Redline Accounts Receivable Purchase Agreement with airSlate SignNow

Do more online with a globally-trusted eSignature platform

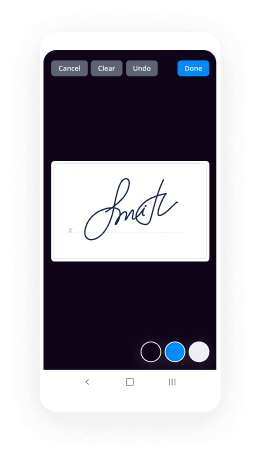

Standout signing experience

Robust reporting and analytics

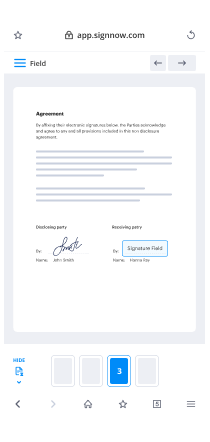

Mobile eSigning in person and remotely

Industry rules and compliance

Redline accounts receivable purchase agreement, faster than ever

Helpful eSignature add-ons

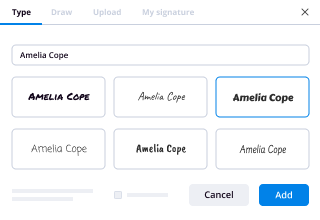

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

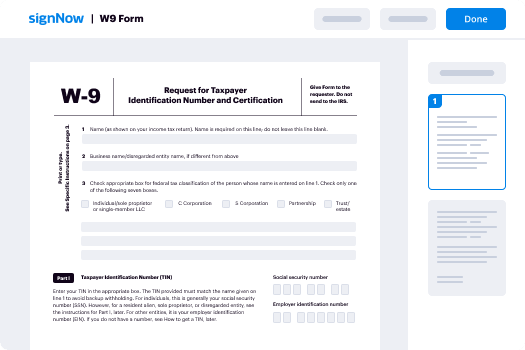

Your step-by-step guide — redline accounts receivable purchase agreement

Using airSlate SignNow’s eSignature any business can speed up signature workflows and sign online in real-time, giving a better experience to clients and workers. redline Accounts Receivable Purchase Agreement in a couple of simple steps. Our handheld mobile apps make operating on the run achievable, even while off-line! eSign documents from any place worldwide and make trades in less time.

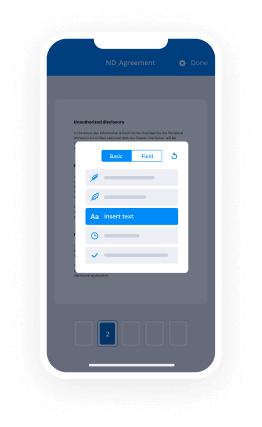

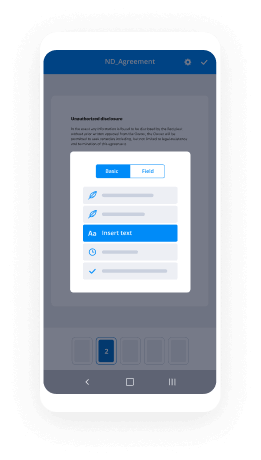

Follow the step-by-step instruction to redline Accounts Receivable Purchase Agreement:

- Sign in to your airSlate SignNow account.

- Locate your document within your folders or upload a new one.

- the template adjust using the Tools list.

- Drag & drop fillable areas, add textual content and sign it.

- Include numerous signees using their emails configure the signing order.

- Indicate which recipients will get an completed version.

- Use Advanced Options to restrict access to the record and set up an expiry date.

- Press Save and Close when done.

Furthermore, there are more extended tools open to redline Accounts Receivable Purchase Agreement. Include users to your common work enviroment, browse teams, and keep track of teamwork. Numerous consumers all over the US and Europe concur that a system that brings people together in one unified work area, is what organizations need to keep workflows working effortlessly. The airSlate SignNow REST API enables you to embed eSignatures into your application, website, CRM or cloud storage. Try out airSlate SignNow and get faster, easier and overall more effective eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results redline Accounts Receivable Purchase Agreement with airSlate SignNow

Get legally-binding signatures now!

FAQs

-

What is receivable purchase agreement?

Receivables purchase agreements allow a company to sell off the as-yet-unpaid bills from its customers, or "receivables." The agreement is a contract in which the seller gets cash upfront for the receivables, while the buyer gets the right to collect the receivables. -

What are future receivables?

Future Receivables means any of Seller's Receivables which are generated on or after the Initial Closing Date. -

What are accounts receivable examples?

An example of accounts receivable includes an electric company that bills its clients after the clients received the electricity. The electric company records an account receivable for unpaid invoices as it waits for its customers to pay their bills. -

What is an MCA contract?

An MCA is a business financing option that involves the advance of funds to a merchant, typically to assist the merchant in managing its short-term cash flow needs, in exchange for the sale of a specified percentage of the merchant's future receivables at a sizeable discount. -

What is the difference between factoring and accounts receivable financing?

The primary difference between factoring and bank financing with accounts receivables involves the ownership of the invoices. Factors actually buy your invoices at a discounted rate, while banks require you to pledge or assign the invoices as collateral for a loan. -

What happens when you default on a merchant cash advance?

One of the agreements in merchant cash advance is a personal guarantee. So, when you fail to pay back your loan, the lender has the full authority to take your finances. Besides, the acceleration clause, you will incur another lump sum that will be due if you default in your payment. -

What does it mean to finance receivables?

Definition. The term financing receivables is used to describe an arrangement whereby a business uses its receivables to gain immediate access to cash. Financing receivables usually fall into two broad categories, which involve either the sale of receivables or a secured loan. -

What is factoring accounts receivable?

Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable (i.e., invoices) to a third party (called a factor) at a discount. A business will sometimes factor its receivable assets to meet its present and immediate cash needs.

What active users are saying — redline accounts receivable purchase agreement

Redline accounts receivable purchase agreement

absolutely good afternoon yen thanks for the quick intro happy to be here my name is ole i'm being with qpr about four years now okay i'll do the presentation at the same time so i'll show my screen four years at qp are doing process mining all kinds of matters projects today i'm to discuss accounts payable especially the finance side of the purchasing process very happy to be here and discussing the points with yen and all of you so anytime you feel like asking something or having a question on your mind don't hesitate to ask directly and shoot it in the question box and ian or myself we will pick it up from there and try to respond to our best knowledge i've got here the webinar agenda so these quick introductions over here then we will go directly to the topic of accounts payable process the typical process variants over there but also the asses process that will be followed with these process mining topics a huge list of business benefits to be discussed and then we actually have a demo there on the product side to demonstrate these capabilities and then we sum it up all in all and have a formal q a session in the end so the rest of time will be spent there but we will pick some questions also meanwhile the discussion very good i don't see any questions coming in so i will go forward with the accounts variable process and now i would focus first of all the indirect purchasing side of it so let's call it something no raw materials but pencils consultancy maintenance for the plants etc anything that is not direct purchasing what is a typical process variant and execution for that one what are the different organizational units i've got your business purchasing and finance lined up and it typically comes with the purchase requisition from the finance side with followed approvals all those steps required raising the purchase order once there's a purchase order obviously purchasing department is responsible of that and will do all the required potential changes over there for the vendor information material master and so on then there is in parallel perhaps the goods received for those are either materials or the goods and services basically and then there's the invoice received typically by the finance department then there's the validation of that invoice whether it's a correct so there's po matching perhaps in place automated systems checking the quantities of the could receive peo and invoice and validating whether it can be paid immediately and there's the invoice payment obviously it's not this simple always that for example cools received it's by the business often and it might be lacking it might be partial there are multiple points that actually are coming up once the finance is tackling the matter and the invoice is received and the investigations of those matters that have been happening in the process before this are being discussed and opened and what are these different colors on the boxes they're actually a limited systems i tried to have a look here that there are often some shopping cart systems array by serum something that you raise those requirements purchase requisitions or what they're an approval flow then perhaps there's a erp backbone sap oracle such where you have the peos and the course receipts and then there is a invoice management system such vm or bus war to basically book the incoming invoice doing the ocr something optical character recognition from paper invoice to electronic format or invoice so it's quite a puzzle if we think about the accounts payable end to end and all these activities that take place before the actual uh payables and and these payments very well this is just the indirect side i want to address also the direct side so now we're talking about those raw materials to be consumed directly there the requirements often basically coming from the business or actually from the shop floor that there's a material resource planning on our mmr ps etc running and automatically raising those peos for the purchasing so basically it's their work to approve those maintain the frame agreements and the prices for the accurate vendors and manage the po site over there then the goods receipts are not done by the business but the warehouse so you have your warehouses incoming warehouse entrances and there's someone to book the pieces and quantities of the raw materials and then the finance is receiving the invoice checking once again the invoice validity hopefully it goes through without any challenges over there so then there's a goods receipt in place peo in place and the material data is matching it's very often that there is a challenge of organization having the material master data different to vendor and then it's difficult doing the matching over here and someone to do a bit of manual work before the invoice payment definitely these systems are not you know always like this it can be that there are different systems in place or only one system to follow up end to end from press mining perspective it doesn't make any ruling or change over there we can manage either data from one single system or various systems in a row okay but if this would be the really the perfect world only two simple variants and two different operational ways direct in direct in in reality what is really popular purchasing without the po or there's just late peo coming i i don't see this as a wanted way of operations in many places but it still happens so actually what happens is in uh finance department having the first in entry of this process actually that the purchase has been made outside of the system and the invoice is received by the finance hopefully there is some sort of reference to a person or some occasion or yet another peo in some different context but there is no po in place it's just the vendor invoice received and something for the finance to validate whether it can be paid or not so there's always a huge discussion between the departments and people or their business reaching for the business purchasing what is this one shall we pay that and potentially raising these peos as we call it then late peo that to to be able to process the invoice there is appeal being raised and it can be also done by the business obviously and then paid up towards there's the goods received needed by the business of the warehouse invoice approvals po approvals and just after that the invoice can be paid i would say po penetration rate that's a kpi that we will discuss later today together and with keep your tool he it wraps this whole topic pretty well that you can promote the organization's pu penetration rate try to mitigate and minimize this kind of operations that you have just invoices coming in and all the hassle starts from there and basically backwards doing process and and the compliance is definitely not maximized over here so this is and also the inverse validity order to the fulfill the whole picture but these are different variations ways or operations how is it in reality it's always like this so we can draw one design two designs five designs but eventually when we do the process mining model we end up with this spaghetti picture you can see there are tons of variants the accepted ways of operation but also deviations that take a numerous rework or hassle there that's not not definitely needed or wanted by the value-added point of view and this is the room for improvement the epi business process improvement but also challenging from automation point of view that the more there are different ways the the basically less high volume variance you've got for automation either it's a workflow or bots and obviously you can restrict your systems to avoid some scenarios happening at all actually i could now jump on the tool to quickly show you that one so i will go to peer tool opening a demo access opening accounts payable model and going to discovery this is the identical place that i to the print screen we've got here flow chart that's really interactive you can play with different activities add some more to see some price changes stock transfers approvals releases manual postings etc what's really beautiful to me i've got now basically the full operations including direct indirect wheat peel without beer they are all together here so to some extent this packet is acceptable but there's so much of non-acceptable matters so you can have a look on the case attributes with me there are different p accounts payable document types first of all this is sap data so on sap you have by default two types of accounts payables re and kr and these are corresponding for the ones that you have a pu happening and these don't really have a po so now that i would select something from the process for instance the po i then created those 16 000 cases that have this one i'm pretty sure they will mainly fall into this category let's have a look yes that was something i was imagining so that from all the cases i'm now looking at only the operations with the po and actually they actually come with this specific ap type repo purchasing i'll move this one a little bit [Music] and now the activity is updated so then the po approval rate is jumping there a little bit and the latter part of the process is totally changed to something that we would have without the pea so we have first these purchase requisitions happening then peos then we have the invoices coming in the ocr stuff dim side over here vendor invoice management and finally the ap document is created and it's something ready for payables and then it's paid just before the due date hopefully not late so there's the clearing happening right next to due date this is how to check we can also check the other variant of not having the po so let's go to the filters instead of including these cases based on this one i will exclude it there we go and we have the is it about 6 000 records yeah 6 300 that actually now start from the end just like on my powerpoint deck so we can see that you are starting with the vendor creating the invoice perhaps on monday and then four days later on average you receive the invoice and it's built to your vendor invoice management system then there's this hassle starting with oh manual postings discussing with business approvals and then you have the ap document created and you move further so it's it's really beautiful to me that from this spaghetti you can identify those different operational ways of doing the purchasing and then start doing the deep dive and analyzing the different cases perhaps looking at different countries you have there on your operations company goes doing checking the process for instance in sweden that oh how are their kpis how is the process working are there perhaps some best practices that we can follow up with and replicate in some perhaps bigger regions or bigger company goes otherwise words are looking at some deviations in either and reflecting from here this is the typical how should i call it free flow analysis or something that you go with the process discovery you amaze yourself and the rest of your organization with the actual process all those variants exploding the spaghetti even with this world trust that you want to see these variations and analyzing those there's huge stack of out of the box analysis is coming up with qpr you do filters you build those and save those that's very valuable and interesting what i'm going to discuss next on the powerpoint site is the basis benefits and what typically our customers gain from this exercise what what are the different views what are the typical analysis they would love to do you get most of it in the least time so basically time to value within the analytics side how it can be minimized in that use case we have this template gallery within the qp accounts payable application so there are yeah this is just a sample of that so over 10 maybe 20 dashboards already here to analyze the most typical and frequent kpis associated with accounts payable and you just click on those and go forward with the business benefits deployment of those for your organization and making sure that you actually retrieve the benefit from the targeted process improvement or initiative okay but before that we go before we go through those different templates dashboards have a look i will go quickly back to the powerpoint side and discuss some typical business benefits with you so what is this process mining specifically to accounts payable what have we seen over there first of all utilizing cash discounts why should we do this for me it's quite a no-brainer that suppliers are providing organizations a payment gym such as over here that there's a 60 days net there's a 100k invoice coming in you can pay a hundred thousand euros within the uh 60 days time period or then you can pay it with only 99 000 so one discount one percent each one percent discount within the 30 days or you can try to utilize the most of the cash discount by paying it within the 15 days from the invoice date and you will receive a three percent discount from the total value so obviously there are two levels on this one first of all you need to negotiate these terms with your vendors so and suppliers so it's a great matter a lot of work over there to have the nice payment terms in place so that's that you your organization is basically offered for those cash discounts but then the second layer of utilizing those and checking that how many percent is of the available gas discounts you are retrieving and if not full hundred percentage why not where could you improve what are the low hanging fruit is that you know what does the qpr dashboards propose you that where should you focus most perhaps is it the course received missing and therefore your organization is not capable of processing the invoice in 15 days but is taking 25 and you cannot pay with the three percent discount or perhaps there's a wrong payment term within the frame agreement or something that it's not maintained the data correct but this is very valuable straightforward immediate business benefits coming up and these are actually repeating so these are annual business benefits so not just you once fix it and then then you re one time business benefit but it's continuation and year to year business benefit that you can monitor with the qp dashboards another one duplicate payments this is something that you you definitely want to mitigate and minimize that well it feels silly that you would pay the similar invoice twice but it starts to happen when you have huge operations you know thousands of invoices coming in daily basis the management of those it starts to build up and then there's always the chance that all those mitigation compliance rules in place there's a chance of doing a duplicate payment it's naturally monetary value on it but then also of course the rework and effort to somehow trying to cancel that negotiation with the vendor checking the different payments with the bank statements and going all that through to to mitigate that chance we have these qpa dashboards you on the time monitor the status what sort of dash invoices there are and the payments of those very nice one i really like it automation it's a big topic in any process i would say not just accounts payable but in any but this is obviously that some certain finance activities you want to minimize the manual effort where it's not needed because there are some really labor-sensitive topics in if for instance three-way matching is not working perfectly there are some uh really frequent challenges to that um invoice being some certain invoices being blocked for instance that you frequently lack goods received in certain material category or you don't have the peo in place something and there's plenty of manual efforts needed if you would have the process in place it would be a mature nice process you could automate it with rpa or these workflows and different apis available and maximize the utilization of your employment and stuff so these resources can be focused on the value reading topics pure penetration rate i already discussed this a little bit with the tool and here you go minimizing maverick purchasing so not acceptable not compliant way of purchasing and increasing the compliance the reasons for obviously increasing the compliance are many folded that you you want to mitigate those risks in the business that there are any fraud something in place but also this purchasing site from commercial point of view that you take most of those um frame agreements with vendors in place and do not do single purchasing in a hurry with some really unique payment terms discussed on the phone with the vendor and causing huge trouble the finance and all the other departments in place putting that end-to-end purchase in place and driving the usage of peos obviously invoice processing times i would say that this pretty much wraps these different topics and and example benefits over here so that you have the agile and mature accounts payable process these different business improvement topics starts to work and they release make the effect you you expect so less deviations and actually also variations but if you negotiate with the vendor those brilliant cast discount terms what if your organization maturity on the process size it's not mature enough to process and pay those on time so you you won't actually save a penny on that one therefore i think this wraps the full picture quite well and now i would like to show those on the qps side so we will jump to the application basically beginning where we were left earlier and and start doing a bit of dashboarding and accounts payable analysis here we go and we are in the press discovery view but i will jump to the application and open you the operations over it's building the ap overview how many items you have in place what's the total value of those providing you a slicer by any attribute perhaps you want to check your biggest vendors you just click on that one and the program is showing you the coping and sounds incorporation being the top number one in pcs different company codes uk takes about half of the ap volume uh the invoice document volume then there's followed with germany france sweden and so on this is the total volume sliced over time you see how stagnant this is data dumps are not frequently updated but just the data dump and you can see that therefore it's skewed a little bit but this is beautiful that you can choose for example the period you would like to just from here that yeah maybe i want one year about and that's it i do a track and drop over there and all the other charts are updated let's confirm the filter you can see there under the header it seems that over this period of 12 months this is pretty similar we we actually chose 93 percentage of the full data model 21 000 records these are the vendors over there what if i wanted to see this top number one vendor how and which company codes are is this vendor providing goods and how is their volume of dime obviously i can just click on that one it will generate another filter on top of that so we have both the time period of one year selected and now this specific vendor if i confirm it we can see that yeah there's that 1055 ap items available standing with the total value around nine million and they are all from uk apart from one purchase so i see that this demo company company called germany have made one purchase out of this company uh but other than that it's been uk operating audi volume pretty stagnant mounted month so not huge jumps over there then there are several other kpis there's po penetration rate for instance we can see that it's jumping somewhere the red line between 70 and 90 percent it's 94 i would say over there peaking a little bit i have another dashboard that will break down this po penetration rate so now that on this dashboard i have an overview i can quickly check whichever kpis i would like to and then these other dashboards are bringing me deep dive and analytics for example for that kpi i i've got over here the po penetration rate one that will go through that from all the other dimensions um some automation rates of account documents ap documents created some lead times what is the lead time from invoice receipt to ap document created within that vendor obviously so different organizations delivering that insight perhaps there's a rework there isn't too much of rework within this vendor for what i can see that it's really rare that there's a pre-work uh reworking place however if we would to take this vendor filter away i'm sure there are other other cases yes where there's more rework happening and it's taking lengthier and and more more time from that invoice received to the ap document being created so you can see that that's 10 dice on average while there's some rework and it's nine days whilst there's not so by average even there's one day wasted by those rework activities and those rework activities are listed over here let's have a look there are payment blocks in place and those needed to deactivate net price changes volume changes on the peo level and and so on i think those are the ones chosen on this demo model you can imagine that from operation point of view there are dozens and dozens of different types of rework and different items you can edit on the pio and we can trace all of those and have labeled as a rework as you can always see over here by the way it's it's interesting that this organization uk great britain they they have a fairly good lead time between those two steps however there are multiple uh front sweden that could do much better and then i see a data issues already organizational information not another really good sign from data governance point of view but highly highly valid and important finding as such okay if this dashboard was to provide you the overview understanding of that spacket with a quick glance providing you the capability of creating filters and actively having a look what are these rest of the dashboards i actually recommend that we start with po penetration something i explained earlier and mentioned that it's a nice one to wrap the full violence operations and the potential challenge that there's no po created by the purchasing and causing a trouble for the violent site let's have a look how that one looks so i'm jumping from the operations to the po penetration rate and we are loading some new graphics we can see that okay we have 22 000 paps in place and 16 of those they have a po match so that's almost three quarters of the business volume 72 percentage of the accounts payable documents have the po match po matches come all together with 160 million on contrast to 220 million of total business volume and invoice is standing out you see the trend over here this is actually pretty similar to the one that we have in the operational overview so the time trend and the penetration over there we didn't go further that what's explaining that is is there some sort of operations that could explain that therefore we have here this table that perhaps is creating you already some insightful finding that what is the company code processing the accounts payable document uh so from these six different organizations we can see that the peo penetration rate is fairly static it's ranging from 70 percent to 75 but already showing a small pattern we with some projects we we have delivered it's really insightful and interesting to see that there is one of the top volume ones peaking with really small po penetration volume and and providing a lot of answers to the business and challenges over there from this attribute filter you can change the slicer that these measures of total value value with the peos and the po penetration rate itself it can be resized at any any dimension of the data when the countries what have we here when the groups we have standard vendors internal vendors uh the potential changes of those let's see the vendors itself perhaps it's interesting that yep we have a lot we could actually add a few more lines over here let's have top hundred vendors here there we go and now we start to see some changes over here that some vendors have higher and some vendors lower pu penetration rate for example over there there are purchases over 1 million with zero percentage of the penetration rate on contrast to some else if we sort by this one so we we see some vendors with even 100 percentage of the penetration rate now you can weight this tape will buy pcs or value or that penetration rate itself and gain gain insights or re-slice the data or any other attribute [Music] we have also this marvelous analytics called root causes so you can do this kind of slicing and dicing yourself or on the contrast you ask from the calculations and the computer algorithm to deliver you analysis that why a certain case cases equal to account payable document did not go through the pi then created process steps that's the we are analyzing over here and you see already a list of different payment terms company codes and such to to bring you insightful uh percentages that how high is the rate in certain case attribute value on contrast the bigger model so on average though no values no po is about 27 percentage but there are some that peak way beyond that for instance in the if the payment term should be this one it's 60 percentage and then there's a in a way call to action table with the case id from sap some items that did not have a peo well potentially they they have a late deal in the future because of the finance uh having having them to create those videos later on and and to be able to process those invoices very well i see time is is running out so we still have a few minutes before we start to wrap and discuss but different business benefits were discussed earlier or maybe duplicate payments really straight forward if we open this one you can actually see that template didn't change too much so the placing of different items are identical and that's the idea because we want to promote to our customers that analyzing and usage of these dashboards is as easy as possible now we have another kpi here with duplicate payments only 251 records or should i say already 251 documents because you would like to make that zero that you wouldn't have any duplicate payments so it's it's two 2.5 million euros of wasted capital over there potentially you know re re negotiating with those vendors if spotted but that's only if spotted by either side or notified by the vendor that ratio over time and the same way of slicing the data and showing those duplicate payments rates if there are any changes and the root cause analytics and the table itself with those duplicate payments i'm sure you you start to get the pattern we we have some key performance indicators here top left corner then a donut slicing the data over time analytics really nice table of slicing and dicing and moving on how about the cash discounts utilization that was yet another topic we have there or there are two dashboards whether those cash discounts are offered to your organization that that was the first stage that you read to negotiate those uh nice payment terms in place there's a certain offering ratio you want to maximize that to cover as much as possible offering rates different values 1.2 million word of those cash discounts available trend over time i see actually it's it's reducing for some reason so some main agreements have definitely been cancelled and must be renegotiated soonest to keep alive with those business benefits and then the second stage you are being offered with something do you utilize that one how are you doing what is the actual payment size can you do that if not what's restricting you so if you either take or lose those cash discounts it's about 50 50 now actually this organization is losing more than gaining utilization by different company codes root cause analytics and obviously a call to action table checking those records from the backbone system sap or similar [Music] payment times something we actually did not discuss but early payments i find this yet another tremendous business impact from their process mining and accounts payable it's something that you negotiate the payment terms you should pay as late as possible to gain most of or at least of the needed working capital by your organization however it's really popular that you have some early payments actually in netherlands it's 18 days ratio or the average for the early payments there's a kpi that running over time and you're wasting every year 300 000 of working capital or actually much more that's millions of working capital extra itself this is just the cost of that so you you're expecting some um profitability for all of your money in the organization if you have extra working capital there's a cost associated typically the interest rate that the organization needs for yet another loan or something uh capital to feed the crowd there's a certain interest rate perhaps that's six percent with seven percent it's ten percent for your organization and therefore it's directly calculated over here in the monetary value of extra working capital because of early payments and similar wise you can set some rules there what's indication for that one early payments in which areas of the operations you're doing that most what are the root causes so there's non-peel purchasing coming up again so actually you do non-po purchasing that is leading into early payments taking place oh beautiful chart so how much early you are paying those invoices and a call to action chart with these items being paid too early i don't know if you have any comments or questions meanwhile i'm really happy to discuss those or if you didn't catch the concept over here of the extra working capital being tied by the early payments i'm really happy to also follow up with you and discuss with the organization with your purchasing volume what is the typical ratio what what kind of a business benefit we could expect expect from there payment terms dashboards beautiful nice one to address mostly the head of purchasing that they they would like to see that what is the average payment term first of all standing out today it's related to dpo kpi days payables outstanding uh related to that what are your top five payment terms what's the value going through of each and there's a calculation that what if that average payment for instance from 45 days 50 days 60 days that's extended to something else that let's call it 90 days what is the saving potential in money-wise of that extra working capital reduced so in contrast you would pay in 45 days what if you're paying in 90 days that's how much of saving potential you have in each company code if i make it here you know something outrageous from the standard point if you ever just run the analytics 120 days average payment term you're gaining millions of euros over there mind renegotiating these tax and this is actually telling the unique count of payment terms 32 of those um being live and maintained within the different vendors perhaps that can be reduced a little bit and making it simpler for the finance department to fulfill the process pay on time and keep the vendors also really happy we did discuss a couple other points like automation conformance let's do a quick review on those before we start wrapping over here we have event automation so this is showing us the different activities on this process model such as good receipts accounts payable documents pavements equal clearings invoice releases p items created i can see that this organization they they haven't got really almost any automation in place but we can flip this on the other side that what sort of a potential they have and that's really big so you can automate these some really founding and basic operations in typical business scenarios rules that if it's a straightforward compliant case it's end-to-end automized and no need to do manual labor we have an automation opportunities code here explaining the different event types their business volume occurrence rate and what's the manual work ratio over there now it's for instance focus received 97.9 meaning that 2.1 percentage of goods receipts are doing automatically and the rest of them not really so there's a lot of room for improvement and these kpis are very often wanted by the company level because of those automation solutions deployed to live by the different operations so you start hopefully hopefully from one of the top volume company codes and move on with those that have not that large business volume but yet something making a business impact over there we can also look at it from case level point of view that how many touchless orders you have that there's a invoice coming in or actually after peo how many touches you need manual in this demo company since the automation rate is such a low it doesn't even make sense so this corporate would need to first have the automation in place and then do a deep dive with these case automation dashboards that how they can further improve and i have the manual activities per case mitigated and minimized it's a really interesting chart that you can see how many manual events there are the more you have the average duration have often this tendency of being lengthier so i am obviously really for the automation workflow rp etc to to keep the amount of manual work in place and just to focus those efforts when it's really needed you need to raise a quick po for something next week or similar and then those can be really handpicked from the queue and processed contrast to doing something really really on the daily basis lead times we can choose any point to point leads on on the first mining model with this example i've got it's from the invoice receivable to the account payables document created it's 9.5 days to me it's telling about the organization's capability of processing the documents and the maturity of the process this is a histogram so we can see that huge amount of cases can be processed in one two three days however the average is still nine days which means that there's huge amount of cases going beyond this chart so that cumulative chart going just to nine percent which is telling me that there's a really long tail that even in 20 days uh this organization has processed 90 percent bits of those records if we want we can do a quick peek also beyond the edge over there to have a few more records let's see oh actually there's a field yeah but do you see the hundred percentage of those documents very well then there's average duration median 19 percentile of processing time it varies a little bit month to month perhaps there was a um christmas boom we can see a small peak in the po volume and therefore there are challenges on the average and median times and there's a per also ninth percentile that means that the last 10 percent which will take even lengthier than this one so even over 20 days to be processed slicing by the company codes providing the root cause is the full package of process in size from the lead time point of view and i said this can be with really ease of an effort configured for any point-to-point lead time just make sure that you have the needed data in the person mining model and then you can pinpoint this analysis to drill down any any times in between and durations perhaps today the last and final dashboard that i will show it's going to be the conformance also not only something from auditing point of view or compliance point of view but the whole organizational maturity point of view regarding the accounts payable process uh cooperation of finance purchasing business warehousing the full operations showing us the conformance and this is a ratio that all of these parties should work together to have hundred pairs in its conformance and that will mitigate the rework extra extra non-valuating steps over there i have a certain design here in place really simple fun one for example how it should go some invoices coming in and creating ap documents directly no any changes no approvals needed just straight through processing of those and we have this 43 percent this conformance rate with those parameters obviously i can change the design add some more steps there allow some level of operator repetition or approvals in different business parameters and we get yet another kpi for this kpi you obviously can set your target to see that are you below or over your target the ambition rate where you're going towards and the root cause is telling that oh at the moment it's our direct purchasing group failing that with really high percentage and something deep diver doing a selection that hey maybe i don't want all the peo department but only that direct purchasing let's give it a go so i do a po purchasing group there we go key of purchasing group and direct selection so instead of all the cases instead of those 17 000 records that have been processed and to end by the organization but only that uh that are indirect seven thousand eight hundred i believe now we have another root cause is said that yeah okay within the diet in direct purchasing it's actually purchasing organization sweden now failing with the high percentage of conformance leading into issues so this is how the conformance works you can drill down make another analysis and go deeper okay ian any comments how are we time wise what do you think about from the accounts payable world this cooperation with process mining and these transactional data records well yeah thank you oli that was a very informative and passionate presentation that you just gave us uh i noticed that we have some questions and so maybe we can quickly go through them now before the time runs out you can check them from the question tab okay i'm just checking yes yeah i have a small hiccup maybe with this cody meeting this question about the different source systems associated with the process so yeah as mentioned earlier the idea is to build this data model in place the event log and for that you can pick one data source perhaps your end to end per se purchasing that's reflected on the oracle that's reflected on the sap so you replicate the timestamps from many other it systems do that backbone system and all you need to do is to connect over there perhaps you have a data lake where you can replicate the needed steps you you do the matching over there or then you just fetch the data do the extraction and and building the data model from several systems one should be the shopping cart then there's the backbone then there's the system having the invoices coming in like three systems five systems depending how many operations you have some merchants and acquisitions in the past perhaps so parallel systems visualizing the full picture of accounts payable and bringing the insights from there um is there any questions you would like to raise from from the questionaries or yeah i can read some of them to you is it possible to have dashboards by call center according to the type of product or service purchased for example consulting services labor assets related to accounting accounts i think they would have to be defined as attributes to be used in the analysis process exactly and and then i have here some example let's see purchasing group is that's just the indirect direct purchasing let me have a look do i have any material over here perhaps on this demo model i don't have any material but obviously you can configure there the raw materials consulting any other material groups that you're purchasing label those directly from sap any other backbone system or build it on top of over here and do the filters and root causes based on those excellent question definitely yep and then we have a question about invoice before purchase order how to check root causes in this in process analyzer yeah so you can do that by going to a application ready-made for that sort of a maverick purchasing and analyzing or you can you know enjoy the easy usability of the tool picking the po item invoice created over there so this is vendor creating an invoice i would like to have only those two event types visualized that's about it yes these two event types and then i would like to check the variations that is it always like that that we have a po and then vendor is creating that definitely not however 13 000 of the business volume 22 000 in total is coming from there there are six thousand that we have only the vendor invoice document date in place so we don't have a po it's an on pure purchasing and these are how i called late peo and maverick purchasing that you have just the invoice document date and seven days and seven hours later the organization is creating the po by by the finance request or something similar so this variation table from these two event types is putting it really nice this will place the question i would say okay yeah and then we have this very new question that just comes in when you do a deep dive analysis is it possible to view the raw data for the filter selection if needed um can you repeat that question doing a root cause analysis can you re uh deep dive analysis is it possible to view the raw data for the filters selection yeah yeah absolutely so so for instance uh yeah i'm clicking on pu item created i'm running the root causes so we can see that yeah case is going through the po item i would like to see the case attribute wise root causes there's a huge list of these and i can pin it to any singular type of you know attribute for instance those two purchasing organizations if i want to see both uh contributing not contributing information but then i can go to the lowest level that i believe that the question for that if i choose this direct purchasing let's include only those and now go to cases we can see the sap record with any other attribute information over there thank you oli um i think that uh we the time is up and uh yeah okay [Music] excellent i will just put this one as the last slider where time flies always so we started with different variants in the process and we saw the spaghetti then these business benefits discussed cash discounts automation lead times maverick and then the qp application is providing the time to value time to insights reduced by remarkable amounts and then thanks a lot for having those questions the others we we couldn't respond yet in time so those open questions we will contact you later and and you will have the recording also you

Show moreFrequently asked questions

How can I make documents so that someone else can electronically sign them?

How do I add an electronic signature to my PDF using a Signature Field in airSlate SignNow?

How can I add multiple signatures in several places in a PDF?

Get more for redline Accounts Receivable Purchase Agreement with airSlate SignNow

- Print electronically sign Advertising Agreement Template

- Prove electronically signing Veterinary Surgical Consent

- Endorse digi-sign Equipment List

- Authorize signature service Colorado Rental Agreement

- Anneal mark Corporate Governance Charter

- Justify eSignature Modern Employment Application

- Try initial Drama Scholarship Application

- Add Guaranty Agreement autograph

- Send Transportation Proposal Template digital sign

- Fax Home Inventory initial

- Seal Professional Employee Record electronically sign

- Password Bonus Plan countersignature

- Pass Remodeling Contract Template digital signature

- Renew Free California Room Rental Agreement Template signed

- Test Freelance Web Development Request digi-sign

- Require Chores Agreement Template esign

- Comment signatory mark

- Boost benefactor electronically signing

- Compel gawker sign

- Void Flooring Contract Template template electronic signature

- Adopt Employee Matters Agreement template signed electronically

- Vouch Music Business Proposal template electronically sign

- Establish CCW Certificate template electronically signing

- Clear Barter Agreement Template template mark

- Complete Appointment Confirmation Letter template signed

- Force Living Will Template template eSignature

- Permit Single Page Business Plan template autograph

- Customize TV Show Pitch Template template digital sign