Initial Benefit Plan Made Easy

Do more on the web with a globally-trusted eSignature platform

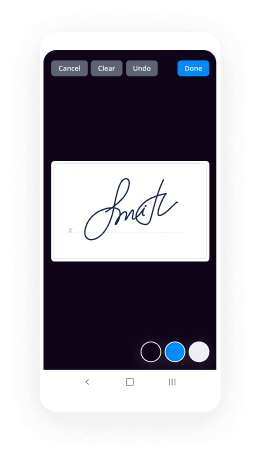

Remarkable signing experience

Trusted reporting and analytics

Mobile eSigning in person and remotely

Industry rules and compliance

Initial benefit plan, faster than ever before

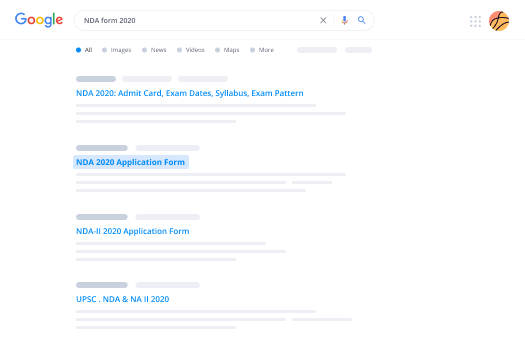

Useful eSignature extensions

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

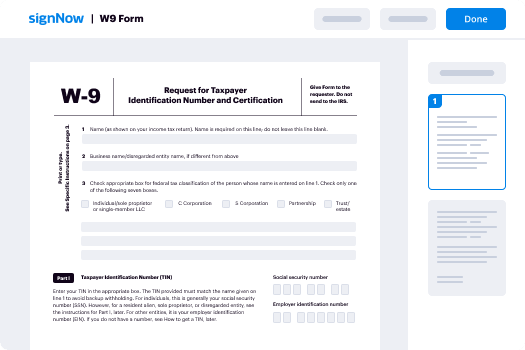

Your step-by-step guide — initial benefit plan

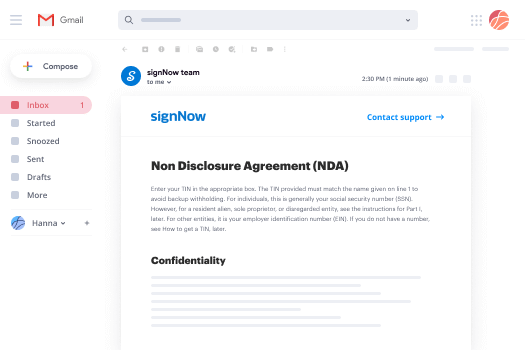

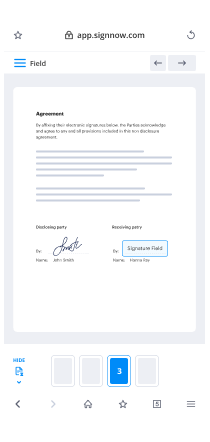

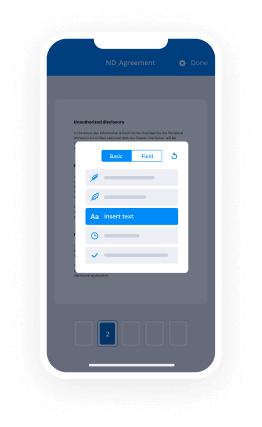

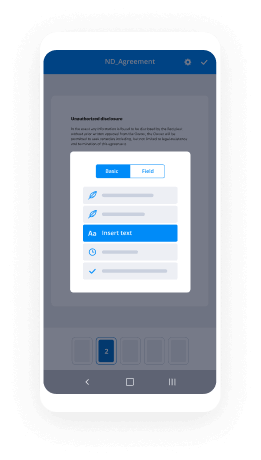

Using airSlate SignNow’s electronic signature any business can enhance signature workflows and sign online in real-time, giving a better experience to customers and employees. Use initial Benefit Plan in a few easy steps. Our mobile-first apps make working on the move feasible, even while offline! Sign signNows from any place in the world and make deals in no time.

Keep to the stepwise guideline for using initial Benefit Plan:

- Sign in to your airSlate SignNow account.

- Locate your needed form in your folders or import a new one.

- Open up the record and edit content using the Tools list.

- Place fillable fields, type text and sign it.

- List several signees via emails configure the signing sequence.

- Choose which users can get an executed doc.

- Use Advanced Options to limit access to the template and set up an expiration date.

- Tap Save and Close when completed.

Moreover, there are more innovative tools open for initial Benefit Plan. Include users to your common workspace, view teams, and track collaboration. Numerous consumers all over the US and Europe recognize that a system that brings everything together in one unified enviroment, is exactly what companies need to keep workflows functioning effortlessly. The airSlate SignNow REST API allows you to integrate eSignatures into your application, internet site, CRM or cloud. Try out airSlate SignNow and enjoy faster, smoother and overall more effective eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results initial Benefit Plan made easy

Get legally-binding signatures now!

FAQs

-

What is initial benefit?

The Initial Benefit Option (IBO) is an optional method of retirement which allows you to receive a lump-sum equivalent of up to 36 months of your maximum retirement benefit at the time of your retirement. ... All future monthly benefits will be reduced based on your age at retirement, and the amount of the IBO selected. -

What is the average Social Security benefit at age 62?

For example, the AARP calculator estimates that a person born on Jan. 1, 1958, who has averaged a $50,000 annual income would get a monthly benefit of $1,289 if they file for Social Security at 62, $1,778 at full retirement age (in this case, 66 years and eight months), or $2,276 at 70. -

What is the maximum Social Security benefit at age 67 in 2020?

As I mentioned, the maximum amount you can receive in benefits in 2020 is $3,790 per month, but to get that payout you must have earned at least the maximum amount of income subject to payroll taxes for at least 35-years during your career. -

What is the maximum monthly Social Security benefit at age 70?

According to the Social Security Administration (SSA) the maximum monthly Social Security benefit that an individual who files a claim for Social Security retirement benefits in 2020 can receive per month is: $3,790 for someone who files at age 70. $3,011 for someone who files at full retirement age (FRA) -

How do I find my Social Security benefit amount?

If you receive your Statement in English and would like to receive it in Spanish, or vice versa, call Social Security at 1-800-772-1213 (TTY 1-800-325-0778), or visit your local Social Security office. Your Statement has personalized messages based on your age. You can view a sample Statement based on your age below. -

Can I see my Social Security statement online?

You can get your personal Social Security Statement online by using your my Social Security account. If you don't yet have an account, you can easily create one. Your online Statement gives you secure and convenient access to your earnings records. -

What's the maximum Social Security benefit for a couple?

The maximum amount is between 150 percent and 188 percent of the worker's monthly benefit payment at full retirement age. There is also a maximum individual retirement benefit, a limit on the amount an individual can collect per month from Social Security. -

What is the maximum Social Security benefit in 2020?

The maximum monthly Social Security benefit that an individual can receive per month in 2020 is $3,790 for someone who files at age 70. For someone at full retirement age the maximum amount is $3,011, and for someone aged 62 the maximum amount is $2,265. -

What are the benefits of a defined benefit plan?

And investors in those plans often earn lower returns than they expected. A defined benefit plan delivers retirement income with no effort on your part, other than showing up for work. And that payment lasts throughout retirement, which makes budgeting for retirement a whole lot easier. -

Why use a defined contribution plan?

Defined contribution plans, like a 401(k) account, require employees to invest and manage their own money in order to save up enough for retirement income later in life. Employees may not be financially savvy and perhaps have no other experience investing in stocks, bonds, and other asset classes. -

How does a defined contribution plan work?

Defined contribution plans help countless employees save for retirement. ... A defined contribution plan is a retirement plan where employers, employees, or both make regular contributions, and future benefits are based on how much money goes into the plan and how the plan's investments perform. -

What is one advantage to having a defined contribution plan?

One of the biggest advantages of using a defined contribution plan is that you have more control over the process. You can decide how much you want to set aside for your retirement and you can also make decisions about the investments. -

What is better defined benefit or defined contribution?

Pension plans are basically promises to employees. With defined-contribution plans, employers simply promise to invest a certain amount of money each year. Their promises are short term, just a year at a time. ... Defined-benefit plans should pay better than defined-contribution plans during economic downturns. -

Is defined benefit or contribution better?

With defined-contribution plans, employers simply promise to invest a certain amount of money each year. ... Defined-benefit plans should pay better than defined-contribution plans during economic downturns. But downturns are precisely when employers are least willing or able to top up their plans. -

Are defined benefit funds still beneficial?

The airSlate SignNow concludes that for the majority of members of Defined Benefit Funds, it will be beneficial to switch to an Accumulation Fund either now in the next few years. Such a decision should not be based solely on the formulae developed in this airSlate SignNow, and financial advice should be sought where necessary.

What active users are saying — initial benefit plan

Related searches to initial Benefit Plan made easy

Initial benefit plan

[Music] well welcome to everyone listening in and thank you for joining me today to talk about benefit plans audits and to discuss some common errors that we often see through our audits of employee benefit plans and hopefully to provide you with some ideas around how to avoid these errors my name is Maria schwinger and I am an audit partner in our I'd Bailey Minneapolis office and I focus a large portion of my time within our ERISA industry practice and serve as an audit partner on many employee benefit plan audits annually I specifically specialize in audits of defined contribution defined benefit and also work on a number of single employer health and welfare plans I also serve on our firms ERISA technical issues committee and have been a part of numerous peer review engagements where I'm focusing my review on audits of employee benefit plans and also regularly attend the National AICPA employee benefit plan conference for those of you that may be less familiar with I dailies experiencing and auditing employee benefit plans I barely has experience working with a variety of plans including 401 K 403 B defined benefit Aesop's profit sharing plans and health and welfare plans our experience encompasses large and small plans with participant counts ranging from those that meet the minimum audit requirement to those that exceed 40 thousand participants we are also a member of the AICPA out of quality center for benefit plans and this membership is just one component of our commitment providing quality services to employee benefit plans you the main objectives I hope to cover today is to help provide an understanding of why plan audits are important and how they can help management teams and I understand there might be a lot of individuals listening who already have audited and play benefit plans that there may be others that have a plan that currently is not audited but may hit the audit requirements soon so I'll touch on different types of audits and then help to understand when an audit may be required and what you can expect the majority of the time I'll be talking about common plan errors that we've seen over the years through various financial statement audits we've performed and through conversations we've had with our clients who also may have gone through DOL or IRS exams for their Pam you might hear the word audit and it makes you cringe a little bit but it's important to understand why there is a need for audits in the world of employee benefit plans according to a 2019 market study that was performed by the investment company Institute are over five hundred and eighty thousand 401k plans in the United States and that's just 401k plans these plans have over 58 million active participants and according to this study the average 401k account balance in 2019 was over ninety thousand dollars and over 6.2 trillion and assets are held within these 401k plans in 2019 there was over twenty seven trillion in total retirement assets once you add in defined benefit other defined contribution plans IRAs and annuities but today our discussion for common plan airs will primarily be around defined contribution or 401k audits specifically talking about financial statement audits which are the types of audits our firm and other public accounting firms would be conducting they are seen as an accountability mechanism by the AICPA these audits are performed by an independent third party therefore the external auditor that's engaged to perform your required financial statement audit would have to adhere to all relevant independence requirements for audit purposes financial statement audits help to ensure that plans are being operated in accordance with their most current plan documents and maintaining compliance with all regulatory standards an audit plan an audited plan is required to produce prepared financial statements and attach those to the form 5500 that's filed with the IRS we also feel there's benefit to management when audits are required especially in a first year plan not if there is opportunity to help streamline plan operations and the auditor can and really should provide information on best practices within the industry if there are gaps or holes in internal control audits can help to identify areas for internal control improvement and also identify areas where the plan or the plan sponsor might be at risk specifically if a plan is subject to an IRS or DOL exam they may tend to have less flexibility when it comes to certain areas and you might find yourself in a situation where something wasn't documented appropriately which might result in a lack of compliance with following your plan document so with no documentation it's assumed that it didn't happen so throughout this presentation documentation will be a common theme that I point to but we'll talk a little bit more about some specific examples and we've seen treats like this we talk about different types of audits audit but I'm gonna be referring to most often during this session is the required financial statement audit needed to be attached to that form 5500 filing and this is required for large large plans which I'll cover here in a bit this audit requires the plan sponsor to hire an independent auditor as I previously mentioned and there are two common types of financial statement eyes full scope limited scope audits in a limited scope audit the auditor is able to obtain a certification letter from a qualified institution typically referred to as the trustee or the stowed e'en this is the entity that holds the investments and executes seni investment related transactions there is a Department of Labor regulation under ERISA that allows the limited scope audit which essentially means the auditor does not perform any auditing procedures over the investments or investment activity and because these procedures are not performed ultimately a disclaimer is issued in the auditor's report but this is a disclaimer of opinion that's considered acceptable by the Department of Labor the other option is a full scope audit which essentially happens in the circumstance you did not have a certification therefore the investments are subject to auditing procedures in the defined contribution world in particular so most 401 k's 403 b's the large majority of these audits are limited scope audits where a certification can be obtained the full scope audits that we do as a firm predominantly occur if we have employee stock ownership plans or Aesop's plans with hard to value investments and 11k audits or plans that are registered with the SEC the terminology behind these limited scope audits will be changing here in a few years so that terminology limited scope will go away and that will be referred to as ERISA section 103 a 3c audits based on a new auditing standard that was approved in late 2018 the standard came about in large part due to some not-so-great results that came out of the DOL audit quality study that occurred back in 2014 so these audit reports will no longer have a disclaimer under the new standard the auditor isn't considered to be disclaiming an opinion but is instead opining on the non certified audit areas and performing limited procedures on the investments high level the standard change really shouldn't have a significant impact on the plan audit itself or for the plan sponsor specifically but there will be some additional procedures that auditors will need to perform over the certified investment activity and an evaluation of management's assessment the certification is qualified other audits that you might find your plan being subjected to is an IRS audit or a DOL inspection both of these agencies they might perform a random desk audit or it can be a more in-depth examination currently both agencies have limited resources and are trying to utilize more data mining tactics from 5500 filings to identify those plans that might get pinged for an audit I do want to emphasize though again that our conversation today is focusing on external financial statement audits but much of what we look for in these audits are also a focus of GOL and IRS exam and inspections as well when talking about the annual audit and understanding when it's required it's important to know what triggers a financial statement audit under ERISA we get this question pretty often and the reality is it's not always straightforward this chart helps to walk through whether or not your plan is considered a small plan or a large plan a large plan resulting in the need for an audit the audit trigger itself is based off of the beginning of your participant count numbers with 120 participants being the magic number for the most part so as an example if you filed your December 31st 2018 5500 in October of 2019 last year and your ending participant count was 122 that means that your beginning of your count for 2019 was 122 therefore you would need an I 19 there's more of a gray area involved in the circumstance where you may be in a large plan situation this year but maybe dropping down to a small plan and there is a window between a hundred and a hundred and twenty participants where you must fall below that 100 participant threshold before you move back into that small plan category oftentimes we get contacted late in the year from plan sponsors who need an audit for the first time but either forget or don't realize it until they get around to filing their 5500 in the following year so your third party administrator or your TPA should be helping you monitor this and making you aware of when the requirement might kick in but if you think your plan might be teetering around that 120 mark it's important to be proactive and seek out a quality auditor timely to ensure you don't run into any issues with any potential late filing penalties this is just an example of the 5500 and on page 2 that's where that participant count information is included on the form this number here on line 5 is the is the count number that I am referring to and we also get asked the question often of what what defines a participant for this number who gets included in that beginning of your account number and it is everyone that is eligible to participate in the plan so you might have only 75 participants actually contributing in the plan but if you have a hundred and twenty-five eligible participants you would still need an audit because of the number of eligible participants exceeding 120 number and then if you're entering an audit for the first time what to expect you know a benefit plan audit functions a little differently than your typical financial statement audit because of the involvement of a third party administrator at EPA for some plans there are other parties involved whether it's an actuary or you might have a trustee or custodian and at EPA and this creates a unique aspect to to plan audits and in some cases it may mean that there's less information that the plan sponsor may need to provide because so much of the information is retained by the third party administrator but it also can sometimes cause delays and the plan audit process so in our benefit plan audits we like to start with an initial planning call that helps us understand major plan events like amendments to the plan employer match calculation changes if there's been any mergers or partial plan terminations this all impacts how we might approach the testing for the current year we also like to have a detailed conversation on understanding the involvement of that third party administrator you know will we be working directly with them would you prefer us to ask all questions for you and then forward questions on to the TPA from there it's really good to understand this as much as possible up front and we're oftentimes give an auditor access to the online portal for the TPA which can really help cut out a lot of the requests that we might otherwise need to ask of you but from there you know we have our audit requests that we provide to clients and usually those come in two phases kind of initial request and then a more detailed request at the participant level and then move for our through our tests review and wrap up with the ultimate goal to get you and issued me a still statement that can be attached to your form 5500 and we know that there likely are some common stressors for plan sponsors when it comes to audits such as feeling unprepared or feeling like the audits taking up too much time and the but the reality is the more time that we can put into preparing for the audit upfront significantly cuts back on that time needed on the backend you know we oftentimes will be given information based on our requests but if it's incomplete that's ultimately going to lead to additional follow-up additional questions and likely additional requests after that so it's important to read through the requests in detail and sure you understand ask questions you know understand what we're asking for why we're asking for for it and it ultimately should help reduce that time on the back end and then staying organized throughout the year and retaining appropriate documentation related to any plan changes will help when any questions might come up during an audit related to those changes so if you have a plan amendment happen during the year make sure you understand the impact that that amendment has on your plan and the administration of the plan whether it's payroll related or documentation retention related responding timely to requests is also key to ensuring efficient audit process from beginning to end again with that additional aspect of a third-party administrator in there I'm trying to keep everyone on the same page is important as well another stressor might be the idea potential findings or deficiencies you know as auditors were trained to audit with the participant in mind and with employee benefit plans it's less about materiality and more about planned document compliance therefore if there are any potential findings you know most likely they can be mitigated and corrected within a year's time and shouldn't be recurring comments if if corrective actions taken kindly and ultimately they're intended to be brought to your attention you know where might the plan be at risk and ultimately the goal is to put the plan in a better position from a regulatory and compliance perspective so now we will move into talking about these common deficiencies and what we oftentimes run into an auditing defined contribution plan so we'll touch on the definition of compensation lack of meeting minutes documented all the way through distribution authorization issues so with that I believe we have our first polling question and so the first polling question is true or false in 2019 there were over 580 thousand 401k plans in the United States alright the first poll is now open there should be a box on your screen that you can actually click on to answer alright let's go ahead and close this poll here and here at the results all right 98 percent said true and that is correct based on that study done by the investment company and I just first up for common errors is issues related to being able to remit employee contributions to the plan timely there is an expectation set by the Department of Labor that indicates that employee or participant contributions should be remitted to the trust into the plan and invested in a participants account as soon as administrative leap ossible there is a misperception that there is a safe harbor provision out there there really is not a black and white number like five days or 10 days or 15 days but rather it's it's as soon as administratively possible and it's important that you are consistent with that trend and and how long it takes you to to remit those contributions so if a plan sponsor can prove that they can remit contributions within one to two days consistently and then have a contribution that takes 10 days to remit dis likely should be identified as a late remittance and corrective action should be taken but if there was a unique circumstance that led to that 10 day outlier and it's well documented to support why you know a period 10 days may have been considered to be as soon as the administrative leap ossible and and you might not have to report it so it really is circumstantial based on those individual pay periods and and when we come in and audit we're looking for what is that trend what does it typically take a plan sponsor to remit those contributions and the key here again is to ensure that you have documentation if and when you have those outliers that kind of occur outside of your normal remittance pattern so you know ultimately ultimately if you have one or two that maybe slip through the cracks you know while on the surface the penalties and fines themselves may seem really insignificant for filing any formal paperwork related for that it will help support that you're committed to compliance and making appropriate Corrections when they're identified and other you know another plan sponsor in comparison to that one too to date Ren you know their plan sponsor theirs as soon as administratively possible it might be more like seven to ten days so really like I said you know there's not an identified X number of days it is individual for each individual plan sponsor but things that you can do to protect yourself against a late deposit situation is you're having documentation to support what is as soon as it ministry possible for your plan having a clear outline of what the process is what the controls are and it's also good to have a back-up plan in place if at all possible you know if one person is typically responsible for emitting to the trustee or the TPA is there a backup that can be put in place if they're out sick or on pto again ultimately having that documentation of what these processes are so that if when you have those that might fall out of your normal routine you have documentation to support that so like I said there are penalties and fines that are imposed if if you find yourself in this situation with late deposits and though the longer they take to deposit and the larger they are the more costly it can become so as long as you correct you know as soon as you discover that that maybe you had a couple that were considered bate and the less costly it should be the second one here is definition of compensation and this is probably the area where we most commonly see issues or errors in our testing the plan document itself for each plan has a defined definition of compensation and it may or may not have specifically identified exclusions so it's important to understand what those are and in practice you're properly applying that definition of compensation as an example we have seen numerous times where a special payroll is issued for bonus compensation and the plan sponsor does not withhold any 401k deferrals on that pay but plans definition says that this is eligible compensation so this would be considered an error if there is no other documentation noting that the participant did not want to girls taken on that pay and when that's applied across the entire population of participants it might be a significant amount but the plan sponsor ultimately may be required to producing their own dollars another example that we commonly see in practice is that you might be excluding certain fringe benefits from 401k deferrals but your plans definition doesn't specifically exclude these items I did have a client a few years ago where we were performing the audit for the first time but it had been audited in the past and the client had notified us that they had discovered an error in their application of the definition of calm during a more in-depth internal audit that they had performed over payroll in that year so the definition for their plan document indicated that all box when wages meaning all taxable wages were eligible compensation with no specific exclusions that were identified they discovered that since 2009 they had numerous pay codes for taxable fringe benefits that have been excluded from eligible compensation for both employee and employer contributions and so they ultimately determined that a correction was needed going back to 2009 all the way through 2017 that totaled over $100,000 plus an additional thirty nine thousand dollars for last earnings and then the plan sponsor made that correction using their own dollars to make those participants full and then in 2018 what they ended up doing was amending their definition of compensation to properly so it's important that you understand your definition and that your payroll team that's processing payroll and applying these inclusions or exclusions understand it as well to ensure that you know what is happening practically each pay period aligns with what is defined in the plan document and at least annually you should perform a review of those compensation definitions and ensure that the individuals in charge of determining compensation for individuals are properly trained and understand what that plan document says as well on the topic of 0% election forms and employee eligibility particularly in plans where there's an age requirement to participate in the plan or there's a service requirement period that must be met it's important to document or have a documented process on how employees are notified of their eligibility to participate in the plan as you know part of our testing we look to see that those participants who are eligible participate in the plan but are choosing not to participate have actually declined participation you know this is best supported by a signed election form stating that the participant does not want to participate to participate but more often than that a plan sponsor indicates that they notify an employee of their eligibility but the participant never returned the sign you know form declining participation and in this circumstance it is important to have that documentation to support how the employee was notified that they were eligible you know was it discussed with the employee during their orientation they were given the enrollment packet at that time they receive an email once they're eligible to participate in the plan because ultimately the risk to the plan sponsor is that the employee would come back months or years later indicating that they were not aware or made aware that they were eligible and would have participated had they known so the plan sponsor would be at risk to make that participant whole for failing to notify the employee of their eligibility if there is no other documentation to support that they were notified so if your plan doesn't have service or age requirements there is much less risk related to this issue for obvious reasons but in other area is auto enrollment can help mitigate this risk as well you know because if someone's not participating in an auto enrollment plan then you know this would mean that they had to decline participation and there should be a paper trail or a virtual trail of this but it's also important that you have an awareness of what that documentation is especially if that's handled all at the third party administrator level you guys that written documentation or does the TPA have a kind of date and time stamp record to support when a participant or an employee might have declined participation on the same topic of eligibility some plans have different eligibility requirements for different classes of employees or for different types of contributions whether it's employee versus employer or sometimes plans have multiple types of employer contributions as an example we have a plan where the the plan sponsor is an insurance company they have several different classifications of employees based on whether their full-time office employees a part-time adjuster or full-time adjuster and each classification of employee has different eligibility requirements both for the employee deferral eligibility and for different types of employer contributions that are offered so the risk here is that employees are not properly notified of their eligibility or allowed to enter the plan based on their employee classification type and so if they change employee classification insuring that you're properly applying any new eligibility requirements and if you have a plan with different requirements again it's important that you as a plan administrator understand this but also important that your Human Resources individuals and payroll individuals understand these different requirements as well and that you have a consistent eligibility notification process where all employees are notified in the same manner when they become eligible so to help mitigate risks related to any issues with eligibility notification and ensuring the application of proper eligibility requirements recommending you know streamlining eligibility requirements as much as possible this might not make sense for every company or every organization based on the dynamics of the employee base ultimately it will make it easier on you and less potential for complications with that eligibility notification and we have seen a lot of plans moving to those auto enroll plans are moving to no age service requirements at least for the deferral portion of participation and plans in recent years just removing some of that kind of administrative effort related to eligibility vacation you the next one here on lack of meeting minutes in fiduciary oversight this is a big one that as planned sponsors or administrators if you're not documenting meeting minutes to support fiduciary oversight this should be an area where you make an immediate change you know if we come in and perform a financial statement audit for the plan and note that there is no documentation or no documented minute support that fiduciary oversight of plans are occurring you know we might conclude that there is a deficiency and internal control and report that to management but we'd still be able to issue our report on the financial statements and have your report to attach to your 5500 if the IRS or the DOL in particular were to come in and perform an exam and note that they likely would have a little bit more scrutiny over this particular area out on the IRS is website there is a section with basic responsibilities listed about retirement plan fiduciary responsibilities and documenting meeting minutes is an important item on there you know it also may be important for you to consult experts in certain fields like investments or accounting and give consideration on whether or not you would want to bring them in and be part of your committee and have that documented in your minutes as well you know and why is this important you know in the last 10 years or so there have been numerous lawsuits in this space where participants alleged fiduciary misconduct particularly related to excess fees charged within plans and in these cases the the plaintiffs were alleging that the plan sponsors members of their benefits committees breached their fiduciary duties under ERISA by requiring participants to pay excessive fees either in the form of overly high expense ratios for mutual funds or overly high fees paid for record-keeping services many of these cases ultimately did go in favor of the employees or the plan participants because of the lack of documentation that was retained related to investment and fee monitoring by the sponsors so in many cases you know there was conversation that that was happening but there is no documentation to support that it was happening so how can you protect yourself in this area having a designated committee charged with oversight is important you may want to consider whether these committee members should have committee trainings so they understand their responsibilities and understand the administrative fees charged directly to plan participants and understand any revenue sharing that's incorporated into your plan administration so this should be formally reviewed and investments should be monitored fees to be monitored and and making sure again to document this all right we have another polling question true or false again here if an employee changes categories of employee type you need to be aware of the impact that this might have on eligibility to participate in the plan or receive certain types of contributions all right that's like the hole is now open alright and that answer again yes is true so always having an awareness when there are any employees changing categories of different employee types especially when you have different alright another area where errors can occur is in the application of vesting and in making sure you're properly utilizing the vesting schedule that's in the plan document and any related forfeiture ectopy the vesting schedules can sometimes be confusing to understand some plan documents indicate that vesting period is based on the plan year others indicate that a year of service is a plan year in which a participant has worked a thousand hours or more so it's really important to understand how the vesting provision should be applied when participants terminate and fall within that vesting window and it probably gets particularly tricky when you have those mid year hires as an example if someone was hired on August 1st they're eligible to participate right away and you're vesting schedule indicates that one year of service for vesting purposes is a plan year in which the participant worked a thousand hours so if this person was able to work a thousand hours from August 1st to December 31st you know this would mean that they they likely get one year of service credit for that four month period and they could terminate in July of the following year technically not having a full actual year of service but could end up with two years of edited service for vesting purposes and depending on how and what the definition of one year of service is so it's important to ensure there's a process in place to review vesting and forfeiture calculations for individuals taking distributions that are not fully vested a lot of times the third party administrator might assist with this calculation but we have had instances where TPA is improperly calculated vesting for for several years and it did create a lot of headache down the road you know in that case it was a new vesting schedule had come out it didn't get properly applied into the administration and you know the issue becomes you might have some employees that had more forfeitures taken from their distribution then should have been or not having enough forfeitures taken the first probably being the bigger issue since those dollars should have been made available to the participant and and can lead to a little bit of a lengthy correction process you know in instances where you have any mergers or acquisitions emerging plans have differing vesting schedules it's important to ensure that you know grandfathered years of services are credited appropriately to employees and and that the new single vesting schedule is properly utilized as well on the topic of loans you know many plans offer a loan option to participants not all plans but a lot of plans do and this is when a participant is able to take money out of their participant account with the intention to pay the dollars back into the plan over a five-year period or less unless the dollars per utilize for a home mortgage in which case the loan period can be extended but most loan policies you know really mirror language let's put out by the IRS but we have seen compliance areas where plan sponsors are not properly following the terms of their own individual loan policies you know for example every policy has a little different language in regards to what loan interest percentage still applied to it any given loan during the year you know prime plus one is a pretty common benchmark utilized but sometimes they're different and and that's something during our audit that we're looking to ensure that they utilize the correct loan interest percentage based on their policy so again it's ensuring that what you're doing and practice complies with what is stated in the policy loan policies also should indicate that a participant cannot take a loan out for more than 50 thousand or more or more than 50% of their bested balance whichever is lower so it's important to monitor the loan amount requested versus the vested balance and the participants account to ensure you don't allow loans outside of that limit and loan policies also always have a limit on the number of loans that an individual person can take it one time most only allow one but some plans do allow up to two or three to be taken at any given time and if you have a plan that does allow multiple loans to be run at once you know this is something to closely monitor so that you don't violate that loan policy you know having a formal loan policy and automating that process will really help mitigate these risks but also making sure that you have you know documentation in place to address any market changes that might occur from the time of the loan being signed versus when the dollars are issued to the participant you know because if there is a market decline might impact that assessment of where they rat from their vested balance versus what was issued as alone and it's good to know that in the current environment here in 2020 there was some relief provisions with the cares Act related to loans kind of expanding what those policy requirements are but a plan would have to formally adopt those provisions for them to apply to their plan you another area that we can sometimes see errors or issues is related to plan compliance testing so there are different types of compliance tests that apply for different types of plans and some incorporate complex calculations based on data that's specific to your plan so it's important to know which tests are actually applicable and it's important to have the compliance testing performed annually and on a timely basis so that you can know you know sooner rather than later if you have any non-compliance issues that you and once you get those results you'll want to make sure you understand the failures and understand the necessary correction involved I've reviewed and read many compliance testing results documents and they're not always straightforward and easy to understand what the corrected practive action is needed if any sometimes there actually isn't any sort of correction that's needed based on circumstances within the plan you know this 880 P and ACP testing has been a focus of the IRS in recent years you know failing to provide timely written notice to participants or failing to provide proper safe harbor contributions to plan participants if your plan is a safe harbor plan you know so this also has been an area of IRS focus during theirs exams as well you moving to the area of distribution so these would be dollars leaving the plans obviously and specifically hardship distributions the IRS and ul in particular have a heightened focus on on hardship distribution activity because this means that dollars are leaving the plans for active participants and not returning like a loan taken from a plan by an active participant with ultimately is making its way back into the plan you know issues that have been identified our plans allowing participants to take hardship distributions when the plan documents didn't actually allow it it's important to know that from the IRS is perspective it's insufficient for plan participants to keep their own records of hardship distributions and there is a responsibility placed on the plan sponsor to obtain supporting documentation so if documentation regarding reason for hardship is obtained and retain by the third party administrator you know do you as a plan sponsor have an understanding of what that process is and what is retained for support of the hardship distribution in order to allow participants to have easier access to the cash balances in their 401 K and 403 B accounts when a hardship occurs recent guidance from the IRS allows a plan administrator to rely on a participants written self certification that the participant has insufficient cash or liquidity satisfy financial need and so unless the plan administrator has any actual knowledge to the contrary they can go ahead and issue those hardship Tribune's based on those self certifications and if a plan permits the self certification the plan sponsor still has a responsibility to notify the participant of a few things the first being that the hardship distribution is taxable that the amount of the distribution cannot exceed the immediate and heavy financial need and the recipient has to agree to preserve those source documents and to make them available at any time upon request to the employer or the administrator you know the last item there generally causes plan sponsors and benefit plan auditors concern because it does not seem to indicate what the plan sponsor would be required provide the to provide the source documentation upon request of an independent auditor or an IRS agent and so in the event that you're under an exam you know how are you going to get access to that information to support that do you feel that that coverage on the self certification of telling the participant that they have to preserve those source documents are going to mean that those source documents are going to be readily available upon audit so I have write in a few places that as a best practice a plan sponsor should consider still requiring a participant to scan the source documents to the plan sponsor for the TPA at the time of the self certification this will mitigate that need to obtain documentation from a participant potentially years after the hardship distribution occurs so really just navigate wisely if you're allowing self certification for hardship distributions and making sure you have a process in place so that if you need to access that source documentation you will be able to do so and also on the topic of distributions you know one of the distribution authorization is probably one of the other areas where we can sometimes see issues and this really is one of the larger risks related to employee benefit plans you have dollars that are leaving the plan and if not being rolled over into another plan they're no longer being utilized for retirement savings purposes so there needs to be a process in place to ensure that there's proper authorization that has occurred by the plan participant so this includes ensuring that the type of distribution the participant wanted to receive is actually what was received that any additional tax withholding was applied and ultimately but the participant was actually eligible to take the distribution certain plans also requires spousal consent and it's not always something that's straight forward when you're reading a plan document so it's important to understand that if this is required in your plan that you're obtaining that spousal consent for for married participants I would say this is most commonly seen in plans that have an annuity option for distributions and in today's electronic world more and more plans and third-party administrators are moving to electronic authorization and approval so if that's the case for your plan again it's making sure you understand what that process is and what a participant must do to properly authorize a distribution from their participant account you know what documentation is the TPA retaining to support that authorization I know as auditors this is an area that we often face as kind of a challenge in our audits as things become more and more electronic and gaining comfort with that participant authorization record so sometimes we opt to confirm directly with participants you know depending on the level of information that can be provided in conclusion that kind of wraps us through those 10 common errors and if you haven't made note of it by now the number one thing that you can do to ensure you minimize your plants risk for many of these errors or issues is to really know your plan understand your plan document and your adoption agreement if you have one you should you know perform a review at least annually of your plan document to ensure that you're following all plan provisions and ensure that you have processes and controls in place to ensure accountability can be upheld you know particularly particularly in those areas of timely remittance of contributions educating employees and participants on the plan a notification of employee eligibility if you have requirements and also you know when you're hiring service providers for the plan whether it's your TPA your investment advisor or external auditor make sure you do your research and you know is the service provider one that you find knowledgeable and and will provide quality services on that same line of what you can do is reviewing information by the plan sponsor must still occur even if you have a TPA that's assisting with much of the plan administration so you have to ensure that your census records are cross-checked with the third-party administrator records periodically that you have proper controls in place to ensure accurate payroll information is kept for participants you know payroll really drives the deferrals and any related employer contributions therefore if the payroll is incorrect by default the pearls are incorrect so if participants are making electronic deferral election changes with you know with the TPA there needs to be a process and a control in place to ensure that the deferral percentage change accurately is adjusted within the payroll records also understanding your plans definition of compensation and any specific exclusions from compensation is important and understanding that process for reviewing and authorizing distributions from the plan as I've mentioned throughout many of these areas automation is something that can really help reduce area errors in your plan but it's also important to recognize that even though a third-party administrator may handle the majority of this with that automation you know the plan sponsor still has a responsibility to understand the process and perform periodic reviews on their own as well you know even in the world of automation and electronic or virtual plan records it's it's important to understand that audit trails and documentation are still key so checking with the TPA periodically for for records they have and retain I often times the emails that I retain to help support certain electronic approvals or change records maintaining supporting records for those 0% elections or when participants are declining participation if at all possible and having support for those deferral election changes and and last but not least and that meeting minutes topic ensuring that you have documented meeting minutes in place to support that you're monitoring the plan and executing on on those fiduciary duties kind of circling back to DOL and IRS you know kind of in conclusion much of what we talked through today a common area errors that we see through our experience with financial statement audits of employee benefit plans you might find yourself in a DOL or IRS exam and as I mentioned much of their exams are data-driven so they're limited resource leads them to using that data mining the 500s often for determining who's gonna be flagged for an audit but filing timely fifty-five hundreds by the first or extended deadline you know is one big way to avoid being flagged by the DOL or IRS for any sort of audit and avoiding any sort of penalties or fines but if you do find yourself in a scenario where an error has occurred whether you discover it on your own or it's discovered through an exam you know it's good to know that it's okay there are correction processes and programs in place but the key is really to ensure that you respond timely and and make proper steps towards correction so if you do find yourself in an audit situation with the DOL or IRS you know biggest recommendation is going to be to provide them with all the documents that they request and provide them as timely as possible these requests can oftentimes be very lengthy and requesting data going back for several years I had a client recently who is flagged for an IRS desk audit and they sent me the request list and it was about 12 pages long and they asked for payroll and plan document information going back for several years so I mean they it's definitely a detailed look at information and and I would encourage you to reach out to your third-party administrator or possibly your auditor to assist in pulling together any information that they're requesting or just to help provide guidance on any questions that you might have during that process as far as kind of what's on their radar you can go online to both the IRS and the DOL websites and read their work plans for the upcoming years so this tells you what their focus has been on and where their attention is directed when it comes to audits you know I mentioned that these exams are based on data mining a fifty-five hundreds but they also commonly act on referrals or claims or complaints so specific areas of focus for the IRS include Aesop's 403 B and 457 plans and terminated cash balance plans with the Aesop's they're looking to determine whether the employee stock has been properly valued the annual allocation of employee stock meets the non-discrimination requirements and that employer loans follow conditions in terms of and document you know with the 403 B 457 plans and terminated cash balance plans they're looking to ensure that the Internal Revenue Code provisions specific to those types of plans are adhered to you know such as universal availability in 403 B plans and in 457 plans you might be looking for excess contributions and the proper use of you know that special three-year catch-up contribution rule it's for the dol their focus continues to be in that area of fiduciary malfeasance and plan oversight but much of their programming is around educating plan sponsors and providing resources to help them avoid being any in any sort of fiduciary malfeasance situations so there are a lot of good resources that the Department of Labor has available to plan sponsors to help in this area as well here we have our first polling question and it is what is the extended 5500 filing deadline for 2020 alright so October 15th is the correct answer so there has not been any sort of extension or change for employee benefit plan filing deadlines I know there's been extensions for the regular 1231 2019 tax filing deadline out to July 15 but currently for the 5500 filing that first deadline still remains as July 31st with an extension out to October 15 and last but not least just wanted to provide this group with some other helpful tools if you have other questions or looking for some other resources out on the AICPA z-- website there is an interest area for employee benefit plan audits and audit quality so just has some plant advisory communication information and tools for plan sponsors also out on the IRS is website they have a specific section for retirement plans and actually a specific section for correcting plan tiers and so in that in that area of the website they have multiple fix-it guides and so they have different guides for different types of plans so as an example there's one for 401k plans one for 403 B plans and has a lot of information some you know similar to what I've shared with you today but you know what are common errors what are ways you can correct it and what are ways you can prevent it there also is information on the IRS website if you do find yourself in a correction situation and you want to follow through with maybe one of the correction programs available a lot of information out on the IRS is website on how to follow through with that so with that that really concludes our discussion today I'm talking through benefit plan errors I have left my contact information here if there are any questions that anyone has feel free to shoot me an email after the session and I'll be sure to get back to you so thank you awesome well thank you all so much for attending and thank you to Maria for hosting and we hope everyone has a great day thank you guys [Music]

Show moreFrequently asked questions

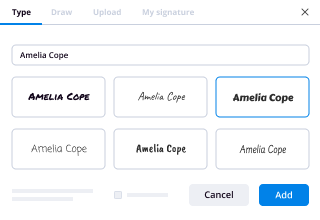

How can I eSign a contract?

How do I add an electronic signature to a PDF in Google Chrome?

How do you sign a PDF doc online?

Get more for initial Benefit Plan made easy

- Print signature service Blood Donation Consent

- Prove electronically signing Compromise Agreement Template

- Endorse digi-sign Insuring Agreement

- Authorize digital sign Hospital Discharge

- Anneal signatory Photo Licensing Agreement

- Justify eSignature Product Marketing Proposal Template

- Try initial Marital Settlement Agreement Template

- Add Recapitalization Agreement autograph

- Send Venture Capital Proposal Template digital sign

- Fax Volunteer Confidentiality Agreement initial

- Seal Training Evaluation Survey electronically sign

- Password Director Designation Agreement countersignature

- Pass Statement of Work Template digital signature

- Renew Rental Inspection Checklist signed

- Test Appointment Confirmation Letter digi-sign

- Require Travel Agency Agreement Template esign

- Comment inheritor signatory

- Boost tenant email signature

- Compel trustee signature

- Void Freelance Graphic Design Contract Template template electronic signature

- Adopt affidavit template signed electronically

- Vouch School Itinerary template electronically sign

- Establish Free Event Ticket template electronically signing

- Clear Software Maintenance Agreement Template template mark

- Complete Concert Press Release template signed

- Force Limousine Service Contract Template template eSignature

- Permit Veterinary Hospital Treatment Sheet template autograph

- Customize Agile Software Development Contract Template template digital sign