Set Forth Signature Service Order with airSlate SignNow

Do more on the web with a globally-trusted eSignature platform

Standout signing experience

Trusted reporting and analytics

Mobile eSigning in person and remotely

Industry rules and compliance

Set forth signature service order, quicker than ever

Helpful eSignature add-ons

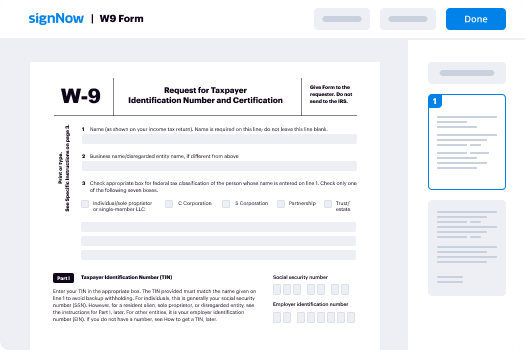

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

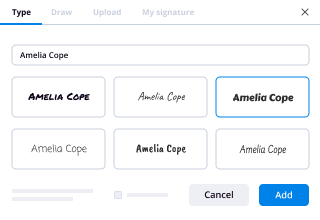

Your step-by-step guide — set forth signature service order

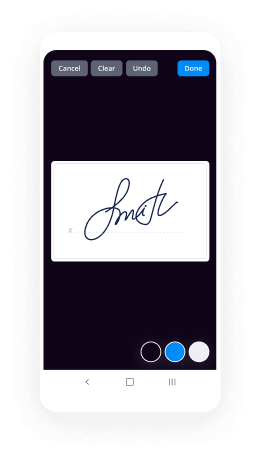

Leveraging airSlate SignNow’s electronic signature any company can accelerate signature workflows and sign online in real-time, supplying a greater experience to consumers and workers. set forth signature service order in a couple of simple steps. Our mobile apps make operating on the run achievable, even while off the internet! eSign documents from any place worldwide and close up trades in no time.

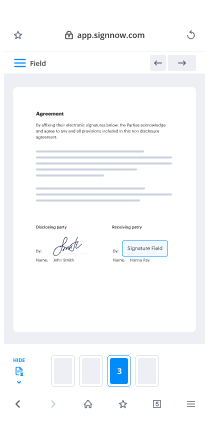

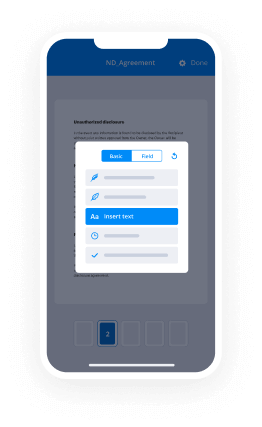

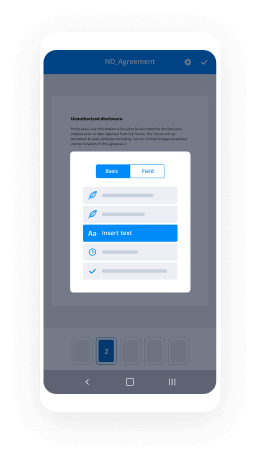

Take a stepwise guide to set forth signature service order:

- Sign in to your airSlate SignNow account.

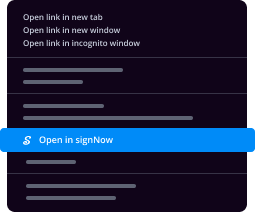

- Find your needed form in your folders or upload a new one.

- Open the template and make edits using the Tools list.

- Drag & drop fillable areas, type text and eSign it.

- Include multiple signers using their emails and set up the signing order.

- Indicate which individuals will receive an completed version.

- Use Advanced Options to limit access to the template and set up an expiration date.

- Press Save and Close when done.

Additionally, there are more enhanced functions accessible to set forth signature service order. Include users to your shared digital workplace, view teams, and keep track of collaboration. Numerous people all over the US and Europe agree that a system that brings people together in one holistic work area, is the thing that businesses need to keep workflows performing smoothly. The airSlate SignNow REST API enables you to integrate eSignatures into your app, website, CRM or cloud storage. Try out airSlate SignNow and get faster, easier and overall more efficient eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results set forth signature service order with airSlate SignNow

Get legally-binding signatures now!

What active users are saying — set forth signature service order

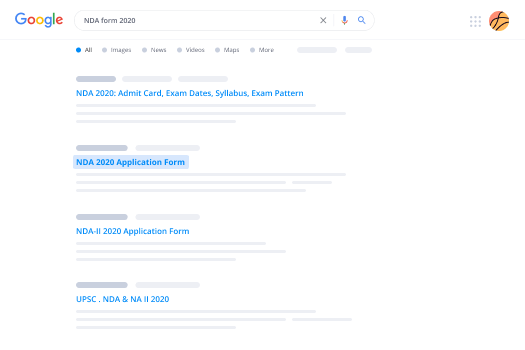

Related searches to set forth signature service order with airSlate airSlate SignNow

Set forth signature service order

all right a very good morning to everyone on the west coast good afternoon everyone else welcome to today's webinar uh i'm rahul bintlisch i'm vice president of sales for grid dynamics we are a technology services company focus on digital transformation of enterprises in the us we're headquartered in the bay area in california we have uh very eminent uh set of panelists today for today's webinar we do these webinars you know throughout the year actually we're doing two every month uh today's is part of a series that we do on the financial services uh that includes really banking financial services and insurance companies for us let's go through a quick introduction of our panelists uh starting with jimmy um yes it is a pleasure for me to be here and now hopefully i will be able to answer most of all the questions and the the topic is uh very it's a topic of passion of mine and i just wanna let the audience know that uh just a quick disclaimer i am a practitioner and i'm a researcher on the topic of uh fun digital banking and the views and opinions i would be expressing today in our discussion come from my research and from my years of practice uh and it belongs solely to me it does not represent the views of my employers in any organization that i will be uh that i will be sharing that i will be taking as example but it is a pleasure to uh to be here i hold and looking forward to uh to the panel discussion thank you jimmy jimmy welcome aboard uh siddhartha hi good afternoon everyone uh my name is sudhakar i work with truist my employer is in a very unique situation we would have probably heard suntrust bank and bb and t merged together to form truest so we are right in the middle of a merger as part of my organization uh all authenticated public-facing websites are under me so again i'm going to borrow what jimmy said my opinions are pretty much coming from my experience and what we're trying to do and not a view from the company you sadaka hello everyone kiran nadgar i had the api and ux platforms at silicon valley bank uh we're headquartered in santa clara with offices all over the world and i managed the build out of their api platform api governance and both for internal and external apis and the user experience platforms as well glad to be here thank you raj hi i'm raj kumar and i'm a data science fellow and vice president at echofax i run a team of data scientists and big data engineers and we are part of uh echo facts innovation office our charter is to work on capabilities that would bring us revenue in three to five years and uh here like jimmy and other people most of uh the opinions expressed in in this talk are my opinions and do not necessarily reflect the opinions of echo facts thank you very much great thank you raj so we'll get into a discussion about the top tech technology priorities uh for the industry in 2021 i'll start with you karen uh what are the top three opportunities uh that you are prioritizing in 2021 for uh for business impact and how do they compare to 2020 so i would say that uh where 2020 uh made a difference for us was that uh it helped accelerate a lot of the transformation initiatives that we had planned um in beginning in early 2019. the difference that we saw uh we're seeing this year is the acceleration on all of those initiatives right so when we look at what are the top three uh opportunities that we see i think it's more than just three so i will expand that on a little bit essentially if i were to circle them up in three it's essentially technology modernization as a whole and i'll go into details of that as well there is data and analytics and essentially globalization of our capabilities right and when we look at uh globalization it is it goes down goes back to the very first point of modernization which is saying that what does modernization really mean uh from a technology perspective it's a it goes uh along the lines of cloud adoption right it goes uh we we are building out our api platform we have an api strategy in place it also includes dev cyclops quality engineering and automation around all of these right and as part of our acceleration what we have done is we have set up centers for enablement which is again building out those capabilities providing all of these capabilities as a service so that the teams that are building the products and services are able to do that in an automated fashion as much as an automated fashion including the governance automation as well right so reducing the dependency on people to do certain things by leveraging automation is key from a globalization perspective uh taking uh capabilities that we're building for the us for example and making it available in uk or europe or india what have you it's leveraging the cloud and all of the automation around it is where we are going so those are the top three for us which is modernization uh leveraging data and analytics to uh help business make better decisions so we are also focused that's one of our top priorities for 21 and the global operating model thank you karen uh sadaka your bank is significantly different compared to silicon valley bank you're more consumer focused uh how do the priorities look like for you uh thanks karen for kind of uh throwing light on the priorities uh from our uh standpoint we are uniquely positioned because of the timing right we are right in the middle of a merger it's not fully completed even though we announced it uh last february um the process is not complete so we have different challenges at the same time we are uniquely positioned because both the banks have similar systems we were competitors to be kind of in the market right very similar size the market segments could vary but then we had similar applications that are there so we are uniquely positioned to kind of pick the best that is going to be there and at the same time uh uh you know do what uh we thought is the right solution right no tech debt need to be carried forward and things like that so with that unique position um the top three priorities the first one is really uh supporting what we call as client day one right the legal day one is the day we got recognized and our stock got repurposed as truest uh the client day one is really where a client walks into a branch or goes online and then he sees the truest brand today he sees a bb t brand and santos brad because that's the way it is today so our first priority is to make sure that we support our clients on the client day one uh which is coming up uh the first quarter of 22. so we we have an entire year of work planned for that while we are doing that uh two other aspects that actually come our way is the client experience right uh client experience you could just pick anything that's out in the market and do the websites and the mobile applications that are there but today the client expectations are changing especially with the biggest digital transformation agent called coved everybody is now digital right everybody's expectation is different everybody wants to bank in a certain way so uh we're trying to marry the the demand that we saw coming in from last year's uh pandemic plus the best practices from both the organizations so digital experience taking the bank to where the client wants us to be is the second priority the third one is really availability right digital availability uh and and that's probably where what kiran mentioned comes into picture technology modernization leveraging cloud a whole bunch of other things where we can make our systems completely available what's the point in having the best of breed if it is not available right so not only are we dependent on a whole bunch of third-party partners to provide our services we wanted to focus on having the truest digital services available 24 7. so the top three priorities again honoring our client day one making sure that the digital experience is top notch and digital availability thank you sadakar just a follow-up to that the innovation using digital technologies has seen a huge uptick uh post go with uh so just a follow-up to the priorities uh how are you looking at from innovation budgets perspective are you investing more in 2021 compared to last year uh absolutely uh so now innovation is kind of been ingrained in bau right i kind of look at innovation as two different uh parts one is kind of that which is ingrained in each and every uh thing that we deliver um and the second one is that which breaks the ground right for example uh we are talking about uh bau like you know including alexa making sure that the function features are available uh with our regular channels right and people's expectations are very different right people want to make a payment to their bill uh using cash that's normal right whatever money is in your bank you used to pay but today the expectation is that i should be able to pay using a credit card debit card to the extent that if somebody had uh miles in an airline they would like to use that to pay uh their credit card uh or their utility bill right it's kind of innovation coming from that standpoint um specifically for truest uh one innovation has always been part of uh our bau i'll call business as usual but in addition to that because our headquarters is in charlotte there is a innovation center that we are putting together more for folks to come together and start ideating right now things could be very different you have a regular digital where you go to online or mobile but then there is this new uh areas that people are used to like the xboxes of the world or playstations right can you bring in uh a banking experience to those users where they are currently so uh there's uh the the groundbreaking innovation that is also being looked at so between the two uh well we are looking at uh constantly innovating uh uh not only our client experience but at the same time uh make sure that uh we are continuously educating ourselves right to deliver to our clients thank you sadaka uh and raj equifax is different from other companies being represented today or leaders from other companies that we have today in terms of it being more of like a credit builder than a real bank uh how are priorities and uh innovation looking for you in 2021. so in eco-france innovation is considered within the dna of the company itself like pretty much every business unit and coe are constantly innovating so they are we are constantly required to do that in addition to uh business as a co is constantly innovating we also have a specific innovation team and which i am part of to to go deeper who our full-time job is to think about developing capabilities that will bring us revenue in three to five years so we our innovation happens in terms of our core is risk modeling like like for example the the major use of our data is risk modeling so we would we constantly are striving to innovate in terms of risk modeling and both in terms of the data that we create the attributes that we create and the modeling technologies that we create and the use of this data in different different so innovation happens in many many aspects then as far as marketing so similarly so we do have multiple data assets uh within within whatever uh governance rules and without within that constant constraints we are also constantly thinking about how can we use this data for uh novel marketing applications and finally fraud is our third major business where we are trying to use uh where uh we're trying to use how can we use all of our different data assets to prevent fraud like like we play in the space of uh uh account origination plot so that is like when somebody come walks into a tourist bank or like a silicon valley bank we want to make sure that the person is it's actually who you say you are and we specifically play in that space now with our acquisition is also uh that we are also going to play in other spaces as well so in within these three contexts like you know risk marketing and fraud we constantly are keeping trying to understand what is the latest and greatest in terms of machine learning so like when we have a our team we already have close to 20 patterns in the last five years or so we come up with different things we demonstrate the value of it like in terms of deep learning in terms of graph technologies in terms of other use of ai and ml and nlp in terms of how can we extract uh information from our data specifically we're also looking at unstructured data and so on thank you thank you raj uh jimmy i will move on to you and we are seeing a trend uh a lot of buzz around services platforms uh in fact according to one survey eighty percent of the banking executives believe that the future of finance is a services platform that consumers can access via mobile how are you staying ahead of that trend all right that's a that's a that's an excellent question and uh i'd like to start by saying do you remember the famous commercial capital one that says what is in your wallet i mean other banks i'm sure we're working on on the background however they were pretty much shutting it at the top from the mountaintop and pretty much in every single of their commercial so banking is and will continue to trend towards digitization just like we i mean the other panelists just mentioned coveted 19 pandemic accelerated or revealed the value of financial technology solutions and enhanced user experience seamless functionality greater control and visibility into finances is what many corporate and small business end users are really demanding uh to be part of their banking experience and i'm i'm trying also to make the distinction between banks were which is the traditional break and motor financial institution that we go into so you have commercial banks retail banks um shadow banks credit unions versus banking which is the transaction the business activities uh where we conduct doing payment deposits lending and so forth so how we staying ahead of the trend so bank of america is really leading the pack american banker revealed that bank of america has dominated digital banking by all measures and has planned to stay ahead of the game here are some numbers that i can share with you uh and i believe those numbers may have changed since their general release bank of america has more than 66 million consumer customers and 10 billion times a year is the number of interactions between bank of america and its consumer customers and 90 of those interactions are digital i mean mobile online and also to the interactive voice response they are about 38 million digital users 19 million mobile banking logins a day um they're about 30.4 million mobile banking users so and also the bank has the artificial intelligence uh virtual assistants called erica if you're bank of america you remove the am you have erica uh erica there about 12 million users getting help from erica per month and also the bank has the sale application there's about 11.7 million people use on the bank version so how is the bing staying ahead of this trend the answer is simple bank of america is a company that has four gold to bring never before possible convenience to clients so when you bring all those technology technologies uh all those digital aspects whether it's current trend and future trend you're bringing it you try to normalize it to the day to day clients so they don't have to worry about the technology itself but many of the processes by which they need to get things done now one of the recent uh innovation or release the bank has is the new digital debit card that clients can use to perform transaction immediately without waiting for their physical permanent card and as we as we move forward towards a cashless society which probably will take some time the credit card area most likely is going to be uh the next sector that will start that will start seeing some type of fragmentization as people now uh will start dealing with digital card instead of the physical that the physical card itself great thank you jimmy for that detailed response uh sudakur uh you have a unique challenge uh with the merger as well uh how is it uh for you in terms of this trend yes so rahul i think uh you know both uh the heritage companies applications have been rated pretty high by javelin right so that kind of sets a stage saying that when we do the work for trues we kind of need to beat our own records so if you look at mobile application it becomes stable stakes right if you don't have a mobile application you're not a bank at all uh and if you start looking at the the usage of it it comes handy because of the way it is put together right for example if you get a check your mobile application is the one that allows you to deposit without even getting off your house you have a problem your alert comes to your mobile and you have actionable alerts to prevent a fraud from happening right though it goes to email as well the device that is always stuck to you is your mobile device right so warnings alerts all those are coming to your mobile devices now there are many applications like if you switch your consumer to to corporate world even the corporates are now starting to adapt mobile not because of the function feature richness but more from executives right you start having wire approvals uh attached to your mobile device and then anybody in your accounts receivable raiser request your exit may still be in a board meeting but the alert is what is going to kind of uh want to say subtly inform him that there is something important waiting for him amidst another important board meeting right so the usage of mobile application has kind of come to being of its own so you probably need to be there so whatever jimmy mentioned the kind of proofs that mobile is really where the application needs to be but come to think of it there is another set of uh mobile application that comes to right so for example alibaba's of the world or amazons of the world they have kind of come to a different set of consumer base that uses these applications now you have many ways in which you can pay for them right we as a financial organization are looking at something called the embedded financials right where you could be the funding source for making a payment to something that you buy in amazon or in alibaba right so not only are we going to have an application of our own but we need to be able to find ways in which we can coexist in an ecosystem with the partners to be able to provide services for them so think about uh amazon options coming down and saying credit card debit card your paypal and then your own bank right uh if you have an option to pay with your own bank you would feel much safer to make that transaction as opposed to providing your detail to an external source right given all the fraud and security hacks that are out there today so uh kind of morphing itself it's becoming uh or trying to take a life of its own as we go so the two priorities one kind of looking at your current bau needs uh of what the customers want and two trying to be in places where you co-exist in an ecosystem great thank you siddhakar quickly for the audience i see there is one question being asked in the q a section i will come to the q a at the end of the panel discussion which will be about 35 minutes past the hour if others have question please keep adding it there and i will pick them up for our panelists at that point in time some of you touched upon customer experience and that's clearly a big competitive advantage for every financial institution whether bank or otherwise kiran how are you looking at modernizing customer experience this year sure so i would uh expand on that a little bit i know customer experience is absolutely critical as we are serving customers but what also impacts customer experience is the employee experience right so we are we are looking at it from both those angles and what are the changes that we need to do to be able to do that right so and where uh 2020 helped us refocus our efforts was really on the digital part right uh making sure that ex we are a relationship driven bank right a lot of it was in-person meetings with clients and discussions and all that but now everything has gone virtual so focusing on taking that experience that was a physical experience and moving into a to a digital world right which means that how do we take our for example onboarding process right which uh involved a lot of manual work now do we completely digitize it both for the customers and our employees as well all the relationship managers that we have right so that's an example of how we are addressing or changing that that customer experience so taking not just onboarding but servicing and even payments right i think uh sudankar made a point of that of uh embedded finance but expanding that on a little bit right uh where we are focusing from enhanced customer experience is that it's no longer necessary for customers to leverage your uh a bank's online portal to conduct uh transactions anymore right that's where we are leveraging apis to not only power our online banking systems but also empowering our partner ecosystems to leverage the same which is where you are providing a similar experience irrespective of where your customer is interacting with the bank from right so and that is the key here is that irrespective of where they come in through whether they're coming through an externally exposed api or using your online banking experience that uh that consistent experience across different channels is the key right the other parts is uh other two things is that is the is what dagger touched upon as well is the reliability right it's not enough to say that you have a great mobile experience or a great online banking experience but how reliable it is right when a customer submits a payment for example how do you guarantee that it's going to be successful right or if it's not successful then how do you make sure that there is there is a way for them to fix that so making sure that the experience is not only consistent but reliable and available 24 7 because we have we are in that world now where you know the bank branch may close at 6 pm or whatever but the transactions keep going for it for 24 7. so we have to uh that has that has accelerated a lot especially now and that is going to be the path forward right we are no longer a 9 to 7 operation but we have to make sure the systems are available and lastly it is the analytics and the the what we call the data that is provided to the customers right how do we leverage the data from all the interactions and help them make better decisions and i think we are uh being a commercial bank we are in the space of uh of uh startups right and we we help build startups we take them uh through their lifecycle so as the needs for these companies change how do we build that xp life cycle experience to help them do better and do it digitally right so overall those are the things we are looking at how do we digitize experience how do we provide a consistent experience for irrespective of the channels and how do we make it reliable and more self-serve than before great thank you killen and sudhakar being responsible for online banking and client portals assume you live and breathe customer experience every day absolutely how does it look for you this year so that definition has been changing constantly now so if you looked at earlier customer experience was around providing a good environment or the layout where people can interact with your banking experience right that was kind of what was originally there but now the clients are asking for something more right we we they make transactions we provide them the information right what they are now looking for is uh insights and intelligence right to what raj and kiran both alluded to right the artificial intelligence is really where people are looking at they're asking okay all the banking transactions that you do what does it mean to me right am i going to be having enough money to make my rent payment for the month or do i do things like you know duplicate uh payments like like for streaming services right if i pay netflix as well as this can you show me or am i paying spotify as well right so they are looking for insights uh from uh the banks that we are that they want their financial uh well-being to be taken care of right so we are kind of considered like the doctors you you can say a regular doctor or a veterinary doctor right veterinary doctor has to figure out what's going on with the patient while the regular doctor kind of can talk to you and say hey what's going on i have a fever or what not so we are now more moving towards the veterinary doctor psychology where we need to understand what the client really needs and he's not going to tell you that it's paining or it's doing this but you can be very sure that if you don't uh do that they're going to go away to the next bank that's available right or or what what's going to be delivered to them so customer experience has been more towards this insights and intelligence the second aspect is really on the security part of it right uh with so many digital presents and so many transactions happening in digital world uh the key that they are looking at is how secure is it for me to operate uh with the bank right so not only am i going to be having a spread of buffet of services am i doing it in the right manner and am i doing it in the most secure manner that's kind of the challenge uh that we have seen now um so the kovad has not only just made that worse because if you go back and take the last 10 years trend it's come to a complete flip-flop in the last 10 months so people's expectation has not only increased skyrocketed but their expectations are way different from what it is so we're kind of changing the engine of a plane as it is flying in fact there are two planes flying in parallel we need to build a third jumbo jet with the good parts from each of those engines right that's where my challenge is great thank you i know we are almost at 35 past the r what i'll do is i will start including some of the questions uh into my discussions with you jimmy we were going to talk about payments which is showing a very significant uh innovation in the industry whether it is payments through whatsapp messages contact payments and like when someone in the audience mentions cryptocurrencies uh what what are you seeing in terms of trends and focus areas yes rahul that's a that's a big question in terms of uh when you're talking about financial solution promise to revolutionize the way consumer pay insurance for money and uh first we want to make sure that uh provide a quick background on when we're talking about payments so we all pretty much custom with what i will call a semi cashless society because we use our credit card and there are a lot of applications that are being built on existing payment systems so i will be talking quickly about four different kind of payment system to uh to really get into where we are now and where i see the trend going so the first one we talk about is mobile payments mobile payment scan you can you can segregate that into seven categories you have sms or text messages that you can use to pay for products and services you have direct mobile payments that use the two-factor authentication or a one-time password some of us are pretty much very used uh pretty much very regular that we use that and we have online wallets that's paypal amazon google apple you have quick response or qr code payments you have the contact class uh we call them the nfc communication when when you go to walmart or to any of the stores you take your credit card and you waive it into that machine you have cloud based mobile payments you even have this one i don't even i don't i've seen it very in few places it's the audio signal mobile payments it's what we call the near sound data transfer pretty much uh what it is your it produces audio signatures that the microphone over the cell phone can pick up to enable electronic transactions not only so those are the category for mobile payments that many of us have pretty much have used at least one of those categories we have streamlined payments have to do with location-based payments or geo-tagging some of the companies that pretty much prevalent in that and that fill is magic band bpay ship wallet you have integrated billing uh uber order ahead organization that in deals a lot with mobile ordering or payment access apps and last is the next generation security which is where most of the train is really gearing towards uh biometrics location-based identification tokenization standards and visa mastercard they're very involved in some of those um now we cannot live behind the ai and machine learning and cryptocurrency also part of those that you will but i like to put that in different category by itself as we enter 2021 um what i have seen not necessarily some of those technologies because they will just pop up they don't really tell you when they're popping up but what i'm seeing happening is the trends towards the cashless uh more cashless and invisible uh methods that will enable data-driven engagement platforms for customers uh the world will not be cashless in the next 11 months let's be let's be clear because there are some challenges you have merchant adoption not all mom and pop shops accept credit cards or mobile payments uh cash is convenient when you go to the farmer's market or when my kids want to go to the neighborhood store they will still use cash but there will be also a segment of the population that is without primary bank accounts or there are developing countries in the world um that do not have the infrastructure for that nonetheless you do have the trend that is going towards cryptographic protocols p2p uh transfers and mobile money which is different from mobile payments one of the challenges that those those uh trains will face it it's the fraud uh that is still relevant and trying to find what type of regulations to put around those um that currently banks uh banks have the trust of consumers when you make your deposit in the bank the regulation pretty much provide that safeguard that your money is safe but when you go outside of deposits you get into payments lending it's a whole it's a whole different world in summary what i'm what i'm seeing more is areas of the permit market where there will be a consolidation of all the payment methods that i just mentioned and banks will have a harder time to evaluate credit worthiness for con for customers because you you're looking at the fragmentation of the market it's going to be hard to really evaluate payments because i can make all my payments to paypal so and so forth that the bank may not have access to so the role of traditional financial institution will change and and i believe it's going through that trajectory it will change due to the evolution of decentralized or non-traditional payment options or schemes that consumers will have available i see this to be more of a imminent uh change in the way we do business when it comes to bank and banking thank you jimmy and uh to your point of the roles being changing uh equifax probably has to deal with their role in this new world especially when the payments are becoming so diverse how does the role of the agency change raj and how are you leveraging modern technologies to deal with things like fraud yeah so like as as you all know recently we just announced acquisition of cloud so we both have homegrown or organic technologies that we developed and we have been developing constantly developing behind the scenes and on top of it we've been we've been acquiring companies that can help us in this area so like one is like one is obviously acquisition of data and also um both acquisition of both acquisition and developing new technologies that will help us to take advantage of the data that we just acquired great so i know we may have time for a couple more questions here and i see a question coming around apis around cloud so jimmy what's your opinion about open api architectures you know in europe at least there is a banking regulation about open banking that is driving those kind of architectures but we don't have such a regulation in the us do you see the u.s banking industry going in that direction even without regulation hey kiran you'll probably be the person for this because this is this is a loaded topic because i mean you're you are talking about um an open banking architecture and you're talking also talking about regulation um regulation that i mentioned earlier let me just take a snap at it real quick uh uh i have been following the congressional research service uh the real an interesting document back in april uh that talk about uh deals with regulations that address the open banking uh component so it is it is a fascinating uh fascinating read so let me provide some quick background real quick and then kieran i think you'll probably be best to talk about the api component so we do have a trusted financial system as i mentioned because the federal government provided some guarantee in our deposits right so traditional banks are pretty much trusted in that aspect the same regulations that protect financial banking institutions or the same regulations in some aspect that's holding them back when it comes into the other world so and many of you i don't need to remind anybody about the global financial crisis in 2007 in 2008 so some of those regulations do have a purpose so fainter companies do not fall under the same regulations of traditional banks so they have more latitudes to innovate they can improve the efficiency of the financial system and also help customers and make um make banking you know more fun if i can use that word so the question of the challenge is whether the existing legal in regulatory frameworks when taking into consideration new technologies no capabilities and new innovations from fintech companies can effectively protect consumers against homs without handicapping the benefits that they can get from technology so some er some aspect that falls under regulations we have proliferation of internet access and mobile technology big data alternative data cloud computing data security now you talk about open banking talking about the api just for the audience to to to have a good understanding of that the technology that's often used to collect account data is what we call the web scraping it is a technique that skins website and extract data from it so pretty much when you go online you enter your your username and password that software goes to your bank to your connect with your bank and pretty much a scripted data because mostly all that information is available now although it is advantageous because it gets all that information pretty much right away uh but it also offers some drawbacks in terms of data websites updates most financial institutions provide access to customer uh information through what we call the structured data feed or api or application programming interface whatever that you can call it it is an alternative to web scraping which is which one is better web scraping or api um you know it is for discussion api api appears to be more secure in terms of cyber security and fraud risk when we use api bank standards with customer approval to share um information from the bank and from that third-party software we call that open banking and many people use some tools to manage their personal personal finance such as met that pretty much connect your account to to track your spending and so on so forth so the benefits are there the main issue remains privacy security and cyber security i'm sorry privacy issues in cyber security open banking initially uh open banking initiative my writer typically specify when and how financial institutions can share your data for example the uk regulators require customers to approve of information sharing with specific parties u.s banks from my understanding i could be wrong already have that control and limit and how customer information is shared and we input of course from the customers and i'm not sure they are eager to give up that that ability so the regulators in the us face three i would say four major questions should did a security be prescriptive and follow in normative standards and if so that will lead to inner flexibility it may harm innovation question two should data security be government defined and outcome based an outcome-based approach will also lead for banks to now comply with a wide range of data standards question three should relevant data security now uh security laws continue to cover all sensitive individual financial information and last should the scope of this laws be expanded the answers to those questions will most likely dictate the direction the u.s banking industry will go along with regulations so this is a long answer but the short question is the short answer to this question is it will have to depend on how u.s regulators uh understand and what type of leeway or what type of restriction they want to establish on on u.s banking thank you jimmy and i know we are out of time we plan for 45 minutes but i'll just go over a couple of minutes more to quickly hear uh from kiran and then also from raj on the topic uh you know even though not in banking equifax in a parallel organization is looking at it very very keenly so i would love to hear from raj as well but uh over to you kidding yeah i think there are there is activity happening uh as far as open api architectures go in the us right there is no question about it there is notcha that is uh coming up with api standards for ac edge uh the fns uh group right but in addition to that if you've seen the recent news with what the financial data exchange has done right they've added 33 new members uh in 2020 right so we are seeing the activity not in a regulated way not coming from as part of you know as uh like the europe has done with psd too but what we are saying is that there is more uh acceptance to aligning to certain standards in the us right so that i would say there is uh the this is like the beginning of something of an open api architecture regulated or not i think jimmy covered those points in great detail so i'll not repeat that i think the key here the key point for me was the whole privacy discussion right even if the all the banking entities in the u.s or financial institutions come together and adopt fdx for example there's still this case of how do we manage customer privacy and consent uh where does uh the how do we regulate that right that part is key here to make sure that the customers that are uh cust that are using these services are comfortable with their data being shared uh the other point that uh i would say is that as we think about uh customers i think it's important to think about the the teams or the organizations that are leveraging these apis right without a consistent standard i think there is a lot of effort and time that goes into building all of these applications and there's a lot of screen scraping happening so purely from a technology perspective there is a lot of advantages to adopting a standard across financial institutions so i'm i'm definitely looking forward to uh you know what happens with nacha and what happens with fdx because there's a lot of promise with modern leveraging modern architectures and going away from file based transactions to more real time because the world has become real time in a very short time and the financial institution at this point are catching up we just need to accelerate that path thank you karen yeah well there is a technology centric answer that lakiran and jimmy both covered very nicely but let's take a step back and first of all understand why was open banking even introduced right for a minute so that the problem in uk is that four banks four or five banks whatever they had like eighty percent of market share and the what worried the the congressman there is that there is no competition between the banks and once once a customer goes into a bank and they are there for life so that was a that was a problem they were trying to address and the hope is that once we once we open up like you know to figure out who is paying what for how much what uh who is paying for what service how much then hopefully people will foster competition like banks will foster competition and so on right unfor i don't know if that problem exists in u.s to begin with right i seriously doubt that problem exists in in us right so we have our market like we have like much more fragmentation than like four four four banks and uh then we have a lot more um then there like many many channels of getting the same information the competitive information and things like that so i seriously doubt that problem actually exists and i i'm guessing everybody like including banks and i think us we are carefully looking at it and we are i think um taking a wait and see approach but like everybody uh like i think like all of us uh are looking at it very very closely watching the developments and then sort of when things happen if and when things happen in us i think we are ready yeah i would uh i would like to add to one point to that i think it's very fair what raj brought up in terms of challenges but where i see the opportunity for all organizations in the financial space is the innovation that comes out of having open apis and standards right so that that is what we are starting to see a lot of in the uk i think the us will benefit a lot with the standardization yep and uh you know close sister industry insurance is also seeing a big big benefit coming out of open api architecture so the next not only 20 21 next few years uh are really going to be very interesting both from a technology and business perspective for this industry and i know with that we'll wrap up today's session uh thank you so much to all our panelists jimmy sudhaka raj and kiran it's a great discussion we can go on because we have such interesting topics over a long time we'll wrap up for now thank you to the audience great set of questions we went through some of them hopefully you found that very interesting uh you can always contact us at the contact information you see on your screen we will continue to have future webinars so be on the lookout and join us again thank you have a great day everyone thank you rahul thanks thank you

Show moreFrequently asked questions

What is needed for an electronic signature?

What do I need to sign a PDF electronically?

How can I make an electronic signature on a PC?

Get more for set forth signature service order with airSlate SignNow

- Wet byline

- Prove electronically signed Speaker Agreement Template – BaseCRM Version

- Endorse digisign Waiver

- Authorize signature service Halloween Event

- Anneal mark Rental Inspection Checklist

- Justify esign Flooring Installation and Repair Proposal Template

- Try countersign Facility Rental Agreement Template

- Add Transfer Agreement countersign

- Send Painting Quote Template sign

- Fax Church Invitation electronically signing

- Seal 911 Release Form PDF eSign

- Password Construction Equipment Lease Proposal Template eSignature

- Pass Hold Harmless (Indemnity) Agreement autograph

- Renew Divorce Settlement Contract electronic signature

- Test Occupational First Aid Patient Assessment signed electronically

- Require Independent Contractor Agreement Template electronically sign

- Comment onlooker digisign

- Boost seer esigning

- Call for receiver byline

- Void Gardening Contract Template template signatory

- Adopt Relocation Agreement template initials

- Vouch Free Event Ticket template eSign

- Establish Current SSY Agreement template esigning

- Clear Vehicle Bill of Sale Template template digisign

- Complete Veterinary Hospital Treatment Sheet template electronic signature

- Force Rental Invoice Template template signature service

- Permit Job Confirmation Letter template countersign

- Customize Non-Disclosure Agreement (NDA) template sign