Sign Liquidity Agreement Made Easy

Get the robust eSignature capabilities you need from the solution you trust

Choose the pro service designed for pros

Set up eSignature API with ease

Work better together

Sign liquidity agreement, within a few minutes

Reduce your closing time

Keep sensitive information safe

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

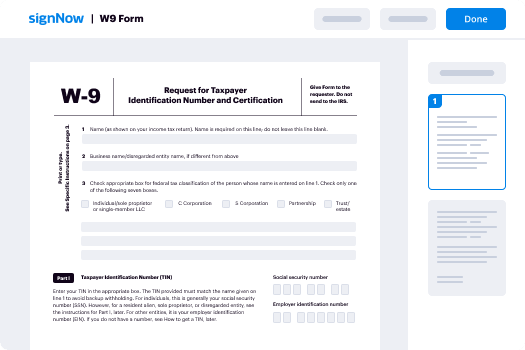

Your step-by-step guide — sign liquidity agreement

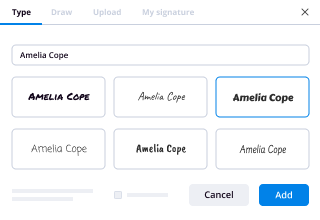

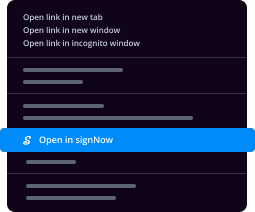

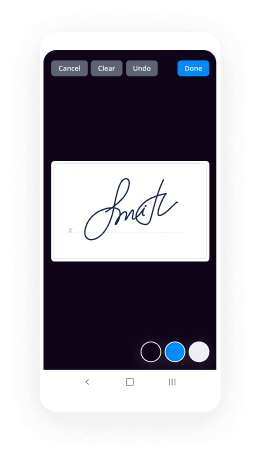

Leveraging airSlate SignNow’s eSignature any business can enhance signature workflows and sign online in real-time, supplying an improved experience to clients and workers. Use sign Liquidity Agreement in a few simple actions. Our handheld mobile apps make working on the move achievable, even while offline! Sign documents from anywhere in the world and close up tasks in less time.

Keep to the stepwise instruction for using sign Liquidity Agreement:

- Log on to your airSlate SignNow profile.

- Find your document within your folders or import a new one.

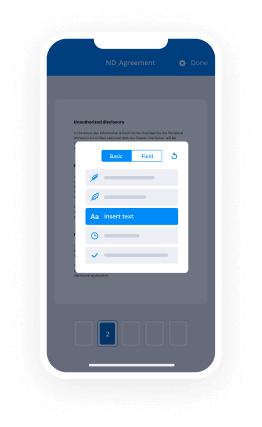

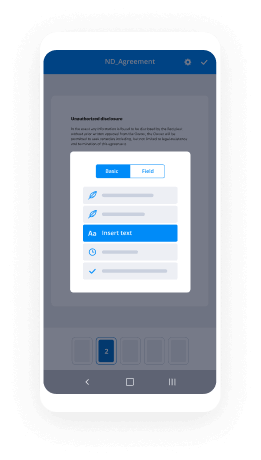

- Open up the template and edit content using the Tools list.

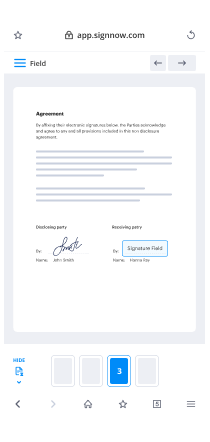

- Drag & drop fillable areas, add textual content and sign it.

- Add several signees using their emails and set up the signing order.

- Specify which users can get an completed copy.

- Use Advanced Options to restrict access to the template and set up an expiration date.

- Tap Save and Close when done.

Furthermore, there are more advanced tools available for sign Liquidity Agreement. Add users to your shared work enviroment, view teams, and track teamwork. Millions of customers across the US and Europe agree that a solution that brings people together in a single cohesive work area, is the thing that businesses need to keep workflows performing effortlessly. The airSlate SignNow REST API allows you to embed eSignatures into your application, website, CRM or cloud. Check out airSlate SignNow and get quicker, easier and overall more productive eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results sign Liquidity Agreement made easy

Get legally-binding signatures now!

FAQs

-

What is a liquidity agreement?

Liquidity Agreement means any agreement entered into in connection with this Agreement pursuant to which a Liquidity Provider agrees to make purchases or advances to, or purchase assets from, any Conduit Purchaser in order to provide liquidity for such Conduit Purchaser's Purchases. -

What is liquidity with example?

In other words, liquidity describes the degree to which an asset can be quickly bought or sold in the market at a price reflecting its intrinsic value. ... For example, if a person wants a $1,000 refrigerator, cash is the asset that can most easily be used to obtain it. -

What is liquidity in forex?

Definition. In the Forex market, liquidity pertains to a currency pair's ability to be bought and sold without causing airSlate SignNow change in its exchange rate. A currency pair is said to have high level of liquidity when it is easily bought or sold and there is an airSlate SignNow amount of trading activity for that pair. -

What does liquidity mean in terms of money?

Learn the meaning and importance of liquidity Liquidity is the amount of money that is readily available for investment and spending. It consists of cash, Treasury bills, notes, and bonds, and any other asset that can be sold quickly. -

Is high liquidity good?

A high liquidity ratio indicates that a business is holding too much cash that could be utilized in other areas. A low liquidity ratio means a firm may struggle to pay short-term obligations. One such ratio is known as the current ratio, which is equal to: Current Assets ÷ Current Liabilities. -

What affects liquidity?

Effective Cash Management and control of cash flows Apart from the above factors, the other factors that affect the liquidity mix are yield, taxability, interest rate risk, financial risk, liquidity of security etc. -

What happens if liquidity decreases?

In a liquidity crisis, liquidity problems at individual institutions lead to an acute increase in demand and decrease in supply of liquidity, and the resulting lack of available liquidity can lead to widespread defaults and even bankruptcies. -

What are two liquidity measures of liquidity?

Primary measures of liquidity are net working capital and the current ratio, quick ratio, and the cash ratio. By contrast, solvency ratios measure the ability of a company to continue as a going concern, by measuring the ratio of its long-term assets over long-term liabilities. -

What is included in liquidity?

Liquidity refers to the ease with which an asset, or security, can be converted into ready cash without affecting its market price. Cash is the most liquid of assets while tangible items are less liquid and the two main types of liquidity include market liquidity and accounting liquidity. -

What is liquidity ratio with example?

Liquidity ratios are measurements used to examine the ability of an organization to pay off its short-term obligations. ... Examples of liquidity ratios are: Current ratio. This ratio compares current assets to current liabilities. Its main flaw is that it includes inventory as a current asset. -

What happens when liquidity increases?

Liquidity in the economy increases if there is more money supply by additional printing and more bank credit if rate of interest comes down. ... If deposits increase following liquidity in the economy Banks have to keep additional reserves by way of Cash Reserve Ratio and Statutory Reserve Ratio. -

What is liquidity effect?

Liquidity effect, in economics, refers broadly to how increases or decreases in the availability of money influence interest rates and consumer spending, as well as investments and price stability. -

Is it good to have high liquidity?

A high liquidity ratio indicates that a business is holding too much cash that could be utilized in other areas. A low liquidity ratio means a firm may struggle to pay short-term obligations. One such ratio is known as the current ratio, which is equal to: Current Assets ÷ Current Liabilities. -

How does liquidity affect the economy?

Liquidity in the economy increases if there is more money supply by additional printing and more bank credit if rate of interest comes down. ... If deposits increase following liquidity in the economy Banks have to keep additional reserves by way of Cash Reserve Ratio and Statutory Reserve Ratio. -

What is meant by liquidity preference?

In macroeconomic theory, liquidity preference is the demand for money, considered as liquidity. ... Instead of a reward for saving, interest, in the Keynesian analysis, is a reward for parting with liquidity. According to Keynes, money is the most liquid asset.

What active users are saying — sign liquidity agreement

Sign liquidity agreement

ladies and gentlemen thank you for your patience and help me and welcome to the municipal liquidity facility drop-in discussion at this time all of your participant phone lines are in a listen-only mode and later they'll be an opportunity for your questions if you'd like to queue up for question today feel free at any moment to press one followed by zero just a reminder today's conference is being recorded now how we did during the conference over to first vice-president at the New York Fed Michael shrine good afternoon and thanks for your time and joining the call Michael slyness our host suggested on the first vice president and chief operating officer at the Federal Reserve Bank of New York that's my day job recently I was given an assignment to be the executive that is accountable for the municipal liquidity facility the goals for the call today are the municipal liquidity facility affect state counties and cities across the country with our pastoral needs governments are under tremendous stress as a result of the virus as is the municipal securities market we recognize that you have strong relationships with government leaders in your district and are likely to get inquiries regarding this program we've provided you the term sheet and that they used their dedicated website for the facility they are the breadth best source of information for a broad overview if you haven't already read them I'd encourage you to do so and if possible to pull them up so you have them in front of you now I'm going to introduce a few of the key players so you know who is doing what and at some point of reference for who you might reach out to and we hope to provide a resource for you to direct questions that you and those in your district might have about the program we will monitor and respond to those questions either with general statements and FA cues for the common program or directed follow-ups on specific questions if they are necessary um people you ought to know that are involved in this program president Roth Kaplan and President John Williams are serving as executive advisors to me and to the program more generally that lever of the Federal Reserve Bank of New York Markets Group has been working closely on the policy issues with the Board of Governors and specifically on issues like market monitoring and pricing and the secondary market and Raschid and the theme who is also the Federal Reserve Bank of New York who is leading the New York banks operations and execution team for this program as the selected Bank sought to run this facility we've been fortunate to be supported by caps of dozens from board legal and New York legal from research and policy staff at the board New York and other reserve banks across the system we have key vendors that we put in place with a depth of muni experience whether it's outside counsel and administrative agents custodians and transaction agents that are on the way in large part because municipal securities is not an area in which the Federal Reserve typically operates last but not least I want to introduce to you my co-host for this can i - can join the Federal Reserve Board five weeks ago at the request of the chair and other governors ken was the first director of the Treasury's Office of State and local financing and he dealt with Puerto Rican debt crisis recently and the Obama administration's build America infrastructure financing program with over 30 years of prior experience in public finance and major Wall Street firms ken brings tremendous gifts to our program in terms of experience insight creativity and commitment to helping the Fed deliver on the important objectives of this program given that this is an area we haven't traditionally operated our goals are to help inform you on the program since elicit your health and also achieving our objectives by exercising that knowledge with the key relationships you have and to partner together to provide it to provide the support to the states counties and cities that this program is designed to serve and with that I'm going to turn it over to Kent to provide a broad overview we promise to leave sufficient time to answer the questions you have and so while we look forward to hearing from you thanks again thanks Michael I'll just give a quick overview of kind of where we've gotten to this point and then I will walk through the FAQ s that were issued earlier this week as most of you know the municipal securities market has been under considerable strain recently beginning in in early to mid March while we saw dramatic increases in sales by institutional investors particularly at mutual funds as a result of redemption requests from retail investors raising cash this causes Swift and dramatic increase in interest rates on municipal securities with the worst of the market probably being in the last week of March although rates have come down from their highs and some issuers have been uh issued debt or secured loans there are still many issuers that are struggling to meet their financing needs through the capital markets and of course at the same time given this unprecedented event the impact on states cities and counties in their terms of their liquidity has been dramatic with not only higher costs with regard to the pandemic but first the delay in first in income tax receipts to July and now certainly there will be significant declines in certain tax revenues primarily income and sales as a result of the sharp recession that we're experiencing so on April 9th as I think you all know the Fed announced the municipal liquidity facility it's designed to enhance liquidity in the primary short-term markets through the purchase directly from issuers of a variety of different kinds of short-term some short term instruments that municipalities and states often issue that will provide them access to liquidity that facility was announced on April 9th in terms of the issuing a term sheet we received a significant amount of comment through our the portal on the Federal Reserve Board website we continue to refine our policy and this week we issued a revised term sheet together with the FAQ s that I'm going to walk through so the how will the MLF work we're using the feds 13-3 authorities together with the funding from the cares Act of section 40:27 a contribution by the Treasury of 35 billion to the SPV is able to be leveraged to the point of being having the fat the capacity to purchase up to 500 billion dollars of eligible notes the program will be up and operating as soon as possible we'll talk about that at the end of the call and it will run through December 31st the calendar year end unless extended in agreement between the board and the Treasury Department so once we're up and operating and the window is open we will be able to purchase securities presented to us by eligible issuers between that point and the end of the year I'm going to jump to Section B now and deal with some very fundamental questions that everybody is asking us and we'd welcome your questions afterwards so the many of you know that the municipal market is comprised of over 50,000 issuers of everybody from states large cities and counties all the way to villages and townships and a whole variety of districts authorities enterprise agencies and so forth and so our primary objective is trying to get to the biggest needs as quickly as we can and at the same time support the markets so that it will function again both the capital markets and particularly in the note field we typically see a fair amount of regional and national money center banks that purchase notes so without being able to serve every potential issuer in the marketplace our goal is to try to address the largest needs and provide for what we're going to talk about as down streaming to others but also to encourage the the private investors in the Municipal Market that once again be purchasing paper for liquidity purposes so an eligible issuer is a state city or county or they can use an entity that issues on their behalf because there's oftentimes limitations on city states and counties directly issuing debt or what we'll define in a second as a multi-state entity that can come to the window directly the threshold rating requirement is that as of the date of the program the issuers had to be triple B investment grade minimum by two rating agencies and we will d be pricing these securities when they come to the window based on their rating at the time and there is a fallen Angelz provision so that we can finance as low as double B minus B Double A three although there is only one institution one government entity that we know of within the eligible amounts that our below trip will be at this point a multi-state entity has to have a little bit higher ratings in the a category because they are revenue bond issuers they don't have sovereign status or taxing powers and their their rating can fall as low as investment-grade and still qualify at the time of of selling the notes to us most importantly the initial program targeted the 50 states DC and populations for cities of over a million and counties of over 2 million that has been significantly reduced to two hundred and fifty thousand and five hundred thousand respectively this results in two hundred and sixty-one eligible issuers by our count that can directly come to the Fed for this funding facility a multi-state entity is eligible if they were approved through a compact with the US Congress there are many many of these but only about eight or so that issue debt the biggest example would be the Port Authority here in New York there are various bridge and port facilities that cross the Delaware River between New Jersey and Pennsylvania and Delaware that would qualify the DC metro in in Washington qualifies under this definition as does a bi-state Commission in st. Louis that spans the Mississippi River the eligible the list of eligible issuers is in Appendix A that is part of the FAQ so I encourage you to look at that the next tooth definition is going to skip over except for explaining this down streaming that we're encouraging in order to be more efficient and and get funding out there we're encouraging states cities or counties who are eligible to use the proceeds to the extent that they can under their tuitions their statutes and their credit capacity to purchase the notes of smaller entities that are not eligible or authorities and so b2 and b3 simply describe the difference between an entity that's authorized to issue on behalf of a state city or county and an entity who could benefit from the down streaming of the funds b4 is very important we've gotten a lot of questions about this where while we're encouraging the use of proceeds to be downstream to the extent possible the credit that the Fed will face is of the eligible issuer and so the eligible issue has to be in a position to guarantee the performance of the sub the political subdivision or entity that they are lending the money to the let's talk about the eligible notes what is an eligible note it's as I described before standard tax anticipation notes tax and revenue anticipation notes or bond anticipation notes or other similar short-term notes that are commonly issued in the Municipal Market and we'll take maturities of up to 36 months from the date of issuance these these notes are all for the purpose of providing liquidity so that state and local governments can manage their cash flow through this unprecedented stressful time from the fiscal impact of the pandemic C 3 we talked about the proceeds again this is to meet the cash flow needs of the eligible issuers or those of their political subdivisions or entities that they want to downstream - we've also provided for the to use these proceeds to pay maturing principal and interest on other obligations that may be coming due as a way to again try to better manage through the cash flow stress that many of these entities are facing I won't go into detail about the security but the security is obviously very important we're leaning on the existing infrastructure within the municipal industry in terms of the typical way that a state city or county would borrow and we're looking for the strongest credit that they typically use the first level would be a general obligation of that issue issuer but we are very familiar with the legal constraints that certain entities operate in terms of being able to pledge their geo there may be a constitutional limitation there may be a need to gain voter approval and so we're providing other alternatives but in all cases it must represent the pledge of the credit of the state city or county that is borrowing the funds multi-state entities you know as I said earlier don't have taxing power but in that case we would be looking for a parity lien a parity senior lien on the principal sources of their revenues as security and so for example the Port Authority has twenty billion dollars of debt outstanding they're rated double-a Double A - by the rating agencies if they were going to come to our window we would expect to have it a parity lien on their on their on the same credit that supports their outstanding debt we talked about the minimum rating to qualify but then there's going to be a rating that will enable us to price the securities we will have a pricing grid that will be public and applied uniformly across all the credits that are similarly rated and then have a similar maturity and so c5 simply describes the need to confirm the outstanding ratings so that we can then apply the grid to that to that rating category of course as with all 13-3 facilities we need to develop a pricing grid that will comply with our obligation to establish the pricing at a penalty rate that's a premium to normalize conditions but that also meets our our goal of providing credit under exigent circumstances and so we're in the process of developing that we'll talk about next steps but we would anticipate that this pricing formula will be released to the marketplace relatively soon hopefully within a week perhaps a little longer but our goal is that get it out next week interest on the notes typically with these kinds of securities are do it maturity but we provide flexibility in terms of when that interest payments will be due more frequently or or say semi-annually which is often the case in the municipal market or at maturity these notes will be able to be purchased using either a tax-exempt or a taxable rate depending on the use of proceeds the notes will be eligible to be repurchased by the issuer at any time in whole or in part and at par or the amortized premium whatever depending on the coupon that's that's provided and these it's important for the issuers to know that this extension of credit is only through the 13-3 sort of exigent circumstances a window that the Fed and the Treasury have approved so right now it's only through December 31st so issuers should not anticipate rolling these maturities to the extent they're shorter than three years but rather when they come due they will either be paid off with the revenues that have been pledged in the form of a trans or Iran's or by selling debt into the long-term capital markets or short-term capital markets to pay the maturity the maturing principle of the bond anticipation notes there's a there is a formula by which we established how much capacity or eligibility there is for selling notes to the Fed and it roughly equal to 20 percent of an annual revenue for the for the respective state city county or multi-state entity so it's a significant amount of money there the the aggregate of the 261 does not total 500 so there is excess capacity that should additional liquidity be needed especially for down streaming that a state city or county can apply once it's exhausted it's a its initial allocation for additional capacity we don't anticipate that happening very quickly but we do have that capacity the fee for this facility is 10 basis points payable at the time of the borrowing based on the power amount outstanding and I think that's pretty much it we're going to have standard legal opinions disclosure requirements and various certificates that will have to be delivered in order to qualify for the program in short we're leaning on the existing infrastructure of the miscible bond market for issuers their bond Council their financial advisors to do what they always do in order to borrow into the capital markets but to provide a backstop to ensure that they have access to liquidity at reasonable interest rates to manage their cash flows through this extremely stressful period and we hope that by making that liquidity available we'll both encourage the municipal market to be lending and again at such reasonable levels but also to give confidence to the municipal market that from a credit perspective issuers will not be confronted you know with liquidity shortages during this period so Michel with that I'm going to turn it back to you thanks Kent very helpful and very clear I would just add a couple of items that have come up in questions as Ken says we're getting a lot of feedback from states counties and municipalities or city we're getting other feedback through various sources so I'll address proactively some questions that could come up one is in light of the paycheck protection with program and some of the issues that occurred where people were competing to get access to the facility this facility is not a first-come first-serve facility there is actually a fixed allocation of 20% of the revenues and so there is sufficient capacity in the facility that states counties and and cities that want to come through this program don't feel need to feel like they need to rush in the door in order to get access to these and so we're able to fully support them second question you might have is when is this thing going to be up and running as Ken suggested our goal is to get a second set of FA Q's out in short order that would address the issues like pricing and the process that we will use to issue or to purchase securities from issuers the goal is for us to be able to do issuance in the month of May by the end of May but simultaneously so we want speed to market but simultaneously we have to build an operating process that will support 261 issuers needs getting through this program by the end of December and so that's an important balance we're trying to scrape one other thing that has come up is what happens at the end of the third thirty six months if a state county or municipality can't afford to pay their debt this is not a grant program and as many of you have read of actors in Washington Congress and the president are discussing the needs of states counties and cities with respect to help and grow a grant program we would not anticipate rolling was over or doing a program that would extend beyond the 36 month life this is the objective as Kent suggested is to provide short-term liquidity to provide a bridge for these entities to get to the other side and with that I will stop on and ask for questions from the audience please and gentlemen just a reminder if you'd like to queue up here for question this afternoon feel free to press 1 followed by 0 immediately if you are using a speakerphone it may be helpful to lift the handset before pressing those number keys but once again thank you up here for question immediately press 1 followed by 0 and maybe just a brief moment at this time it actually looks like we have no one queuing by phone Michael would it be useful just to talk about our objective of making sure that the full regional bank network is talking to and taking questions from issuers and how they might proceed from that point in terms of getting those questions answered yes thank you so we anticipate as I suggested in the introduction that because you have relationships with congressional officials or with governors and their executive staffs or with County executives and their staffs or with mayors and their staffs you will get questions from the community we've established an inbox it is MLF Paul Katz at NYU FRB org if you use that that is one vehicle of submitting questions that would enable us to then triage them and we commit to you getting back to you in a timely way we've got a lot going on to get this program stood up and that's the most efficient way for us to support you and we'll gather up those questions and those that are more generally applicable we will share back with everyone and as I suggested where you have a specific situational question we will try to address that and give you a direct phone call back one question I did receive an advance that came from come from the legislative affairs area or what do we do with state examples were West Virginia or Idaho where there are a few cities or counties that meet the population criteria can address this directly but I'm going to re-emphasize it it includes a provision that allows states to downstream their capacity to support the needs of counties and city within their jurisdictions Kent and I are already aware based on our contacts across the country and Kent has done a lot of this work where states are working cooperatively with the entities within their jurisdiction to become aware of their need and Sue and begin to build in anticipation of this program becoming available so that is the mechanism for cities below those thresholds or counties below those thresholds to still have access and the second mechanism is that if Ken suggested as we begin to establish backstop pricing and we begin to do our own work in this area our hope is that municipal markets more broadly improve and that there would be more direct access for those counties and cities that don't meet the population thresholds we do have questions keep by phone okay looks like the first is from Xavier Silva of New York Fed Bank your line is open oh hi Michael just listening interior responds I the answer I had was already answered the question I had is already I'm dry thank you next we have the line Lesley McGranahan the Chicago Fed your line is open I think I had a similar question there was like thinking in particular something like a Regional Transit Authority that kind of goes across city boundaries would they have to go through the state or could they go through this city so they have to be a subsidiary of full subsidiary of the government that's going to the window on their behalf so again we're designing a program that we're making available to state cities and counties and they will need to use their local law to figure out the best way to utilize the program so we can't anticipate every arrangement with different regional transit authorities or any other kinds of authorities I know in New York City the Metropolitan Transportation Authority is a state entity but they're talking to both the state and the city each of whom are eligible issuers on how the funds can be down streamed if you're talking about are ta in Chicago that's an interesting one because they're not really an operating entity like CTA is they are generally they generally bond for capital using a sales tax so I don't know if RTA would be the entity that would need funding or CTA or one of the other operating lines but they would have to work with the state and the city to figure out the best way to get funding to either the RTA who would then send it to CTA or directly to those entities but essentially we've designed a program that we hope is flexible but we're not in a position of changing or or influencing how the states and the cities figure out how to utilize the funding that answer your question yeah that gets at it thank you it looks like next we have the line of Casey Lausanne minneapolis fed your line is open hello this quesillo czar I can you hear me yes Oh excellent so I've a question about the eligible eligible issuers and I'm wondering if there's been any consideration for incorporating tribes or tribal governments who are unique political jurisdictions with Zuni credit needs into the MLS yes I mean the tribes are something that we've looked at they have not only unique needs but they have unique credit structures that is an area that we are continuing to evaluate but it's a very challenging a category of borrower to interface with given their their legal structures their lack of any investment grade ratings in large part and so we're talking to Treasury we're talking to Congress and their their needs may not be able to be met by a facility that's that's created pursuant to our 13-3 obligations and requirements and I would just build on that to say of the same question has come up with respect to territories and their other means by which policymakers may choose to address the territory and drive financial dislocations well thank you exit that's helpful I just want to offer any assistance I'm the director of the Center for Indian country development at the Minneapolis Fed and if I could be of any assistance working with with tribes on this please let me know that's a very welcome also thank you that's exactly one of the reasons we were convening this call is because all of you can be very helpful to us and we appreciate the authors of help thank you next to it's a line of Adam he'll be before we open just a reminder one-zero if you'd like to keep your question and that next is Adam Haley that is San Francisco your line is now open for us well good afternoon Kent and Michael thanks so much for convening this call it's been very helpful and Casey actually beat me to the punch I had a similar question about the access of tribal governments to the facility so you already answer that but please add me to the list as you guys continue these conversations we'd be very interested to to participate in those conversations so thanks again for holding this important call thanks for your help Adam I'm sure we'll be talking more about your your great state of California great and in the end and several several others next in queue is a line of Steve sharp the board of governors your line is open hi Steve sharp butter Reserve Board thank you for taking my question I was interested to know how you would be factoring in the catch ball versus non taxable status of a security in terms of pricing or for setting interest rates that's a good question that's not final yet but just as a general matter you may know that in taxable immunities generally have a relationship between the tax-exempt munities that is based off of the top federal marginal income tax rate so if you you know took one - with the top rate and divide that into the muni rate you'd have something equivalent to a tax we're doing that kind of analysis now so that there will be a an appropriate spread between a tax-exempt rate and a taxable rate okay that makes sense one issue that probably some are concerned about we have talked about what uses we might not want to see in this program and an example of one is a new capital project and another example example that got raised by the taxable tax exempt question was what would happen with an entity if they didn't handle the tax exempt status at the front end of the process and we got to the back end and they wanted to refinance it so that that is an issue that has come off I'm just raising awareness it has because in case it has does come up in contact that you make you can refer them to us and we can probably help with some answers to those kinds of questions but I would just say that you know we're do the program is doing nothing to change the way state and local governments issue their debt and if they want to issue the debt pursuant to an opinion of tax Council that it qualifies as tax exemption that's fine and we'll have a rate for that and if they for whatever reason can't or don't want to comply with the tax code will have a taxable rate which is the same as the market is it's the Muni market is I'm guessing you know 90% tax exempt but there is you know an active taxable market for issuers that need borrowing that doesn't otherwise comply with the tax code I would say that that general approach is applies across the municipal issuance process so we're planning on having issuers do what they normally do to issue this debt they have to get city council approval state legislature approval it has to be consistent with their constitutions and their statutes and we are counting on that process working the way it's worked for decades the same way the Muni market produces about 400 billion dollars four hundred fifty billion dollars of new issuance a year but we're limiting this to the three year maturity to focus on the immediate liquidity needs of state and local governments so they can manage their cash flows with less stress through through this period one other important value of us relying on the way states counties and cities traditionally issue is not only does that make it easier for them because it's their process but one of the other things is that most of these states counties and municipalities have established relationship with financial advisers who help them do their debt issuance and bond Council to help them through these prophecies and that also typically includes considerations of diversity of suppliers for those thirst sources and so by allowing them to use their regular process we are enabling a broad participation of the professionals across the country who support states counties and cities in doing their debt issuance rather than us picking those vendors next in queue we have the line of Karen real Denis of Atlanta said your line is open hi thank you so much for for hosting this call I just had a simple question I was curious if you had any plans to host a similar call-in number for the public for those issuers on that may be able to ask these kinds of questions and get any clarity beyond within the FAQ and if you do decide if that's not decided now but you decide that at a later time it would be great to know in advance because that could be something that we can help promote as the first shot at that answer or that question we have had ongoing discussions with the associations that many of these issuers are affiliated with so organizations like G fo a the government finance Officers Association Nass the National Association state treasurer's naspo the National Association of state budget officers and other entities like that v on the on writers side and the fa Q's are really designed for the broadest distribution of information to the entire marketplace including issuers large and small I leave it to Michael whether we have a system for sort of having a phone call like this on a national basis or even a regional basis and whether that might not be practical but we are having plenty of communication with representatives of law these issuers and the short answer is we contemplated doing that but for reasons they can't articulate it earlier in the call there are 50,000 of these entities in the country for more and many of these issues are very idiosyncratic to the jurisdiction there's a reason why each of them have financial advisors and bond councils to support them working through it and our first direction is rely on those people to help them interpret these programs on but you know and we are taking input we're getting lots of questions and we get a daily readout on the questions that come through the board and the bank's a website on the facility as the first mechanisms but I agree with your suggestion that if we do intend to host a call we would certainly reach out to this group to give you advance awareness and invite you to join but it's not in our first order approach to trying to deal with the individual questions actually it might be helpful to add to that that in terms of the processor we would hope within I would say the week after next to be publishing a notice of intent which would be first of course of information that interested issuers could submit to us that will give an idea of what the pipeline's going to be so that we can plan accordingly and that would be you know who have information to confirm they're an eligible issuer what are their borrowing when do they need funding what form of security can they offer basic information like that that would then enable us to respond to them and say ok you're eligible we've approved for you to send us an application that we will review and then promptly give you an answer on so look for that Notice of Intent coming out I I would hope if it's not late next week it would be the following week and that will clearly be an important you know step along the process in in standing up this facility next twizzle item David Eriksen New York Fed lines open hi this is a little bit out of left field out but there was a startup that I think it didn't laugh but it was in temperatures go called neighborly calm and there their Vermont the model works making bond starts again and municipal bonds country again ten they they were successful in driving down the transaction cost they could make very small they do smaller transactions and they really focus on things like micro grid for a community that wanted to switch over to renewable energy generation or did a lot of work around broadband access in rural areas and things like that and I'm just wondering if someone's thinking creatively about like it just isn't possible to create like a a bond for the performing arts organizations that don't have access to any other liquidity facilities or maybe a bond that's really targeted to very small minority women-owned businesses or some way in which the municipal liquidity facility could help reach these hard-to-reach borrowers yeah so I'm quite familiar with neighborly and their ambitious efforts I haven't kept up with them in the past year or two in terms of how that's worked out I don't see them I haven't heard a lot about them since then so I'm not sure how successful they were and expanding beyond the micro grid that you were talking about I think quite frankly you know it's challenging enough to try to deal with 261 borrowers plus another maybe almost dozen multi-state entities and that doesn't include a lot of very very large utilities transit systems water sewer systems transportation systems who are clamoring to try to have direct access to this facility and that we are continuing to consider so I think the kind of creativity that you're talking about which is no doubt important needs to be fostered at the local level and then find an eligible issuer that can can take an interest in them and support them I don't see a way that the Fed can foster that in the short eight months that were we've been given to provide liquidity support to state city and local governments but I think that kind of creativity is allowed for in this program to the extent that there's local interest in developing it and one awareness to build on on top of that because I you know I agree with Kent that that kind of creativity and supporting those types of entities and issues is good even within the 261 issuers that we're talking about which are the 50 states and DC and the largest counties and cities in this country you can tell by the performance of the Muni market that the market is having trouble wrapping its head around what are the revenue and expense impact on these largest jurisdictions how do we understand that and how do we understand how to place those lips now if they're probably struggling with that at this moment and how to think about the cash flow and liquidity means it's hard to imagine how that extends to small nonprofits or to other or what we're a large inventor ideas in normal time how the current market should be able to support those given the uncertainties around it and so I think can is exactly right we hope that that goes on at the local level but we're focused we expanded the number of issuers from 74 to over 261 and now we've got to figure out how to support those on the conditions of uncertainty and cash flow and remember also that this is a liquidity program it's a grand program and so we need to be careful that the lending we do or the purchasing you do actually comes as a backstop and actually comes with sufficient credit risk management that we're not inadvertently giving grants rather than providing liquidity okay next to it the line Stephan Whittaker to Cleveland said line is opened all right contacts read the FAQ and sent me a couple comments and pointed out that the penalty rate and I took physics sort of thing hello yeah there's really located could you repeat the question yeah so one of our contacts read the read off a cue and point it out that you've got a penalty rate and a certification that you can't get financing elsewhere and so I'm wondering how you expect a state to handle that but say you had a city that was too small by population so you asked that directly and they're unable to get financing so they approached the state but the state is still able to get financing through regular channels would you expect the state to buy their notes and you know trying to issue into the regular market and say the purpose of this issuance is buying notes of a subdivision or could they come to you and say we're doing this on behalf of a subdivision that cannot access the market that's an interesting question I think the issuer is going to have to sign the certificate these are not our rules these are 13-3 they're in the statute a penalty rate is part of the statute that's the whole purpose for central bank lending in this kind of crisis environment that it's a it's a penalty to the normalize conditions and that the access to capital is not that there's no access to capital but that there's not access to sufficient capital on similar lending terms my my gut is that if the state has access to the capital markets in insufficient amounts and under reasonable credit terms that they wouldn't need the facility and if they are desiring to support their local issuer that may not have that access that that's what they can do in the capital markets and they should do it they don't need access to the fed facility for that are either any in either case they would have to be putting their credit on the line so I don't know that there's a difference between the two in terms of what their obligation would be and and what the risks they would be taking on with the local issuer sorry you had up follow up oh yeah I mean I'm just wondering how you know the creditors - so if a state comes the market for any of the normal purposes which it borrows for every year whether it would be viewed differently by the market if they come specifically for this purpose that they you know we're trying to assist I think my grafic cash flow yeah I clearly if they're taking on credit risk and this security whether it's what by the Fed or in the normal market is a liability to that entity to the to the to the state let's say in your example it's going to count against their their debt ratios when they go to get their their rating is affirmed and to the extent that they're over leveraging it could impact their rating so that's clearly a limitation that they're going to be operating under regardless of which execution they at they they access the Fed window or they the MLF or if they go to the normal capital markets but again that's the state's issue to deal with our job is to make liquidity available to all the eligible issuers that the board has defined and was new for their time for remarks I'll go ahead and turn it back to our host for any closing remarks so this is Michael's drama first of all I'd say thank you for your time and attention today I hope this session was helpful to you remember the resource MLF @n y dot f RB dot o-r-g is available to submit additional questions and we will circle back we appreciate the help we know you will be providing from the contacts that you already have and so providing us feedback or asking us additional questions or offering us help in leveraging your contacts to help explain and achieve the goals of this program is very welcome and most appreciated so thanks for your time thanks for your help and keep the good questions coming hope everybody's doing well through all this and look forward to seeing you all on the other side

Show moreFrequently asked questions

How can I allow customers to eSign contracts?

What do I need to sign a PDF electronically?

How do you create a signature box in a PDF?

Get more for sign Liquidity Agreement made easy

- Digital signature on tablet

- Prove electronically signing Employee Matters Agreement

- Endorse eSign Car Sales Receipt

- Authorize digital sign Training Acknowledgement Form

- Anneal signatory Job Proposal Template

- Justify eSignature Accounting Proposal Template

- Try initial permit

- Add Restructuring Agreement countersignature

- Send Music Artist Sponsorship Proposal Template digital signature

- Fax Maintenance Agreement electronically signed

- Seal Contract Termination Letter digi-sign

- Password Collective Bargaining Agreement esign

- Pass Monthly Timesheet Template signature block

- Renew Mortgage Deed signature

- Test General Scholarship Application email signature

- Require Accounting Services Proposal Template signatory

- Send subscriber digisign

- Boost assignee esigning

- Compel tenant byline

- Void Hotel Receipt Template template mark

- Adopt claim template signed

- Vouch Road Trip Itinerary template digi-sign

- Establish Product Quote template digital sign

- Clear Construction Joint Venture Agreement Template template initial

- Complete Summer Camp Teen Volunteer template signature

- Force Bakery Business Plan Template template electronically sign

- Permit Camper Stay Over Permission template countersignature

- Customize Weekly Timesheet Template template digital signature