Redline Tax Sharing Agreement with airSlate SignNow

Upgrade your document workflow with airSlate SignNow

Versatile eSignature workflows

Fast visibility into document status

Simple and fast integration set up

Redline tax sharing agreement on any device

Detailed Audit Trail

Strict security standards

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

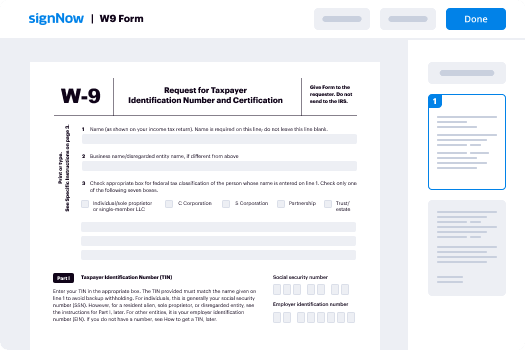

Your step-by-step guide — redline tax sharing agreement

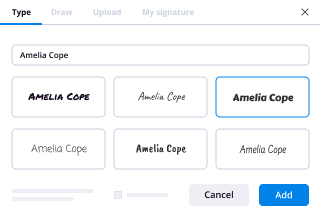

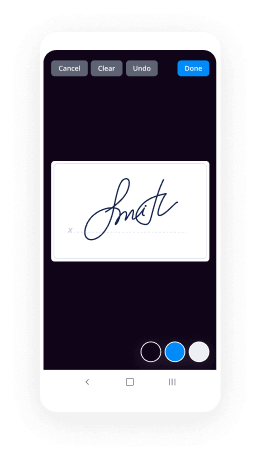

Adopting airSlate SignNow’s electronic signature any business can accelerate signature workflows and eSign in real-time, supplying a greater experience to consumers and employees. redline Tax Sharing Agreement in a couple of simple steps. Our handheld mobile apps make operating on the go feasible, even while offline! eSign contracts from anywhere in the world and close up tasks in no time.

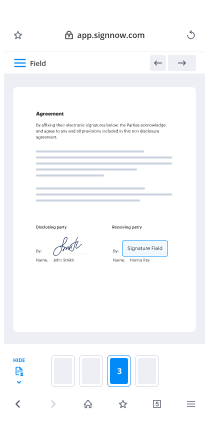

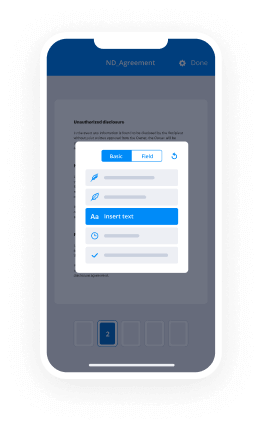

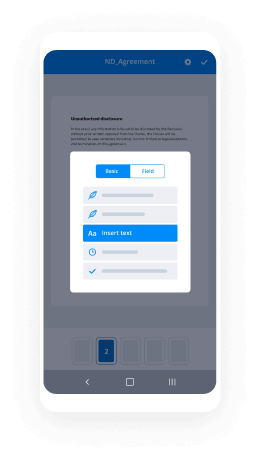

Keep to the stepwise guide to redline Tax Sharing Agreement:

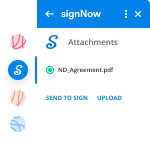

- Sign in to your airSlate SignNow profile.

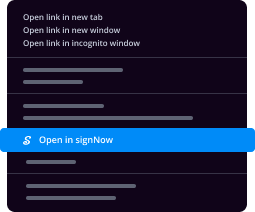

- Locate your document in your folders or import a new one.

- Open up the record adjust using the Tools menu.

- Place fillable areas, type textual content and sign it.

- List several signees by emails and set up the signing sequence.

- Specify which users will receive an completed version.

- Use Advanced Options to limit access to the record and set an expiry date.

- Press Save and Close when completed.

Moreover, there are more enhanced functions accessible to redline Tax Sharing Agreement. List users to your collaborative workspace, browse teams, and keep track of teamwork. Numerous consumers across the US and Europe agree that a system that brings people together in one holistic digital location, is the thing that enterprises need to keep workflows performing smoothly. The airSlate SignNow REST API allows you to embed eSignatures into your application, website, CRM or cloud storage. Check out airSlate SignNow and get faster, easier and overall more efficient eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results redline Tax Sharing Agreement with airSlate SignNow

Get legally-binding signatures now!

FAQs

-

What is tax sharing agreement?

Broadly, tax sharing agreements: prevent joint and several liability arising by \u201creasonably\u201d allocating the group's income tax liability to group members. ... A buyer of a subsidiary in a tax group will normally request that the seller group enter into a valid tax sharing agreement and comply with the \u201cclear exit rules\u201d. -

What is the purpose of a pro forma?

Pro forma, a Latin term meaning "as a matter of form," is applied to the process of presenting financial projections for a specific time period in a standardized format. Businesses use pro forma statements for decision-making in planning and control, and for external reporting to owners, investors, and creditors. -

What is a consolidated group for tax purposes?

An affiliated group can enter into a tax sharing agreement and file a consolidated group return with the IRS. This enables the group to consolidate the income, expenses, gains, losses and credits of all of the members onto one tax return to simplify the group's filing obligations and to enjoy various tax benefits. -

What are the major advantages and disadvantages of filing a consolidated tax return?

What are the major advantages and disadvantages of filing a consolidated tax\u200b return? An advantage includes income of a profitable member can be offset by losses of another member. \u200b However, a disadvantage includes losses of an unprofitable member may limit deductions or credits of a profitable member. -

What is a pro forma report?

Pro forma financial statements are financial reports issued by an entity, using assumptions or hypothetical conditions about events that may have occurred in the past or which may occur in the future. ... Investment pro forma projection. -

How do you create a pro forma financial statement?

Calculate revenue projections for your business. Make sure to use realistic market assumptions to write an accurate pro forma statement. ... Estimate your total liabilities and costs. Your liabilities are loans and lines of credit. ... Estimate cash flows. ... Create the chart of accounts. -

What is India's corporate tax rate?

India slashed corporate tax rates to 22% from 30% for existing companies and to 15% from 25% for new manufacturing companies. Including a surcharge and cess, the effective tax rate for existing companies would now come down to 25.17% from 35%. Companies can opt for the higher tax rates or the new ones. -

How do you read a pro forma?

Suggested clip How to read a proforma - YouTubeYouTubeStart of suggested clipEnd of suggested clip How to read a proforma - YouTube -

What are targeted allocations?

Targeted allocations, which generally do not meet any of the safe-harbor requirements, allocate partnership items so that the partners' ending capital accounts equal the amount the partners should receive under the partnership agreement's specific order of distribution in liquidation, commonly called the distribution ... -

Who collects corporate tax in India?

The Central Board of Direct Taxes is responsible for the collection of all direct taxes including corporate taxes. Can the government of India afford the revenue loss from the corporate tax rate cut? In September, why did India cut its corporate tax rate from 30 percent to 22 percent? -

What is the difference between consolidated and combined tax returns?

The Difference A consolidated tax return is filed with the IRS by a parent company or a corporation that owns a group of affiliated companies. A combined tax return is filed with a state. -

Who do corporate tax cuts benefit?

Who Benefits When States Cut Corporate Taxes? ... 40 percent of the economic benefits accrue to companies and their shareholders, 35 percent to workers, and 25 percent to landowners. State-level policymakers often adjust corporate income-tax rates to keep or lure businesses.

What active users are saying — redline tax sharing agreement

Related searches to redline Tax Sharing Agreement with airSlate airSlate SignNow

Redline tax sharing agreement

and now we'll move on to uh public hearings item 6a hold a public hearing regarding an economic development subsidy report pursuant to government code section 53083 adopt a resolution accepting the report and authorizing the city manager to execute a tax sharing participation agreement with walmart.com usa llc city manager okay as i hear the screen okay that should be uh so uh good evening uh mayor uh members of the city council and members of the public javon grogan city manager uh tonight uh this public hearing uh and action uh is will be jointly presented to you by myself and city attorney mark zapparano the the action that's requested of the city council is to accept the report and authorize the city manager to enter into a tax sharing participation participation agreement with walmart.com so what is the benefits to this agreement for the city first it's important to know it achieves two of our important economic development goals one for business expansion walmart.com is investing in their headquarters here in the city of san bruno and business retention it also improves the city's fiscal sustainability in providing approximately 3.6 million dollars to the city for a 25-year period annually in addition it accomplishes the goal of having direct community benefits to the city really as a reflection of the impacts that business expansion has on our community the agenda tonight will will first provide a background we'll review the proposed features of the agreement we will hold the public hearing on the for the required economic development subsidy report and then we will be asking the city council to both accept the report and authorize the city manager to execute the agreement a little bit of background on walmart.com and so walmart.com is headquartered in san bruno uh they have been headquartered here since they uh moved here in 2012. they purchased their facility at 850 cary avenue for a total of 821 million in 2014 it is a 271 square foot facility it employs the here in san bruno they employ just over 2 000 employees they are one of two of our largest employers and so uh our two largest employers are youtube and walmart.com each of them employ approximately 2 000 employees they they own the building uh and there are currently performing tenant improvements approximately 20 million dollars of improvements uh that they are actively underweight uh at the 850 cary avenue building they sell in walmart.com as we all know they sell inventory owned by walmart on various platforms and though that merchandise has shipped around the state of california and through this agreement we are seeking to designate san bruno as the point of sale for all online transactions the result of which is the city of san bruno will receive our local 1 sales tax when a online transaction occurs and is delivered anywhere in the state of california and so it's important to note that we will also be receiving uh that one percent but our local schools both county uh and our local school district will receive additional revenue as well because they share in in the sales tax allocation uh once again uh we talked about this at our prior meeting uh but the city receives a one percent allocation uh for the statewide sales tax that here in san bruno is 9.75 uh sales tax is our second largest revenue source in the general fund our total sales tax revenue in the adopted budget this year is 6.5 million dollars and so through this agreement we are increasing that amount by more than 50 uh a very significant amount of increase for our second largest general fund revenue source our sales tax currently represents 13 of the general fund budget and as we all know sales tax is declining this year as a result of covet 19 and retail store closures important to note i know the council knows this but in the prior fiscal year we received 7.9 million dollars uh in total sales tax revenue to the general fund and so that is the precoc 19 number nearly 8 million dollars this year the number is 6.5 million dollars so more than a 1.5 percent reduction in our sales tax due to copic 19. and now i will turn the presentation over to mark zapparano our city attorney that will provide a little background on the landscape for how sales tax has changed due to court decisions mark thank you very much mr mayor members of the city council you have seen this in some of the subsequent slides before but just to recap there were a couple of changes in the law that triggered walmart's reevaluation of their california operations and e-commerce sales to designate san bruno as the point of sale there's a 2018 decision by the u.s supreme court the wayfarer decision is how it's referred to and then also in 2019 more recently this california law called the marketplace facilitator act which refers to online platforms remitting sales tax on sales by remote sellers so the combination of those those two legal decisions and operational decisions by walmart they they had determined that san bruno should be designated as the point of sale for walmart.com transactions if you could go to the next slide that would be great so as we told you last time the city did review over a dozen other agreements throughout the state of california they seem to average about 15 to 18 years a term and about 50 revenue sharing between the city and the business next slide please the main features of this agreement as we reported on there's been no no substantive change from the last time is that the city will receive about 58 overall of of the total tax over a 25-year term and so the total taxes little over six million the city will receive you'll see on the next slide a share that's about 58 percent of that this does not affect the measure g sales tax allocation that comes to the city uh irrespective of this particular agreement and so on the next slide you see the breakdown of the 6.2 million again the same slide as you saw last time with the city receiving 3.625 in the first year and in subsequent years if the amount remains the same of course the amount could go up or down but the percentage is it is what it is and uh so the agreement is in effect for uh for 25 years assuming of course walmart stays in the city next slide so we have a couple of actions tonight uh the first one is to open the public hearing take any testimony and then close the public hearing on this economic development subsidy report and let me just pause for for one second and talk to the city council very briefly about what that report is and why it's included in your staff packet so the government code does require this type of report and it also specifies what needs to be in the report and so the city manager in his presentation has actually touched on all of the aspects of the report that benefit the city and why the economic subsidy for development purposes is important the report requires that we describe the agreement we did that it describes the public purpose for the agreement the city manager did that very well in his first couple of slides especially important for the city to revitalize its economy in light of the decline of brick and mortar stores and a variety of other factors the revitalization of bay hill by a variety of businesses so all of these things are substantial benefits that indoor to the city in the agreement so those are all in the economic development subsidy report that's included in your staff packet so uh tonight's actions then to recap or to hold the public hearing and then adopt a resolution that staff is recommending to accept the report and then the same resolution also authorizes the city manager to enter into the participation agreement that's attached to your packet so that concludes my presentation and we'd be happy to answer any questions okay um with council's permission it is a public hearing so why don't we begin by opening the public hearing and seeing if there's any uh persons wishing to speak on this item i currently don't see any hands raised okay um once we close public hearing then therefore we come back to the council for uh discussion and our action um any motion in regards to closing the public hearing please removed um and this i'm understanding is still city attorney we can take a voice vote on this one yes that's correct okay uh this is for closing the public hearing motion made in second all those in favor say aye aye opposed 5-0 okay let's bring it back to council um for questions comments councilmember medina um thank you i'll go ahead and start um this is um this is a big deal you know um it's definitely having some some some good news um a couple questions the consequences of of walmart breaking the agreement let's say x amount of years from now for whatever reason they either choose to move or or something what what happens so i'd be happy to answer that through through the chair mr mayor so the agreement does contain a provision that we negotiated that prohibits walmart from soliciting or entering into another similar tax sharing agreement with another locality for up to five years we were mostly concerned that we didn't want a situation where walmart could leave for the purpose of negotiating a different agreement somewhere else or there would be at least a disincentive to that we of course understand that any company can decide to leave the city whenever they want we can't make them stay but we wanted to make sure that if they do leave it's it's not because they're of a better tax sharing agreement somewhere else and that's for five years so they we pretty much they're going to be here for five years we can kind of almost count on that i we certainly hope so i mean optimistically um during during the presentation um i heard when the the sale when the sales are in california so when walmart sells across the country if not the world i would think so any sales that were in nevada that would that how does that work that's just not included in the state law right so this agreement covers sales tax that is owed to the state of california okay um and the last question was it was um about the 20 million in improvements um just curious what are they doing at the property that's 20 million dollars of improvements it seems pretty substantial city manager various uh tenant improvements on every floor they appear to be going floor by floor making changes to office spaces and employee common areas what i would say is that this work was was playing pre-code in 19 and they're committed to doing that work and it is still ongoing um i don't have the full scope of work in front of me but it is a significant investment in their headquarters that they have been planning for quite some time thank you anyone else counsel your chair uh vice mayor salazar thank you so i just wanted to clarify a point that essentially what we're talking about is a tax break to this to this company and i know that's one of those things that that gets often criticized uh by the public for you know this is a huge corporation and why should san bruno agree to a tax break and so i just what i wanted to put out there was or at least clarify is that walmart had the option to pay their state tax in any locality of their choice their headquarters happens to be here but they could have picked another headquarters location and said that's where we want to pay our tax and so the city does have a vested interest in keeping their headquarters here and keeping their sales based here and if we were to say no we don't want to give you a tax break they could just as easily say okay then we will set up shop elsewhere and that's where we'll pay our taxes and possibly get a better deal from them so um i wanted to put that out there just because you know i've seen some things some some commentary made on on social media about you know the city and uh us not making smart decisions and perhaps not giving a deal but in my opinion this is a very good deal for the city and i think that it does make sense for us to go and enter into this contract and um and i think walmart was um uh very generous in in picking um their location here i know that uh they paid already paid more taxes than they previously used to when they were in brisbane and in addition to that they were willing to negotiate this and so um i wanted to make that statement because i i wanted it at least to be on the record that we do understand what we're getting into and i i personally believe that this is a very good deal for the city so that was it just a comment okay thank you councilman mason or i'm sorry council member davis yeah no i was just gonna say i i hope that uh our city attorney can encourage with michael's comments because i'm i'm glad he said something and i'm glad he so eloquently explained that but i think that's an important thing that it for those who are watching or listening should understand if i may through the chair mr mayor i i do concur i think there's also one thing that sometimes gets lost in those discussions and and that is that some members of uh of the public might feel that agreements like this these are are unfair when they're pitting cities against each other and it's sort of a race to the bottom about who's going to who's going to give them the biggest break and that's actually not the case here walmart.com has been here consistently for you know for 10 years now um and they made it clear in the negotiations that that we were you know they they have a commitment to being in san bruno as evidenced by their presence here for a long time so this is not one of those situations that sometimes garners a lot of public attention because cities are competing against each other to bring in the business that that's not the case here it was not not the situation excellent point mark thanks councilman mason yeah and i would i would also say that based on the last report that was given um they're actually giving san bruno more than some of the other um city agreements that are similar so i actually think that the city that's really in need of funds is in a better position now with this agreement one once it's signed than it would be before so um i just wanted to say i concur and i want to see a signed agreement before i get too excited thank you and uh just won't repeat but again thanks to to staff for your efforts and uh bringing this forward to us this evening um see no other um comments from council uh this is for a resolution any action okay we have a motion made in a second i will let's see clerk i'll work that one out uh roll call please council member davis aye council member mason hi councilmember medina hi vice mayor salazar hi mayor medina aye motion carries mr city attorney is that all that you need on this topic thank you very much yes it is thank you and thank you again to both uh both of you and city manager

Show more