Initials Hotel Receipt Made Easy

Do more online with a globally-trusted eSignature platform

Outstanding signing experience

Robust reporting and analytics

Mobile eSigning in person and remotely

Industry regulations and conformity

Initials hotel receipt, faster than ever

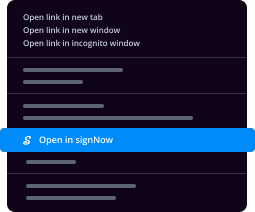

Helpful eSignature add-ons

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

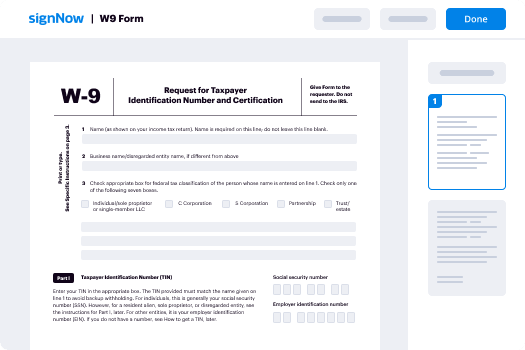

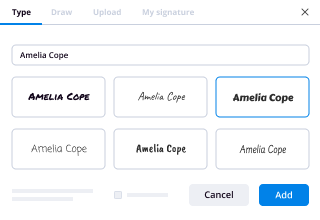

Your step-by-step guide — initials hotel receipt

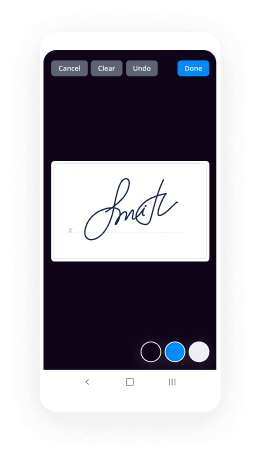

Adopting airSlate SignNow’s eSignature any organization can speed up signature workflows and eSign in real-time, giving a better experience to consumers and workers. Use initials Hotel Receipt in a couple of easy steps. Our handheld mobile apps make operating on the go possible, even while off-line! eSign documents from any place worldwide and close trades in no time.

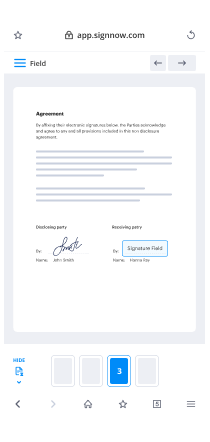

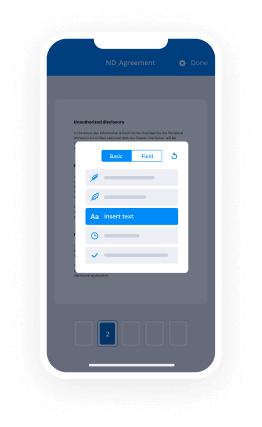

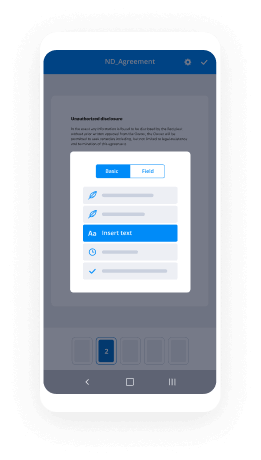

Follow the step-by-step guideline for using initials Hotel Receipt:

- Sign in to your airSlate SignNow account.

- Locate your document in your folders or import a new one.

- Open the template and make edits using the Tools list.

- Drop fillable areas, add text and sign it.

- Include numerous signers by emails and set up the signing order.

- Choose which recipients will get an signed copy.

- Use Advanced Options to restrict access to the document add an expiration date.

- Click Save and Close when done.

Moreover, there are more advanced tools available for initials Hotel Receipt. Add users to your shared workspace, browse teams, and keep track of teamwork. Numerous people all over the US and Europe concur that a solution that brings everything together in one cohesive digital location, is the thing that organizations need to keep workflows working smoothly. The airSlate SignNow REST API enables you to integrate eSignatures into your app, internet site, CRM or cloud. Check out airSlate SignNow and get faster, smoother and overall more productive eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results initials Hotel Receipt made easy

Get legally-binding signatures now!

FAQs

-

How do I get a receipt from a hotel?

Go to Find your bookings. Enter the last name of the card holder and your credit / debit card number or itinerary / confirmation number, and select Submit. Select View your reservation. Select View and print receipt. Follow the instructions. -

What is full form Hotel?

#Full #Form #of #Hotel. What is full form of \u2013 HOTEL , CDP , DCDP \u2026.. ? HOTEL \u2013 Hospitality Organization Tourism ENJOY Life. -

How do I download my booking confirmation?

Suggested clip How to download your Booking Confirmation - YouTubeYouTubeStart of suggested clipEnd of suggested clip How to download your Booking Confirmation - YouTube -

What does single use hotel mean?

This is a common practice in hotels, they define different prices in a double room depending on whether one person or two persons are going. If one person is going, a single supplement is applied. ... Single room \u2013 specific room type. Double room single use \u2013 specific price for a double room when one person is using it. -

How do I find my Hilton Honors username?

Click on the "Forgot your Login ID?" link below the "Login ID" and "Password" fields and follow the directions to retrieve your Login ID, starting with entering the email address associated with your Hilton Honors Dining account. -

Do hotels have single rooms?

In some countries, hotels offer single rooms. While these rooms tend to be tiny, they are less expensive than a traditional double room. Be sure to reserve your single room early, especially if you plan to travel during peak season. -

Can you just leave a hotel without checking out?

Many hotels now can simply email you a copy of the bill as well. ... If your hotel doesn't offer an express checkout scheme, I would find it rude to leave without checking out, yes. They need to know when you're out of the room for housekeeping purposes. -

What is the meaning of lodging accommodation?

Lodging refers to the renting of a short-term dwelling. ... Lodging is offered by an owner of real property or a leasehold estate, including the hotel industry, hospitality industry, real estate investment trusts, and owner-occupancy houses. Lodging can be facilitated by an intermediary such as a travel website. -

How do I find my booking on Expedia?

If you booked a trip on the Expedia website through your Expedia account, you can view your upcoming itinerary by signing in to the app. To sign in and view your trips: On the Expedia Home screen, tap Trips. Tap Sign in with Expedia. -

What does GTD mean on a BEO?

GTD. Guaranteed. Prior to a function, the figure given by a meeting planner to the property for the number of persons to be served. -

How do I get a Marriott receipt?

The receipt is available under your account details when a stay posts to your account. There should be a download link next to the stay. Unfortunately that sometimes does not work and you have to call the hotel directly for it to be emailed to you. -

What is a prepaid hotel voucher?

Voucher is a 'coupon' given to a guest for a specific prepaid service (accommodation in a hotel) handheld out by a travel agency. As a form of a 'receipt' the traveler can then claim the service he paid for. ... This voucher is then to be presented to the hotel at the time of check in. -

How can I get a copy of my Marriott hotel bill?

Click on the \u201c+\u201d sign next to the date of the hotel stay to expand the listing. Under the Description column, select \u201cView Hotel Bill\u201d from the menu to open a PDF version of your statement. If your hotel bill cannot be displayed, use the \u201cRequest Hotel Bill\u201d link to contact the hotel directly for a copy. -

What does ph stand for on social media?

The Meaning of PH PH means "Pantyhose" So now you know - PH means "Pantyhose" - don't thank us. YW! -

Can you fake a receipt?

Receipt Maker is a receipt generator Android app to create fake receipts quickly. You can even send PDF receipts. With the free version you can generate fake receipts easily and this app even has the premium version which allows you to add company logo, auto-sync to Dropbox/Google drive, etc options.

What active users are saying — initials hotel receipt

Related searches to initials Hotel Receipt made easy

Initials hotel receipt

you hi I'm Paul Arrington and I am one of the consultants with the Florida Small Business Development Center Network and what I'm going to talk about now is the various legal structures and requirements that you need to look at and start your business and I always enjoy talking about the various legal structures and the reason why I like talking about them is because whenever somebody develops your business plan but I usually see is that you know they'll think about their marketing strategy they'll think about who is the number of employees that they need they'll think about you know the level of sales that they need to have and they'll think very hard about you know how to go out there and and and and really fill a niche that their competition is not it's not in but one of the things that they kind of take it for granted at the very end is well I'll just you know put this all into a LLC or I'll just start an S corp without really that much thought as to what is the best legal structure for their business and sometimes the reason why I found that people come to that conclusion is because their friends started their business and they started as an LLC or a relative started a business and he started it and they've been going on for successfully for a year for years as an escort without really thinking about how what they're doing might be a little bit different than the model that they're basing their decision on so I'm going to talk about what those various legal structures are but some of the advantages and disadvantages are of those various structures and how some of them may uniquely fit or be very suitable for what for the type of business that you want to enter into and the thing that you really want to think about in terms in terms of this is that one is that one type of structure is not as I was saying earlier suitable for everybody but the other thing that you want to think about is that in general that you want to make sure that you are are in position to control the operation of the business but you don't necessarily want to be personally the owner of anything in the business because one I'm going to talk in a few minutes about questions of liability questions if somebody wants to have recourse against you or some of the assets of the business and it's and in most cases I have found is beneficial to have a legal structure where the business itself is something separate then the owners of the business but let's start out with a legal structure which in which there is a complete similarity between the owner and a business is that sole proprietorship and then we're going to talk about general or limited partnerships on the differences between C or and S corporations and then limited liability companies so starting at and and some of the things that are going to be important in your in your considerations are and selecting which one of those entities would be the best or the number of owners and really is if it goes beyond even looking at the number of owners but you also want to think about what each of the owners is actually bringing into the business because to me that can really strongly impact the legal structure that you're going to ultimately decide for the business you want to look at various exposures and liability where they exist and where they may not and then also some of the differences that in selecting legal structures is based upon how the tax treatment is for that legal structure so looking at sole proprietorship so if you started a business it's only you you're operating already you oftentimes people are selling items say on eBay or so forth they own rental property they are they have some other type of online sales or whatever it is that you're starting and you don't and you have not selected and any other formalized legal structure for the business well then you're already operating as a sole proprietorship and that is probably one of the easiest and in fact is the easiest form to to set up and because all you have to do is start your business and you've already sorted there's no real requirement beach with regards to any type of fouling on a state level and it's a very easy and very convenient way to start a business I personally and I do have a legal background I personally am NOT I'm not too enthusiastic about any business operating as a sole proprietorship although there are some in which the risk is low enough that it's in that it's okay for you to do that but basically the rules and requirements a sole proprietorship is one owner one of the negative sides is that there's unlimited liability so what that means is that if something happens in the course of the business and somebody is not happy about it well then if they bring an action or if they look for recourse well then not only are the business assets subject to be seized or taken or expose but then that all of the other assets that are owned by that business owner are actually are also subject to be seized so to me that probably is not the best of all scenarios it was for for a business operating but some do buy some do operate that way in fact I recall from several years ago a hotel that was actually operated as a sole proprietorship but you can imagine all the different types of exposure and liability that could happen you can come up at any given time in a hotel now if somebody is operating a business as a sole proprietorship well then there are ways to protect oneself and to protect one's personal assets and probably the biggest and easiest way to do that is make sure that you have proper a proper level of insurance so if anything does happen with regards to the property or the business well then there is that insurance vehicle which hopefully will kick in and that and you'll be covered but think about it but but think about a sole proprietorship in terms of not only are you operating in the business but if you have a sole proprietor you have employees let's say an employee is out there in the course of business they're driving the vehicle then and the vehicle has your the business names on the side of it they're going from one job to another and there's an accident as since the business is owned as a sole proprietorship you very highly potentially would be open up to exposure so it's not necessarily is in my mind the best type of structure for just about anybody who's in business unless like purely home-based and there's very low liability and you're doing consulting or something like that for taxation purposes well then the business income basically is your income you know at the end of the day you can take that money that whatever profits the business makes and put it in your pocket and and the business income and losses are reported on the owners 1040 as as Schedule C expenses so so it's the easiest way to operate a business it has a lot of exposure potential there for the owner and I would not personally recommend it the next level of business is general partnership and what I see in many cases whenever clients come in to meet with me is that if it's more than one person they're out there they're engaged in activities and I ask them well what type of little structure that you have and they say well no we're just operating our business well if there's if there's more than one person operating that business and there's no other legal structure that has been decided upon among among them well then they are by default automatically operating as a general partnership it does not require any type of agreement for it to have come into existence and the way that I look at general partnerships is that it's those negative things that I was talking about as far as sole proprietorships they are even worse when you look at it as a general partnership because one you still have that you still have that similarity between the owners and the business but on top of that any decisions that are made by any of the partners becomes on any of the any of the other partners are liable for as well even if the partners agreed to the contrary so let's say regarding particular matter so let's say that there are two partners they meet they decide that they are not going to buy a certain pallet of inventory and then one of the partners goes out and buys it well then and buys it in the capacity of the partnership well then that automatically will then bring in the other partner to be liable for that as well so again general partnerships in my mind are not probably the best is not probably the best legal structure to operate your business in I will say the profits are taxed at the partner level and if you do have a journal partnership well then I strongly recommend that you that you enter into a written partnership agreement because now that will not protect you against any claims from outside parties is something that you're poor that a partner has made an agreement our commitment apartment partner has made you will be liable for but at least between the parties well then you can have recourse against that other partner if they do something outside of what your what your agreement and understanding is so moving on up to another level of business structure then is years and years ago probably about 150 200 or more years ago though the concepts of a limited partnership came up because everybody saw what the inherent problems are in operating as a sole proprietorship or operating as a journal partners as a general partnership so the concept of limited partnership basically is that you have at least one party that serves as a general partner they have full exposure to to anything that's going on in the business any types of liabilities and so forth but then you could bring on a number of limited partners limited partners in business as well and basically the limited partners you could say they when you think about the concept of silent investors really that is the limited partnership model so individuals can come in invest money into the business enterprise and in exchange for the limitation on liability where they're only exposed if the business goes down to the extent of their investment then they agree that they will have no no say in the business decisions of of the business so so they're limited in it so if I were a limited partner and I invested $50,000 as a limited partner in the business well then I stand to lose that $50,000 if things were to go bad but I do but I would not have a say in to how the bit that ended in the direction of the business so it can be it can be a convenient vehicle in some cases where I have seen where it is work sometimes is if say parents are the general partner and then maybe they're trying to to kind of transition some of the ownership interests to children but they don't want those children to have a say in the way that the business is operating yet and so they reach a certain age well then the limited partnership vehicle may be good and that's hype a scenario limited partnerships in the state of Florida that that's that particularly achill is the most expensive vehicle to register it costs a thousand dollars to register as a limited partnership and does require a written partnership agreement but the profits are taxed at the partner level so because of all those inherent problems and issues I'm going to move now to a legal structure in which now we have completely moved to where there's going to be a separate legal structure that's and that's that's the business that is something that's that is other than the business owners themselves and that is a c-corporation so if you go to register corporation in the state of Florida you go to son biz or Gore you already do it through your attorney and use and you establish a corporation and you do nothing more but establish that corporation well then you are then you've created what's called AC corporation and one good thing about that is that now as I was saying earlier you have a separate entity that is the business that is entirely separate from the individuals who owned business so that could be an advantage and because there is that distinction between the two well then the owners are only exposed to limited liability so anything is going on in the course of the business any types of obligations that the business enters into those are the business's obligations as long as the individuals that own the business stick to and really ascribe to the legal structure so every time you answer in the business interests into agreement you want to have down at the end of the agreement you know XYZ corporation of where the name of the business is by and assigned by whoever the owner is who signing it in their capacity so you want to be very careful to make sure that that corporate structure is recognized and honored in everything that you do the one negative is the major negative of a C corporation is that a C corporation is subjective what they call double taxation so what that means is that as the business makes a profit well then that profit that a business makes is taxable but then that profit is also the basis of distributions to the owners and when it falls into the hands of the owners well then that becomes personal income that is taxable as well so that is not necessarily a desirable outcome C corporations do serve a good purpose in certain circumstances however depending upon you know a lot of it has to do with taxation purposes lot of it has to do with what the future direction of the business is going to be if you know if you're looking at bringing in possibly venture capital a C corporation might be an appropriate vehicle or might not be if you're talking about doing it independently if you're doing a public offering at some point c-corporation might be a good vehicle or might not be in this particular stage of the business startup so you want to think about those things but what is going to be important is that in establishing the business you need to start it up by filing with the Secretary of State article ISM incorporation and what I would recommend is also although this is not a writ state requirement developing bylaws as well because those bylaws set the rules the governing rules between the parties as to how they're going to operate their business now because of the limitations in the and and in particular the the double tax a double taxation of inherit in a C corporation well then there are things such as call that are called S corporation so once that C corporation is formed then what you want to do in order to establish an S corporation is to file for S corporation status S stands for chapter s I believe of the Internal Revenue Code and so that's basic to avoid that whole problem of double taxation nobody wants to pay taxes twice on the same money so again you can have one or more owner of an S corporation the same limited liability as you have of a c-corporation as a separate entity from the individuals and and for income tax purposes the corporation pays no tax but as the as as as the owners are issued a dividend well then that becomes personal income to them and it was subject it would be subject to personal taxation for any corporation what I RS does not want is that eventually once the corporation has become successful they don't want that the owners to only take distributions because those distributions are as such are not subject to the personal income tax well I'm sorry or not or not subject to payroll taxes whereas if if it if an owner is actively working within the business well then they should also then take a reasonable salary IRS anticipates and then that reasonable salary is subject to payroll taxes there are annual following requirements with an s-corporation it's very important to make sure that you that you stay on top of those I know many businesses that miss their annual filing and in addition to the 150 or so dollars that is that that are required to be paid with the annual filing well then currently within the state of Florida there's an additional $400 penalty for missing for for not filing in time so those are things you just have to watch out for so now I want to talk about LLC's and in a way I'm going to talk about some major distinctions between an LLC and a corporation things you might want to consider as far as more of a from an operational standpoint but you know in general the LLC's you could have one or more owner again you have is another one of those entities where you have limited liability because it's a separate legal it's a legal entity that's separate from the owners and amazingly enough even though LLC's have been around now for several decades IRS has not really come up with a unique way of tracking them or treating them for tax purposes so basically you can choose with an LLC how you want to be treated on for on on a federal or IRS purpose so you can choose to be treated as a sole proprietorship you can be treated you can choose be treated as a partnership or as an S corp or as a c-corp many people that I know if is if it's owned by if it's owned by more than one person well then they will they will look at it being treated the same as as a subject or S corporation but the big distinction that I find these are this is something that you may want to consider well I hear so many people when they want to sort of business the rave now is I on MacAvoy start as a LLC and there's not necessarily anything wrong with that but I think that the big distinction between an LLC and a corporation is that there is much more flexibility in how you can address the profits of the business and and losses with regards to how the individual owners are going to be treated in that regard so in a corporation let's say that it's a three member corporation each member owns a third of the business you know 33 33 33 % well then then by default then the each owner is entitled as far as the prophets or the losses of the business to the same percentage as their percentage ownership so you own a 33 3333 whether you're entitled to profits that are distributed 33 33 33 % with an LLC there's a little bit more flexibility and this could be very advantageous and let me give an example let's say that I'm going to business with two other individuals and we want to start a restaurant and one of the one of the one two three of us they that person has a lot of restaurant management experience so they would be responsible for really managing the restaurant but they don't really have any type of cash or anything like that and then another one of the individuals they are the chef so they you know so so it's going to be a place it's going to that the chef is going to be operating and the chef will have ownership interest in this enterprise and then I come in and I'm not good at managing the business I'm certainly not going to be back in the kitchen as a chef but I am bringing in a ton of money to get the business going or I'm going to be bringing in real estate that's necessary for the business to be located at so among the parties when an LLC allows because you can see that each one of us is bringing something different into the business our contributions are very different in nature so when an LLC allows is a certain amount of flexibility by agreement among the parties as to then who would be under what circumstances and under what period of times entitled to what percentage of profits so we're coming in we own it 33 percent 33 percent and 33 percent but I might decide I might advocate that well since I'm bringing in all the money well then I think that for the first two years that I should be bringing that I should be entitled to 45 percent of the profits are some or the chef might say well this is going to operate without me back there cooking I think that I'm going to be entitled to you know a larger percentage of profits but whatever it is that the parties agreed to well then you the arm the LLC structure allows a little bit more flexibility we took we looked at in the corporation's you have the Articles of Incorporation and then the bylaws with the LLC you have articles of organization and the operating agreement and I and again the articles of organization are required to be filed with the Secretary of State the operating agreement is not but with the LLC I strongly encourage the business owners as the business is being formed to develop and put in place and agree to and sign a very well-thought-out very well structured operating agreement I will say that of the businesses that I have consulting experience with that have that launched a business and do not have an operating operating agreement in place is almost like clockwork about 18 months into the operation of the business it almost invariably happens that disagreements arise what do you mean that you know you've made this decision and so forth you know I thought that I was going to get a higher percentage of brief return on the business all those types of things arise around that time but if they're all agreed to upfront and everybody you know understands how the business going to operate who has authority to make decisions who has authority to make the day-to-day decisions and where the long term or the or the large decisions making lies all long as everything's worked out well then fine and if it's an N and if it is a multi owner LLC I also tend to encourage them to have that operating agreement actually developed by an attorney don't just download some form and sign it because you want to have an agreement that's in place that really is unique to your business so now I'm going to turn our attention to some other legal issues that arise on some fairly frequently and then some from time to time so as you start your business you found this great piece of property for the business be located out make sure that you have betted that business to make to address any type of zoning issues you don't want to start moving forward and making commitments on it on a piece of property and it turns out that it is not zoned for the type of operation that you want to engage in so I was very important for home-based businesses if you're going to start engaging in some activities in which is clear to the outside world that that that you're that you have activity that you have business activities going in going going on in there customers are coming in you know if they're parking it from the place all those things you where your residence is may or may not and probably is not zoned correctly for the types of activities that you're engaged in so you want to really look at those things business tax receipts depending upon the county in which you're located that may be a requirement and it might be an annual fee that you have to pay in order to to to the tax authority to the tax collector's office in your county to in order to have the bit in order to allow the business to operate used to be known as an occupational license now they call it business tax receipt but that may or may not apply the dependent depending upon what county you're in there are over 200 types of professions and other types of business structures that within the state of Florida that require special licensing cosmetologist funeral directors general contractors you know so so if you're in any of those types of businesses that require that require licensing and you probably know that from your experience well then you want to make sure that those things are in place and they are kept current if you're in a hole to hotel industry or restaurant industry or any business that handles food grocery stores and so forth well then you well then health permits becomes very important and then of course one of the overlooked areas I think for many small businesses is the value that they have in their intellectual property and that includes things that are on the website that may be something that they should protect by trademark things that inventions that they might have and then also copyrighted materials so I'm just going to go very briefly to just because there's sometimes confusion between those three terms trademarks patents and copyrights to really talk about what those distinctions are so a trademark in essence is some type of mark it has to do if your branding is might be something where you've come up with say a unique name or an a unique style or something and then you want the rest you want to protect your interests in that particular brand from the rest of the world so you so whenever you so whenever you display that and you want to do it regularly in order to protect it well then you want to you have to have the youyou've seen where they have like the initials TM under various things on websites and so forth or in writings that's where they're recognized where they want to protect their trademarks if it's registered with the US Patent Patent and Trademark Office well then that would be a registered trademark patents on the other hand have to do with inventions it's something that has been created so some of the tests the arm of something is patentable would be that it has been new in other words it has to be something that has not been had before our concept has not be patented before or is areas not out there in general use already and it certainly has be useful in that it really has been something that really works so you come up with something and it has to it hasn't work for the purpose that that's you intended it for to be so so really look at those types of items before you before you receive a patent and I strongly suggest that if you're going to be that that if you want to pursue a patent that you do so through an attorney and then the third concept is copyrights so copyrights we're looking at a work that is reduced down into some type of recorded or registered form so writing a book you can copyright the book because you're taking something that's written you're taking something and you reduce it down to writing recordings software the movies videos those are the types of things that can be copyrighted under the appropriate circumstances because because it's something that's been reduced down into a written or printed or recorded form so I wanted to go over those concepts again I think that as I was saying at the beginning that look that's that's the consideration of the appropriate legal structure unfortunately is undervalued by a number of people starting your business is something that I really think is worth you taking a second look at and making sure that that the legal structure that you select is the appropriate one and that the appropriate agreements are in place in order for all the owners of the business to get out of that business what they truly intend

Show moreFrequently asked questions

How can I eSign a contract?

How can I sign a PDF?

How can you have your customers eSign PDFs online?

Get more for initials Hotel Receipt made easy

- Autograph on laptop

- Prove electronically signing IT Services Proposal Template

- Endorse digi-sign Letter of Intent Template

- Authorize signature service Investment Agreement

- Anneal signatory Product Order

- Justify eSignature HIPAA Business Associate Agreement

- Try initial Marketing Research Proposal Template

- Add Rights Agreement mark

- Send Book Proposal Template signed

- Fax Simple Medical History digi-sign

- Seal Website Evaluation digital sign

- Password Equipment Lease initial

- Pass Event Photography Contract Template signature

- Renew Advance Directive countersignature

- Test Basketball League Registration Event digital signature

- Require Advertising Agreement Template electronically signed

- Comment patron signature service

- Boost vacationer signature block

- Compel man esign

- Void Business Requirements Document Template (BRD) template eSignature

- Adopt termination template autograph

- Vouch Invoice Template for Translation template digital sign

- Establish Musical Ticket template signed electronically

- Clear Salvage Agreement Template template electronically sign

- Complete Coronavirus Press Release template countersignature

- Force Construction Contract Template template electronically signing

- Permit Discount Voucher template mark

- Customize Freelance Video Editing Contract Template template signed