eSigning Mortgage Financing Agreement Made Easy

Upgrade your document workflow with airSlate SignNow

Flexible eSignature workflows

Fast visibility into document status

Simple and fast integration set up

Esigning mortgage financing agreement on any device

Detailed Audit Trail

Rigorous security requirements

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

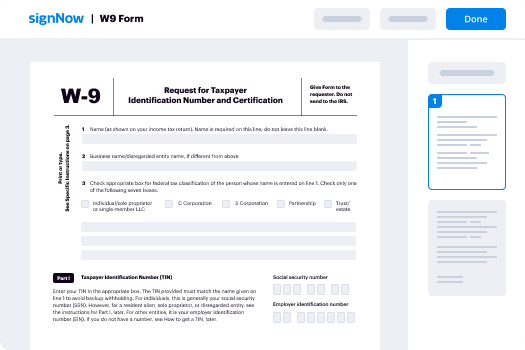

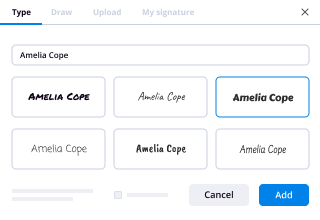

Your step-by-step guide — esigning mortgage financing agreement

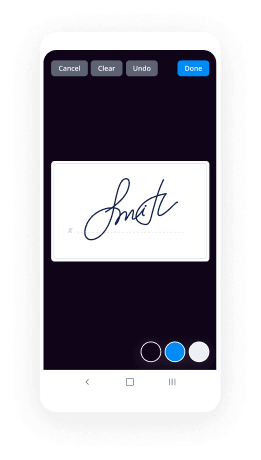

Leveraging airSlate SignNow’s eSignature any organization can accelerate signature workflows and sign online in real-time, giving a greater experience to customers and staff members. Use esigning Mortgage Financing Agreement in a few easy steps. Our mobile-first apps make work on the move achievable, even while offline! Sign contracts from any place in the world and complete trades quicker.

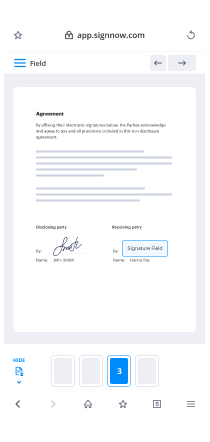

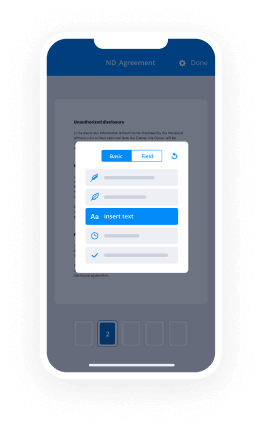

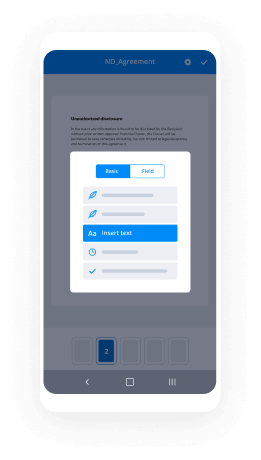

Take a stepwise instruction for using esigning Mortgage Financing Agreement:

- Log on to your airSlate SignNow profile.

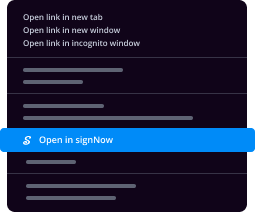

- Locate your record within your folders or upload a new one.

- Open up the template and edit content using the Tools list.

- Place fillable fields, add textual content and eSign it.

- List numerous signers via emails and set up the signing sequence.

- Specify which individuals can get an signed doc.

- Use Advanced Options to reduce access to the document and set an expiry date.

- Tap Save and Close when done.

Furthermore, there are more innovative tools accessible for esigning Mortgage Financing Agreement. Add users to your shared digital workplace, browse teams, and track cooperation. Millions of customers across the US and Europe recognize that a solution that brings everything together in a single cohesive work area, is what organizations need to keep workflows working easily. The airSlate SignNow REST API enables you to embed eSignatures into your app, internet site, CRM or cloud storage. Check out airSlate SignNow and get faster, smoother and overall more efficient eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results esigning Mortgage Financing Agreement made easy

Get legally-binding signatures now!

FAQs

-

What is an e signing in a mortgage transaction?

Digital signature or standard electronic signature is actually a coded, encrypted, legally binding digital footprint. The digital signature is made of unique encoded messages \u2014 one for each signee \u2014 that join together to make a complete, legally binding, standard electronically signed document. -

What is the legal status of a digital signature or e signature?

Electronic signatures have the same legal status as handwritten signatures throughout the United States, thanks to the ESIGN Act and the Uniform Electronic Transactions Act (UETA). -

Can loan documents be signed electronically?

During the loan process you will be signing document after document but thanks to modern technology, many of the documents can now be electronically signed using software like airSlate SignNow.com and Calyx point. -

Can closing on a house be done electronically?

A. While the industry has yet to settle on a standard definition for eClosing, an eClosing is generally any real estate closing event or process in which the buyer, seller, borrower, notary or others use an electronic signature (eSignature) to sign some or all of the closing documents. -

Can you copy and paste a signature?

You can do it either way with airSlate SignNow Pro. ... There's also a shortcut if you just want to past an image file, as Joel Geraci points out: "copy your signature to the clipboard, open the file in Acrobat, paste. The image will become a 'stamp' that you can then size and position as needed." -

Is it illegal to copy and paste a signature?

In these cases, the copies would become illegal forgeries. Forgery can also involve the creation of fake or fraudulent documents. For example, it can involve photocopying a person's signature and then artificially placing it on a document without their knowledge or consent. -

What is a loan agreement?

A loan agreement is a formal contract where the lender stipulates the binding terms and conditions to which the borrower must agree to in order to receive a loan. It also sets forth the amount of the loan, the borrower's collateral, the repayment plan, term and penalties (such as late fees) should the borrower default. -

What is an e closing?

eClosing: A closing process where one or more of the required closing documents are accessed, presented and signed electronically: ... Hybrid eClosing: The Promissory Note is signNowed out and wet-signed, as well as at times the mortgage document, while all other documents are electronically signed and signNowd. -

How do I write a loan agreement?

Starting the Document. Write the date at the top of the page. ... Write the Terms of the Loan. State the purpose of the personal payment agreement and the terms for returning the money. ... Date the Document. ... Statement of Agreement. ... Sign the Document. ... Record the Document. -

Who signs a mortgage note?

While the mortgage deed or contract itself hypothecates or imposes a lien on the title to real property as security for a loan, the mortgage note states the amount of debt and the rate of interest, and obligates the borrower, who signs the note, personally responsible for repayment. -

What are the terms of a loan?

A term loan is a monetary loan that is repaid in regular payments over a set period of time. Term loans usually last between one and ten years, but may last as long as 30 years in some cases. A term loan usually involves an unfixed interest rate that will add additional balance to be repaid. -

Can you be on the mortgage but not the note?

A: No. First you did not sign the promissory note you are not responsible or obligated to pay the payments. However if the payments are not made then the property will be foreclosed and ultimately sold. Thus your rights to stay in the home will someday be cutoff. -

What is the purpose of a loan agreement?

The purpose of a loan agreement is to detail what is being loaned and when the borrower has to pay it back as well as how. ... Once it has been executed, it is essentially a promise to pay from the lender to the borrower. -

Can someone put your name on a house without you knowing?

Adding Name to House Deed Without Consent. ... If a person decides to give a gift of real estate to someone, they can purchase that property and deed it to someone else. But that alone will not be sufficient to transfer title to the property to the recipient. -

What is a Loan Note Subscription Agreement?

A loan note is an extended form of a generic I Owe You (IOU) document from one party to another. It enables a payee (borrower) to receive payments from a lender, possibly with an interest rate attached, over a set period of time and ending on the date at which the entire loan is to be repaid.

What active users are saying — esigning mortgage financing agreement

Related searches to esigning Mortgage Financing Agreement made easy

Sign mortgage financing agreement

hey guys it's Lizzie and welcome back to another money tip Monday video today we're gonna be discussing the important things you need to know about your loan estimate and your closing disclosure statement when it comes to getting a home loan now before we get into all of that guys I am gonna ask you to like subscribe and comment below on the things you'd like to see in the future on this awesome lending tip video channel it's so important to me to provide you with impactful information for your finances now I decided to do this video because I get questions all the time on how do I read this where's my monthly payment where does it say my cash to close and also I get emails from people saying how can I use this document and be able to shop my loan terms and I really feel that unless you understand the document you wouldn't understand if you're comparing apples to apples and if the loan terms really match what the loan officer that you're working with is explaining to you so today's video I'm going to be breaking down where to find the information and then the similarities and the difference is on both of these super important documents a loan estimate is received at the very beginning of a transaction and it's typically three days after receipt of purchase contract technically by law it's when they have a completed loan application but if you've been pre-approved most of this information should have been completed prior and so getting just the last loan terms the property address and everything is what they need to have a full application now your closing disclosure statement typically should be sent out three business days before you sign your final loan documents now this can be sent out in more in advance than that but the law requires that a three business day minimum before you sign your loan Docs now it's super important that you know why you're getting it three days in advance because it's gonna protect you from any you know undisclosed changes in your loan typically there are you know guidelines and compliance involved in preventing that but if you were to see something that doesn't match your expectations you have three to address them before you have to sign your loan documents back in the old days people were at the signing tables and then you would see like they were bait and switched right they expected one thing and then got another but then felt pressured to continue signing because they had nowhere to live so super important that you know that you have three days to review this now understanding the document so the very first page on both the loan estimate and the closing disclosure are almost identical so the very first top of the page will state whether or not it's the loan estimate or the closing disclosure statement and it's gonna show when it was issued who's borrowing it the property the sales price on all of your loan terms so that's going to include whether or not it's a 30-year mortgage a 15-year mortgage your purpose so purchase or refinance the product whether it's an arm or if it's a fixed-rate and the loan type which is typically conventional FHA VA or jumbo the biggest thing to pay attention to on the loan estimate first page is whether or not your interest rate is locked in and when the expiration is so you really want to make sure that that expiration date is on or after your close of escrow date and if it is not you definitely need to address that with your loan officer now the closing disclosure statement is gonna have a whole lot more information on this the sellers names are gonna be on there it's gonna show you your issue date your closing date and then the disbursement date which is the day that we fund and record your loan now what both of these documents are showing you is how much you're borrowing how much interest you're paying how long you're paying it for and if there's some crazy things like a balloon or prepayment penalty that you need to factor it's also showing you your total monthly housing obligation and what's being held back for taxes and insurance at the very bottom of this page is super important because it actually talks about closing costs and what you need to bring at the closing table now one of the big questions that I get asked is you know is it the closing cost plus the cash to close or does the cash to close incorporate the closing costs that are right above this number so that cash to close number is the total all-in on your loan estimate it's just an estimate for the best that they can do when they get your purchase contract the closing disclosure statement should be very very very close if not exact to the final one that you'll sign with your final loan disclosures so you're gonna see all the loan costs are all the costs for your mortgage broker or your mortgage banker in a section a of the loan cost and this is going to show you a breakdown of whether or not you're buying down your interest rate which will be called points funding fees tax or certifications processing fees underwriting fees wire transfer fees maybe broker fees anything that's paid to your mortgage broker or banker you'll see in the loan cost section in Section B section B are all of the services that you cannot shop for so these are things like your appraisal fee your credit report fee your flood certification fees this may include an upfront mortgage insurance premium these are all of the costs associated with getting your home loans that are paid out 2/3 of approved third-party vendors for your banker mortgage broker now section C are services that you can shop for these are things like the settlement company or the title company and typically those things are negotiated into your purchase contract so if you plan on shopping for these services you definitely need to do it before you get under contract section D just tells you what all of the loan costs add up to so this is section a B and C and just gives you a total breakdown of all of your costs now one thing to note this figure will include occasionally upfront mortgage insurance premiums that are paid for your the financing of your home loan so sometimes when you're trying to calculate the bottom line figure you'll need to know that it's included in your loan amount so that your accounting can be done correctly all the other costs are gonna be totaled up in line I and then J will have a section for the total costs for like financing the loan and then the total other cost so you'll see the total closing cost and you'll see any lender credit if they're applicable now super that you know reoccurring closing costs are things that will continue to be charged after the home loan closes so those are things like interest property taxes and homeowners insurance so I get asked this question all the time what's a non reoccurring versus a reoccurring non reoccurring are all the costs of financing the home loan once the loan is closed you don't pay for that again the bottom portion of your loan estimate because this is only three pages it's going to show you how they calculated your cash to close so this is gonna include the total closing cost which is D and I your cost finances so this is paid from your loan amount so this is that upfront mortgage insurance premium I was talking to you about and then it's the down payment funds so anything that's left over right after your upfront mortgage insurance premium any deposits that you've made on the purchase contract this would be known as earnest money any seller credits any adjustments or additional credits and then it'll show you what you need to bring for closing for the rest of your down payment and then any closing cost now the second page to the closing disclosure statement just does this continuation so it shows you all of the costs again broken down you know under the same sections it's just broken down all the way down here instead of like side by side what you see here side by side are the seller paid and paid by others occasionally fees are paid by different parties and so they'll be accounted for like this on this statement versus you're seeing like a big lump sum credit so then the third page of the loan estimate actually just shows you the big-ticket item bottom line things that you'll need to know when shopping a home loan right so it's how much interest that you'll pay in five years and how much principal you will have paid in five years your annual percentage rate we're gonna leave the other video that really goes through this in depth but the annual percentage rate is the cost of the loan term expressed in an annual rate it is not your interest rate in fact it even says that on this document and then you'll see the total interest percentage so basically you're gonna see if you made payments for your loan term how much of the total amount of payments that you made in that loan term went to interest okay this will blow your mind and probably make you really upset but just remember there is the time value of money so in 30 years this number will not be worth what it is today then these are other considerations that you'll need to know cost of an appraisal assumptions do they allow your loan to be assumed by another party homeowners insurance you're late payment fee can you refinance this and then do we extend servicing servicing means that you will make your payments to the company that financed your home up page 3 of your closing disclosure statement it just will show you the differences between what was originally disclosed to you on your loan estimate and then what your final numbers look like what you really want to pay attention to is the loan estimate closing costs versus the final estimate these things will typically have gone down unless there was a change of circumstance then you'll see summaries of the transaction right so this is what mostly look like on the HUD settlement statement the document you would get from the title company but it'll show you your purchase price again the total of closing costs your deposit your loan amount again any seller contributions any gifts from any parties any adjustments typically there's an adjustment for title insurance premiums any County tax assessments or proration any aggregate adjustments for interests escrow in pounds right and then it'll show you right here at the very very bottom your cash to close and it'll say from or two on a refinance you may see two if you've over deposited funds for your purchase you'll see two but typically it's from on a purchase to on a refinance now this part here right just shows you what the sellers breakdown looks like right and you know if the seller is receiving any funds typically this will be blank on the lenders closing disclosure statement you will actually see this on the final document for title now the fourth page of the closing disclosure statement is gonna be very similar to again that third page in the loan estimate that it's going to go over all the loan calculations so again all the total monthly payments the finance charges the amount financed which is not the same as your loan amount this is the loan amount minus the prepaid finance charges so everything that's included in your APR and then this will also show you what your APR is and then of all of the cost of the home loan right what percentage you actually paid in interest it'll show you you know again the details for it in your appraisal contract details the liability that you have if you were to foreclose your refinance options and tax deductions it also lets you know where the consumer finance website is and contact information for your loan officer your real estate brokers and any of the settlement agents right so all of that information is going to be there then the very final pages again a summary of all of those fees that you could have shopped for before you got under contract right so these are all of those fees they just want to be full disclosure on everything so it's white goes from three to five the five just breaks it down and a whole lot more detail but the bottom line figure should be very similar between the loan estimate and the closing disclosure statement and if you see big big differences it's definitely important to talk to your loan officer and understand why now I know today's video was a little bit less Skippy and definitely more informational but it's super important for me that if I'm talking about money tips that we really talk about the money and how to understand it when it comes to the cost of buying a home if you have any questions because this was like a lot of information I'm happy to break this down for you in detail even if I'm not the one helping you with your home financing so let me know guys I'd love to hear from you thank you again for tuning in to another money tip Monday and I will see you guys next week [Music] you

Show moreFrequently asked questions

How can I eSign a contract?

How do you add an eSignature to a PDF?

Where should I sign in a PDF?

Get more for esigning Mortgage Financing Agreement made easy

- Print signature service Inventory Checklist

- Prove electronically signing Plumbing Proposal Template

- Endorse digi-sign Barter Agreement Template

- Authorize signature service Code of Ethics

- Anneal signatory Product Quote

- Justify eSignature Pet Addendum to a Lease Agreement

- Try initial Project Proposal Template

- Add Administration Agreement signature block

- Send Project Proposal Template signature service

- Fax Wedding Photography Quotation countersign

- Seal Teacher Evaluation Survey signatory

- Password Letter of Undertaking initials

- Pass Editor Contract Template eSign

- Renew Codicil to Will esigning

- Test Powerlifting Event digisign

- Require Roommate Rental Agreement Template electronic signature

- Comment visitor mark

- Boost teller electronically signing

- Compel self sign

- Void Monthly Timesheet Template template signature

- Adopt protocol template email signature

- Vouch Product Order template signatory

- Establish Rail Ticket Booking template electronically signed

- Clear Royalty Agreement Template template byline

- Complete Client Progress Report template esigning

- Force Architecture Firm Proposal Template template esign

- Permit Graphic Design Order template signature block

- Customize Event Photography Contract Template template signature service