Redline Tax Agreement with airSlate SignNow

Do more on the web with a globally-trusted eSignature platform

Outstanding signing experience

Trusted reports and analytics

Mobile eSigning in person and remotely

Industry polices and conformity

Redline tax agreement, quicker than ever

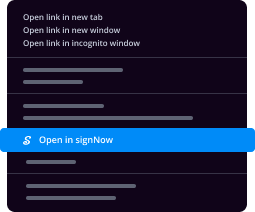

Useful eSignature extensions

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

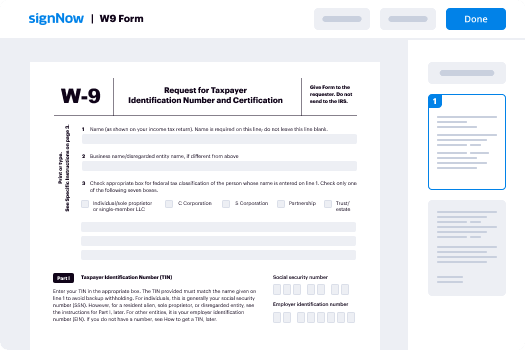

Your step-by-step guide — redline tax agreement

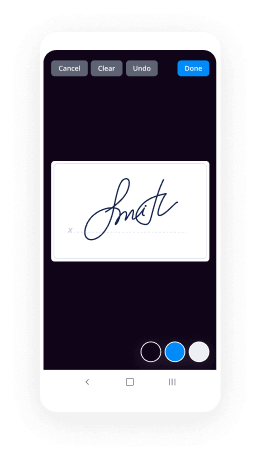

Employing airSlate SignNow’s electronic signature any business can speed up signature workflows and eSign in real-time, providing a greater experience to consumers and workers. redline Tax Agreement in a couple of easy steps. Our mobile-first apps make working on the run achievable, even while offline! Sign contracts from anywhere in the world and make deals quicker.

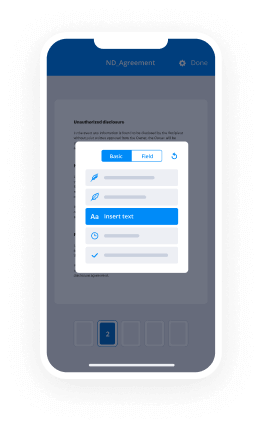

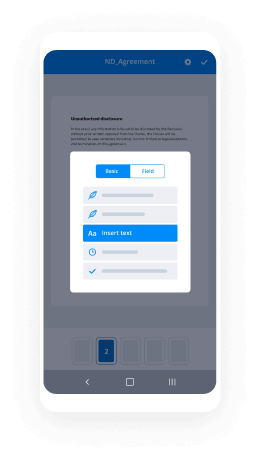

Take a stepwise guideline to redline Tax Agreement:

- Log on to your airSlate SignNow account.

- Find your record in your folders or upload a new one.

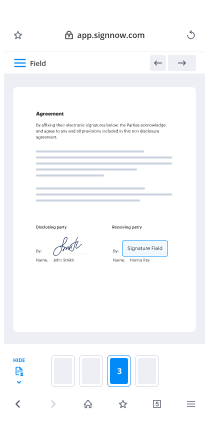

- Open the record and edit content using the Tools list.

- Drag & drop fillable boxes, type textual content and sign it.

- List several signees via emails configure the signing sequence.

- Specify which individuals will receive an signed version.

- Use Advanced Options to limit access to the template and set up an expiry date.

- Press Save and Close when done.

Additionally, there are more enhanced features open to redline Tax Agreement. Include users to your collaborative digital workplace, browse teams, and monitor collaboration. Millions of users across the US and Europe concur that a solution that brings everything together in one unified work area, is what enterprises need to keep workflows working easily. The airSlate SignNow REST API enables you to embed eSignatures into your app, website, CRM or cloud. Check out airSlate SignNow and get quicker, easier and overall more efficient eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results redline Tax Agreement with airSlate SignNow

Get legally-binding signatures now!

FAQs

-

How do you redline a contract?

Redlining a contract is the process of editing a draft. The draft might have been provided by opposing counsel, or it might be an old contract you are using as a template. Redlining requires that you go back and forth with the other side to hammer out the details of your agreement. -

What is a redline in legal terms?

Legal Definition of redlining 1 : the illegal practice of refusing to offer credit or insurance in a particular community on a discriminatory basis (as because of the race or ethnicity of its residents) \u2014 compare reverse redlining. 2 : the practice of showing changes to a draft of a document by marking with red lines. -

How do you mark up a contract?

Always track your changes. Did we say always? ... Avoid double red lines. ... Avoid defined term errors. ... Keep your marks to a minimum. ... Work with the existing text. -

How do I redline a contract in Word?

In the toolbar at the top of the screen, click the "Review" tab. This tab contains tools to help with spell checking and editing, including the "Track Changes" feature. Click the "Track Changes" button to enable Track Changes. This feature places a red line in the margins next to any edited text. -

How do you make a red liner?

Know Your Redlining Software. ... Never Create a Redlining over another Redline while doing Contract Changes & Terms. ... Avoid Reading Triple Redlining. ... If in Doubt over another Party's Redline, Run Yours. ... Do not Rely on \u201cTrack Changes\u201d ... Very Few Changes. -

How do you make homemade eyeliner?

½ teaspoon of grated beeswax or beeswax pastilles (find beeswax here) ½ teaspoon oil \u2013 coconut, grapeseed, or sweet almond all work well (find these oils here) ¼ teaspoon activated charcoal (find charcoal powder here or capsules here) ¼ teaspoon distilled water.

What active users are saying — redline tax agreement

Redline tax agreement

No okay so again for beholding pants you should have a temper alright we've all the sources of income and the definition section why is the hallway holding tax rate right and then their relation yeah derivation of each source of income and then for all these or are in terms of non-compliance we holy tell you should know what's the implication yeah why happened if you do not comply Tommy anyone why if you do not comply with any holding tanks anyone huh I send one now you quizzing one alright if you do not comply direct to one is the non-compliance non-compliance mining up where the 10% penalty of the withholding tax or the among do right so there's ten percent but the other one is the inheritance always the implication of inheritance alright so you have to really understand this to non-compliance issue right so what's the implication I remember that if you do not comply the whole amount is not non-deductible spends the whole amount for example talk about royalty expense the whole royalty aspect is not that the bull but it before submission of your income tax returns for example your year and is the deepest of December and then what you do is that you what you do in your die if you were to if you were to pay the beholding tax or the amount you the penalty before submission of your income tax returns away she's bite the thickest of July then the whole immorality now becomes deductible but the penalty amount still not deduct ammonia so for example you pay out the authority a hundred thousand but you did not withhold tax on me in the case of you know we paid we holding pass within the due time for example one mine all right so you paid the penalty but they'll be holding facts before submission oh everything from see so the whole of my royal tea now becomes deductible expense but if you fail then the whole amount is not deductible all right so when it is not it at the bulb but it happened that you claim that expense right so then becomes a problem because when you where the expenses should not be done not the best friends in the case of withholding tax all right non-compliance so by you claim the expense you claim the royalty expense to be deductible expense then in the written submitted is an incorrect written so the Inc emeritus penalty is one hundred percent of the best and it's charge so how much is it actually charged again it depends wide open the case all royalty so you just now had been hundred thousand nine so hundred thousand is actually the amount which is non-deductible but you have claimed that so if you have done that correctly or you have to 800,000 so then hundred thousand means that passed twenty four percent that would be twenty two thousand twenty four thousand isn't a hundred thousand twenty four thousand twenty four percent of that so the recording packs here is actually among you from the way owning ties is ten percent okay the penalty is the ten hundred percent of the test under charge so even hundred thousand times twenty four percent is twenty four thousand tests and the charge all right your penalty is also 24 thousand I believe in the test good example is ten thousand so that's why it becomes two thousand four hundred yeah so two thousand four hundred plus there is the penalty hundred percent I remember that you have not paid they'll be holding back ten percent of the Iran deep blast & 10% on the recording you are the holy amount of the do alright so all these act together becomes among due to the government yeah so make sure that you can actually explain them right you understand the concept of non-compliance to do with holding believe me me Billy a numbered we'll all right next yes all right so I assume that we have covered yeah we holding that definitely there will be a question in your final exam only holding tags and if you look into the past this question it could most likely it's going to be theoretical if computation is just a simple calculation whereby how much is the loading times alright means that you must know how much is a gross amount how much is the rate of the withholding tax and you must also know if you're given information all right which is the amount which is subject withholding tax all right for example if the the question give that scenario whereby you purchase a machine right hundred thousand and then you repay for the installation right you pay for the installation to the nor exiting present so the amount which is subject to be holding test either installation costs not the cost of the machine yeah the cousin machine is not subjective holding test but it services in installing the machines all right each subject that we have in test so you're wearing ties is certain percentage of that installation cost yeah so be careful which one is actually subject to the scope of your beholding pants all right I think that's all for the withholding ties we go to the next topic which is double tax agreement all right we're supposed to cover this topic last week but because I of SLAM alright so I should have actually given you a my recorded recorded video on dte or I actually I already have my recorded video all right maybe you can have a look at these right but I will not do it now ah alright so we already have this if you want to look at be of these let's see what the Regency so it takes about one hour all right I already put the lid do that DUPLO already put the link in the Google classroom so I think that rather than I am repeating the same topic doubled as agreement today so I would rather you to read go back to the recorded lecture and listen to the lecture first before we go into any question yeah because again the Buddhist agreement is a it's a theoretical question of course that will be in your final exam all right because we have just submitted the final exam question yesterday all right for betting etc okay question on this are you okay to watch the video right so we are watching the video you can just pause and if you understand or if it feels boring you can just fast-forward right oh so you are very creative in there yeah so again this top it will be in your final exam okay what I want to look now is on the is on the course outline again because I I always want to make sure that we are on the track all right so you'll be holding tanks and about this agreement okay so this is the one that we have covered today all right our PG t all right I want you to also refer back to your RPG t video all right in mine where is it huh where to do I look for my video right so in oh maybe I just keep you I have a happy here right where is my recording let you with these three 142 oh session recorded a che guevara right so we already have here RPG T alright so please refer back to our PGT if you're not sure because I want to do have you done the tutorial question right because we also had a tutorial question still but if you want to do the tutorial question with me I'm also okay but I will not record again because I really have the recorded version on my tutorial on RPG T so I'm not sure whether I should repeat again excuse me all this while can you hear me or not yes ma'am yes eh yes madam open your mutiny okay where was I tutorial I'll give tutorial on our PTT thank you all right coming back alright tutorial RPG T panic room movie right tell me how do you how do you feel if you have to refer to the recorded lecture is that okay for you or you delay key what was your question madam I when I asked you to wash my recorded lecture in the Google classroom is that okay for you oh yes it is very good yeah no problem yeah so I have asked you to refer to the SS agreement lecturer and because RPG T we have left the topic long time ANBU my sword is also in your final exam so I wanted to go back to RPG it of me and if you think that you want to do tutorial again I'm not sure we do we have done the tutorial or not can someone can check on whether we have done the tutorial on RPG T or not teacher your notes or you don't have notes with you how is that right I do not know whether I have done the tutorial on our PT t if you you have the tutorial questions on RPG te alright why and in tutorial question up in GDS we do have that all right we do have question number one miss Lisa and then question number two my and then question number three is mr. John oh right so again I want you to do all these questions all right because these all this essentially in the tutorial and the recorded tutorial but I want you to do that first before you watch my video all right okay all right okay so that's on our PGT what else [Music] okay okay because I have just come from I have just submitted the final exam question all right your midterm test would be on D where's your victims that's 17th of July 17 of July which is okay the coverage for your midterm exam I have done that okay all right that's why I say it's going to be three hours instead of two hours why because the topic is Spanish it is your midterm exam area right down top is Spanish sheep capital allowance where you have planning machinery and industry building allowance plus another question on agricultural allowance yes and then you have the self-assessment for company so this one two three four five cockpits will be in your midterm exam your final exam you will have your corporate tax or I mean that top question where you have given copper a profit and loss account and then profit and loss account then the competitive income we all the income and expenses do the adjustment meet them and investment something will also be there all right is either your finest details investment tehsil hours it could also be reinvestment allowance all right even though I have not covered reinvestment allowance but I've told you that the computation is similar IPE investment allowance whereby whatever type I think the qualifying tempest is given as a deduction sixty percent of your campus again 70% of your as I all right so that is your investment allowance and by the criteria for investment allowance is different from I near an investment and that from your IDE yeah so go through while the criteria for you to fulfill in order for you to apply the investment allowance computation is similar to IDE we are in tests and about that will also be in your final exam RPG T we in your final exam and your indirect access will also be in your final exam indirect taxes yeah yes yes all right okay question on the midterm and final exam so all right because you're going to watch the double tax agreement video I just would like to go through that the topic here is actually a summary of your double test agreement is that when you have all right business in militia right and then you want to have another business outside militia all right so we are talking about international business right that's why sometimes the top is not only called double tax agreement you recall also that as a cross-border activities it means that when you have activity outside monisha or if you want to be carry is that if you have an investment from outside and to put a business in Malaysia alright so when you have that kind of businesses or I have to understand that let's see assimilation tight sphere right your militia resident company right you have to protect on the territorial basis it means that income derived Malaysia you are going to pay that in Malaysia and another income which is for example foreign income alright remember that foreign income is exempted so whenever you have business income from outside whenever you have dividend income interest income from outside Malaysia the income is and sent it from why in 2004 is that clear right by talking about our special industry where we call this besa besa banking insurance shipping and align so these four types of industry all right if the company is a Malaysia resident company whenever the the school of chargeable is that where every income is derived we call it as a World Cup basis so whenever the income is derived whether is in Malaysia or eyesight militia if the company is a militia resident company and then whatever income is derived will be taxed in Malaysia all right so you now understand that for example let's say that I have a banking company right I have been in Malaysia I also have been in Taiwan for example yeah i won so because it's a banking we find a specialized industry visa or banking insurance ship en and I tell you remember that yeah so this for industry wherever in chemistry drug will be taxed in Malaysia so it means that you have to pay tax even though the income is a CD right outside Monisha so what happened here is that in Malaysia you have to be turns right pay tax for income english' and also income in Taiwan why because in this case because the ink is a worldwide school but at the same time because you have business in Taiwan you also have to fit as in Taiwan to Taiwan government look at that so in this case on the same business income in this case banking income in Taiwan you have to pay the tax payer has to pay tax too Taiwan and pass to Malaysia why because the Banky is actually under was good basis so on these you have to understand that on the same banking income the company has to pay double tax tax on the same income you have to pay tax to Taiwan and tax to Mauritius so that's what we called double taxation all right so double that so means that you're paying past to taxes on the same income do you get a right so of course this is not of course in if you have to be to Texas for the same income of course not everyone is happy so what we do is that in order to encourage international trade for example in order to facilitate world 3 aunty stigma you have to promote energy transfer for example so governments or our countries will have an agreement all right Malaysia and Taiwan for example will come up with an agreement to to how to to reduce the burden of the taxpayer all right in this cable talk about this Malaysian here right that's failure when you have business in Taiwan is there any way that you can reduce your tax liability in other way you can reduce your tax tax burden right so for that we come up with what we call double tax agreement agreement between countries on how to reduce the tax burden of an ox to you right so in Malaysia for example currently we have 76 treaty arrangement all right we have Malaysia with Taiwan Malaysia with China Malaysia with Hong Kong ratio with Malaysia Malaysia and Singapore so total 76 treaty so 1 3 T is one nation and other country alright so we had this agreement in order to say ok if there is a case whereby for superb nation and by one income on the business how can we reduce the tax liability of this person alright so then come the tax relief in the text Machpelah alright that we call as a double tax relief how can we reduce the tax liability so that's why we come up with an assumption that's crazy and tax deduction so this why here okay we have passed you that shell we have exemption and then we have tax credit yeah so for the following or I want you to refer to my video on double test as Liman alright I hope that you can understand it's the same all right it's the same person talking on the same time P all right it different time okay so that is another then you have to understand how each might take all right the double tax rate double tax relief all right this one would call double test relief mechanism all right how it works and how it helps the taxpayer to reduce yeah that's like read it so they give you a very clear example on this okay and then we go on with a term our we call permanent establishment all right hominid establishment so we have a very long top P and a permanent establishment well we talked about when where it could be right the central issue we talked about a cross-border transaction is which country has the right to tax on the gain or profit earned there from yeah in the double tax agreement between Malaysia and treaty countries the PE concept is employed to resolve the issue so now we are talking about business income yeah when a foreign enterprises carrying on the business you talk about business income here alright threw a PE information so I mean that if you have for example you have a Japanese or a having a business in Malaysia so you want to see whether that Japanese company has a permanent establishment in Malaysia or otherwise how do you know whether that person has a permanent establishment of e then you have to look at the we call that the definition of permanent establishment yeah so it says that each you have PE in Malaysia then the Japanese company must pay tax in Malaysia on the income to write in Malaysia but if the business the Japanese company or a half a business in Malaysia but does not happy II initial right you have business but you don't have any permanent establishment in Malaysia then that Japanese company are not subject to tax in Malaysia yeah so how do you know whether you have a PE or not so they give you some of it for example a fist place of business yeah so if you have a piece you have an office for example alright the business is wholly or partly carry-on so it includes for example a place of management a branch office factor me workshop alright all this a building site of construction that long for the exist for more than six months all right a farm of foundation so if you have any of these or I means that if you are a foreign company having a business in issue with all with any of these may be you can have an office or you may have a factory in Malaysia or you may have a farm or plantation in Malaysia that it shows that you have a permanent establishment in Malaysia when you happiiy English it means that you have to pay tax on the income derived from the business in Malaysia to Malaysian government you get a right so when you happy eat me we say that you have trade in Malaysia but if you don't have any PE for example you can have a business transaction but you don't have any permanent establishment then you are you see that you don't trade in Malaysia but you trick with Malaysia alright there's a difference between trade in and 3 B right of course there is a definitional definition all right let's look at this example right where we have say that DC incorporation is a manufacturing company in New York all right United States okay is a United States oh it's a non-resident company all right the Disney imp when you see in here means that the company is non Malaysian company it manufactures Mickey Capetian the cost of distilling in Malaysia where the selling price in u.s. is 45 ringing both are translated from the USD in 2019 the company's sole Mickey cat t-shirt to acquire an independent agent in Malaysia for 35 ringing it curtisha right the gross income 17,500 which is the 35,000 a third family eight times by 500 so total income 17,500 would not have any mention income tax exposure because this Neyland does not have any PE emission right why is he here you have this company in US and this company in Malaysia so what happen is that all right that you are the Machine Company Hotel from the US and US n the order all right so their fulfill just from them so means that the US company don't have any factory they don't have any branch they don't have any any office in Malaysia in order for them to sell the t-shirt all right it's just that you can just order online and then set up right in this case so in this case even though us have income from Malaysia they don't have to fit as English even though the US have a in this case Disney Land Inc have a business in with Malaysia all right but they don't have business in Malaysia so because of that they don't have to be touch in Malaysia there's no test exposure in Malaysia all right so I have this discussion s1 okay so lease rental on sheiks all right remember that section floor remember when you do your feet holding taxation for big a number three at least off movable property or rental of movable property so in this case it fall under for example if you have any boats and is she or any cargo that you rented out all right so then you have to look at whether is there a business in Malaysia or not so remember that when you talk about the section 4b e is income to a non-resident person right the wielding tax is whenever you have income paid to an arrested person whether subject to income tax objective withholding tax or not all right so why is this that in this example this me lemme all right can you tell me why is that under in the case of dissonance in cooperation the question is is this innate Inc in this case is subject to withholding tax Disneyland is an aurochs in the prison payment of 17,500 to Disneyland incorporation is it subject to tax or not is it subject to withholding tax or not anyone what about is a he okay nothing not yeah okay why why do you think that okay if you say that it's not subject to be holding back why if your answer is yes I also want to know why want to go back to here let's see game do you understand my question all right why my question if we holding Disneyland in subject to withholding tax no good yes and why no and why okay when you want to check with this subject we holding test or not what you have to check first remember this now no resident present recipient is a non-resident person may them not sure very sick and silly okay yes in this villa in Capri she is a non-resident person number two is the income subject to the scope all right is it any fund that Israel is a royalty is it an interest is it a public entertainer is it what else in trista contract payment easy how many do you have section four be a alright so the Disick fall into any of those to Disneyland Inc what kind of income is this come on that's - okay can I go up I don't want to talk for you get let's go this one talk about the issue of me holding time so because you may find that the durable tax cream and we wouldn't ice is all related because we Orion test is payment to Norris it in prison all right so if you have the income subject to the recording task and you are unauthorized in person they have to pay withholding tax all right but if you talk about punishment and permanent establishment is a business income so it is a different issue all right and then across payment okay all right so okay they sound about that agreement please refer again to my video on the double test agreement right for detailed discussion on this topic what else okay so now it's 3 o clock so I want you to have I'm giving you time to actually I can actually leave the session alright if you have any question I will still be here I'm still here right but I want you to go back and look into the lecture on the bottles agreement if you have any question you can always ask me right I also want you to go back and ponder the question I asked you about when the warrant is subject to this example 50 1.50 1.4 so I think with that right if I don't get a response from student I don't have the energy to talk about yeah so rather than talking to myself all right I think that I would rather end the class now insha'Allah ask you again next time with their assalamu alaikum wa rahmatullahi wa barakaatuh unless you have question again right just now be void in the double tassel in mine all right now believe me that you have come from Silesia so remember that income or submission and visa is their subjective intent because income is charged on the wherever income is Iran all right be some so when talk about visa right they have to see whether there's an agreement which measure and the other country why we have an agreement we try to reduce the tax burden on the taxpayer number one is right through the mechanism and then under the Buddha's agreement also we do have for example if the person is subject to be holding tanks already we're talking about other than business income all right so means that in your making you I have to make payment to be non-resident percent where you have to be home fax there may be for example ended up email for example interest is 15 percent all right but now because it's a double that's agreement which in Malaysia and for example Indonesian right then we say their own royalty payment made to her an Indonesian or I see the person instead of 10 percent royalty you only have to pay 8% or 6% so it depends on the agreement all right there's women which you one country to another East Ukraine so whenever you want to have business in another country number one you also have to check whether Malaysia has a double test and we know with that hunter country all right because why you want to see how will be your tax exposure alright and how can you reduce your tax burden in the case of for example if you were to pay to an erisa 10% on that country all right so initially if you have to be whole 10 percent maybe you just have to be whole 8 percent or maybe 5 percent it depends yeah under the agreement so what else yeah that is on because this copy the holding times and about this Agreement I would say is a [Music] interchangeable all right it's not in the chain because sometimes it's overlaps all right so you have to look again at the scenario and to be sad whether first is bigger impact subject or not if not then it's business time and then how can you actually reduce the tax liability then you have to choose check whether is it a permanent establishment everything else so all this thing yeah say I want to stop just now right other question no passion if no question then I can

Show more