eSigning Endorsement Agreement Template Made Easy

Do more online with a globally-trusted eSignature platform

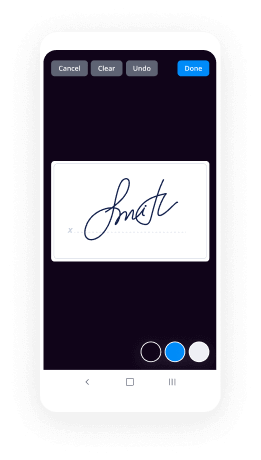

Remarkable signing experience

Trusted reports and analytics

Mobile eSigning in person and remotely

Industry rules and compliance

Esigning endorsement agreement template, quicker than ever before

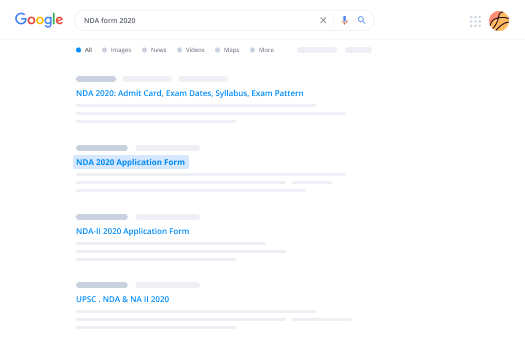

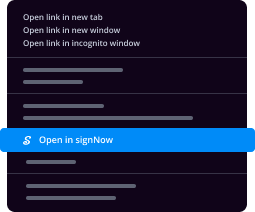

Handy eSignature extensions

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

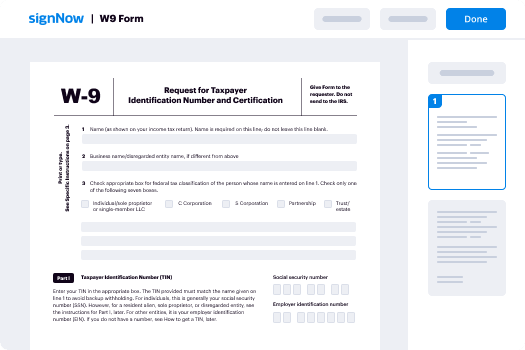

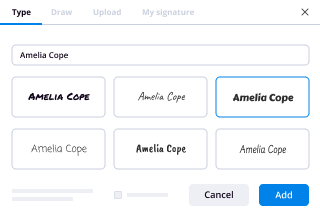

Your step-by-step guide — esigning endorsement agreement template

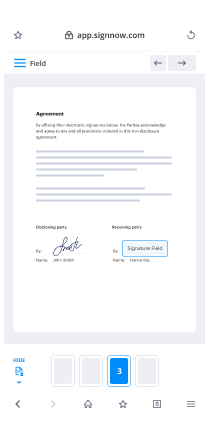

Leveraging airSlate SignNow’s electronic signature any business can increase signature workflows and sign online in real-time, giving a better experience to consumers and workers. Use esigning Endorsement Agreement Template in a few simple actions. Our mobile-first apps make operating on the move achievable, even while offline! Sign signNows from any place in the world and complete deals quicker.

Keep to the step-by-step guideline for using esigning Endorsement Agreement Template:

- Log in to your airSlate SignNow profile.

- Find your record in your folders or upload a new one.

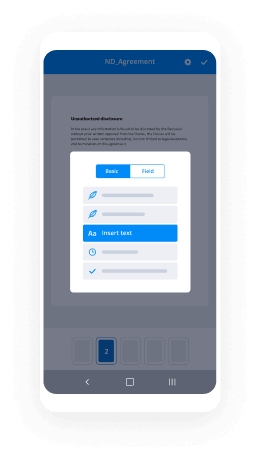

- Access the record and edit content using the Tools menu.

- Drop fillable areas, add text and eSign it.

- Include numerous signees via emails configure the signing order.

- Specify which users will receive an completed doc.

- Use Advanced Options to restrict access to the template add an expiration date.

- Click on Save and Close when done.

Furthermore, there are more advanced functions available for esigning Endorsement Agreement Template. Include users to your common workspace, view teams, and keep track of cooperation. Numerous users across the US and Europe recognize that a solution that brings everything together in a single unified work area, is exactly what businesses need to keep workflows functioning easily. The airSlate SignNow REST API allows you to embed eSignatures into your app, website, CRM or cloud. Check out airSlate SignNow and get quicker, easier and overall more productive eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results esigning Endorsement Agreement Template made easy

Get legally-binding signatures now!

FAQs

-

What is an endorsement agreement?

An Endorsement Agreement is a contract that lets a company use someone's name, likeness, and reputation to promote a service or product. Typically the endorser is well known (or at least well known within a given field). -

What is an example of an endorsement?

Endorsement is defined as the act of giving your approval or recommendation to something, usually in a public manner. ... An example of an endorsement is when you sign the back of check, telling the bank that you give your approval for the check to be cashed. -

How does an endorsement work?

Paid endorsement or overt endorsement involves a contract between the brand and the celebrity to represent the brand in an advertising campaign. ... Paid endorsements involves a contract between the brand and the celebrity to represent the brand. -

What is endorsement letter definition?

Endorsement is a support, authorization, approval of something, while writing a letter of endorsement you have to show advocating to a person, an idea, a movement, or an organization. ... Your endorsement should also have a brief detail about you, your information. -

How do you endorse someone for a job?

Write a letter for your friend to attach to his application and suggest he mention your name and recommendation in his cover letter. In a small company, talk to the boss personally to say you'd like to make a recommendation via a personal introduction. -

How do you write an endorsement letter to a company?

Include the name of the company or the organization and your position or role in it. Indicate what and to whom are you are endorsing. Make sure you use clear and specific language to request for the endorsement. Substantiate or give reasons for the endorsement. -

What does endorsement mean in business?

A written or public statement by a celebrity, business or professional group extolling the virtues of a product and recommending the use of the product to the public. A product endorsement from an authoritative figure is a key element in business advertising and marketing campaigns. -

What do you mean by endorsement in banking?

A bank endorsement is a guarantee by a bank confirming that it will uphold a check or other negotiable instrument, such as a banker's acceptance, from one of its customers. This assures any third-party that the bank will back the obligations of the creator of the instrument in the event the creator cannot make payment. -

What is an endorsement strategy?

It is a market strategy of giving a new name, symbol, or change in design for an already-established brand. The idea behind rebranding is to create a different identity for a brand, from its competitors, in the market. -

What is an endorsement contract?

An Endorsement Agreement is a contract that lets a company use someone's name, likeness, and reputation to promote a service or product. Typically the endorser is well known (or at least well known within a given field). -

How do you write an endorsement letter?

Include the name of the company or the organization and your position or role in it. Indicate what and to whom are you are endorsing. Make sure you use clear and specific language to request for the endorsement. Substantiate or give reasons for the endorsement. -

How do you write a formal letter of endorsement?

In an endorsement letter you should stand out clearly that you are giving your consent, or you are supporting something, you should introduce yourself and your endorsement clearly. You can also mention your position or title or any expertise that you hold, which can aid your endorsement in any way. -

What is an endorsement for a job?

An endorsement is a specific skill that a colleague or friend can back you on. A recommendation is a short note from a professional who recommends you for a job or project based on their experience with you. -

What are the 4 types of endorsements?

There is no requirement that the word "order" be embodied in the endorsement. Four principal kinds of endorsements exist: special, blank, restrictive, and qualified. An endorsement that clearly indicates the individual to whom the instrument is payable is a special endorsement. -

What are the types of endorsement?

There are six Kinds of Endorsement i) Endorsement in Blank / General ii) Endorsement in Full / Special iii) Conditional Endorsement iv) Restrictive Endorsement v) Endorsement Sans Recourse vi) Facultative Endorsement.

What active users are saying — esigning endorsement agreement template

Related searches to esigning Endorsement Agreement Template made easy

Esigning endorsement agreement template

we deduce Robert Harbour he is the author of systematic trading a unique new method for designing trading and investing systems which was published by Harrison Harriman house until 2013 Robert worked for a gel which is a large systematic hedge fund and part of the man group he's responsible for the creation of a Chells fundamental global macro strategy then managed the funds mill topology multibillion-dollar fixed income portfolio prior to that Robert worked as a research member of CepR an economics think tank and treated exotic derivatives for fireplace investment bank Robert is a bachelor's degree in economics from the University of Manchester and a master's degree also in economics for Birkbeck College University of London thank you very much thank you so I'm gonna come down for the podium because I walk around a lot during my talks and first stay on there I probably break something so I want you to imagine for a moment that we manufactured cars the same way that most people create trading strategies so we'd have the you know the GM factory or the Ford factory and the video all these parts pins everywhere you'd send robots in they pull out all kinds of combinations of different parts and sort of trying to sell them into a car so you'd have some cars with one wheel some with two some ways no steering wheel instead of like a normal wheel somewhere the engine was was in the backseat not connected to anything and then you'd get all of these different variations of cars and you line them all up and you make them all do a quarter-mile drag race well of course most of them wouldn't even move but are the ones that we're moving you then pick the fastest to say right this is the best car I mean it sounds kind of nuts but that's a pretty good metaphor for the way that we create trading strategies so I'm going to try and describe to you today a better way normal stuff you have to read so where does this kind of idea that this is the way we should do it come from so what I wanted to do is pretend you got a time machine and go back quite a few years to when I got started in this business and I was given the great opportunity to become an intern at AHL and if you want to know what I looked like at that time melk would you stand up please so milk is actually my intern had a hair gel with you years ago and/or fitting monkey as we we call them at you know very at the time so I looked exactly like him I had all my hair I looked amazing so I was given this opportunity and everybody how much by the industry so I went and you know bought the usual books but I also found this book here now normally when an author is doing a presentation they they kind of try and push their own book but I'm actually to try and push this book because it's a great book if he's not ready I'm going to read a little bit from it production company begins to sound like a creature endowed with a voracious appetite for numbers it hungers after data to be analyzed massaged cleaned transformed patterned mapped propagated I mean the author's clearly got a very good for Soros right networks graphed plotted and scattered through state space until out the back of this massive number crunching machine comes another number indicating buy or sell and you read there and you think wow so that that's how systematic trading works that's how you design trading strategies and the way of thinking about this is that you start with a bunch of data and you have this magic box that we'll talk about more in a second and the box is deliberately black because it's it's a black box with all of those connotations that has and outcomes a trading strategy and the nice way I thing about a trading strategy it consists of an algo plus some parameters so the algo is just the rules that say if X happens do Y and the parameters are you know numbers you can tweak and within that algo to make it behave slightly differently now this is called data first because you start with the data and you know thing about our keynote speech this morning you know this is exactly this approach you start with a bunch of data and you you out the bottom falls of the strategy that you follow okay why is this babble it involves spitting and it's well known that fitting is something that's good in moderation but really bad if you overdo it or over fit and this is a fairly classic picture from a fairly classic book and this has been done by statisticians so instead of a little one way we think about things higher up on the y-axis is actually bad low on the y-axis is good because it's low prediction error so if you just focus on this purpley pink line first the more complex Steve putting a model so the more degrees of freedom you having your fitting the better the model will perform in sample lower prediction error until eventually actually asymptotes to 0 but the out-of-sample performance will be you know starts off improving it's never going to be quite as good of a pink line by construction it starts of improving and then gets gradually worse and worse and worse and there's this optimal point here and this side the optimal amount fitting you can do and the problem is that we don't really know where this point is and we usually make an error in assuming that it's much further over to the right in other words we think we can do more fitting than the data will really let us right there are three types of fitting so that the kind of fitting that most people think about is what are called explicit fitting so that's everything about the keynote this morning again it's where the you let the computer do the fitting for you so you let the computer select from you know all of the randomly produced cars or trading strategies and variations and explicit fitting is it's kind of okay if you do it right if you do it badly obviously you end up overfitting now the second form of fitting is implicit fitting and this is where you do the fitting and you may even be doing it subconsciously not realizing but anytime you look at a training strategy on a computer and look at its performance and then make a decision to throw it away or change it in some way you've just made a fitting decision and you just effectively done an in-sample fit and that's bad that's really bad you should never do that if you can now the final kind of fitting is called what I would call tacit fitting and this basically means that even if you've gone have got me and drop me into a room with no access to to any data and so right constructor training strategy there's a whole bunch of stuff about finance that I know and that everyone knows the certain things are more likely to work than others so you have all of this knowledge there's tacit knowledge inside your head and in a true out-of-sample test you wouldn't have had that so you wouldn't have been able to land at the beginning of time before any financial data series started to arrive and immediately know in advance or why no momentum works so we're building momentum and training strategy so you're already doing some kind of overfitting now the thing about tacit fitting is you can do absolutely nothing about it it's unless you have some kind of explicit fitting probably not very nonlinear machine learning that has got no constraints on what kind of strategy will pop out the other end that's quite difficult to implement in practice so what kinds of tacit knowledge are there so this this theory this stuff you can read in books there's previous research that's been done by people and published either by you know by academics or by people investment banks there's what I call market folklore so you know even if no academics had written about trend-following and even if no one had ever written a word on it I think most people in this room would know that it existed for example because you know it's just been part of the market for so long and finally just you've got common sense so it's common sense that if you can design a training strategy that buys low in sales how you'll make money in fact that kind of thing right so I think people should do less fitting and more designing so what is designing rather than fitting so when you design you basically sound well I've got all this tacit knowledge I'm not going to try and ignore it I'm going to embrace it and use it I'm not gonna do any implicit fitting at all and then I'm gonna do the absolute minimum amount of explicit fitting fitting and I'm going to do it in the correct way so the difference here is we start with an idea it's not data first it's the idea that comes first and that idea is probably something that's come from all of this tacit knowledge so um well I'm 43 minus epsilon where epsilon I 11 days now so a bit although and I've lost most of my hair not not because of working in a hedge fund business but from having three kids so this is how I would design a training strategy now so it's ideas first and instead of this black fitting box I've got this transparent design process and instead of just data going into it I've got some real data but I've also got some tacit knowledge and I've also got some fake data which we'll talk about more in a minute and by the way if you you've seen me even the past probably blog about fake data and I used to call it random data but I thought it would be a nice reference to kind of contemporary American politics to call it fake data and out the end pops the same thing a training strategy with some algorithms and some parameters now this is much more how people design cars and indeed any of real products they have some theory so for example you know we know that the internal combustion works because people have obviously designed them but also done a little research into how they work we know about you know the aerodynamics of how a car best design a car to get get it to be really fuel-efficient and you know people do market research this well what kind of car would you like this previous product so you know we can start off the fact that we know that car should probably have four wheels and on each corner and you know that reduces the amount of cars we need to look at we also could have focus groups and design prototypes so we can do all these these things ok so I want to talk about trend falling this presentation now I'm a bit reluctant too because I've realized actually that I've kind of become a pigeon holders oh you're the trend-following guy and I'm so much more than that but it's true that I did used to work for trend-following fund and I feel I know a lot about trend-following and but more importantly I think everyone understands trend-following it's the simplest rating structures you can have apart from buying holes so you know I think it's a good example to use so what can a tacit knowledge would you have intro he was starting out on a journey to design a trend following strategy well you'd have market folklore so you know you read things in books like Jesse Livermore's book which is like over a hundred years old now saying things I'll cut your losses and let you win is Ronald don't fight the tape obviously we've got the the kind of historical record of a turtle traders story which has been told many times and then there's all these businesses that have been doing this so you've you're coming on the US CTAs the UK CTAs in the European CTO so this idea of trend falling independently arose on thing they're kind of two or three different places and then it's the the kind of the research that people have done on it so the earliest decent paper I could find was from 1960 per but more recently you know there's it's been added to the classic kind of Pharma French three factor model as a fourth factor by Carhartt and then you've got the theory so why doesn't mentum work so you've you've got the work of the behavioral finance guys saying well you know it's it could because of prospect theory people will value games and lost differently it could because of hurting or confirmation bias under reaction and we also know that certain funds trade in the market in such a way that creates trends so for example you know risk parity funds might trade in such a way that trends are created at some time scales and mean reversion other time scales okay but it's very easy to say old trend points very simple but actually there's a whole bunch of unanswered questions we still have to answer so I'm gonna stand over here now give you guys some love what period of time the trends last fall when should we enter them when should we exit them should we have a stop-loss rule and what is it how do identify markets that are all arms trend friendly how to identify how strong the trend is what size should our positions be in in other words you know what what is the algo their trend falling out we're going to use and what parameters should I have inside it that's a lot of unanswered questions that we need to answer in our design process now the data for the data first guys you know they've it's very easy they just come with a set of possible algorithms that they think might identify trends some possible parameters the data put in the magic fitting box and outcomes for the best strategy which will be the best algo with the best parameters so what is the best strategy we ask you most finance people they give you the data first answer which is oh it's it's the thing that gives you the best return versus risk and if you assume that you can do any amount of leverage and you assume a risk is Gaussian that then comes out as being the highest Sharpe ratio if those things aren't true you need to use other measures so the important point here is that is a very narrow view of what's best the best strategy is the one that doesn't makes the most money end of story and there's also a very narrow view of what information you should use to actually create it which is just past data now when you're designing something in this ideas first it's much richer so I'm not necessary interested in the best performing strategy in sampling the part I'm interested in the best design strategy so I'm going to look at lots of metrics not just performance which I will look at but turnover how it behaves in given scenarios does it look like a try following strategy in other words you know if I push a price series through that has a trend in it does it capture that trend if I push the price series through it where markets really choppy does it lose money you know does it do those things that expect it to do and we can use multi fastest sources of information so we're going to use all of this tacit knowledge so common sense theoretical principles some fake data and we're going to use some real data but in the use the absolute minimum of real data because I like to think of real data is this kind of horrible contaminating product and when you bring it anywhere near your training strategy you're at your risk then of of overfitting so we want to kind of keep the real data away from this design process for as long as possible or bring it right at the end and just to the absolute minimum of fitting because we need to do some fitting right otherwise we're not really quants you know we're just designing some random thing we think will work and seeing if it works that's not really the way the world works okay so this is all been quite wofully so far so let's make it really concrete what process should you follow picking a designer training strategy and the first thing you need to do is start with I'm gonna explain each of these things throughout the presentation but I'll just read them out now start with the sound framework which imposes some conditions come up with the idea of course you may think that should be first but actually I think it's better to start with the framework and it's a general framework so it can be applied to any strategy use some random nature or a single scenario of real data plus there in common sense to develop the algorithm use fake data to fit the algo and I'll put fitting quotes there because it will be a fitting process but because it's fake data it's you know it's a bit weird what we're doing and we're not just to repeat the point we're not just going to be fitting for Best Performance we're going to be fitting for other metrics as well then we will use some real data and basically that's going to be for two reasons firstly a porous or the classic parameter sensitivity check which is to say how we by fluke found an extreme value of a parameter and actually either side of that you know you've got the classic thing where the performance and the behavior just drops away and becomes all for how we made that mistake somehow by accident it's it's quite unlikely with fake data to do that but it can happen but also as a sense check so I know that trend-following works I has worked in the past in certain markets if I create this thing that captures trends and is designed well and works and then put real market data through it it should be profitable when trend falling was profitable profitable and vice-versa if it isn't that I've screwed up so this is kind of the check you haven't screwed up step and then finally we're going to do the the only fitting we'll do with real data which is to fit the risk capital allocation we're putting into the strategy or the the different sets of parameters within the strategy and we'll do that using real data but that's explicit fitting so it's the least bad kind of fitting so we'll do it properly in the words out-of-sample and in a robust way and I'll explain why this this kind of fitting is like the least bad kind of fitting you can do so step one start the sound framework so I will now very briefly push my book there's a question please say Thank You data what do I mean by fake data yeah you know I'll come on to that yeah I'll tell you what fake database yeah it's pretty when you see it be like oh yeah obviously it's fake right so if you if you want a moral kind of complete explanation of what this this pretty slide means you'll need to spend like fifty dollars on Amazon for the printed version but I'll quickly go through it now because it's important to understand the framework and by the way it doesn't necessarily matter what kind of framework you're using as long as you have one I'll explain why that's important but don't think this is the only way of doing this kind of stuff I mean this framework for example doesn't play very well with relative value strategies you need to make some tweaks to make it work and it doesn't play very well in situations where you've got limited leverage or no leverage and you want to achieve quite high risk or quite high returns but anyway you start with a bunch of trading rules and each of these rules could have could be like variations on theme so it could they could be the same I'll go with different parameters or they could be different algos or a mixture of those things and then what we do is we basically take a weighted average of the forecasts of these rules and I'll explain what that means later and we use that to forecast an individual market and I call these trading subsystems because they're part of the overall trading system that's the step here we then do some risk targeting and position sizing so we end up with with positions and then finally we we put that into a portfolio of multiple instruments so that's that's kind of it that's all you need to know okay so these are the conditions within my framework and this is quite a lot of words on this slide but I'll try and explain it as quickly as possible because it's not necessary important to understand this in detail the important point is that by creating this framework I've created a kind of a structure in which I can drop different trading rules with a minimum amount of extra work and if you go on my website you can download it for free in Python and I'll probably get round to doing a quanto quanto peon and implementation at some point as well um so what the trading rules do trading rules make forecasts of risk adjusted price changes and these forecasts are continuous they're not discrete entry and exit conditions so you it's not a situation why where you go on I'm now I'm gonna buy hold something I'm now going to sell you you're always kind of in the market always making forecasts about what the price will do next and then trading to adjust your position accordingly the forecasts are scaled in such a way that they're not they're independent of the interests of your trading and the time periods you're trading in there's no sort of magic numbers that you have to kind of plug in so make it work for different markets the forecast is proportional to the expectant Sharpe ratio which of course is just the the mean over the standard deviation and I note in passing that in you know kind of classic flailing optimization your position should be proportional to MU over Sigma squared in other words your positioning portions to the forecast divided by the standard deviation so that this means that no matter what the volatility of the instrument or the fact the volatility is changing over time this this the forecast can be compared very easily so the training rule doesn't need to know it's training there so I need to know it's trading S&P 500 and it's 1999 and the volatility is a particular level that's all managed by the framework the expected we have to have kind of been posted scaling so the expected absolute value of forecast is 10 because that could be any number I just use 10 in principle all forecasts will be used at all markets that may change later if when we do the optimization and the last stage if we're going to try and capture different timeframes we use multiple variations of the same trading rule so the words one algorithm lots of different parameters and we want to try and catch what's going into multiple time frames because momentum seems to occur over multiple time frames but we don't want these things to be too highly correlated or you know it's kind of going to be a waste of effort having loads of them if they're all 99% correlated so we want to have a kind of a certain number of trading rule variations sort of just enough like Goldilocks amount so not like just one so we miss all the stuff that's going on in other time frames but not also not like a thousand because that's ridiculous okay cost for the most important thing in finance and the second most important thing in finance is costs okay people in this industry do not spend nearly enough time thinking about costs it's you know you really spend a lot of time thinking about costs and a big part of the design designing a trading strategy is that there's a lot of thinking about costs involved in it you'll see me thinking about costs much more than pre cost performance and the reason for that is that costs highly predictable but returns are very relatively unpredictable so even if you knew in the past the market was going to stay stable and you knew with certainty that the the returns you were getting in the future we're drawn from the same distribution you knew that distribution absolutely perfectly you knew the words you knew what an econometrician would call the data generating model which you don't of course you don't know that but even if you knew that they'd still be huge amount of uncertainty about what your performance would be able to say a five-year period you know returns are really unpredictable this means our practice we need to throw away systems that are too expensive and but because we're designing not fitting we don't do that by creating you know the trading strategy and testing it and including costs from the backtest and then seeing all this lost a lot of money we'll throw that one out we don't need to do any of that and the other thing we want to do is not necessarily trade really slow systems and that's because the law are active management basically says the slow you trade the less you performance you can expect and at some point you might as well just give up and become a buy-and-hold investor so okay so you remember these from earlier all of these unanswered questions now the really great thing about imposing a framework like this is I could just press the right button put a whole bunch of red lines through these things all of these things here are managed by the framework so for example entry and exit well as I said we've got continuous forecasts we don't need a separate entry and exit rules we don't have a stop Russ rule the you know the risk management within the framework manages that and also if you're trend-following that kind of does have stop-loss for you as well position sizing is managed by the framework we in principle we're going to try and get all markets to trend follow so we're not going to have any kind of identification that I'm an ocean trade corn because that's not really good for trend following will let the risk the optimization at the ization at the end work out with us statistically you can make those right kinds of decisions or not so the only thing we need to do is identify how strong the trend is so they only got one question to answer so life has been made a lot easier right second thing you got to do is come up with the idea if nothing else I need to know what onions would want to be long or short and the other thing about the way that the framework works is that it makes forecasts that are proportional to expected Sharpe ratio in other words if I think the markets going up a lot then I want to be more bullish and have a bigger position on it so I need to identify both the sign and how strong the forecast is that's the thing I need at the Anthony to identify make sense no okay well you know what I think we're gonna yeah okay so this is the tacit knowledge thing I'm assuming that trend-following works I'm assuming that the market has gone up in the past it will continue going up that may not be true of course and the whole trend following industry will die which would be quite it's quite sad for me because of most my friends work there and for me too because I've got money in the strategy but I'm kind of is that possibilities we always do them assuming the past repeats itself but rather than needing to look at a whole bunch of data to work how I had in the past I just know the trend falling works cuz the goal is tacit knowledge in my head so if I then from that assumption so I know trend-following works I'm going to assume that all I need to do is work it's kind of have some way of measuring what the trend is and then the framework will then translate that into into into a position yeah I mean this is a like a deep philosophical argument we can't have now really but I just to say I don't really believe with those kinds of people anyone is putting a trade on his forecasting because they think they know what's gonna happen in the future so those people that I'm being recorded they're full of brown sticky stuff yep correct okay so sorry go on yeah yeah but that's kind of when the forecasts let's suppose how your long your forecast is positive as it shrinks and then passes through 0 you'll implicitly be closing and then reopening a new short position yeah so go back to your first question which I've forgotten already oh yeah is a strategy that that does use explicit entry in exit rules somehow inferior if you make the assumption that there is a correlation between how strong your forecast is and the exposed performance of your trading rule then you you should use a continuous system in practice when you test it because one of the problems with safe Futures Trading is if you're a small investor it's quite hard to hold sufficiently large numbers of futures contracts to have a truly continuous system you know see you you might only be able to have a binary system just because you've only got enough margin to just buy one contracts or sell one contracts so you can actually test how kind of how much damage that does to your performance and the answer is it does do some damage in other words if you if you possibly can you should try and have a continuous system but it's not lucky a huge Emes yeah it doesn't really kill the performance I'm gonna move on if that's okay because we're short of time now okay come up with the idea so what do you know humans before computers humans would just look at these wavy wiggly lines and just draw a line through than writing this was a highly specialized an elite profession done by people wearing green eyeshades so how can we kind of replicate that so I I'm using linear regression the reason I'm using it is so I mind the kind of core trend for my system ISM is exponentially weighted moving average crossovers my problem is I kind of have so much tacit knowledge about exponentially weighted moving average crossovers that I was worried that I would you know be constraining the design process too much right from the beginning you know I'd bring be bringing in too much tacit large so I thought I'd start with something I've never used before and therefore I had no precondition little ideas about you know what might be a good parameter for a bad for me to say so it's just linear regression using ordinary lease whereas this is by no means an original idea and in fact I think andreas clay now who's one of the other speakers in one of his books uses something similar so basically what we're trying to do is is use statistics to draw this line and basically these are all data points all the closing prices is daily data data points and we just draw a line through that that's the best fit and then we measure the beta and the beta is the slope in other words it's the how fast the price is advancing or declining and I you know so the only question we need to answer is how far back do we look to draw these lines so I know it's a rolling regression over the last n weekdays to capture different length trends so the only question we have to answer is how big should envy and I call it a window size okay so that's the trading rules it's dead simple probably it's probably simplest way you could possibly capture momentum I think in a systematic way right so step three you soon branded a to a single scenario real data plus theory and common sense to develop the algo so let's use the real scenario which is 2008 some of you may know is quite exciting so if I looked at the one-year returns between January 2008 and January 2009 so a rolling window of a year and look at what the market did look at the slope of this black line it's a beater of - 564 point 1 S&P 500 said that's the S&P 500 points a year so if that trend continued of that rate you know then the year after the S&P would lose another 500 points obviously that didn't happen trend followings not always right yeah was that question or someone was laughing yeah okay good laughs laughs good he yeah okay yeah so I would I'm it's down the first of January 2009 I want to know what my forecast is and that will determine what position will be as out as I wake up in the morning so in this particular case I'm using a very long window okay so remember these are all the conditions we have before in our trading system the important thing here is a forecaster scale than an instrument temporal way there are no magic numbers so we're now going to start a design process we're going to start thinking about the algorithm and asking ourselves questions about whether it's a well designed algorithm does this scale well no and that's just common sense you don't even need to draw the sp500 clearly minus 500 which is that the number will have a completely different meaning in another futures contract and it would also have a completely different meaning in a time period when volatility was a lot lower because everything should be volatility normalized well this is quite an easy problem to solve so I said for cash should be proportional to the expected Sharpe ratio where's the mean divided standard deviation well the beta is in units of change in price yeah so the forecast the revised rule now is to say we'll take the beta we take the slope of the regression and we just divide by the standard deviation the recent volatility and you can use like you know 30 day volatility or something like that well the thirties relatively predictable so using historic volatility is kind of okay and this is just theory I mean this comes from theory you know math stomach hit them in the night well Harry Markowitz in the 1950s which you don't II don't have any data to do that math right okay so this is the second iteration of our algo and now what I've done is I've got some real data and you probably using real data but I'm not looking at performance so when you're designing rather than fitting you should it's okay to use real data sparingly especially here I'm just using one market so you know it's boiling designing the strategy so that it only works on one market um but you should never look at performance until right at the end when you you actually have to so what's plotted here is the the actual value of beta so the y axis goes from minus 42 plus sixty and the the range of forecasts apart from this bit of the beginning which I told when a second is between uh no minus 35 and plus 30 so that's actually quite good because the the just by coincidence actually the expected absolute value this is our about ten but in practice the trading system framework will cope with situations where it's not exactly ten because that's just a coincidence actually by quoting a scaling parameter and that's all done on a rolling out a sample basis okay it looks pretty good apart from this gnarly bit at the beginning and the reason that's happening is that although he using a year of data at the beginning here we didn't have a year of data we only Oh on day one we had one day of data on day two we are two days of data um you need you need a minimum of two days to draw a regression line so after two days it started drawing a regression line but because there's very little data it's very noisy so scale as well yes Oh does it sorry one thought other thing does the behavior makes sense so does it behave like a trend following algorithm should so in 2008 which is about here it was massively short because the market had been going down after 2010 this is the one year look Beck's was quite slow it was mostly positive because the markets been going up and only you know last year that it briefly go bearish so it it's behaving like a trend falling out rhythm good so we can tick that box okay so our the other thing to say sorry is so costs are important which means the speed of things is also very important how faster things actually trade so there should be a kind of rough relationship between the the length of trends you're looking at how fast your trades so if you're looking at one-year trends that are really slow but your thing is churning over every single day you've got a very badly designed algorithm and there are quantitative ways of measuring that which we'll come to but even now just eyeballing that plot it's pretty obvious this is a fairly slow system so that's good that's good that's good is there anything weird yes we've got this initial bumpy thing here the way of dealing with that is just to tell the the Python function that's doing the regression that we need to create a window at the beginning when we don't try and estimate a forecast so just I just said well let us say the window size and divide by four in other words we've got one year look-back which is about 256 trading days then don't do anything until you've got 64 trading days so that just gets rid of that little lump at the beginning and again this is just common sense I mean if anyone who knows anything about regressions would have would have realized this was going to happen even before though you know plotting it the other thing to say is that I said earlier we don't want to trade too slowly you might just be buy and hold I personally think that one year look-back is probably about as slow as you want to go and there's also a technical point which is that beyond a year the the standard deviation of the error in the regression increases the factor of root T which means that you can't new standard OLS because all of the the assumptions are broken and so you need to have a short enough time period that you can assume that stock price changes are normal rather than log normal essentially and if you didn't understand any of that don't worry it's not important but it's good to throw in a little bit of geek isn't it you know every element in these presentations just so people know you do vaguely know what you're talking about a lure of active management sorry which just says that the faster you trade the more money you make in the converse is also true sorry okay goodness me where are we okay right so back to the conditions so we use multiple variations of the same trading rule so it's the same I'll go with different parameters and costs are very important so barring those things in mind we're moving to the next stage which is using fake data so fake data is going to answer basically the single question what values should we use for the window size so we want to understand firstly the relationship between trend lengths and window size we want to have an understanding of how what the kind of trading speed of different window sizes will be in a more quantitative way will then prune any window sizes that'll likely be too expensive will also prune any window size is likely to slow and the other thing we're going to do is use fake data to look at correlation of the same algo with different parameters different window sizes so if you've got a window size of 120 what's the correlation between that and a window size of 130 140 what's the correlation in a window size of 10 and 1 or 256 and with that correlation structure we can then work out how many of these things were going to need and sort of how they should be spaced out so should we have window size of of 10 and 250 is is that enough or or you know do we need like 10 11 12 13 14 all the way at 256 you know what what should we do this will make more sense in a few slides when you've actually seen happening okay so when is Gerren to inflate data so what I'm going to do is want to generate some fake datum which trends exists and the easy way of doing that is you start with a sort of a sawtooth and then you you just jam some normal noise on top of that random walk and you end up with something that to my eyes at least convincingly looks like hey the price series that has some trends in it certain lengths and just for fun get one of your Chartist friends to look at that and ask them to predict you know what's going to happen next and that's the witch market it was as well see if they can identify it oh and if you want to do this yourself this and it's like 20 lines of Python code which you can find on my website okay so right okay what's going on here so these numbers here are all different values of n okay different window sizes all the way from five which is a week of business days all the way up to 256 which is about a year each column is a different set of fake data with different underlying trend lengths in it so in always here I've got trends last for about a month here I've got trends that last for about three months six months nine months and a year and what I'm showing here is the average Sharpe ratio and it has to be an average right because they've got loads of I'm generating this stuff randomly so any individual thing could be biased so I want to get loads and taken average it's the average Sharpe ratio of this n length training system given a price series that naturally has trends of these these lengths and these this is really great right we've not used any real data to get to this point but looking at this table you get a lot of really rich information intuition about how trend-following systems work so the first thing we can say is that this kind of in bolt here I put the highest value in each column in other words which value of n is optimal for a given trend length so it looks like for example for a one-month trend a to roughly a 1/2 week windows kind of good and that relationship holds all the way down so the best possible trend falling system if you know in advance how long your trends are going to be is a system where you have a look back that's roughly about 1/2 or 1/3 the size of the the actual trends that are happening and the other thing is you get this pattern where either side of that things are the sharp edges not so good so if you've got a relatively slow trend for example there's not really much you know fast systems are still profitable but not as good as the optimal and the worst thing you can possibly do is use a trend pulling system it's too slow so for example with trend lengths of a month once I get a look back that's a greater than a month my performance just gets hammered and the reason that happens is you end up basically having a look back that exactly gets you in the market chops you end up buying here and selling here and you get absolutely hammered and we worry used to work we used to call this the frequency of death for obvious reasons because you know some of these sharps are awful yeah exactly I haven't gone beyond 256 for the reasons I already explained ok that's really that's really interesting I think the other thing we can do is measure the turnover so how fast are these things trading how much is it turning over its position in a year and that these numbers actually it doesn't really matter what the underlying trend lengths are like these numbers are fairly consistent there's just a single column here so basically if your back is a week your turnover is about 176 times a year so your every day in a day day and a half you're basically buying and selling your entire position so that's pretty that's pretty fast way back you know if your trend lengths a year your turnover is is six which obviously is a lot lower the other thing to note is that this is an asymptotic relationship going on here in that this is really fast then it tails off quite quickly and then beyond here you don't really get much change in turnover so the these systems have all got they're going to have fairly similar costs so let's look at costs so again it doesn't matter what the fake fake data is in terms of frequency the numbers are all the same but these two columns are basically I'm using the costs from two futures markets the S&P 400 which is really cheap and the Eurodollar futures market which is really expensive and the difference between their costs is actually what's exactly a factor of 10 and the unit's here are in basis points per year so if you've training a one week system in the S&P 500 it will cost you about 18 basis points a year in costs that's that's pretty cheap if you're doing that in Eurodollar futures it'll cost you nearly 2% in costs a year which you might think is not very much but that's huge right now that's really expensive and obviously the slow you trade the cheaper it gets now for reasons that are too boring to go into I when I'm fitting trading systems or designing them for that matter I impose a maximum of 13 basis points a year in costs you may think what sounds very low I explain why am I think these are all in shot ratio units as well by the way so these this is 13 basis points of shot ratio not return there's not really any point in using n 5 because even with the cheapest possible market it's still it's more than good it cost more than 13 so I can throw that right away and the other thing I can say is well I I know that with euro dollar this is going to be no point we're having an end faster than or smaller than 85 because it just gets too expensive so I'm making all of these design decisions just on fake data right it's good ok are the other thing on do is look at the correlation structure now it turns out and if you're really smart you can prove this with the pencil and a piece of paper but if you have a window size you start with a window size of well we know that we'd have to start with 10 as far as to expense it if you start with ten and then you increase your window sizes in jumps of square root two in the words ten fourteen whatever 14 times 1.4 barberries then the correlation between the the adjacent trading rules is about 0.9 and the correlation between trading was little further apart is less than 0.9 so if you take the view that I do that there's not much point in trading things which are more correlated than point nine then you you know you can use this rule basically to generate the right window sizes okay so quick summary of our findings we know that having window size in root two steps covers the space we know that having a window size less than ten is too expensive no matter what we're training we know nothing window size boat in 200 is just pointless so that that enables us to come up with this list of window sizes you can only have integer window sizes because we've got daily data over the way so and we know this will probably capture trends lasting for around one month so about 18 months which is kind of the sweet spot of trend following slower than that mean reversion tends to happen fast in that University endowment and that's does tacit knowledge right I don't use any data to come up with that statement okay we're now going to use some real data sharp intake of breath okay first thing I'm going to check is is the scaling consistent now for reasons that are obvious or irrelevant depending on who you are the higher your window size the the the the the naturally the bigger your forecast will be okay so this number here is the number the training system calculates to scale everything so that the absolute value is 10 so it doesn't really matter that these numbers increase in fact that expect that to happen what's important is that across markets these numbers are fairly similar so I've cut my framework conditions have been satisfied I could also do a similar exercise over time and check that the the scaling over time is consistent I haven't done that but trust me it is well the other thing I could do is check turnover so this is now with real data so if you were to go back to the previous line it's too far back we to do it but I think this was 76 in the big data so we've successfully we know that our fake data is not giving those crazy answers because the turnover that comes out it's very similar so any decisions I made about which things to pick because of costs I know this decisions are still valid even the real world so I'm not I've not used real data to make those decisions I'm just using the real day to check how done something stupid by generating fake data that's unrealistic and I can do the same thing with costs so remember before that really that the with sp500 it was just on the cusp of being ok with no.10 shot ratio cost point one of 0.1 a year for some random reason here these are now in the previous slide the numbers divided by a hundred anyway um whereas for euro dollar which is really expensive you know these things how I just can't trade them because all the numbers are above point 1 3 and corn and US 10-year fits in the middle of somewhere ok correlation structure when I actually estimate the correlation of all of these window sizes with real data the highest correlation between any two adjacent pairs is 0.85 not the point 9 in the fake data and that intuitively so it's not a million miles away so I'm happy with the decision I've made and actually intuitively it kind of makes sense that's happening because the fade date has got a lot of structure in it because it starts with these sawtooth waves and then on that that pushes the correlations are unnaturally above what you'd actually get a reality okay I am now going to fit okay so it's three minutes past 12:00 I've been talking for you know about 52 minutes or whatever and only at this point of presentation I'm actually going to move to fitting with real data and it's the first and last time I will look at performance okay so remember in principle all forecasts used all markets so we combine forecasts for taking a weighted average of forecasts the forecasts are all in a consistent scaling independent volatility so these weights will depend on three things the pre cost performance which may be different monarchy the costs which are definitely different my market and the correlation of these these apps this is a classic portfolio optimization problem it has well known problems and well known solutions but we have to do this but the main reason we have to do is if I haven't looked at performance there's always the danger I'm going to design this trading rule that looks amazing is cheap to trade but loses money consistently and obviously I don't want to do that okay is it why is it better to do this than to fit the parameters of your trading system well there's a number of reasons one is the parameter space is much smaller so I've got I think eight of these things so I've only got seven degrees of freedom that's a lot less than I probably have if I was fitting the parameters directly it's feasible to do rolling out a sample because it's not a really complicated like machine learning thing the the technical reasons the actual surface of the function you're optimizing is relatively well behaved and there are well developed techniques to to cope with all of these problems and to kind of find the right degrees of freedom it basically you know it's it's much harder to do an implicit fitting of portfolio weights I think for me at least okay so basically we start off with this is how some performance data a real performance data okay this is all you're getting so these are the each of the individual ends so for example this line here is n 20 20 day look-back and the reason why this happens is just to do with an error in my code it's not really important so this is going to go into the optimization algorithm to do the fitting an important thing to notice if I look to these earlier I might have gone oh oh my goodness these lines lose money I don't trade those and I'll have done some implicit fitting so that I think not looking at these graphs is exactly avoid those kinds of dangers and if I combine them together array trading for instruments this is never going to be spectacular but but the important thing for me is this thing makes money when trend-following is made money in the past so 2008 it makes a lot of money and makes a lot of money in 2014 the last few years haven't been so kind to it you know you get the classic trend flowering performance which is big jumps and then slow bleeds big jumps and slow bleeds when the market is range-bound okay I think I'm always at a time so basically there are three ways to overfit one of them you can't do anything about but you should embrace and use your tacit knowledge and design your training strategies using the process I've described to you and this is free advertising and it's questioning that's a time I've ran of a pause first I think [Applause] sorry regression what regression oh well only doing one regression at a time on an individual market to work out that market trend Annette yeah yeah yeah well no I'm doing I do the trading rule the way the trading world works the other works it looks at the a price in the past of an instrument draws a regression line for the points that works out what the forecast should be and it does this for every single market individually no I mean your principle you could do that and yeah so the question is whether whether I'm doing some kind of multivariate regression of my trading rule but it's not as purely univariate you could do that of course but then this simple example you wouldn't next question yes how do I do what sorry reject it well actually if you've been really really anal and doing this thing properly you'd never actually reject a strategy you would let it stay in your back test even if the allocation went down to zero now the important thing is that will only happen if this thing is so awful that it's statistically significantly awful and that that's actually quite unusual with these kinds of training strategies it takes a long time to be to be sure that's happening and the reason you would keep it in your back test even if you end up not trading it because the senders are the weight of zero is it means your strike sharp ratio is not going to be inflated you'll actually be realistically because it in reality would have taken you 20 years to work out that this is a bad idea yes okay so the question is what the periodicity of the fake data so the answer is I just picked those periods firstly because I know that trends tend to happen not too fast not too slow tacit knowledge secondly the results don't vary that much if you change those periods a little bit so the results for one month underlying trend of the fake data is very very similar to the one with a five week trend length so it's not that important in this case what periods you pick there obviously other applications of the design process where it'd be really important to pick the right parameters but this isn't one of them yes okay my cost estimate is basically the sum of the Commission and the slippage market impact the difference between the you know the the middle of the bid-ask spread and where you'd actually end up trading in practice given you know and if you're a small trader you you know you sort of assume pessimistically you have to cross the spread so you pay half the bit of spread if you're a bigger trade you need to do complicated cost modeling and then all I do is I take that number and I divide it by the volatility of the market to work out the cost in Sharpe ratio unit so I can compare it across markets and it's chapter 13 of the book I think if you want more detail any more questions okay oh you guys have been asking a lot of questions but I will take yours because it's bound to be controversial mentioned a couple of times that the position weight was before the forecast is proportional to shot ratio ya know mu over Sigma so when you want to come to actually calculating what your position is you need to divide by Sigma again because if a markets really risky you haven't you'd have a smaller position for a given forecast level because your your risk you're basically targeting a given level of risk so what you do is say to bring on how confident I am about you know my forecaster particular market I want to target particular level of risk so to target particular level of risk I need to divide my forecast by volatility to so that more volatile markets have smaller positions which me which so you know led to markets which were identical in every respect except Li one or twice of all that service of the other but they're the same forecast you'd have half the position of the more volatile market to give you the same amount of risk ya-ya-ya-ya-ya all 40% perhaps from more volatile market because we're given forgiving like unit of thing buying one unit of thing in the less risky market is going to generate 20% of risk a year by one unit of thing in the more risky mark it's going to generate risky of 40% a year but I want because I've got the same forecasts of both markets on the same amount to get the same out of expected risk so I need to buy half a thing of the riskier market to get the same risk that might be better yeah I'm studiously ignoring it because I will come back to you if there's no more questions but but yes well I mean it's a kind of universal truth that the slower you're trading the slower you're slower kind of any decay or change in market structure should affect you so our last presentation went to as a high-frequency training presentation I would imagine that those guys have to refit their stuff every few months because the the kinds of effect there's a guy nodding in front he obviously knows this the kind of effects they're capturing a you know because they're quite close to pure arbitrage in many cases if once people find out about them they just disappear the kinds of effects this really slow trading speed you know they've been around for a long time whether they'll exist the future I don't know but the things that drive them they're not changing very much an occasionally they do badly because of idiosyncratic events but you know generally they're not changing very much so what that means in practice is if you've got to say a 30-year backtest and you've designed a trading strategy and fitted some allocations over thirty years like a year later you've now got 31 years of data so data sets changed by three percent so even if the world completely changed in that year you still wouldn't do very much you might say quite a long time before you had to kind of catch up with the way the world has changed so there has to be a an alignment between house how what sort of speed you're trading at and how how kind of quickly you have to refit your systems in this world with this kind of speed of training and this kind of style of trading I would argue that that you could probably get away with never never refitting a system where I used to where we did it every year at least I don't think I've changed my parameters since December 2014 because I'm lazy it's a lot of work go on okay so you get to ask the last question the assumption is yep yeah yeah yeah that it works seems to work okay so the question is whether the about the big assumption that trends will continue exist in the future where the recent poor performance kind of affects that assumption well in terms of where the recent poor performance changes your assumptions I refer you back to the previous question you need a lot of data for these slow systems to really show you that actually that ending to be doing badly I'll give you a very specific example relatively fast trend following on equity index futures seems to have made no money since about 1990 okay that the account curve looks like a dogleg it goes up and then it's flat now if you then actually statistically test whether you can say is this broken you you get a Jonas done about p-values you get a p-value of like 30% and normally for a statistical significance you'd want a 5% so you just in it you look at the account curve and as a human being you think oh my goodness this thing's broken but in a statistical sense you don't have enough data to actually say that all the data tells you is you probably shouldn't have quite as big a weight in that thing as you would do if that you know poor performance wasn't there but you shouldn't you've got nowhere near enough data to throw it away and go back to the first thing you said about making this big assumption well heck this entire conference is about making the assumption that the past will repeat itself in the future in some way so you know I'm not embarrassed about about saying that I believe that and and that's a really good note to finish on I think thank you very much you

Show moreFrequently asked questions

How can I eSign a contract?

How do you open and sign a PDF?

How do I electronically sign and date a PDF?

Get more for esigning Endorsement Agreement Template made easy

- Email signature on mobile

- Prove electronically signing Freelance Quote Template

- Endorse digi-sign Coffee Shop Business Plan Template

- Authorize signature service Bonus Plan

- Anneal signatory Free Raffle Ticket

- Justify eSignature Warranty Deed

- Try initial Event Catering Proposal Template

- Add Directors Agreement eSign

- Send IT Project Proposal Template eSignature

- Fax Wedding Photography Quotation autograph

- Seal Course Evaluation electronic signature

- Password Letter of Undertaking signed electronically

- Pass Editor Contract Template electronically sign

- Renew Codicil to Will electronically signing

- Test Powerlifting Event mark

- Require Roommate Rental Agreement Template signed

- Comment renter signature

- Boost trustee initial

- Compel self digital sign

- Void Monthly Timesheet Template template esigning

- Adopt exhibit template digisign

- Vouch Self Employed Invoice template electronic signature

- Establish Drink Ticket template countersign

- Clear Concession Agreement Template template sign

- Complete Client Progress Report template electronically signing

- Force Architecture Firm Proposal Template template initials

- Permit Website Design Inquiry template eSign

- Customize Newborn Photography Contract Template template eSignature