundred thousand dollars I died after only receiving fifty thousand my survivor will get a check for the other fifty thousand if I live past receiving all of the one hundred thousand dollars there is nothing available for my survivor but the insurance company will keep paying me until I do die ten years certain is available for single life only and that's assuming that I'm single and for whatever reason I want to ensure that I have ten years of guaranteed income if I should die before that ten year period then my survivor will continue receiving the payments over the course of that ten year period the remaining ten year period if I live past that ten year period there's nothing available for my survivor but the insurance company will keep paying me required minimum distributions required minimum distributions is a rule from the IRS that says once you have separated from service and you reach the age of 72 you must begin taking a minimum amount of monies out of your TSP account and that's the same for 401ks for to the 457 and traditional IRA so that required minimum distribution but as you'll see in the parentheses suspend it for 2020 so based upon the carers Act that was passed excuse me my apology so based upon the character Act that was passed left last month required minimum distribution will not be made or paid out for 2020 so if you are eligible to take a required minimum distribution and you have turned age 70 and a half after January of this year and you were supposed to get a required minimum distribution you will not be getting one this year because of the Care Act and this has to do with the markets dropping due to covet 19 but if you recall we talked about installment payments based on life expectancy the required minimum distribution payments are also based upon life expectancy but the age begins at 72 and again that table is provided to us by the IRS you looks like I might being lost a little bit there we go so here we see the uniform lifetime table works the same way they balance the requirements required minimum distribution balance will be based upon your account balance as of December 31st of the previous year and the age of when you take your required minimum distribution so for example again I have two hundred and fifty thousand dollars in my account and I am 72 years old come 2021 I've separated from service and so I need to begin taking my required minimum distribution and that means that that amount would be nine thousand seven hundred sixty-five dollars a year or four do it on a monthly basis eight hundred thirteen dollars or eight hundred and fourteen dollars a month for that year and then you are required to take that each year so this is how it's going to work with your required minimum distributions you if you do not take your required minimum distribution as the IRS has stipulated you may be subject to a fifty percent penalty yes five zero and that is on the amount that you did not take or that you were required to take of your required minimum distribution if you are setting yourself up on a stream of income whether it's monthly quarterly or annually and those installment payments meet your required minimum distribution then you're fine you don't have to worry about it if you are setting yourself up on installment payment and those installment payments do not meet your required minimum distribution then we at TSP will send you a hardcopy check for the difference so let's say for example on my required minimum distribution is ten thousand dollars but I'm set up to only receive $8,000 for the year in December TSP is going to send me a hardcopy check for $2,000 I will have to cash that check to show the IRS that I have taken my required minimum distribution let's say for example I'm supposed to take out $10,000 for the year but I'm not set up on a stream of income but I did do a single withdrawal or a partial withdrawal I took out $5,000 for whatever reason earlier during the year if I do nothing at all again TSP is going to send me a hard check in December for that other $5,000 to ensure that I have met my required minimum distribution okay so that's how required minimum distributions work if you are still employed at the age of 72 or older and when I say employed I mean employed with the federal government you do not have to take your required minimum distribution it is only once you separate from service that's only from your TSP account if you have other employer sponsored accounts or IRAs traditional IRAs you will be required to take the RMD from those accounts but not from your TSP account here are some other considerations early withdrawal penalties the IRS early withdrawal penalty is put into place because the IRS is allowing us to defer taxes until we get to retirement because we are saving for retirement if we take money out before we have retired there could be an early withdrawal penalty from the IRS unless it meets one of these exceptions so once you reach the age of 59 and a half there's no more penalty for anybody all right so 59 and a half whether you're still working or you have separated from service you will not have a penalty when you withdraw from your TSP account if you decide to separate or retire from Federal service during or after the year you reach the age of 55 when you withdraw there is no penalty for you to withdrawal you'll still have to pay taxes but there's no penalty if you are a public safety employee as I referred to earlier that's B that being a law enforcement officer air traffic controller or firefighter then that age drops to 50 if you separate or retire from service at age 50 or older and there is no penalty for both of these if you separate some service before these required ages then you will have to wait until age 59 and a half to avoid the penalty for withdrawing early there is no early withdrawal penalty if you set up TSP payments based on life expectancy there's no early withdrawal penalty for annuity payments there's no early withdrawal penalties if you're ordered by a domestic relations court thank child support or divorce there's no early withdrawal penalty because of death or any papers made from a beneficiary participant account if you have questions about death benefits we do have a webinar that will go into more detail about death benefits so please enroll in that webinar there is no early withdrawal penalty if you withdraw from your TSP account in the same year that you have deductible medical expenses that exceed 10% of your adjusted gross income there's no penalties if you receive a withdrawal based upon being totally and permanently disabled we at TSP do not qualify you as being totally and permanently disabled that is done by the IRS by you completing IRS forms 53:29 and there's no early withdrawal Oh penalty if you receive a withdrawal as a military reservist has been called to active duty for a period of 179 days for more spouses right for FERS and uniformed services members when you take a look draw you will need to have your spouse's notarized signature however that has been waived for the time being it's been temporarily waived based upon the social distancing requirements of COBIT 19 and because of that we will not permit you to have the notarized signature your spouse can just sign off on it it does not need to be notarized if you're CSRs employees you do not have to have your spouse's signature because we send a notification out to them if you do not know where your spouse is or there are some exceptional circumstances that are preventing you from getting your spouse's signature please complete TSP 16 form TSP 16 which can be found on our website submitting withdrawal requests so if you recall at the beginning I was showing you what it looks like when you log in to your account to make a withdrawal once you have separated if you log into your account and it shows that you are still active that means that your agency has not sent to us your separation codes or to put it a nice away we have not received your separation code from your agency alright so once we receive that separation code then your status will go from active to separate it and you will be able to make a withdrawal from your TSP account as separated employees ok so again s is for everyone P is for public safety please air traffic controllers law enforcement officers firefighters also as a fair warning it typically takes approximately 30 days for your agency to get your separation code into it okay and as a reminder once you take once you've requested withdrawal if you are married your spouse's signature is all that is required we do not need to have a notary on that signature as that has been temporarily way due to Kovac 19 so what you'll do is a married employee as a married employee requesting a withdrawal you will print that form have your spouse sign it and then you can fax it back into us or you can mail it back into it just a really quick note if you decide to get a single withdrawal each time you log in we will need your participant signature okay I mean not your participant signature your spouse's signature okay eligible rollover distribution what this is is telling you or showing you how you can transfer money out if you choose to do so if you have a traditional TSP you can transfer those monies to a traditional IRA or a traditional employer sponsored plan like a 401 K for 3 V 457 B or you can take your traditional TSP and transfer a roll it over into a Roth IRA if you opt to do that keep in mind that a Roth IRA is after taxes and so you will have to pay taxes on those money if you have a Roth TSP you can transfer that to a Roth IRA for another raw employer sponsored plan like a Roth 401 K Roth 403 B Roth for 57 days if you opt to take these monies as a distribution you have 60 days to get those monies into another financial institution another source such as an IRA or an eligible employer-sponsored plan for those of you who are nearing retirement and are considering transferring completely out of TSP or partially out of TSP we have developed this scorecard for you to ask questions of that next financial institution so you can get a comparison on what they offer versus what is offered by your TSP so you can make an informed decision you can ask questions such as what will be the net expense that you'll pay for every $1,000 that you invest with them how much will you pay an annual fees and commissions do they make a profit if you invest with them do they have a financial obligation to put your interests ahead of their own will they protect your retirement funds from creditors claims when you retire can you set up a series of scheduled withdrawals without giving up control of your account and can you make investment changes or take the draws without being subject to any surrender fees or back-end charges so all of that is important it will affect how much you have in your account balance going forward so you can always review this information or commute this scorecard to compare with your other financial institution so to help your transition go smoothly I'm going to point out the withdrawal booklet and the tax notices for you to review I strongly encourage you to review that information anything that is in the booklet that is different than what I said please believe the booklet that is going to be a lot more accurate I'm not saying that what I'm saying is wrong I'm just saying that it's early in the morning okay so make sure that your indicative data is up-to-date your name in your address and most importantly make sure that your quarterly statement properly reflects what your retirement coverage is if you are CSRs your quarterly statements should say CSRs if you are first your quarterly statement should say first etc again you cannot submit a withdrawal request until we receive the separation code and if you are wanting to take a withdrawal after separation and you have a an outstanding loan on your account you will have to make a decision on how to settle that loan before you can take a withdrawal and you have 90 days to do so and then finally please make sure you have set up a user ID and password so that you can make withdrawals from your TSP account this is a snapshot of our website at the very top you'll see it says forms and publications that is where you'll go to get the information on your TSP help making withdrawals loan contributions etc as you can see also if you forgotten your password you can reset your password online now you don't have to wait to have your password mail to you however if you forgot your password and you do not have your account number or user ID to reset it then your account number will have to be mailed to you for you to reset your password these are some of the things that you can do on tsp.gov and here are the publication's so for this particular session you want to access the booklet withdrawing from your TSP for separated and beneficiary employees and you want to take a look at these notices TSP 536 tax information payments from your TSP account this is probably one of my favorite pieces of information we have at TSP because it lists all the options you have to withdraw from your TSP account and give you the tax Quincy's on each option and then you have TSP 780 tax information for installment payments and so this is talking about installment payments based on ten years or less less than ten years or ten years and more and how that will affect your TSP account and we also have a fact sheet on annuities that can be found in forms and publications you can always give us a call if you have any questions questions or assistance but no advice we still cannot give you it any advice so our number is eight seven seven nine six eight three seven seven eight we are available Monday through Friday 7 a.m. to 9:00 p.m. Eastern Standard Time and every time you call that number press the number three because that will give you access to a participant service representative who can answer your questions we are also on social media our handle for Facebook Twitter and YouTube is PSP the number for gov if you put in TS key then you're going to get all of those people who have not been endorsed by TSP speaking about the plan so definitely make sure you put in TSP the number for gov our YouTube channel has a lot of videos that have been professionally done and have even won awards that talk about everything about TSP so there's even information out there about this course if you want to listen to it again we do have we have been known to have live Facebook events so please feel free to subscribe to our Facebook page so that you can be notified of those events and here's our survey we would very much like it if you would complete the surveys and give us your input you can if you have your cell phone in front of you if you put your camera up to the QR code the survey we'll come up the link will come up and you can complete it right away or you can copy down the link and put it into your web browser and complete the survey that way so we look forward to hearing from you any question and I project again for that little coughing debacle it wasn't that bad all right Thank You Arvella terrific job as always so we have a couple minutes here we can go over some of the questions let's just first ask folks not to submit any more questions in the Q&A because what's in there now is what we'll get to and probably not every one of those in the time remaining so try not to continue to put questions in that cause it just scrolls it back up but what we can do is let's grab some of these I just mentioned Scrolls up and then I'll lose it let me um address the 10-year rule again the 10-year rule is basically if the question is please explain explain the impact of the 10-year rule the ten-year rule is going to determine how taxes are withheld from your withdrawal request so if you are getting a lump sum payment or if you're set up to get payments that will have you running out of your TSP account balance in less than ten years then that means every payment 20% will be withheld for federal income taxes however if you have set yourself up on an installment payment that will have your account balance lasting longer than 10 years then you can determine how those taxes will be withheld or even opted for the default federal withholding of married with three dependents alright let me just go over real quickly - well our Villa is catching a breath and grabbing a question or two more I'll go over the slides because there's that question at the end here so if you still haven't downloaded the slides and you want to do that try and do that now because as we end the event I can't guarantee that WebEx will still have that as an attachment so it is attached to WebEx go back to several ways you can go back to the approval message that you receive when you registered maybe even there's the link in the reminder message today in that message there is a joint event usually green box or a blue tab of some sort and you can generally click on that and get to the next page and that's where you'll find the event information event materials at the bottom of that page some folks may have to copy and paste into a different browser or even use a personal device if your agency or service blocks these sort of things one other way you can get to the slides is just go back to the registration where you originally began at our website at tsp.gov slash webinars and where it says register now click on that it'll take you to another page click on that it'll take you to the page that I just mentioned with the event information so those are a few ways you can go and still download the slides I'd like to answer Steve question we did discuss this in detail at the beginning of the presentation but I'm more than happy to reiterate it do you need to touch your TSP account after you retire and secure employment outside of the federal sector absolutely not your TSP account is set up to give you a lifetime stream of income so as long as you have two hundred dollars or more you do not need to touch your TSP account however per IRS rules once you reach the age of 72 not counting this year you must begin taking a minimum out of your account called the required minimum distribution so for those of you who have questions about this we will always notify you we will begin notifying you before the year before you reach your required minimum distribution age at that time period is coming up once you get to that point we will let you know based upon your account balance and your age what your required minimum distribution amount will be so we will notify you of that but again if you go on to another employment after Federal service no you do not have to touch your TSP in fact once you finish working for another company whether it's in the private sector or a public sector like churches hospitals universities you can always transfer those monies into your TSP account as well there were several questions I just want to answer this real quick I'm sorry I cut you off there but some we've had participants a few things just to heads up for future reference if you attend two webinars in WebEx when you submit the question and continue to submit it over and over and over again it just makes it more difficult and makes the Q&A section continue to scroll up further and further so it it just prevents us from as answering more questions we will get to them as soon as we can and as quickly as possible so there were a few questions about making changes to your elections and things of that nature if you start out with say a life expectancy monthly option or installment option you can always change at one time and move over to the fixed dollar side once you make that change you will stay on the fixed dollar side so yes if I'm on the life expectancy I decide hey at some point in the future for whatever the reason is I want to make a change that I can but I would have to move over to the fixed dollar side and start setting the amount that's coming out for that installment payment on my own so you do have options to alter this and in fact with a lot of the big changes that happen last year in September with the withdrawals gave you this flexibility gave you more ways that you can touch your money and and sort of create something that works best for you one question we have does the post TSP withdrawal of any amount affect your first retirement fund absolutely not your TSP account balance and options are separate from your pension whether it's for CSRs or uniformed services they have nothing to do with that when it comes to withdrawing from your TSP account this is the only way that was I could say it better your option to withdrawal from your TSP account has nothing to do with your years of service it has to do with your age only your age because the rules for the TSP withdrawals are given to us by the IRS so it does not have any impact on how many years of service so as long as you are separated from service if your regular employee you separated from service from age 55 or older there is no 10% penalty whether you have worked for the federal government for one year or 30 years it does not matter it's only based on your age and I'll try answer this question again here so somebody is well a couple folks have submitted questions in this sort of area is there any kind of tax benefit to we withholding so for the options that give you the ability to waive withholding or decrease it are you getting a tax benefit by doing that no you're still going to owe taxes on those funds when you go to file your taxes at the beginning of the next year so what you're doing is you're just waving the withholding along the way now maybe you've taken out enough taxes from other income in that year that covers this or what-have-you but that doesn't mean you don't owe taxes on this money just always remember the tax withholding the federal tax withholding is not taxes owed so if you're waiving the withholding they're just not taking money out of that installment payment along the way it doesn't mean you won't owe taxes on that money at you know at the end of the year still there yeah trying to find a question huh it is phones it really does if you've ever worked with WebEx it does the Q&A section is scroll down and we have a hundred and nine questions in the queue for Q&A so a lot of questions out there these are terrific questions by the way and we'll go a little bit over the the normal hour here so we're trying to get to as many those as a matter of fact let's go ahead and take maybe one more and then we'll close things out one good question no early withdrawal penalty if I separate at age fifty and request life expectancy or annuity payments that's correct all right so we will wrap things up and I will say one other thing there were several questions here that ventured off into the area of death benefits we do provide a death benefit webinar topic so look 2tsp go slash webinars for the dates and sessions for death benefits in the coming weeks and months and we will try to get some some renewed or some new recordings of the webinars up on our YouTube channel as soon as possible so we will dive into all those details of how your spouse can withdraw the money and what their options are and things of that nature that apply to death benefits and beneficiaries so with that said I'll saw myself out here and hand things over to our Ella and let her say goodbye have a terrific day and thank you for joining us a one last question that I want to address can you transfer a portion of your traditional TSP into your Roth TSP the answer is no they must remain separate at this time they cannot be combined so having answered that final question I want to give thanks to each and every one of you for taking the time out of your day to join us on this webinar please note that we will have we have other webinars that are coming up and we will have this webinar offered again so if there's some information in this webinar that you weren't able to understand or get your questions answered please feel free to join us again and just we so that we can reiterate that information for you and you can get the information that you need to manage your TSP account correctly I wish you all good will and that you may remain safe and hopefully we'll be able to see you in person one day thank you again and stay well

Show moreFrequently asked questions

How do I add an electronic signature to a PDF in Google Chrome?

How can I eSign a document sent to me by email?

How can I get others to sign a PDF file?

Get more for endorse age field with airSlate SignNow

- Mobile initial

- Prove electronically signed Lease Amendment

- Endorse digisign Venture Capital Proposal Template

- Authorize electronically sign Exclusivity Agreement Template

- Anneal mark Pet Adoption Letter

- Justify esign Dental Supply Order Invoice

- Try countersign Leave of Absence Agreement

- Add Security Agreement electronically signed

- Send Bartending Services Contract Template byline

- Fax Letter of Recommendation Template for Coworker esigning

- Seal Coronavirus Press Release signature block

- Password License Agreement Template signature service

- Pass Firearm Bill of Sale countersign

- Renew Commercial Sublease Contract signatory

- Test Simple Cash Receipt initials

- Require Graphic Design Proposal and Agreement Template eSign

- Print beneficiary email signature

- Champion customer signature

- Call for companion initial

- Void End User License Agreement template digi-sign

- Adopt Framework Agreement template esign

- Vouch Free Admission Ticket template signature block

- Establish Birthday Gift Certificate template signature

- Clear Consulting Contract Template template email signature

- Complete Web Banner Design Request template signatory

- Force Business Contract Template template digital signature

- Permit Video Release Consent Letter template electronically signed

- Customize Leave of Absence Letter template byline