Redline Service Invoice Template with airSlate SignNow

Get the powerful eSignature capabilities you need from the company you trust

Choose the pro service designed for pros

Configure eSignature API quickly

Collaborate better together

Redline service invoice template, in minutes

Reduce your closing time

Maintain sensitive information safe

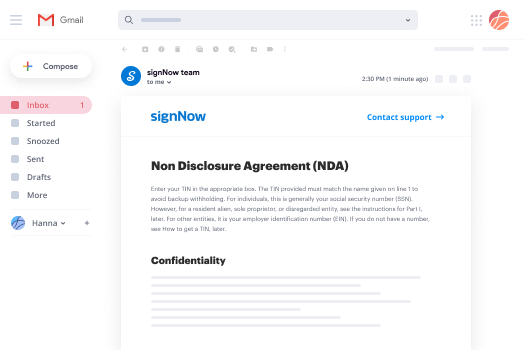

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

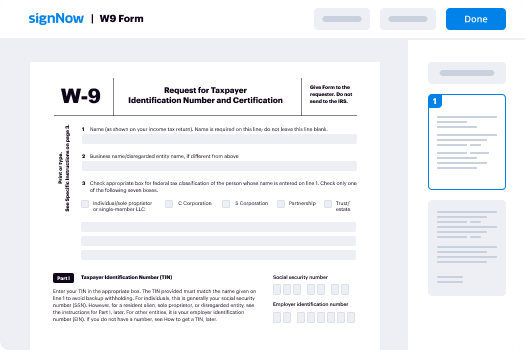

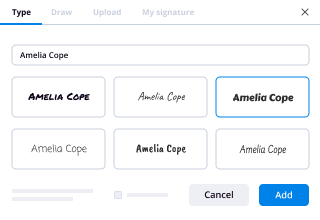

Your step-by-step guide — redline service invoice template

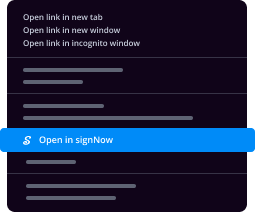

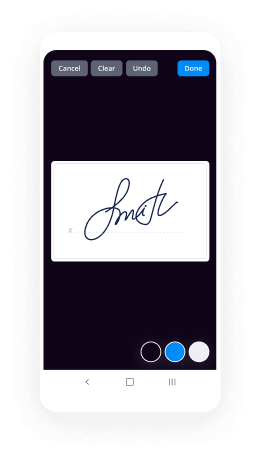

Leveraging airSlate SignNow’s eSignature any organization can enhance signature workflows and sign online in real-time, delivering an improved experience to consumers and employees. redline Service Invoice Template in a few simple steps. Our handheld mobile apps make working on the go achievable, even while off the internet! Sign signNows from any place in the world and complete deals faster.

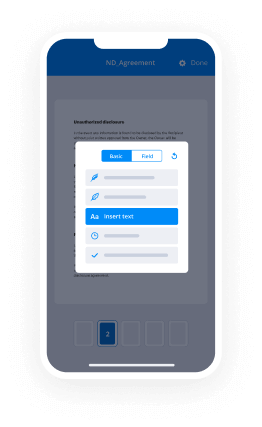

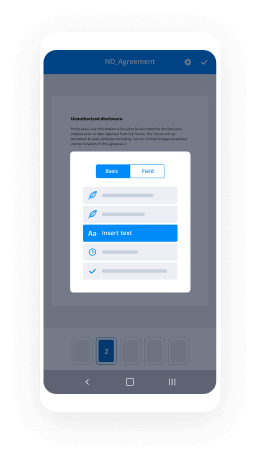

Follow the stepwise instruction to redline Service Invoice Template:

- Sign in to your airSlate SignNow profile.

- Locate your needed form in your folders or import a new one.

- Access the document and edit content using the Tools list.

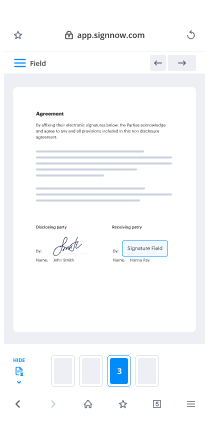

- Drop fillable fields, type text and eSign it.

- List numerous signees using their emails and set up the signing sequence.

- Choose which users can get an completed doc.

- Use Advanced Options to limit access to the document and set up an expiry date.

- Click Save and Close when done.

Furthermore, there are more advanced features available to redline Service Invoice Template. Add users to your common workspace, browse teams, and track collaboration. Numerous customers all over the US and Europe recognize that a system that brings everything together in one unified workspace, is the thing that organizations need to keep workflows performing efficiently. The airSlate SignNow REST API allows you to embed eSignatures into your application, website, CRM or cloud storage. Check out airSlate SignNow and enjoy quicker, easier and overall more productive eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results redline Service Invoice Template with airSlate SignNow

Get legally-binding signatures now!

FAQs

-

How do I write a service invoice?

Add Your Business Logo. ... Include Your Contact Details. ... Add the Client's Contact Information. ... Assign a Unique Invoice Number. ... Include the Invoice Date. ... Set the Payment Due Date. ... Create an Itemized List of Services. ... Add the Total Amount Due. -

How do I bill for consulting services?

Front-load your billing. If you invoice after signNowing milestones, try to load your fees into the front of the project rather than at the end. ... Bill your clients often. ... Invoice immediately. ... Use e-mail whenever possible. ... Offer a discount for prompt payment. ... Monitor client payments closely. -

How do you send an invoice to a customer?

Use the word \u201cinvoice.\u201d Don't assume the customer will know the invoice is an invoice if you don't use that word. ... Give the invoice a number. -

How do you bill clients?

Create a (Verbal or airSlate SignNow) Contract. Before you even begin working with a client, it's important to have a mutual agreement in place. ... Use a Template for Your Invoices. ... Simplify the Payment Process. ... Don't Hesitate to Send Out Invoices. ... Don't Be Too Shy to Follow Up. ... Being a Professional in Billing Clients. -

How do I create an invoice template?

Suggested clip Creating a Basic Invoice Template in Word - YouTubeYouTubeStart of suggested clipEnd of suggested clip Creating a Basic Invoice Template in Word - YouTube -

How do you write a service invoice?

Your company name, logo, and contact info. A clear title with the word 'Invoice' Invoice issue date and payment due date. Invoice number. Name and address of customer. Description of services rendered. Subtotal for each service (including rate, amount, and/or quantity used) -

Can you apply a template to an existing Google Doc?

Apply a document template to an existing document - Docs Editors Help. I have multiple Google Docs templates. ... It's not possible at this time to apply a template to an existing document. You would need to transfer (copy/paste) your content to the template (rather than the other way around). -

How do I create a service invoice in Excel?

Open Microsoft Excel. ... Search for an Invoice Template. ... Choose Your Template. ... Open the Invoice Template. ... Customize the Invoice. ... Save the Invoice. ... Send the Invoice. ... Open Microsoft Excel. -

How do I get a Google invoice?

Sign in to the Google Cloud Console. ... Open the console Navigation menu (menu), and then select Billing. -

What is the difference between sales invoice and official receipt?

While an OFFICIAL RECEIPT is a document which records the payment of sale of goods or services . As per BIR: Sales Invoice is used if you are selling goods or properties while Official Receipts is issued for services rendered. -

How do I create a PDF invoice?

Download the free PDF Invoice Template. Open the new invoice on your computer or device. Add your business information, including your business name, contact information and logo. Customize the fields in the free editable invoice template. ... Name your invoice. ... Save.

What active users are saying — redline service invoice template

Related searches to redline Service Invoice Template with airSlate airSlate SignNow

Redline service invoice template

hi guys and welcome to this webinar by zero the educate tomorrow is a historic day we are going to see the introduction of a nifty financial services index uh tomorrow uh we'll have weekly futures and options trading on this index so we thought to talk more about it let's get an expert on this topic um so we have um with us uh mr aloof dharya from qc alpha qc alpha happens to be one of the country's foremost quantitative volatility trading guys out there so if you have anything related to options anything related to algos or options anything related to algos and volatility and options you know who are the guys to go to uh allo is one of the founders of qc alpha and he has more than 20 years of experience trading the financial markets in india and in the us he previously worked with merrill lynch on the commodities trading desk in texas before moving to india to pursue his entrepreneurial efforts in the indian markets so to talk about it more we have alok and i happen to be up with your friendly neighborhood sensible guy so let's get this thing started right so i look my first question right the 101 question which everyone wants to know so what is this whole thing all about what is this financial services nifty index anyway thanks and thank you the hk for giving me this opportunity to talk to you guys uh so let's let's talk about this right but before before we talk about the financial services index what i really want to talk about is uh what we already have right and what we trade currently which is essentially the banking index right uh the financial services index is probably going to be a proxy for bank if otherwise or vice versa since uh the financial services indexes will be more diversified and i like to call it a glorified bank industry right uh so let's talk about bankruptcy what is banking so bank nifty is essentially a free float market cap based index of the private and public sector banks in india right uh so essentially it is a proxy for the indian banking sector because it's a market cap based index as we all know the private banks have a very very large market cap compared to the public sector banks so when their market cap increases their date in the index increases so currently uh bank nifty for example you know as of december 31st uh let me go ahead and share my stream real quick so this is the current weight of the uh different stocks inside the bank news game okay uh the way these indices are constructed is that you know you have each stock with their closing price in their market cap as on a certain date uh and then they basically add up the total market cap and then take the market cap of the stock divided by the total market cap and that gives you the weight of the stock in the index okay so hdfc bank for example as of december 31st right so this is december 31st right so as on december 31st uh htfc bank has a 26 percent weight in bankruptcy followed by icsa bank at 20 quarter bank at 60 and so on right now these numbers very big large a very big bank gets a very big weightage you mean to say yes yes and as its price increases its weight in the index keeps increasing and likewise uh so you see like a yes bank doesn't exist in this index anymore right if you go back and look at 2015-16 uh yes bank had almost a four four and a half percent weight in this index at some point right uh so as the market cap the stock starts reducing its weight in the index starts reducing at some point they'll just throw it out the index right and as new banks come in they'll keep churning this index right uh for the most part the constituents of the index uh get rebalanced i think at the end of each month if i'm not mistaken uh so nse will report at the end of each month the constituents inside each index along with their corresponding rates uh now obviously that weight is as of that particular day right so supposing if you ask me what is the current weight what you would have to do is uh calculate this number right here this is what i said the free the free float shares outstanding right which is essentially the market cap divided by the closing price as on that day so that gives you the number of shares outstanding of hdfc bank and not the total number of shares or selling with the free flow shares option uh the difference between free float and total uh shared outstanding is the promoters holding right so if you have uh companies that have a very large promoters holding uh those shares are not considered uh in the uh calculations right uh so if uh you know deeper park owns a huge chunk of hdfc bank this state is not a part of these fleet load chairs or uh immigration monies taken reliance industries would not be a part of the free flow uh likewise government of india's holdings in a particular stock are not considered free float uh government of india even uh like for example in access bank uh the gui holds a super stake those shares are not a part of the free flow chairs right so essentially a free float market cap uh is is what you use in order to calculate the weightage inside the ignition okay so that's about the index constituents and the index uh how the index rates are calculated let's look at the financials index so essentially that's where we are right now uh what is the need for uh you know uh would probably be asking me next is what is the need for financials index right correct what is the financial aid that it almost looks like the bank nifty exactly right exactly yeah there you go so in terms of the weight right so if you look at these top five stocks right hdfc icsc bank access and sbi right these are the top five weights in the bank if you look at the top five dates here you'll probably see a very similar constituents right except for hdfc and baraj finance which are the two additional heavyweights that are coming into the finances index right uh but essentially what is financial services and you know why why is why do we even need one right so what's happening is uh you know for a long period of time in india banks private banks public sector banks were essentially offering most of the financial services right uh what happened is in the last maybe a decade or so we've actually seen the advent of nbfcs insurance companies uh broker dealers and a lot of these other companies that are dealing with the financial sector have gone in for a secondary public offering and have are now publicly listed shares right so for example sbi life was always a part of sbi bank and was offering these services but inside the umbrella of sbi right now that it has ipode it it has its own uh market cap right so sbi life is now publicly created company or an htfc life is now a publicly traded company uh and with these new public early listed companies uh essentially we now have uh new stocks that can be incorporated into the financial services index right and uh that's where uh you know we have a whole bunch of other stocks that have recently gone public and are part of the new index called financial services now this index used to exist as far back as 2012 if i'm not mistaken at least i have the data back to 2012 um and i have the the index weightage data from 2014. so i have similar numbers for the financial index going back 2014 and back then the composition of the index was a little different right uh so if you go back and look at uh you know if you see my screen this is the current weight as of december 31st right so you can very quickly see what the difference in weights is so hdfc is in the financial services index is not in the banking state and then you have a whole bunch of other stocks that are in the financial services index but not in the bank nifty and then obviously there are a few stocks that are in the bank nifty but are not in the financial services right and we can come back and talk about some of these kind of you know small observations that i have about these indexes later uh but i just want to kind of show this very quickly in terms of you know what the weights are and then let me let me just very quickly talk about let me see i wanted to talk about what the composition of this index was back then but i haven't made a chart for it [Music] i mean just give me like two couple of minutes and let me let me figure out the best way to show what this companies if that is even interesting to you right i mean you want to see what this index looked like in 2014. so you mean to say that you should have you so the index did not exist but all the stocks which are there in the index now existed in 2014. the index has existed since 2012. okay uh nse has been publishing the closing prices it was never traded the composition of the index was always there uh you know so similar tables exist for each month right so i can i can tell you what this numbers or the composition look like in november of 2020 in october 2020 and so on right so i have numbers going back to turn 14. if you want to see because some of these stocks did not exist right as as public uh publicly companies okay so the composition of the index was very different back then but but then something else uh i caught my attention so you were talking about uh there are some things which you want to illustrate about what is really similar to bank nifty out there and what's really the difference out there right of the most notably around the big ones that have come in and the big ones that are not in they can throw some more light on the data analysis which you've been doing over the last 10 years on what's really different than what's really similar yeah so uh that's exactly the thing i was trying to get to i have a couple of uh charts that will show the the time series of how the weights have changed over time so uh this is for example hdfc bank right uh what i've done is i looked at the stocks that are common to both the indices right and have been common to both indices over the long enough period of time right so for example an hdfc bank hdfc bank has been in both the indices since 2014 okay so this is february of 2014. back then hdfc bank in the financial services index had a twenty two point six percent rate and in bangladesh they had a thirty point two two percent right so how has bank uh hbc banks paid in the index changed over time and how has it changed in bank nifty over time right uh so i find this interesting because uh you know maybe on bank community and uh uh financials you see that for htfc bank for example the bait in the financial services index has been fairly constant right it's been in a very nice tight range out here in bank you see the weight has actually been falling right you can see a trend down here uh so this is one and then if you look at access bank right access bank again is very stable in the financial services index you know it's been kind of sideways since 2018 uh but since right around that time the weight of access bank in the bank nifty has actually been increasing okay and i i can i can you know fathom one reason as to why that is happening right i think what has happened is uh it's the government super stake that's been offloaded right so as government stake is being offloaded the number of free float shares of access bank has been increasing over time and that's causing the weight in the index to increase right uh i'm just guessing that's probably one of the reasons i don't see access bank outperforming bank nifty causing this uh this weighted change uh but these are things that you need to keep in mind uh when you look under the hood on the index right you need to understand what are the components that are affecting the specific index uh you know when you are actually trading uh the two instruments maybe you really don't care about all of these things what we are trying to do here is trying to understand what are the indices what are the rates inside the indices how concentrated is the index uh you know is it easily manipulatable is this is this a top heavy index is it more diversified index that's what we but that's what we're here to discuss today uh we can talk about trading models all day long uh you know once we have enough data on the features and options later on so you know and sbi is another interesting uh chart you know where it's great in the financials has actually been increasing increasing uh while in bangladesh it's actually been increasing uh you know over a specific time so you know these are these are a couple of uh you know observations that i had another key observation that you know i actually uh you know when me and i were just talking we saw this uh is uh you know and a very large bank like industrial bank is not in the financial services index right uh most of the large banks like hdfc bank icse bank access sbi they're all in both the indices uh but an industry bank is only in bank nifty and not in the financial services index right uh the others i can probably understand because they're kind of smaller banks right so you know they can be specific to you know bank king index and not to the financial services index uh but industrial bank was a big uh to me a big miss in the financial services index uh and then obviously there's hdfc and barrage twins that are in here that are kind of not in the okay let me ask you something which i'm pretty sure all of our users will be very interested in knowing uh so the big question right do you think this thing is going to take off do you think this is going to be a hit or a miss and and also will bank nifty and this coexist or will one kill the other i mean what are the what are your thoughts around this and how do you think see this whole thing panning out uh that's it's actually a beautiful question and we've actually internally at qc alpha also been uh you know discussing talking uh about uh what's gonna happen right uh you know it it feels like uh most people will totally be like what's all this first all about right why are you what do you really care it's just a new instrument that's coming in uh for us it's a big thing right because when you when you introduce a new uh stock or a new index in a futures option segment we have to be prepared to start trading right now you don't just start trading it without having a view so we need to start building models around it right so not having enough historical data is a big problem because how do you build a model then you have no installation so for us it's it's you know the past month or so we've spent a lot of time trying to collect the data trying to build models optimize models trying to figure out what is the right way to trade this instrument once it gets launched right so there is there is a lot of fusion right and success and failure uh will decide uh whether whether you know there's an option to make money down the line so it is important there is uh in our mind we need to talk about it we need to talk about why be successful or not so let's let's talk about a few of the instruments that lse has started with you know in the past and has not succeeded right and there are a few that i can think of right uh cnx it features right one uh they've also introduced the world critic features the indiavix features that they introduced in 2014 which never took off uh they've also done uh junior nifty which never really took off uh you know so the question is why did these instruments not take off right uh i can see two main reasons uh just my this is my analysis on on why i think they failed one reason was that there was no liquid options market in these instruments clearly okay uh so volatility the india vx features did not have options behind them uh neither did the cnx iq features i think the cnx id features they did introduce options just never picked up liquidity right uh and i think that's the other problem the cnx it index is also that it's very very top right if you look at the cnx i.t infosys and tcs is about 80 of the index right so somebody might just be like why the hell would i worry about an index when two stocks make up eighty percent of the weight of the index rather than just create those two stocks and not touch the index so that would be the reason why it didn't really get successful um but there is uh you know so besides having a liquid options market uh another reason why these instruments failed is also because of the contracts right for example the volatility futures i think was a great initiative but failed because the exchange deliberately tried to keep retail people out of this market out of the big trading instrument by and the way that they did that was by increasing the lot size to such a large number uh that was just you know nobody would want to take that kind of bet on volatility going up or down right so instead if they had come up with a contract that is in this six flags eight lakhs kind of range uh i'm fairly sure volatility features would have been one of the biggest uh you know hit in in the market uh it is extremely critical to have an instrument related to volatility features and options in the indian market uh you know typically option players like ourselves really have no way of hedging vega which is your volatility risk uh if there were features we could just very quickly hedge our vega risk by buying features if you were short options and selling features that give our long options uh we do not have that option uh you know the only way to hedge that risk is to also buy more emissions right if you're short options so to me there are there are a couple of other uh instruments that innocent could have introduced before introducing the pin nifty uh you know there is a lot of urgent need for other instruments you know there could have been an introduction to the nfc 500 features for the you know lse 50 mid cap or 100 mid cap or 100 small cap in india most of the retail public have exposure to you know small cap mid cap stocks uh when you go into an extended downturn like the 2018-19 period uh you know most people don't have a way to hedge that exposure um so to me there were other instruments that they could have introduced now having said that uh you know given a choice between say nifty and bankruptcy what would i trade i absolutely would trade the famous people yeah i will give you a couple of reasons yeah i'll give you a couple of reasons as to why right uh first of all as we can see from this chart itself right uh this is a more diversified index right uh it is not you know even though it is top heavy right so let's go back and look at uh look at these weights right so the top five stocks in the bank if they account for about eighty eight percent of the rate right uh the top five here account for about seventy seven percent rate so you know versus the bank nifty this is less top heavy it is more diversified right it has more number of constituents in there uh so you know if i were to trade uh you know between bankruptcy and nifty what would you trade i would pay them right well why because it's more diversified it's less manipulatable uh even though nifty is also a top-rated index in the sense that the top 10 components account for about 65 weight in the index right in the remaining 40 accounts so by definition any market cap weighted index will be top-heavy right with a few components writing the show uh the s p 500 in the u.s right uh it is an index of 500 stocks uh but the top 10 stocks account for a good 30 of the weight right and so as the weight of as the large cap companies start doing better and their price starts increasing related to the small cap companies their weight in the index people keeps increasing and when that happens uh they do become popular right um you know financials the way i look at it if you look at the banks right uh do you see a situation where uh the private sector banks lose market share to say the public sector banks and you know there's more even distribution of market cap in this space i see a very low probability of that happening correct versus here uh in the financials index uh you know we have a lot of uh new sectors right sunrise you know there are a whole bunch of new sectors out here that have the potential of over time gaining a lot of market cap right so you see like it can become a three lakh market company down the line right and it might compete with some of these companies up here and start increasing its weight so what is currently a top heavy index can actually become a fairly evenly distributed index over time because of these new sunrise sectors that are in here right the the nbfcs and the you know the insurance companies and the broker dealer companies you know if a zero that gets uh goes public zero that's probably going to be in here in this index content down the line right so um i think if i had to trade this for a long long period of time i would say that this is probably a better index to trade now having said that bank nifty's got you know maybe a decade worth of need time over the financials index in terms of data in terms of available history in terms of ivs for options trading uh you know financials has none of that right so it's going to take time for the finances index to you know kind of approve bank nifty as the uh you know as a financial benchmark uh for trading uh but i think in the long run finances are probably going to uproot banking right simply because the way the index is constructed i sincerely hope that there is enough liquidity out there for it to uh you know kind of do it uh nfc is doing a good job they've actually introduced introduced a six-month moratorium on etc exchangeabilities for this instrument so that gives people enough of an incentive to go and try this instrument out and you know to me to me if you ask me is this going to be successful i would say uh yes i think this is a little different from all the other products that they've launched in the past which have not succeeded uh because one the lot size is small right so the lot size is 40. uh the underlying is at 15 thousand so it's about a six lakh notional right uh which is in the ballpark of lexington if you're a banknote that banks these are 25 uh lot uh contract with a thirty thousand notional so that's about seven and a half lakhs of motion right so it's actually smaller than uh magnificent in terms of emotional uh and then uh the other advantage that this instrument has versus say a bang theory is that they're introducing weekly features along with the weekly options i think that that is to me a big plus from the retailer's perspective right because uh even today we get questions on you know weekly's weekly spot is here the spot is here and weekly options are trading distantly why uh you know most people don't understand the concept of synthetic futures and you know how gp options are actually priced so by introducing weekly futures i think they've done the the national big service in my mind uh by making things a lot more easier uh so that might be actually another reason why it might just be like let's trade this instrument versus a bank because there's more clarity around the pricing options right so i think um i think those those are in my mind a few of the reasons why uh you know these this index is probably looking much better in the bank right and in terms of like you know if you think you know one of the one of the things you asked me is that is this gonna uh approve bank news i think it would right because if you look at you know let me just show you a couple of other charts so this is the uh 20-day rolling correlation of bangladeshi versus the financials right uh so what that is is basically saying you know if a correlation is one it basically means they're moving exactly in tandem right so if banks is up one percent financially also one percent right uh but you'll see that there is a very very high correlation between these two indexes with the exception of a few periods of time uh you know the correlation is very high somewhere in that 80 to 90 zone uh you know should they move in tandem so you know if i'm used to trading a bank ministry i don't think i'd be uh it would be very difficult for me to trade the financials right the movement is very similar but the advantage is that because it's a diversified index its uh daily volatility is actually lower than that of bank right so it's giving me a diversification benefit so the red line here is the bank needs the volatility daily and the green line is the financials you'll see that the red is generally over the green mostly times very few instances here and maybe here that you'll find that you know the the green line is above the red line uh but more often than not you'll see banknotes more volatile than financials though the behavior is very identical right i mean when one is going up the other is going up as well it's just that the magnitude is lower and that dampening effect is actually a good thing right and that i think it's the diversification um benefit that financials are providing that's reducing that volatility over time okay okay so i have one question here right so if i were to summarize what you said for our users you are saying that this is a um for lack of a better adjective it's a healthier alternative to trading bank nifty in the sense that it is much more diversified it is less likely to be manipulated by one or two players uh and it is you know it has possibly it has a lower volatility which by itself is not necessarily a good or a bad thing but you know it is what it is right but i have one question right there so one of the things which you pointed out is you know the weightage of hdfc and a few big players have come down in financial services nifty compared to bank nifty but then that has also happened at the cost of introducing hdfc the non-bank hdfc right the agency limited along with hdc bank now the problem is hdfc bank and hdfc themselves might be highly coded after their group companies right they are they are actually you know if you're going to try and build a pair one of the one of the best pairs in india to trade is really the hdfc hbc bank there because they are very very highly correlated uh they're also very very highly co-integrated right so generally they move very well together uh it's actually one of the best mean reverting strategies you can build in india it's essentially the easiest event so you say that this is almost a 50 hdfc index yeah yeah it is okay so that is the essential downside of this being you know maybe or hdfc yeah well in all fairness you know i mean the two hdfc is also about 20 of nifty so about a fifth of the large cap index is really these two these two stocks right so uh that that's a risk yes uh you know but i think the bigger problem is that hdfc uh is not very widely owned right as a stock uh it's very very highly concentrated in a few hands uh a very large number of fis actually own a huge chunk of hdfc in fact somewhere i read somewhere around 75 to 80 of the stock is actually not even held by indians anymore it's held by fis very large number uh and i think that's that's what the worry is right a few concentrated hands controlling a very large chunk of the index can actually have uh slightly more manipulatable impacts on the index okay something that we'll have to figure out as time goes by right uh but i mean when i look at the volatility uh it it gives me a little bit of a comfort that you know whatever is happening with bank nifty is also happening with finances for the most part right within a certain very tight tolerance so versus trading a bank nifty i would be a little more comfortable uh running with the financial services index because despite all these reservations we are talking about you know hdfc and hbc bank and all that both the stocks have been in the finances for uh donkeys years right and they've been there since inception so i don't see anything here that basically makes me uncomfortable uh when i compare it with bankruptcy right so supposing if i had seen very large spikes here in the volatility index because of hdfc which is a very large component of financial services index then i would say that's a red flag because look hdfc is controlling the showroom uh i'm not seeing that on this chart though right i'm not seeing that uh hdfc controlling the financial services index versus bank news because that's the real big change between the two indices i'm not seeing that in the lecture or in the correlation some of these very sharp moves that you are seeing could be the impact of hdfc per se or barrage twins right uh which are the two inclusions in the financial services index so there could be times when you know uh you know baraj finance specifically or hdfc is having a very large move and bank nifty components are not having that same move right which is when the correlation is breaking down uh but again for the most part the the two indices are moving very nicely in sync with each other i'm not seeing that that concern that you raised but we will see time will tell us whether okay so now i'll just go to a question with a lot of people get excited about and ask every time anything new comes into the picture and that is the a word so do you see arbitrage opportunities arising between nifty and bank nifty in the short run do you think more importantly do you think these kind of opportunities are even available for retail investors the short answer is no right uh i i really don't think arbitrage is a play i'll tell even at our level we are not able to uh comfortably come up we've tried misleading right uh just very simply the easiest arbitrage or easiest uh kind of a fair play in india would be like a favorite bank he tried building models on nifty as a bank we built a few successful models uh on the gross level right so on the cross level the model is beautiful the minute you incorporate costs uh expectancy is negative right uh so you know it's not even a pure arbitrage plan right we're not even here talking about pure arbitrage uh we're actually talking about trading a pair and even the pair despite being profitable at the gross level is not successful when you incorporate costs the cost structure one is uh is is a big hurdle uh to overcome when it comes to these arbitrage strategies uh and secondly i think you you will probably need very fast moving hf2 kind of systems in order to take advantage of these arbitrages uh coming up with the view at the retail level i don't think there is any play here for non-crash right uh i i don't even at some point we tried it and then you know even with fair trades we basically given up we basically said it's just not worth our time and effort now to build something because the minute you incorporate many number of legs on a trade uh the cost structure eats up into the pockets to the point where there's more there's no uh positive expenses so yeah having said that the large players yeah the large players will probably take advantage of this uh you know there is probably going to be some arbitrage uh because the way the indices are constructed there will probably be some arbitrage actually early on especially when people are trying to understand the behavior of the two indices relative to each other the movement the co-movement the correlations uh we are looking at it we we think there is some opportunities here you will see that then the oscillation is somewhere between 95 and say 80 right 80 to 95 you you initiate some arbitrage trade whenever it gets up here and very tight each other you basically unwind there will be these kind of opportunities over time uh even not just arbitrage but you know just the pure trading play right so uh but arbitrage per se is something that will exist for a limited period of time and then we'll go away right that's the nature of all arbitrages you know in the past we had dsc nsc arbitrages we had uh cash features arbitrage you know we had uh hdfc hdc bank arbitrage there's probably all kind of after edges that have been there in the past and at some point does go away right as more people start playing it arbitrage basically gets you know it shrinks and the entire uh the advantage of the edge is gone something so that will probably happen with these two indices as well uh you know bottom line if you ask me what's gonna happen uh i think the financial services index will probably uh engulf bank listing uh over the next couple of years over the next you know maybe a good number of years i would say uh over time he'll start seeing bank nifty volumes fall and financial nifty volumes rise uh open interest shifting from one to the other right uh i think i think financial services index is probably gonna be the new bank nifty and it's it's gonna stay here for a very long period of time i think that's that's what's gonna happen i seriously doubt that this product is going to fail i don't see any particular reason why this this product okay i'm guessing the people at tennessee would be very happy here in bliss but having said that you know if the guys at tennessee are watching this guys we need some volatility features some volatility options uh you know we have a beautiful index we need to have some fno products on it at the retail level right you can't price you can't have a futures contract uh that has a 50 lakh emotional right i mean nobody's ever gonna trade it you need to create smaller sized contracts that retail will trade and there are people enough people out there trading options now uh that you know if you if you want to hedge your bigger risk you need to have limited futures and you know maybe like weekly volatility options in there uh you know there are there are more diversified indices out there for which we need uh features and options exposure introducing an nfc 500 a nifty 500 or a 500 or a slightly more diversified index uh in the fmo segment there is a lot of opportunity guys take advantage and start introducing new products so this is just a glorified bank if i really don't know why there was urgent need to bring in a financial services index in the ethno segment per se i'd love to trade it versus the bankruptcy of course uh but i i don't see the immediate need for a product that is very similar to banking right uh that's just my my two cents there were there were other products that could have that would have been of more interest to the market okay have you said that sorry having said that i think this is still a better product than binding okay and how do you see the evolution of this uh product so an interesting question right so you are saying that there are some sunrise sectors most notably insurance which will come into play and you know start trying to dominate uh financial services index so one of the insurance names which have been doing the rounds of latest lic and if alicia comes into picture i'm pretty sure it'd be a huge market cap right so do you think there's going to be a significant impact of these sectors becoming bigger and the index itself drifting significantly from bank nifty going ahead i absolutely you nailed it that that truly is what i what i think is going to happen uh i you know in all fairness you know if lic comes into the market with an ipo and velyc is in the index then it might still be a top heavy index with lic becoming the largest mate in the index right i mean could it could just be i i have no idea when licks coming in with an ipo and uh when these things happen but yeah because it's a market cap based index uh if you have a very large uh stock that ipos or comes into the index it is probably going to take away market share from the other uh components of the index but you know i think that the potential is there with bank nifty i don't see any potential for uh you know the index to become kind of evenly distributed versus becoming top heavy that it is right now uh with the financial services index at least there's an opportunity that the potential chance of the next couple of years for the index to become more distributed and uh become less top shipping right so if i if i were to get an exposure to an index today between the two i would gladly in a blink of an eye to the franchise okay if there is enough liquidity obviously right and so that is the more important uh factor to consider when it comes to actually building trading models which is liquidity but i i seriously think that there will be liquidity okay so you are expecting the liquidity to be improving on this index every day okay i think so i think so okay so uh let me put in this to summarize all of this which we have talked about right as a you know final kind of parting words to you know mostly retail investors who are with us right so in in a nutshell right if you're a retail investor why should you be excited why should you be trading this and what advice would you give to the new users as well as the existing uses of bank nifty on how to proceed whether they lose what are the rules yeah uh first of all don't jump in tomorrow morning as soon as the bell opens you don't need to trade it they didn't wait and watch the index uh see if there's enough liquidity out there uh most of the retail guys will probably be playing with a few lots right so liquidity is probably not a big factor but what i mean by liquidity is you know the beta spread uh other options liquid you know a lot of times see see what what is the strike difference between the different options understand option change uh look at the open interest is it building is there enough people participating uh you know look at look at not just the very first week also look at the next or the monthly feature of the monthly option see if there's enough participation going on um and then then maybe you know a couple of weeks down the line once you feel like i think this instrument is going to do well and speaking of volume then you can start trading it a little more actively uh start building your models you know uh one of the things that we are discussing is that uh you know until the options actually start trading there is no id data on this index so for people like us it's a little more harder to build uh models when we don't have any history on ivs uh the volatility chart i showed you was more of a realizability uh historical day which is uh based on actual underlying price so that's easy uh but the ids uh are a little more trickier so until we have some history on ideas it's difficult to see whether there is a volatility premium in this instrument uh given that it behaves very similar to a bank nifty we can probably you know if you absolutely have to trade tomorrow morning uh use your bank nifty models to trade the financials it will probably be about 80 right stay away from it for a little bit uh you know and then apply your bankruptcy models if you absolutely have to trade it uh the advantage is there for six months you essentially are reducing your cost by not paying utc so instead of running bank if they run financials i don't think there is a lot of difference between the two but uh give it a little more time to understand the liquidity in the market okay okay so that was just about my last question with you alok thank you for joining us on this webinar i'm pretty sure it's been very informative for a lot of users who have joined thank you so much for your time hey no worries uh just a quick note guys uh i'm just gonna put up a slide here with our contact details in case if you guys have any questions feel free to contact us uh regarding financial if you are just voted in general uh you know there is if you go to qcalpha.com uh you will see a whole bunch of stuff about us but i'm just gonna put this up here so this is us uh you know your qc alpha we have two offices one mumbai and pune uh we have four promoters within the company uh you know this is we are on social media as well feel free to reach out to us in case you have any questions regarding specifically what you heard here today uh we're also gonna i think uh you know we haven't discussed this with zero da but uh you know i have a working document of you know kind of things that we discussed here uh and so you know we might we might make this available to the people as well we'll share the details with these guys thanks once again for for joining us this was great thank you awesome thank you thank you zeroth for real

Show more