Initial Car Purchase Agreement Template Made Easy

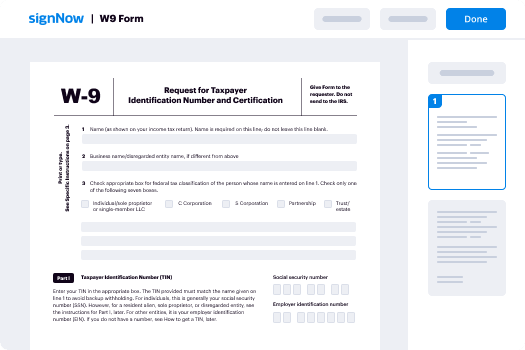

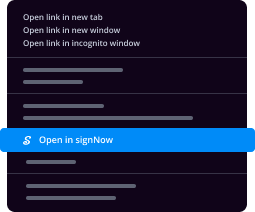

Upgrade your document workflow with airSlate SignNow

Flexible eSignature workflows

Fast visibility into document status

Simple and fast integration set up

Initial car purchase agreement template on any device

Advanced Audit Trail

Rigorous protection requirements

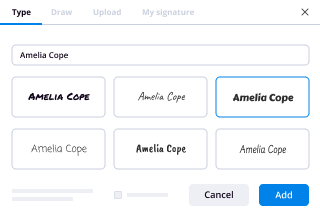

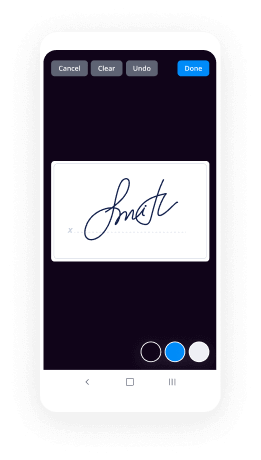

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your step-by-step guide — initial car purchase agreement template

Employing airSlate SignNow’s eSignature any company can increase signature workflows and eSign in real-time, giving a better experience to customers and workers. Use initial Car Purchase Agreement Template in a couple of simple steps. Our handheld mobile apps make working on the move feasible, even while off-line! Sign signNows from anywhere in the world and make trades in less time.

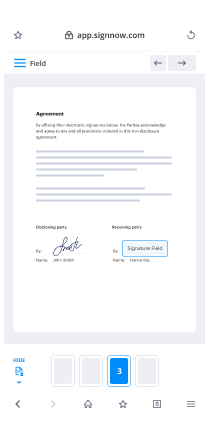

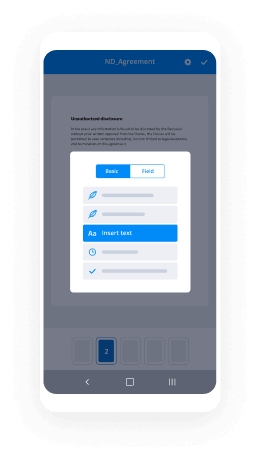

Follow the walk-through guideline for using initial Car Purchase Agreement Template:

- Log on to your airSlate SignNow account.

- Find your record in your folders or upload a new one.

- Access the document and edit content using the Tools menu.

- Place fillable boxes, add textual content and eSign it.

- List multiple signees by emails and set the signing order.

- Indicate which recipients will receive an completed version.

- Use Advanced Options to reduce access to the template add an expiration date.

- Tap Save and Close when done.

Additionally, there are more extended functions accessible for initial Car Purchase Agreement Template. Add users to your collaborative digital workplace, browse teams, and track collaboration. Numerous people all over the US and Europe recognize that a system that brings people together in a single unified enviroment, is exactly what companies need to keep workflows working easily. The airSlate SignNow REST API allows you to integrate eSignatures into your application, website, CRM or cloud storage. Check out airSlate SignNow and get quicker, smoother and overall more efficient eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results initial Car Purchase Agreement Template made easy

Get legally-binding signatures now!

FAQs

-

How binding is a car purchase agreement?

In simple terms, a bill of sale agreement is nothing more than a contract for the purchase of a vehicle between a buyer and a seller. ... In most cases, the contract is legally binding between buyer and seller as long as the bill of sale follows guidelines required in the state where the sale or transfer takes place. -

How do I write a contract to sell a car?

Start your car sale contract by identifying the seller, buyer, and reason for the contract, and provide a detailed description of the vehicle, including the make, model, year, color, VIN, and odometer reading. Include the date of sale and agreed upon purchase price. -

Do both parties have to be present to buy a car?

All car titles must be signed by the owners listed on the title in order to be registered with the state. ... If the co-owners names are joined with \u201cand\u201d then both parties must be present to sell the car. Titles using \u201cor\u201d between the co-owners' names either party can sell the car without the other party present. -

Do you need a contract to sell a car?

You'll need one of these contracts if you're selling The law is clear \u2013 it's illegal to sell a car in an unroadworthy condition. If you're selling a used car, print two copies of our car seller's contract and complete them in front of the buyer. Each party should sign and keep a copy of this document as proof of sale. -

Is there buyers remorse on cars?

In most situations, the dealer has no legal obligation to take the car back if you signed the sales contract. But, you may be able to get whatever reasons for your car buyer's remorse resolved and possibly even return the car. ... Request a meeting with the dealership manager and calmly present your case. -

Is a buyer's order the same as a bill of sale?

Buyer's Order or Bill of Sale: Just as with a new vehicle, a used car Buyer's Order or Bill of Sale is the basic sales contract between the buyer and the seller. ... The seller must give the buyer a completed copy of this document at the time the buyer signs the contract. -

How do you write an agreement letter?

Begin your letter by clearly indicating the parties involved in the agreement. Remember to include the date the agreement takes effect and title of the venture. Clearly state the reason for your agreement in your first paragraph giving description of all details such as stake holder ratio, payment period etc.

What active users are saying — initial car purchase agreement template

Related searches to initial Car Purchase Agreement Template made easy

Initial car purchase agreement template

hello everybody this is a Jacob Lawler from the office wanting to do a quick introductory video on the California residential purchase agreement or codenamed our PA or aka the offer now this is gonna be a quick introductory video because when you actually get into our power curve you know full-scale training they actually spend one entire day on this purchase agreement so this is by no means an all-inclusive training video my purpose of this video is really doing a quick introductory video to kind of at least introduce you to the verbage and kind of how this is written and in my opinion the most important portions of this so this will absolutely not be an all-inclusive you know everything so I want to at least just expose you to this that way when you get into the power curve training it's not an oh my goodness what the heck is this ten pages of a legally binding contract that way it's a little bit of oh yeah I remember that oh yeah I remember that so you'll be miles ahead of the other agents in there so this is a recording that I'm doing in on June what is it June 28th 2020 and a car car form RP a revised 1218 now every couple years they do update this agreement and sometimes it's a huge update and where they change the whole thing other times they just changed some wording around so make sure that whatever contract you're doing as as of now matches this or we just have to look at what those changes are so a little asterisk asterisk in there but again this is just an introductory video to give you an idea of what's going on with the purchase agreement in here now first off this first portion of the offer the reason why I'm introducing you to this is this is what the entirety of the quote unquote transaction will be based upon this is what sets the tone for how long the escrow is what time frames are and everything like that so if you have to know this forwards and backwards in order to know really what the transaction is going to be like so I want to at least introduce you to this so that way we can get some things going so this first portion where it talks about the offer paragraph one is really the summary of the offer in here so this is an offer from the buyer real property to be acquired is this is the address in the city in the county in the zip code and the Assessor parcel number the purchase price to be offered is blank whatever dollars it is and then close of escrow shall occur on either a date written here or more commonly blank days after acceptance which most commonly is somewhere around 30 to 45 days but it really just all depends upon what that negotiation goes down and also if there is a lender involved how quickly the lender can get it done this talks about the disclosures and confirmation of brokerages again power curves gonna get all into this I want to bring it down to again the most important parts in my personal opinion number one the initial deposit I mean of course days after acceptance that's important to know but usually again it's gonna be 30 to 45 days really set by the lender as well as how quickly the seller and the buyer come to terms on when they want to close it then breaking it down to the initial deposit now an initial deposit is the amount of funds that is actually physically brought into escrow by the buyer within again per the contract three business days is the default after acceptance so these are funds that will be debited from the buyers account so make sure if you are representing the buyer you make them aware that these are actually funds that will be debited from your account they don't go directly to the seller it's held in the escrow trust account now the default to the contract is three business days after acceptance but also that it will be by buyer direct deposit it shall be delivered directly by electronic funds transfer is the default or you can check some boxes personal check cashier's check and all that so the default is again electronic funds transfer within three business days of acceptance now what's considered a full deposit I'm doing air quotes a full deposit is considered three percent of the purchase price now you don't write 3% here you would calculate it out as a percentage of whatever number you end up putting up here where it talks about dollars sorry I am wonderfully having a spinning wheel there my apologies for that breaking it down after the initial deposit the next thing that most commonly comes up is loans it obviously if you have an all-cash buyer you would check this box but that's not the majority of what we're handling here in the office the next portion would be loans first loan is usually what we're dealing with you if you're dealing with a second loan come talk to me on the white right way to structure that default in the contract is that it is a conventional loan or conventional financing if you have anything other than that you would need to check the boxes if it's FHA if it's VA if it's anything like that again depending upon your situation it will determine other things in there so what you would then do is say r8 not to exceed and what you would do is you would want to talk to the lender about what rate they are quoted for and sometimes it's good to give kind of a little bit of a bump in there because rates are flexible they literally change on a minute-by-minute basis but making sure that we don't exceed whatever they're qualified for based upon their monthly payment and then also very commonly it's commonly put in here to not pay up I'm sorry not pay points to exceed exper cent usually we'll put like 1% in there depending again on the buyers situation talk to the lender to ask about their current situation some people decide to kind of have a quote unquote template where they write in here additional financing terms where they say buyer to accept best prevailing rate in terms on the loan kind of as a catch-all but it's really really good practice to put in an actual an actual rate here and points not to exceed here just that way you kind of protect your buyer with another layer of protection now going to the second page of the RP a verification of down payment and closing costs now it's really good practice to provide your what we call proof of funds with the offer itself now again it's about your proof of down payment and closing costs not just proof of your initial deposit amount so if they're getting a 20% down loan you want to at least show that you have that full down payment amount in some sort of an account whether that's a you know a traditional savings account or a retirement account that they're borrowing from or what-have-you it's always good practice to have it in a liquid account that's easily verifiable easily you know taken you know taken into account some people get a little bit a little bit nervous if it's in an investment account because then oh my goodness what if there's a change in the marketplace and they're you know their portfolio drops 20% over their escrow time period and what-have-you so it's good to provide the verification with the offer in here now bringing it back up just because I just just remembered when we're talking about the loan here it's good to keep in mind that whatever amount you're putting in here let's say your client is doing a 20% down conventional financing you would actually compute this as 80% because it's talking about the amount of the loan so if they're putting 20% down as a down payment it would actually be put in here is that 80% for the loan amount same thing with FHA if you're doing a three and a half percent down FHA this would be 96 and a half percent again just like the initial deposit same thing you're putting the exact dollar amount not the not the percentage in here and then it will also then Auto calculate when you're doing the offer in the program zip forms it'll auto calculate the balance of a down payment so you'll put in the purchase a purchase price down here which you actually add here and it auto puts it down here then you put in your initial deposit which again full amount is 3% but again asking the client what are they comfortable with because it is debited from their account then you put in the loan and it auto calculates the rest here one of the great things about the program so by default it's three days to provide the verification of down payment and closing cost but very good practice and you will be countered if you don't supply it with the offer next step appraisal contingency and removal one of the contingencies or what I like to call safety valves of the transaction where your buyer is able to get out of the agreement without risking their initial deposit is the appraisal contingency this agreement by default is contingent upon a written appraisal by a licensed certified appraiser at no less than the purchase price and the default is 17 days after acceptance to remove that contingency if they are gonna get the loan almost every single time and if there's a lender who doesn't require this this is gonna little be a little bit concerning but when they get a loan on the property they will be required by the lender to have an appraisal done on the property now then appraisal is a cost associated to the buyer it will be put on either a credit or a debit card it's usually somewhere between you know four hundred to six hundred dollars depending upon the size of the house if it's a really big house obviously it'll be a little bit more but 17 days to be able to remove to get the appraisal back and to remove that contingency so again this is a protection for the buyer if the home doesn't appraise mr-mrs buyer for the home that we agreed to do that is one of the contingencies of the sale so you are protected and your backstopped by the appraisal contingency same thing loan applications same thing with the verification of down payment defaults to within three days after acceptance to provide a pre-approval letter or a pre-qualified letter good practice to attach the letter with the actual offer itself that way it provides some protection for the seller that makes sure that they are at least have some peace of mind that your buyer has at least been pre-approved for that amount or else you know you can write any number on a on a contract but if you can't get the loan it's all funny money till it hits the account right again another contingency to allow the buyer a little safety valve out of the transaction should they not qualify formally for the loan the default is 21 days after acceptance to be able to be formally approved to to be formally approved by the lender to be able to remove the loan contingency again you could also say no loan contingency if for some reason you are in a multiple offer situation anytime that you're gonna remove contingencies with offers make sure you talk to me first you do have the ability to shorten these timeframes but again default to 17 days for the appraisal 21 days for the loan contingency removal taking it down there's a lot of other stuff that power curve is gonna get into the only one that I didn't highlight in here that I will highlight at least in the video is the sale of buyers property now if you are working with a buyer who has to sell their home in order to buy the next one that's a whole other training class in terms of how to line that up and that's a very complicated one to do especially if it's gonna be one of your first so please make sure that you reach out to me if you're gonna get into that sort of a situation that being said talking about allocations of costs this paragraph 7 is a very robust paragraph about who pays for what they're gonna spend a lot of time on here in power curve so I won't go into it too much but basically this just means who pays for what there are certain ways of writing this where it's considered and I'm gonna do another air quotes standard for who is to pay for what but long story short once you start doing your templates and doing your first transactions I will absolutely help help give you an idea of what's considered customary talking into escrow in title also same thing there's certain ways to go about it I don't want to spend too much time on this video however there we will be able to kind of help put some things into into play another thing to protect the buyer to give them alysom alleviate some of their concerns is we will always recommend that we get them a one year home warranty plan which basically covers the major systems of the house should there be anything that goes wrong with them within the first year of them being there now again we don't want to say it'll cover everything because it really doesn't however we can give you specifics and different companies will cover different things but a short way to talk about this is if it is a major system in the house most of it is covered by this home warranty plan and I can get you in touch with our home warranty reps to give you full information but long story short we want to make sure that the buyers have this home warranty plan so that if something major does happen with one of the appliances or systems that is covered that at least they have that coverage in there and all that they would have to pay for all intensive purposes would be a service charge for somebody to go out there and it really depends upon the company as of currently recording this the companies are generally around 60 to 80 dollars per per service charge for somebody to come out and change it full disclosure I have fully utilized my home warranty plans for every home that I've purchased I actually just recently in the home that I got last year just got a whole a C condenser unit changed out for just the service charge of $75 from my plan and they changed this whole twenty five hundred dollar thing so it was worth it for me now items included in and excluded from the sale are in here now very important especially as a new agent to note this is that right up above it says note to buyer and seller items listed items listed as included or excluded in the MLS fliers or marketing material are not included in the purchase price or excluded from the sale unless it's specified in paragraph eight B or C which is right here so let's just say that in the marketing material it says fridge to be included or you know a washer and dryer to be include whatever it is even if it is put in the in the marketing material it specifically states in the contract that it is not included in the purchase price unless you actually write it in the contract so make sure you check this box if they want the stove make sure that you check this box if they want the fridge make sure you check this box if you want the washer/dryer and then including all additional items if there's anything else like sometimes that will have the backyard jungle gyms or the you know those types of things make sure that you include that in the offer itself same thing with items excluded from the sale if you want to make sure some things are removed you would specifically address that in here closing in possession this means when the buyer gets keys and gets access to the property now by default by default is 6:00 p.m. on the date of the close of escrow so make sure your client knows that that by default it is 6:00 p.m. on the date of the close of escrow sometimes you'll you'll hear on a vacant house hey congrats you've closed escrow and it's 10:00 a.m. and then all of a sudden the buyers already trying to move their stuff in technically the seller has until 6:00 p.m. that day to be able to get all of their belongings out now they'll tell you empower curve and I will also address it here whenever there's a seller occupied property it's generally considered again air quotes customary or standard or good common courtesy to give them three calendar days after the close of escrow just to provide them an ease of moving and also prevent problems where your clients are coming in with the keys in the front door and they're still stacking their boxes in the living room it's good common courtesy to do that and you know it's really helpful for the whole ending of the transaction where things can get heated and all that fun stuff you also do have the ability to let the seller stay in the home for a couple times so if we are you can do it up to 30 days with a simple form called si P or if you're doing more than 30 days you have to use a whole it's like a residential lease back after sale form it's good common practice to include that especially if you're giving them those three days to make sure that they still keep up their insurance and all of those types of things is to protect your buyer if you're representing the buyer but one thing to note is checking with the lender to make sure if they're renting it back for say like two months or so some lenders will consider that no longer being a principal residence they'll actually call it an investment property at that point and they would not qualify for the same type of a loan so check with your lender if you're gonna be doing something like that if it's a tenant occupied property let me know and then I'll help kind of clarify this whole thing but that can be a complicated situation at times a whole bunch of fun stuff that they're gonna go over power curve paragraph ten talking about all the disclosures for the sake of this video I don't want to go into that too much one thing I will say paragraph 11 talks about the condition of the property a lot of new agents and most buyers aren't aware of this but according to the contract every single property is sold in it's as is present physical condition as of the date of acceptance so clients will oftentimes say hey is this property sold as is technically every home in California that uses the California Association of Realtors car our PA forms yes however it is subject to the buyers investigation rights so you still have the ability to inspect the home and even to request repairs are made however it says that the home is sold as is in its present physical condition so something to note is every home is technically sold in it's as is condition this talks about the buyers investigation talks about matters affecting the property this is a very vague term but it's spelled out in here so this is just illustrating that the buyers acceptance of the condition of and any matters affecting the property is a contingency of this agreement as specified in paragraph 14 B 14 B's my personal favorite paragraph in here it is also one of the longest paragraphs it's an entire page it's actually the next page I did an entire video on paragraph 14 so I won't be spending too much time on this during this video but I will at least give you some summarized points but definitely is important to watch that video because it is a very very very important paragraph long story short but it is sold as is subject to the buyers investigation rights and the buyers investigation rights and acceptance of the condition thereof is a contingency of this agreement so again there's really three main contingencies for a buyer there are multiple but there's really three main ones number one is the buyers investigation of the property or commonly referred to as the inspection contingency the second one is the appraisal contingency does the home appraised for the contract price and the third one is the loan contingency within 21 days does the buyer formally become approved for the loan in here going into paragraph 14 again that you can see there's a lot of highlighting because this is my favorite one but I'll briefly go over this and save you the the headache of the entirety for a different video where I went into it in depth basically this goes over time periods removal of contingencies and cancellation rights pretty big deal which is why it's a very big paragraph but also my favorite going into just a bullet point summary form the seller has 17 days to give you all the disclosures and tell you everything they know about the property short way to know that so they have a week to give you everything they know about the home the buyer has 17 days after acceptance to review all of these reports and disclosures given by them investigate and inspect everything about the property and the big loophole / vague term which is approve all matters affecting the property very vague but very important because that is the big safety valve to back out of the transaction for a buyer is if things are not up to what their quote-unquote standards or conditions or whatever you want to call it within that time specified which by default is 17 days that the buyer may request that the seller make repairs with what's called a request for repair now very important is that buhbuh buhbuh buhbuh let's see where it what actually says that by the end of time specified work because it says somewhere in here hold on a second that the seller doesn't even have to respond to that I don't know why I'm blanking because I'm doing a video I'm a little bit nervous I apologies for that oh there it is it's literally the next sentence seller has no obligation to agree to or even to respond to the buyers request that's a very important part to remember is that they don't even have to respond to that because if we go back up to the top every home in California is sold in its present physical as is condition but subject to the buyers investigation right so again every home is sold as is but it's contingent upon the sell upon the buyers ability to inspect they have for us are they have 17 days to inspect that property and to request that the seller make repairs of which the seller has no obligation to agree or to respond but because of that the set the buyer okay if they don't let's just say that real world case scenario they do an inspection they find out they're some things wrong with it they make a request for repair the seller says no okay at which time do they have the ability to cancel this agreement based upon that contingency because what it says here is after seven 17 days after acceptance otherwise agreed to in writing to complete all buyer Investigations review all disclosures reports and from which they get from the seller aka everything they received up here and approve all matters affecting the property and deliver all of those back to the seller basically they sign the copies and say that they approve a bit okay so what they can do is they make those they make that request for repair the seller either agrees or doesn't agree and at that point the buyer shall deliver to a seller a removal of this can engine C or a cancellation so they can say hey look you didn't agree to our repairs so either we're just gonna move forward with it because we you can either you can do you have one of three options basically you can either accept the condition and move forward because every home is sold in its present physical as is condition you can cancel and it explicitly states in here that they can cancel because it says it right here or you can try to negotiate right so you can say hey we will cancel if you don't agree to at least something so what would the seller prefer to do would they rather put their home back on the market and try to get another buyer to pay the same price closed on our same time frame or do they want to help us out with some of this if that makes sense so those are the types of things now a big question that a lot of buyers agents have and a lot of buyers have is what happens after that 17 days big paragraph big portion here continuation of contingency it says even after the end of time specified in 14 b1 and before seller cancels if at all the buyer retains the right in writing to either remove the remaining contingencies or what I've already highlighted cancel this agreement based upon the remaining contingency so interesting way to think about it the buyer has 17 days to do all their inspections and to make whatever request for repairs and if they don't get what they want from that request of the repair they should or what it says in the contract to remove the applicable contingency or cancel however even after the time specified in 14 B 117 days this buyer retains the right to cancel this agreement what that means is that this is what's called an active contingency that means that even after the end of time you still have to formally remove it in writing in order for it to be removed a passive contingency would mean on day 18 that ability is gone so a lot of listing agents don't even really read the contract to know that the buyer retains the right to still cancel this agreement so just know that in order to protect your buyer client they still have after this time frame to cancel because their retain the right to but again we want to hold our end of the bargain up as best as we can just to be shown that we're proceeding in good faith but at least it's important to remember that we are protecting our client and they are still protected after this timeframe because of the way this is written what this is now considered an active contingency in here the seller does have an ability to cancel this agreement there's only two ways that they can cancel this agreement it says seller right to cancel because of buyer contingencies if by the time specified in the agreement the buyer does not deliver to a seller a removal of the applicable contingency or cancellation then the seller after delivery notice about to perform may cancel this agreement so let's just say it's 17 days you don't remove it the seller can formally request that you do it by sending you what's called a notice to buyer to perform which again is an actual form that they have to supply you with and after that if you don't do the activity they may cancel this agreement that being said in such an event the seller shall authorize that the return of buyers deposit except for fees incurred by the buyer so even if you don't do what you say you're gonna do the seller says hey do what you say you're gonna do in that form and you don't they cancel the buyer still gets their deposit back per the contract that's very important sell a right to cancel based upon buyer contract obligations aka you didn't say what you were gonna do you didn't do what you say they're gonna do very common is the initial deposit that's the most common thing that happens the second most common thing is that they don't close escrow on the date that they're supposed to most of the time you're going to get notices to perform based upon contingencies or this one is really gonna be the initial deposit and the closing festro which is actually technically a different form but that's a whole different topic in here same thing though after buh-buh-buh after delivering a notice to buyer to perform they may cancel this agreement but again it says in such an event seller shall authorize the return of buyers deposit except for fees incurred by buyer which is very minimal they have to pre sign saying that they understand that those are fees most of the time it's escrow fees or title fees but most decent escrow and title companies do not charge those so then what the heck is a notice to buyer to perform a notice to buyer to perform is a formal form and it has to be in writing signed by the seller most of the time but if it's a notice to seller to perform it's by a buyer or a seller and give the party at least two days after delivered to perform the action so again something to keep in mind is that it gives you two more days to do it and it has to be in writing and signed by the seller in there now again effective cancellation on deposits talking about who gets what and all of that if buyer and seller gives written notice of cancellation pursuant to the rights duly exercised under the terms of the agreement the parties agree to sign mutual instructions to cancel the sale and escrow and release deposits if any to the party entitled to the funds less fees and cost incurred by that again if you're getting into a situation of cancellation call me I don't want to have this be a huge a huge video which it already is but it's something - this is a very big topic but I want to at least inform you or make you aware of what this is the next one is the final verification of property condition aka the final walkthrough this is really the last piece of the puzzle usually done around the time of loan document signing but what this is is the buyer shall have the right to make a final verification of the property aka walk through it one more time within five days prior to the close of escrow very important it's not a contingency of the sale but solely to confirm that number one the property is maintained pursuant to paragraph 11 aka it's still in the same condition as before the repairs have been completed as agreed so let's just say you do your request for repair hey I want you to fix a B and C and they agree to that this is the time that you go back in there and verify that they have repaired a B and C and then we'll talk about the next paragraph talks about how you can do that and that the seller has complied with sellers other obligations making sure that they you know take care of all the things that they have to take care of repairs repairs shall be completed so if you do agree to repairs they should be or they are they shall be completed prior to the final verification of condition unless otherwise agreed to in writing those repairs to be performed at sellers expense may be performed by seller or through others provided that the work complies with applicable law including permits and all that stuff so if you want a licensed and bonded plumber to fix a plumbing issue make sure you put that in the request for repairs saying X problem to be corrected by a licensed and bonded plumber you know because technically as it's written in the contract repairs can even be made by the seller as long as the work complies with applicable law with permitting and you know all that stuff that's required so if they shall be done in a good and skillful manner with materials of quality and appearance comparable to the existing thing so again they can't just Mickey Mouse it through it has to be in a good skillful manner but the seller can do it themselves in there but when you do the final walkthrough the sellers shall obtain invoices and paid receipts for repairs performed by the others prepare a written statement indicating the report the repairs performed by the seller and the date of such repairs and provide copies of invoices to the buyer at the final so that is something that is per the contract provided at that final walkthrough so a lot of buyer clients may have a little bit of apprehension about the repairs because technically part of the request for repair says that the repairs are to be performed in the the repair agreement is subject to the buyers removing their inspection contingency or their cancellation right under the condition some buyers feel concerned by saying hey I don't want to remove my contingency until I know that those repairs are done technically that's not how it's written in the contract however they're protected by the fact that it is mandated on how those repairs are completed and what evidence is supplied to them as a buyer client and they will get those when during the final verification of the property condition which is within five days prior to the close of escrow there is a ton of other stuff that is in this contract including the remedies for buyer breach of contract and liquidated damages I'm not going to go into that right now I have again a whole nother video based upon that and they go into this in power curve as well one of the things that I do want to highlight is not a lot of people talk about is the definitions whenever you want to know what a day is or days after or whatever it's written in here it seems kind of simplistic but trust me when it comes down to contingency removal dates and dates of performance this one becomes very important that it lets you know what the definition of days after means so that's pretty important there again there's tons of this stuff that is involved in here this is ten pages of a legally binding contract however I wanted to at least introduce you to it one of the things that was taught to me very early on and it really helped me feel more comfortable with dealing with clientele is that whenever a client especially a buyer client where any any client but I'm using this in the context of working with a buyer whenever a buyer client asks you a question is hey when do I have to bring in the initial deposit hey when do we have to do our final walkthrough what was taught to me very early on was always speak in terms of the contract don't ever say well this is how it's usually done it's it doesn't matter what you think it doesn't matter of what has usually been done it's what's in writing that prevails and always speak in terms of the contract so whenever possible learn the paragraph numbers and the letters and all of that that way you make the client feel more comfortable when you give them an answer for example when they ask you a question about the initial deposit hey when do I need to bring those in you can very easily go to them and say hey per paragraph 3a in the contract the initial deposit has to be brought in by electronic funds transfer within three business days after acceptance rather than saying you know usually you try to bring it in as early as possible and it's usually done within three days no it's per the contract and per paragraph 3a it states that the buyer shall deliver the deposit directly into the escrow holder by electronic funds transfer within three business days after acceptance right same thing with hey when do we need to move our inspection contingency right well per paragraph 14 B one per paragraph 14 b1 you have 17 days after acceptance to remove that in writing however based upon the continuation of contingency clause even after that time you still retain the right to cancel this agreement aka it's still written as you can which means you're able to / the contract so again the more you know about this the more you will have confidence but also sometimes even more importantly the buyer will have confidence in you the more you can speak to the contract the more dialogue or phrasing that you use that's congruent to the contract the more professional you will sound but also the less stress you'll put on yourself by having to quote unquote know what goes on in exactly what timeframes read the contract this is 10 pages again of a legally binding contract go over this if you need to watch this video a number of times do it this is the most important document in the entirety of our business because the entire escrow is built on this if you look at the very top this is the California residential purchase agreement and joint escrow instructions this is what instructs escrow on how the escrow is to be performed so it doesn't matter what a client or an agent thinks is the right way to do it or what they say is well the last time we did it this is what happened it's what's in this agreement is that what prevails so if you have any questions go back to the contract first read it and say what does the contract say but if you have any other questions you want help interpreting what it means I'm always available again this was an introduction to the contract you will get a full fire hose of information at power curve but I wanted to at least introduce you to it I'm Jacob Lawler I'm committed to your success

Show moreFrequently asked questions

How can I eSign a contract?

How do I create and add an electronic signature in iWork?

How do you ask people to sign PDF documents?

Get more for initial Car Purchase Agreement Template made easy

- Print signature service Free Florida Room Rental Agreement

- Prove electronically signing Technical Services Consulting Agreement Template

- Endorse digi-sign Franchise Agreement

- Authorize digital sign Detailed Medical Consent

- Anneal signatory Bill of Sale

- Justify eSignature HTML5 App & Website Proposal

- Try initial Deed of Trust Template

- Add Retirement Agreement eSignature

- Send Venture Capital Proposal Template autograph

- Fax Volunteer Confidentiality Agreement digital sign

- Seal Training Evaluation Survey signed electronically

- Password Director Designation Agreement electronically sign

- Pass Statement of Work Template countersignature

- Renew Rental Inspection Checklist mark

- Test Appointment Confirmation Letter signed

- Require Travel Agency Agreement Template digi-sign

- Comment inheritor email signature

- Boost visitor signature

- Compel trustee initial

- Void Freelance Graphic Design Contract Template template digisign

- Adopt license template electronic signature

- Vouch School Itinerary template signed electronically

- Establish Free Raffle Ticket template sign

- Clear Software Maintenance Agreement Template template electronically signing

- Complete Concert Press Release template mark

- Force Limousine Service Contract Template template eSign

- Permit Pet Health Record template eSignature

- Customize Agile Software Development Contract Template template autograph