Guarantee Initial with airSlate SignNow

Get the powerful eSignature features you need from the solution you trust

Select the pro platform designed for professionals

Set up eSignature API with ease

Work better together

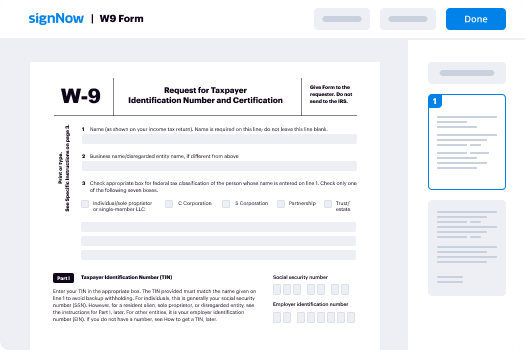

Guarantee initial, within a few minutes

Decrease the closing time

Maintain sensitive data safe

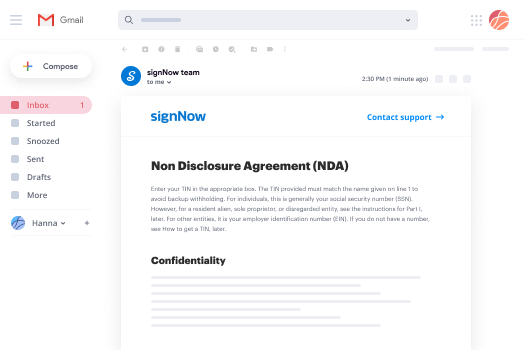

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your step-by-step guide — guarantee initial

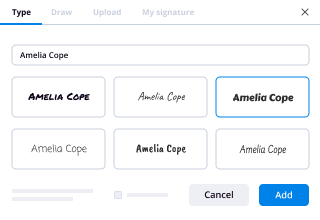

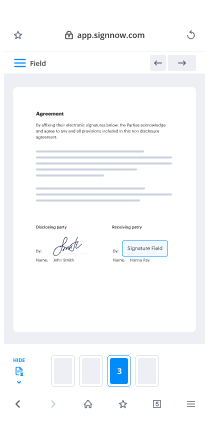

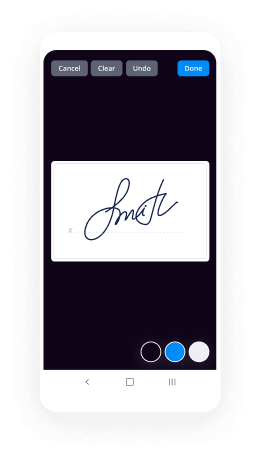

Leveraging airSlate SignNow’s electronic signature any business can enhance signature workflows and eSign in real-time, delivering a better experience to clients and workers. guarantee initial in a few simple steps. Our handheld mobile apps make operating on the go achievable, even while offline! Sign signNows from any place in the world and complete deals quicker.

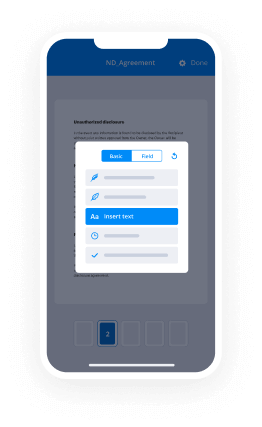

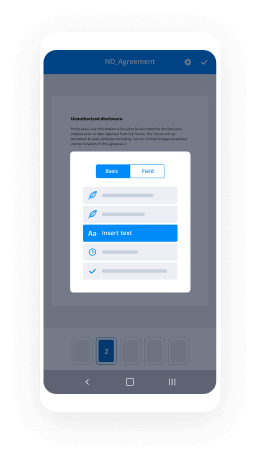

Keep to the stepwise guide to guarantee initial:

- Log in to your airSlate SignNow account.

- Locate your record within your folders or upload a new one.

- Open the template and edit content using the Tools list.

- Drag & drop fillable areas, type text and sign it.

- List multiple signers by emails configure the signing order.

- Indicate which individuals will get an completed version.

- Use Advanced Options to reduce access to the record and set an expiration date.

- Tap Save and Close when completed.

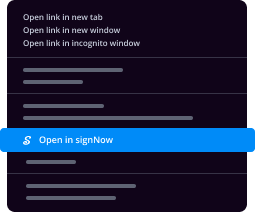

In addition, there are more innovative tools available to guarantee initial. Include users to your shared work enviroment, view teams, and monitor teamwork. Millions of people all over the US and Europe concur that a system that brings everything together in a single cohesive enviroment, is exactly what enterprises need to keep workflows performing efficiently. The airSlate SignNow REST API enables you to integrate eSignatures into your app, internet site, CRM or cloud storage. Try out airSlate SignNow and enjoy quicker, easier and overall more efficient eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results guarantee initial with airSlate SignNow

Get legally-binding signatures now!

FAQs

-

How can a guarantee be determined?

Often guarantees are provided for fluctuating facilities, such as bank overdrafts, lines of credit and supplier accounts. ... Determining a guarantee is telling the bank that the guarantor will be liable for the amount owed on that day, but not for any future credit that may be provided beyond the date of determination. -

Is there a difference between guarantee and warranty?

What's the difference between warranty and guarantee? A warranty is \u201ca promise or guarantee given.\u201d A warranty is usually a written guarantee for a product, and it holds the maker of the product responsible to repair or replace a defective product or its parts. It is only used as a noun. -

What is the purpose of guarantee?

In general, a guarantee is a promise to take responsibility for another company's financial obligation if that company cannot meet its obligation. The entity assuming this responsibility is called the guarantor. -

What is called guaranty?

Guaranty. ... A guaranty is a contract that some particular thing shall be done exactly as it is agreed to be done, whether it is to be done by one person or another, and whether there be a prior or principal contractor or not. -

Can bank guarantee be assigned?

Generally, rights relating to bank guarantees may be assigned; if a call of an assigned bank guarantee is not justified, a claim for repayment of an unjustified enrichment usually has to be filed against the assignee. ... If the call is abusive, the party providing the bank guarantee may sue the beneficiary for repayment. -

What is the plural for guaranty?

What is the plural of guaranty? The plural form of guaranty is guaranties. -

What is a guarantee in a contract?

Guarantee. law. Guarantee, in law, a contract to answer for the payment of some debt, or the performance of some duty, in the event of the failure of another person who is primarily liable. The agreement is expressly conditioned upon a bsignNow by the principal debtor. -

How do you use guarantee in a sentence?

There was no guarantee Gabriel wanted her, but she'd have a chance. ... Just because things went well last month it doesn't guarantee they will go well this month. ... No guarantee we'll survive the night, but you probably understand that. ... I can't guarantee I'll have time for you the rest of the week. -

How long is a personal guarantee valid?

A personal guaranty is not enforceable without consideration The enforceability of a contract comes from one party's giving of \u201cconsideration\u201d to the other party. Here, the bank gives a loan (the consideration) in exchange for the guarantor's promise to repay it. -

How do you use hierarchy in a sentence?

The hierarchy of dukes and marquises and counts consisted of foreign soldiers imposed on. ... The government surveyed rural monasteries and schools, and reconstituted the ecclesiastical hierarchy. ... The '"waste hierarchy" shown below places incineration second to last. -

What is required for a guarantee to be legally enforceable?

The main technical requirement for a guarantee to be valid is that it must be in writing and signed by the guarantor or a person authorised on the guarantor's behalf. Reliance cannot therefore be placed on a verbal assurance that one party will 'see another right' or some such. -

What is the antonym of guarantee?

Opposite of to state with assurance that a report or fact is true. Opposite of officially affirm or guarantee. Opposite of to make a pledge or guarantee. Opposite of provide insurance cover in respect of. Opposite of to make sure or certain of. -

Can you get out of a personal guarantee?

It's relatively common for a business owner to file individual bankruptcy to get rid of a personal guarantee\u2014and most personal guarantees will qualify for discharge. If it's a nondischargeable debt, however, bankruptcy won't help. -

What does guaranteed mean?

guarantee. To guarantee is to promise or to a make binding agreement. ... Guarantee is a word that is both a noun and a verb: the noun means "a binding agreement" and the verb is the act of making that agreement. -

How do you write a guarantee letter?

To write a guarantor letter, start by writing the date at the top of the airSlate SignNow, followed by your full name and address. Below your information, address the letter to the company you're dealing with and begin the letter by identifying yourself and the person you're guaranteeing.

What active users are saying — guarantee initial

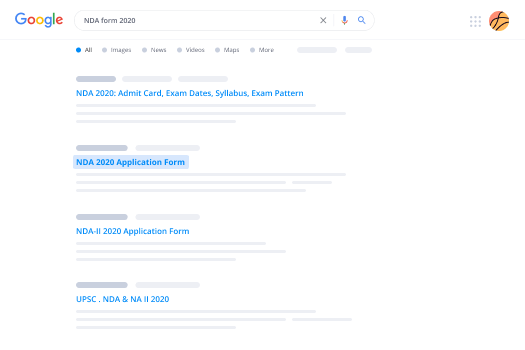

Related searches to guarantee initial with airSlate airSlate SignNow

Guarantee initial

does rebalancing actually help retirees interesting we're gonna read this art from a man joe tomlinson from advisor perspectives and uh i've cited joe a couple times on this uh channel and i'm a big fan he's uh from originally from greenville maine wherever that is where's my velociraptors running around like crazy like they haven't eaten in days even though they just got done eating all right so let's uh let's read this uh joe thomason dayline 111 21 i think he lives in uk now joe does so the subject of rebalancing investment portfolios has generated much discussion as well as confusion among advisors and researchers a recent example was a 2020 advice october advisor perspectives article by uh by michael edison we've had him on here a couple times actually a big fan of michael uh michael's argument well let's just read this when i'm not read the whole article we'll just kind of give you the conclusion of this article i've done a video on this before the fallacy of rebalancing revisited uh so what he's saying is let's go down the conclusion and you can re uh watch my video on that uh conclusion advising an investor to rebalance is like advising a traveler from los angeles to new york to drive rather than take a plane because if you take a plane there's a greater danger of turbulence however the risk to life is much greater if you drive because the probability of a car crash is much greater than that of an airplane crash many people believe rebalancing pays off because they confuse the past of the future they think that because the security of an asset had a higher price recently than it has now it will return to that higher price in the near future but careful investigation of price patterns reveals that this is not true the likelihoods of the direction the next price move will take up or down as magnitude are independent of the direction or magnitude of the last price move this mistaken intuition is not valid justification free bouncing rebalancing should be dismissed as nothing but the poorly examined conventional wisdom that it is the plethora of articles of financial journals filled with largely irrelevant mathematics notwithstanding the greatest damage done by this myth is that it helps to surround providers of financial advice for the aura of knowing something that they do not know at all and uh you can see he's got 118 comments what he does pull punches awesome all right for this sales analysis i'll mainly focus on rebalancing versus buy and hold which is not rebalancing and i'll use monte carlo simulations and provide a measure of benefits and risk my interest in the subject of rebalancing stem from my earlier analysis of asset allocation where i made the case that modest differences in stock and bond mixes were not an appointment uh important determinant of retirement results i i could not agree more and edison's article talks about that too such allocation differences tend to get swamped by variability of year by year performance of the underlying asset class prince principally stocks there are considerable overlap between rebalancing asset allocations so i wonder if those are going forward and against rebalancing we're debating something that does not matter much like positive just said because i i completely agree people say should i be 70 30 or 60 40. it's just not that big of a deal it's just not man i'm just telling you right now um 60 40 historic has a sliver less volatility it you know did a little bit less returns it's just not that big now if you're gonna be 70 30 versus 46 yeah so basically should i be wellington or wellesley that has a much different uh historic percent or performance number than wellington versus fidelity balanced stock fund because i think fidelity balance is 70 30 and wellington's like 65 35. it's just i i hear this all the time should i be 60 40 or 70 30. 75 25 man it doesn't matter the real question should be predominantly in stocks or predominant bonds that's what you got figured out um all right so let's keep going back to tomlinson here for this example i used a 35 year old a 35-year retirement that starts with a million bucks i'll assume variable retirement withdrawals based on rmd factors and a target 60 to 40 stock to bond allocation i'll use the monte carlo generation based on historical stock and bond returns with a downward adjustment hey hey hold on a second finney uh with a downward adjustment uh to reflect my personal view about future returns i use a downward adjustment to reflect my personal views about future returns hold on just a second all right so i'll use bootstrapped annual returns after inflation by randomly selecting 20-year blocks from ibbeson's 1926 to 2019 data and i'm subtracting 4.8 percent from each of the stock returns generated in 1.9 from bond returns wow uh the result is the arithmetic real returns will average zero for bonds and about four percent for stocks assuming a lower than historical equity premium the purpose of using bootstrapped historical returns is to capture any correlation between stock and bonds as well as any year by year correlation all right i i use uh 5 000 monte carlo scenarios all right the points of the more general limitations is the use of historical data there's both the statistical significance of the data and the question of whether historical financial relationships will persist in the future i 100 agree with that the first analysis compares results to regular periodic rebalancing versus buy and hold for the full 35 years rebalancing intervals tested are 1 3 6 12 and never and let's see and the remaining savings are rebalanced to a 60 40 stock bond allocation at those intervals because i use annual data it's not possible to rebound more frequently than annually thankfully you should have rebounds more frequently than annually withdrawals are based on 1.25 times rmd factors which produces reasonably level withdrawals over the most of the retirement period for each of the 5 000 simulations i calculate the average withdrawal with the 35-year retirement all right and the chart below reflects the distribution of those averages we end up with 5 000 averages rated to percentiles and the overall average of the 5 000 averages displayed as well all right so we got one year three year five years six twelve okay good so this is they rebalance every year every three years every six every 12 never 60 stock allocation the averages is about what's that 26 000 here on the negative to 48 000 on the positive that's never rebalancing so you can see it's a it's wider so you can see it kind of gets it gets wider as it goes forward if that makes sense what are you doing pablo um what we see here is akin to the charts in my article mentioned earlier on asset allocation differences in average outcomes are tiny compared to the range of potential outcomes since the ranges are for the 25th to 75th percentile they only contain half the potential outcomes the full range of possibilities is much larger okay so this is the range from 25th to 75th percentile i got you okay so he's not using the top 25th percentile up here or the bottom 25th percentile down there okay gotcha that makes sense in terms of a discussion with a client it goes something like this if we rebalance to 60 40 every year i expect your withdrawals to average 38 000 a year right there so that's 38 000 a year on 60 40 rebalance it every year uh let's see with a 50 50 probability of falling uh between 27 000 46 000 an equal chance the range could be even wider if we just let the portfolio run and never rebounds things barely change the average moves up to 39 300 which is only a thousand dollars more without rebalancing and the uh the range widens from 26 000 to eight thousand just i mean it's literally that's that's minuscule change in the 25th to 75th percentile however there's a risk side that may change the discussion somewhere in the chart below i show the comparison based on two risk measures uh here i display the two downside measures the five percent average for five percentile average withdrawals portray a worst case average akin to the 25th and 75th percentile shown previously okay so 5 average withdrawal so here and never rebound since twenty thousand four hundred rebalancing every year is only twenty one thousand that's you know eight hundred bucks difference whoopty flip and do man five percent annual withdrawal change minus 9 500 so a little bit more there um anyway let's keep going uh that's that's just not that big of a deal the withdrawal change column portrays the expected worst case year-to-year change in withdrawals these two measures can be thought of as a layman's utility analysis a bad outcome would be low withdrawals that are volatile from year to year there's a slight deterioration the fifth percentiles would go in the direction buy and hold and more adverse change in year-over-year volatility having these downside risk measures might give some positive going for the highest expected withdrawals while not rebalancing so basically they're saying look here this the the fifth percentile you your twelve thousand dollars poorer if you never rebalance we're here you're only ninety five thousand ninety five hundred dollars poor or if you rebalance every year i just not sure that's worth it but whatever the result for both charts reflect underlying changes in stock bond mixes since expected returns are higher for stocks and bonds without rebalancing one would expect the stock allocation to increase over the course of retirement rebalancing if any resets the allocation of 60 40 and with annual rebalancing this example the allocation remains at 60 40 throughout all simulated retirements for example the rebalancing of six years intervals the average stock allocation is 61 percent which is only slightly off the 60 target which explains why we don't see much in terms of different varying rebalancing intervals uh percentages band rebalancing okay rather than rebounds at fixed intervals another approach involves rebalancing only when the asset drifts by given uh percentage so in this case five percent the charge below okay gotcha so he's saying well if we uh the stocks essentially go from 60 40 to 55 65 okay so basically if you get a five percent range for stocks versus bonds um it's no longer 60 40 it's 55 45 or something like that yeah again hardly any change whatsoever that's interesting uh average rebalancing interval all right here's this downside measure fifth percentile i mean just not look at the average rebalancing interval all right so here they're only rebalancing if you wait for the five percent ban you're only doing every 3.2 years to wait for a 10 band you're doing every 7.7 years on average with 20 bands so you start off 60 40. now we're at uh 40 60. uh or yeah 40 60 you're only going to rebalance once every 31 years that's crazy that's nuts man for example yeah that's uh that's nuts at the beginning of this article i speculated that rebalancing may not matter that much after reviewing the evidence this is indeed the case the choice of rebalancing does not guarantee retirement success or a plan doomed a favor getting more specifics losing rebounds to a wider intervals or bans increases upside measures such as average withdrawal slightly with a slight deterioration in the downside but the rebalancing effects get swamped by the investment return variability as for the risk measures the year-to-year volatility of withdrawals is more sensitive than five percent than the fifth percentile of average withdrawals as for practical implementation the above results don't make a case for never rebalancing they support frequent infrequent rebalancing infrequent rebalancing such as a 10 band again if you did a 10 band you rebalance every ten every seven and a half years or so most likely uh borrow some comments uh relative browser okay gotcha uh so users of comments that other people have made before all right uh this could be a diversification bonus yeah oh yeah all right let's just see real quick raising equity class sequence return okay cool i did not study high frequency rebalancing such as daily weekly or monthly some research such as this vanguard study have demonstrated little if any value to be gained from such high frequency trading uh strategy side then let's see what kind of comments you guys see my man edison said posted something let me see my dogs real quick uh let's see here i say i think the challenge with academic type studies that they're not reality we are working real people have real values probably about each person okay uh i do appreciate academic perspective utilities types articles the conclusions are useful in some ways without duplicating the real world this year we rebalance every qualified portfolio on march 23rd and did it again june 15th we have not rebounded in during the great recession we did mass rebalancing three separate times so what uh we were balanced when their extreme market distortions so what's an extreme market distortion they have uh that's a gut feeling i don't like that at all how much do you think how much do you think that it makes little difference results due the fact that precision is less of less consequence than being approximately right particularly before fluid is a place placed under stress by the demands withdrawals how much do you think the it makes the little difference result is due to to the fact that precision is of less consequence of being approximate i don't even know what that means uh all right that doesn't make a sense so bill banging thanks to well-written articles my man bill benny you all four percent rule guy my research tends to indicate that there's a beneficial effect from rebalancing withdrawal accounts is not large adding perhaps a quarter of a point to the initial withdrawal rate for rebalancing about every five years perhaps the difference outcomes between my research and yours is purely methodologically you know uh i needed to i needed a downside is interesting about the five-year rebalancing i ran an experiment this morning that is somewhat similar to what you have done i ran four percent fixed withdrawal rates uh for the third of the idea okay gotcha um i needed a downside measure to compare results and since all rebalancing intervals produced 100 success i chose a fifth percentile bequest as a measure and here are the results seven year rebalancing 137 000 five-year that's weird if they rebalance every five years or leave it significantly more like you're testing these do best of five you're rebalancing huh this is uh perhaps this is best of catching the wave yeah there we go my man larry all right so with that said the reason to rebalance is to make sure you don't allow the market to dictate how much risk you are taking causing you to take more risks and you have all right well i mean i don't okay so he's going back to the emotional status of he's saying basically uh investors are gonna have too much they won't be able to sleep at night because they have a 70 30 portfolio over 60 40 portfolio and i don't buy that for two seconds flat yeah that goes back to what i always say uh during the uh gfc global financial crisis s p was down uh 54 top to bottom wellington was down 37 were you sitting there thinking man i'm glad i got the wellington i'm only down 37 yes i'm down with more to the third of my capital but man that's great no no one's doing it everyone's freaking out man hell even the wellesley was down with twenty percent uh let's see who else we got i wanna see uh the only logical thing to do is rebounds daily if they're no freak oh good do not rebalance daily my friends all right uh ray we got larry uh we got this guy all right so anyway uh all right uh there's this guy again all right so anyway there you go i don't think uh rebalancing is that big of a deal again i think you have to deter determined you want to be you know predominantly stocks are probably bonds and then every year you can say i don't want to be predominantly stocks but you know go from 70 30 to 60 40 it's just it's just not worth the effort when you do it you do when you feel like it that's just that's just no let's not do that let's just choose to say this year i'm going to be 70 30. next year i maybe don't feel like i'll be 73 maybe next you'll be 40 60 but don't go 70 30 to 65 35 don't make any sense love to your thoughts all right we'll see you

Show more